Topic Covers:

1. What is short-term capital gain?

2. STCA ( Short-term capital asset )

3. Conditions for applicability of Section 111A

4. Calculation of tax on STCG u/s 111A

5. Set Off & Carry Forward losses

6. FAQs

What is short-term capital gain?

Any profit or gain that arises from the sale of short-term capital assets is known as short-term capital gain. And this gain is taxable under the head “income from capital gain”. Such capital gains are taxable in the year in which the transfer of the capital asset takes place.

Based on the period of holding of assets there are two types of Capital Gains:

1. Short-term capital gains (STCG)

2. Long-term capital gains (LTCG).

In this article we discuss about the Short-term capital asset as per section 111A and its tax calculation

STCA ( Short-term capital asset )

As per section 2(42A) of the Income Tax Act “An asset held for a period of not more than 36 months is a short-term capital asset.”

However, some assets are considered as short-term capital assets if it is held for not more than 24 months. These assets are unlisted shares (those shares which are not listed in a recognized stock exchange in India) and immovable properties such as land, buildings and house property.

For instance, if you sell immovable property after holding it for a period of 24 months, so income arising from this sale will be treated as a long-term capital gain.

Further, there are assets considered as short-term capital assets if it is held for 12 months or less.

• Equity or preference shares in a company listed on a recognized stock exchange in India.

• Securities (like debentures, bonds, govt. securities etc.) listed on a recognized stock exchange in India.

• Units of UTI, whether quoted or not

• Units of equity-oriented mutual fund, whether quoted or not

• Zero coupon bonds, whether quoted or not

Conditions for applicability of Section 111A of the Income tax Act

Section 111A is applicable if certain conditions are fulfilled.

1. In the case of STCG earned from the following securities

• Equity shares

• Units of equity-oriented mutual funds

• Units of business trust

2. If the mentioned capital assets are transferred through a recognized stock exchange, on or after 1-10-2004 and

3. STT is paid at the time of buying or selling securities on a recognized stock exchange.

However, the third condition of payment of STT is not applicable in the following cases:

• The transaction is undertaken on a recognized stock exchange located in an International Financial Service Centre, and

• The consideration is paid or payable in foreign currency.

In other words, any profit arising on the sale of equity/units of business trust/units of equity-oriented mutual funds, within one year from the date of acquisition, through a recognized stock exchange on which Security Transaction Tax has been paid shall be treated as short-term capital gain under section 111A of the income tax act.

Tax rate:

The applicable tax rate is 15% (plus surcharge if applicable and cess) for short-term capital gains under section 111A.

Illustrations:

Mr. Alok sold equity shares of Infosys Ltd. Through the National Stock Exchange (NSE) for a profit of ₹ 5,000. These shares are held for a period of 11 months.

The profit earned on the sale of shares will be treated as STCG and shall be taxable at @15% under section 111A.

If Mr. Alok held the above-mentioned shares for 15 months. Therefore such gain will still be considered as long-term capital gains and shall not be taxable under section 111A.

Calculation of tax on STCG u/s 111A

Let’s take an example to understand the tax calculation:

Mr. Abhiram, a resident of India, bought 10,000 equity shares of ITC Limited in December 2023 at ₹ 100 per share. He sold the shares in May 2024 at ₹ 145 per share through BSE. He paid brokerage of ₹ 1 per share and STT of ₹ 1500.

In this case, he sold the equity shares within 12 months hence it will be considered as a Short Term Capital Gain. And the company was a listed equity share with STT paid, STCG is taxable at 15% under Section 111A. Hence, in this case, the calculation of short-term capital gain on shares will be as follows:

| Particulars | Amount (₹) |

| Sales consideration (10,000 * 135) | 14,50,000 |

| Less: Transfer expense (10,000 * 1) | (10,000) |

| Net sale consideration | 14,40,000 |

| Less: Cost of Acquisition (10,000 * 100) | (10,00,000) |

| Short Term Capital Gains | 4,40,000 |

| Short term capital gain tax u/s 111A (4,40,000 * 15%) | 66,000 |

Set Off & Carry Forward losses

The Short Term Capital loss is a loss on the sale of listed equity shares and mutual funds held for up to 12 months. According to the provisions of the income tax act, Short Term Capital Loss can be set off against Short Term Capital Gains as well as from the Long Term Capital Gains in the current year. A taxpayer can set off Short Term Capital Loss against STCG and LTCG from another capital asset. Further, the remaining loss can be carried forwarded for 8 years and set off against future STCG and LTCG.

FAQs

Q. Can the basic exemption limit be adjusted against STCG mentioned in section 111A?

Ans. The Resident taxpayers can take the benefit of adjusting the special rate income against the basic exemption limit to reduce taxes. It means if the total taxable income is less than the basic exemption limit, it can be adjusted to special rate income such as Short Term Capital Gain under section 111A, Long Term Capital Gain under section 112A, etc. against the shortfall in basic exemption limit and pay tax on the remaining income only.

For example, If Mr. Abhinav a resident Indian has income from capital gains ₹ 3,40,000 and income from interest ₹ 1,00,000 and no other income but the basic exemption limit is not utilized. In this case, the calculation of tax liability would be in the following manner:

Since Mr. Abhinav is a resident and the basic exemption limit is not utilized, he can take the benefit of adjusting the special rate income against the basic exemption limit.

Hence, Income from other source is ͅ₹ 1,00,000 unexhausted basic exemption is (2,50,000- 1,00,000 = 1,50,000) this short fall of 1,50,000 can be adjusted from the STCG

Taxable STCG = 3,40,000 – 1,50,000 = ₹ 1,90,000.

Tax Liability = 1,90,000 * 15% = ₹ 28,500.

Q. Can the 80C to 80U deduction be adjusted against the STCG referred to in section 111A?

Ans. No, the deductions under section 80C to 80U cannot be allowed out of STCG referred to in section 111A. However, such deductions are allowed against STCG other than that covered u/s 111A.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Every taxpayer has to furnish the income tax return to the Income-tax Department which discloses the income earned by the taxpayer during the previous year. Once the income tax return is filed by the taxpayer, the next step is the processing of the income tax return by the Department. The Department examines the details of income disclosed by the taxpayer for its correctness. This process of examining the income tax return by the Income Tax department is called “Assessment”.

Intimation Under Section 143(1)

Assessment under section 143(1) is a preliminary assessment and is referred to as summary assessment without calling the assessee (i.e., taxpayer). Once the assessee files his income tax return, the income tax department does a preliminary assessment. And sends Intimation under Section 143(1). This intimation is not a Notice but a communication received from the income tax department.

This includes verifying arithmetical errors, any incorrect claims in the return, the difference in tax calculation, verification of tax payment, etc. It is a preliminary checking of the return of income.

After making the following adjustments (if any), the total income or loss is computed, namely:-

1. Any arithmetical error in the return; or

2. An incorrect claim of exemption or deduction, if such incorrect claim is apparent from any information in the return;

3. Disallowance of loss claimed, if the return of the previous year for which set-off of loss is claimed was furnished after the due date specified under section 139(1); or

4. Disallowance of expenditure disclosed in the audit report but not considered while computing the total income in the return; or

5. Disallowance of deduction claimed u/s 10AA, 80IA to 80-IE, if the return is furnished after the due date specified under section 139(1); or

6. Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return.

Following are the Types of intimations possible :

• Intimation with no demand or no refund – This is the intimation when the department has accepted the return as filed, without carrying out any adjustments to it.

• Intimation determining demand – Demand intimation is Issued in case of adjustments made under Section 143(1) due to a discrepancy found and tax liability is arrived at. And assesse needs to take action

in this case by replying.

• Intimation determining refund – Issued where any tax is found to be refundable either where no discrepancy in the return filed or after making adjustments as referred to in Section 143(1). The refund

will be credited to the bank account of the assesse.

Time Limit

Assessment under section 143(1) can be made within a period of 9 months from the end of the financial year in which the return of income is filed.

Mode of Communication

By Mail: The system auto-generates the intimation u/s 143(1) and communicates to the assessee on the email entered while filing the income tax return.

The intimation is an attachment to the email in a pdf format. It is password- protected. The password to open is PAN in lower case and the date of birth in ddmmyyyy format. Eg: aaapa1234a10101990 for PAN: AAAPA1234A and DOB: 10/10/1990

By SMS: The system auto-generates the intimation u/s 143(1) and communicates to the assessee on the mobile entered while filing the income tax return.

