LAW LEGENDS OUTLINE:

Central Board of Direct Taxes (CBDT) ने assessment year 2024-25 के लिए Notification Number 24/2024-Income Tax dated 01ST March, 2024 में Income tax return form ITR-7 Notify किया है।

Topic Covers:

1. Introduction

2. What is advance tax?

3. Threshold limit to pay advance tax

4. Due dates to pay Advance Tax

5. Consequence of Nonpayment or Short Payment of Advance tax

6. Difference between Section 234B and Section 234C

1. Introduction

In the Income Tax Act, assessee have to pay advance tax, if the net tax liability exceeds ₹ 10,000 /- after tax deduction or collection (TDS/TCS). Advance tax has to be paid as income is earned. In this article, we will understand all the provisions related to advance tax.

2. What is advance tax?

Advance tax is a system in which the taxpayer pays tax, in the financial year in which income is earned, rather than making lump sum payments after the end of the financial year. It is applicable to all individuals, self-employed professionals, business entities and corporations who cross the threshold limit.

3. Threshold limit to pay advance tax

Any Assessees whose tax liability is more than ₹ 10,000 after TDS/TCS deduction have to pay advance tax. Assessee means self-employed individuals, salaried employees, partnership firms, companies and taxpayers who have opted for the presumptive tax regime.

4. Due dates to pay Advance Tax

| Installment due date | All Assesse other than those who opted Presumptive Scheme U/S 44AD OR 44ADA | Taxpayer who opted for presumptive scheme U/S 44AD OR 44ADA |

| By 15th June | Min 15% of Advance tax | Nil |

| By 15th Sep | Min 45% of Advance tax | Nil |

| By 15th Dec | Min 75% of Advance tax | Nil |

| By 15th Mar | Min 100% of Advance tax | 100% of Advance tax |

Note:

-

- If the bank is closed on the last date of payment of advance tax, then the taxpayer will have to pay advance tax immediately on the next working day.

- There will be interest charge on non-payment or short payment of advance tax.

- NRI whose tax liability is more than ₹ 10,000/- will also have to pay advance tax.

- You can consider TDS and TCS to calculate net advance tax.

- In the case of capital gain, it is not possible to predict the amount of capital gain in advance, in this case if the capital gain is arises after the due date of advance tax, then it will have to be adjusted in the installment of the remaining advance tax.

- Challan no. ITNS 280 is needs to be used for advance tax pay.

5. Consequence of Non payment or Short Payment of Advance tax

If the assessee does not pay advance tax with in the due date or paid less, then he will have to pay interest. The payment of interest will be charged according to section 234B and 234C. Let us now understand these sections in detail.

Section 234B – Non payment of Advance Tax

As per Section 234B, interest is charged in 2 circumstances –

where the taxpayer has not paid advance tax or

advance tax is paid but it is less than 90% of the total due.

So interest is required to be paid at the rate 1% per month or part of month on the nonpayment or short payment.

The interest of section 234B of the financial year for which advance tax is to be paid will have to be paid from the 1st April to the date of determination of income under 143(1) or the date of regular assessment.

Note- Calculation of advance tax is calculated by deducting the amount of TDS from the assessed tax liability.

Section 234C – Delay in payment of Advance Tax

In case of default in payment of installment(s) of advance tax i.e. In case of taxpayers (other than those who opted for presumptive taxation scheme under section 44AD or section 44ADA), interest shall be levied as per the provisions of section 234C

• If advance tax paid on or before 15th June is less than 12% of advance tax payable

• If advance tax paid on or before 15th September is less than 36% of advance tax payable

• If advance tax paid on or before 15th December is less than 75% of advance tax payable

• If advance tax paid on or before 15th March is less than 100% of advance tax payable.

In case of short fall in payment of 1st, 2nd and 3rd installment Interest under section 234C is levied for a period of 3 months, and in case of short fall in payment of last installment interest shall be levied for 1 month. This interest shall be levied at the rate of 1% per month.

In case of assesse, who have income under section 44AD and 44ADA do not pay advance tax or till March 15, pay advance tax less than the prescribed tax in returned income, then the assessee is liable to pay simple interest of 1% per month or part of month.

6. Difference between Section 234B and Section 234C

Section 234B of interest is imposed on taxpayers who fail to pay advance tax or pay less than 90% of the total assessed tax in advance tax. This interest will be charged at 1% per month or part of month from the end of the financial year till the date of payment of tax. Interest under section 234C will be charged on taxpayers who have not paid tax on time during the financial year.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

GST on Mobile Phones

In this article, we understood the GST rate on mobile phones, GST on mobile accessories, and whether we can claim an input tax credit on mobile phones under GST.

Introduction

Before the introduction of GST, earlier Excise and VAT were charged on mobile phones. Under the VAT Regime, rates varied from state to state. So, it was difficult to set a uniform price for the mobile phone.

With the introduction of GST, the tax rate is the same all over India and thus a uniform price can be set for a mobile phone.

When CGST & SGST or IGST will be applicable:

In GST, there are two types of transactions: Inter-state supply and Intra-state supply. If the supply is within the state, then CGST & SGST are levied, and if the supply is between two different states or union territories, then IGST is levied.

