The Goods and Services Tax (GST), implemented in India in 2017, aimed to revolutionize the country's tax system by replacing a complex web of cascading taxes with a single unified levy. While heralded as a game-changer for the economy, its impact has been a double-edged sword, offering both advantages and disadvantages that continue to be debated. Let's delve into the two sides of this transformative reform and assess its overall impact on businesses, consumers, and the national landscape.

Advantages of GST:

1. Simplified Tax Regime: Replacing multiple indirect taxes like VAT, excise duty, and service tax with GST streamlined the compliance burden for businesses, reducing paperwork and administrative costs. This eased operations, particularly for small and medium enterprises (SMEs), and led to improved efficiency and resource allocation.

2. Reduced Cascading Effect: Prior to GST, taxes were levied on taxes, leading to a cascading effect that inflated the final price of goods and services. GST eliminated this distortion, lowering overall costs for consumers and boosting competitiveness in the market. This translated into reduced prices for essential goods and incentivized increased consumption.

3. Improved Transparency and Traceability: GST's online filing system enhanced transparency and accountability within the tax system. This allowed for better tracking of goods and services across the supply chain, curbing tax evasion and promoting fair trade practices.

4. Increased Government Revenue: The broader tax base under GST, encompassing previously untaxed sectors like real estate, widened the government's revenue streams. This enabled increased investment in public infrastructure, social welfare programs, and economic development initiatives.

5. Enhanced Ease of Doing Business: GST brought about a unified national market, eliminating state-level tax barriers and streamlining interstate trade. This facilitated faster movement of goods and services, lowered logistics costs, and improved the overall business environment.

Disadvantages of GST:

1. Initial Implementation Challenges: The hasty rollout of GST led to initial confusion and disruption for businesses, particularly SMEs. Adapting to new compliance procedures and technology platforms increased initial costs and posed challenges for smaller players.

2. Complex Rate Structure: While simplified compared to the pre-GST era, the current four-tier GST rate structure (5%, 12%, 18%, and 28%) still creates complications for businesses and consumers. Inconsistencies in taxation across certain sectors like agriculture and real estate also create confusion and compliance burdens.

3. Impact on Informal Sector: The formalization push under GST has pushed informal businesses into the tax net, impacting their margins and profitability. This can potentially lead to job losses and reduced economic activity in the informal sector, which remains a significant part of the Indian economy.

4. Increased Compliance Costs: While compliance is simplified in some aspects, maintaining GST records and filings can still be cumbersome for smaller businesses. The cost of software and professional assistance, particularly for frequent updates and complex transactions, can be a significant burden.

5. Challenges for Certain Industries: Certain sectors, like textiles and agriculture, have faced challenges under GST due to inverted duty structures, where the input tax burden exceeds the output tax. This can erode their competitiveness and hamper growth.

The Balancing Act:

The advantages and disadvantages of GST highlight the ongoing evolution of this complex reform. While delivering undeniable benefits like ease of doing business and increased revenue, its implementation challenges and impact on certain sectors require constant review and refinement. The key lies in striking a balance between simplifying the tax system, encouraging compliance, and supporting economic growth across all segments.

The journey towards a fully optimized GST regime is ongoing. Continuous consultations with stakeholders, simplification of procedures, and rationalization of rate structures are crucial steps in making GST truly beneficial for all. Open communication, timely response to emerging challenges, and a data-driven approach to address specific concerns will be paramount in ensuring its long-term success.

With its potential to boost economic activity, enhance transparency, and promote efficiency, GST holds immense promise for India's future. Recognizing its advantages and mitigating its disadvantages through ongoing refinement will be key to unlocking its full potential and fostering a truly inclusive and resilient economy.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Introduction

Since its introduction in 2017, the Goods and Services Tax (GST) has revolutionized the Indian tax system, aiming to create a seamless and unified tax regime. To ensure compliance and prevent fraudulent activities, the government periodically introduces amendments and rules.

In this article, we will delve into the details of Rule 86B in GST, explaining its purpose, implications, and how it affects businesses.

Understanding Rule 86B

Rule 86B was introduced by Notification No. 94/2020 Dated 22.12.2020 as an anti-tax evasion measure under CGST Rule 2017. The primary objective of this Rule is to target fraudulent practice of fraudulent input tax credit claims and curb the misuse of ITC. This rule restricts taxpayers to the utilization of ITC available in the Electronic credit ledger.

Restriction Imposed under Rule 86B

Rule 86B limits the utilization of available ITC in the electronic credit ledger to discharge the output liability. This rule has an overriding impact on all other CGST rules.

- Applicability:

Registered person having taxable supplies (other than exempted or Zero rated supplies) of more than Rs. 50 lakhs in a month has to follow Rule 86B. This limit of Rs.50 lakhs has to be checked every month. - Restriction of Rule 86B

Registered persons who fulfill the above criteria are restricted to use only up to 99% of outward liability through Available ITC in the electronic credit ledger. This means 1% of outward liability to be paid in Cash even when ITC is available. - Exception to Rule 86B

f registered person or proprietor, karta or Managing Director of the registered person or any of the partners or whole time directors or any other person as the case may be, have paid more than Rs.1 lakh as Income tax in each of the last two financial years for which the time limit to file a return of income under subsection (1) of section 139 of the said Act has expired. If the registered person under concern has received a refund of an amount greater than Rs.1 lakh in the preceding financial year on account of export under LUT or due to an inverted tax structure. If the registered person has discharged his liability towards output tax through the electronic cash ledger for an amount that is in excess of 1% of the total output tax liability, applied cumulatively, upto the said month in the current financial yearIf the registered person is - - Government Department; or

- Public Sector Undertaking; or

- Local authority; or

- Statutory body.

- When restriction can be removed.

The commissioner or an officer authorized by him may remove the restriction after such verification and such safeguards as may deemed fit.

Implications for Businesses

- Cash flow impact: The 1% cash payment requirement can have a significant impact on the cash flow of businesses even when ITC is available.

- Compliance challenges: Rule 86B imposes an additional compliance burden on taxpayers, requiring them to meticulously plan and manage their ITC utilization to ensure proper compliance of the rule.

- Effect on working capital: Since businesses must now allocate a portion of their GST liability for cash payment, it affects their working capital requirements.

- Increased documentation: To prove compliance with Rule 86B, businesses need to maintain accurate documentation of their income tax payments and GST refund receipts. This emphasizes the importance of maintaining detailed records to avoid any discrepancies.

Conclusion

Rule 86B in GST represents the government's efforts to prevent fraudulent practices and misuse of ITC provisions. While it strengthens the tax administration, it also presents challenges for businesses, impacting their cash flow and working capital requirements. To navigate these challenges effectively, businesses need to adapt their compliance processes and maintain meticulous records of their income tax payments and GST refunds.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken.

Madras High Court issued an Order Nos 7173-7174 of 2023 (W.P.(MD)No.6764 & 6765 of 2023), on 24 November, to address technical obstructions faced by taxpayers when trying to claim ITC due to the non-availability of Form GSTR-2 on the portal. As per Section 16(4) of CGST Act, any belated claim for Input Tax Credit cannot be reversed since filing GSTR3B does not serve this function and there exists no mechanism that enables it. Finally, no prejudice can result from the denial of ITC in such circumstances.

Factual Outline of the Case:-

The petitioner is engaged in the business of Petroleum Gases and other Gaseous Hydrocarbons and submitted her returns regularly to us.

Due to financial hardship, Petitioner filed Form GSTR-3B manually so as to take advantage of ITC. GSTN did not permit taxpayers to submit Form GSTR-3B online when non-payment of outward supplies was involved.

The petitioner submitted that after reviewing his GSTR-3B forms for the 2017-2018 and 2018-2019 financial years, his ITC claim had been disallowed due to the late filing of returns during those periods.

Submitters noted that Section 38 of the GST Act read in conjunction with Rule 60 of TNGST Rules mandates filing Form GSTR-2 when seeking ITC credits; however, GSTN had yet not provided access to the GSTR-2 filing facility.

As stated above, Form GSTR-3B was never meant for claiming ITC; its absence made filing eligible ITC claims impossible; thus the Section 16(4) CGST Act is inapplicable here.

GSTR-3B was not filed as required under Section 39 of the CGST Act and was not returned at all, contrary to Section 39 requirements. Notification No 49(Central Tax), issued on 9/10/2019 by the government stated that reconciliation statement GSTR-3B could be considered GSTR-3 retroactively which violated constitutional rules and is incorrect in practice.

On top of this, other end suppliers had reported sales made and taxes collected from the petitioner through GSTR-1 forms; as no Form GSTR-2 notification has yet been given out for these claims to be claimed; thus prompting the petitioner to account purchases using tax invoice, credit the payment with ITC in their books of accounts, claim ITC manually filed via GSTR-3B forms as soon as physically possible.

Held:-

The Department's case against an Individual cannot stand on the legal ground when no FORM GSTR-2 form is available and electronic filing cannot take place, meaning an Individual cannot expect him or herself to fill and submit this Form electronically.

As further noted by the Court, not permitting GSTR-3B filing online creates an unreasonable practical hardship where dealers had not paid taxes on outward sales/supplies; had there been an option on the GSTN portal to file incomplete GSTR-3Bs within time, the petitioner would have filed his ITC claim online within that deadline.

GST Council should remain the appropriate authority, yet respondents need to take measures in order to remedy it and allow dealers to file returns manually until this issue can be rectified.

Reliance was placed upon judgment from Punjab and Haryana High Court's Hans Raj Sons Vs Union of India case (CWP No 36396) wherein the Court has allowed taxpayers to file returns either electronically or manually when the portal does not open properly.

Referring to its decision in Adfert Technologies Private Limited Vs Union of India and others, the Madras High Court noted that the lack of any mechanism enabling ITC cannot prejudice an assessee in any manner.

The Court subsequently directed respondents to permit the petitioner to file manual returns, accept belated returns if in order, and allow any claim for ITC on outward supply/sales without prejudice due to lack of an enabling mechanism. Furthermore, their impugned order was set aside and their writ petitions granted.

Full Judgement

1. These writ petitions are filed for a writ of Certiorari to quash the impugned orders, dated 16.08.2022. The writ petition in W.P.(MD)No.7173 of 2023 is filed for the financial year 2017-2018 and W.P.(MD)No.7174 of 2023 is filed for the financial year 2018-2019.

- The petitioner is doing business related to Petroleum Gases and other Gaseous Hydrocarbons in Urangampatty and registered with the respondent department in GSTIN.33BAGPA0449A1ZM and was promptly filing monthly returns. Based on the scrutiny and verification of GSTR-3B returns filed in the financial year 2017-2018 and 2018-2019, the 2nd respondent issued notice dated 27.04.2022 and directed the petitioner to show cause why there was a belated claim of Input Tax Credit (ITC) and also directed to remit back the same as wrong claim of ITC and proposed to reverse the same. Further, it is alleged that the petitioner had claimed on the purchase of Petroleum products. The petitioner submitted that due to financial crisis, the petitioner had submitted GSTR-3B physically and the same was already explained to the respondents in person through his Accountant and hence the allegation by the respondents that the said claim is false cannot be accepted.

- The Contention of the petitioner is that he had also explained the fact that the claim of ITC is described under Rule 60 of the TNGST Rules and the Form prescribed is Form GSTR-2, but the same was not notified. Moreover, the filing of GSTR-3B is to avail the input tax credit and not to claim the same. So the reversal of input tax for belated claim as per Section 16(4) of TNGST Act is not applicable, since the filing of GSTR3B is not meant for claim of input tax credit. The further Contention of the petitioner is that the sales made to the petitioner and the tax collected from the petitioner were duly reported by other end supplier through their respective GSTR-1 and the petitioner could not claim the same since Form GSTR-2 is not notified. Hence, the petitioner has accounted the purchases and credited the tax payment made through tax invoice, claimed ITC in the books of accounts and availed the same through GSTR-3B filed physically. Hence, the allegation of belated claim of ITC itself is false and misleading.

- However, to the shock of the petitioner, the 2nd respondent has passed the impugned order and confirmed the proposal with regard to the alleged belated claim of input tax credit. The 2nd respondent has not at all dealt with the specific Contention that the claim of the ITC can be made only through GSTR-2 and the said Form was not notified and the filing of GSTR-3B is not meant for claiming of ITC. The petitioner`s specific Contention of the petitioner is that the petitioner had claimed ITC without violation of procedures contemplated under the Act and rules. When the petitioner is entitled to ITC as per the provisions, disallowing the same by observing that the returns are not filed in prescribed time and the same is totally irrelevant. Moreover, the respondents had passed a non-speaking order, without meeting out the specific contentions of the petitioner. Moreover, GSTR-3B is not at all returned as prescribed in Section 39 of the TNGST Act. As per Notification No.49 of 2019 (Central Tax), dated 09.10.2019, the Government declared that the reconciliation statement GSTR-3B may be treated as GSTR-3 in retrospective manner and the same is not correct and the same is against the Constitution. Hence, the petitioner has approached this Court to quash the impugned order.