Action to be taken against Intimation u/s 143(1)

Cases where no action is required:

1. The calculation in the ITR filed matches with the calculation as per income tax i.e. No Demand & No Refund

2. Tax paid as per ITR filed is more than the tax payable as per income tax calculation i.e Refund. In this case, refund would be credited to the bank account of the assessee.

Cases where action require:

1. After receiving intimation if you observe any mistakes in the ITR filed, this mistake can be corrected by filing Revised Return u/s 139(5) within the time limit prescribed for the revised return.

2. Tax payable as per ITR filed is less than the tax payable as per income tax calculation i.e. Outstanding Demand. If you agree with the Demand of tax raised in the intimation then Pay Demand and File

Response (within 30 days)

3. Tax payable as per ITR filed is less than the tax payable as per income tax calculation i.e. Outstanding Demand. If you disagree with the Demand of tax is raised in the intimation then File

Rectification Request u/s 154 and File Response (within 30 days)

The department considers the response received from the assessee, if any, before making any adjustment. In cases where the response is not received within 30 days of the issue of such intimation, such adjustments shall be made.

In conclusion, Every assesse who files an income tax return receives intimation under 143(1). Assesse should read the intimation carefully and must take action accordingly within the time. To avoid further litigation and notices from the department, assessee must ask for the professional help in case where required.

FAQs

Q. What are various types of assessment under Income tax Act?

A. Following are the types of assessment under the Income Tax Act:

1. Summary Assessment as per section 143(1)

2. Regular Assessment

3. Scrutiny Assessment

4. Best Judgement Assessment

5. Income Escaping Assessment

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

People generally takes personal loan for wedding, vacation, home renovations or any other urgent financial need.With the introduction of the GST, it is very important to understand the implications of GST on personal loans because it is very essential for managing your financial objectives.

How we can minimize the Impact of GST on Personal Loans

When you take a personal loan there are two major charges on which GST is applicable :-

• Loan processing charges

• Prepayment charges

So, it is very important that the above charges should be minimal to reduce GST impact.

There is always scope for reduction in loan processing charges and Prepayment charges. So, when you are applying for a loan try to bargain in processing charges and Prepayment charges. In many cases, some banks & NBFCs also allow Nil prepayment charges.

This way availment of loans with lower loan processing and prepayment fees can help reduce the burden of higher GST payments.

We shall understand the charges that are applicable on personal loans and GST impact:-

1. Impact of GST on Processing Charges :-

When a borrower applies for a personal loan, banks/ NBFCs charge processing fees as financial institution also bears administrative costs, salary of credit manager/ marketing team etc. These expenses are passed on to the borrower in the form of processing fees.

Since this processing is considered a service provided by the financial institution. The GST Rate on processing charges will be 18%

For example, if you borrow a personal loan of Rs. 5,00,000 and financial institution charges processing charges @ 2%, then processing charges without GST will be Rs. 10,000.

So, GST will be Rs.1800 (Rs.1,00,000*18%), So you need to pay total processing charges including GST will be Rs.11,800.

2. Impact of GST on Prepayment Charges :-

Personal loans often offer borrowers the convenience of early repayment. But, it comes with prepayment charges. If the borrower wants to repay the loan before its tenure, the borrower have to pay prepayment charges plus GST.

Since this prepayment charge is considered a service provided by the financial institution. GST Rate on prepayment charge will be 18%

For example, You have taken a loan of Rs. 10,00,000. Now, as on date the outstanding balance is Rs. 1,00,000. Suppose, you want to prepay this amount and the prepayment charges is 2%. Then, prepayment charges will be Rs. 2,000.

So, GST will be Rs.360 (Rs.2,000*18%), So you need to pay total prepayment charges including GST will be Rs.2,360.

3. Impact of GST on Interest :-

Interest does not come within the criteria of GST. There is no difference where you are taking loans from Banks and NBFCs. Interest is always exempt from GST.

4. Impact of GST on Additional Charges:

GST also applies on other charges associated with loans like penalties on late payments and fees for bounced cheques etc.

FAQ’s

Q1. What is the GST rate applied to loans?

Ans. Loans in India are subject to a GST rate of 18%.

Q2. Does GST applicable on personal loans?

Ans. Yes, Loans in India are subject to a GST. It's important to emphasize that GST is not directly applied to the principal loan amount; instead, it is levied on additional services such as processing fees, loan charges, and other services provided by the lender.

Q3. Is there any liability for borrowers to pay GST on loan processing fees?

Ans. Yes, GST is applicable on loan processing fees. Therefore borrowers are required to pay GST.

Q4. Is there any liability on the borrower to pay GST on the interest accrued on loans?

Ans. Interest accrued on loans is not considered as a supply of goods or services. Hence GST is not applicable on the interest accrued on loans. GST is usually applied to processing fees, loan charges and other services provided by the lender. Therefore borrowers do not need to pay GST on the interest portion of their loans.

Q5. What is the applicability of GST on the bank interest earned by individuals?

Ans. GST is not applicable on the interest earned by individuals on bank deposits or savings accounts or recurring deposits as it is considered a part of the financial service provided by the bank which is exempt from GST.

Q6. How to calculate GST on the interest component of Loan EMIs?

Ans. Since GST is not applicable on the interest component of EMIs related to loans, there is no calculation involved for GST on interest.

Q7. What are the GST implications on loan transactions and related charges?

Ans. Loan transactions and related charges such as processing fees are subject to GST but the interest component and EMIs themselves are exempt from GST as they fall under the category of financial services.

Q8. Are credit card EMIs subject to GST?

Ans. Yes, according to the ruling in the case of Ramesh Kumar Patodia Vs Citi Bank by the Calcutta High Court, it's evident that GST is applicable to credit card EMIs.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Taxpayers may make errors at the time of filing income tax returns. The assessment officer highlights such mistakes from the records, during assessments. In some cases, it may so happen that an order passed by the assessing officer contains mistakes. Section 154 of the income tax act provides an opportunity for the assessing officer and the taxpayer to rectify any mistake or error that was made by him.

Order that can be rectified under section 154:

With a view to rectifying any mistake apparent from the record, an income-tax authority may, -

a) Amend any order passed under any provisions of the Income-tax Act.

b) Amend any intimation or deemed intimation sent under section 143(1).

c) Amend any intimation sent under section 200A(1) [i.e. TDS return].

d) Amend any intimation under section 206CB.

It is to be noted that, If an order is subject matter of any appeal, then the Assessing Officer can rectify only those matters that are not decided in such appeal. Any matter which is decided in such an appeal or revision cannot be rectified.

Initiation of rectification:

• The income-tax authority can rectify the mistake on its own motion.

• The taxpayer can intimate the mistake to the income-tax authority by making an application to rectify the mistake. Assessing officer review and pass the order.

Time Limit:

A rectification order cannot be issued after 4 years from the end of the financial year in which the order to be rectified was passed. This period of 4 years is calculated from the date of the order to be rectified, not from the date of the original order. Therefore, if an order is revised, set aside, or any other action is taken, the 4-year period will be counted from the date of the new order, not from the date of the original order.

If a taxpayer submits an application for rectification, the authority must either amend the order or reject the claim within 6 months from the end of the month in which the application is received.

To understand the provision let’s have an example:

Que. The assessment order was passed on 21-10-2013. The assessee made an application on 15-11-2015 for rectification under section 154 pointing out that depreciation has not been allowed on certain assets. The rectification order was passed on 18-2-2016. The assessee made another application under section 154 on 15-05-2018 pointing out that he was entitled to get depreciation on the factory building @ 10% instead of 5% allowed to him. The Assessing Officer rejected the second application for rectification as being made after the expiry of 4 years from the end of the financial year in which the original order, dated 21-10-2013 was passed.

Ans: In the above case, the word “order” in the expression “from the date of the order sought to be amended” does not necessarily mean the original order. It could be any order including the rectified order. The assessee could also apply for rectification within 4 years of the end of the previous year in which the amended order, dated 18-02-2016 was passed i.e. up to 31-03-2020. Hence, the action of the Assessing Officer was not justified.

How to file rectification :

Taxpayers can raise an online request to rectify the return if they finds it necessary.

