The Meaning of ‘Notice’ is not defined under the GST. But, in general terms notice means – “A warning or announcement of something that is going to happen in the future or the act of observing or paying attention to something.”Every registered person is required to comply with the provisions, rules, circulars, notifications, and guidelines issued by GST law. If such person does not comply with the provisions of GST Act, like delay in filing of returns or not filing of GST returns or non-payment of GST or short payment of GST or excess ITC claim or ITC utilized in the wrong manner, then in such cases proper officer can issue notice.There are different types of notices like Show Cause Notice (SCN), Scrutiny Notice, or Demand Notice, depending on the issue. These notices can be sent if the GST department finds something concerning in a taxpayer's GST Returns or if they get information from another Government department or third parties.

There are some reasons for receiving GST Notice

- A person is liable to register under the GST Act but GST registration is not taken.

- GST returns not filed on time.

- Difference between filed GSTR-1 and GSTR-3B.

- ITC not claimed as per GSTR-2B.

- GST collected but not paid to the Government.

- Tax invoices not issued as per GST law.

- Wrongly claimed GST refund.

- After GST registration cancellation, the final return (GSTR-10) is not filed.

We shall understand different types of Notices with the help of below table :-

|

S.No. |

Form Name/Type of Notice. | Description | Action to be taken | Time limit to reply Notice | Consequence if Not Reply. |

| 1 | GSTR-3A. | Notice to return defaulter u/s 46 for not filing return i.e. GSTR-1, GSTR-3B, GSTR-4 and GSTR-8. | File GST returns with late fee and Interest. | Within 15 days of receiving such notice. | To furnish the said return within 15 days failing which the be assessed u/s 62 of the Act, based on the relevant material available with this office. |

| 2 | CMP-05. | Violated the conditions and restrictions necessary for availing of the composition scheme u/s 10. |

Why the taxpayer should continue to be eligible for the composition scheme justify in Form CMP-06. | Within 15 working days from the date of service of this notice. | Penalty Imposed under section 122 and order issued in CMP-07 denying the benefit of composition scheme. |

| 3 | REG-03. | Clarification is required in respect of information furnished at the time of New registration or amendment in registration. | Reply in form Reg-04 with clarification. | Reply within 7 working days from the date of receipt of notice. | Reject the application. |

| 4 | REG-17. | Show Cause Notice for Cancellation of GST Registration. | Reply in REG-18 with the reason for non-cancellation of GST registration. | Reply within 7 working days from date of receipt of notice. | Cancel GST registration. |

| 5 | REG-23. | Show Cause Notice for rejection of application for revocation of cancellation of GST registration. | Reply in REG-24. | Reply within 7 working days from the date of receipt of notice. | Cancellation of GST registration. |

| 6 | PCT-03. | Show Cause Notice for disqualification of GST practitioner. | Reply in PCT-04. | Reply within time prescribed in Show Cause Notice. | Cancellation of GST Practitioner license. |

| 7 | RFD-08. | If the proper officer is satisfied, that the whole or any part of the amount claimed as refund is not admissible or is not payable to applicant. | Reply in Form GST RFD-09. | Within 15 days of receipt of such notice. | Order issue in Form GST RFD-06. |

| 8 | ASMT-02. | Additional information or documents in support of Provisional assessment under GST. | Reply in Form GST ASMT-03. | Within 15 days of service of the notice. | Application may be rejected. |

| 9 | ASMT-06. | Additional information for final assessment. | Reply in Form GST ASMT-03 with supporting documents. | Within 15 days of service of the notice. | Order issue in ASMT-07. |

| 10 | ASMT-10. | Notice for intimating discrepancies in the return after scrutiny under section 61. | Reply in ASMT-11 furnish reason for discrepancy in GST returns. | Within time prescribed in Show cause notice or not exceeding 30 days from the date of service of notice. | Exe-parte assessment. Proper officer pass an order on the basis of information available to him. |

| 11 | ASMT-14. | Show cause notice for assessment under section 63 (Best Judgment assessment). |

Reply furnished in written manner and appear before the GST Authority issuing GST notice. | Reply furnish within 15 days. | Assessment order pass in Form GST ASMT-15. |

| 12 | ADT-01. | Notice for Audit conduct under section 65 – Audit by Tax Authorities | Directed to attend in person or through an authorised representative or produce record | Reply furnished in time prescribed in notice. | Proper officer may initiate action under section 73 or Section 74. |

| 14 | RVN-01 | Notice u/s 108 issued by Revisional Authortiy. | Reply within prescribed time and appear before the authority. | Reply furnish within 7 working days from the service of Notice. | Issue a summary of the order in Form GST APL 04 clearly indicating the final amount of demand confirmed. |

| 15 | DRC-01 | Summary of Show Cause Notice for demand of tax. | Reply submit in DRC-06. | Reply furnish within 15 days of receipt of notice. | Pass order in Form GST ASMT -15. |

| 16 | DRC-10 | Notice for Auction under section 79 (1) (b) or section 129(6) of the Act. | Pay outstanding demand as per DRC-09. | last day for submission of bid or the date of auction shall not be earlier than 15 days from the date of issue of the Notice. | Proceed e-auction and sale proceed. |

| 17 | DRC-11 | Notice to successful bidder. | Pay bid amount. | Within 15 day of Auction. | Re-auction if not pay amount. |

| 18 | DRC-13 | Notice to a third person under 79 (1) (c). | Deposit the amount specified in notice and reply in DRC-14 | Not applicable. | fail to make payment then treat deemed to be a defaulter |

| 19 | DRC-16 | Notice for attachment and sale of immovable/movable goods/shares under section 79. | Creating charge on assets. | Not applicable. | If contravention of notice penalty and prosecution |

Mode of Sending of GST Notice :

As per Section 169(1) of CGST Act 2017 Notice can be issued in the following manner.