- The 2nd respondent had filed counter affidavit in both the writ petitions stating that the writ petitions are not maintainable since the petitioner has an alternative remedy to prefer an appeal before the jurisdictional Appellate Deputy Commissioner (GST Appeals). Prima facie the revision of assessment was made out based on the scrutiny of GSTR-3B returns and hence notices in Form- GST-DRC-01A (Rule 142(i)) were issued to explain the issue with the documentary evidences why there was a belated claim of ITC. The statute is very clear that the burden of proof is lying with the taxable person and he has to prove that there is no evasion of tax. Based on the belated filing of returns GSTR-3B, a notice, dated 03.03.2022, was issued proposing to levy tax under Section 73(5) of the Act, 2017. The petitioner has not filed any objections with the supportive documents till the show cause notice in Form-GST-DRC-01 (Rule 142(I)), dated 27.04.2022, was issued. In the absence of objections, the said show cause notice in Form-GST-DRC-01 Rule 142(1) dated 27.04.2022 was issued proposing to levy tax and penalty, calling for objections to the proposal, but the petitioner had not submitted any objections. Thereafter, personal hearing was granted on 07.07.2022 in order to grant natural justice. But the petitioner has not attended the personal hearing with supportive documents till the passing of order in Form-GST DRC-07 (Rule 142 (5). When the petitioner has not filed any objections, it would be evident that the petitioner is not having any record or documents to prove his case. As per the provisions of Act and Rules especially Rule 61(5) 2017, every taxable person has to file monthly return for every month on or before 20th of the subsiding month. The taxable person is mandated to file monthly returns only electronically and not by manually. Since the petitioner had not filed any objections and had not attending the personal hearing, the respondents left with no other option than to confirm the proposal already made in the notice. Accordingly, order, dated 16.08.2022, was passed. Therefore, the 2nd respondent prayed to dismiss the writ petitions.

- Heard Mr.Raja Karthikeyan, learned Counsel appearing for the petitioner in both the writ petitions and Mr.A.K.Manikkam, learned Special Government Pleader appearing for the respondents in both the writ petitions and perused the records.

- The Contention of the petitioner is that as per Section 38 of the GST Act read with Rule 60 of the TNGST Rules, the ITC shall be claimed through GSTR-2, GSTN had not provided the facility of GSTR-2 till now. The Learned Counsel appearing the petitioner specifically submitted that it is due to technical reasons and the mistake ought to be rectified by the GST Council, unfortunately the GST Council had not taken up the issue to rectify the same. Since the GSTR-2 was not notified, which is meant for claiming ITC, hence the petitioner could not claim the ITC within the prescribed time. In the counter affidavit, the respondents have not denied the allegation. Further the 2nd respondent has only stated that any Form can be filed only electronically, that too it has to be filed on or before 20th of every month. When the said GSTR-2 Form is not available, then electronical filing is not possible, then taxable person cannot be expected to file the Form electronically. Therefore, the basis of initiation of the proceedings itself is not sustainable.

- The petitioner further submits the claim of ITC defined under Rule 60, which reads as under:

“Rule 60:- Form and manner of furnishing details of inward supplies:

1….

2….

- The registered person shall specify the inward supplies in respect of which he is not eligible, either fully or partially for input tax credit in Form GSTR-2 where such eligibility can be determined at the invoice level”

When the Rules specifically prescribes GSTR-2 to specify the inward supplies for claiming ITC, when the said form is not notified, the petitioner cannot be expected to file the same to claim ITC.

- The respondents without giving any opportunity to file the returns by notifying the Form GSTR-2, cannot expect the taxable person to file returns. In fact, the petitioner has no intension to violate the provisions of the Act. In order to show his bonafide, he has filed physically. Moreover, all tax liability is paid and there is no loss to the department. Moreover, the petitioner has also claimed financial crisis. Even though the financial crisis cannot be a ground for not filing the returns in time, not notifying of Form GSTR-2 is clearly a ground to consider the petitioner`s claim of belated returns.

- The learned Counsel appearing for the petitioner relied on the judgment rendered by the High court of Punjab and Haryana in the case of Hans Raj Sons Vs. Union of India and others in CWP No.36396 of 2019, dated 16.12.2019, wherein the Hon’ble Court has allowed the tax payer to file the return either electronically or manually, if the portal is not opening. In the said judgment, the High court of Punjab and Haryana has relied on another judgment rendered in CWP No.30949 of 2018, in the case of Adfert Technologies Private Limited Vs. Union of India and others, dated 04.11.2019. The same issue was also considered by the Madras High court in W.P.No.29676 of 2019, dated 06.10.2020, wherein it is stated as under:

“19. Admittedly, the 31st of March 2019 was the last date by which rectification of Form – GSTR 1 may be sought. However, and also admittedly, the Forms, by filing of which the petitioner might have noticed the error and W.P. No.29676 of 2019 sought amendment, viz. GSTR-2A and GSTR-1A are yet to be notified. Had the requisite Forms been notified, the mismatch between the details of credit in the petitioner’s and the supplier’s returns might well have been noticed and appropriate and timely action taken. The error was noticed only later when the petitioners’ customers brought the same to the attention of the petitioner.

- In the absence of an enabling mechanism, I am of the view that assessee should not be prejudiced from availing credit that they are otherwise legitimately entitled to. The error committed by the petitioner is an inadvertent human error and the petitioner should be in a position to rectify the same, particularly in the absence of an effective, enabling mechanism under statute.

- This writ petition is allowed and the impugned order set aside. The petitioner is permitted to re-submit the annexures to Form GSTR-3B with the correct distribution of credit between IGST, SGST and CGST within a period of four weeks from date of uploading of this order and the respondents shall take the same on file and enable the auto-population of the correct details in the GST portal. No costs.”

In the above said order, this Court has clearly held that in the absence of any enabling mechanism, the assessee cannot be prejudiced by not granting ITC. Therefore, following the aforesaid judgments this Court is inclined to set aside the impugned order.

- The next Contention of the petitioner is that the ITC can be claimed through GSTR-3B, but GSTN has not permitted to file GSTR-3B in online if the dealers had not paid taxes on the outward supply / sales. In other words, if the dealer is not enabled to pay output tax, he is not permitted to file GSTR-3B return in online and it is indirectly obstructing the dealer to claim ITC. In the present case the petitioner was unable to pay output taxes and so the GSTN not permitted to file GSTR-3B in the departmental web portal it is constructed that the petitioner had not filed GSTR-3B online, that resulted the dealer unable to claim his ITC in that particular year in which he paid taxes in his purchases.

Hence if the GSTN provided an option for filing GSTN without payment of tax or incomplete GSTR-3B, the dealer would be eligible for claiming of input tax credit. The same was not provided in GSTN network hence, the dealers are restricted to claim ITC on the ground of non-filing of GSTR-3B within prescribed time. if the option of filing incomplete filing of GSTR-3B are provided in the GSTN network the dealers would avail the claim and determine self-assessed ITC in online. The petitioner had expressed real practical difficulty. The GST Council may be the appropriate authority but the respondents ought to take steps to rectify the same. Until then the respondents ought to allow the dealers to file returns manually.

- Therefore, following the above-mentioned judgments, this Court is inclined to quash the impugned orders and accordingly, the impugned orders are quashed. The respondents shall permit the petitioner to file manual returns whenever the petitioner is claiming ITC on the outward supply / sales without paying taxes. Further, the respondents are directed to accept the belated returns and if the returns are otherwise in order and in accordance with law, the claim of ITC may be allowed. Hence, the matter is remitted back to the authorities for reconsideration.

- With the above-said observation, the writ petitions are allowed. No costs. Consequently, connected miscellaneous petitions are closed.

Decision: The Court subsequently directed respondents to permit petitioner to file manual returns, accept belated returns if in order, and allow any claim for ITC on outward supply/sales without prejudice due to lack of an enabling mechanism. Furthermore, their impugned order was set aside and their writ petitions granted.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

E-way bill has to be generated from E-way bill website https://ewaybillgst.gov.in.

There are two parts of the E-way bill.

Part A and Part B

Part-A :- The registered person who moves the goods is required to file Part A of the E-way bill before starting the movement of goods. In Part A, it is important to mention the transporter ID or vehicle number along with the invoice details. After Part A of the e-way bill is filed, no modification can be made in it. On filing Part A of the E-way bill, you will generate a unique number which will be valid for 72 hours to update Part B of the E-way bill.

Part-B :- After Part-A is filed by the supplier or receiver, Part-B is filed by the transporter. As long as the time limit of the E-way bill has not expired, there is no limit on the number of times it can be updated. But keep in mind that the actual movement of the vehicle should match the description of the described vehicle.

When an unregistered transporter enrolls himself on the e-way bill portal, Transporter ID is issued to him. This Transporter ID enables the transporter to generate E-way bills at any time.

The transporter can update Part B of the e-way bill. The reason for this could be anything like transferring the goods from another vehicle if the vehicle breaks down or if more than one transporter is involved in taking the consignment to the end consignee.

Pre-requisite required to generate E-way bill

To generate an e-way bill we need-

- Tax invoice or bill of supply

- Transportation details

- Mode of supply

- Vehicle type

- Vehicle number

- Transporter documents

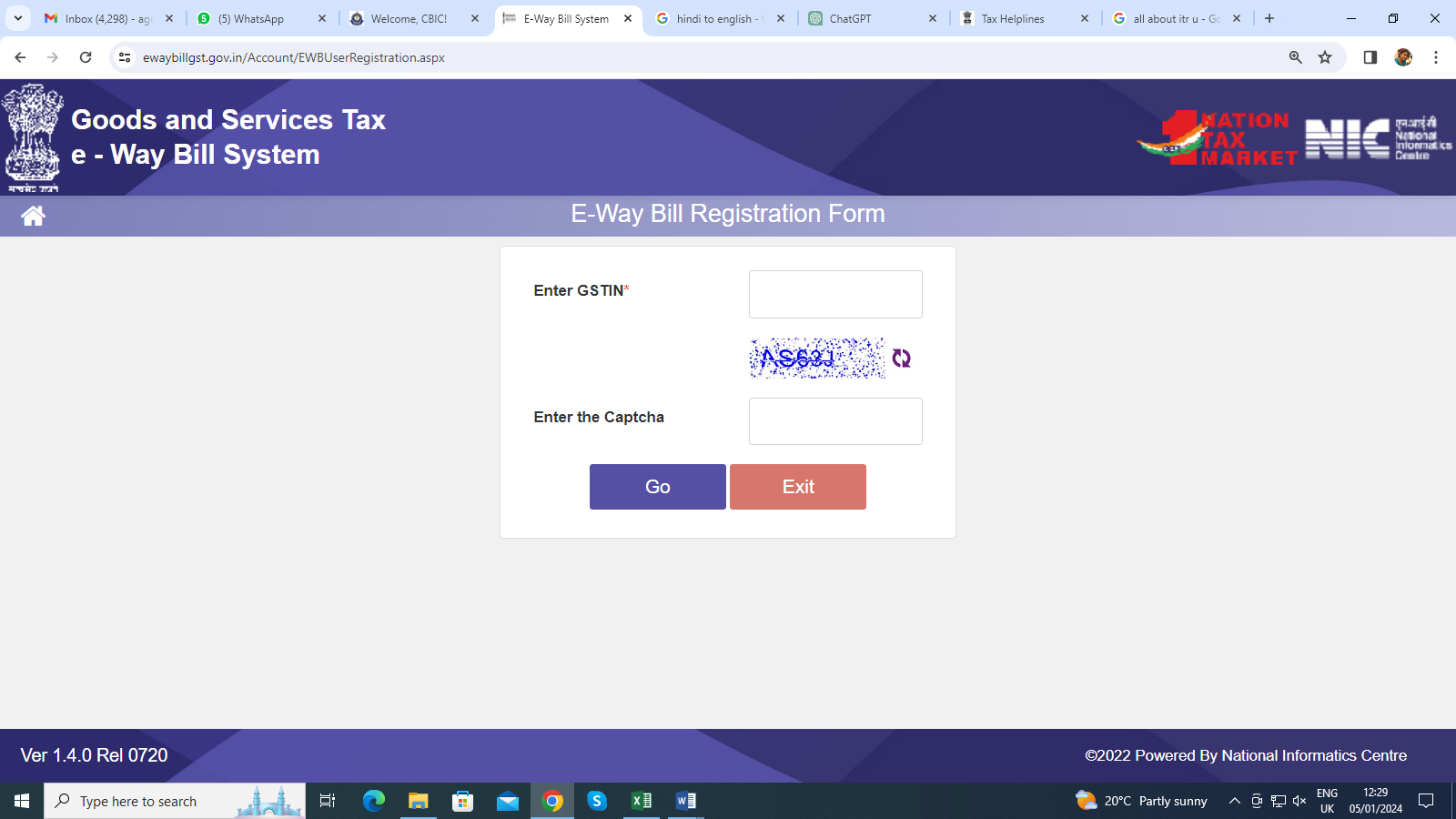

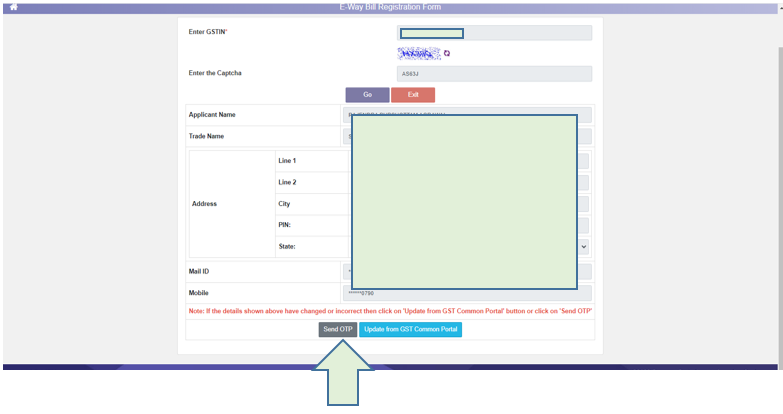

Step-1 To get Registered on E-way Bill portal:

- First of all, visit E-way bill website http://ewaybill.nic.in

- If you are registered on this website then you will login, if not registered then you will click on register and enter your GSTN and captcha

- then following information about your organization like Name, address, Email ID and mobile will display

- Now click on send OTP enter OTP and create a user id and password.