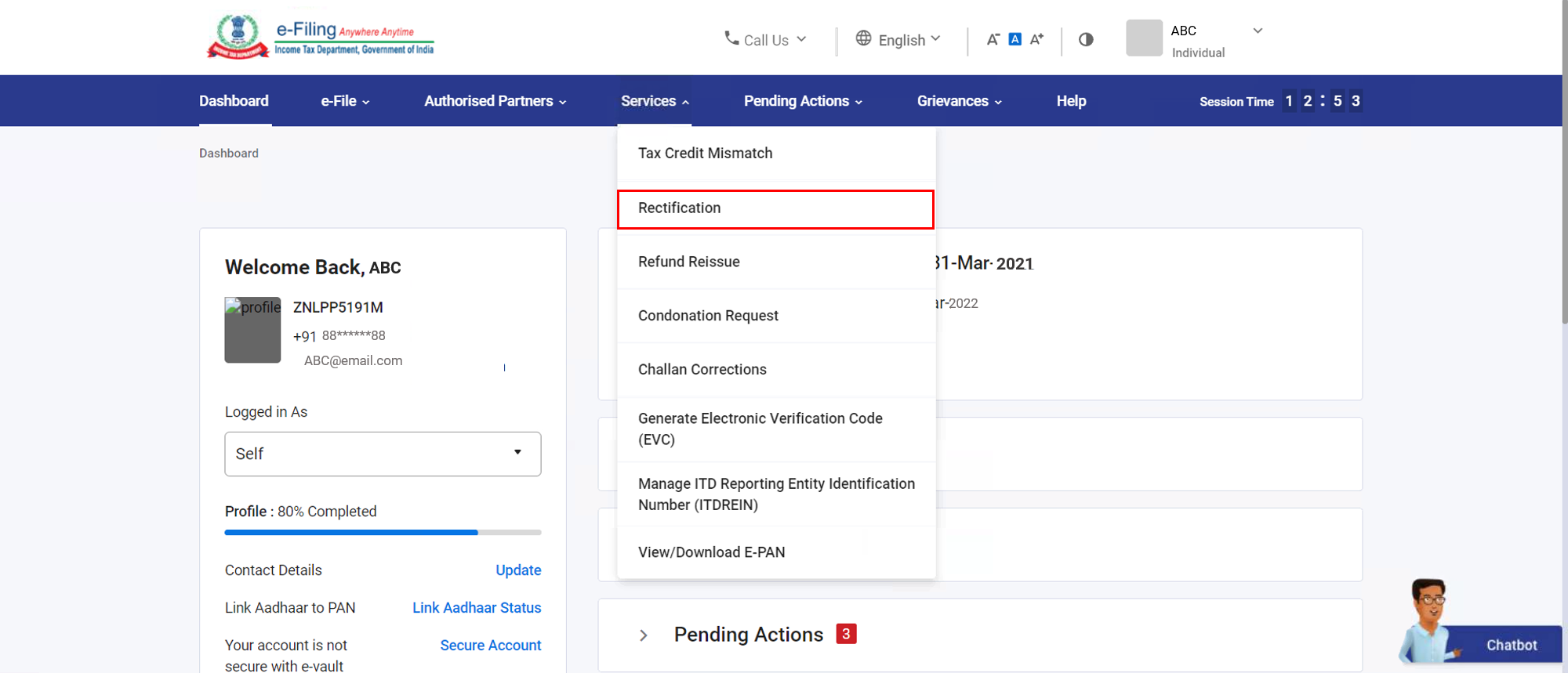

With a valid user Id and password, log in to the e-filing portal.

Click on the ‘Services’ and select Rectification from the drop-down menu.

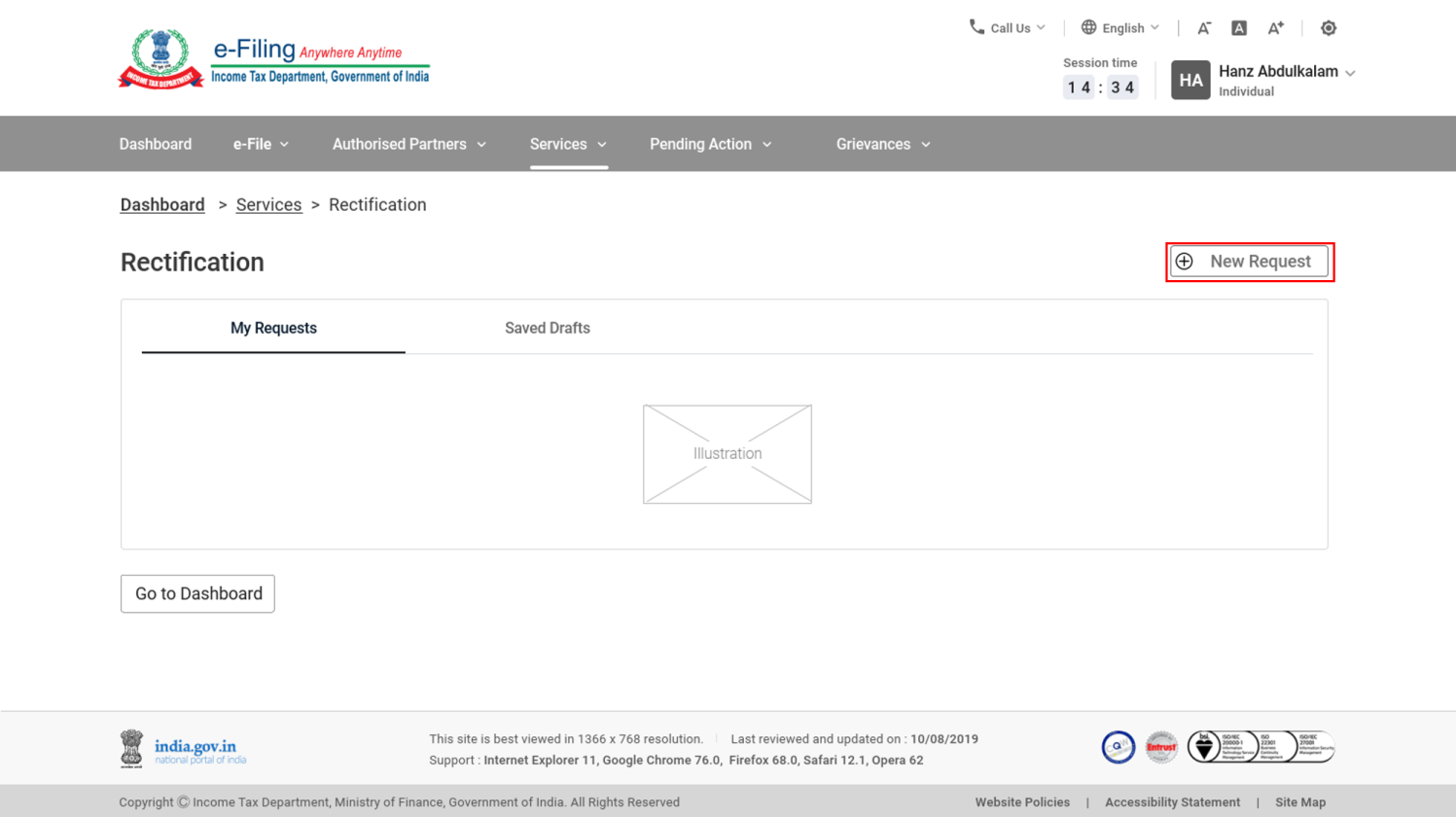

Click on ‘New request’.