• By Hand delivered either directly or through message.

• By registered post or speed post or courier with acknowledgement due, or his authorised representative, or at his last known place of business or residence

• Communication to his registered e-mail address provided at the time of registration or amend time to time.

• By making it available on the Common GST Portal.

• By publication in a newspaper circulating in the locality where the taxable person is last known to have resided, carried on business, or personally worked for gain.

• Affixing it in some prominent place at his last known place of business or residence. If this is not found as reasonable by the tax authorities, they can affix a copy on the notice board of the office of the concerned officer or authority.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Overview

2. Purpose

3. Who can use it?

4. Form at glance

5. Steps for filing

Overview

Form 10-IEA has been introduced in the Income Tax Act, 1961 to select the old tax regime and opt out of the new tax regime.

The new tax regime is the default tax regime from the financial year 2023-24. This means that if a taxpayer does not select the old tax regime, they will be admitted to the by default new regime. However, individual, Hindu undivided families (HUFs) who do not have income from business or profession can directly select the old tax regime while filing income tax returns.

Form 10-IEA is required to be filed by individuals, HUFs, Association of Persons (AOP) (other than co-operative society), Body of Individuals (BOI) & Artificial Judicial Persons (AJP) whose income is from business and profession. If the taxpayer wants to change the tax regime from new to old or want to opt for the new scheme again, he will have to mandatorily submit Form 10-IEA within the time specified in under section 139(1).

Purpose of Form 10 IEA:

Form 10-IEA was notified vide Notification No.43/2023 on 21st June 2023. This form can be filled twice in life, once to opt out of the new tax regime and once to re-enter the new tax regime. Once the old tax regime is selected, it will be applicable for all subsequent assessment years. This means 10 IEA files are not to be filed every year.

Who can use it?

Taxpayers who have income from business and profession can use Form 10-IEA to "Opt out or Re-enter" in the new tax regime.

Form at a Glance

Form 10-IEA is divided into three parts: Basic information, Additional Information, and verification.

