Introduction

When the GST was introduced, there was considerable ambiguity surrounding its application to the real estate sector. Following persistent appeals from stakeholders, the government provided some clarification in 2019.

There are two types of apartments in the Real Estate sector:

1. Residential apartment

2. Commercial apartment

Residential apartments are further categorized into two distinct groups:

a) Affordable Apartments

b) Other than affordable apartment

a) Affordable Apartment:

| Particulars | Conditions | sq.meter | Gross amount upto ( In Rs.) |

| NON metropolitan cities | Apartment having carpet area upto | 90 | 45 Lacs |

| Metropolitan cities | Apartment having carpet area upto |

60 | 45 Lacs |

Note: Gross Amount will include all the amounts paid like Preferential Location charges, Development charges, Parking charges, and common facility charges.

b) Other than Affordable Apartment:

These apartments will be those that fall outside the classification of affordable housing.

Similarly, in the Real Estate sector, projects also fall into two categories:

1. Real Estate Project

2. Residential Real Estate Project

1. Real Estate Project: Real Estate projects are defined as those where the commercial apartment's carpet area exceeds 15% of the total carpet area.

2. Residential Real Estate Project: These projects are where the carpet area of commercial apartments amounts to 15% or less of the total carpet area.

Rate of Tax & ITC Availability

| Particulars | Effective Tax rate after 1/3rd deduction |

GST Payment mode |

|

Affordable Residential houses |

1% without ITC | Electronic Cash ledger |

| Other than affordable house |

5% without ITC | Electronic Cash ledger |

| Sale of under construction commercial units(in RREP up to 15% of total carpet area |

5% without ITC | Electronic Cash ledger |

| Sale of under construction commercial units(in REP) |

12% (proportionate ITC) | Cash/credit |

| Sale of completed flats Post Completion Certificate |

Nil | NA |

| 1. If the apartments are sold at a reduced rate (either 1% or 5%), then ITC will not be available in that scenario. 2. If apartments are sold at a reduced rate (either 1% or 5%), then the output tax liability will be settled solely in cash. 3. Reverse liability in case of purchase from an unregistered person. |

||

Several additional points have been incorporated into the new scheme.

1. Under the new scheme, it is permissible to procure up to 20% of the total input or input services value from an unregistered person. This implies that 80% of the total input or input services value must be procured from a registered person, eliminating the requirement to procure the entire 100% from a registered person.

For this calculation, the value of the following services has been omitted:

• Grant of developmental rights

• Long-term lease of land

• Floor space index

• Value of electricity

• Value of high-speed diesel

• Motor spirit and natural gas

2. If purchases exceed 20% from an unregistered person, tax will need to be paid on it through a reverse charge mechanism. Under reverse charge, the tax rate applicable will be 18%.

3. For cement procurement, the 80:20 benefit does not apply, necessitating the purchase of cement solely from registered suppliers. A reverse charge tax rate of 28% will be applicable on cement purchases.

4. The new scheme will apply to all new projects commencing from 1st April 2019 onwards.

FAQ’s

Q1. What is the GST on flat/house purchase?

Ans. GST is applicable on under-construction flats at a rate of 1% GST for affordable housing and 5% GST for non-affordable housing without input tax credit.

Q2. Is GST applicable on apartments?

Ans. GST applies to the purchase of under-construction properties such as flats, apartments & bungalows. For properties categorized as affordable housing, the GST rate is 1%. For non-affordable housing properties, the GST rate is 5%.

Q3. What is the GST on flats priced below 45 lakhs?

Ans. Under the Affordable Housing Scheme, for flats priced below 45 lakhs and with an area below 90 square meters, the GST rate on such under-construction flats is 1%.

Q4. How to avoid GST on flat purchase?

Ans. Avoiding GST can be achieved by opting for ready-to-move-in properties or resale properties, as GST is mainly imposed on under-construction properties.

Q5. What is the GST on the construction of residential property?

Ans.The GST rates of 1% and 5% without Input Tax Credit (ITC), effective from April 1, 2019, are applicable to the construction of residential apartments in a project that begins on or after April 1, 2019.

1% GST- These GST rates apply to affordable housing projects, defined as those with a carpet area up to 60 square meters in metropolitan cities and 90 square meters in cities or towns other than metropolitan cities, where the gross amount charged by the builder does not exceed forty-five lakh rupees.

5% GST- It is applicable on non-affordable Residential housing projects.

Q6. Is GST applicable on resale flats?

Ans. GST is not applicable to the sale of resale flats since they are classified as ready-to-move-in properties.

Q7. Is GST applicable on sale of fully constructed Flats or houses?

Ans. Construction of a complex, building, civil structure, or any part thereof, including those intended for sale to buyers, either wholly or partly, where the entire consideration has been received after the issuance of the Completion certificate by the competent authority or after its first occupation, whichever occurs earlier, is not considered a supply of goods or services under GST. Consequently, the sale of constructed flats is not subject to GST.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Introduction

2. TDS (Tax Deducted at Source) deductible

3. Consequences of not paying TDS

4. Reporting requirement under Income Tax act for remittance

5. How NRI can claim a TDS refund

6. Non-Deduction / Lower Deduction of TDS

7. FAQs

Introduction

An NRI is permitted under Reserve Bank of India (RBI) rules to sell a property he owns in India. There could be any reasons to sell property in India.

So let us understand what we have to keep in mind while selling property in India.

NRI can sell his residential property to either Resident Indian, NRI (Non-Resident Individual), PIO (Person of Indian Origin), in these transactions there is no requirement of special permission from RBI.

TDS (Tax Deducted at Source) deductible:

Section 195 of the Income Tax Act requires withholding the tax on income earned by an NRI and which is chargeable to tax India. The gain on the sale of property in India is income liable to tax in India. Therefore the buyer of the property is responsible for deducting TDS at source while making the payment to the NRI seller.

Tax rates are-

• The TDS rate is:

o 20% for long-term capital gains.

o 30% for short-term capital gains.

When the gain from the sale of property is chargeable as a long-term capital gain, the buyer is liable to deduct TDS @ 20%.

In case the holding period of the property is less than 2 years then, it will be considered as short-term capital gains and TDS @ 30% will be applicable.

One thing should be kept in mind here the TDS is required to be deducted on the sale proceed and not on the net gain.

The sales proceeds will be received by the NRIs net of TDS. NRI must collect Form 16A (TDS certificate) from the buyer and cross-check the TDS amount with the tax credit mentioned under Form 26AS.

NRI can receive the sales proceeds only in FCNR or NRE/NRO bank account.

Consequences of not paying TDS:

In some cases, the buyer pay TDS at the rate applicable to residents instead of the rate applicable for NRI or does not deduct TDS. He will have to face adverse consequences. The buyer is legally bound to deduct and deposit the TDS as per the prescribed TDS rate for the NRI seller or at the rate the prescribed in the NIL/lower deduction certificate issued by the Income Tax Department.

Following are the consequences when the buyer does not deduct the TDS as per the prescribed rates

• A penalty of an equal amount of TDS not deducted can be levied.

• The buyer will be liable to pay interest on the default amount.

• The seller cannot repatriate the sale consideration amount or sale proceeds received to his/her foreign bank account/NRE account.

• For misrepresenting facts about his/her tax residency the seller can be prosecuted.

Reporting requirement under the Income Tax Act for remittance:

As per the provisions of the Income tax Act to repatriate the sale proceeds of a property the NRI seller must submit Form 15CA and 15CB. The Form 15CB must be signed and submitted by a chartered accountant. An NRI seller can repatriate up to USD 1 million in a year outside India.

How NRI can claim a TDS refund

To claim a TDS refund NRI can follow the following steps:

1. NRI is required to file an ITR for the financial year in which the property was sold.

2. Attach the Form 16A issued by the buyer.

3. Provide supporting documents if any exemptions or deductions on the capital gains are claimed from the property sale

4. Once the ITR is processed, the Income Tax Department (ITD) will refund the TDS amount.

Non-Deduction / Lower Deduction of TDS:

In some scenarios, the TDS amount might be more than the seller’s actual tax liability. In such a scenario, the assessees will have to face difficulties as they would be required to pay taxes in the form of TDS even if there is no tax liability for the year, which they end up claiming as a refund.

Such a situation leads to unnecessary blockage of funds till the refund is received. Furthermore, the NRIs have to comply with filing an income tax return to claim it even if NRI is not liable to do so.

To eliminate this unnecessary compliance burden on such NRIs, the NRI can obtain a certificate of Lower Deduction Certificate (LDC) from the Assessing Officer under the provisions of Section 197 of Income tax act, allowing either a lower rate of TDS compared to the effective rate or a NIL rate of TDS, depending on the facts and features of each case based on the application made.

Apply for a certificate to reduce TDS

To get the certificate for deducting TDS at a lower rate you need to apply the Jurisdictional Assessing Officer of the Income Tax department.

This certificate is issued usually within 30 working days of the application. After this certificate is received by the NRI seller, the buyer can deduct TDS at the rates provided in the certificate and deposit the same against the NRI’s PAN.

The application for such a certificate is required to be made before executing the sales agreement. Any advance or token money received before making such an application will continue to attract higher TDS rates.

Documents and information required for application:

• Mobile number of the applicant

• E-mail ID of the applicant

• Copy of ITR and computation of income of last three years

• Copy of Form 26AS of last three years

• Copy of bank statements reflecting payment for the purchase of property

• Agreement to the sale of property

• Purchase deed of the original property Builder statement Proof of NRI (Passport or any other document signifying the residence of the applicant abroad)

• Supporting documents if claiming exemption under section 54

• Power of Attorney (should be signed by the applicant and his/her authorized representative).

Once the application is filed successfully, the assessing officer will review the documents/information submitted and ask for further queries and documents before issuing the certificate/rejecting the application.

On being satisfied that a lower deduction of TDS is justified, he shall issue a certificate for the same under Section 197 of Income tax Act. On successful issuance of the lower deduction certificate, the TDS will be deducted as per the TDS Rate stated in the Certificate. This certificate would be issued online, and the taxpayer can download it from the Income Tax portal.

FAQs

• What is the TDS on NRI property?

TDS (Tax Deducted at Source) shall be deducted at the time of any property is sold/ purchased. The buyer needs to deduct TDS and pay the balance to the seller. The amount to be deducted depends on the residential status of the seller. In the case of an NRI seller, the amount of TDS to be deducted will depend on the quantum of money received by the seller.

• How can NRIs avoid paying TDS on property sales?

Withholding of tax is mandatory as per the provisions of the income tax act. However one can apply for deduction of tax at the lower rate.

• What is the TDS rate on sale of property by NRI?

Long-term capital gains on the sale of property held for more than 2 years: 20% TDS Rate Applicable.

Short-term capital gains on the sale of property held for less than 2 years: 30% TDS rate applicable.

• Do NRIs pay capital gains tax?

Yes, capital gains tax provisions for an NRI are similar to those for a resident individual except for the applicability of TDS provisions. Like resident investors, capital gains tax for an NRI depends on the holding period and the type of property sold.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

In this article, we will discuss how to register for GST. If your aggregate turnover exceeds the prescribed limit for taking registration under the GST Act i.e. in case of goods limit is Rs.40 lakh (in specified states Limit is Rs. 20 Lakhs) or in case of service such limit is Rs. 20 lakh (in specified state limit is Rs.10 lakh) or If you want to take voluntary registration under the GST Act, then you can also take voluntary registration.

In GST, registration is issued state-wise and while applying for registration, you should have PAN (Permanent Account Number) i.e. without PAN, Application for GST Registration cannot be made.

If within the state, you have more than one business place then you can take only one single registration for all the different places. But, if you have more than one business place in different states, then you have to apply for each state separately under the GST Act.

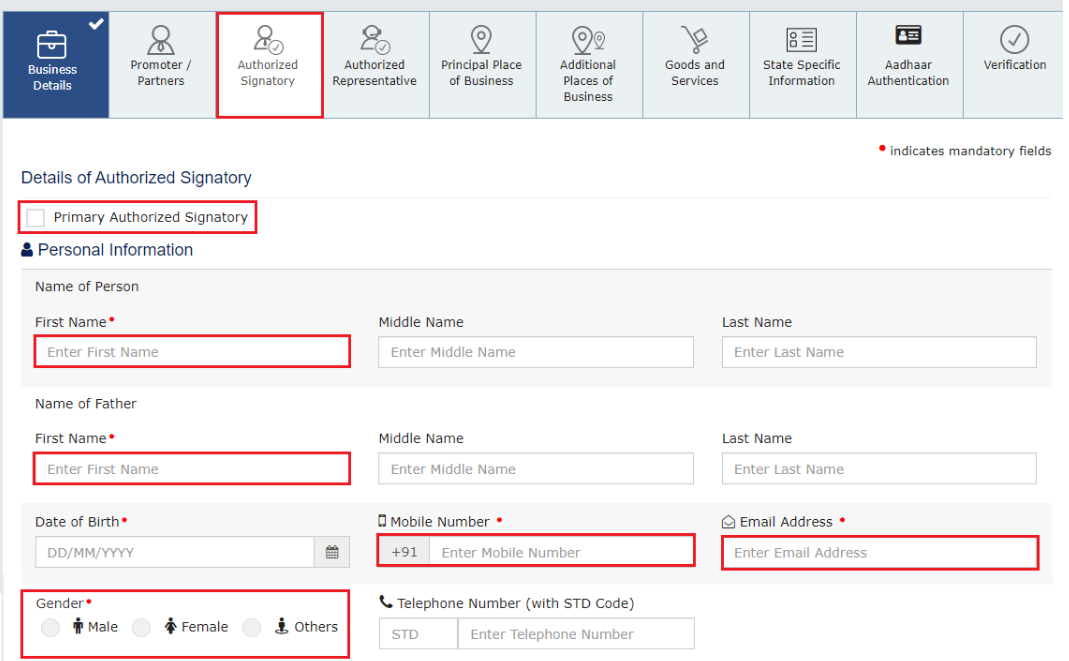

Steps to be followed for GST registration.