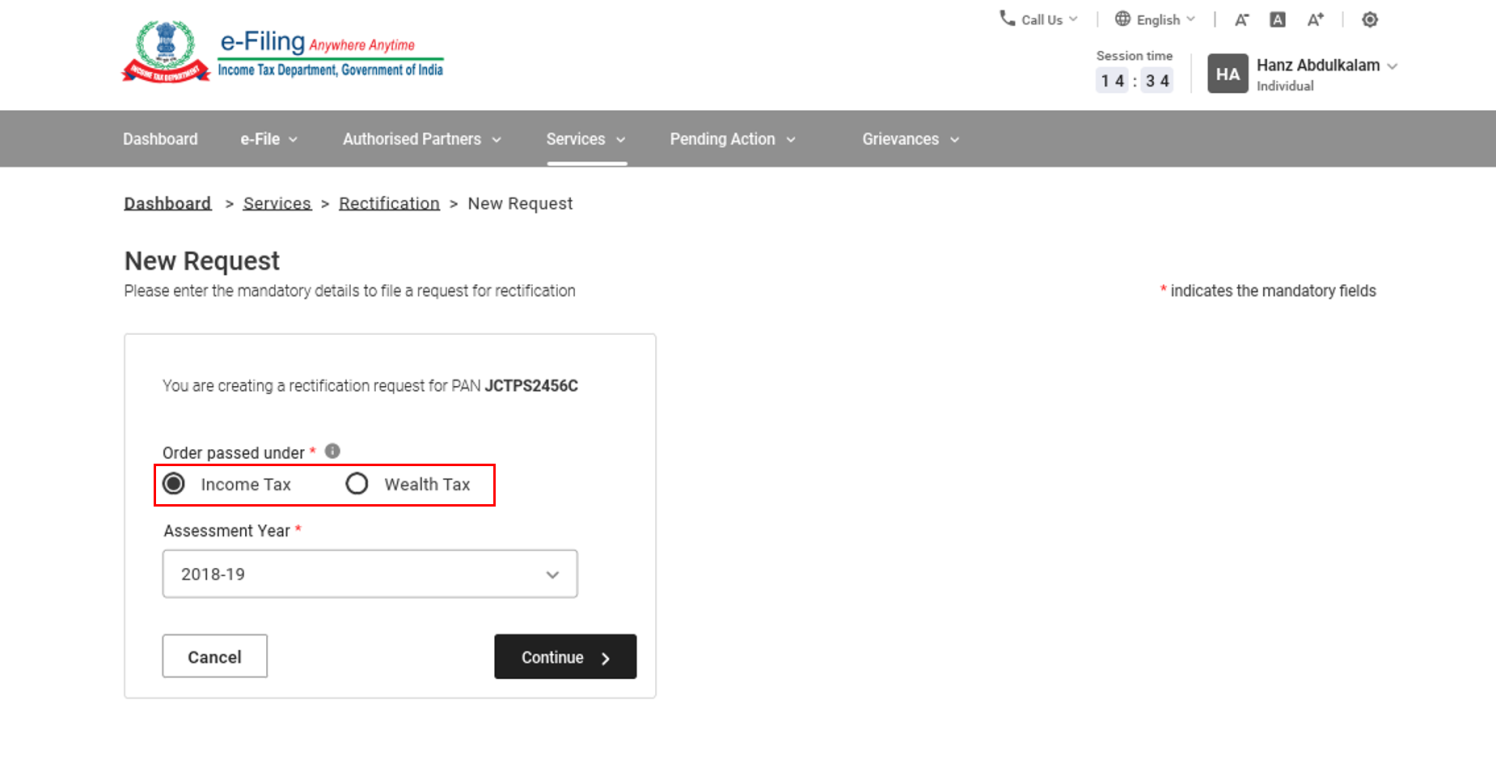

Once on the ‘New Request’ page, your PAN number gets auto-filled. Now you have to select between wealth tax and Income Tax.

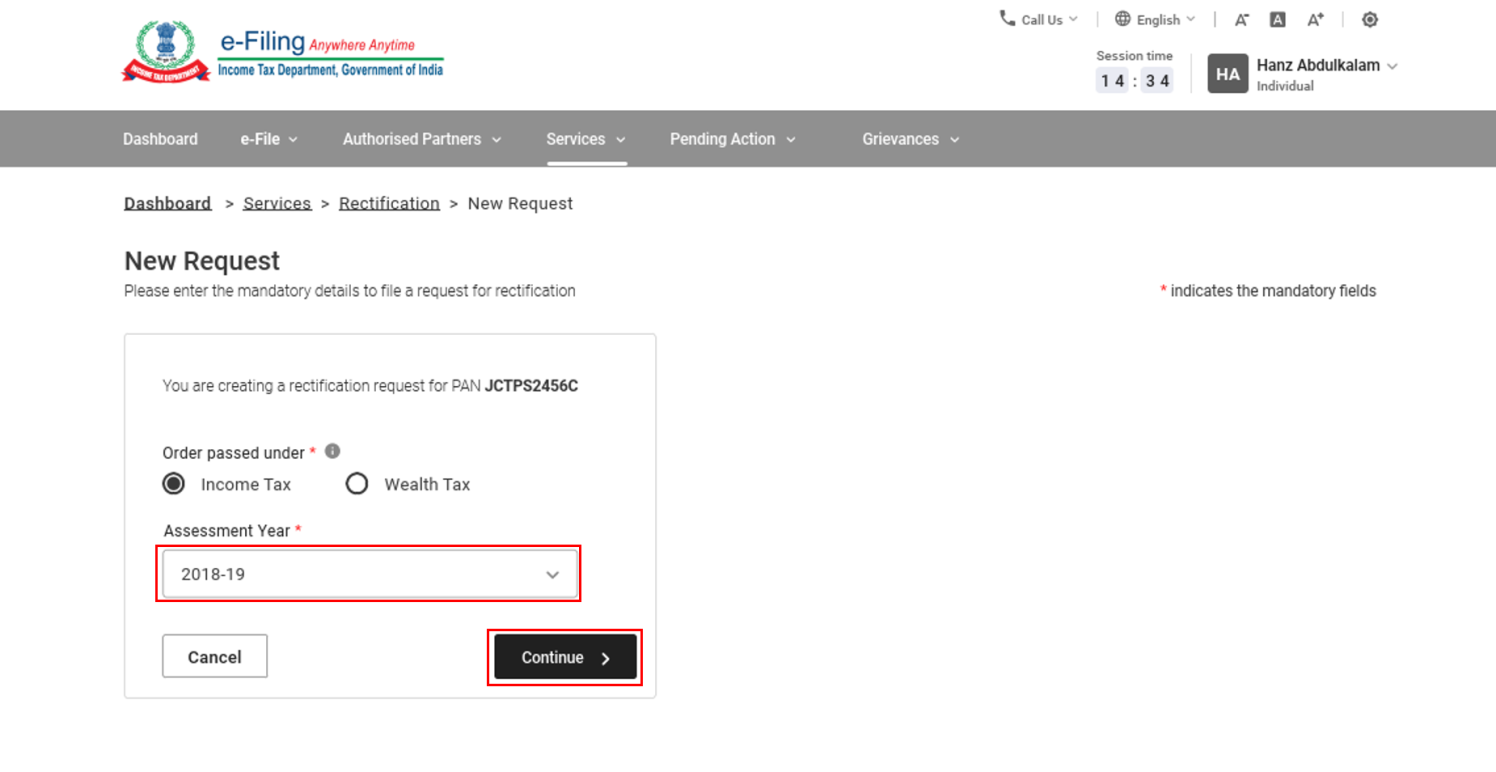

Select assessment year from the drop-down menu and click ‘continue’.

The rectification requests can be classified as follows -

| Income Tax Rectification | Reprocess the return |

| Tax credit mismatch correction | |

| Additional information for 234C interest | |

| Status Correction | |

| Exemption section correction | |

| Return data correction (Offline) | |

| Return data correction (Online) | |

| Wealth Tax Rectification | Reprocess the Return |

| Tax Credit Mismatch Correction | |

| Return Data Correction (XML) |

Select the correct rectification requests provide the required information then submit the request and complete the verification procedure.

In conclusion, if a filed income tax return or the order contains a mistake apparent from the record then it can be rectified by virtue of provision of section 154. The assessing officer has the power to rectify the mistake on his own or on application by the assesse within the time limit. The rectification can be result in enhancing the tax liability or refund, and intimated to the assessee in both the cases. It is hectic to comply with the law in such cases, it is advisable to take professional help in that case.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Topic Covers:

1. Introduction

2. Eligibility Conditions for NRI

3. Benefits of section 115H

a. Exemption for specified Income b. Lower tax rates for certain investment c. Facilitation of fund repatriation d. Avoidance of double taxation

4. Conclusion

1. Introduction

Every person earning income in India is required to pay tax if he fulfills the conditions. To calculate the correct income tax liability is required to determine the residential status of the person every year. The tax liability will differ and depends upon the residential status of the person. This section gives benefits to the NRI who became residents in the subsequent year. In this article, we understand the eligibility conditions and benefits of section 115H.