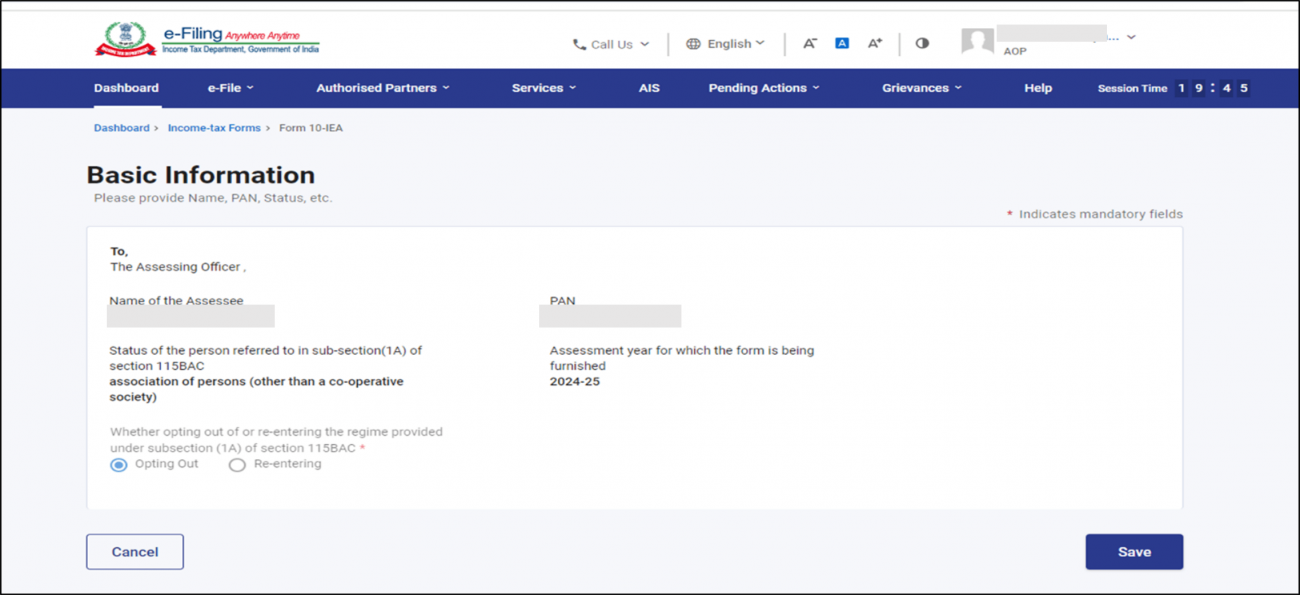

1. Basic Information: This part includes the taxpayer's name, PAN, Assessment Year, and Person's status.

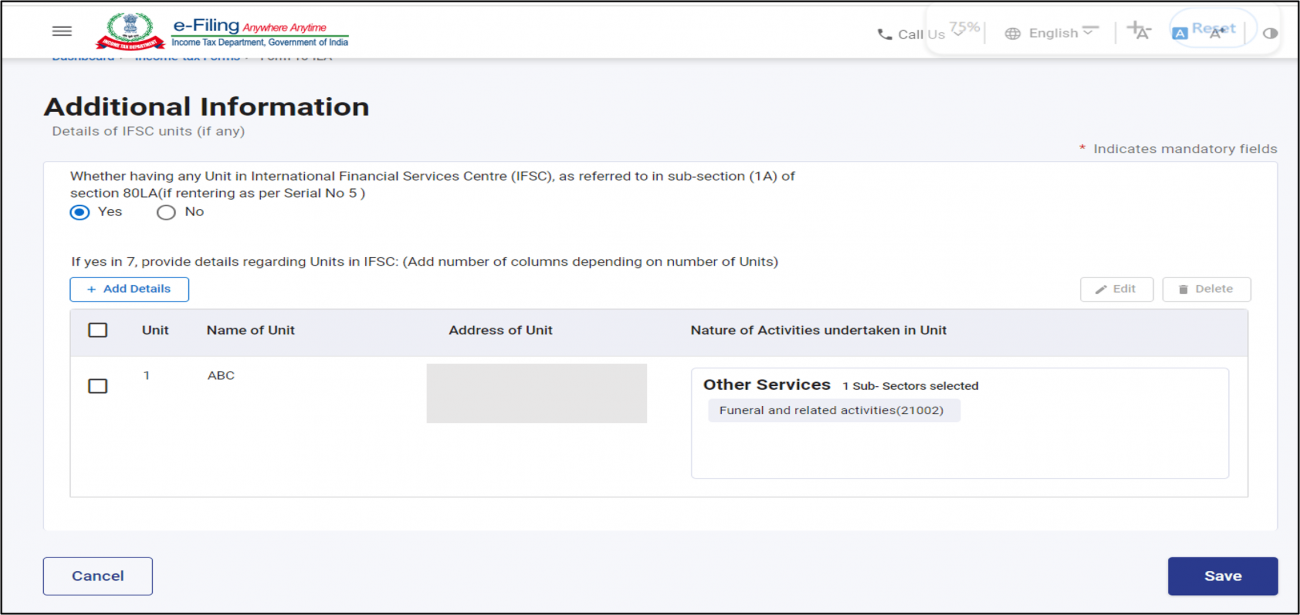

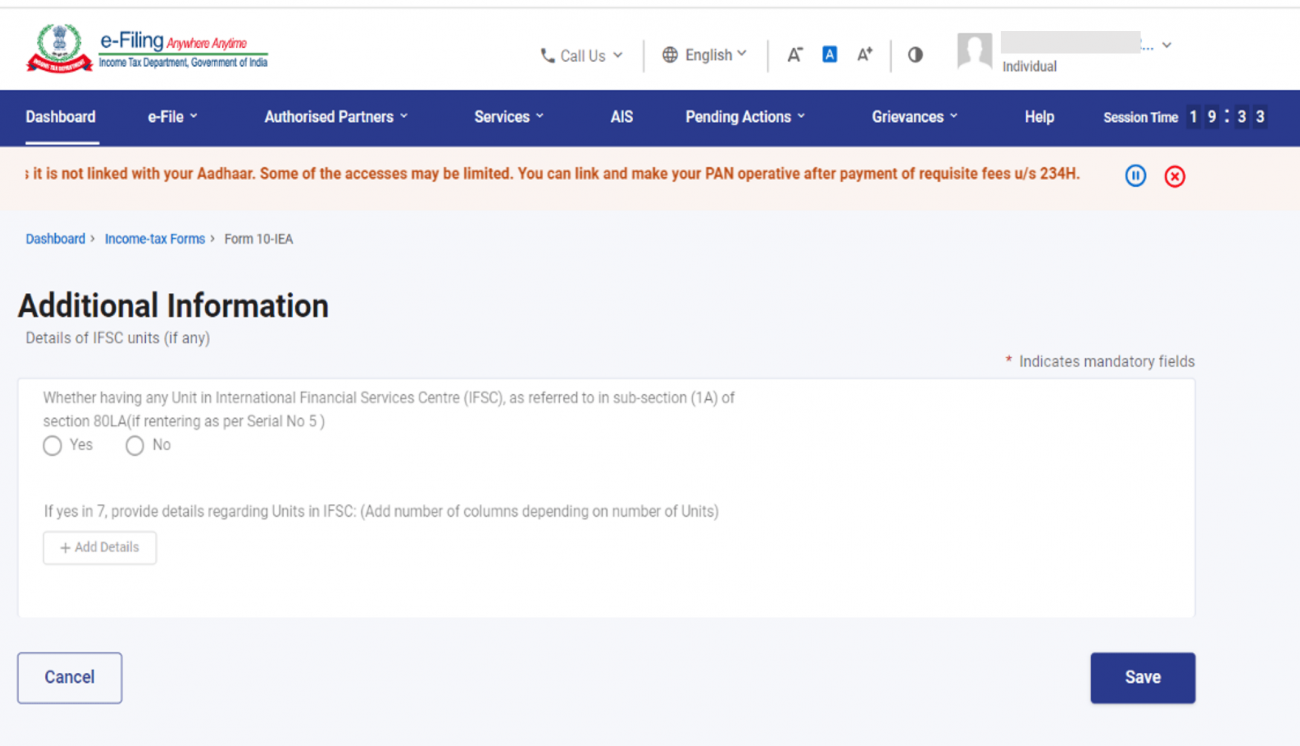

2. Additional Information: This part is related to additional information where the taxpayer has to provide additional information related to the IFSC unit (if any).