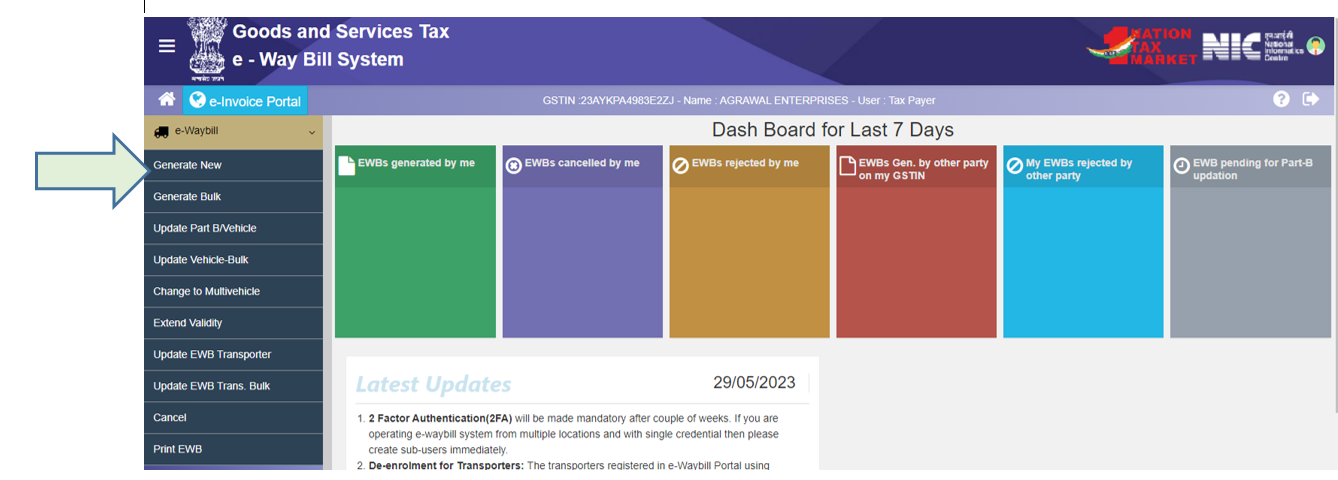

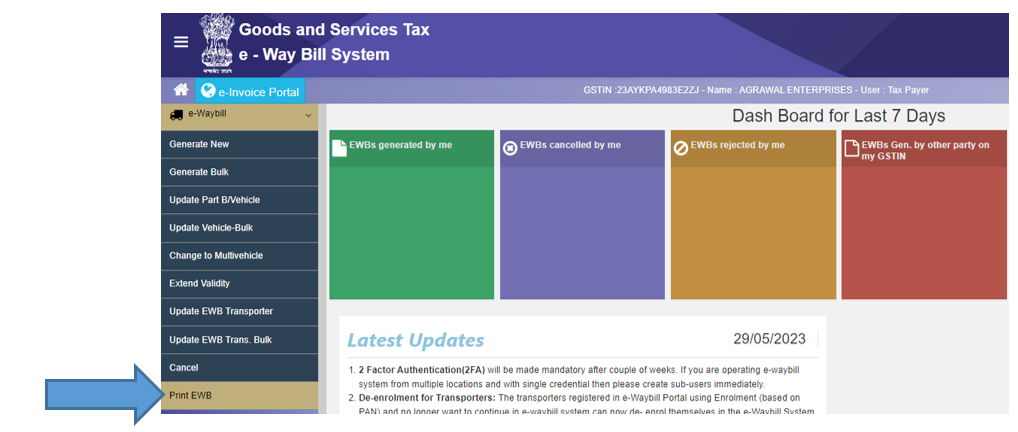

Step-2: How to Create an E-way Bill

After creating a login ID, login to the E-way bill portal by entering the login credentials.

Now click on the e-way bill & then on the Generate New tab.

Now we understand single bill generation - for this, we have to click on generate new tab and enter the required details.

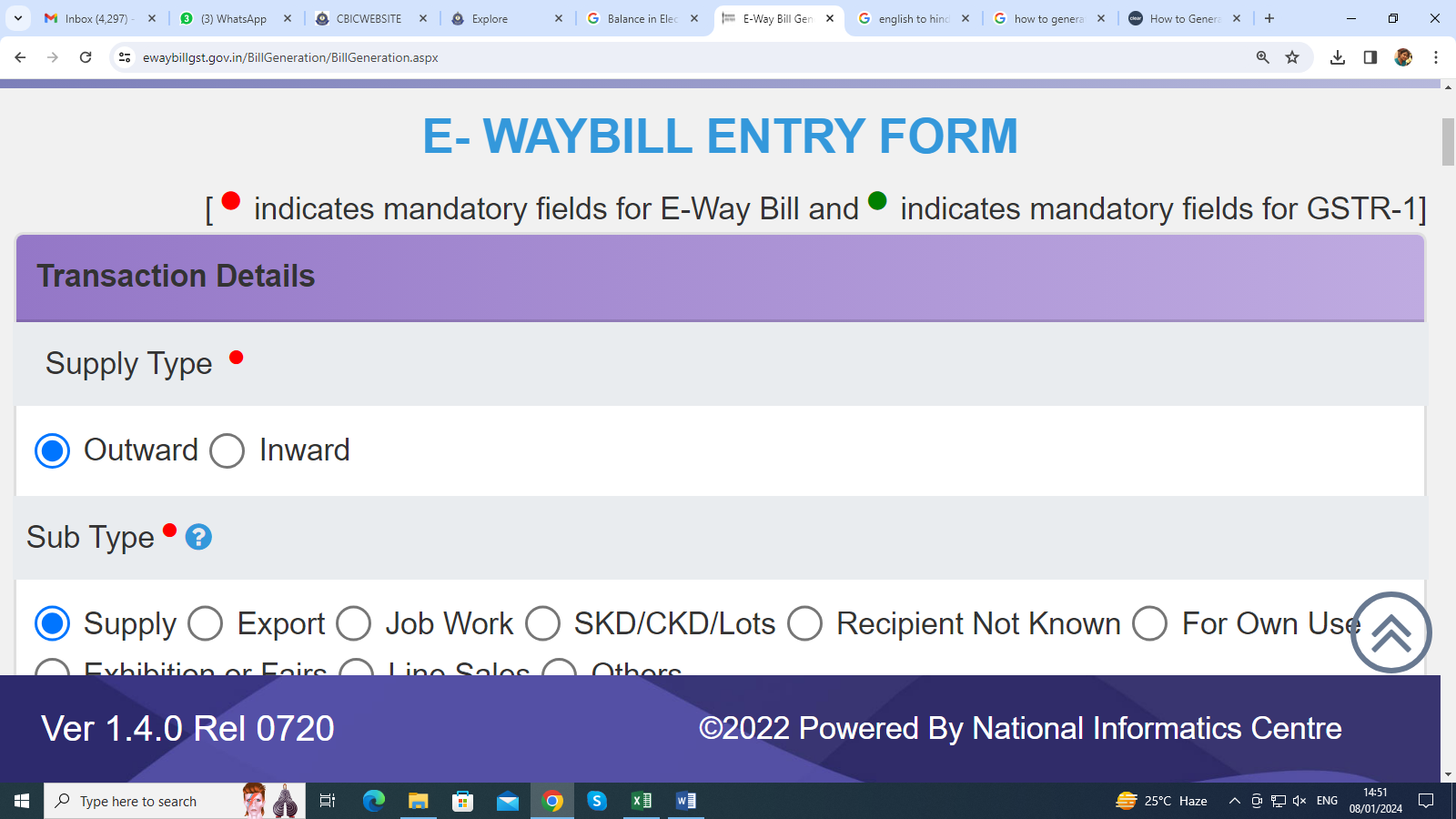

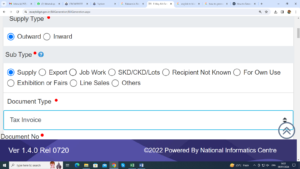

- First of all, you have to select the supply type. If you want to generate an E-bill for outward supply i.e. for sale then you will select outward and If you want to generate an E-bill for inward i.e. for purchase then you will select inward.

2. Sub type में आपको बताना होगा की की किस तरह का supply है –

- If there is regular supply then select supply.

- If you are exporting then select export or if you are sending goods for job work then select job work.

- If you are sending goods in lot or SKD / CKD then select this option.

- Own use is selected when the goods are being transported to one's own business places.

- Line sales have to be selected when the taxpayer takes the goods from his premises to the buyer/customer's place, in this case it is not determined what quantity will be sold.

- Recipient not known – When it is not known who the recipient is but when the taxpayer takes the goods from his premises to the buyer/customer's place.

- Exhibition/fair has to be selected when the goods are transferred from the taxpayer's premises to the place of exhibition or fair.

- Others will be selected only when the options mentioned so far are irrelevant.