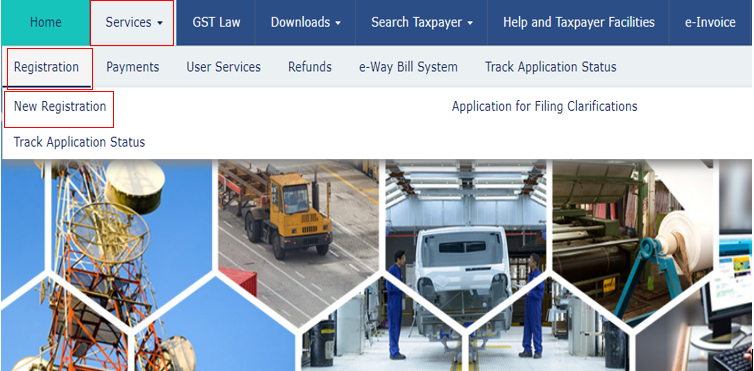

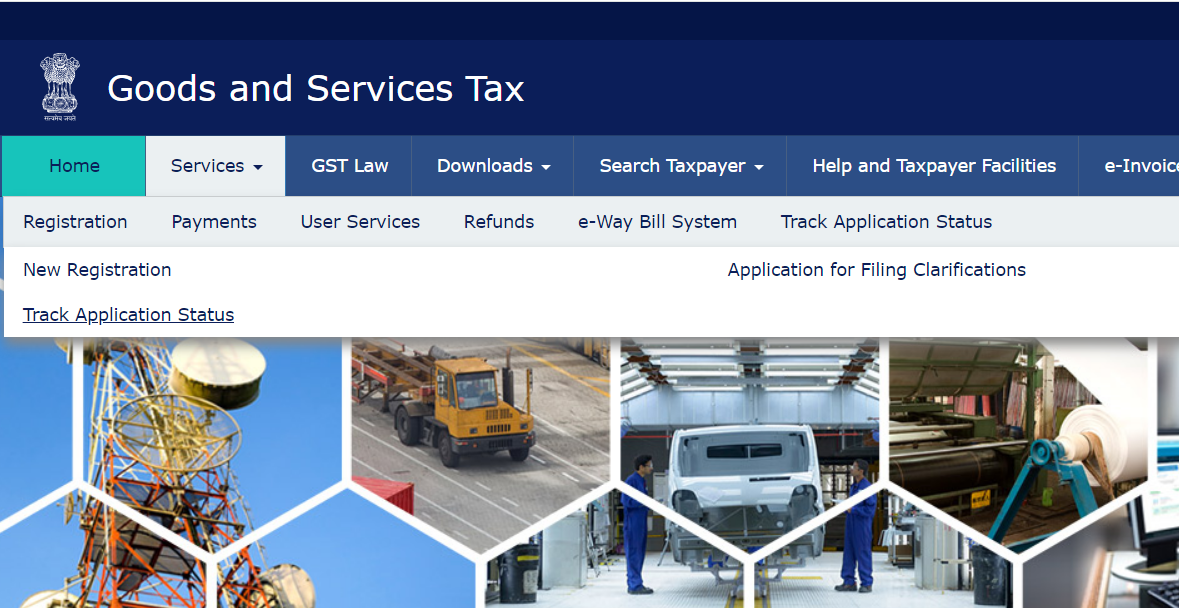

Step 1 – Go to the GST portal. Click on the Services tab, then click on the ‘Registration’ tab, and thereafter, select ‘New Registration’

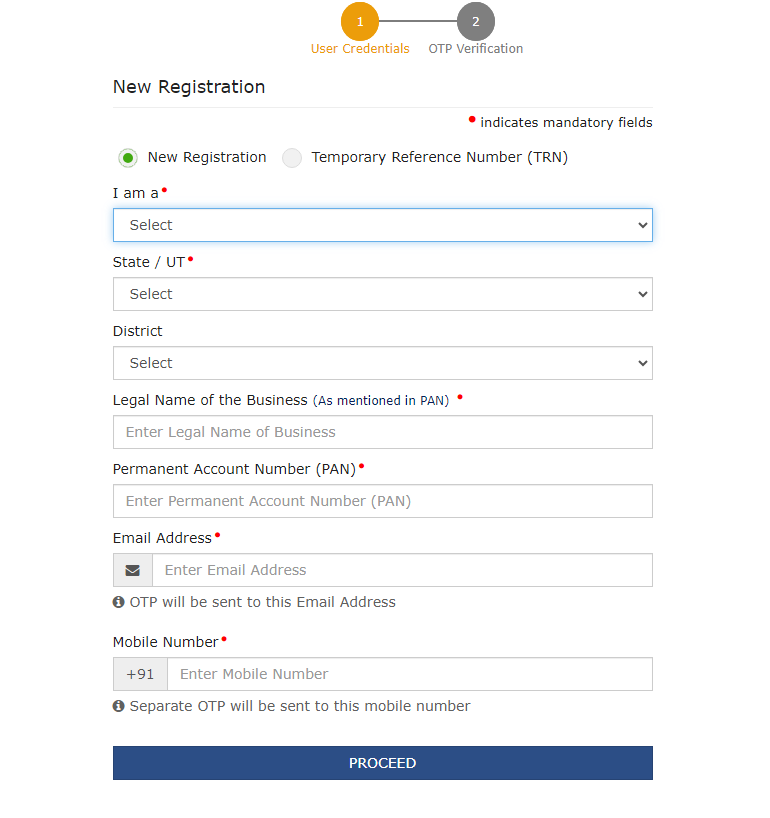

After clicking on new registration, this type of window will appear:-

Click on New Registration and fill respective details. After filing all the respective details click on proceed.

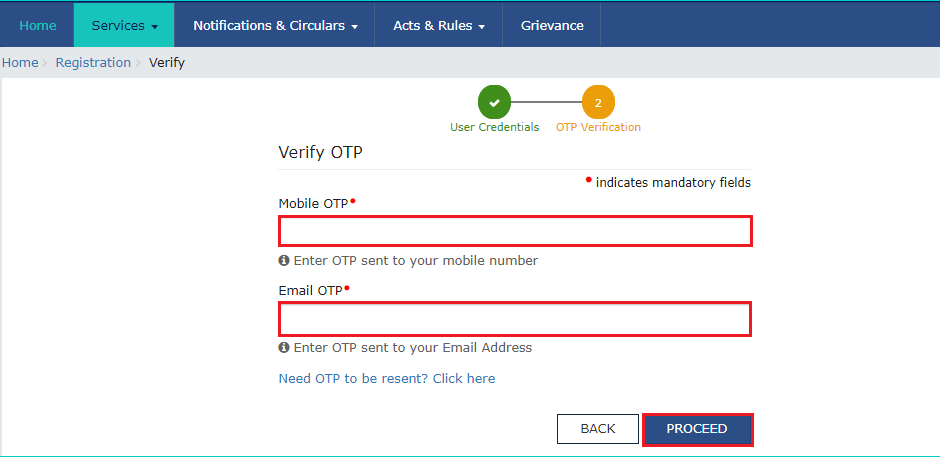

Enter the OTPs received on the email and mobile. Click on proceed.

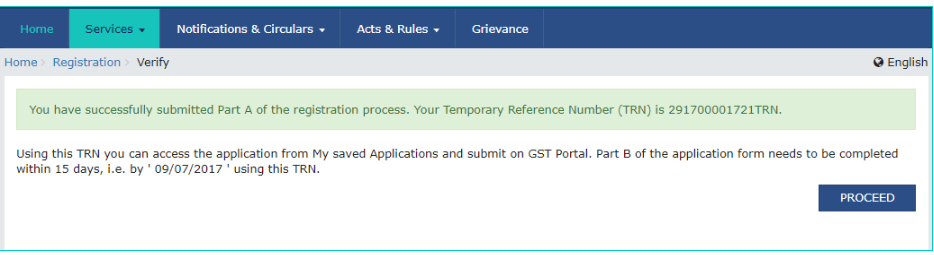

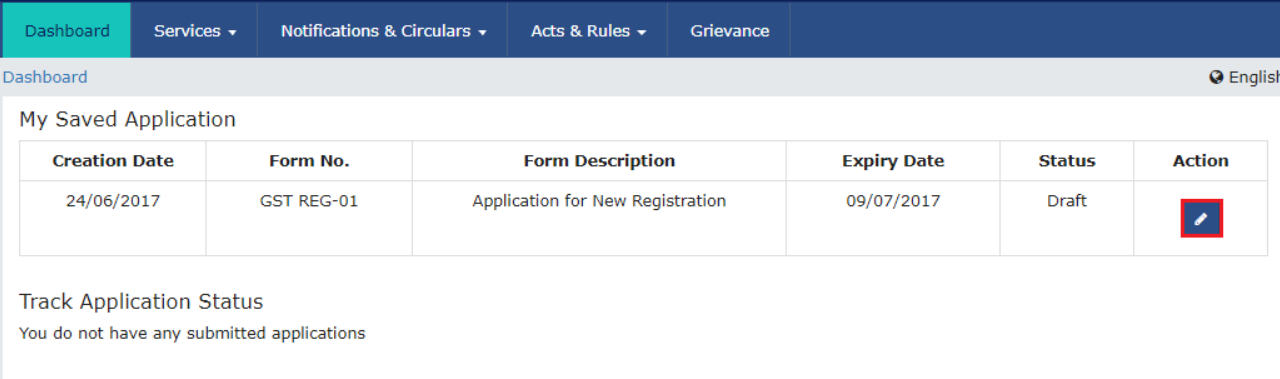

After successful verification, you will receive the 15-digit Temporary Reference Number (TRN) on your registered email and mobile no. This TRN is used for further reference. You need to complete filling the part-B details within the next 15 days.

After clicking on proceed, this type of window will appear. Then, Click on the action tab.

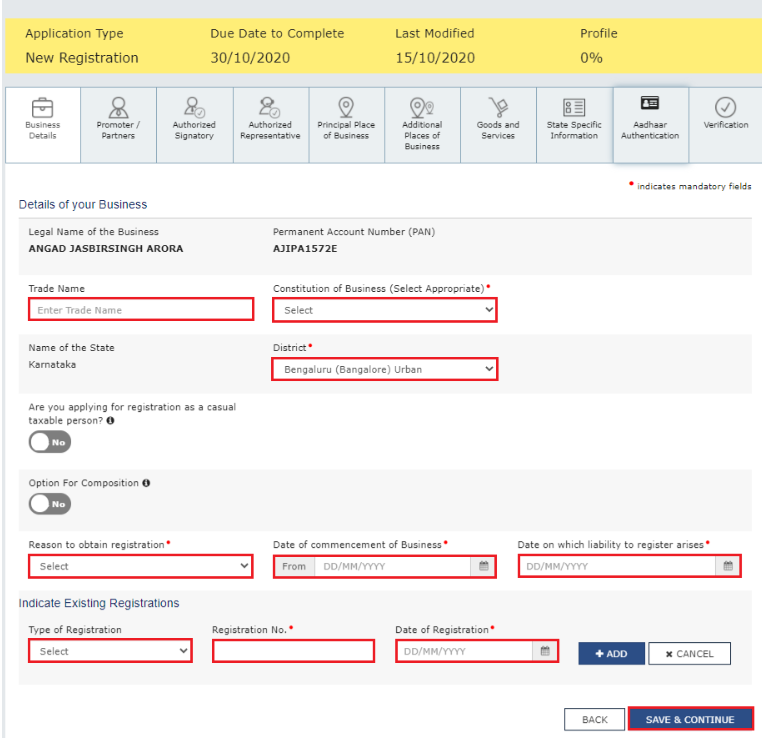

After clicking on the action tab, Part-B will open. In Part-B, There are 10 tabs.

Before filling the part- B, here is the list of documents you need to keep while applying for GST registration-

• Address of Principal Place of Business like Municipal tax receipt, rent agreement, Registration deed.

• Electricity Bill.

• Photograph.

• Any license issued by local authority i.e. Establishment of registration certificate.

1st tab is related to Business details.

In the business details section, fill in information such as the trade name, constitution of the business, district, whether you are applying as a casual taxable person (if yes, then select yes; otherwise, select no), whether you want to register under the composition scheme (if yes, then select yes; otherwise, select no), reason for obtaining registration, date of commencement of business, etc. After filling in all the details, click on "save and continue."

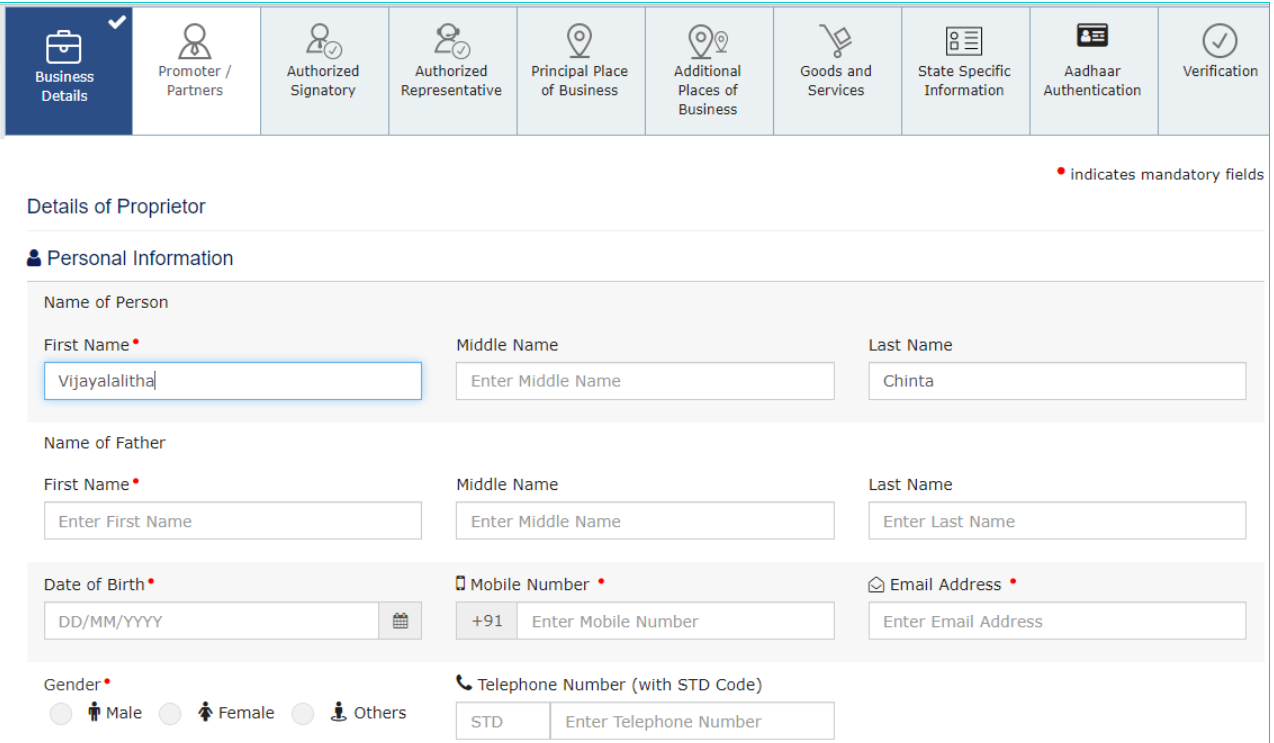

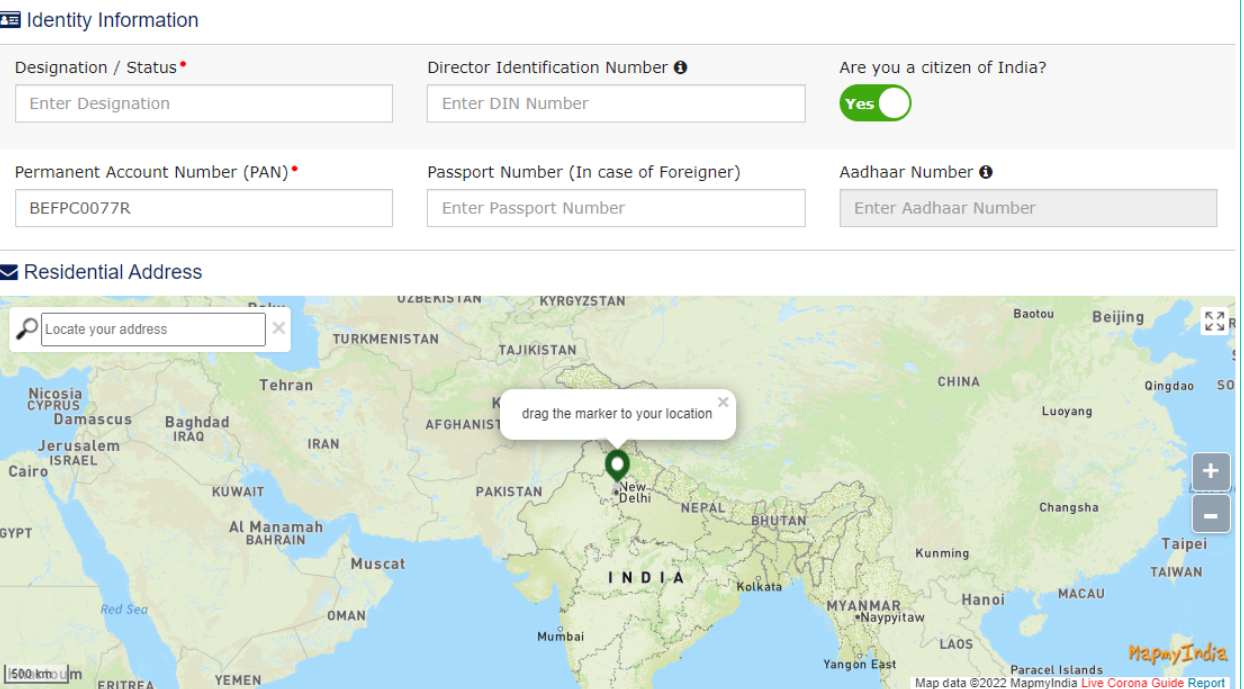

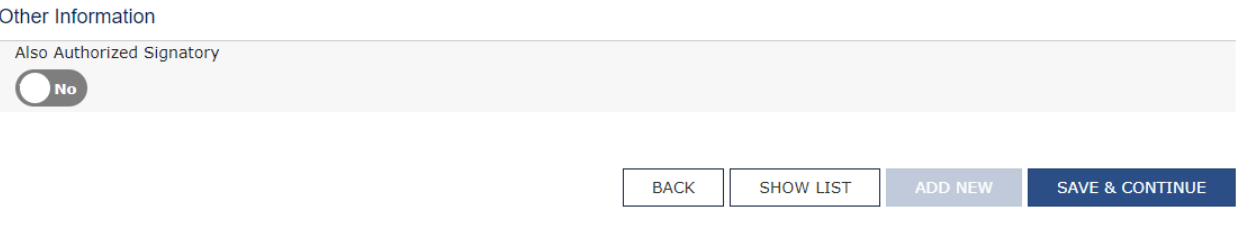

Next Tab is related to Promoter Partners details.