Example: Mr. Sourabh, located in M.P., purchases a mobile phone from a dealer located in the same state i.e. M.P. In such a case, 9% CGST and 9% SGST will be charged. If he purchases a mobile phone from a different state or Union Territory, then he is required to pay IGST at 18%.

How GST will be charged when a mobile phone is sold with a charger and USB cable?

To know how the GST will be charged, first we have to understand the definition of the Composition scheme.

“Composite supply" means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

In the case of composite supply, tax rate of principle supply is applicable to all products.

In case of mobile phones, a mobile phone is usually supplied along with the charger and USB cable, which is essential for using the mobile phone. So, the GST rate that applies to the mobile phone will also apply to the charger and USB cable.

However, in some cases, the earphones are also sold along with the mobile phone, which is not naturally bundled and is classified as mixed supplies.

How to compute GST on mobile phones?

Under the GST, GST is charged on the transaction value. Transaction value means the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related, and the price is the sole consideration for the supply.

For example : Mr. X sells a mobile phone to Mr. Y at the price of Rs.50,000, and the buyer (Mr. Y) and seller (Mr. X) are not related parties. In such a case, GST is charged on the transaction value, i.e. Rs.50,000.

In the case of exchange offers, dealers of smartphones often come up with exchange offers whereby customers can get a new phone in exchange for an old one, and they just need to pay the differential sum. Under GST, barter is also included in the definition of supply.

For example, where a new phone is sold for Rs. 28,000 in exchange for an old phone. The price of the new phone without exchange is Rs.35,000. In this case, GST will be charged on Rs. 35,000.

Discounts - At the time of sale, the supplier gives a discount, and such a discount is recorded on the invoice. Then, in such a case, while determining the taxable value, discounts are excluded from the taxable value.

For example, Mr. X sells a mobile phone to Mr. Y at Rs. 45,000 and gives a discount of Rs. 5,000, and such a discount is recorded on the invoice. Then the transaction value of such a transaction is Rs. 40,000.

What is the GST rate on mobile phones?

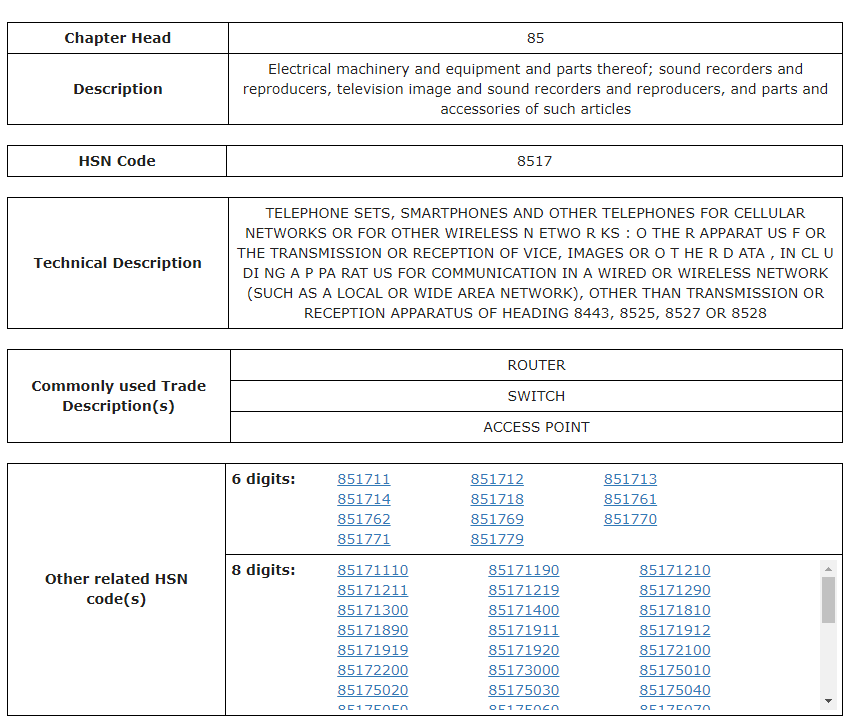

Before the GST regime, a smartphone’s price was not fixed as taxes varies from state to state. Under GST 18% GST charge on mobile phone. The related HSN code for mobile phone is 8517.

GST rate on mobile phones and accessories is covered under HSN chapter 85.

Rates of GST on mobile phones and accessories are below :

| Product name | HSN code | GST rate |

| Mobile phones | 8517 | 18%

|

| Lithium-ion batteries | 8507 60 00 | 18% |

| Power bank | 8507 | 18% |

| Memory card | 8523 | 18% |

| Speakers, headphones, earphones | 8518 | 18% |

| Plastic screen protector | 3919 | 18% |

| Tempered glass screen protector | 7007 | 18% |

Can a person claim GST paid on Mobile Phones?

Input tax credit (ITC) can be claimed on mobile phones subject to certain conditions :-

1. Every registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

2. He is in possession of a tax invoice or debit note issued by a supplier. He has received the goods or services or both.

3. Tax charged in respect of such supply has been actually paid to the Government. Then the buyer can claim ITC on the mobile phone.