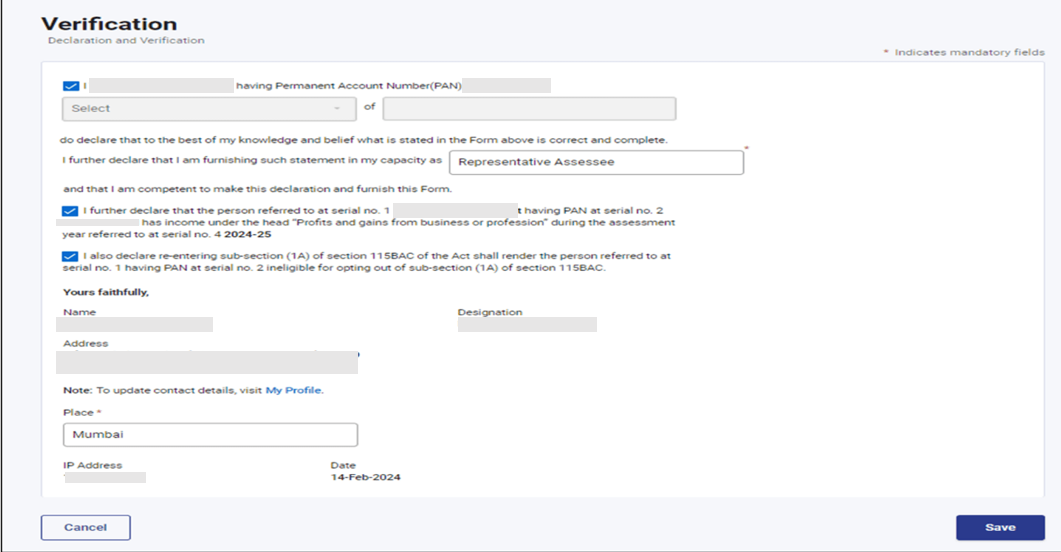

3. Declaration and Verification: This part is for Declaration and Verification by the taxpayer to opt out or re-enter from the new tax regime.

Filing of Form 10IEA:

Following are steps to fill Form 10IEA

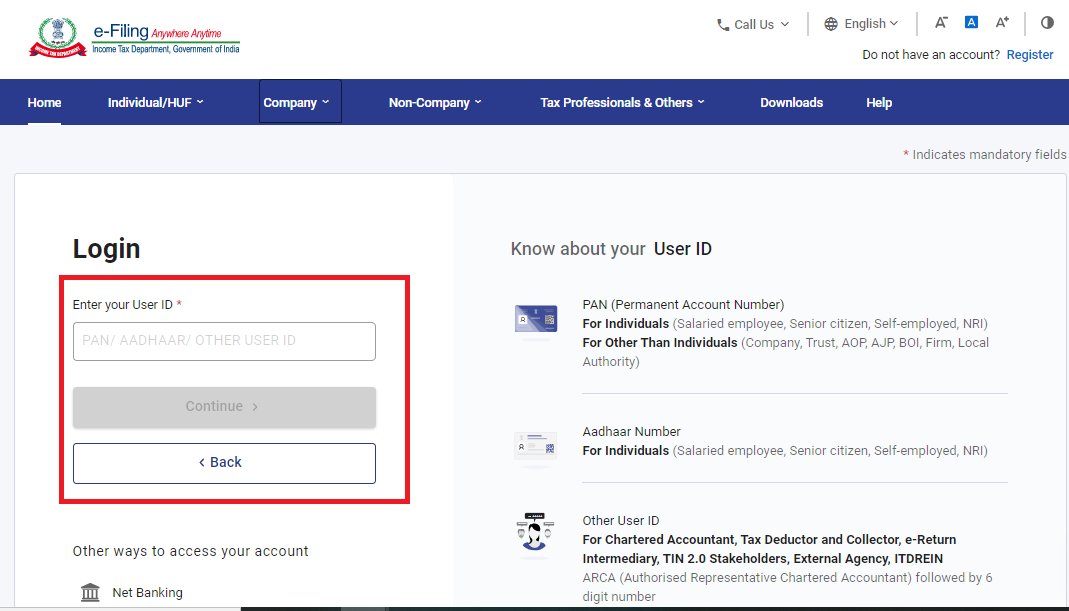

Step 1: Login on the e-Filing portal.

Step 2: Enter your user ID and password.