In this tab fill basic details of partners like Name, Date of birth, Contact no., email address, Gender, Designation, and address and Photograph.

If a partner is also an authorized signatory then select yes. After filling all the details, click on Save & Continue.

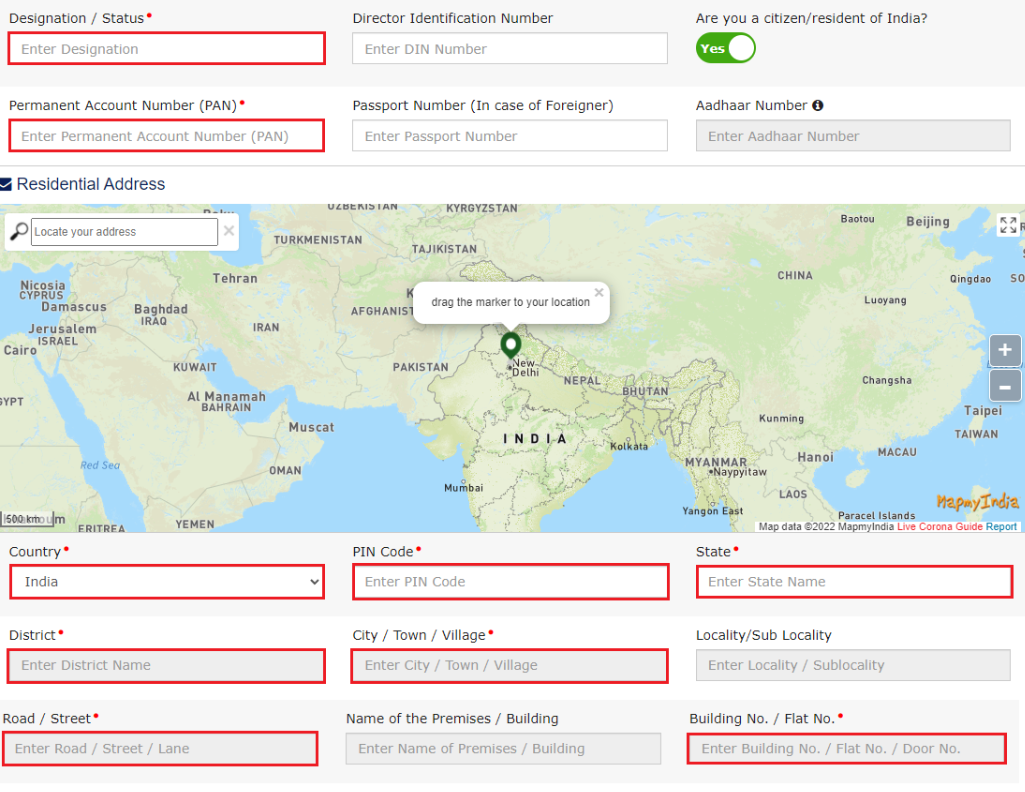

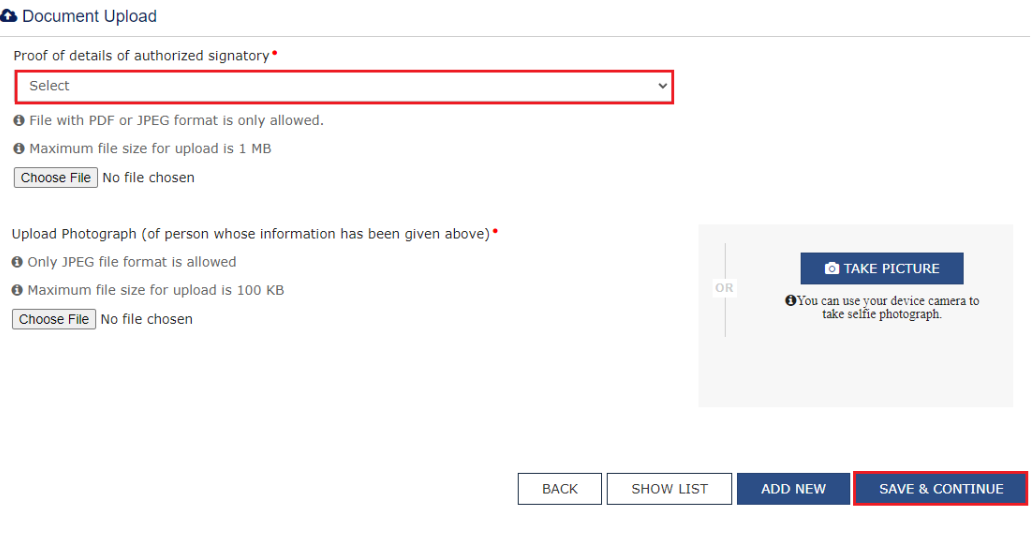

Next tab is related to the Authorized signatory.

If the promoter or partner is also an authorized signatory, then in the earlier table under "Other Information (Promoter/Partner)," click on "Yes."

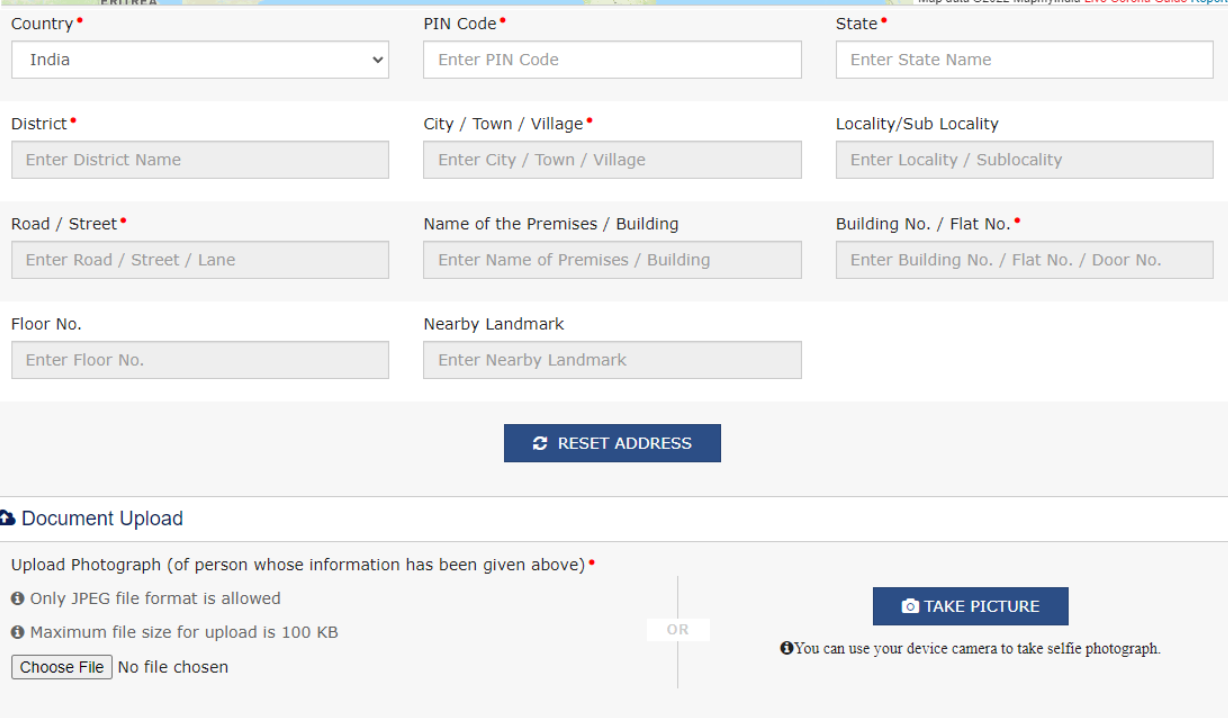

If the promoter partner is not authorised signatory then fill all respctive details like Name, Date of birth, Contact no. PAN, E-mail address, Gender, Designation, Address and Photograph.

After fill all the details click on Save & Continue.

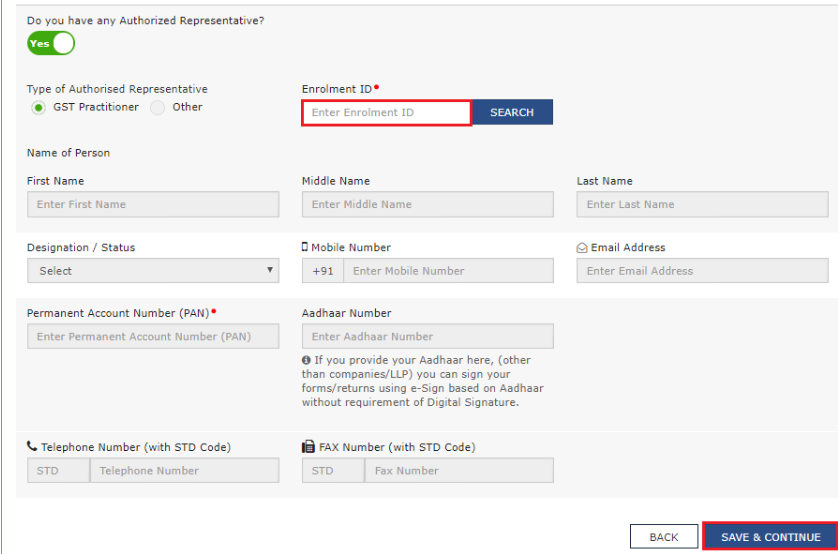

Next tab is related to Authorized Representative.

If you have an authorized representative click on “Yes” and fill the respective details.

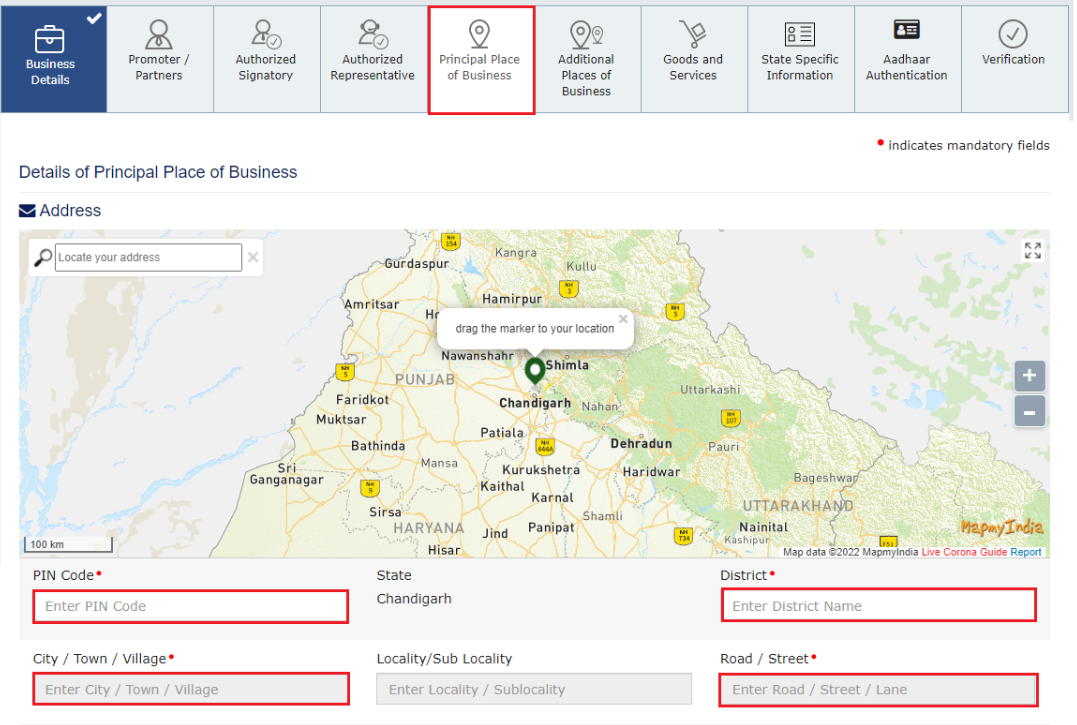

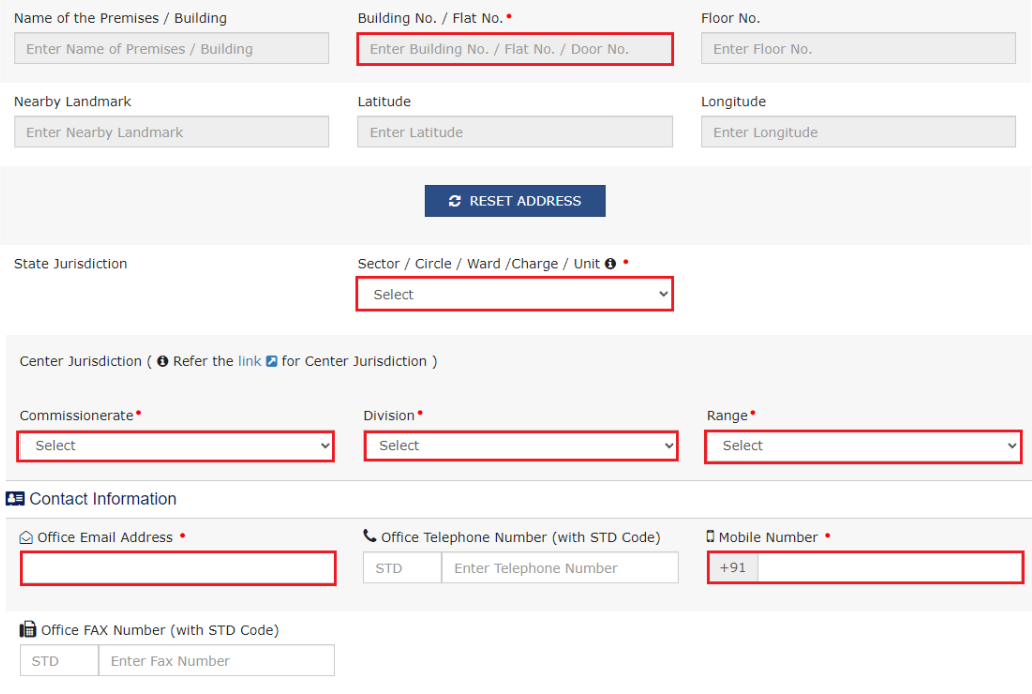

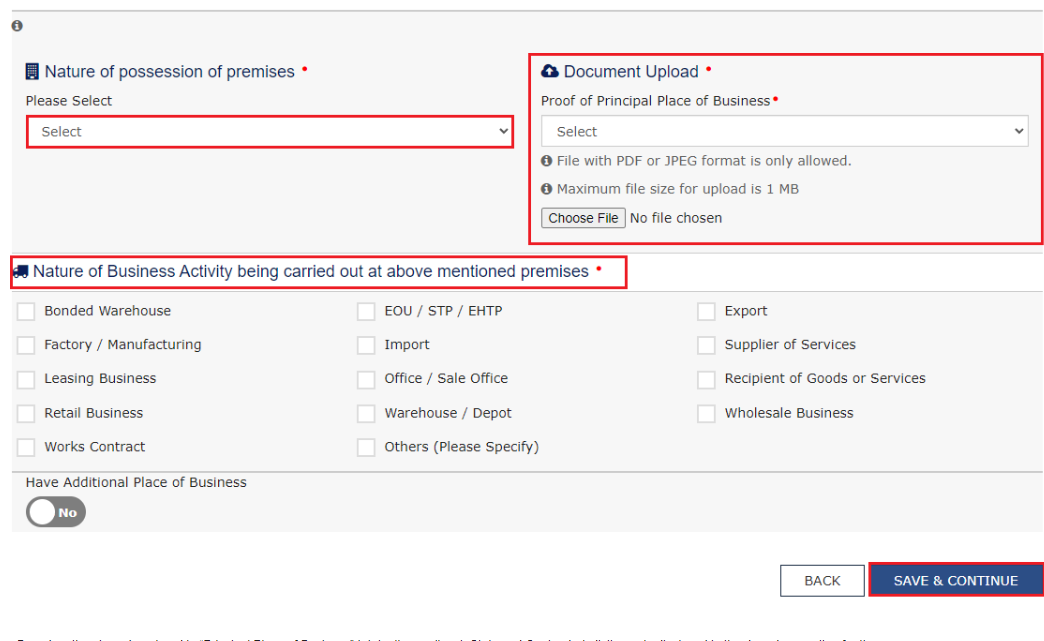

Next tab is related to the Principal Place of Business.