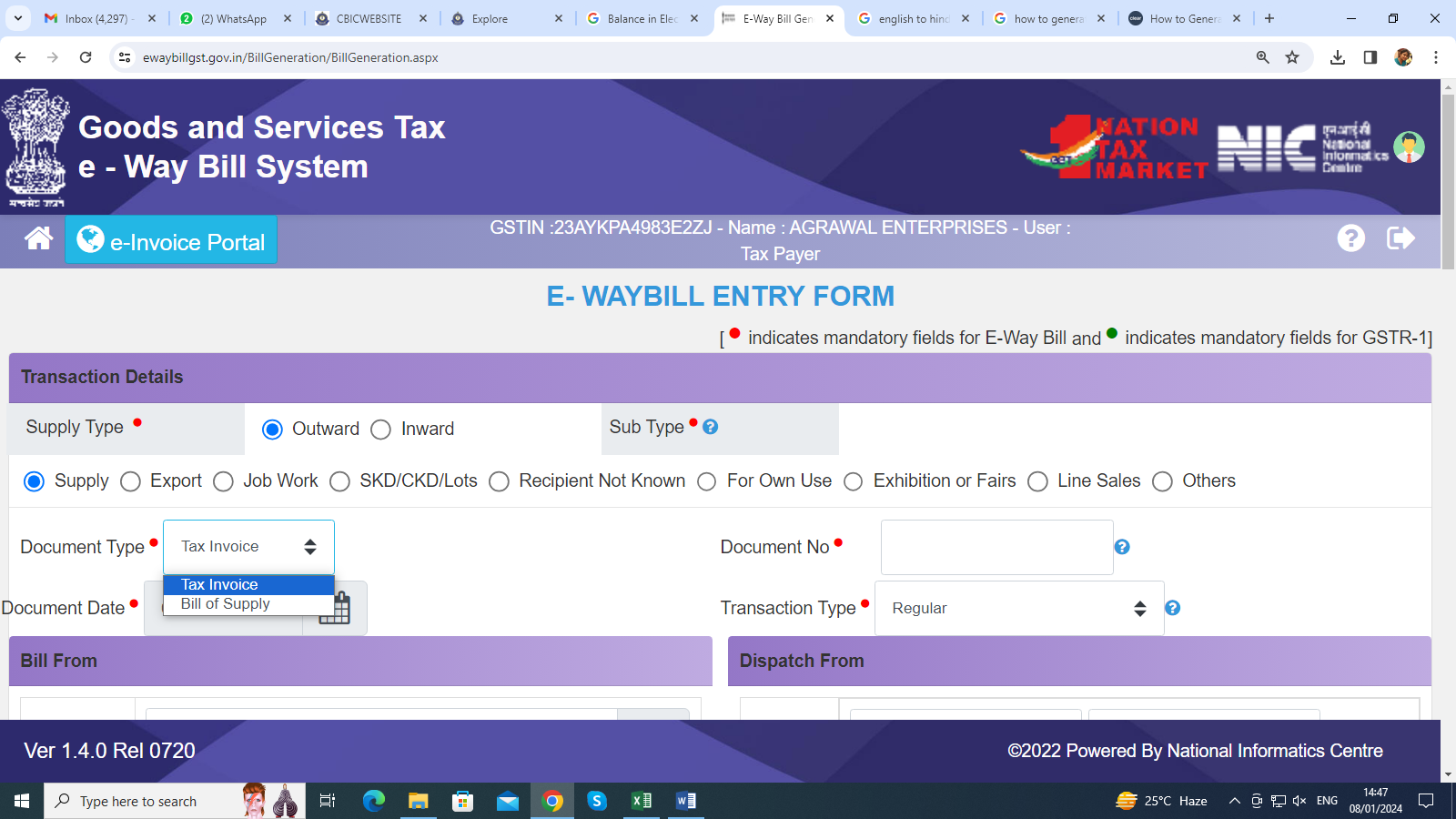

3. Now you have to select document Type on the basis of which E-way bill is generated. Here you have 2 options

- Tax Invoice

- Bill of supply

4. Enter document number & document date

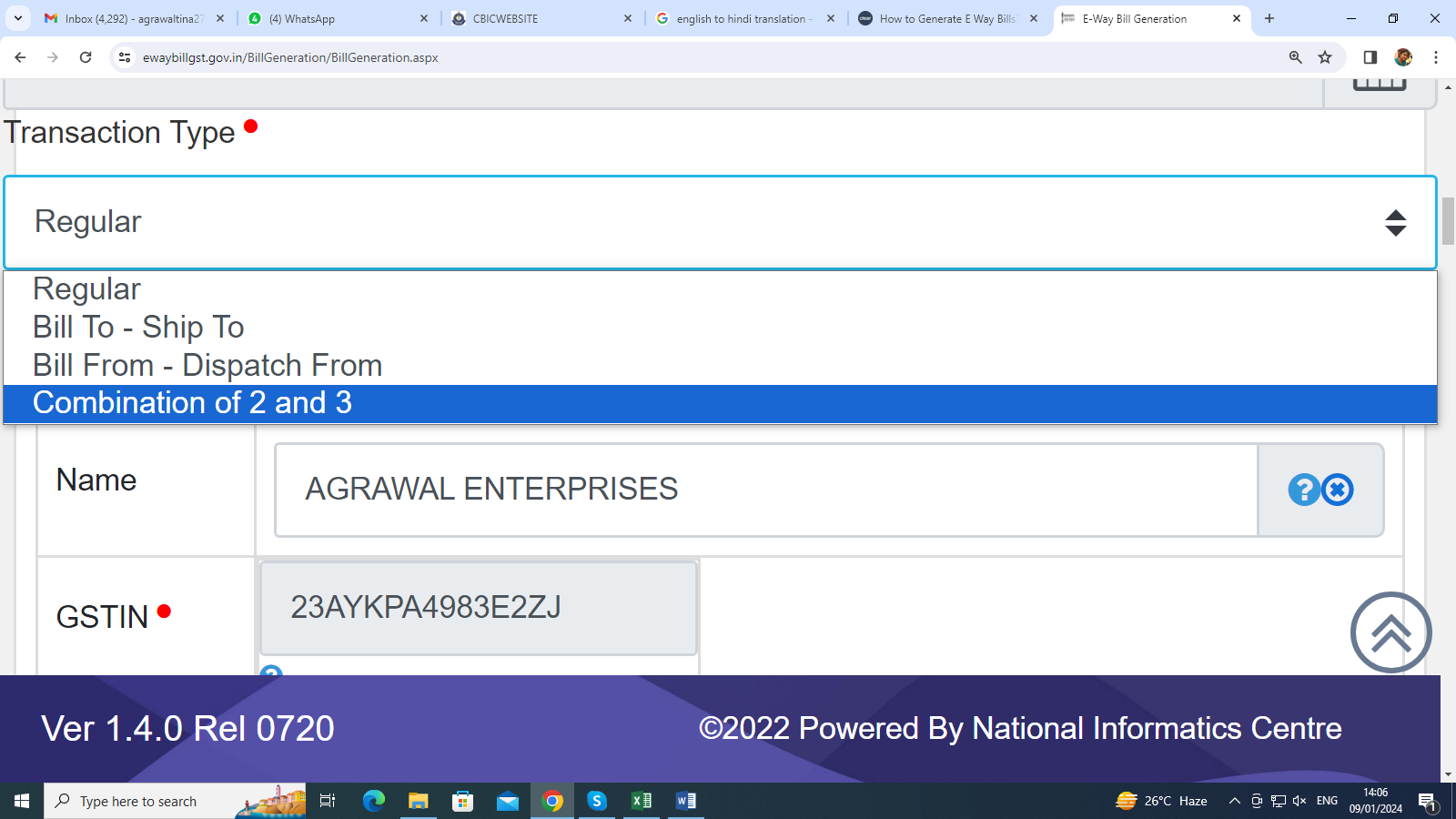

5. Transaction type has to be entered. Let us understand this

- In case of normal supply, select Regular means when the goods are delivered from the principal place of consignor to the principal place of consignee.

- Bill to ship to is selected when 3 parties are involved in the transaction, meaning when billing is being done from the buyer's location but the goods are being supplied at a different place as per the buyer's instruction.

- Bill from-dispatch from: means in this the goods are delivered from the additional place of business of the consignor to the principal place of the consignee.

- Combination of 2&3 means when the goods are delivered from the consigner’s additional place of business and the goods are delivered to a third place under the instruction of the buyer.

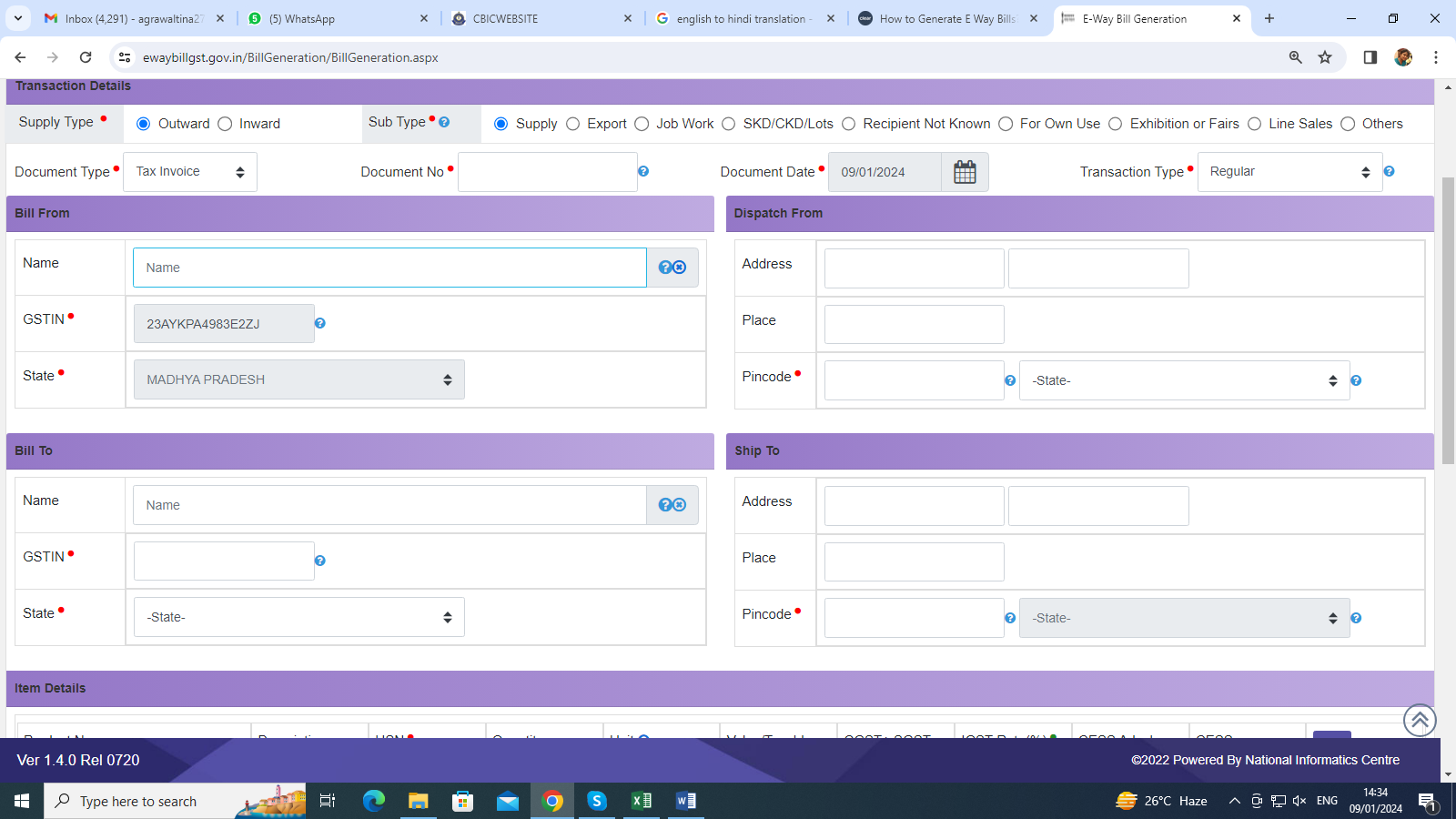

4) In Bill from tab, details of the person with whose login id is logged in like name, state, GSTIN will be shown. In dispatch from tab the address of principal place of business will be shown but if the dispatch address is different than you can enter it manually.

5) In Bill to you have to enter the name, GSTIN, state of the person you are billing and in ship to you have to enter the address where the goods are to be delivered.

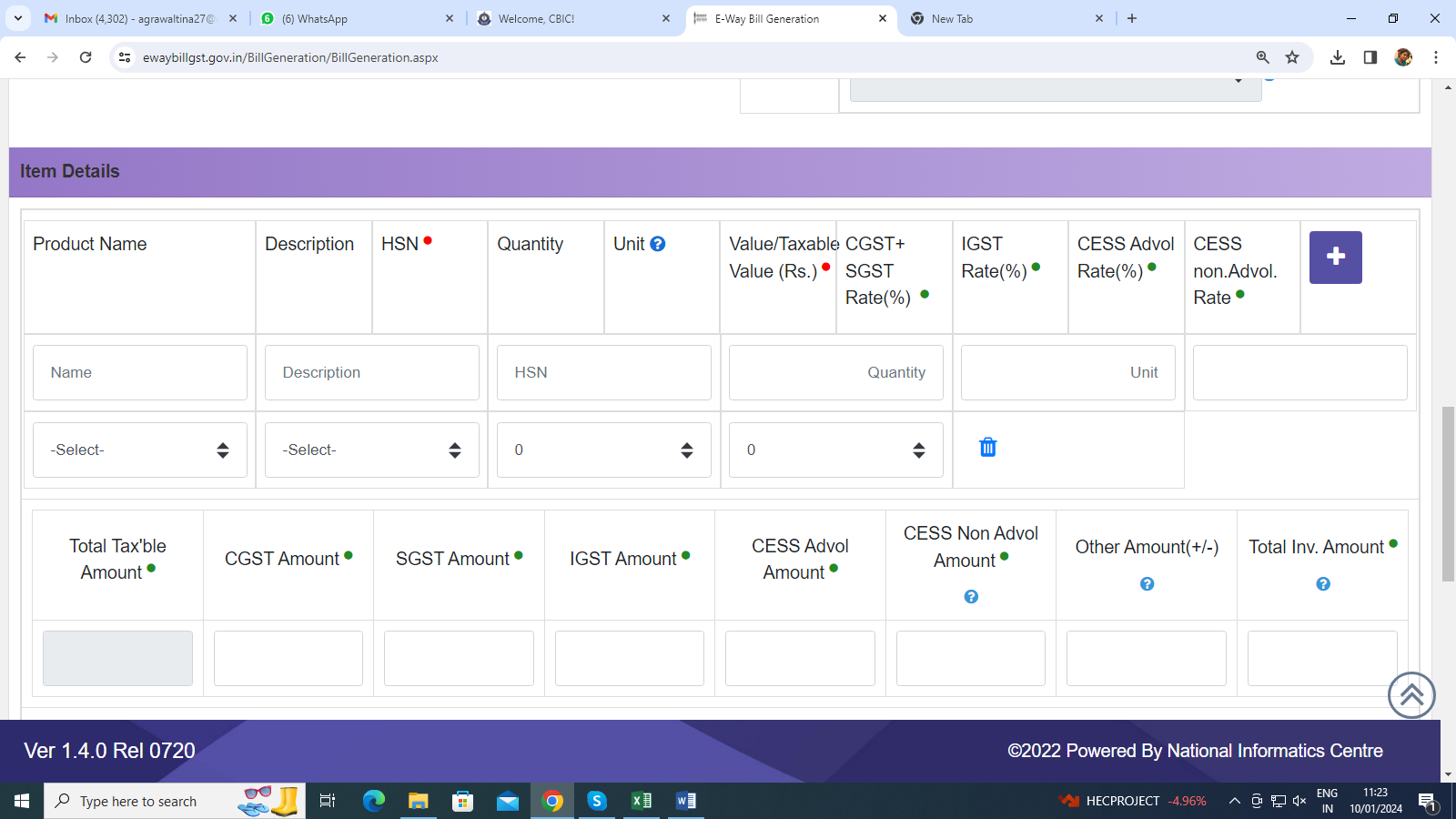

6) Now give the details of Consignment item HSN wise.

Product Name, Description, HSN, Quantity, Units (units means product bags, buckles, bottles, carton, box etc), Taxable value, Tax rates of CGST & SGST & IGST (in %) & Tax rate of Cess, if any charged (in %).

