Job Work

Job Work itself explains the meaning. It is processing of Goods supplied by the principal for further processing.

Section-2 (68) defines Job Work as “any treatment or process undertaken by a person on goods belonging to another registered person.”

The one who does the said Job Work would be termed as “Job Worker”. The Job Worker is responsible for processing the goods provided by the principal, but it's important to note that ownership of the goods remains with the principal throughout the process.

There may be some reason for goods is being sent for Job Work like Capacity Constraints, Limited Resources, Specialized Equipment, Cost-Efficiency, Time Savings & Focus on Core Competencies.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Section-143 (5) of CGST, defines the procedure for GST compliance regarding waste generated during the job work. This procedure takes into account two possible scenarios: one where the job worker is registered, and the other where the job worker is unregistered.

1.Waste and Scrap by a Registered Job Worker :

During the process if waste or scrap is generated, and Job worker is registered under the GST Act, then after paying tax amount the waste and scrap can be removed from his business place.

2.Waste and Scrap by a Unregistered Job Worker :

If the job worker is not registered under the GST Act, the responsibility for GST compliance regarding waste and scrap falls on the principal (the owner of the goods).

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

GST on Perquisite by employer to employee

Goods and Services Tax (GST) doesn't apply to perquisites provided by an employer to an employee in employer-employee relationship. Perquisites are benefits or advantages given by the employer to the employee and they are often considered a part of the employment package i.e. it is part and parcel of the cost to the Company (CTC).

Circular No. 172/04/2022-GST dated 6th July, 2022 also provides clarification in this matter -

- Schedule III to the CGST Act provides that “services by employee to the employer in the course of or in relation to his employment” will not be considered as supply of goods or services and hence GST is not applicable on services rendered by employee to employer provided they are in the course of or in relation to employment.

- Any perquisites provided by the employer to its employees in terms of contractual agreement entered into between the employer and the employee are in lieu of the services provided by employee to the employer in relation to his employment. It follows therefrom that perquisites provided by the employer to the employee in terms of contractual agreement entered into between the employer and the employee, will not be subjected to GST when the same are provided in terms of the contract between the employer and employee.

Example : ABC Limited provides accommodation to its employees. So, this accommodation is considered part of the overall cost to the company (CTC). Hence, no GST will be chargeable.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Circular No. 92/11/2019- GST dated 7th March 2019 clarify GST applicability on GST on buy one get one free offer.

Interpretation: As per sub-clause (a) of sub-section (1) of section 7 of the CGST Act, the goods or services which are supplied free of cost (without any consideration) shall not be treated as supply under GST (except in case of activities mentioned in Schedule I of the said Act).

At first glance, it might seem that offers such as "Buy One, Get One Free" involve giving away one item at no cost, without any exchange. However, in reality, it doesn't constitute a single supply of free goods. Instead, it involves two or more separate supplies bundled together under a single price. This arrangement can be best described as providing two goods for the price of one.

Taxability: The tax treatment of this supply depends on whether it qualifies as a composite supply or a mixed supply. The applicable tax rate will be determined in accordance with the provisions outlined in section 8 (Tax liability on composite and mixed supplies) of the CGST Act.

Availability of ITC: It is also clarified that ITC shall be available to the supplier for the inputs, input services and capital goods used in relation to supply of goods or services or both as part of such offers.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

In the GST law, there's no specific definition for the word "gift. In common parlance, gift is made without consideration, is voluntary in nature and is made occasionally. A gift is something you give to someone without expecting anything in return and it usually happens on special occasions It can not be demanded as a matter of right by the employee.

It is being reported that gifts and perquisites supplied by companies to their employees will be taxed in GST. Gifts upto a value of Rs 50,000/- per year by an employer to his employee are outside the ambit of GST. However, gifts of value more than Rs 50,000/- made without consideration are subject to GST, when made in the course or furtherance of business.