FAQs on GST on mobile phones :-

Q.1 What is the GST rate on Mobile phones?

Ans. GST rate on Mobile phone is 18%.

Q.2 Can the buyer claim ITC on a Mobile phone?

Ans. Yes, if mobile phones are used for business and profession, then the buyer can claim an Input Tax Credit (ITC) on the mobile phone.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Introduction:

Section 192 of the Income Tax Act, requires that every person responsible for paying income chargeable under the head salary shall deduct tax on the estimated income of the payee. To deduct the TDS, tax is required to be calculated at the average rate. However there is no requirement to deduct the TDS, If the income not exceed the amount not chargeable to tax applicable in the case of an individual in the relevant financial year. In this article, we understand the provision relating to section 192.

1. Responsibility to Deduct Tax:

Any person responsible for paying income chargeable under the head "Salaries" (typically, the employer) is required to deduct tax at source.

Conditions :

TDS should be deducted only if the employee falls under below conditions:

• The employer-employee relationship must exist between the deductor and the deductee.

• The employer makes payment to the employee.

• The nature of payment must be salary.

• The income under the head salary is above the maximum amount not chargeable to tax.

2. Timing of TDS:

As per the provision of this section, tax is required to be deducted at the time of making the payment of salary to the employee.

3. Rate of TDS:

TDS is deducted at the average rate of tax computed based on the prescribed rates applicable for the financial year in which the payment to the employee is made.

Tax is calculated at the estimated income chargeable to tax under the head salary.

4. Exempted Limit:

Taxes need not be deducted if the taxable salary is below the basic exemption limit.

5. Payment of Tax by Employer:

Tax on non-monetary perquisites without deducting it from the employee's salary, can be paid by the employer. The tax on these non-monetary perquisites is also calculated at the average income tax rate for the relevant financial year.

6. Particulars of Perquisites:

Employers must provide a statement containing detailed particulars and the value of perquisites or profits in lieu of salary in Form 12BA, to employees (whose salary exceeds a certain limit).

7. Salary from Multiple Sources:

If an individual is employed with more than one employer simultaneously, then he can furnish details of taxable income from all employers, and one employer can deduct tax on the aggregate salary.

8. Treatment of Other Income:

When an employee also has income under other heads like income under house property, or income from another source, he may choose to furnish particulars of such income and tax deductions to the employer to calculate the correct tax liabilities. Under Section 192 of the income tax act, tax deducted is determined based on specific rules, considering other income and losses.

9. Evidence of Claim:

To calculate the correct income of the employee, the employer must obtain evidence, proof, or particulars of prescribed claims. He should also obtain evidence of claims for set-off of losses, from the employee. Like House loan interest certificates, rent receipts etc.

Conclusion:

Section 192 of the Income Tax Act deals with the provisions to deduct tax on salary income. Employers and employees for both compliance is essential. Employers must deduct the correct TDS on the income of the employee and the employee must have knowledge of TDS deduction out of his income.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application.

GST has a substantial impact on the jewellery business in India. Under GST, the taxation on jewellery is primarily governed by the GST rates and the determination of the taxable value.

GST Rates on Jewellery and Making Charges:

In instances where an individual is involved in the trading or manufacturing of jewellery with gold or silver being the primary component, a GST rate of 3% will apply to the jewellery itself. Additionally, the registered person will be required to pay 5% GST on the making charges.

GST Registration Requirement:

The GST registration threshold limits that are generally applicable to regular taxpayers also apply to such businesses. Furthermore, businesses in this category have the option to choose the composition scheme as provided in section 10 of the CGST Act

GST on Job work charges & its applicability on ITC:

In this type of business, it's common for jewellers to transform gold bars into jewellery with the assistance of a goldsmith. This activity is known as job work and is classified under the category of supply of service. The goldsmith will charge for their services known as making charges on which GST at 5% is applicable.

The GST paid by registered jewellers on making charges can be claimed as an Input Tax Credit.

GST Rates with HSN Code for Jewellery

| S. No. | Particulars | HSN/SAC Code | GST Rate |

| 1 | Rough and un-worked diamonds, precious and semi-precious stones | 7102, 7103, 7104 | 0.25% |

| 2 | Pearls, Gold, Silver, Articles of jewellery of gold, silver, etc | 7106, 7108, 7113, 7118 | 3% |

| 3 | Job work in relation to cut and polished Diamonds, plain or studded jewellery of gold, silver, etc | 9988 | 5% |

| 4 | Gold (Including Gold Plated With Platinum) Unwrought Or In Semi-Manufactured Forms, Or In Powder Form - Non-Monetary | 7108 | 3% |

| 5 | Gold (Including Gold Plated With Platinum) Unwrought Or In Semi-Manufactured Forms, Or In Powder Form - Non-Monetary : Powder | 71081100 | 3% |

| 6 | Gold (Including Gold Plated With Platinum) Unwrought Or In Semi-Manufactured Forms, Or In Powder Form - Non-Monetary : Other Unwrought Forms | 71081200 | 3% |

| 7 | Gold (Including Gold Plated With Platinum) Unwrought Or In Semi-Manufactured Forms, Or In Powder Form - Non-Monetary : Other Semi-Manufactured Forms | 71081300 | 3% |

| 8 | Gold (Including Gold Plated With Platinum) Unwrought Or In Semi-Manufactured Forms, Or In Powder Form Monetary | 71082000

|

3% |

| 9 | (1) Precious stones (other than diamonds) and semi-precious stones, whether or not worked or graded but not strung, mounted or set (2) Ungraded precious stones (other than diamonds) and semi-precious stones, temporarily strung for convenience of transport (includes synthetic or reconstructed stones, apart from unworked or simply sawn or roughly shaped) |