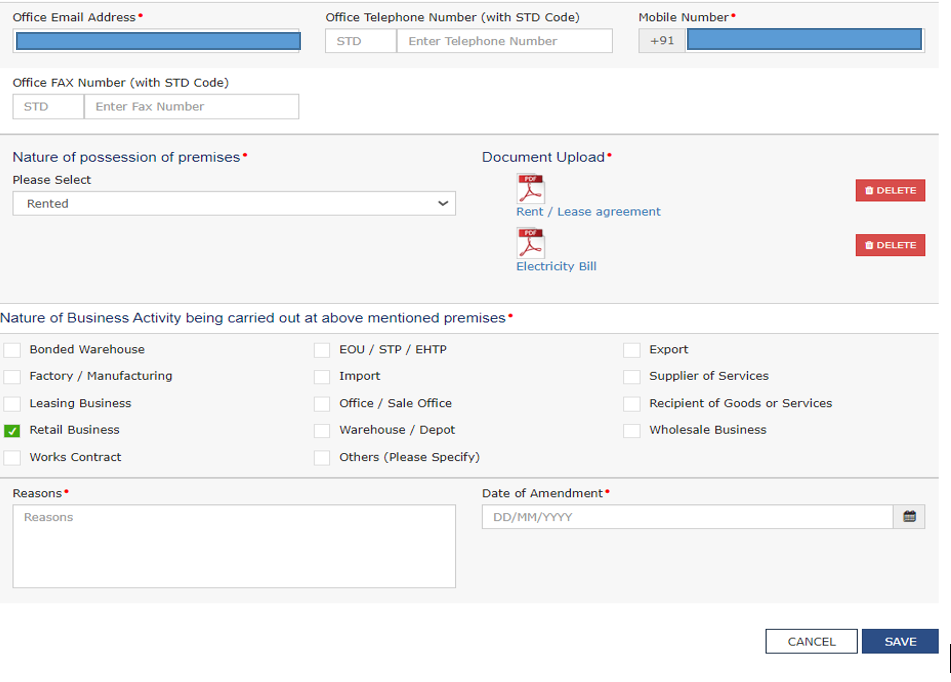

In this tab, enter the details of the business like the address of principal place of business, State jurisdiction, Commissionerate division range, Office email address and Contact number and Nature of business activity like trading, Manufacturing, Import, Export, etc.

If you have any additional place of business then select “yes”, otherwise select “No”.

After fill all the details upload the documents like

• Address of Principal Place of Business like Municipal tax receipt, Rent agreement, Registration deed any one of them.

• Electricity Bill.

• Any license issued by local authority i.e. Establishment of registration certificate.

After filling all details click on save and continue.

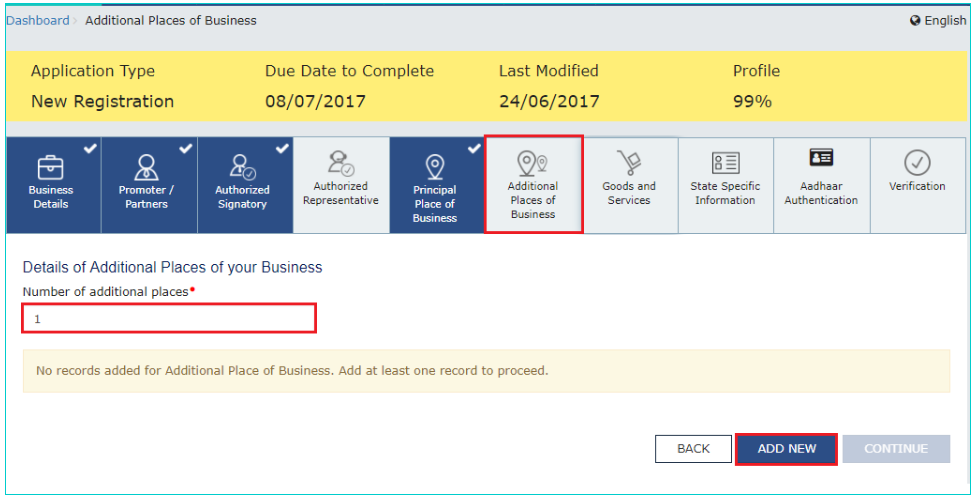

Next tab is related to additional place of business.

If have additional place of business enter the details.

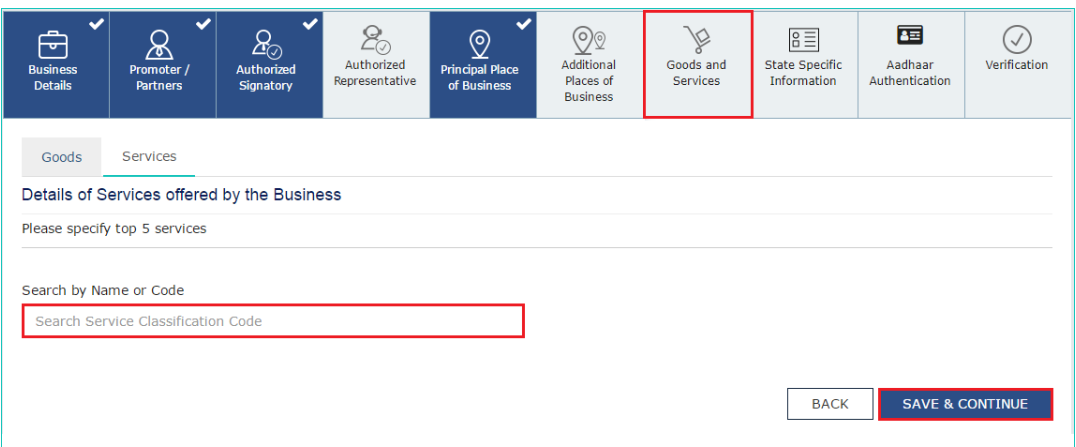

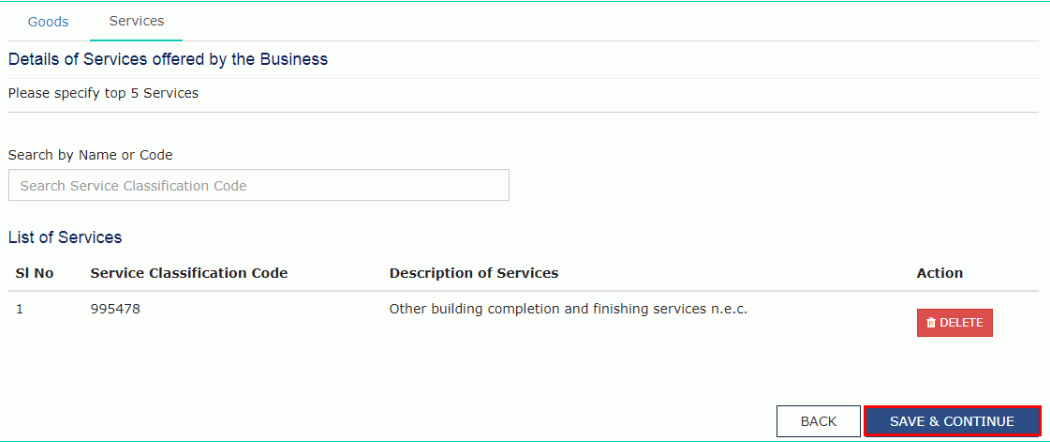

Next tab is related to Goods and services.

In this tab, enter the HSN/SAC code of goods or service and add product here maximum 5 HSN/ SAC code can be added.

After fill the details click save and continue.

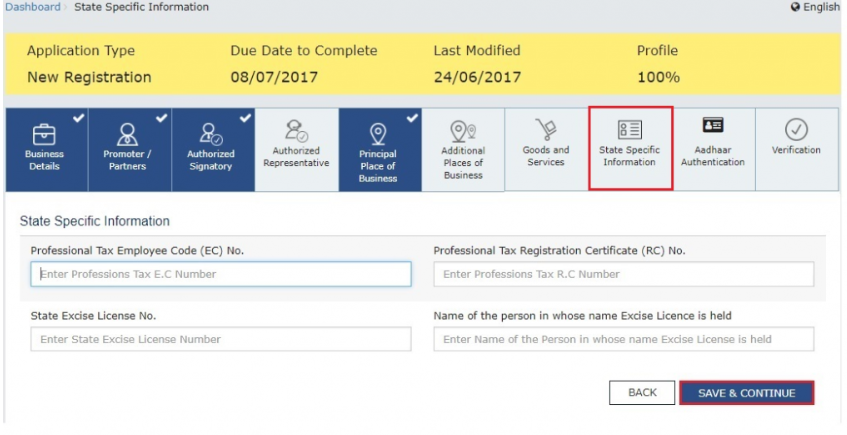

Next tab is related to State Specific Authentication.

In this tab, if any state requires a specific license, then enter such details here. This tab is not mandatory.

After fill the details click on save and continue.

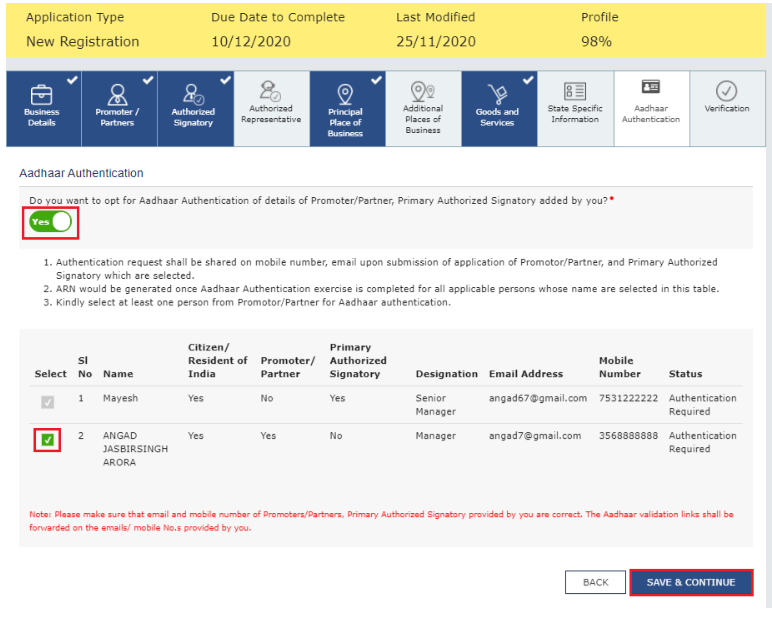

Next tab is related to Aadhaar Authentication.

In this tab, Click on Yes “for aadhaar authentication”.

After click on the check box click on save and continue.

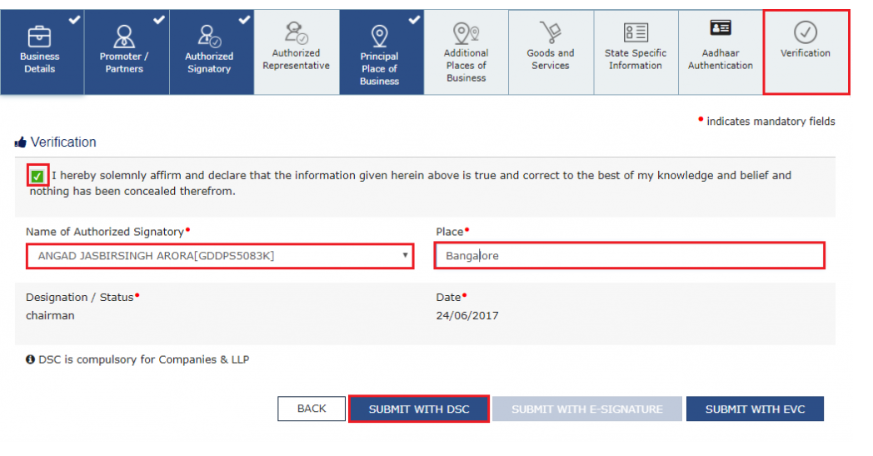

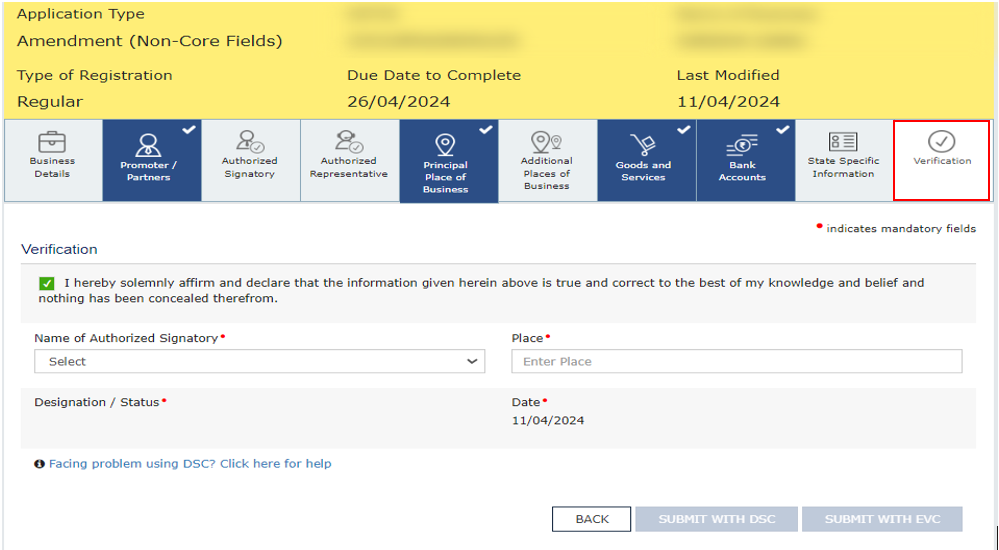

Next tab is related to Verification.

In this tab click on the check box for verification, select name of authorized signatory and enter the Place.

After filling all the details, you can verify through DSC or EVC.