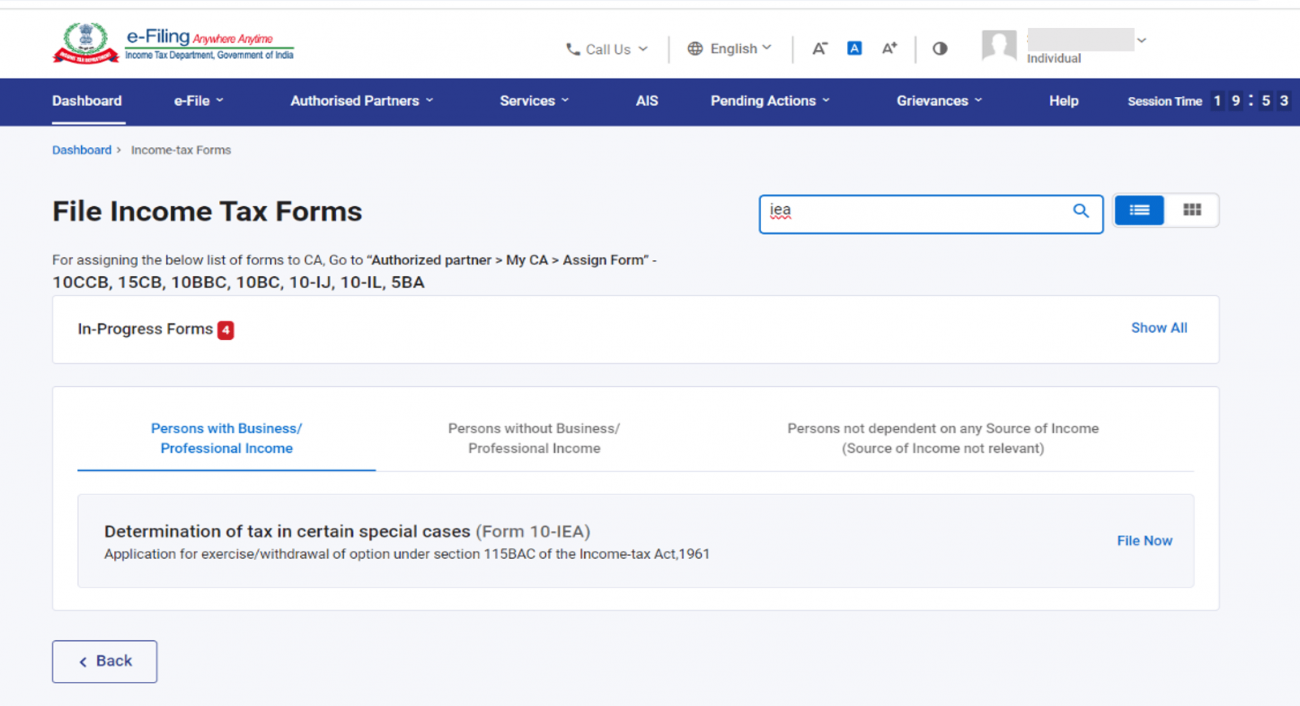

Step 3: Go to e- File menu > Income Tax Forms > File Income Tax Forms.

Step 4: On the page- File Income Tax Forms -‘Persons with Business/Professional Income -select the option-Form-10IEA.

Alternatively, enter Form 10IEA in the search box to file the form.