2. Eligibility Conditions for NRI

NRI must fulfill the specified condition to take the benefit of the section 115H. He must have been a resident of India for the previous year. Factors to determine the residential status of the individual are provided in the income tax act. The residential status of an individual is based on the number of days stayed in India during the financial year.

3. Benefits under section 115H

a. Exemption for specified Income:

Certain types of income are exempted for the NRI. Like interest earned on NRE accounts and dividend from specified investments.

b. Facilitation of fund repatriation:

This section simplified the manner to repatriate the income earned in India and investment proceeds subject to fulfilling specified regulations.

c. Avoidance of double taxation:

India has signed a double taxation avoidance agreement with various countries. DTAA is a bilateral agreement between two countries that helps to avoid taxing the income twice. Once, in the country in which the income is earned and second in the country of resident. DTAA specified rules for taxing various income earned by the NRI.

According to the provisions of DTAA, NRIs are allowed to claim tax credits or exemptions in the resident country.

d. Compliance requirement:

NRI must comply with the obligations. Like other person, NRI is also required to file the Income tax return within the prescribed due date.

According to foreign assets and liabilities disclosure NRI are also required to disclose the foreign assets and income.

e. Exemption of specified Income:

Certain types of income are exempted under this section115H.

• Interest earned on the NRE account is exempted from tax.

• Subject to specified conditions NRI can also avail the tax exemption on capital gain arising from the sale of specified assets.

4. Conclusion:

This section offers benefits to NRI by optimizing tax liabilities. To avail the benefit of this section NRI must comply with the specified conditions. To maximize the advantage NRI can take professional advice.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Credit availment and its utilization represent distinct processes within the GST framework. While credit availment pertains to claiming an input tax credit, credit utilization involves applying this credit against tax liabilities. These processes are typically governed by separate sections or rules within GST legislation. Section-17 of the CGST Act specifically addresses the rules regarding the availment of credit, ensuring compliance and legitimacy in claiming input tax credit. Section 49(4) & (5) of the CGST Act outline the provisions relating to the utilization of credit.

Manner of utilization of credit:

1. IGST Credit

As stated in Section 49 of the CGST Act & SGST Act and Section 9 of the UTGST Act, the IGST credit available in the electronic credit ledger must be first utilized for the payment of IGST. Following this it can be used for the payment of CGST, SGST, or UTGST in the specified order. Therefore, the utilization of IGST credit is prioritized for IGST payment followed by the payment of CGST, SGST or UTGST in the prescribed sequence. Therefore, although IGST credit can be applied towards the payment of all four taxes it must be utilized in the order specified above.

2. CGST Credit

According to section 49(5)(b) of the CGST Act, any credit balance in the electronic credit ledger attributable to CGST must initially be used for the payment of CGST. Any remaining amount, if available, can then be utilized for the payment of IGST. It's explicitly stated under clause (e) that the balance in CGST cannot be utilized for the payment of SGST or UTGST.

3. SGST Credit

According to section 49(5)(c) of the SGST Act, any credit balance in the electronic credit ledger attributable to SGST must initially be used for the payment of SGST. Any remaining amount, if available, can then be utilized for the payment of IGST. It's explicitly stated under clause (f) that the balance in SGST cannot be utilized for the payment of CGST or UTGST.

4. UTGST Credit

According to section 9 of the UTGST Act, any credit balance in the electronic credit ledger attributable to UTGST must initially be used for the payment of UTGST. Any remaining amount, if available, can then be utilized for the payment of IGST. Notably, the balance of UTGST cannot be employed for the payment of CGST.

Balance to be utilized after exhausting CGST:

As per the provision, the balance of UTGST can only be applied towards the payment of IGST after exhausting the entire balance of CGST. Consequently, the balance of CGST must reach zero before any utilization of UTGST for IGST payment.

5. CGST will not be used for payment of SGST and UTGST.

6. SGST or UTGST cannot be used to pay CGST.

The sequence of utilization:

Firstly the balance of IGST is utilized for the payment of IGST; following this, as per section 49(5), the balance of CGST is used for IGST payment. Only thereafter, the balance of SGST/UTGST be utilized for IGST payment. Hence IGST is required to be settled by utilizing balances in the order of IGST, CGST, SGST or UTGST.

FAQ’s

1. What are GST Set-off Rules?

Ans: The regulations on GST set-off dictate how Input Tax Credits (ITC) are utilized to offset tax liabilities within the Goods and Services Tax system. These guidelines outline the procedures for utilizing credits from CGST, SGST, and IGST.

2. Is there a tool to calculate GST Set-off?

Ans: Yes, a GST Set-off Calculator is accessible to aid businesses in calculating the portion of their GST liability that can be offset by utilizing available Input Tax Credits.

3. What is the Hindi translation of 'Utilization'?

Ans: 'Utilization' translates to 'उपयोग' (Upyog) in Hindi.

4. Could you explain the ITC Set-off Rules?

Ans: The regulations governing ITC Set-off determine the parameters for utilizing Input Tax Credits to offset tax liabilities, outlining conditions and restrictions regarding their utilization across various GST components.

5. Is Cross Utilization of ITC Allowed?

Ans: Under GST, cross-utilization of credits between taxes is permitted. This implies that credits from CGST/SGST can be utilized for IGST, and vice versa. However, it's important to note that credits of CGST and SGST cannot be used interchangeably.

6. What are the new ITC Set-off Rules under the recent GST notification?

Ans: The new ITC Set-off Rules introduced through the latest GST notification govern the utilization of Input Tax Credits (ITC) to offset tax liabilities. These rules may introduce changes or updates to the existing framework, impacting how businesses utilize their credits.

7. Between which GST components is there no offset available?

Ans: Under GST regulations, there are restrictions on offsetting tax liabilities between the certain components. There is no offset available between CGST and SGST components of GST.

8. Can IGST be directly adjusted against SGST?

Ans: Certainly, IGST cannot be directly offset against SGST liabilities. Initially, IGST is adjusted against IGST liability, followed by CGST, and finally SGST.

9. Is adjustment of IGST against CGST and SGST permissible?

Ans: Yes, adjustment of IGST against CGST and SGST liabilities is permissible. After offsetting IGST liability, any remaining IGST credit can be utilized to offset CGST and SGST liabilities in accordance with GST regulations.

10. Can SGST be directly adjusted against IGST?

Ans: SGST cannot be directly adjusted against IGST liabilities. Initially, SGST is adjusted against SGST liability and then against IGST.

11. Is it permissible to offset CGST against IGST liabilities?

Ans: Any surplus funds in the electronic credit ledger linked to CGST must first go towards paying off CGST dues. If there's any money left after that, it can be used to settle IGST liabilities. However, it's important to note that this balance in CGST cannot be used to cover SGST or UTGST payments.

12. Is it permissible to offset CGST against SGST liabilities?

Ans: According to section 49(5)(b)(e) of the CGST Act, It's explicitly stated that the balance in CGST cannot be utilized for the payment of SGST or UTGST.

13. Is it permissible to offset SGST against CGST liabilities?

Ans: According to section 49(5)(b)(f) of the CGST Act, It's explicitly stated that the balance in SGST cannot be utilized for the payment of CGST or UTGST.

14. What are the provisions outlined in Rule 88A of the CGST Rules?

Ans: Rule 88A of the CGST Rules specifies provisions related to the order of utilization of input tax credit for discharging tax liabilities.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

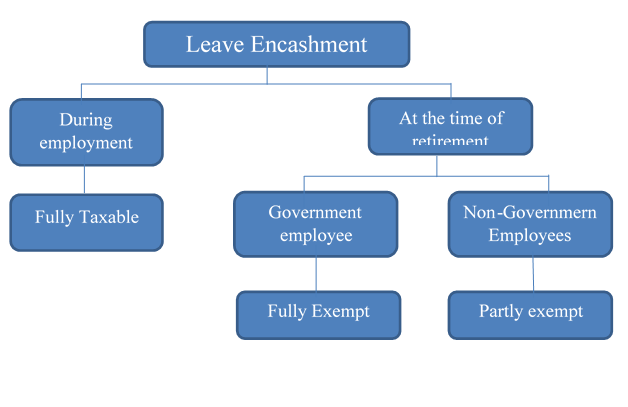

Topic Covers:

1. Introduction

2. Taxability

3. Leave Encashment calculation and exemption

Introduction:

Generally, the employee gets leaves during the employment if the employee does not avail those leaves, either that will be lapse or carried forward. Employees can encash those leaves at the time of termination or retirement or every year. Section 10(10AA) deals with the provision of exemption for leave encashment.