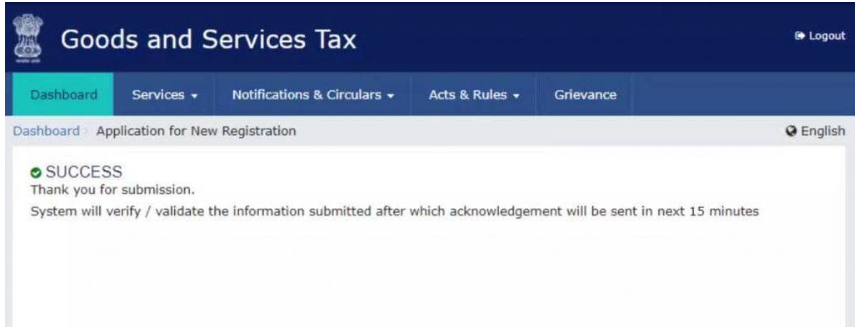

After successful verification, a success message is displayed on the dashboard.

FAQs on GST Registration

Q : How we can obtain GST registration?

A : GST registration can be applied by submitting an application online on the GST portal as described above and completing the verification process.

Q : What is the full form of TRN in GST?

A : TRN stands for ‘Temporary Reference Number’, Which is used for GST Registration procedure.

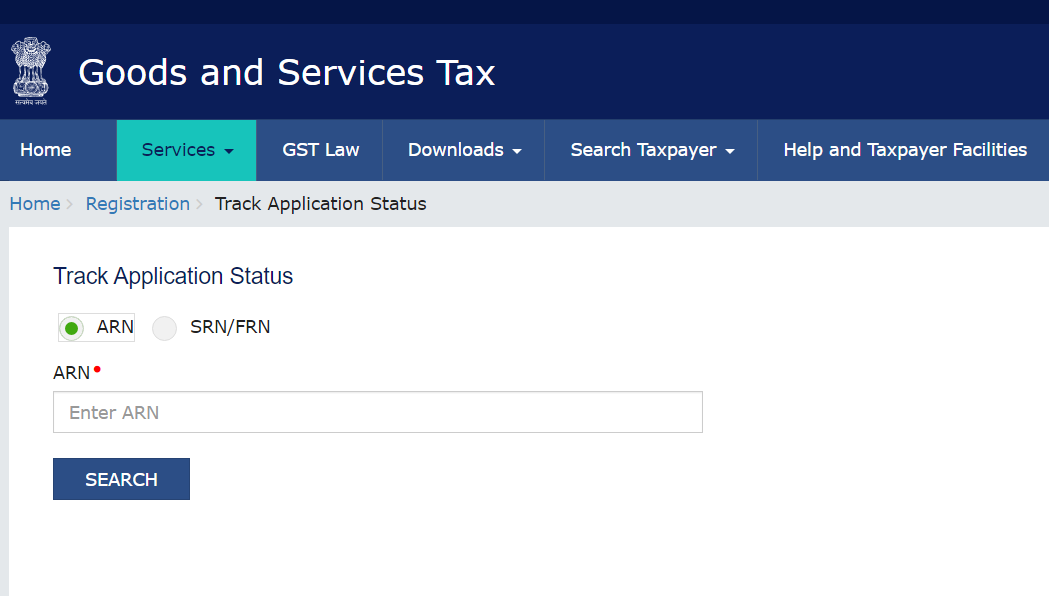

Q : How to check GST Registration Status with ARN ?

A : To check GST status application using the ARN,

1. Visit the GST Portal (www.gst.gov.in),

2. Navigate to the ‘Registration’ section,

3. Select the ‘Track Application Status’ option.

4. Enter your ARN to view the current status of your application.

Q : What are the steps for GST registration?

A : Below are the steps for GST Registration :

• GST Registration will be made online on www.gst.gov.in

• Navigates to services > Registration > New Registration.

• Generate a Temporary Reference Number (TRN) by filling basic information (PAN, mobile no., mail ID etc.)

• Complete online application with business details.

• Upload all the required documents.

• Verification will be done by GST authorities.

• After verification by GST authorities, if they are satisfied with all documents and information provided, then GST Registration will be granted.

Q : Can we apply for GST registration online?

A : Yes, there is only online procedure for GST Registration.

Q : How much cost for GST Registration?

A : GST Registration procedure is absolutely free. Government does not take any fees for registration. However, you have to pay professional charges to CA, Tax Consultant for their professional services.

Q : Where can we find videos on GST registration?

A : You can download our App Law Legends where you will get the video for GST Registration.

Q : GST Registration process in Hindi.

A : You can download Law Legends where you will get the full explanation for GST Registration in Hindi.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Understanding Income Tax Rebate under section 87A

The government has set up provisions to reduce the tax liability, like claiming income tax relief under section 87A of the income tax act, which aims to ensure taxpayers with low taxable income do not face the burden of paying more taxes. This rebate helps taxpayers to reduce their tax liability. Resident individuals can claim the rebate of ₹ 12,500 or ₹ 25,000 based on the tax regime and income criteria. In this article eligibility to claim, calculation of rebate and other relevant matters are discussed.

Eligibility to claim rebate under Section 87A of the Income Tax Act:

- Must be a resident individual taxpayer of India

- Total income of the individual after deducting eligible deductions under chapter VI-A, below ₹5,00,000. This limit is increased to ₹ 7,00,000 for the new tax regime from AY 2024-25

- Rebate is available to only an Individual & not to any Firm or Company or HUF.

- Senior citizens can also avail the benefit of the rebate

- Rebate is available under both the old tax regime and the new tax regime.

This rebate can be claimed against the tax liability in respect of normal income which is taxed at the slab rate, long term capital gains under Section 112 of the Income Tax Act. (Section 112 applies for long-term capital gains on the sale of any capital assets other than listed equity shares as well as equity oriented schemes of mutual funds.) This rebate can also be availed against the tax liability for short-term capital gains on listed equity shares, equity oriented schemes of mutual funds under Section 111A, on which tax is payable at flat rate of 15%.

Rebate under Old Tax Regime

Tax rebate for FY 2022-23 (AY 2023-24) remains unchanged. If your taxable income is up to ₹ 5,00,000, you can get a maximum tax rebate of ₹ 12,500.

Rebate under New Tax Regime

To make the new tax regime more lucrative, several amendments are proposed in budget 2023. From the FY 2023-24(AY 2024-25)], a resident individual with taxable income up to ₹ 7,00,000 and opting for new tax regime will get a rebate of ₹25,000 or the amount of tax payable (whichever is lower). However, for the old tax regime, the threshold limit will remain the same, i.e. ₹ 12,500 for income up to ₹ 5,00,000.

Incomes Not Eligible for Tax Relief

i. Special Incomes

Special incomes like income from gambling winnings, online gaming wins, virtual digital assets (VDA), betting wins, or game show wins are taxable at flat tax rate of 30% plus surcharge and cess. These incomes are not eligible for tax rebates under Section 87A of the new tax regime.

ii. Long-term capital gain Income:

The rebate provided under Section 87A cannot be claimed against tax on long-term capital gains resulting from the transfer of certain securities under Section 112A of the Income Tax Act, 1961.

In other words, if an individual is having taxable income which qualifies for the tax rebate under section 87A, and also having LTCG from equity shares or equity mutual funds, in this case, he requires to pay tax at a special rate of 10% on the LTCG amount without considering the rebate.

This provision is applicable for old as well as the new tax regime.

For example, if Mr. Ram an individual has a net taxable salary of ₹ 4.3 lakh a year and LTCG of ₹ 1.20 lakh, he pays 10% tax on the LTCG amounting to ₹ 20,000 plus cess @ 4%, total ₹ 2080. The tax payable on the net taxable salary would still be eligible for the rebate under section 87A, reducing their tax liability.

How to Calculate Income Tax Rebate under Section 87A

After the new union budget and introduction of the new tax regime from FY 2023-24 (AY 2024-25), the income tax rebate calculation varies based on whether you have chosen a new or old tax regime.

For the Old Tax Regime

Step 1: Calculate the gross total income, including income from all sources.

Step 2: Deduct deductions and exemptions for which you are eligible, such as 80C, 80D, HRA, LTA, etc.

Step 3: Calculate the net taxable income by subtracting deductions and exemptions from gross total income.

Step 4: If net taxable income is less than ₹ 5,00,000, you are eligible for a tax rebate under Section 87A, which will be automatically considered during return filing.

Step 5: Your tax payable will be zero if your income is ₹ 5,00,000 or below under the old tax regime. And there are no special incomes that are not eligible for the rebate.

For the New Tax Regime

Step 1: Calculate the gross total income, including income from all sources.

Step 2: Deduct applicable deductions under Section 80CCD (2) for the employer's contribution to the employee's NPS account. Salaried employees get a standard deduction of ₹ 50,000 as per section 16.

Step 3: Calculate net taxable income by subtracting applicable deductions from gross total income.

Step 4: If net taxable income is ₹ 7,00,000 or lower, you are eligible for a tax relief under Section 87A, which will be automatically considered during return filing.

Step 5: Your tax payable will be zero if your income is ₹ 7,00,000 or below and there are no special incomes that are not eligible for the rebate.

Marginal Relief under Section 87A For New Tax Regime

As per Section 87A, the tax rebate can only be availed if the total taxable income is less than the prescribed limit. Even though the prescribed limit has been increased under the new tax regime a slight increase in income from ₹ 7,00,000 will not remove the tax rebate benefit due to marginal relief.

The marginal relief for income tax rebate is a new amendment to Section 87A applicable only to the new tax regime. Instead of paying the full tax amount if your income is more significant than ₹ 7,00,000, you can pay only a small amount for the excess income. The tax payable will not exceed the income of more than ₹ 7,00,000. So, the tax you must pay will be less than the difference between your total taxable income and ₹ 7,00,000.

It can be easily understood with the following example:

| Total Income | Tax Liability before claiming rebate U/s 87A | Excess Income above 7,00,000 | Excess of tax over income earned above 7,00,000 | Rebate available u/s. 87A | Net tax payable after rebate |

| 1 | 2 | 3= (1-7Lac) | (4=2-3) | 5 | (6=2-5) |

| 7,00,000 | 25,000 | – | 25,000 | 25,000 | – |

| 7,05,000 | 25,500 | 5,000 | 20,500 | 20,500 | 5,000 |

| 7,10,000 | 26,000 | 10,000 | 16,000 | 16,000 | 10,000 |

| 7,20,000 | 27,000 | 20,000 | 7,000 | 7,000 | 20,000 |

| 7,25,000 | 27,500 | 25,000 | 2,500 | 2,500 | 25,000 |

| 7,27,780 | 27,780 | 27,780 | – | – | 27,780 |

| 7,30,000 | 28,000 | 30,000 | -2,000 | – | 28,000 |

FAQs

Q1. Can non-resident individuals claim tax rebate under section 87A?

Ans. Rebate u/s 87A is not available to non-resident individuals can claim.

Q2. Is health education cess included while calculating rebate under 87A?

Ans. No, the tax rebate is calculated and availed before adding health and education cess to the total tax liability.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

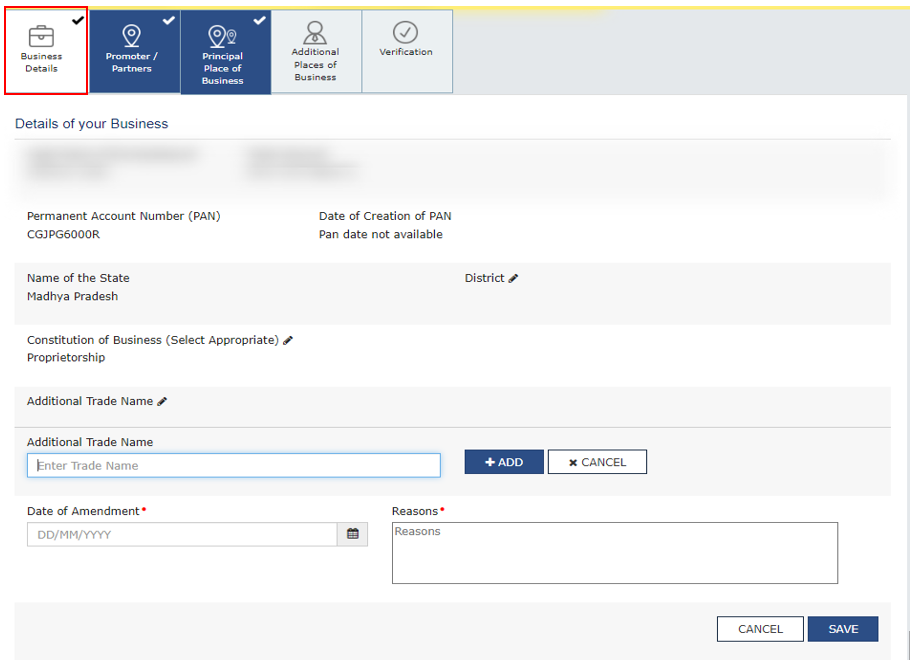

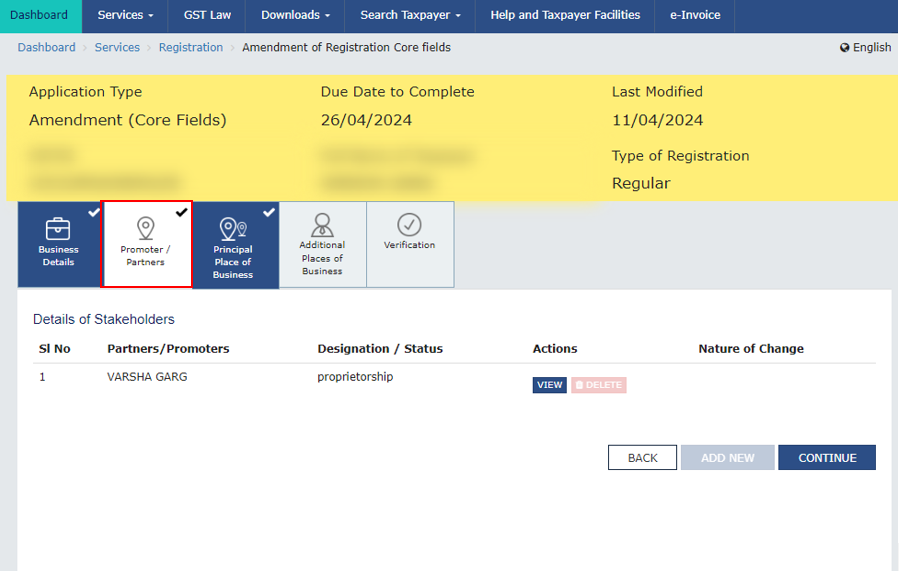

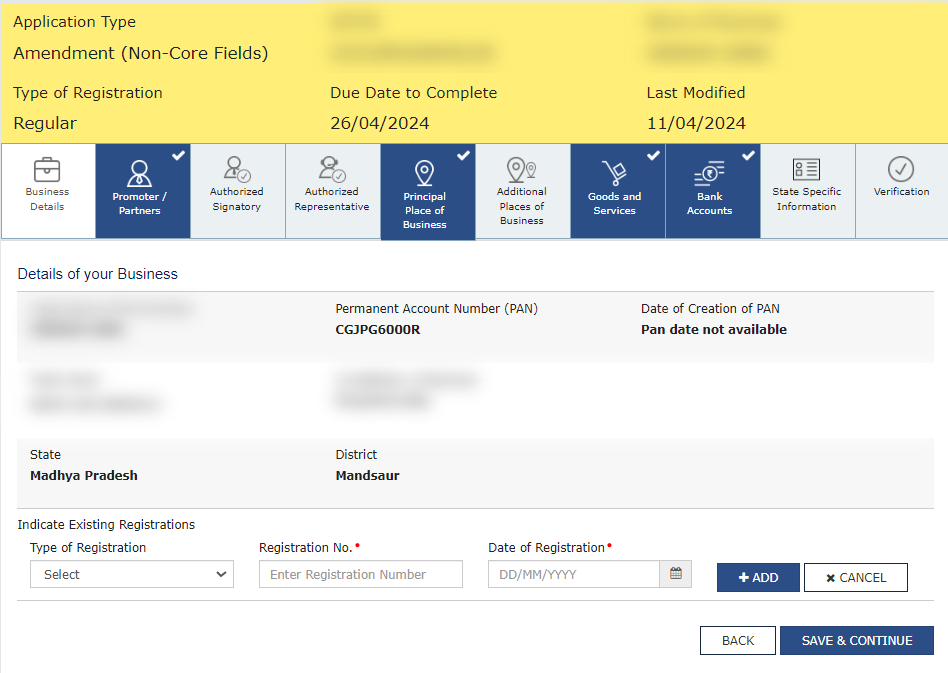

In this article we will discuss that after getting the GST registration, there may be a need to modify registration details later on due to mistakes made while applying for GST registration or over the time any changes made in business details like Change in Trade Name, addition and deletion of Stakeholders, add Business license in GST, add or Edit in Bank Account.Where there is any change in any of the particulars furnished in the application for registration either at the time of obtaining registration or as amended from time to time, the registered person shall, within a period of 15 days of such change, submit an application along with the documents relating to such change at the common portal.