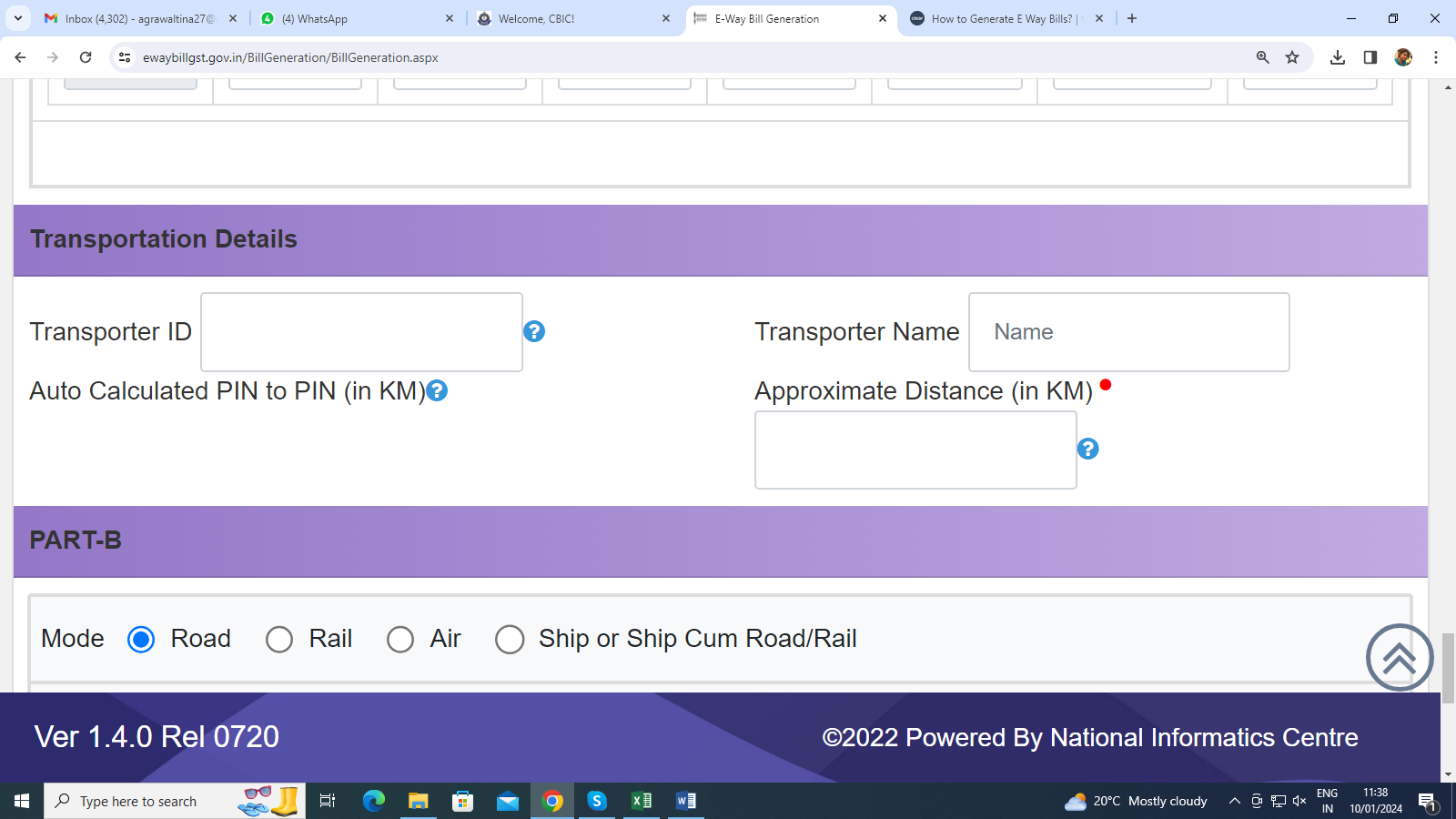

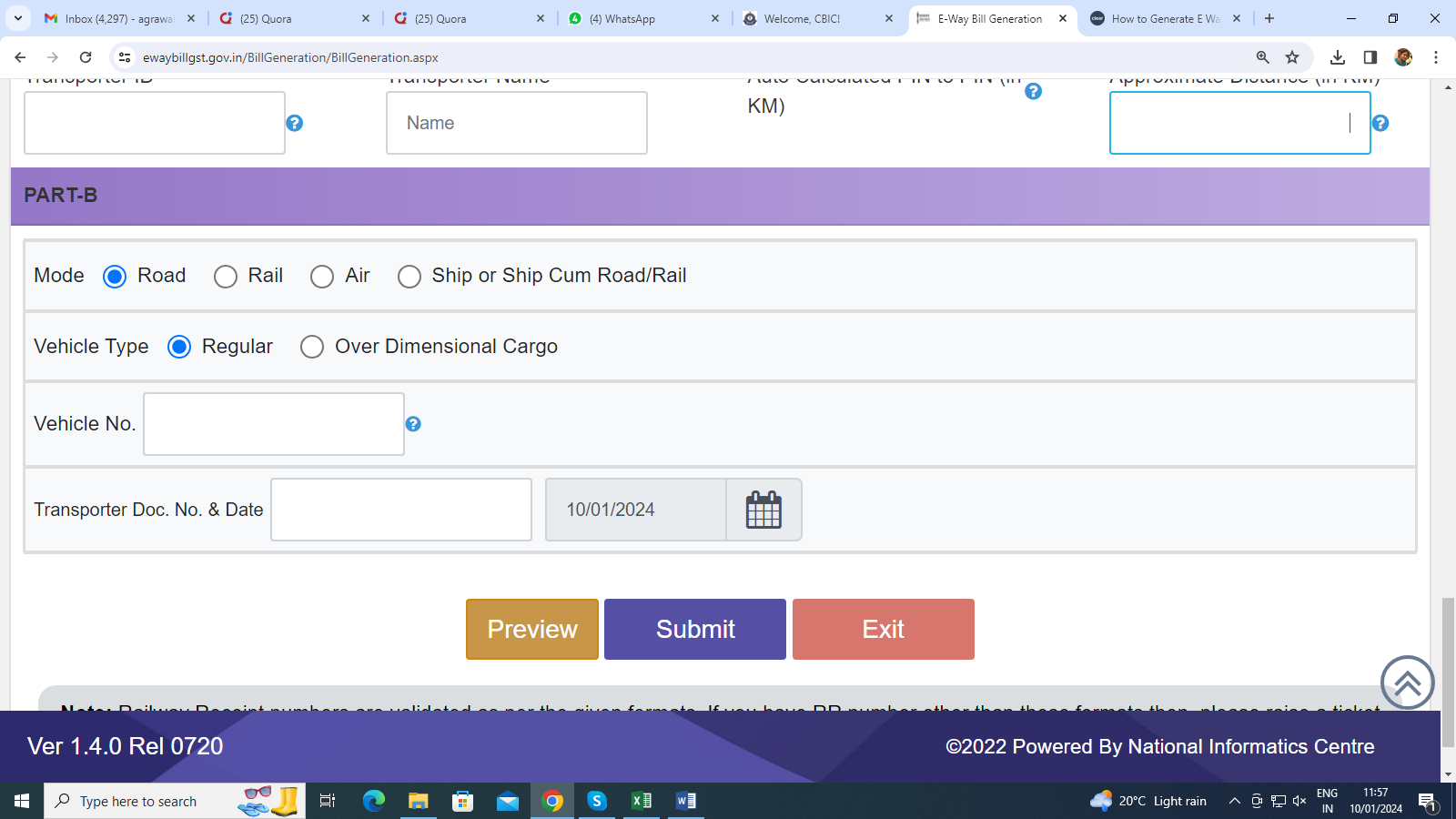

7) Now enter transportation details as follows:

Transporter id, Transporter Name.

8) Under Part B select mode of transportation by road, rail, air, ship. Select type of Vehicle between Regular Vehicle or over dimensional cargo (Over dimensional cargo means vehicles which are larger in size than a regular vehicle). Now enter Vehicle Number, Transporter Doc No. & Date.

Preview all the filled details & click on the submit button.

After submitting you can take a print out of the generated E-way bill.

FAQ’s

- What is an E-way bill?

An E-way bill is an electronic document required for the movement of goods valued over as specified in India. It needs to be generated on the E-way bill portal by the consignor or consignee before the commencement of the movement of goods.

- How to download the E-way bill app for PC?

Currently, there is no standalone E-way bill app for PC. Users can access the E-way bill portal through a web browser on their PCs to generate E-way bills.

- Can I generate an E-way bill using a debit note?

No, an E-way bill is generated based on the invoice issued for the goods. A debit note is used to make adjustments in the invoice value.

- What is the E-way bill portal?

The E-way bill portal is an online platform provided by the government for businesses to generate, manage and cancel E-way bills. It can be accessed at https://ewaybillgst.gov.in/.

- Can I log in to the E-way bill portal on a mobile device?

Yes, you can log in to the E-way bill portal on a mobile device.

- What is the GST waybill?

GST waybill is another term for an E-way bill, which is required under the Goods and Services Tax (GST) regime for the inter-state and intra-state movement of goods.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

The E-Way Bill system is equipped to automatically calculate the distance for the movement of goods based on the PIN codes of both the source and destination locations.

What is Pin to Pin Distance?

"PIN to PIN distance" is referred to as a physical distance calculated using their respective postal PIN codes as reference points. This calculation plays a crucial role in various logistics operations such as the generation of e-way bills, in accordance with GST regulations.

Get concise answers to your GST and Income Tax queries.

Clarify doubts and navigate complexities with ease.

Why is Pin to Pin Distance Important for e-Way Bill?

For generating an E-Way Bill for transportation of goods, knowing the precise route distance between the starting point and the destination is not just a logistic detail but a regulatory requirement.

The Electronic Way Bill system has been enabled with a feature that automatically calculates the distance for the transportation of goods using the postal PIN codes of the origin and destination.

This functionality simplifies the calculation of the validity period of the E-Way Bill, thereby reinforcing the importance of PIN-to-PIN distance in ensuring compliance with GST regulations.

How to Use a Pin to Pin Distance Calculator?

The E-way Bill portal is quite easy & useful for calculating the distance between two PIN codes.