7103, 7104 | 0.25% |

| 10 | Services by way of job work in relation to diamonds falling under chapter 71 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975); | 9988 | 1.5% |

| 11 | Rough diamonds or simply sawn diamonds, industrial or non-industrial | 7102 | 0.25% |

| 12 | Pearls, natural or cultured, whether or not worked or graded but not strung, mounted or set; pearls, natural or cultured, temporarily strung for convenience of transport | 7101 | 3% |

| 13 | Base metals, silver or gold, clad with platinum, not further worked than semi-manufactured | 7111 | 3% |

Taxable Value:

The taxable value for jewellery under GST is determined by the transaction value, which encompasses the cost of the jewellery, making charges, and any additional expenses such as transportation, insurance, etc., associated with the sale.

FAQ’s

Q-1: What will be the GST on Gold and Gold Jewellery?

Ans- The GST rate on gold jewellery is 3%. However, registered jewellers have to pay 5% on making charges for making jewellery

Q-2: Is “Karigar” required to take the GST number?

Ans- Yes, if his income from making his jewellery exceeds Rs.20 Lacs per annum then he must obtain a GST number.

Q-3: My man takes 20kg of Goods to different states in which he brings back some goods and he sells some goods, how SGT will be levied?Ans- GST will be levied on all goods which are sold, but he cannot take goods to other states where you don’t have an office and where you have not applied for a casual taxable number in that state.

Q-4: Sometimes, one “karigar” directly sends goods to another “Karigar” in that case is it necessary to prepare vouchers etc.?

Ans- Yes, otherwise goods can be confiscated.

Q-5: How will the GST be applied on repairing jewellery?

Ans- GST will be applied on repairing charges only. However, if some gold is added while repairing goods, GST @3% is to be paid on additional gold used for repairing. 18% GST will be applied on repairing.

Q-6: A customer wants to exchange a coin/bullion into ornaments. How will GST be applied?

Ans- Provisions of reverse charge will not be applicable on old Gold purchases. As per a Press release dated 13.07.2017 even though the sale of old Gold by an individual is for consideration, it cannot be said to be in the course or furtherance of his business (as selling old Gold jewellery is not the business of the said individual), and hence does not qualify to be a supply per se. Accordingly, the sale of Old jewellery by an individual to a jewelers will not attract the provisions of section 9(4) and jeweler will not be liable to pay tax under the reverse charge mechanism on such purchases. However, if an unregistered supplier of gold ornaments sells it to the registered supplier, the tax under RCM will apply.

Q-7: How will GST apply if a unregistered customer wants to convert a chain to a mangalsutra?

Ans- Since a customer is unregistered & original product is getting converted to different product, GST will be levied only on making charges.

Q-8: Is it necessary to write making charges separately while raising invoices to the customers?

Ans- If the international standards are to be adopted, making charges and wastage must be written separately while raising invoices to the customer. However, the government has stated that jewellery will be taxed at 3% and hence there is no need to write making charges separately.

Q-9: Is it necessary to prepare vouchers etc. while issuing goods to “Karigar”?

Ans- Yes, otherwise goods can be confiscated.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Introduction –

GST exemptions are some specific goods or services that are exempt from the GST. In other words, there are certain goods and services that are not covered under the ambit of the GST Act. The government can grant exemptions for various reasons like alleviating the tax burden on essential goods and services or supporting specific sectors.

Where the Government is satisfied that it is necessary in the public interest so to do, it may, on the recommendations of the Council, by notification, exempt generally, either absolutely or subject to such conditions as may be specified therein.

Types of Exemption under GST-

- Absolute exemptions: These do not have any conditions attached to them.

- Conditional exemptions: Some exemptions are subject to certain criteria.

Definition of Exempt supply :-

Exempt supply means the supply of any goods or services or both which attracts a Nil rate of tax or which may be wholly exempt from tax under Section 11 of the CGST Act or under Section 6 of the IGST Act, and includes the non-taxable supply.

Nil-rated Supply means Supplies subject to 0% tax rate.

Non-taxable supply means a supply of goods or services or both which is not leviable to tax under this Act or under the IGST Act. Like petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas, and aviation turbine fuel.

GST Exemption for Registration

- Agriculturists to the extent of supply of produce out of cultivation of land.

- Taxpayers who fall in the threshold exemption limit of turnover for the supply of goods Rs. 40 lakhs and for the supply of services Rs. 20 lakhs and for specified categories Rs. 20 lakh and Rs. 10 lakh.in special category states.

- A person who is making NIL-Rated supply and exempt supply of goods and services such as milk, agriculture services, etc.

- Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax such as funeral services, Services by any court or Tribunal, Services by an employee to the employer in the course of or in relation to his employment etc.

- A person making supplies of those goods that are covered under reverse charge such as GTA service provider, Insurance agent, recovery agent tobacco leaves, cashew nuts (not shelled and peeled) etc.

List of Exempted Goods Under GST

| Types of Goods | Examples |

| Live Animals | Cows, sheep, goats, etc. |

| Meat | Fresh and frozen meat of sheep, cows, goats, pigs, etc. |

| Fish | Fresh or frozen fish |

| Natural products | Honey, fresh and pasteurized milk, cheese, eggs, etc. |

| Live trees and plants | Bulbs, roots, flowers, foliage, etc. |

| Vegetables | Tomatoes, potatoes, onions, etc. |

| Fruits | Bananas, grapes, Orange, etc. |

| Dry fruits | Cashew nuts, walnuts, Almond etc. |

| Tea, coffee and spices | Coffee beans, tea leaves, turmeric, etc. |

| Grains | Wheat, rice, oats, etc. |

| Products of the milling industry | Flours of different types |

| Seeds | Flower seeds, oil seeds, cereal husks, etc. |

| Sugar | Sugar, jaggery, etc. |

| Water | Mineral water, coconut water, etc. |

| Baked goods | Bread, pizza base, puffed rice, etc. |

| Fossil fuels | Electrical energy |

| Drugs and pharmaceuticals | Human blood, contraceptives, etc. |

| Fertilizers | Goods and organic manure |

| Beauty products | Bindi, kajal, kumkum, etc. |

| Waste | Sewage sludge, municipal waste, etc. |

| Ornaments | Plastic and glass bangles, etc. |

| Newsprint | Judicial stamp paper, envelopes, rupee notes, etc. |

| Printed items | Printed books, newspapers, maps, etc. |

| Fabrics | Raw silk, silkworm cocoon, khadi, etc. |

| Hand tools | Spade, hammer, etc. |

| Pottery | Earthen pots, clay lamps, etc. |

List of Exempted Services Under GST-

| Types of Services | Examples |

| Agricultural services | Cultivation, supplying farm labour, harvesting, warehouse-related activities, renting or leading agricultural machinery, services provided by a commission agent or the Agricultural Produce Marketing Committee or Board for buying or selling agriculture produce, etc. |

| Government services | Postal service, transportation of goods or Passengers, services by a foreign diplomat in India, services offered to diplomats, etc. |

| Transportation services | Transportation of goods by road, rail, water, etc., payment of toll, transportation of passengers by air, |

| Judicial services | Services offered by the arbitral tribunal, partnership firm of advocates, senior advocates to an individual or business entity whose aggregate turnover is up to Rs. 40 lakhs |

| Educational services | Transportation of faculty or students, mid-day meal scheme, examination services, services offered by IIMs, Services relating to admission to, or conduct of examination etc. |

| Health Care Service

|

Like by way of transportation of a patient in an ambulance, charities, veterinary doctors, medical professionals, etc. does not include hair transplants or cosmetic or plastic surgery. |

| Organizational services | Services offered by exhibition organizers for international business exhibitions, tour operators for foreign tourists, etc. |

| Entertainment and Sports related Services | Service by way of admission to a museum, national park, wildlife sanctuary. etc. |

| Renting of Immovable property-related service | Renting of residential dwelling for use as a residence |

Reasons for Exemption:-

Under the Goods and Services Tax system, certain goods, and services, are exempt from GST, which means they are not subject to GST. There are various reasons for granting exemptions under GST, and these reasons are based on policy objectives, socio-economic considerations, and administrative simplicity. Here are some of the common reasons for granting exemptions:-

- For Social Welfare and Public Interest:- Certain essential goods and services that are considered essential for the welfare of society may be exempted from GST. This includes items like basic food items i.e. rice, wheat, milk), healthcare services, transportation services, education services. Entertainment and sports-related services and Agriculture services.

- For Small Businesses:- To reduce the compliance burden on small businesses and promote ease of doing business, there may be exemptions or concessional rates for businesses with lower turnover. i.e. Composition Scheme for small tax payers.

- Export of Goods and Services: Exports are typically zero-rated under GST, which means that while they are subject to GST, the tax rate is set at zero percent. This ensures that exports remain competitive in international markets and do not suffer from the burden of GST

FAQs on exemption under GST :

Q.1 What is zero- rated supply?

Ans. Zero-rated supply means the Export of goods or services or both or Supply of goods or services or both for authorised operations to a SEZ developer or a SEZ unit.

Q.2. What do you mean by GST exemption?

Ans. Government has the power to notify goods or services in the public interest by notification, exempt generally, either absolutely or subject to such conditions as may be specified therein.

Q.3 Example of services that are exempted under GST?

Ans. Some services that are exempted under GST i.e. Government services, health care services, sports-related services, entertainment services, education services, renting of immovable property services, judicial services, transportation services etc.

Q.4 What is nil-rated supply?

Ans. Nil-rated Supply means Supplies are subject to 0% tax rate.

Q.5 What is Non- taxable supply?