There are 2 types of changes–

• Change in Core Field

• Change In Non- Core Field

Change in Core Field - If changes related to core-field then permission of the proper officer is required like -

(a) Change in Trade Name (not involving change in PAN).

(b) Addition and deletion of Stakeholders

(c) Change in Principal Places of Business or additional place of business.

Proper officers may approve or reject amendments in the registration particulars.

Change in Non-Core-Field- In case of change in the non-core field permission of proper officer is not required. Amendment in non-core field can be made directly on the common portal i.e.-

(a) Add Business license

(b) Add Authorized Signatory

(c) Add Authorized Representative

(d) Update Residential Address

(e) Addition or deletion in Bank Account.

(f) Change in Email ID or Mobile No.

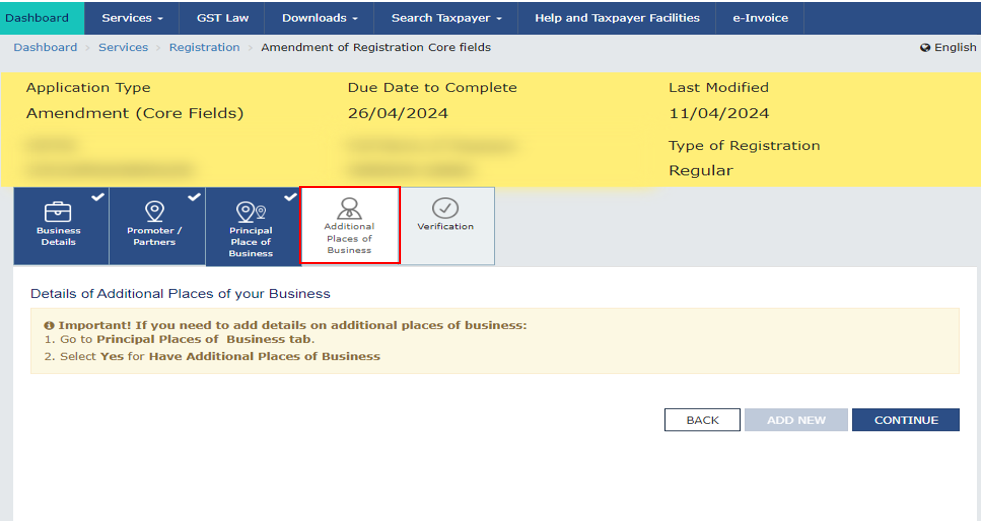

Steps to Follow For Amendment In Core-Field –

Step -1 Log in to GST Common Portal.

Go to Service > Registration > Click on Amendment of Registration Core Fields

After clicking on the Amendment of Registration Core Fields, this type of window opens where we show Business details, Promoter/Partners, Principal Place of Business, and Additional Place of Business.

If you want to change in Business Details click on Business Details and make the necessary amendments :-

If you want to change in Promoter Partners details, click on Promoter Partners details and make the necessary amendments :-

If you want to change in Principal Place of Business, click on Principal Place of Business details and make the necessary amendments.

If you want to change in Additional Place of Business, click on Additional Place of Business details and make the necessary amendments.

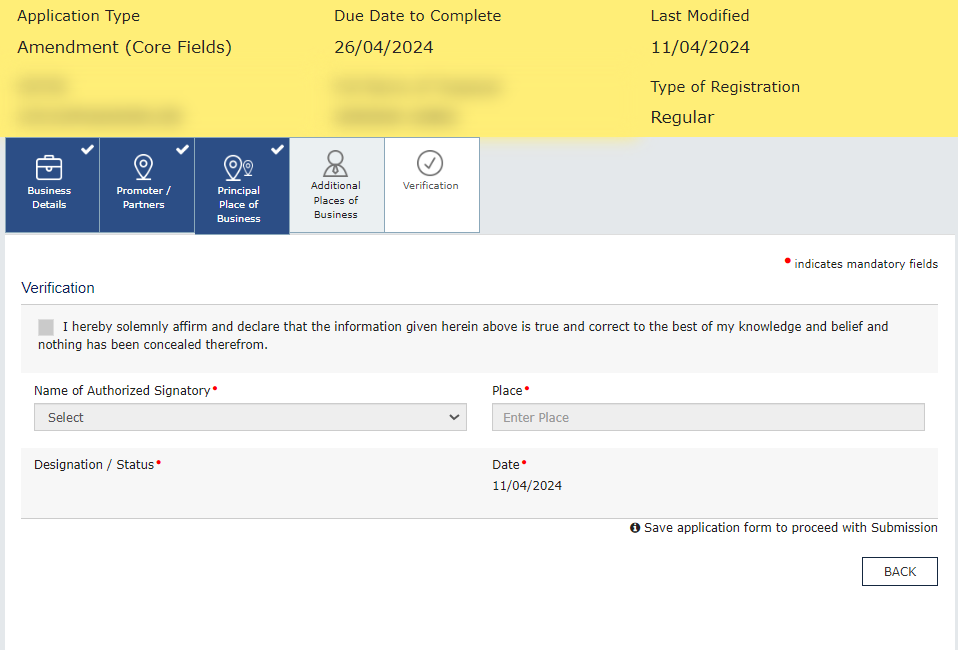

After the necessary changes Click on Verification, check box select Authorized signatory enter the place and verify through EVC or Digital Signatory

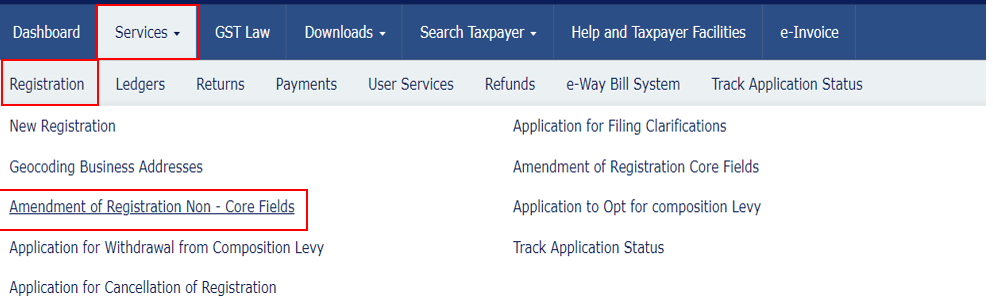

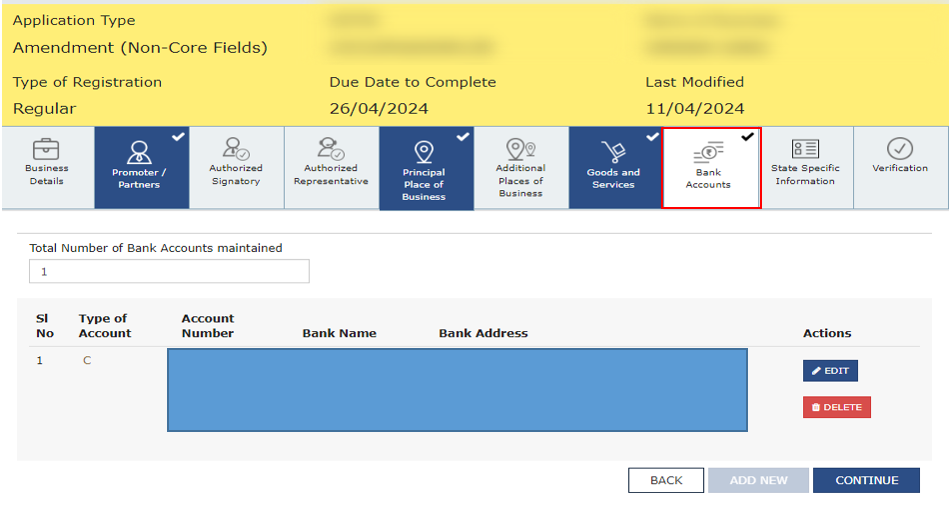

If you want to change in the Non-core field –

Go to service > Registration > Amendment of Registration Non-Core Fields

After clicking on "Amendment of Registration Non-Core Fields," this type of window will appear :-

If you want to make change in Bank Account details, click on bank accounts and make necessary amendment.

After the necessary amendment Click on Verification, click on Verification check box, select Authorized signatory & enter the place and verify through EVC or Digital Signatory.

After verification, a message confirming successful application submission appears upon submitting an application for registration amendment.

In the next 15 minutes, you will receive an acknowledgement to your registered e-mail address and mobile phone number.

FAQs on How to change GST registration details of a business under GST:

Q.1 What is the time limit for amendment in GST registration?

Ans. Within a period of 15 days of such change, submit an application along with the documents relating to such change at the common portal.

Q.2 How to change your mobile number & email in the GST portal?

Ans. If change in mobile no. or email id then Use the Amendment of Registration - Non-Core Fields and option to update your contact details.

Q.3 How to add/remove additional place of business?

Ans. If change in an additional place of business then use the amendment of registration – Core field. And update additional place of business.

Q.4 In case of Change in Core-Field proper officer prior approval is required?

Ans. Yes, if any changes in core-field than proper officer prior approval is required.

Q.5 How to change the Principal Place of Business?

Ans. If change in the principal place of business then use the amendment of registration – Core field and make the necessary amendment.

Q.6 What Types of changes are there?

Ans. There are 2 types of changes -

• Change in Core-field.

• Change in Non-core field.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Tax Rates for a salaried employee

2. Rebate under Section 87A

3. Rate of Surcharge

4. Comparison of old tax regime and new tax regime

5. Which regime is beneficial?

6. How to opt for the new tax regime?

As per the provision of the Income Tax Act the income under the head salary shall be taxable on a due basis or receipt basis, whichever is earlier. To tax the income there must be an employer and employee relationship. As per the provisions, salary due shall be chargeable to tax, even if it is not paid during the year.

1. Tax Rates for a salaried employee

A. Normal Tax Rates (Old tax regime)

First Schedule of the Finance Act prescribes the normal tax rates. The tax rates in the case of an individual have been given in the below table:

| Net income range | Resident Super Senior Citizen | Resident Senior Citizen | Any other Individual |

| Up to ₹ 2,50,000 | Nil | Nil | Nil |

| ₹ 2,50,001- ₹ 3,00,000 | Nil | Nil | 5% |

| ₹ 3,00,001- ₹ 5,00,000 | Nil | 5% | 5% |

| ₹ 5,00,001- ₹ 10,00,000 | 20% | 20% | 20% |

| Above ₹ 10,00,000 | 30% | 30% | 30% |

‘Super senior citizen’ means an individual whose age is 80 years or more at any time during the relevant previous year.

‘Senior citizen’ means an individual whose age is 60 years or more at any time during the relevant previous year but less than 80 years on the last day of the previous year.

B. Normal Tax Rates (New tax regime)

A New tax regime has been introduced through section 115BAC of the income tax act which provides reduced tax slabs for individuals. However, to avail of the benefit of this tax regime, the taxpayer has to forgo some specified exemptions and deductions.

If an eligible taxpayer opts for this regime, the income shall be taxable at the following rate:

| Total Income (₹) | Rate |

| Upto 3,00,000 | Nil |

| From 3,00,001 to 6,00,000 | 5% |

| From 6,00,001 to 9,00,000 | 10% |

| From 9,00,001 to 12,00,000 | 15% |

| From 12,00,001 to 15,00,000 | 20% |

| Above 15,00,000 | 30% |

2. Rebate under Section 87A

Old tax regime - A rebate of up to ₹ 12,500 is allowed under Section 87A to the individual. If the total income of such individual does not exceed ₹ 500,000 he can avail the rebate. Subject to specified conditions.

New tax regime - A resident individual paying tax as per the new tax regime under Section 115BAC shall be allowed a higher amount of rebate under Section 87A if the total income is up to ₹ 7,00,000. Further, if the total income of the resident individual marginally exceeds ₹ 7,00,000, he will be eligible for the marginal rebate.

3. Rate of Surcharge

In respect of an individual, the rate of surcharge for the assessment year 2024-25 shall be as under:

| Nature of Income | Range of Total Income | ||||

| Up to

₹ 50 lakhs |

More than

₹ 50 lakhs but up to ₹ 1 crore |

More than

₹ 1 crore but up to ₹ 2 crores |

More than

₹ 2 crores but up to ₹ 5 crores |

More than ₹ 5 crores |

|

| Short-term capital gain covered under Section 111A or Section 115AD | Nil | 10% | 15% | 15% | 15% |

| Long-term capital gain covered under Section 112A or Section 115AD or Section 112 | Nil | 10% | 15% | 15% | 15% |

| Dividend income (not being dividend income chargeable

to tax at a special rate under sections 115A, 115AB, 115AC, 115ACA) |

Nil | 10% | 15% | 15% | 15% |

| Unexplained income chargeable to tax under | 25% | 25% | 25% | 25% | 25% |

| Section 115BBE | |||||

| Any other income (if opted for the old tax regime) | Nil | 10% | 15% | 25% | 37% |

| Any other income (if opted for the new tax regime of Section 115BAC) | Nil | 10% | 15% | 25% | 25% |

Health and Education Cess

Every person is liable to pay health and education cess additionally at the rate of 4% on the amount of income tax plus surcharge.

4. Comparison of exemption/deductions available under the old tax regime and new tax regime of Section 115BAC

| Particulars | New tax regime | Old tax regime |

| Standard Deduction [Section 16(ia)] | Available | Available |

| Leave Travel concession [Section 10(5)] | Not Available | Available |

| House Rent Allowance [Section 10(13A)] | Not Available | Available |

| Official and personal allowances (other than those as may be prescribed) [Section 10(14)] | Not Available | Available |

| Allowances to MPs/MLAs [Section 10(17)] | Not Available | Available |

| Entertainment Allowance [Section 16((ii)] | Not Available | Available |

| Professional Tax [Section 16(iii)] | Not Available | Available |

| Interest on housing loan for self-occupied house property [Section 24(b)] | Not Available | Available |

| Deduction under Sections 80C to 80U other than specified under Section 80CCD(2), and Section 80CCH(2) [Chapter VI-A] | Not Available | Available |

| Set-off of any loss under the head "Income from house property" with any other head of income | Not Available | Available |

| Exemptions or deductions for allowances or perquisites provided under any other law for the time being in force | Not Available | Available |

5. Which regime is beneficial?

The decision to opt-out from the new tax regime will depend on the amount of exemptions and deductions available to the assessee. One should must compare the tax liability under both the regimes and then opt for the beneficial one.

For example, if an individual is willing to avail the deductions under Section 80C, Section 80D, and the interest on a housing loan under Section 24, it would be beneficial for him to opt for the old tax regime. On the other hand, if an individual is not availing deductions under the old tax regime, it would be beneficial for him to opt for the new tax regime.