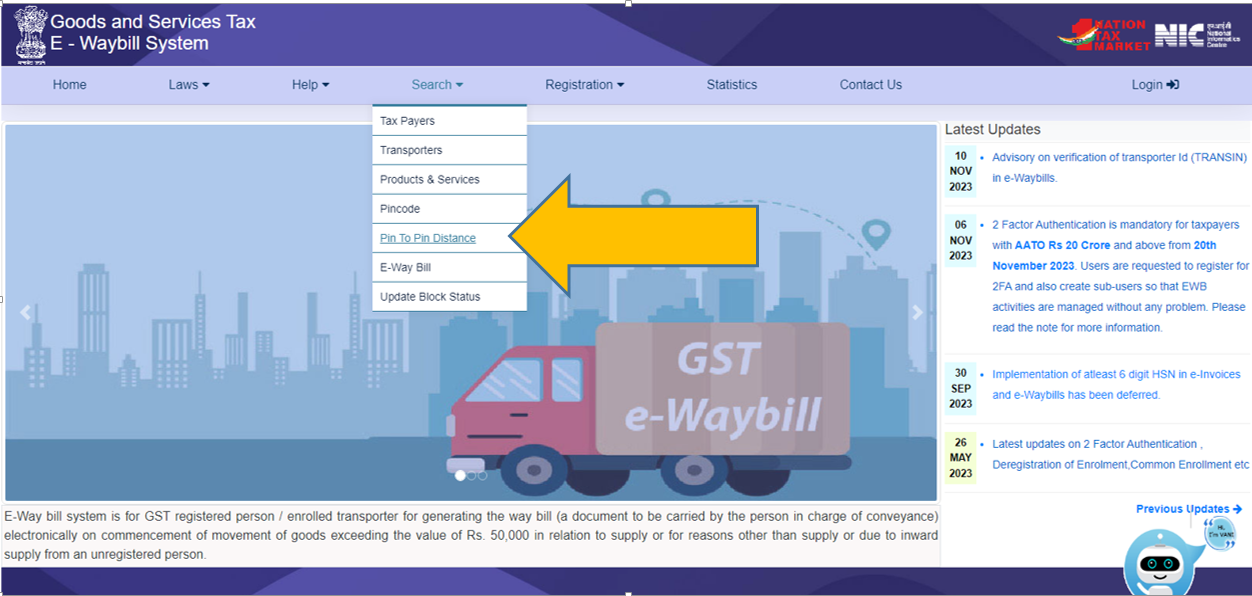

Step:-1 Visit the GST E-way Bill Portal

Step:-2 Click on Search Tab & select Pin to Pin distance

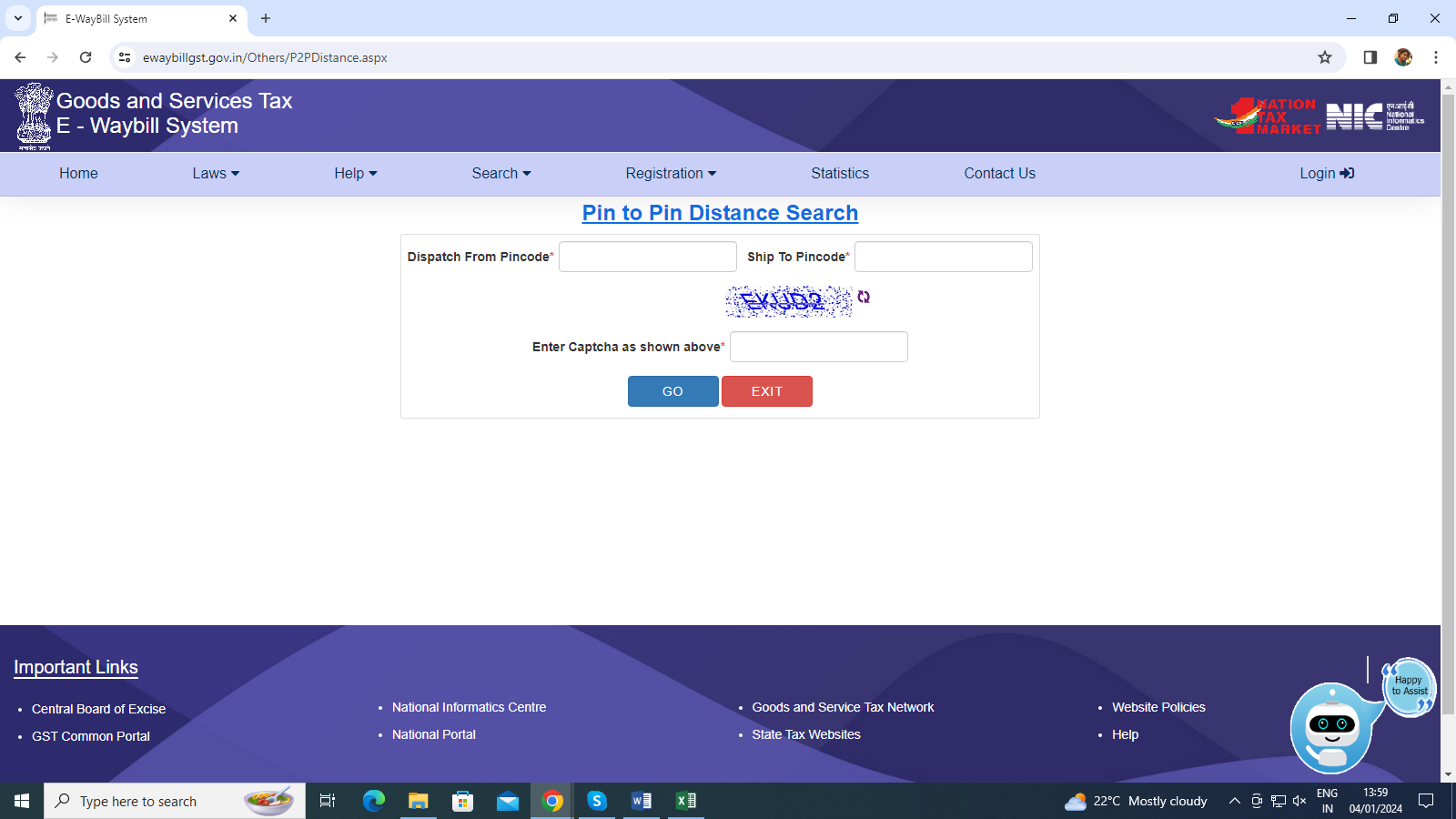

Step:-3 Enter the source and destination postal PIN codes

Step:-4 The tool will subsequently calculate and display the distance

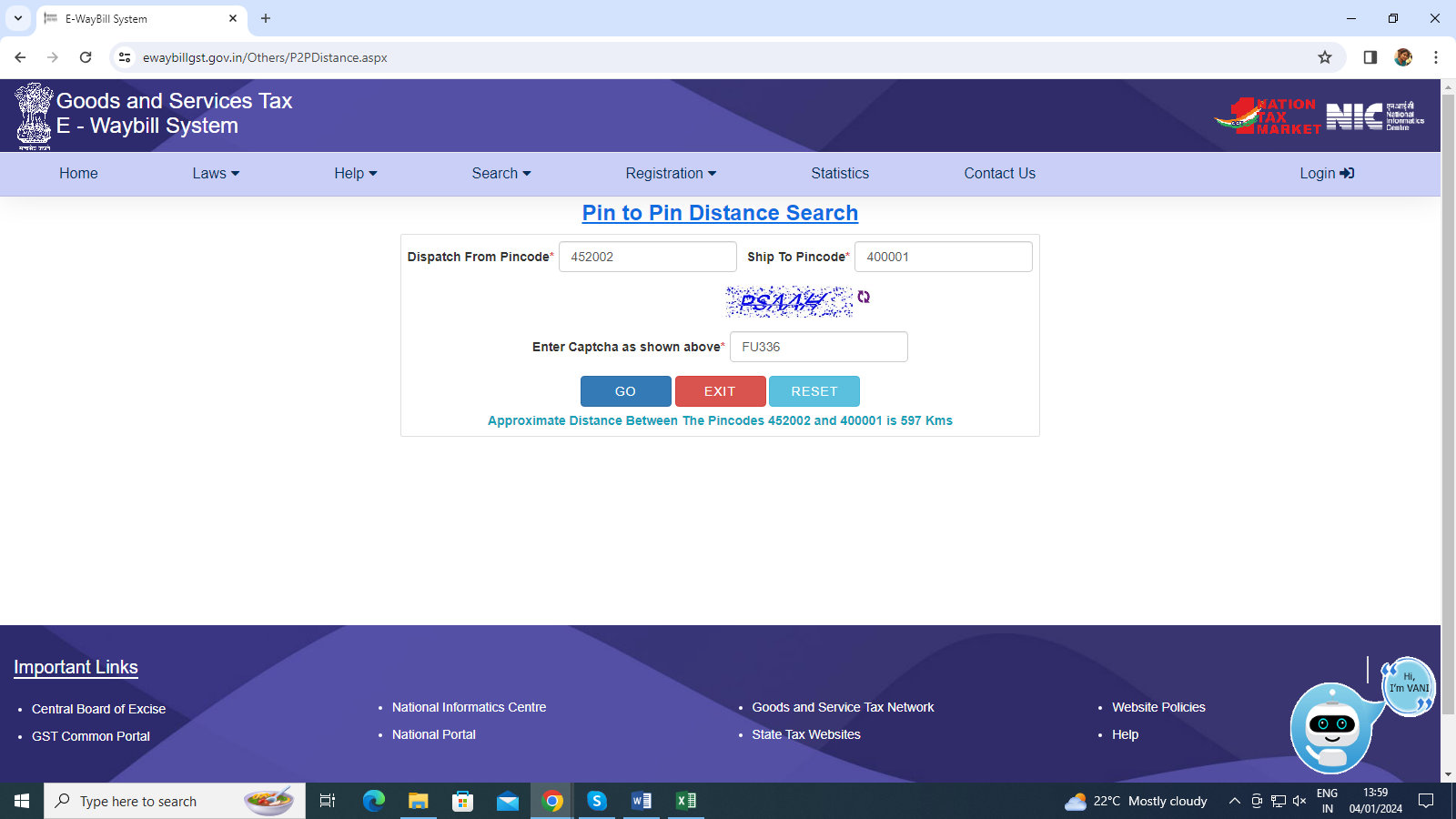

Examples of Pin to Pin Distance Calculation

Source PIN Code: 452002 (Indore)

Destination PIN Code: 400001 (Mumbai)

Using the pin to pin distance calculator, the distance is calculated to be approximately 597 kilometers. This information is crucial for generating an accurate e-way bill for transporting goods between these locations.

FAQ’S

Q-1 What is "pin to pin distance"?

"Pin to pin distance" means physical distance between two locations calculated using their respective postal PIN codes as reference points.

Q-2 How is the distance calculated on the E-Way Bill portal?

The E-Way Bill portal utilizes the PIN codes of the source and destination locations to automatically calculate and display the distance between them.

Q-3 Is there a specific tool for calculating the distance between PIN codes?

Yes, the tool available on the E-Way Bill portal is specifically designed for calculating the distance between PIN codes.

Q-4 Can I calculate PIN code distance for GST compliance?

Especially when generating E-Way Bills, knowing the PIN-to-PIN distance is crucial for ensuring compliance with GST regulations.

Q-5 What is the significance of PIN code distance in logistics and e-way bill generation?

PIN code distance plays a crucial role in various logistics operations, including the correct generation of e-way bills, and ensuring adherence to GST rules.

Q-6 Is there a PIN code calculator for determining the distance between locations?

Yes, the tool available on the E-Way Bill portal is specifically designed for calculating the distance between locations.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

What Is E-Commerce?

E-commerce sellers are businesses or individuals, who through e-commerce platforms such as Amazon, Flipkart, Myntra etc. sell products or services online. These sellers can be manufacturers, distributors, retailers, or even individuals who want to sell their products or services online.

What Is TCS?

"TCS" stands for "Tax Collected at Source." In the Goods and Services Tax system, every e-commerce operator is required to collect 0.5% under the CGST Act and 0.5% under the SGST Act. In the case of inter-state transactions, the E-commerce operator is required to collect 1% on the net values of taxable supplies under the IGST Act.

WHO IS LIABLE TO COLLECT TCS UNDER GST

When making payments, e-commerce operators will collect TCS from the seller. This collection will be considered as a credit for the supplier for supplies made through the online portal. It will be collected on the net value of the taxable supplies.

APPLICABLE RATE UNDER TCS

TCS at the rate of 1% is required to be collected by E-commerce operators, from the sellers for taxable supplies made through their platform. The TCS collected by the e-commerce operator must be deposited with the government and reported in their GSTR-8 return.

Dealers or businesses supplying goods and/or services through e-commerce operators will receive payments after a deduction of TCS at a rate of 1%.

GST REGISTRATION FOR TCS

GST registration is mandatory for e-commerce operators irrespective of their turnover.

REQUIREMENTS FOR TCS REGISTRATION

For Registration as Tax Collector:

- Applicant has a valid PAN.

- Applicant must have a valid mobile number.

- Applicant must have a valid E-mail ID.

- Applicant must have a place of business.

- Applicant must have an authorized signatory with valid details.

- Applicant has to file form GST REG-07 for taking registration as Tax Collector.

TCS RETURN

GSTR-8 is a return filed by e-commerce operators, and it necessitates the deduction of TCS under the GST regime. It includes details of supplies made through the e-commerce platform and the amount of TCS collected on such supplies.

DUE DATE FOR RETURN

The operator is also required to submit monthly details in Form GSTR-8 by the 10th of the following month.

WHERE TO SHOW SALES DETAILS IN GSTR-3B

An ECO is required to report supplies made u/s 9(5) of the CGST Act 2017 in Table 3.1.1(i) of GSTR-3B and shall not include such supplies in Table 3.1(a) of GSTR-3B.

From the View Point of an E-commerce Seller

GST Registration Requirement for E-Commerce

E-commerce sellers are required to obtain GST registration if their annual turnover does not exceed Rs. 40 lakhs (for businesses operating in special category states, the threshold limit is Rs. 20 lakhs). If the E-commerce seller is registered under GST, they must mention their GST registration number on their website and all invoices generated.

According to Notification no. 34/2023-Central Tax dated 31-07-2023, persons who supply goods through E-Commerce Operators are exempted from the liability of taking registration in GST, if they fulfill the conditions as given in this notification.

The amount of aggregate turnover in the previous financial year and the current financial year should not exceed the amount over which a supplier is required to be registered in that State or Union territory as per the provision of section 22 sub-section (1) of the CGST Act. Then in such a case, the person mentioned above is exempted from the liability of taking registration in GST with certain conditions.

- Such persons will not make any inter-State supply of goods;

- Such persons will not supply goods through electronic commerce operators in more than one State or Union territory;

- Such persons will be required to have a Permanent Account Number issued under the Income Tax Act, 1961;

- such persons shall, before making any supply of goods through an electronic commerce operator, declare on the common portal their Permanent Account Number issued under the Income Tax Act, 1961 (43 of 1961), the address of their place of business, and the State or Union territory in which such persons seek to make such supply, which shall be subjected to validation on the common portal;

- Such persons have been granted an enrollment number on the common portal upon successful validation of the Permanent Account Number declared as per clause (iv);

- Such persons will not be given more than one enrollment number in any State or Union territory;

- No supply of goods shall be made by such persons through the electronic commerce operator unless such persons have been provided with an enrollment number on the common portal; And

- Where such persons are subsequently allowed for registration under section 25 of the Act, the enrollment number will cease to be valid from the effective date of registration.

Collection and Payment of GST

When E-commerce sellers are registered under GST, then they are required to collect and pay GST on the supplies made by them. They must charge GST on the products sold and remit the collected GST to the government within the prescribed time limit.

FILING OF GST RETURNS

Registered E-commerce sellers must file GST returns to report their sales, purchases and tax liability. The frequency of GST return filing depends on the turnover of the e-commerce seller. The GSTR-1 return is required to be filed by e-commerce sellers to report the outward supplies made by them, while the GSTR-3B return is required to be filed to report the summary of sales and purchases and the tax liability.

WHERE TO SHOW SALES DETAILS IN GSTR-3B

A registered person who is making supplies of such services as specified u/s 9(5) through an ECO, shall report such supplies in Table 3.1.1(ii) and shall not include such supplies in Table 3.1(a) of GSTR-3B. The registered person is not required to pay tax on such supplies as the ECO is liable to pay tax on such supplies.

Frequently Asked Questions :-

Q: What is the meaning of E-commerce?

A: Electronic Commerce has been defined in Sec. 2(44) of the CGST Act, 2017 to mean the supply of goods or services or both, including digital products over digital or electronic networks.

Q: Who is an E-commerce Operator?

A : Electronic Commerce Operator has been defined in Sec. 2(45) of the CGST Act, 2017 to mean any person who owns, operates, or manages a digital or electronic facility or platform for electronic commerce.

Q: Is it mandatory for an E-commerce operator to obtain registration?

A: Yes. As per Section 24(x) of the CGST Act, 2017 they are liable to be registered irrespective of the value of supply made by them or provide electronic facility or platform. For an E-commerce operator, there is no threshold limit for registration.