Ans. Non-taxable supply means a supply of goods or services or both which is not liveable to tax under this Act.

Q.6. Example of Goods that are exempted under GST?

Ans. Some goods that are exempted under GST i.e. live animals, meat, fish, live trees and plants, printed items, handicraft goods, pottery, etc.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application.

Introduction:

Section 194H of the Income Tax Act deals with Tax Deducted at Source (TDS) on commission or brokerage payments, excluding insurance commission, made to resident individuals and entities. In this article, we discuss about the person liable to deduct the tax, threshold limit, rate of deduction of tax and timing etc.

Meaning of Commission or Brokerage:-

Person liable to Deduct tax:

TDS on commission or brokerage as per this provision is required to be deducted by the following entities:

- Any person, other than an individual or Hindu Undivided Family (HUF).

- Individual or HUF whose total sales, gross receipts, or turnover from business or profession exceed ₹1 crore (for business) or ₹50 lakh (for profession) during the financial year immediately preceding the year in which such payment is made.

Threshold Limit:

No TDS is required if the aggregate commission or brokerage payments credited or paid to the payee during the financial year do not exceed ₹15,000.

Timing of TDS Deduction:

TDS must be deducted at the time of making the payment or crediting the payee, whichever is earlier.

Rate of TDS:

As per this section, TDS is required to be deducted at a rate of 5%. In case of absence of PAN of the deductee, TDS needs to be deducted at a higher rate as per section 206AA.

Exemption or Relaxation:

Recipients can apply to the Assessing Officer in Form No. 13 to obtain a certificate authorizing the payer to deduct tax at a lower rate or not deduct any tax, as per Section 197.

Retained Commissions:

If the consignee/agent retains commission or brokerage at the time of remitting the sale consideration, the consignor/principal is responsible for deducting and depositing the tax to the government, on the amount of such retained commission, as per Circular No. 619.

Other Points:

Commission or brokerage includes any payment received or receivable, directly or indirectly, by a person acting on behalf of another person for services rendered (excluding professional services) or for any services related to the buying or selling of goods or transactions involving assets, valuable articles, or items other than securities.

To ensure compliance with tax regulations effectively, understanding these provisions is essential for entities involved in making such payments. It is advisable to seek professional help where complications are involved.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application.

CBDT recently issued an order F. No. 375/02/2023- IT-Budget dated 13th February 2024, regarding the waiver/ extinguishment of old tax demands which were outstanding as on 31st January 2024. This order not only remits/ extinguishes tax demands of income tax but also the demand of wealth tax and Gift tax. The Order specified the Conditions for withdrawing the demands.

Monetary limits and assessment years covered

This order specified the monetary limit for remitting or extinguishment of the demand. The maximum limit for extinguishment is ₹ 1,00,000 for specified assessee.

| Assessment Year/s (A.Y.) to which the entries of outstanding tax demands as on January 31, 2024 pertain | Monetary limit of entries of outstanding tax demands which are to be remitted and extinguished (in Rupees) |

| Upto A.Y. 2010-11 | Each demand entry upto ₹. 25,000/- |

| A.Y. 2011-12 to A.Y. 2015-16 | Each demand entry upto ₹. 10,000/- |

Demand entries which are consider for waiver

- Principal component of tax demand under the Income-tax Act, 1961 or corresponding provisions of Wealth-tax Act, 1957 or Gift-tax Act, 1958 and

- Interest, penalty, fee, cess, or surcharge under various provisions of the Income-tax Act, 1961, or corresponding provisions, if any, of the Wealth-tax Act, 1957, or Gift-tax Act, 1958.

How will the maximum ceiling limit of tax demand be calculated?

The remission and extinguishment of entries of outstanding tax demand will be carried out in respect of each demand entry falling within the specified monetary limit, starting from the earliest assessment year to subsequent assessment year(s) subject to the condition that the aggregate value of such demand entries shall not exceed ₹ 1 lakh for any specific taxpayer.

To compute the maximum ceiling of ₹ 1 lakh any tax demand entry having value more than the specified monetary limit.

For example

Mr Arun has four outstanding demand for

AY 2003-04 – ₹ 25,000,

AY 2005-06 - ₹ 20000,

AY 2006-07 - ₹ 23000

AY 2007-08- ₹ 12,000 , and

AY 2008-09- ₹ 18,000 .

Further there is another demand of ₹ 30,000 for AY 2004-05. Hence in aggregate his outstanding tax demand is ₹ 1,28,000. However, as for AY 2004-05, outstanding demand (₹ 30,000) is more than specified limit hence the said demand will not be extinguished and same will not be considered for calculation of overall limit of ₹ 1,00,000.

Autonomous Applied

This waiver will be applied automatically without any intervention required by the taxpayer. Assessee can check the status of their waived demands by logging into the income tax portal and accessing the "Pending Action > Response to Outstanding Demand" section.

Waiver is not applicable to

This relief does not extend to demands against tax deductors or tax collectors under TDS or TCS provisions of the Income-tax Act, 1961.