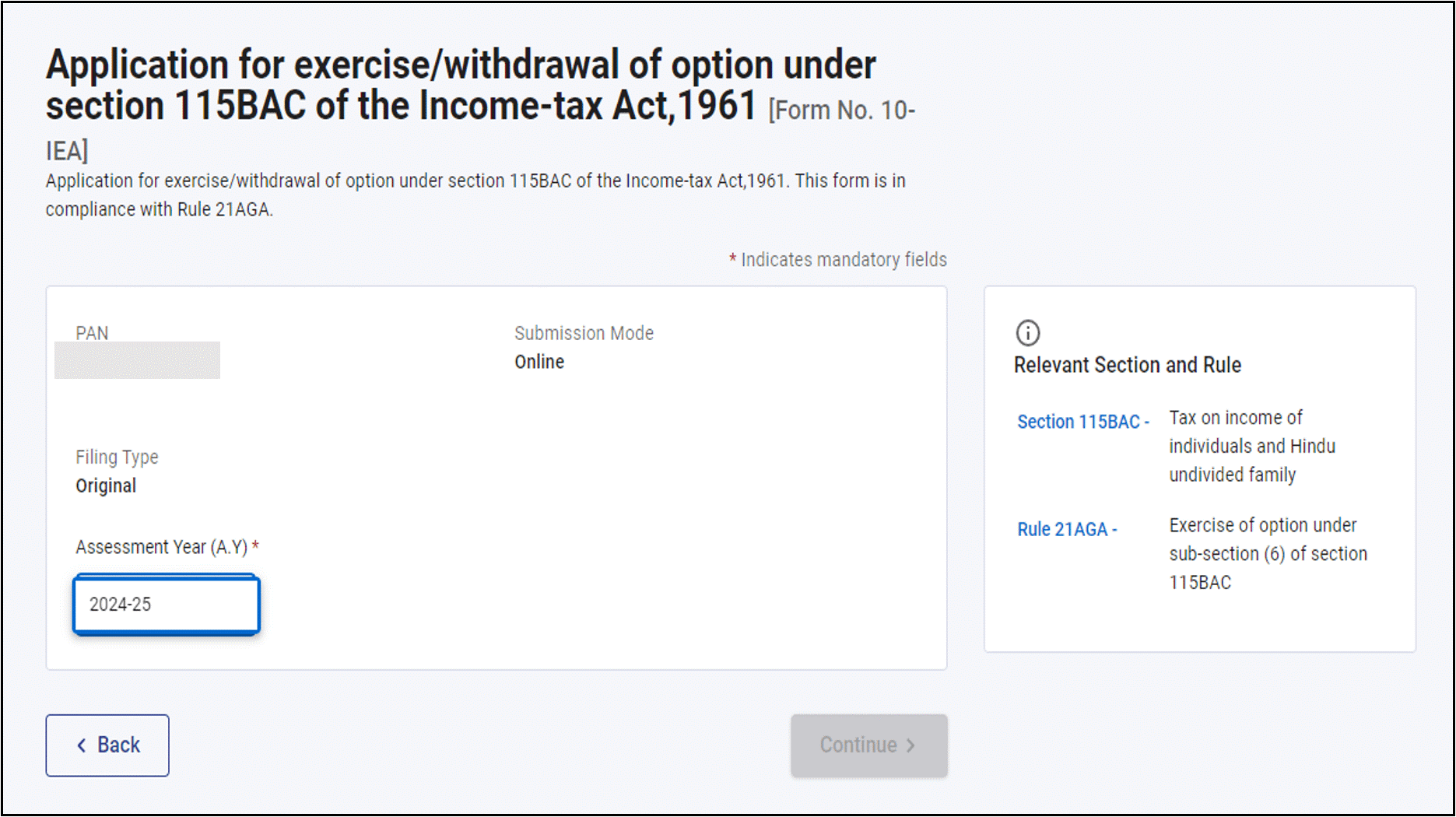

Step 5: Select the relevant Assessment Year and click on continue.

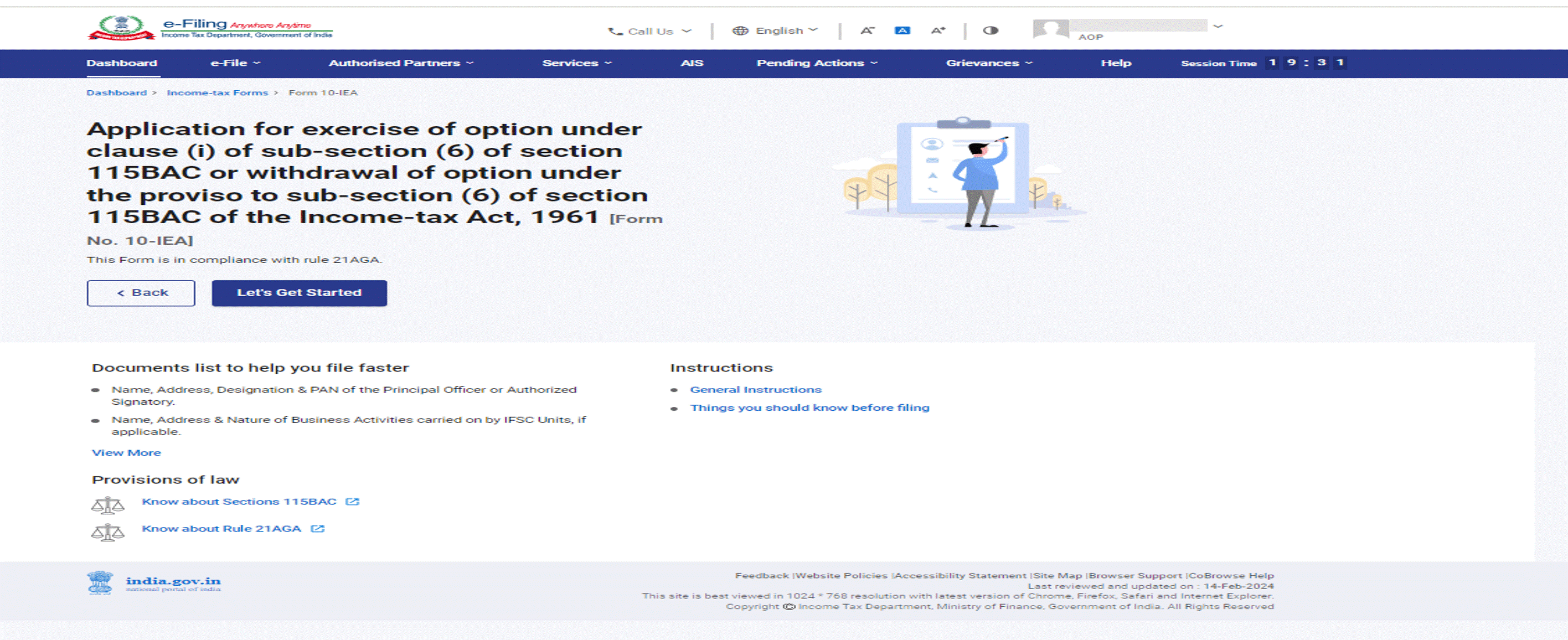

Step 6: Check the documents required for filing the form and Click on Let’s Get Started