Taxability :

The amount encashed leaves is a part of the salary. If leave is encashed every year then it is part of the salary and will be taxable in the same year.

But if leave is encashed at the time of retirement or termination then it is exempted as per section 10(10AA) of the Income tax act.

Leave Encashment calculation and exemption:

Leave encashment received during the year is fully taxable. Whether received by a government employee or non-government employee.

Leave encashment received by a government employee at the time of retirement or termination is fully exempted.

1) Leave encashment received by a non-government employee at the time of retirement or termination is exempted up to the specified limit.

In the case of non-government employee exemption will be the least of the following amounts:

i) ₹ 25 lakhs ( Earlier this limit was ₹ 3 Lakhs, From 1st April 2023 it is increased to ₹ 25 Lakhs vide , notification no S.O. 2276(E) dated 24th May, 2023 )

ii) Leave salary actually received

iii) 10 months Salary (on the basis of the average salary of the last 10 months )

iv) Case equivalent to 30 days for every completed service year on the basis of the average salary of the last 10 months

As per the provision of section 10(10AA) maximum 30 days per year for the calculation of exemption

If more than 30 days of leave in the year are provided by the company, then a maximum of 30 days for a year will be considered to calculate the exemption, but if the company has provided leave of less than 30 days in the year, then the calculation will be done for exemption from fewer days

Salary means: Basic salary + Daily Allowances (forming part of salary) + fixed % commission on turnover

In cases where payment is received from more than one employer exemption will be calculated on the aggregate amount.

Leave encashment received from the previous employer in the past and also received from current employer. In this case, to calculate the exemption amount received from the previous employer will be deducted from the maximum exemption limit of ₹ 25 lakhs.

Example:

Suppose the service period of Mr A is 12 years & 5 months

He got 36 leaves every year during the service period, so the overall leaves allowed during service was 447 (36 x 12 )

Out of which Mr A availed 265 leaves, the balance unavailed leaves 182 days.

Mr A gets a Basic salary and DA ₹ 36000 per month and leave encashment received ₹ 2,18,400

Leave encashment exemption Calculation:

least of the following will be exempted amount-

1) Actual Amount receive - ₹218400

2) Maximum ₹ 25 lakhs (After notification no S.O. 2276(E) dated 24th May, 2023)

3) Average Salary for 10 month = ₹3,60,000 (36000x10)

4) Cash equivalent of unavailed leaves = 1200 x (12year x30)- availed leaves 265 =95x1200=114000

Least of the these 4 will be exempted i.e. ₹ 1,14,000

FAQs:

Q. Can I claim leave encashment for all the leaves annual leave, sick leave, sabbatical leave, maternity leave etc.?

A. No such differentiation is provided for leaves in the income tax act. Employer policy should be referred for this purpose. So can claim leave encashment for any type of leave if specified conditions are fulfilled.

Q. What are the tax implications If leave encashment is received by heirs of deceased ?

A. Leave encashment is fully exempt in case received by the legal hires.

Q. Is leave encashment taxable on retirement?

A. Yes, Leave encashment is taxable even if received at the time of retirement. However exemption as per the provision can be availed.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

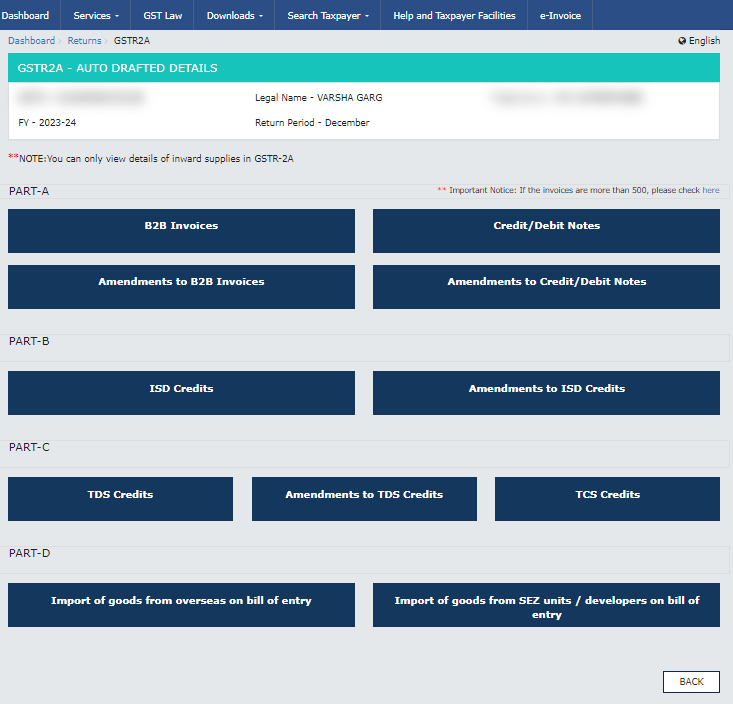

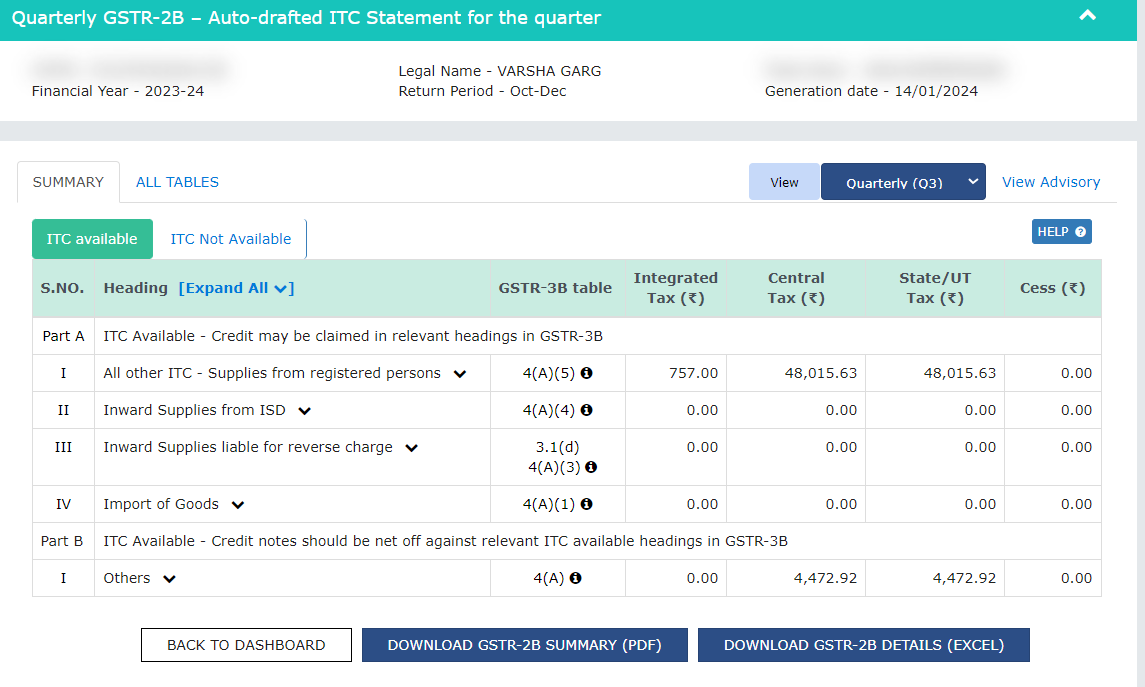

Introduction :-

Under the GST, a critical issue for a registered taxpayer arises regarding the claiming of ITC (input tax credit) in a particular period/Month. To address this conflict, the concept of GSTR 2A and 2B was introduced.

What is GSTR-2A

GSTR-2A is a dynamic statement, where purchase details is auto-generated as per details submitted by the supplier, accordingly GSTR-2A is updated. In GSTR-2A data is updated through returns filed by seller.

How to file GSTR-2A

You don’t have to file GSTR-2A. GSTR-2A is an auto-generated read-only statement. It can be viewed or downloaded by the recipient.