Elimination of interest calculation

It is clarified that there shall not be requirement of calculation of interest on account of delay in payment of demand under section 220(2)

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Topic Covers:

- Introduction

- Persons require deducting TDS

- Time of Deduction of TDS :

- Payment, Return filing and TDS Certificate:

- Penalty Provisions:

The Income Tax Act introduces a tax deduction scheme as and when the revenues are generated, to facilitate the quick and efficient collection of taxes. The payer of the income deducts the tax and remits it to the government on behalf of the payee. Payments, such as salaries, interest, commissions, brokerages, professional fees, royalties, contracts etc., are covered under the provisions relevant to tax deductions at source(TDS).

The payer of the income is responsible to deduct tax at the source for payments as per the relevant provision, and also responsible for depositing the deducted tax to the Government's account. As per the Income Tax Act, any person must deduct tax at the source as per the provisions of the act.

Persons require deducting TDS

There are two parties involved in every transaction, the payer and the payee. According to the provisions, specified persons are required to deduct tax at a rate prescribed in the law and remit the same to the government. Certain individuals who are required to deduct Tax Deducted at Source (TDS) for specified payments are notified by government:

- Individuals and Hindu Undivided Families (HUFs) must deduct tax if they meet the following criteria:

- Individual /HUF engaged in a business with a turnover of ₹1 crore or more in the previous financial year, or

- Individuals engaged in a profession with receipts of ₹50 lakh or more in the previous financial year,

- Any other entity besides Individuals and HUFs, such as Partnership Firms, Limited Liability Partnerships (LLPs), Private Limited Companies, Co-operative Societies, etc.

There are also instances where individuals or HUFs are required to deduct tax even if they are not engaged in any business or profession, such as the purchase of immovable property or payment of rent for land or buildings exceeding the threshold limit.

Time of Deduction of TDS :

Deduction of Tax depends on the type of payment being made. Generally, TDS is supposed to be deducted either at the time of credit of the income or at the time of payment, whichever is earlier. This applies to payments such as Commission, Professional fees, Consultancy, contract, etc. However, there is an exception to this rule. In certain cases, TDS is to be deducted at the time of payment, as in the case of Dividends, winnings from lottery, crossword puzzles, or horse races. The provisions regarding TDS deduction are provided under sections 192 to 195 of the Income Tax Act. These sections specify the threshold limit and the rates at which TDS is to be deducted.

Payment, Return filing and TDS Certificate:

The deductor of TDS is required to deposit the amount of Tax deducted to the Government within the prescribed time limit and submit returns quarterly containing such information.

The TDS certificate displays the deducted and deposited tax amount by the deductor. It is obligatory for the deductor to furnish the TDS certificate to the deductee within the given time limit. It is recommended to acquire the certificate from the deductor to confirm the tax has been deposited and accurate reporting of Deductee PAN.

Penalty Provisions:

Under income tax act there are provisions for penalty and interest in cases where Tax is required to be deducted but not deducted or deducted but not deposited, or late deposited, return not filed, or certificate is not issued.

- TDS is not deducted: In case tax is deducted after the due date, interest at the rate 1% per month or the part of the month shall be levied for the late deduction. Interest shall be levied for period starting from the date on which TDS is deductible to the date of actual deduction.

- TDS is deducted but payment is made lately: In case tax is deducted but deposited late, interest at the rate 1.5% per month or the part of the month levied for the period. The period will start from the date on which Tax is deductible to the date of actual deduction.

- Late filing fee under section 234E:

- For any delay in furnishing the TDS statement Penalty of ₹ 200 per day shall be levied.

- The total late filing fees should not exceed the total amount of TDS reported in the return.

- Penalty for not filing TDS statement: If the statement of TDS is not filed within one year from the due date of furnishing of TDS return, then a penalty under section 271H of the income tax act can be levied.

- Penalty for not issuing TDS certificate: TDS certificate is required to be provided to the deductee within the specified date. For any delay in issuing TDS certificate a penalty of ₹ 500 per day shall be imposed. The amount of penalty should not exceed the total amount of TDS reported in the return.

In Conclusion, the implementation of TDS might have been aimed at reducing the chances of tax evasion by the recipient of income. It is obligatory by law to deduct TDS and submit it along with all the necessary details in the specified format and within the specified time limit. Non-compliance with this provision can result in penalties. TDS deduction is applicable only in specific transactions as specified by the act. Seek customized professional guidance when necessary and particularly in situations where complications arise.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Topic Covers:

- Introduction

- Capital Assets u/s 2(14)

- Holding Period

- Transfer u/s 2(47)

- Transactions not consider as transfer

Introduction

Capital gain arises when capital assets are transferred and this transfer results in profit or loss. For the chargeability of capital gain, there must be a transfer of capital asset. In this article we discuss the meaning of “Capital assets”, and “Transfer” and know about the holding period, types of capital gain and exceptions.

Capital Assets u/s 2(14)

Let’s understand first the meaning of capital assets. A "capital asset" is a most important concept in understanding the taxation of capital gains. The definition of a capital asset is provided under Section 2(14) of the Income Tax Act:

Any Kind of Property: A capital asset can encompass any kind of property, regardless of whether it is held in connection with the assessee's business or profession. The word property includes both movable and immovable assets, tangible (e.g., furniture, jewellery) and intangible (e.g., goodwill, copyright) assets.