Q: What is Tax Collection at Source (TCS)?

A : The e-commerce operator is required to collect an amount at the rate of one percent (0.5%CGST + 0.5% SGST/UTGST) of the net value of taxable supplies made through it, where the consideration with respect to such supplies is to be collected by such operator. The amount so collected is called Tax Collection at Source (TCS).

Q: How can actual suppliers claim credit of this TCS?

A : The amount of TCS paid by the operator to the government will be reflected in the e-cash ledger of the actual registered supplier (on whose account such collection has been made) on the basis of the statement filed by the operator. The same can be used at the time of discharge of tax liability in respect of the supplies made by the actual supplier.

Q: Whether TCS to be collected on exempt supplies?

No, TCS is not required to be collected on exempt supplies.

Q: What is the full form of E-com?

A : E-com is a common abbreviation for electronic commerce.

Q: We purchase goods from different vendors and are selling them on our website under our own billing. Is TCS required to be collected on such supplies?

A : No. According to Section 52 of the TSGST Act, 2017, TCS is required to be collected on the net value of taxable supplies made through it by other suppliers where the consideration is to be collected by the ECO. In this case, there are two transactions - where you purchase the goods from the vendors, and where you sell it through your website. For the first transaction, GST is leviable and will need to be paid to your vendor, on which credit is available for you. The second transaction is a supply on your own account, and not by other suppliers and there is no requirement to collect tax at source. The transaction will attract GST at the prevailing rates.

Q : What is the full form of RTO in e-commerce?

A : The full form of RTO in e-commerce stands for Return to Origin i.e. returning a shipped item to the seller's location.

Q: How do I register for GST as an e-commerce operator?

A : To register as an e-commerce operator, an application can be made using REG-07 on the GST portal.

Q: What is the GST rate for e-commerce?

A : The GST rate for e-commerce transactions is the same as the regular GST rate. There is no difference in rate in the case of supply through an e-commerce operator. The rate of tax depends on the type of supply made.

Q : What is the GST registration threshold limit for an E-commerce Operator (ECO)?

A : As per Section 24(x) of the CGST Act, 2017 they are liable to be registered irrespective of the value of supply made by them or provide electronic facility or platform. So, it is always compulsory to get registration for an e-commerce operator.

Q : Example of an Electronic Commerce Operator (ECO)

A : Examples of an Electronic Commerce Operator is Amazon, Flipkart, Myntra etc.

Q : Who is an e-commerce operator?

A : An e-commerce operator is any person who owns, operates, or manages a digital or electronic platform for e-commerce transactions.

Q: What are the GST responsibilities of an e-commerce operator?

A : An e-commerce operator is required to deduct TCS on supplies made through them, pay to the government and file the appropriate return.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Introduction:

Section 194-I of the Income Tax Act governs Tax Deducted at Source (TDS) on payments made as rent to a resident person. This provision ensures the correct deduction and remittance of taxes on rent payments. Here's a comprehensive overview of Section 194-I:

Responsible for Deduction:

TDS on rent is to be deducted by the following entities:

Any person, other than an individual or Hindu Undivided Family (HUF).

Individual or HUF whose total sales, gross receipts, or turnover from business or profession exceed ₹1 crore (for business) or ₹50 lakh (for profession) during the financial year immediately preceding the year in which the payment is made.

Threshold Limit:

No TDS is required if the aggregate rent payments credited or paid to the payee during the financial year do not exceed ₹2,40,000. This limit applies separately to each co-owner when the share of each co-owner is known.

Definition of Rent:

"Rent" includes any payment, by any name, under any lease, sub-lease, tenancy, or any other agreement or arrangement for the use of various assets, including land, buildings, machinery, plant, equipment, furniture, fittings, and equipment, whether or not owned by the payee.

Timing of TDS Deduction:

TDS must be deducted at the time of making the payment or crediting the payee's account, whichever occurs earlier.

| Nature of Assets | TDS Rate |

| Machinery, plant, or equipment | 2% |

| Land, building (including factory building), land appurtenant to a building (including factory building), furniture, fittings | 10% |

Exemption from TDS:

TDS is not applicable in the following cases:

Payments to the Government, local authorities under section 10(20), and statutory authorities under section 10(20A).

Rent payments to a business trust, being a real estate investment trust, for real estate assets referred to in section 10(23FCA) owned directly by such business trust.

Exemption or Relaxation:

Recipients can apply to the Assessing Officer in Form 13 to obtain a certificate authorizing the payer to deduct tax at a lower rate or not deduct any tax, as per Section 197.

Circular & Notification

Circular. No.23/2017 TDS not deductible on GST Component: CBDT

In the light of the fact that even under the new GST regime, the rationale of excluding the tax component from the purview of TDS remains valid, the Board hereby clarifies that wherever in terms of the agreement or contract between the payer and the payee, the component of ‘GST on services’ comprised in the amount payable to a resident is indicated separately, tax shall be deducted at source under Chapter XVII-B of the Act on the amount paid or payable without including such ‘GST on services’ component. GST for these purposes shall include Integrated Goods and Services Tax, Central Goods and Services Tax, State Goods and Services Tax and Union Territory Goods and Services Tax.

CIRCULAR NO. 4/2008, DATED 28-4-2008

Clarification on deduction of tax at source (TDS) on service tax component on rental income under section 194-I of the Income-tax Act

Service tax paid by the tenant doesn’t partake the nature of "income" of the landlord. The landlord only acts as a collecting agency for the Government for the collection of service tax. Therefore it has been decided that tax deduction at source (TDS) under sections 194-I of the Income-tax Act would be required to be made on the amount of rent paid/payable without including the service tax.

Circular: No. 718, dated 22-8-1995

Query No. 1: Whether tax is required to be deducted at source where rent has been paid in advance before 1-6-1994?

Answer: Where an advance of rent has been paid before 1-6-1994, there is no requirement for deduction of tax at source.

Query No. 2: Whether tax is required to be deducted at source where a non-refundable deposit has been made by the tenant?

Answer: In cases where the tenant makes a non-refundable deposit tax would have to be deducted at source as such deposit represents the consideration for the use of the land or the building, etc., and, therefore, partakes of the nature of rent as defined in section 194-I. If, however, the deposit is refundable, no tax would be deductible at the source. It is further clarified that if the deposit carries interest, the tax to be deducted on the amount of interest will be governed by section 194A of the Income-tax Act.

Query No. 3: Whether the tax is to be deducted at source from warehousing charges?

Answer: The term ‘rent’ as defined in Explanation (i) below section 194-I means any payment by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any building or land. Therefore, the warehousing charges will be subject to a deduction of tax under section 194-I.

Query No. 4: On what amount the tax is to be deducted at source if the rentals include municipal tax, ground rent, etc?

Answer: The basis of tax deduction at source under section 194-I is "income by way of rent". Rent has been defined, in the Explanation (i) of section 194-I, to mean any payment under any lease, tenancy, agreement, etc., for the use of any land or building. Thus, if the municipal taxes, ground rent, etc., are borne by the tenant, no tax will be deducted on such sum.

Query No. 5: Whether section 194-I is applicable to rent paid for the use of only a part or a portion of any land or building?

Answer: Yes, the definition of the term "any land" or "any building" would include a part or a portion of such land or building.

Circular 5-2002/30-07-2002

Question 20: Whether payments made to a hotel for rooms hired during the year would be of the nature of rent?

Answer: Payments made by persons, other individuals, and HUFs for hotel accommodation taken on a regular basis will be in the nature of rent subject to TDS under section 194-I.

Question 21: Whether the limit of Rs. 2,40,000 * [ As per effective date ]per annum would apply separately for each co-owner of a property?

Answer: Under section 194-I, the tax is deductible from payment by way of rent, if such payment of the payee during the year is likely to be Rs. 2,40,000 or more. If there are a number of payees, each having a definite and ascertainable share in the property, the limit of Rs. 2,40,000 will apply to each of the payee/co-owner separately. The payers and payees are, however, advised not to enter into sham agreements to avoid TDS provisions.

Question 22: Whether the rent paid should be enhanced for notional income in respect of the deposit given to the landlord?

Answer: The tax is to be deducted from the actual payment and there is no need to compute notional income in respect of a deposit given to the landlord. If the deposit is adjustable against future rent, the deposit is in the nature of advance rent subject to TDS.

Question 23: Whether payments made by the company taking premises on rent but styling the agreement as a business centre agreement would attract the provisions of section 194-I ?

Answer: The tax is to be deducted from rent paid, by whatever name called, for the hire of a property. The incidence of deduction of tax at source does not depend upon the nomenclature, but on the content of the agreement as mentioned in clause (i) of Explanation to section 194-I.

Question 24: Whether in the case of a composite arrangement for user of premises and provision of manpower for which consideration is paid as a specified percentage of turnover, section 194-I of the Act would be attracted?

Answer: If the composite arrangement is in essence the agreement for taking premises on rent, the tax will be deducted under section 194-I from payments thereof.

- P. Warehousing & Logistics Corporation v. ACIT (ITA No. 491/Ind/2019)

TDS threshold will apply to each joint owner of the property separately while deducting tax on the payment of rent

- CIT v/s Khamba [1986] TDS on Agricultural income

Bombay High Court has interpreted the highlighted words ‘Subject to’ in Section. 5 as follows:

“The expression ‘subject to’ used in the opening portion of both Ss.(1) and Ss.(2) of S. 5 has to be read keeping in mind that S. 5 is intended to explain the scope of total income. Therefore, what the use of the said expression shows is that in considering what is total income u/s.5, one has to exclude such income as is excluded from the scope of total income by reason of any other pro-vision of the IT Act and not that the other provisions of the IT Act override the provisions of Section 5.”

Agricultural income is defined under the Income-tax Act, 1961 of Section. 2(1A)

“any rent or revenue derived from land which is situated in India and is used for agricultural purposes;”

Hence, it is obvious that the TDS provisions are not independent of other provisions of the Act and whether the income is chargeable to tax under the Act or not has to be considered while deducting TDS.

Additional Information:

Payments made by an individual reimbursed by a company are generally not subject to TDS. This is because the individual makes the payment, and the company reimburses the expenditure.

Lump-sum lease premiums or one-time upfront lease charges that are not adjustable against periodic rent are not considered payments in the nature of rent under Section 194-I and are not subject to TDS.

Understanding these provisions is essential for entities involved in making rent payments to ensure compliance with tax regulations effectively. It promotes transparency and efficient tax administration.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application

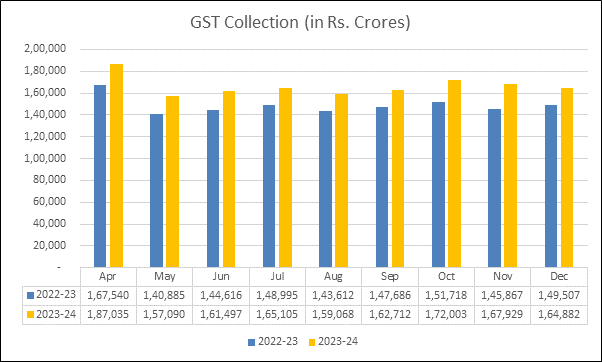

The gross GST revenue collection for the month of December, 2023 is ₹1,64,882 crore.

The bifurcation of GST Revenue collection is as below :-

| Particulars | Amount |

| CGST | ₹30,443 crore |

| SGST | ₹37,935 crore |

| IGST | ₹84,255 crore (including ₹41,534 crore collected on import of goods) |

| CESS | ₹12,249 crore (including ₹ 1,079 crore collected on import of goods) |

| Total | ₹1,64,882 crore |

The GST revenue collection for December 2023 is 10.30% higher than the GST revenue collection in the same month last year.

This is the seventh time in FY 2023-24 when gross GST collection crosses ₹1.60 lakh crore, signaling a robust economy and proving that India is doing well economically.