Difference between GSTR-2A and GSTR-2B.

| GSTR-2A | GSTR-2B |

| GSTR 2A is a dynamic statement. | GSTR 2B is a static statement. |

| No cut of date for GSTR-2A | Cut of date for GSTR-2B is 14th of the succeeding month. |

| Source of Information in GSTR-2A is GSTR-1 or IFF, GSTR-5, GSTR-6, GSTR-7, GSTR-8, ICE Gate portal. | GSTR-1 or IFF, GSTR-5, GSTR-6 |

| Supplier cannot claim ITC on the basis of GSTR-2A. | Supplier claim ITC on the basis of GSTR-2B. |

What happens, if the Supplier filed GSTR-1 after the due date-

GSTR-2A is a dynamic statement. If the supplier files GSTR-1 after the due date then in such case invoice is reflected in GSTR-2A but the supplier cannot claim ITC. ITC can be claimed only through GSTR-2B. GSTR-2B is a static statement and it is generated on the 11th or 13th of the next month (depending on the return filing frequency)

GSTR-2A

GSTR-2B

FAQs Related to GSTR-2A under GST

Q.1 Can I claim ITC on the basis of GSTR-2A?

Ans. No, taxpayer cannot claim ITC on the basis of GSTR-2A.

Q.2 Any due date for filing of GSTR-2A?

Ans. You don’t have to file GSTR-2A. GSTR-2A is an auto generated read only statement.

Q.3 Can I as a taxpayer make change or add any invoice in GSTR-2A?

Ans. No, taxpayer cannot make any changes in GSTR-2A. It can only be viewed or down loaded by recipient.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Introduction

When a registered person buys goods or utilizes services, they pay GST on these inward supplies. These supplies are utilized to advance the business, facilitating the provision of outward supplies. GST is charged to the recipient on these outward taxable supplies. However, the total GST collected on outward supplies isn't entirely payable to the Government. It gets reduced by adjusting the tax paid on inward supplies, provided certain conditions are met.

GST laws extend the benefit of Input Tax Credit (ITC) not just to input goods/services but also to capital goods. This available ITC is reflected in the taxpayer's electronic credit ledger maintained at the GST common portal.

Input Tax Credit Meaning

As per Section 2 (63) of the CGST Act, 2017 “input tax credit” refers to the credit of input tax.

Input-tax as defined under section 2(62) of the CGST Act, includes:

Central tax, State tax, integrated tax or Union territory tax charged on any supply of goods or services or both to a registered person excluding tax paid under the composition levy.

It shall also include:-

(a) The integrated goods and services tax which is charged on the import of goods.

(b) The tax payable as per section 9(3) and (4) of the CGST Act.

(c) The tax payable as per section 5(3) and (4) of the IGST Act.

(d) The tax payable as per section 9(3) and (4) of the respective SGST Act.

(e) The tax payable as per section 7(3) and (4) of the UTGST Act.

The legal framework governing Input Tax Credit provisions

The regulations pertaining to Input Tax Credit (ITC) are detailed in Chapter V (Sections 16-21) of the CGST Act and the corresponding CGST Rules. The provisions regarding Input Tax Credit (ITC) under the Central Goods and Services Tax (CGST) Act are also applicable to the Integrated Goods and Services Tax (IGST) Act. Section 20 of the IGST Act has extended these provisions accordingly.

The various sections cover the following aspects:-

| Section 16: | Eligibility and Conditions for taking Input tax credit |

| Section 17: | Apportionment of credit and blocked credits |

| Section 18: | Availability of Credits in Special Circumstances |

| Section 19: | Taking input tax credit in respect of inputs and capital goods sent for job work. |

| Section 41: | Utilization of ITC |

| Section 42: | Matching, Reversal, and Reclaim of ITC. |

CGST Rules, 2017 relating to ITC

The Chapter V of CGST Rules, 2017 contains the following rules in relation to ITC

| Rule 36: | Documentary requirements & conditions for claiming ITC |

| Rule 37: | Reversal of ITC in the case of Non-Payment of consideration |

| Rule 38: | Claim of credit by a Banking Company or a Financial Institution |

| Rule 39: | Procedure for distribution of ITC by Input Service Distributor (ISD) |

| Rule 40: | Manner of claiming credit in special circumstances |

| Rule 41: | Transfer of credit on sale, merger, etc. |

| Rule 42: | Manner of determination of ITC in respect of inputs or input services & reversal |

| Rule 43: | Manner of determination of ITC in respect of Capital goods & reversal thereof |

| Rule 44: | Manner of reversal of credit under special circumstances |

| Rule 44A: | Manner of reversal of credit of Additional Duties of Customs |

| Rule 45: | Conditions and restrictions in respect of inputs and Capital Goods to the job worker |

Eligibility for Availing ITC:

As per section 16(1), “Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of business and the said amount shall be credited to the electronic credit ledger of such person.”

The analysis of the above statutory provision reveals the following:

• According to Section 16(1), only registered individuals are eligible for ITC. When a registered individual receives goods or services or both, on which tax has been levied, they are permitted to claim credit for the input tax paid. This is subject to the provisions governing the utilization of Input Tax Credit (ITC) as outlined in Section 49, as well as the conditions and restrictions specified in the rules. Consequently, an unregistered person would not qualify to claim an Input Tax Credit.

• The goods or services must be utilized or intended for use in the course of or to advance the registered individual's business activities.

However, Input Tax Credit is not available for inputs utilized in the outward supply of exempted goods or services.

• There is a sole exception to the availability of Input Tax Credit (ITC) even if the individual is registered. This exception pertains to individuals who pay taxes under section 10 of the CGST Act, operating under the compounded levy scheme. Such indiv iduals are ineligible to claim ITC for inward supplies made by them.

Conditions to be satisfied for availing ITC:

As per Section 16(2), the registered person is eligible for input tax credit on a supply only if all of the following conditions are met:

(a) Possession of a Tax Invoice or Debit Note.

(b) Furnishing and communication of details.

(c) The ITC is not restricted.

(d) Receipt of goods and/or services.

(e) Payment of tax to the Government.

(f) Furnishing the valid return under section 39.

a) Possession of Invoice:

According to section 16(2)(a), a registered person cannot claim input tax credit for any supply of goods or services to them unless they possess a tax invoice or debit note issued by a supplier registered under this Act or documents as specified in Rule 36.

Rule 36 defines, Documentary requirements and conditions for claiming input tax credit. As per Rule 36(1), The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely,-

• an invoice issued by the supplier of goods or services or both (as per section 31)

• an invoice raised by the recipient in case of inward supply from unregistered.

-

- a debit note issued by the supplier of goods or services or both (as per section 34)

• a bill of entry or any similar document prescribed under the Customs Act, 1962

• an Input Service Distributor invoice or Input Service Distributor credit note or any document issued by an Input Service Distributor for distribution of credit. (Rule 54).

As per Rule 36(2), The ITC shall be availed by a registered person only if all the applicable particulars as specified in the provisions of Chapter VI are contained in the document mentioned in Rule 36(1).

Provided that if the said document does not contain all the specified particulars but contains the details of the amount of tax charged, description of goods or services, the total value of supply of goods or services or both, GSTIN of the supplier and recipient and place of supply in case of inter-State supply, input tax credit may be availed by such registered person.

b) Furnishing and communication of details:

As per section 16(2)(aa), the details of the invoice or debit note has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37.

As per Rule 36(4), No ITC shall be availed by a registered person in respect of invoices or debit notes the details of which are required to be furnished under sub-section (1) of section 37 unless-

(a) The details of such invoices or debit notes have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1 or using the invoice furnishing facility; and

(b) The details of ITC in respect of such invoices or debit notes have been communicated to the registered person in FORM GSTR-2B under rule 60(7).

ITC claims will only be permitted when the supplier has furnished the details of the invoice/debit note in their GSTR-1 and subsequently it appears in the recipient 's GSTR-2A. Consequently, recipients can no longer claim provisional ITC. In simpler terms, the ITC claimed must be visible in the recipient's GSTR-2A.

c) The ITC is not restricted:

The communication of input tax credit details regarding the supply to the registered person under section 38 has not been limited.

d) Receipt of Goods or Services or both:

As per section 16(2)(b), the registered person should have received the goods or services or both. This implies that ITC will not be available unless the goods are received by the registered person.