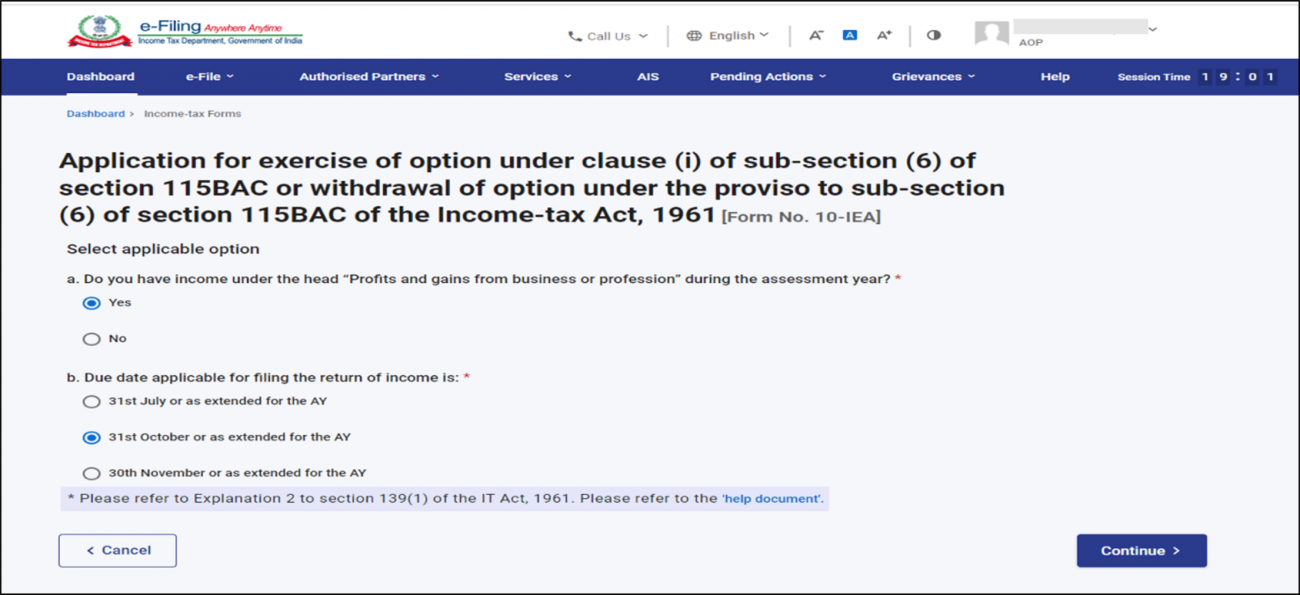

Step 7: Select Yes if you have Income under the head “Profits and gains from business or profession” during the assessment year. Select the due date applicable for filing of return of income and click on continue.