6. How to opt for the new tax regime?

From the Assessment Year 2024-25, the new tax regime of Section 115BAC is the default tax regime. If an assessee does want to pay tax according to the old tax regime, he will have to explicitly opt out of the new tax regime and choose to be taxed under the old tax regime.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

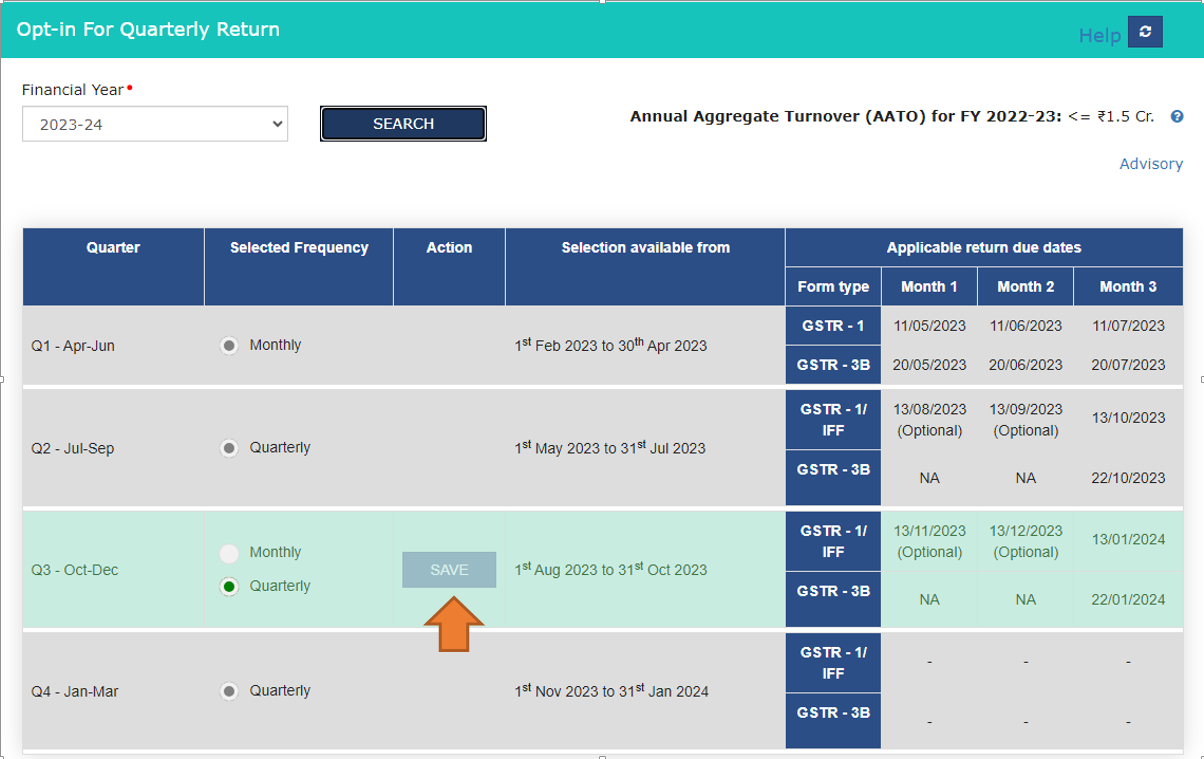

Introduction

The QRMP (Quarterly Returns with Monthly Payments) scheme enables eligible taxpayers to submit their Form GSTR-1 and Form GSTR-3B returns on a quarterly basis. Under this scheme, taxpayers are not obligated to file monthly returns. However, they are required to make tax payments on a monthly basis through challan submissions.

Eligibility for the Scheme

In terms of Notification No. 84/2020- Central Tax dated 10.11.2020, a registered person who is required to furnish a return in FORM GSTR- 3B and who has an Aggregate Annual Turnover of up to Rs. 5 Cr in the preceding financial year is eligible for the QRMP Scheme.

The Aggregate Annual Turnover for the previous financial year will be computed on the common portal, incorporating the information provided by the taxpayer in their returns for the tax periods of the preceding financial year. If the total annual turnover exceeds Rs. 5Cr in any quarter of the ongoing financial year, the registered person will be ineligible for the Scheme from the subsequent quarter.

Therefore, taxpayers with an aggregate turnover (computed on a PAN basis) for the current and preceding financial years amounts to Rs. 5 crore & less and who are required to file GSTR-3B return are eligible for the QRMP scheme.

The QRMP scheme is exclusively accessible to taxpayers who are required to file both Form GSTR-1 and Form GSTR-3B.

This scheme can be opted

- By registered taxpayers (Normal taxpayers, SEZ Developer, SEZ units)

- By taxpayers who have chosen to withdraw from the composition scheme.

- By persons who have applied for fresh registration whose AATO is up to ₹ 5 Crores.

Furnishing of details of outward supplies

The registered person opting for the QRMP Scheme must provide details of outward supply in FORM GSTR-1 on a quarterly basis in accordance with Rule 59 of the CGST Rules.

IFF facility has also been provided for the QRMP scheme. IFF stands for Invoice Furnishing Facility, through which, those who have opted for the QRMP scheme can declare the outward supplies of the first two months of a quarter through this facility.

It is highlighted that the IFF is not mandatory and is solely an optional facility made available to registered persons under the QRMP Scheme.

The details of invoices submitted through the IFF during the initial two months do not need to be provided again in FORM GSTR-1. As a result, the details of outward supplies made by such a registered person during a quarter will include information on invoices submitted using the IFF for each of the initial two months, along with details of invoices furnished in FORM GSTR-1 for the entire quarter. A registered person has the option to report the details of outward supplies made during a quarter exclusively in FORM GSTR-1, without utilizing the IFF.

This feature enables the filing of B2B invoices, credit notes and debit notes. The deadline for filing IFF for any given month is the 13th of the subsequent month.

If a registered person chooses the QRMP scheme and files details of outward supplies using the IFF facility, the recipient taxpayer can claim credit for those invoices within the same month.

If you possess multiple GSTNs under the same PAN, whether in different states or within the same state, you have the option to enroll in the QRMP scheme for specific GSTNs while opting out of the scheme for the others.

Timeline for out-in or opt-out from QRMP Scheme

| S. No. | Quarter of a particular year | QRMP Scheme can be opted in or opted out during the following period |

| 1 | Q1 (April – May – June) | 1st February to 30th April |

| 2 | Q2 (July – Aug – Sept) | 1st May to 31st July |

| 3 | Q3 (Oct-Nov-Dec) | 1st August to 31st October |

| 4 | Q4 (Jan-Feb-March) | 1st November to 31st January of next year |

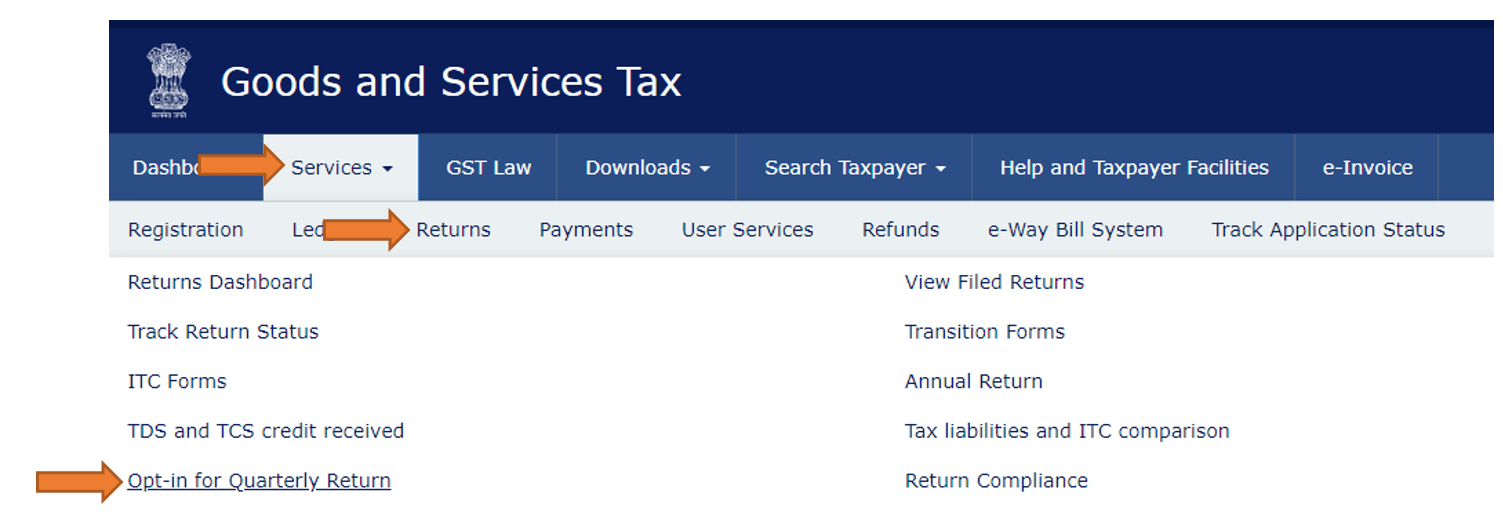

How to opt in/ opt-out from QRMP Scheme

The eligible taxpayer can choose to opt in or opt-out from the scheme by accessing the GST portal and navigating to Services > Returns > Opt-in for Quarterly Return or opt out of the QRMP scheme.

FAQ’s

Q-1: What is Quarterly Returns with Monthly Payment (QRMP) Scheme?

Ans. The Quarterly Returns with Monthly Payment (QRMP) Scheme enables eligible taxpayers to submit their Form GSTR-1 and Form GSTR-3B returns quarterly while fulfilling their tax obligations monthly via a challan.

Q-2: How can I switch from monthly to quarterly GST filing?

Ans. To opt in or opt out of the QRMP scheme, sign in to the GST portal with your valid credentials, then proceed to Services > Returns > Opt-in for Quarterly Return option.

Q-3: Who is eligible to file quarterly GST returns?

Ans. All taxpayers with an aggregate annual turnover (based on PAN) of up to ₹ 5 Crore in the current financial year and the preceding financial year (if applicable) and who have already filed their last due Form GSTR-3B return, are eligible for the QRMP scheme.

Q-4: Is there a turnover limit for filing quarterly GST returns?

Ans. Taxpayers with an aggregate annual turnover of up to Rs. 5crores are allowed to file quarterly GST returns.

Q-5: What are the differences between monthly and quarterly GST returns?

Ans. Monthly GST returns require taxpayers to file returns and pay taxes every month, whereas quarterly returns involve filing returns once every quarter while making monthly tax payments.

Q-6: What is the payment due date for quarterly GST returns?

Ans. In the first two months of the quarter, payment of liability can be made by either of the following two methods:

a. Fixed Sum Method: Portal will generate a pre-filled challan in Form GST PMT-06. The system-generated pre-filled challan in this case is commonly also known as 35% challan.

b. Self-Assessment Method: The actual tax due is to be paid through challan, in Form GST PMT-06, by considering the tax liability on inward and outward supplies and the input tax credit available for the period as per law.

The due date for making payment by challan is 25th of the next month.

Q-7: What is the turnover limit for filing monthly GST returns?

Ans. There's no specific turnover limit for filing monthly GST returns. However, taxpayers with a turnover exceeding Rs. 5crores are generally required to file monthly returns.

Q-8: Is the QRMP scheme available to every taxpayer?

Ans. The QRMP scheme is accessible exclusively to taxpayers obligated to file Form GSTR-1 and Form GSTR-3B returns and it can be opted for by:

• Registered taxpayer (Normal taxpayer, SEZ Developer, SEZ unit)

• Taxpayers who have chosen to withdraw from the composition scheme.

• Person who has applied for fresh registration whose AATO is up to ₹ 5 Crores.

Q-9: I have opted for the QRMP scheme. Will I now be required to file both Form GSTR-1 and Form GSTR-3B on quarterly frequency?

Ans. Certainly, under the QRMP scheme, both Form GSTR-1 and Form GSTR-3B are to be filed on a quarterly basis. However, tax payments are required to be made monthly, with tax dues settled through a challan.

Q-10: If a tax payer has opted for QRMP scheme and his AATO exceeds ₹ 5 Crores, then will the scheme be valid?

Ans. If a taxpayer's Aggregate Annual Turnover (AATO) exceeds the ₹ 5 Crore limit, they will no longer qualify for the QRMP scheme.

Q-11: Whether it is required to exercise the option every quarter/year?

Ans. Registered persons do not need to opt in or out of the scheme every quarter. Once the option has been chosen, they will continue to submit returns according to the selected option for future tax periods, unless they decide to revise the option or their Aggregate Annual Turnover (AATO) exceeds ₹ 5Crore.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Beta feature

Beta feature

Beta feature

Form DRC-07 serves as a vital link between taxpayers and tax authorities ensuring transparency, compliance, and fair resolution of any outstanding tax obligations.

What is Form DRC-07 in GST?

Form GST DRC 07 is a summary of the order issued by the Proper Officer, to be uploaded on the GST Portal. It specifies the amount of tax, interest, or penalty payable by the person chargeable with tax under Section 73(9), or Section 74(9) or Section 76(3) of CGST Act, 2017.

This form outlines the details of the demand and provides an opportunity for the taxpayer to respond or appeal against the demand.

Legal Framework of DRC 07 Summary Orders

Issuance of Form DRC-07:

Tax officers have the authority to issue Form DRC-07 when they identify unpaid tax liabilities based on their assessment and the responses filed by taxpayers in compliance with the show-cause notice.

Demand should be substantiated by valid reasons and calculations, clearly defining the nature of the demand and the period to which it pertains.

Time Limit for Issuance of Form DRC-07:

In response to the show cause notice, the taxpayer is required to frame a reply along with relevant supporting documents and the reply shall be filed via Form GST DRC-06 wherein he can also opt for a personal hearing.

After considering the reply filed by the taxpayer, the officer will issue an order in Form GST DRC-07.

Tax authorities should issue Form DRC-07 within the prescribed time limit upon identifying tax liabilities. This timeframe assists taxpayers in receiving timely notifications regarding their outstanding dues.

Communication to Taxpayer:

Upon issuance of Form DRC-07, tax authorities are required to send a copy of the form to the taxpayer's registered email address and their GST portal account.

Appeal Process:

In accordance with Section 107(1), any taxpayer or unregistered person who is aggrieved by a decision or order passed against them by the adjudicating authority can file an appeal to the appellate authority within three months from the date on which such decision or order is communicated to them.

Hence, if taxpayers disagree with the demand raised in Form DRC-07, they have the option to appeal the decision.

Filing of GST appeal:

To initiate an appeal, the appellant is required to submit Form GST APL-01 along with the necessary documents. Upon submission, a provisional acknowledgment will be promptly issued.

However, the final acknowledgment, which includes the appeal number, will be provided in Form GST APL-02 only after the manual submission of Form GST APL-01, a copy of the appealed order and a statement outlining the facts and grounds for the appeal, within seven days of receiving the provisional acknowledgment.

Key Components of DRC 07 Summary Orders

The DRC-07 form encompasses the following key points:

• Details of Order:

Order number

Order date

Tax period

• Issues Involved: It outlines the specific issues involved, such as classification, valuation, rate of tax, suppression of turnover, excess input tax credit claimed, excess refund released, place of supply, and others

- Description of Goods/Services: This section includes the serial number, HSN code and description of the goods or services involved.

• Details of Demand: It specifies the amount of demand in the form of the tax, interest and penalty payable by the person chargeable with tax together with tax rate, turnover, tax period & place of supply.

FAQ’s

Q1. What is the essence of DRC 07 summary orders?

Ans. Form DRC-07 is a specialized type of demand summary order issued by tax authorities to taxpayers with significant tax liabilities.

Q2. Where is the designated location to submit Form DRC 07?

Ans. You can file on the GST portal. GST Portal -> My Application -> Form DRC-07

Q3. Can a DRC 07 summary order be issued without a show- cause notice?

Ans. No, a DRC 07 summary order cannot be issued without a show- cause notice.

Q4. Which section of the GST Act gives foundational pillars to DRC-07?