| Particulars | GST Applicability |

| Gift upto Rs. 50,000/- per year | Not Applicable |

| Gift more than Rs. 50,000/- per year | Applicable |

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

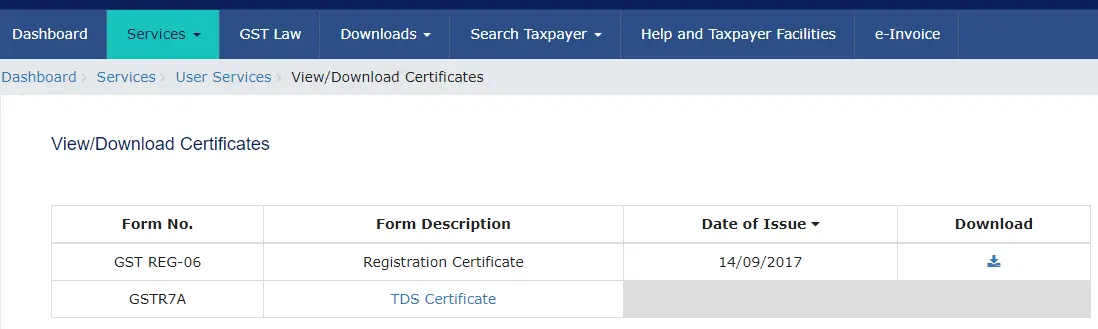

How to Download GST Certificate

It is mandatory for all the persons who are registered under GST Act to display GST Certificate at their registered place of business.

If registration certificate is not displayed then Rs. A penalty of Rs. 50000/- can be imposed.

After the GST registration number is allotted, the department does not deliver the GST certificate to the person at his registered address.

After taking GST registration, generally the question arises that how to download the GST certificate. GST registration certificate can be downloaded only when username & password is available.

To download GST certificate, the following process has to be followed:-

Have to visit GST website www.gst.gov.in.

Valid credentials, meaning you will have to login using Username and Password.

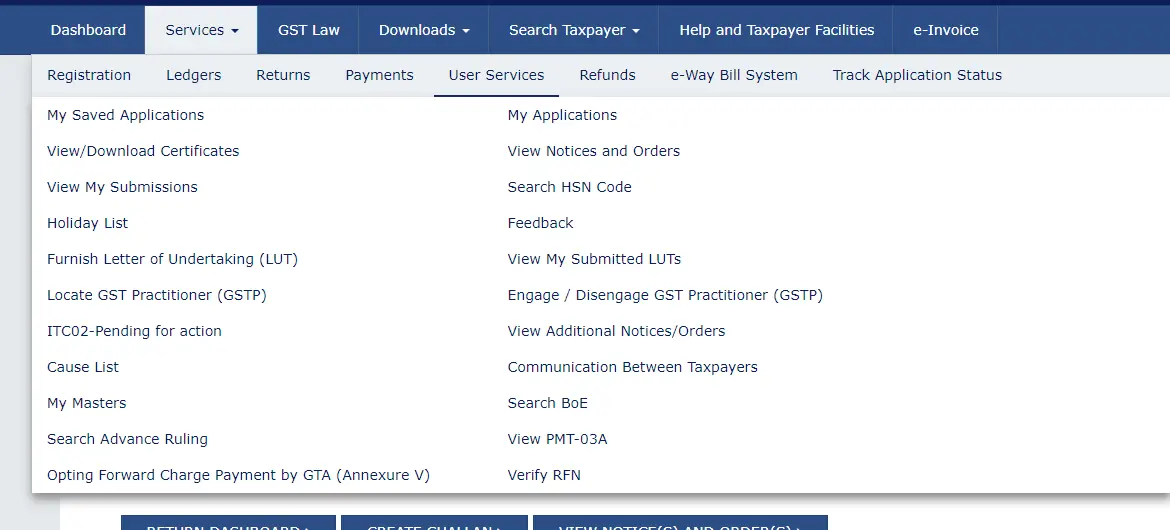

After login, you have to click on Services > User Services > View/Download Certificates.

In this way the certificate can be downloaded by clicking on the download option.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

GST Implication on Services provided by Freelancer in India and Abroad

| In this Article you will learn :

Ø Who is Freelancer? Ø Is Freelancer covered in GST? Ø Does registration liability also arise? Ø Turnover Limit for GST Registration Ø GST Rate on Freelancing Ø Can freelancers opt for Composition scheme? Ø Invoicing Ø ITC (Input Tax Credit) Ø GST Returns Ø Provisions of GST on export of services Ø Will Import Export Code (IEC) be required to export service? |

In today's Digital Era, services of freelancers are being taken globally. What implications can GST have on freelancing services, this is a big topic and the people who are engaged in freelancing are not even aware of GST implications and even if they have the information, it is only incomplete. Because of which they are not able to comply with the law knowingly or unknowingly. Because of which they can become victims of heavy penalty.