Impressive growth is observed in GST collection, with a 12% year-on-year increase for FY 2023-24 up to December 2023. The gross GST collection for FY 2023-24 up to December 2023 is ₹14,97,322 crore (an average of ₹1.66 lakh crore per month). If we compare it with the same period last year, the average GST collection for FY 2022-23 up to December 2022 was ₹1.49 lakh crore per month

Comparison chart of GST collection for the FY 2023-24 upto December 2023 & FY 2022-23 upto December 2022

State-wise growth of GST Revenues during December, 2023 (Rs. In Crore)

| State/UT | Dec-22 | Dec-23 | Growth (%) |

| Jammu and Kashmir | 410 | 492 | 20% |

| Himachal Pradesh | 708 | 745 | 5% |

| Punjab | 1,734 | 1,875 | 8% |

| Chandigarh | 218 | 281 | 29% |

| Uttarakhand | 1,253 | 1,470 | 17% |

| Haryana | 6,678 | 8,130 | 22% |

| Delhi | 4,401 | 5,121 | 16% |

| Rajasthan | 3,789 | 3,828 | 1% |

| Uttar Pradesh | 7,178 | 8,011 | 12% |

| Bihar | 1,309 | 1,487 | 14% |

| Sikkim | 290 | 254 | -13% |

| Arunachal Pradesh | 67 | 97 | 44% |

| Nagaland | 44 | 46 | 4% |

| Manipur | 46 | 50 | 9% |

| Mizoram | 23 | 27 | 18% |

| Tripura | 78 | 79 | 2% |

| Meghalaya | 171 | 171 | 0% |

| Assam | 1,150 | 1,303 | 13% |

| West Bengal | 4,583 | 5,019 | 10% |

| Jharkhand | 2,536 | 2,632 | 4% |

| Odisha | 3,854 | 4,351 | 13% |

| Chhattisgarh | 2,585 | 2,613 | 1% |

| Madhya Pradesh | 3,079 | 3,423 | 11% |

| Gujarat | 9,238 | 9,874 | 7% |

| Dadra and Nagar Haveli and Daman & Diu | 318 | 333 | 5% |

| Maharashtra | 23,598 | 26,814 | 14% |

| Karnataka | 10,061 | 11,759 | 17% |

| Goa | 460 | 553 | 20% |

| Lakshadweep | 1 | 4 | 310% |

| Kerala | 2,185 | 2,458 | 12% |

| Tamil Nadu | 8,324 | 9,888 | 19% |

| Puducherry | 192 | 232 | 21% |

| Andaman and Nicobar Islands | 21 | 28 | 35% |

| Telangana | 4,178 | 4,753 | 14% |

| Andhra Pradesh | 3,182 | 3,545 | 11% |

| Ladakh | 26 | 58 | 127% |

| Other Territory | 249 | 227 | -9% |

| Center Jurisdiction | 179 | 243 | 36% |

| Grand Total | 1,08,394 | 1,22,270 | 13% |

SGST & SGST portion of IGST settled to States/UTs April-December (Rs. in crore)

| Pre-Settlement SGST | Post-Settlement SGST[2] | |||||

| State/UT | 2022-23 | 2023-24 | Growth | 2022-23 | 2023-24 | Growth |

| Jammu and Kashmir | 1,699 | 2,188 | 29% | 5,442 | 6,021 | 11% |

| Himachal Pradesh | 1,731 | 1,929 | 11% | 4,205 | 4,160 | -1% |

| Punjab | 5,719 | 6,280 | 10% | 14,371 | 16,382 | 14% |

| Chandigarh | 451 | 495 | 10% | 1,582 | 1,708 | 8% |

| Uttarakhand | 3,568 | 4,046 | 13% | 5,758 | 6,288 | 9% |

| Haryana | 13,424 | 14,992 | 12% | 23,134 | 25,733 | 11% |

| Delhi | 10,167 | 11,544 | 14% | 21,426 | 23,611 | 10% |

| Rajasthan | 11,483 | 12,732 | 11% | 25,903 | 28,794 | 11% |

| Uttar Pradesh | 20,098 | 24,164 | 20% | 49,384 | 55,656 | 13% |

| Bihar | 5,307 | 6,067 | 14% | 17,360 | 19,157 | 10% |

| Sikkim | 221 | 341 | 54% | 623 | 738 | 18% |

| Arunachal Pradesh | 344 | 464 | 35% | 1,176 | 1,418 | 21% |

| Nagaland | 158 | 226 | 43% | 716 | 781 | 9% |

| Manipur | 216 | 254 | 18% | 1,046 | 813 | -22% |

| Mizoram | 130 | 197 | 51% | 623 | 707 | 14% |

| Tripura | 311 | 375 | 21% | 1,074 | 1,166 | 9% |

| Meghalaya | 339 | 438 | 29% | 1,087 | 1,244 | 14% |

| Assam | 3,785 | 4,346 | 15% | 9,280 | 10,727 | 16% |

| West Bengal | 15,959 | 17,428 | 9% | 29,170 | 31,300 | 7% |

| Jharkhand | 5,562 | 6,545 | 18% | 8,237 | 9,148 | 11% |

| Odisha | 10,313 | 11,903 | 15% | 14,046 | 18,093 | 29% |

| Chhattisgarh | 5,426 | 6,004 | 11% | 8,370 | 9,937 | 19% |

| Madhya Pradesh | 7,890 | 9,606 | 22% | 20,834 | 24,026 | 15% |

| Gujarat | 27,820 | 31,028 | 12% | 42,354 | 46,624 | 10% |

| Dadra and Nagar Haveli and Daman and Diu | 479 | 481 | 0% | 889 | 804 | -10% |

| Maharashtra | 63,169 | 74,589 | 18% | 95,981 | 1,08,887 | 13% |

| Karnataka | 25,976 | 30,070 | 16% | 48,642 | 54,881 | 13% |

| Goa | 1,435 | 1,685 | 17% | 2,606 | 2,951 | 13% |

| Lakshadweep | 7 | 17 | 153% | 22 | 72 | 222% |

| Kerala | 9,011 | 10,293 | 14% | 21,953 | 23,045 | 5% |

| Tamil Nadu | 26,657 | 30,329 | 14% | 43,332 | 47,960 | 11% |

| Puducherry | 344 | 371 | 8% | 876 | 1,037 | 18% |

| Andaman and Nicobar Islands | 133 | 155 | 16% | 365 | 388 | 7% |

| Telangana | 12,287 | 14,579 | 19% | 27,964 | 29,889 | 7% |

| Andhra Pradesh | 9,298 | 10,407 | 12% | 21,137 | 23,481 | 11% |

| Ladakh | 123 | 186 | 51% | 420 | 523 | 25% |

| Other Territory | 135 | 182 | 35% | 420 | 903 | 115% |

|

Grand Total |

3,01,175 | 3,46,938 | 15% | 5,71,807 | 6,39,052 | 12% |

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

All about Tax Deduction at Source (TDS) : Meaning, Return and due dates, exemptions

Topic Covers:

- Introduction

- What is TDS?

- Person liable to deduct TDS

- Payments liable for TDS deduction

- Due date of depositing TDS

- Issue of TDS certificate

- Interest for delay in payment of TDS

- Exemption from TDS

1.Introduction:

The government aims to collect the tax at every source of income and introduce the concept of TDS on income. The government specified the payments on which TDS is required to be deducted. According to this concept, tax should be deducted at source by the person who is liable to make such specified payments.

2.What do you mean by TDS?

TDS meaning in tax is the reduction or deduction of the amount from the gross amount paid or payable in respect of specified payments like Interest, commission, brokerage, rent etc. The person liable to make such payments is required to deduct tax at source at the rate prescribed in the relevant provision.

3.Who is liable to deduct TDS and Who is the TDS Deductor and TDS Deductee?

The person making the specified payments is liable to deduct tax at source. As per Income Tax Act the term person includes: individual, HUF, AOP, BOI, company Firm etc.

TDS Deductor: The payer, who makes payment, is known as TDS deductor.

TDS Deductee: The payee, who receives the net payment, is called the TDS deductee.

4.Payments on which TDS is required to be deducted:

Almost all types of payments are covered by the different provisions of the Income Tax Act for the purpose of deducting tax at source. Here is an illustrative list:

- Salary (section 192)

- Commission, brokerage

- Payment for contracts

- Payment of rent

- Payment for technical services, professional fees

- Sale of immovable property

- Payment of Interest

- Income by way of winnings from lotteries, crossword puzzles, card games and other games

- Payments of Dividend

Tax should be deducted at the specified rate provided in the relevant section.

5.Due date of depositing the TDS amount with the government

Tax deducted at source must be deposited within the due date. The due date for depositing the tax with the government is given in the table below:

| TDS Payments | Due date of Payment | |

| TDS/TCS made during the month ( other than March) | On or before the 7th day of the following month | |

| TDS/TCS made during the month of March | On or before 30th April. | |

| TDS on purchase of immovable property (194IA) | On or before 30 days from the end of the month of deduction. | |

| TDS on rent (194IB) | On or before 30 days from the end of the month of deduction. |

6.Interest for delay in payment of TDS

According to section 201, the person is liable to pay interest if TDS is required to be deducted on payment but TDS not deducted or deducted but not deposited to the government. The person shall be liable to pay interest at the following rates:

-

- 1% for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted.

- 5% for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid to the Government

Note: Amendment has been made to section 201 by The Finance Act, 2022 that if the Assessing Officer has passed an order treating the assessee in-default, then the interest shall be paid by the assessee in accordance with the said order. [Effective from Assessment Year 2023-24]

7.Issue of TDS certificate:

The deductor must issue the TDS certificate to the deductee (payee) of the deduction of tax. This is an acknowledgement that the payer has deducted tax and deposited it with the government. It contains the particulars of information of payer and payee, PAN and TAN, amount paid to payee, amount of tax deducted etc. The form and due date of th0065 certificate can be summarised in the following table:

| TDS Certificate Form | Return From | Descriptions | Section | Return Filling | Issue Of Certificate |

| From 16 | 24Q | TDS On Salary | 192B | Quarterly | Annual |

| From 16A | 26Q | TDS Non Salary | 192A, 193, 194, 194A, 194B, 194BA, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194N, 194-O,194P, 194Q, 194R, 194S, 197A | Quarterly | Quarterly |

| From 16A | 27Q | TDS on Non-Residents | 194B, 194BA, 194BB, 194E, 194LB, 194LBA, 194LBB, 194LBC, 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A, | Quarterly | Quarterly |

| From 16B | 26QB. | Payment on transfer of certain immovable property other than agricultural land | 194IA | Monthly | Monthly |

| Form 16C | 26QC | Payment of rent by individual or HUF not liable to tax audit | 194IB | Monthly | Monthly |

| Form 16D | 26QD | Payment of commission (not being insurance commission), brokerage, contractual fee, professional fee to a resident person by an Individual or a HUF who are not liable to deduct TDS under section 194C, 194H, or 194J. | 194M | Monthly | Monthly |

| Form 16E | 26Q / 26QE | Payment on transfer of Virtual Digital Asset | 194S | Monthly | Monthly |

8.Exemption from TDS

Payees can apply for an exemption or lower TDS rates by submitting Form No. 13 to the Assessing Officer or furnishing a declaration in Form 15G.

In the case of a resident individual whose income is below exemption limit, such individual can furnish a declaration in writing in Form 15G/15H (as the case may be) to the payer, for non-deduction of tax under this section.

Form 15G: when the recipient is other than a senior citizen.

Form 15H: when the recipient is a senior citizen.

The payee can also file an online application in Form No. 13 to obtain a certificate of no deduction of tax or lower deduction of tax at source. The AO may issue an appropriate certificate on receiving such an application. Before issuing the certificate in this regard AO verified the document and information that the total income of the payee justifies the deduction of income-tax at any lower rate or nil deduction of income tax.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Objective:

The method of accounting holds a vital role in the structured computation of income falling under the categories of

- "Profits and gains of business or profession" or

- "Income from other sources"

as defined by the Income-tax Act.

Effective from

Section 145 of the Income-tax Act mandates the application of a specific method of accounting for the computation of income under the mentioned heads. This provision became effective from the 1st day of April, 1997.

Permissible Method of Accounting:

The taxpayers choose between the cash and mercantile systems. Under the Income-tax Act, taxpayers have the discretion to adopt either of these methods for computing income under specific heads, such as "Profits and gains of business or profession" or "Income from other sources."

- Discretion for Taxpayers: Taxpayers are allowed to choose the accounting method that best aligns with their business operations and financial reporting preferences.

- Cash System: This method recognizes income when it is received and expenses when they are paid.

- Mercantile System: Also known as the accrual basis, this method recognizes income when it is earned and expenses when they are incurred, regardless of actual cash flow.

No role of Method of accounting if incomes are taxable under the head:

- Salaries

- House Property

- Capital Gains

Regulation of Income Computation and Disclosure Standards (ICDS) or Other under Section 145(2)

Section 145(2) of the Income Tax Act vests the Central Government with the authority to prescribe Income Computation and Disclosure Standards (ICDS) to be adhered to by assesses, specifically those employing the mercantile system of accounting. Notably, individuals and Hindu undivided households are exempt from the mandatory compliance stipulated in section 44AB, barring them from having their accounts subjected to scrutiny. The issuance of ICDS notifications must be periodically published in the Official Gazette.

Recent developments have witnessed the Central Government unveiling 10 new ICDS, effective from 2017-2018 .

ICDS DEALS WITH

- Disclosure of Accounting Policy

- Valuation of Inventories

- Construction Contracts

- Revenue Recognition

- Tangible Fixed Assets

- Effects of Changes in Foreign Exchange Rates

- Government Grants

- Securities

- Borrowing Costs

- Provisions, Contingent Liabilities & Contingent Assets

Best Judgment Assessment under Section 144: Circumstances Triggering AO Intervention

Section 145(3) outlines three circumstances under which the Assessing Officer (AO) may choose to initiate and conclude the assessment using the approach detailed in Section 144(1), which involves the Best Judgment Assessment:

- Inadequate Completeness or Correctness: If the Assessing Officer is dissatisfied with the completeness or correctness of the Books of Accounts and documents provided by the assessee.

- Non-Adherence to Correct Accounting Procedure: If the assessee fails to follow the correct accounting procedure on a daily basis, the Assessing Officer may opt for the Best Judgment Assessment.

- Non-Compliance with ICDS: If the Income Computation and Disclosure Standards (ICDS) notified by the Central Government under section 145(2) have not been adhered to by the assessee in the computation of income, the Assessing Officer may initiate the Best Judgment Assessment process.

AO's Authority to Reject Books in Case of Discrepancies

- If the accounts were not produced for authentication.

- If no records are produced.

- If the accounts were defective.

- If the stock register was not maintained.

In these situations, the Assessing Officer has the discretion to choose the Best Judgment Assessment approach as outlined in Section 144(1) of the Income Tax Act. • If the method of accounting is improperly followed.