According to section 16(2)(b), the registered individual must have received the goods or services or both. This implies that theInput Tax Credit will not be accessible unless the goods are received by the registered individual.

When it is deemed that goods or services have been received:

Following the amendment by the Central GST (Amendment) Act, 2018, the Explanation to section 16(2)(b) specifies that, under this clause it will be considered that the registered person has received the goods or services as the case may be.

(i) Where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) Where the services are provided by the supplier to any person on the direction of and on account of such registered person.

e) Payment of Tax to the Government:

As per section 16(2)(c), the third condition states that the tax must have been duly paid to the government on the goods or services for which ITC is being claimed. This payment can be done by the supplier either by:-

(a) Making the payment through cash or

(b) Through utilization of ITC.

f) Filing of valid Return:

As per Section 16(2)(d), the registered person should have furnished the return under section 39.

FAQ’s

Q-1: What is Input Tax Credit (ITC)?

Ans: Input Tax Credit (ITC) is a mechanism under GST that allows taxpayers to claim credit for the taxes they have paid on their purchases, which can be set off against the taxes they are liable to pay on their sales. It prevents the cascading effect of taxes and ensures that taxes are levied only on the value addition at each stage of the supply chain.

Q-2: What is the full form of ITC in GST?

Ans: ITC stands for Input Tax Credit in Goods and Services Tax (GST).

Q-3: What does Input Tax Credit mean?

Ans: Input Tax Credit refers to the credit that a taxpayer can claim for the GST paid on their inputs (purchases) against the GST liability on their outputs (sales).

Q-4: What are the conditions for claiming Input Tax Credit under GST?

Ans: To claim Input Tax Credit under GST, certain conditions as given under section 16 of CGST Act must be met, including possession of a valid tax invoice, receipt of goods or services and payment of tax to the government.

Q-5: What is Blocked Credit under GST?

Ans: Blocked Credit refers to certain categories of goods and services for which Input Tax Credit cannot be claimed under GST. The list of items covered under blocked credit are given under section 17(5).

Q-6: Is Input Tax Credit available on the purchase of cars?

Ans: Generally, Section 17(5) blocks input tax credit for motor vehicles, but there are specific situations in which you can still avail of input tax credit under GST. If you fall into these cases, you can take benefit of ITC.

Q-7: What is Ineligible ITC?

Ans: Ineligible ITC refers to Input Tax Credit that cannot be claimed under GST due to various reasons such as non-compliance with GST rules or utilization for purposes not allowed under the law. The list of items are covered under section 17(5) & 16(4).

Q-8: Can you provide an example of Input Tax Credit?

Ans: Suppose a manufacturer purchases raw materials worth Rs.10,000 and pays GST of Rs.1,800 on it. When they sell the finished goods for Rs.20,000 with a GST of Rs.3,600, they can claim an Input Tax Credit of Rs.1,800 (the GST paid on purchases) against their GST liability on sales.

Q-9: Is Input Tax Credit available on capital goods?

Ans: Yes, Input Tax Credit is available on capital goods, which are goods used for the furtherance of business such as machinery, equipment, etc., subject to certain conditions.

Q-10: What are eligible and ineligible Input Tax Credits?

Ans: Eligible Input Tax Credits are those for which the taxpayer meets all the conditions prescribed under the GST law. Ineligible Input Tax Credits are those that do not meet the prescribed conditions or fall under blocked credit categories.

Q-11: What are the time limits for availing Input Tax Credit?

Ans: A registered individual cannot claim input tax credit for any invoice or debit note related to the supply of goods or services after the 30th of November following the end of the financial year to which the invoice or debit note pertains or after filing the relevant annual return, whichever occurs earlier.

Q-12: Can Input Tax Credit be claimed only for certain expenses?

Ans: Input Tax Credit can generally be claimed for GST paid on inputs, capital goods and input services that are used or intended to be used in the course or furtherance of business.

Q-13: Can we claim Input Tax Credit on bank charges?

Ans: Input Tax Credit on bank charges can be claimed if the charges are directly related to the business and are subject to certain conditions specified under the GST law.

Q-14: What are the rules for claiming GST Input Tax Credit (ITC)?

Ans: The rules for claiming GST Input Tax Credit include possession of valid tax invoices, compliance with GST law provisions, and utilization of credit only for eligible purposes. The detail list is given under section-16 of CGST Act, 2017.

Q-15: Is ITC can be claim on traveling expenses?

Ans: Input Tax Credit can only be claimed when it is utilized to advance business activities. To put it plainly, claiming ITC on travel expenses is permissible only if the travel serves a business purpose. Consequently, ITC cannot be claimed if the travel is for personal reasons.

Q-16: Is Input Tax Credit available on capital goods?

Ans: Yes, Input Tax Credit is available on capital goods, subject to fulfillment of certain conditions specified under the GST law.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Introduction

2. Applicable tax rate as per Section 206AB

3. Applicable tax Rate of TCS as per Section 206CCA

4. Additional Provision of Section 206AA and 206CC

5. Compliance with Section 206AB and section 206CCA

6. Conclusion

Introduction:

Under income tax act Section 206AB has been introduced to ensure the tax compliances obligations. According to this section specified persons who have not filed their income tax returns are liable for tax deductions at higher rates. Similar provision has been inserted through section 206CCA for tax collection at source.

Applicable tax rate as per Section 206AB:

According to Section 206AB, if TDS is required to be deducted on any sum or income payable to a specified person, the tax shall be deducted at the higher of the following rates:

a. Twice the rate specified in the relevant provision of the Income Tax Act.

b. Twice the rate or rates in force.

c. At the rate of 5%.

Exception to section 206AB:

The provision of section 206AB does not apply if the tax is required to be deducted under the following section:

• Section 192: Income from salary

• Section 192A : Premature withdrawal of EPF

• Section 194B: Winnings from any lottery or card games, or crossword puzzles

• Section 194BB : Winnings from any horse races

• Section 194LBC: Income concerning investment in securitisation trust

• Section 194N: Cash withdrawals

• Section 194IA: Consideration paid on sale of Immovable property

• Section 194IB: Rent payment to the landlord above ₹ 50,000 (Individual and HUF)

• Section 194M: Payment for contract or professional services above ₹ 50 lakh by an Individual or HUF

Applicable tax Rate of TCS as per Section 206CCA:

Section 206CCA requires TCS at the higher of:

• Twice the rate specified in the relevant provision of the Act.

• 5%. Effective from July 1, 2023,

The maximum TCS rate for non-filers of income-tax return should not exceed 20%.

Specified Person u/s 206AB and 206CCA:

A "specified person" is defined as an individual or entity who meets the following criteria:

• Has not filed their income tax return for the assessment year relevant to the previous year immediately preceding the financial year in which TDS is required to be deducted

• The time limit for filing the return of income under Section 139(1) has expired.

• The aggregate of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) in their case is ₹ 50,000 or more in the said previous year.

• Exclusion for Non-resident without Permanent Establishment.

The definition of "specified person" excludes non-residents who do not have a permanent establishment in India. A permanent establishment refers to a fixed place of business through which the enterprise's business is wholly or partly carried on in India.

Example:

For instance, if tax collection is required in January 2024, the higher rate under section 206CCA applies if the buyer has not filed the income tax return for the assessment year 2023-24, and the aggregate TDS/TCS in the buyer's case is ₹50,000 or more in the previous year 2022-23.

Additional Provision of Section 206AA and 206CC:

If the provisions of Section 206AA (relating to the requirement of furnishing a Permanent Account Number or PAN) are applicable to a specified person, the tax shall be deducted at the higher of the rates provided in Section 206AB and Section 206AA.

In case of collection of tax, If Section 206CC and Section 206CCA both are applicable to the specified person, TCS is required at the higher of the rates specified in both sections.

Compliance with Section 206AB and section 206CCA:

This section places the responsibility on deductors and collectors to identify specified persons who have not filed their income tax returns and apply the higher tax rates as mandated. It encourages tax compliance and filing of income tax returns by individuals and entities falling under the specified person category.

Conclusion:

Section 206AB and section 206CCA of the Income Tax Act, 1961, enforces higher TDS/TCS rates on specified persons who have not filed their income tax returns and whose aggregate TDS and TCS exceeds ₹50,000 in the previous year. Deductor or collector must ensure compliance with this provision to meet their tax obligations and promote tax compliance among payees.