Today we will discuss this topic in depth in this article.

Who is Freelancer?

Freelancer means a person who works on specific assignment basis, means project basis. Freelancers work independently, meaning there is no relationship between employee and employer in freelancing services. Freelancer is a self-employed professional and all the rules of service provider are applicable on him, whether he provides service to a single client or multiple clients.

The most important question?

- Is Freelancer covered in GST?

- And does the liability of registration also arise?

Freelancer is covered under section 2(17)(g) of GST, meaning GST will be applicable on the services provided by the freelancer.

Turnover Limit:-

If the turnover threshold limit of Freelancer is Rs. 20 lakh or in special category states if it is more than Rs.10 lakh, then it is liable for registration.

| Special category states

(In case of below states the limit of registration will be Rs.10 lakh) |

|

| Manipur | Mizoram |

| Nagaland | Tripura |

Important notes:

- If you are exporting 100% services, the value of the services provided by you should be Rs. 20 lakh or more than Rs.10 lakh (as applicable) in the specified state, then you will have to take compulsory GST registration in such cases.

- If your turnover is the threshold limit (20 lakh / 10 lakh) or less, then you can provide service within state, outside state and outside India also without GST registration. The rule that mandatory registration is required if sales are made inter-state, applies only to the sale of goods and not to the provision of services.

GST Rate on Freelancing

GST rates are decided according to the category of service provided by you. Generally, the kind of services that freelancers provide, like accounting, software development, technical service, data entry, domain & hosting, marketing, designing, consultancy etc. GST at the rate of 18% will be applicable on these.

You can visit the official website of GST Rates Government:

https://cbic-gst.gov.in/gst-goods-services-rates.html you can check by visiting.

Can freelancers opt for Composition scheme?

In GST, on 7th March 2019, a notification no. 02/2019-A new provision was added to the composition scheme by Central Tax (Rate), in which the aggregate turnover of the service provider in the preceding financial year is Rs. Not more than Rs 50 lakh or turnover in the current year is Rs. If the income is not more than Rs 50 lakh then Composition scheme can be opted and they will have to pay 6% GST (3% SGST+3% CGST).

Invoicing

General invoicing rules are applicable for freelancers also. Freelancer will also have to make tax invoice as per GST Act, in which all the necessary information “name, address, GSTIN of the service provider as well as the recipient, SAC of services, date, the value of service provided” will have to be mentioned.

If you are providing services outside India by filing LUT and are not charging GST, then you will have to mention in the invoice:-

“Export of Services without payment of GST under LUT filed on dated_____________having ARN _________________”

ITC (Input Tax Credit):

The provisions of GST Act are equally applicable for freelancers, hence freelancers are also eligible to claim ITC on purchases of goods and services. Like laptop, computer, office rent etc. But you can adjust the GST paid from your output tax liability. But if the freelancer is registered in composition then he cannot claim ITC.

| GST RETURNS | |

| (a) For normal tax payers :

If the aggregate turnover of the service provider is less than Rs 5 crore in the preceding financial year then he can file Form GSTR-1 and Form GSTR-3B quarterly, but if the turnover is more than Rs 5 crore then he will have to file monthly return. |

(b) For composition tax payers :

They have to file CMP-08 return on quarterly basis. |

What provisions of GST will have to be complied with when exporting services?

Due to technological advancement, there has been exponential growth in the freelancer market globally, due to which exporting services has become very easy today. Export of services has been explained in GST, if the service provider exports services then it will be considered as export when:-

1) The supplier of services should be in India.

2) The recipient of the service should be outside India.

3) And the service being supplied should be outside India.

4) Payment for the services supplied should be received in convertible foreign exchange or Indian currency (as permitted by RBI).

5) The supplier and recipient of the service should not be establishments of separate persons.

| To export service, freelancer can opt for 2 options:- | |

| (a) By filing Bond/LUT (without payment of tax):

In case of LUT, the service provider is not required to charge IGST in the tax invoice, he can export the service by filing LUT (Letter of Undertaking). |

(b) with payment of tax and later apply for refund :

If the service provider does not file LUT then they will have to export after paying IGST. After exporting, the service provider can take refund claim of IGST. |

Will Import Export Code (IEC) be required to export service?