Securities Held by Foreign Institutional Investors: Securities held by Foreign Institutional Investors (FIIs) who have invested in accordance with the regulations under the Securities and Exchange Board of India Act, 1992 is also covered in this definition.

Certain Unit-Linked Insurance Policies: Unit-linked insurance policies (ULIPs) for which exemption under Section 10(10D) does not apply due to the fourth and fifth provisos thereof. These provisos set limits on the premium payable for ULIPs issued on or after a certain date.

Exclusions from the Definition of Capital Asset:

The definition of a capital asset is comprehensive but some specific categories of assets are not included. Following are exclusions from the definition of a capital asset:

Stock in Trade: Stock-in-trade, consumable stores, or raw materials for held for business or profession are not considered capital assets. And profit arising from the sale of such assets is taxable under the head "Profits and Gains of Business or Profession."

Personal Effects: Movable properties which are held for the personal use of the assessee or their dependent family members have personal effects. However, specific items are excluded from this definition. Personal effects include items such as clothing, furniture, cars, cycles, and scooters used for personal purposes. Excluded items encompass jewellery, archaeological collections, drawings, paintings, sculptures, or any works of art.

Holding Period

Period of holding of capital assets is important to know the types of capital gain. It is short-term or long-term capital gain.

Short-term Capital gain:

Capital assets held for less than 36 months immediately before the date of transfer will be treated a short-term capital assets. However, the following assets held for less than 12 months shall be treated as short-term capital assets:

- Equity or preference shares in a company which are listed in any recognized stock exchange in India;

- Other listed securities;

- Units of UTI;

- Units of equity-oriented funds; or

- Zero-Coupon Bonds. Note: Unlisted shares and immovable property (being land or building or both) held for not more than 24 months immediately prior to the date of transfer shall be treated as short-term capital assets.

Long-term Capital Gain

- Equity or preference share in a listed Indian company (held for more than 12 months).

- Any security like debentures, government securities, etc., listed in India (held for more than 12 months).

- A unit of an equity-oriented fund (whether quoted or not).

- Zero-Coupon Bonds (whether quoted or not).

- Units of UTI (whether quoted or not).

- Equity or preference share in an unlisted company (held for more than 24 months).

Immovable property, i.e., land or building or both (held for more than 24 months).

| Transaction | Short Term Capital Gain | Long term Capital Gain |

| ·security (other than a unit) listed in a recognized stock exchange in India · a unit of the Unit Trust of India · unit of an equity oriented fund or a zero coupon bond |

≤12 months | >12 months |

| ·Share of a company (not being a share listed in a recognised stock exchange in India) ·an immovable property, being land or building or both |

≤24 Months | >24 Months |

| · Unit of debt-oriented Fund · Unlisted securities other than shares · Other capital assets |

≤36 Months | >36 Months |

Exception to the long-term capital asset rule:

Any gain on the transfer of an asset on which depreciation is allowed as per the Written Down Value (WDV) method under Section 32(1)(ii) shall be taxable as short-term capital gain, regardless of the period of holding.

Transfer u/s 2(47)

Meaning of "Transfer" under Section 2(47):

The definition of "transfer" under Section 2(47) of the Income Tax Act is crucial for determining when a capital gain arises. It includes various scenarios where an asset is considered to be transferred, and capital gains may become taxable. Here are the key components of the definition of "transfer":

Transfer in relation to a capital asset includes:

- Sale, Exchange & Relinquishment of the asset;

- Extinguishment of any right in an asset;

- Compulsory acquisition of an asset under any law;

- Conversion of asset into stock-in-trade by the owner;

- Any transaction of immovable property u/s 53A of the Transfer of Property Act, 1882;

- Any transaction which has the effect of transferring or enabling the enjoyment of any immovable property.

- Maturity or redemption of a zero coupon bond

Transactions not considered as transfer

Capital gains are taxed in the previous year in which the asset is transferred. However, there are exceptions to this rule, such as in the case of compulsory acquisition by the government, where capital gains may be taxable in the year in which the consideration is received rather than in the year of the actual transfer.

To charge any income under the head of "Capital Gains," the following essential conditions must be satisfied:

- Existence of a Capital Asset: There must be a capital asset involved in the transaction. A capital asset can include various assets like land, buildings, securities, jewellery, etc.

- Transfer of the Capital Asset: The assessee (taxpayer) must transfer the capital asset to another party. Transfer can occur through various means, such as sale, exchange, gift, or any other mode of disposal.

- Profit or Gain on Transfer: There should be a profit or gain (which can also include negative profit or loss) arising from the transfer of the capital asset. In other words, the difference between the sale consideration and the cost of acquisition should result in either a profit or a loss.

- The Capital Asset at the Time of Transfer: The asset being transferred should qualify as a capital asset at the time of transfer. Certain assets may be excluded from the definition of capital assets, such as stock-in-trade, personal effects, agricultural land in rural areas, etc.

In summary, capital gains are taxable when there is a transfer of a capital asset, resulting in a profit or loss. It's essential to consider the specific conditions and exemptions outlined in the Income Tax Act to determine the taxability of capital gains in different scenarios.