Ans. Section 73(9), or Section 74(9) or Section 76(3) of CGST Act, 2017 provides legal power to DRC-07.

Q5. What does DRC stand for in GST?

Ans. DRC stands for "Demand and Recovery Form" in GST.

Q6. Can a DRC 07 summary order be issued electronically?

Ans. Yes, a DRC 07 summary order can be issued electronically in the CBEC-GST portal.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. New functionality

2. How to opt Old regime

3. Changes in New ITR forms

The financial year 2023-24 has ended and it’s time to finalise the income earned during the year and file the income tax return. As finance act amended some section which increased the discloser liability of the taxpayers. CBDT brought changes in the ITR 3 form for the assessment year 2024-25. In this article we discuss the changes and things that should be kept in mind while filing the return.

New functionality

• ITR verification through EVC

To verify the return of income through an electronic verification code amendment has been made to Rule 12. Now individuals and HUF who are liable to tax audits under Section 44AB can verify ITR through EVC code. Earlier, which can be done only through a digital signature.

The new tax regime is the default tax regime; taxpayers must choose to opt-out to go with the old regime

Amendment has been brought through the Finance Act 2023 in the provisions of Section 115BAC to make it the default tax regime for the assessee being an Individual, HUF, AOP, BOI and AJP. If an assessee wants to pay tax according to the old tax regime, he will have to explicitly opt out of the new tax regime (default) and choose to be taxed under the old tax regime.

How to exercise this option-

• Assessee having income (other than income from a business or profession)

To exercise this option, the assessee must select the tax regime at the time of filing the return of income (ITR) for the relevant assessment year under Section 139(1).

• Assessee having income from a business or profession

Such assessee can also opt for the old tax regime for a relevant year. To exercise this option assessee is required to file Form No. 10-IEA. This form is required to be filed on or before the due date for filing the return of income under Section 139(1).

In simple words, an assessee filing ITR 3 will be required to file Form 10-IEA to opt for the old tax regime. If he has income from Business or profession

Changes in New ITR Forms

Some other changes have been incorporate in the new ITR Forms

1. Details of Legal Entity Identifier (LEI)

To uniquely identify parties in financial transactions worldwide the Legal Entity Identifier (LEI) is used. It contains 20-character which is a combination of alpha-numeric code. For better risk management it has been implemented which helps to improve the quality and accuracy of financial data reporting systems.

As per the RBI Regulations, all single payment transactions of ₹ 50crores and above undertaken by entities (non-individuals) should include remitter and beneficiary LEI information. This applies to transactions undertaken through the NEFT and RTGS payment systems.

The new ITR Forms have incorporated a column for furnishing details of the LEI number to be in lined with the RBI regulations,. Such taxpayer who are seeking a refund of ₹ 50crores or more is required to furnish the LEI details.

2. Section44AB: Furnishing of the reason for tax audit

In the New ITR-3 form the assessee subject to audit under Section 44AB is required to provide additional details regarding circumstances under which the entity is obligated to undergo an audit, such as:

• Sales, turnover or gross receipts exceed the limits specified under Section 44AB;

• Assessee falling under Section 44AD/44ADA/44AE/44BB but not opting for presumptive basis;

• Others.

3. Acknowledgement number of the Audit Report and UDIN

Entities are required to furnish the acknowledgment number of the audit report and the UDIN at the time of providing information about audits conducted under Section 44AB, including audits under Section 92E.

4. To claim an enhanced turnover limit “Receipts in Cash” column added

The turnover threshold limit has been enhanced through the Finance Act 2023, from ₹ 2 crores to ₹ 3 crores for opting for the presumptive taxation scheme under Section 44AD. If the receipts in cash do not exceed 5% of the total turnover or gross receipts for the previous year.

Similarly, Amendment has been made to Section 44ADA to enhance the threshold limit of gross receipts from ₹ 50 lakhs to ₹ 75 lakhs, if the receipts in cash do not exceed 5% of the total gross receipts for the previous year.

The CBDT has amended ITR forms to give effect to the above amendments. Under the Schedule BP a new column of “receipts in cash” for disclosing cash turnover or cash gross receipts has been inserted.

5. Details of the sum payable to MSME

A new clause (h) in Section 43B has been inserted through the Finance Act 2023 to provide that any sum payable to a micro or small enterprise beyond the time limit specified in Section 15 of the Micro, Small and Medium Enterprises Development Act 2006 (MSME Act) shall not be allowed as a deduction.

Accordingly, to disclose the sum payable to Micro or small enterprises beyond the specified time limit per the MSMED Act, a new column is inserted under Part A-OI (Other Information).

6. Information pertaining to the Capital Gains Accounts Scheme

Information about the capital gains earned by the taxpayer is required to be disclosed in the Schedule-CG of ITR forms. This schedule requires disclosures about the capital asset sold, the particulars of the buyer, and specifics regarding the amount spent for claiming exemptions.

In the new ITR-2, Schedule-CG has been modified to gather more information regarding the sums deposited in the Capital Gains Accounts scheme (CGAS). The following additional details towards CGAS are required to fill in the revised schedule:

• Date of deposit

• Account number

• IFS code

Until the previous Assessment Year, details pertaining to the sum deposited in CGAS were only required to be provided by the taxpayers.

7. Winnings from online games chargeable under Section 115BBJ

To tax winnings from online games, w.e.f. Assessment year 2024-25 the Finance Act 2023 has inserted a new Section 115BBJ. With effect from 01-04-2023 a corresponding Section 194BA has also been inserted for the deduction of tax from the net winnings from online games. Thus, all winnings from online games on or after 1-4-2023 shall be taxable under Section 115BBJ and subject to TDS under Section 194BA.

To disclose income by way of winning from online games chargeable under Section 115BBJ, to report such income in ITR form, Schedule OS has been amended.

8. Details of contributions made to political parties : New Schedule 80GGC

Deduction for contributions to a political party or electoral trust is allowed under Section 80GGC. The new ITR forms include a new Schedule 80GGC, which requires the furnishing of the following details:

• Date of Contribution

• Contribution Amount (with a breakdown of contributions made in cash and other modes)

• Eligible Contribution Amount

• Transaction Reference Number for UPI transfer or Cheque Number/IMPS/NEFT/RTGS

• IFS Code of the Bank

9. ‘Schedule – Tax Deferred on ESOP’ seeks PAN and DPIIT Registration Number of the eligible start-up

When an employer allots securities to an employee under ESOP scheme, free of cost or at a concessional rate, it is taxable as perquisite in the year of allotment of securities. However, the liability for payment or deduction of tax on such perquisite is deferred in the case of an employee of an eligible start-up.

Information relating to such tax-deferral as mentioned in Section 17(2)(vi) is furnished in the ‘Schedule – Tax Deferred on ESOP’. This schedule seeks information such as assessment year, amount of deferred tax brought forward, amount of tax payable in the current assessment year, balance amount of tax deferred to be carried forward to the next assessment year, etc.

In order to enhance transparency, the new ITR forms amended this schedule to seek additional details such as the PAN of the employer (an eligible start-up) and its DPIIT Registration number.

10. New column to claim deduction under Section 80CCH

A new Section 80CCH has been inserted through the Finance Act 2023, which states that individuals enrolled in the Agnipath Scheme and subscribing to the Agniveer Corpus Fund on or after 01-11-2022 will be eligible for a deduction for the amount deposited in the Agniveer Corpus Fund.

To furnish the amount eligible for deduction under Section 80CCH, new ITR forms have been amended.

11. Schedule 80U inserted for claiming deduction if the assessee is a person with a disability

In the new ITR-3, a new ‘Schedule 80U’ has been added, requiring details of deduction in case of a person with a disability.

The ‘Schedule 80U’ required the following details:

• Nature of disability

• Date of filing Form 10-IA

• Acknowledgment number of the Form 10-IA

• UDID number (If available)

12. Details towards maintenance & medical treatment of the person with a disability: New Schedule 80DD

In the previous ITR forms, the taxpayers were required to mention the amount claimed as a deduction under Section 80DD in Schedule VI-A. The new ITR forms have introduced a new ‘Schedule 80DD’ seeking details of deduction in respect of maintenance, including medical treatment of a dependent with a disability.

These details comprise:

• Nature of the disability

• Type of dependent (spouse, son, daughter, father, mother, brother, sister or member of the HUF)

• PAN of the dependent

• Aadhaar of the dependent

• Date of filing and acknowledgement number of Form 10-IA

• UDID Number

13. Reporting of dividend income derived from a unit located in IFSC

The Finance Act, 2023 has amended the provisions of Section 115A by inserting a proviso to Section 115A(1)(a)(A) to provide that the dividend income received from a unit in an IFSC, as referred to in Section 80LA(1A) shall be taxed at a reduced tax rate of 10% instead of 20%.

‘Schedule OS’ has been amended in new ITR forms to incorporate such change.

14. Schedule-OS includes an additional column for the declaration of bonus payments received under life insurance policies

ITR forms have been updated to incorporate reporting of the sum received from excess or high premium life insurance policies which are chargeable to tax under the head ‘other sources’. The amendment has been made in the Schedule-OS.

15. Reporting of sums received by a unit holder from the business trust

[ITR 2, 3 and 5]

The Finance Act, 2023, inserted clause (xii) to Section 56(2) which provides that the sum received by the unit holder shall be taxable under the head of other sources.

Further, in case of redemption of units, under the proviso to clause (xii) of Section 56(2) it is provided that the cost of acquisition of the unit shall be allowed to be deducted from the sum received on redemption.

ITR forms have been amended to include a new column under Schedule-OS to report income earned by the unit holder under Section 56(2)(xii).

16. Reporting of all banks held at any time

From this assessment year it is obligatory for the taxpayer to disclose all the bank accounts they have ever held, with the exception of dormant accounts. And amendments have been made in this regard in the new ITR forms.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Any taxpayer or unregistered person, who is aggrieved by any decision or order passed against them by the adjudicating authority, can appeal to the appellate authority within three months from the date on which such decision or order is communicated to them.

Who is Adjudicating Authority?

As per Section-2(4), the term "Adjudicating Authority" refers to any authority appointed or authorized to make decisions or issue orders under this Act. However, it does not include certain specific entities such as the Central Board of Indirect Taxes and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the National Appellate Authority for Advance Ruling, the Appellate Authority, the Appellate Tribunal and the Authority mentioned in subsection (2) of section 171.

Orders that can be appealed:

Below are the orders against which the aggrieved party may choose to appeal:

| S.No. | Particular |

| 1. | Enforcement Order |

| 2. | Assessment or Demand Order |

| 3. | Registration Order |

| 4. | Refund Order |

| 5. | Assessment Non-Demand Order |

| 6. | LUT Order |

Filing of GST appeal:

To file an appeal, the appellant must submit Form GST APL-01 along with necessary documents. Upon filing, a provisional acknowledgment will be promptly issued. However, the final acknowledgment, containing the appeal number, will be provided in Form GST APL-02 only after the manual submission of Form GST APL-01, a copy of the appealed order and a statement detailing facts and grounds for the appeal, within seven days of receiving the provisional acknowledgment.

Time Limit for filing an appeal

The appeal shall be filled within three months from the date of communication of order by the adjudicating authority. However, as per the provision for condonation of delay in filing the appeal, a maximum of one additional month is allowed only after providing a justified reason for the delay along with suitable evidence.

Appeal Fee

As such there is no fees for filing an appeal. However, while filing an appeal a pre deposit is required i.e. a specific amount has to be deposited along with the appeal.

Pre deposit amount is as follows:

| S.No. | Particulars | Pre deposit amount |

| 1 | In respect of the amount admitted | 100% of tax, interest, fine, fee and penalty |

| 2. | In respect of disputed amount | 10% of the tax in dispute, subject to maximum of twenty five crore rupees |

| 3. | In case of order with respect to detention or seizure | 25% of the penalty as specified in the order has to be paid. |

Adjournment of hearing:

The Appellate Authority can postpone an appeal hearing and give more time to the parties involved if there's a valid reason shown at any stage. They must record the reasons in writing. However, no party shall be granted adjournment more than three times during the hearing of the appeal.

Time Limit to decide an appeal:

The appellate authority, where feasible, shall hear and decide each appeal within a period of one year from the date of its filing. However, if a court or tribunal has put a stay on the issuance of order, that period of stay shall not be included while computing the one-year period.

Can we add another ground of appeal at the time of hearing?

During the time of hearing of an appeal, the Appellate Authority may permit an appellant to add any additional ground of appeal that were not initially specified, provided it is satisfied that the omission of that ground was not intentional or unreasonable.

FAQs

Q1. What is the time limit for filing an appeal under GST?

Ans. The appeal shall be filled within three months from the date of communication of order by the adjudicating authority.

Q2. What does "appellate authority" mean in GST?

Ans. The appellate authority refers to the body or person to whom an appeal can be made against an order passed by the adjudicating authority under GST.

Q3. What is the procedure for filing an appeal in GST?

Ans. To file an appeal in GST, one needs to submit Form GST APL-01 along with the required documents to the appropriate appellate authority within the stipulated time limit.

Navigate to Services > User Services > My Applications > Application Type as Appeal to Appellate Authority > NEW APPLICATION button. Select the Order Type from the drop-down list.

Q4. Is there a specific form for filing a GST appeal?

Ans. Yes, Form GST APL-01 is used for filling an appeal under GST.

Q5. Are there any fees for filing a GST appeal?

Ans. As such there is no fees for filing an appeal. However, while filing an appeal a pre deposit is required i.e. a specific amount has to be deposited along with the appeal.

Q6. What does "adjudicating authority" mean in GST?

Ans. The adjudicating authority in GST refers any authority appointed or authorized to make decisions or issue orders under this Act.

Q7. What are the grounds of appeal under GST?

Ans. Grounds of appeal under GST may include errors in the decision, incorrect interpretation of law, procedural irregularities or any other legal grounds as specified under GST laws.

Q8. What is Section 107 of the CGST Act about?

Ans. Section 107 of the CGST Act pertains to the filing of appeals to the appellate authorities under GST laws.

Q9. Who possesses the authority to file an appeal to the Appellate Authority?

Ans. Any taxpayer or unregistered person, who is aggrieved by any decision or order passed against them by the adjudicating authority, can appeal to the appellate authority within three months from the date on which such decision or order is communicated to them.

Q10. What will happen if appeal is not filled within the prescribed period?

Ans. The Appellate Authority has the discretion to extend the filing period by up to one month if convinced that the taxpayer had valid reasons preventing the submission of the appeal within the initial three-month period. In such cases, the appeal can be accepted within one month from the original deadline.

Q11. Is it mandatory to submit 10% of the disputed tax amount?

Ans. Prior to filing an appeal, it is a legal requirement to make a pre-deposit of at least 10% of the disputed tax amount. However, a lesser percentage may be permitted upon approval from the appropriate authorities.

Q12. Can I withdraw an Appeal application after filing it?

Ans. Yes, an Appeal application can be withdrawn.

Q13. Can an Appeal application be filed again after withdrawal?

Ans. After withdrawal, an appeal application can be filed for one more time. The Order ID will remain consistent, while a new ARN will be generated.

Q14. What are the various Appeal statuses?

Ans.

| S.No. | Description | Status |

| 1 | Appeal Form successfully filed | Appeal Submitted |

| 2 | Appeal Form successfully admitted | Appeal admitted |

| 3 | Appeal Form is Rejected | Appeal Rejected |

| 4 | When Hearing Notice is issued | Hearing Notice issued |

| 5 | When Counter Reply received against notice | Counter reply received |

| 6 | When Show cause notice is issued | Show cause notice issued |

| 7 | Appeal is confirmed/modified/rejected | Appeal order passed |

| 8 | When hearing is adjourned and next date is issued | Adjournment granted |

| 9 | When application is filed for Rectification | Rectification request received |

| 10 | When application for Rectification is rejected | Rectification request rejected |

| 11 | Appeal is order is rectified | Rectification order passed |

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.