‘Import Export Code’ is a 10 digit code, which is issued by the Director General of Foreign Trade (DGFT). It is not compulsory to export the service. But, if the service provider is taking benefits of Foreign Trade Policy, then he will have to take IEC.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

GST aspects on the Return of Time-Expired Goods

In this article we will know that if the goods have expired, because of that the goods are being returned by the retailer to the wholesaler or by the wholesaler to the manufacturer, then how will they be treated in GST in this case.

Circular No. 72/46/2018-GST dated 26.10.2018 has clarified such situation. Two options have been provided for this:-

- Return of time expired goods to be treated as fresh supply

- Return of time expired goods by issuing Credit Note

- Return of time expired goods to be treated as fresh supply

If the goods have been returned by any person (other than the composition taxpayer), then there is an option to treat it as fresh supply and an invoice has to be issued for the same. For the value of the invoice, the price at which it was purchased can be made the base.

The recipient (wholesaler/manufacturer) of the goods will be eligible for ITC by following the condition of section 16.

If the goods are being returned by the composition taxpayer then he will have to issue bill of supply and also pay tax at the applicable rate. Since this goods composition is being returned by the taxpayer, the recipient (wholesaler/manufacturer) of the goods will not be eligible for ITC.

If the goods are being returned by an unregistered person, it can be returned through commercial documents without charging any tax.

- Return of time expired goods by issuing Credit Note

Another option given in the circular is that in case of return of time expired goods, credit note can be issued by the supplier (wholesaler/manufacturer). Credit note will have to be issued according to the time limit mentioned in section 34 (2). Goods will have to be returned through delivery challan.

The supplier will have to issue the credit note within the time limit specified in section 34 (2). Along with this, tax liability can also be adjusted, if the person making the return has not availed ITC or had availed ITC but has reversed it.

Apart from this, even if the time limit has expired, credit note can be issued, but the liability cannot be adjusted and there is no need to upload this credit note on the common portal.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Goods & Service Tax

Continuous Supply of Goods Services

"Continuous Supply of Goods" means

According to the contract the goods are being supplied, or are to be supplied, on a continuous or recurring basis whether or not by means of a wire, cable, pipeline or other conduit and where the supplier makes billing on a periodic basis. Or any other supply which has been notified by the government, it will be called Continuous Supply of Goods.

"Continuous supply of services" means

According to the contract, the services which are being provided or to be provided continuously or whose period is more than 3 months and it involves giving periodic payment, or any other supply which has been notified by the government, is called continuous supply. of service will be called.

In this type of supply, two things need to be kept in mind from the supplier's point of view: when to pay tax and when to take ITC credit.

So to pay tax the most important thing is to know the time of supply. From that it will be determined when tax has to be paid and in which month the tax liability will arise.

In case of Goods the time of supply will be

When the invoice has been issued by the supplier, or the last date by which the invoice was to be issued as per section 31 of CGST Act, 2017. Whichever of the two occurs first, tax liability will accrue on that day.

In case of service the time of supply will be

Tax liability will arise on the date the invoice is issued or the date payment is received, whichever is earlier.

According to Section 31, when to issue invoice –

In case of continuous supply of goods –

As per section 31, as per agreement, the date on which the periodic statement is being issued or the date on which payment is received.

Whichever is earlier among the two.

The invoice will be issued by the supplier on that date.

In case of Continuous Supply of Service –

Where due date of payment is confirmed then on the due date of payment, invoice will be issued.

- In case the due date of payment is not confirmed, the invoice will be issued only when the payment has been received.

- Where the payment is linked to a completion of event, in that case the invoice will be issued on completion of the event.

Now we understand from the recipient's point of view when the recipient has to take ITC -

Section 16 of CGST Act 2017 which talks about eligibility to claim ITC, according to section 16, the recipient must have a tax invoice. The goods and services have been received and tax has actually been paid to the government by the supplier. And GST return has been filed as per section 39 of CGST act 2017.

Then the customer will get credit of the tax declared in the invoice.