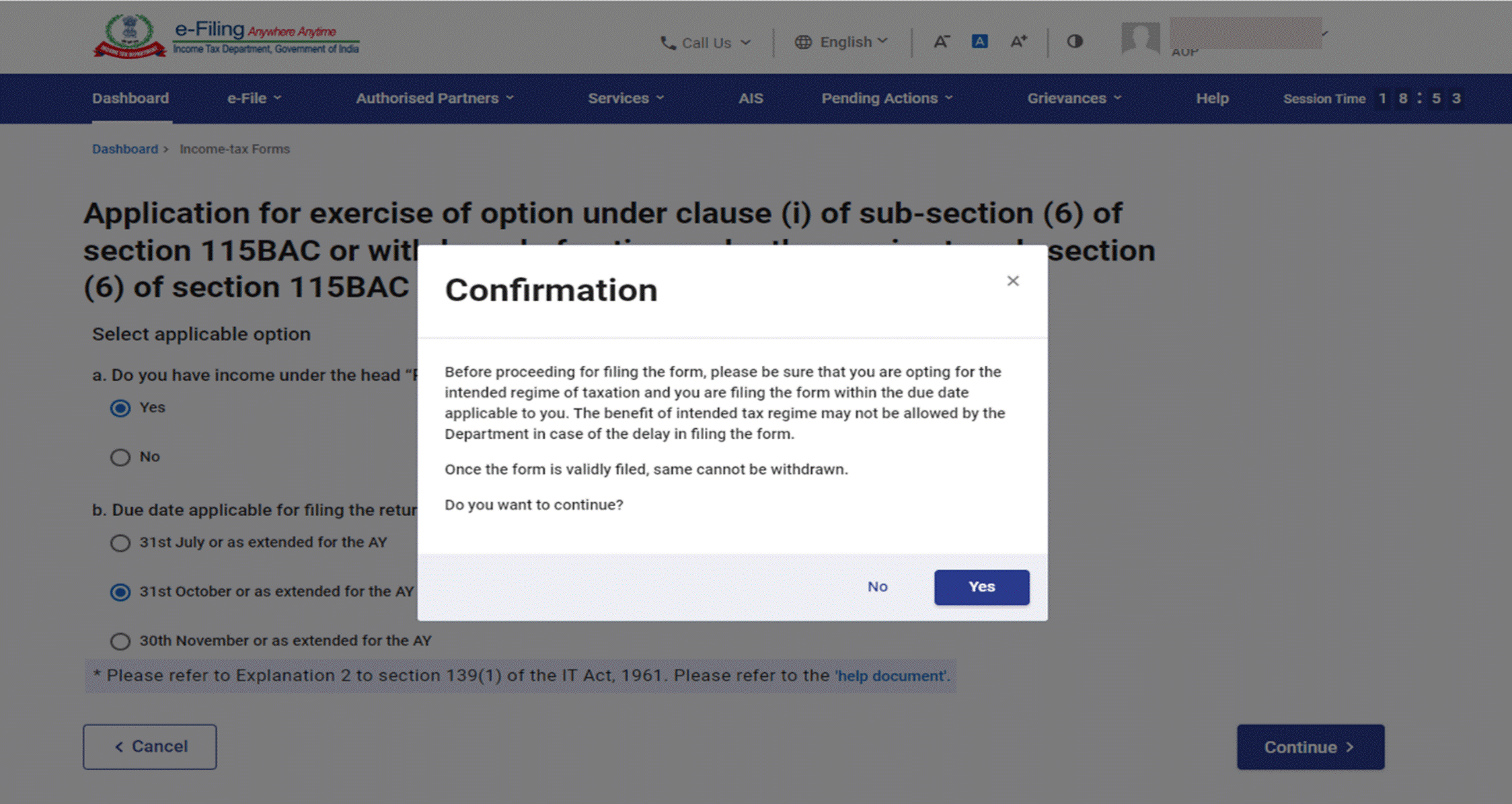

Step 8: Click ‘Yes’ to Confirm the selection of the regime.

Step 9: Form 10-IEA has 3 sections. Verify and Confirm each section. They are as follows:

i. Basic Information: In the Basic Information section, your basic information will be pre-filled. If you are filing a form for the first time then the opting out option will be auto-selected and if the system has a valid form with opting out option, then re-entering option will be auto-selected. Click on the ‘Save’ button.

ii. Additional Information: Fill the necessary details in the Additional information section related to IFSC unit (if any) and click on ‘Save’.

If you are opting out of the new Tax regime this Additional Information panel will be greyed off

iii. Declaration and Verification: The Verification section contains self-declaration where you will be required to check the boxes and agree to the terms and conditions. Verify whether all the details are correct and save the information. Once done, click on ‘Preview’ to review Form 10-IEA.

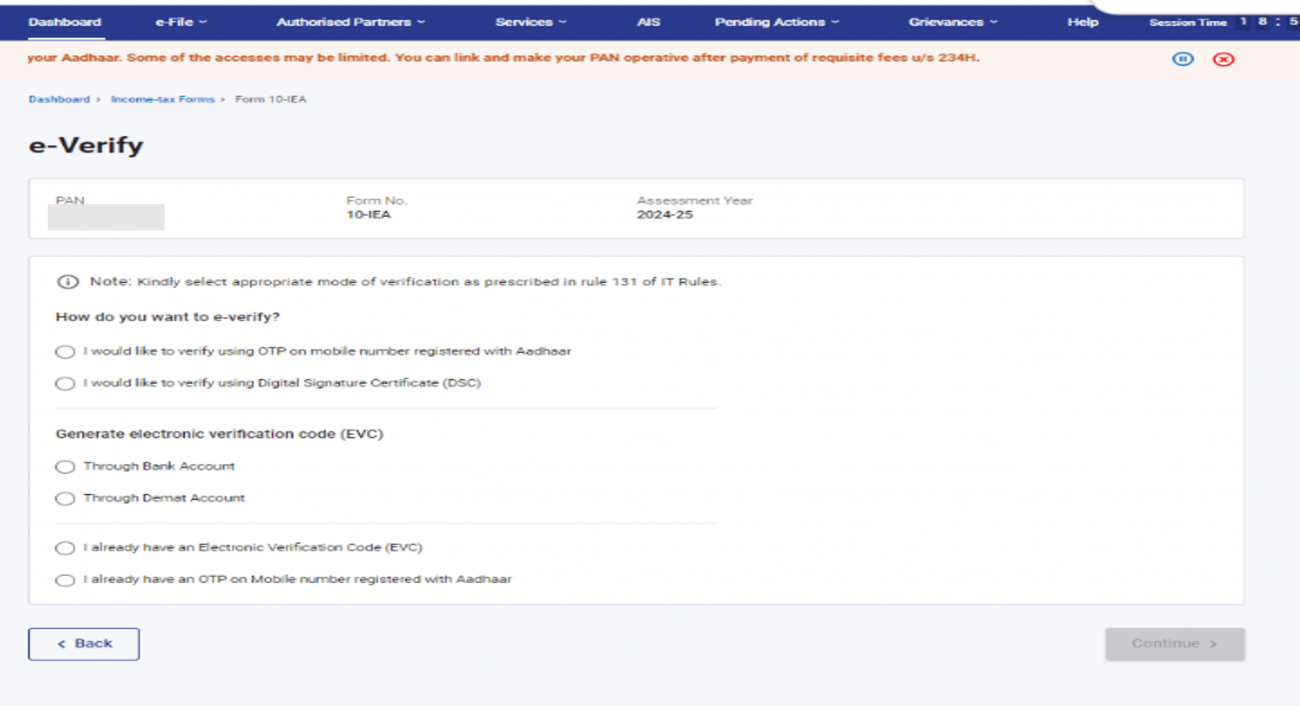

Step 10: After reviewing all the information, ‘Proceed’ to e-verify'. You can e-verify either through:

1. Aadhaar OTP

2. Digital Signature Certificate (DSC)

3. Electronic Verification Code (EVC)

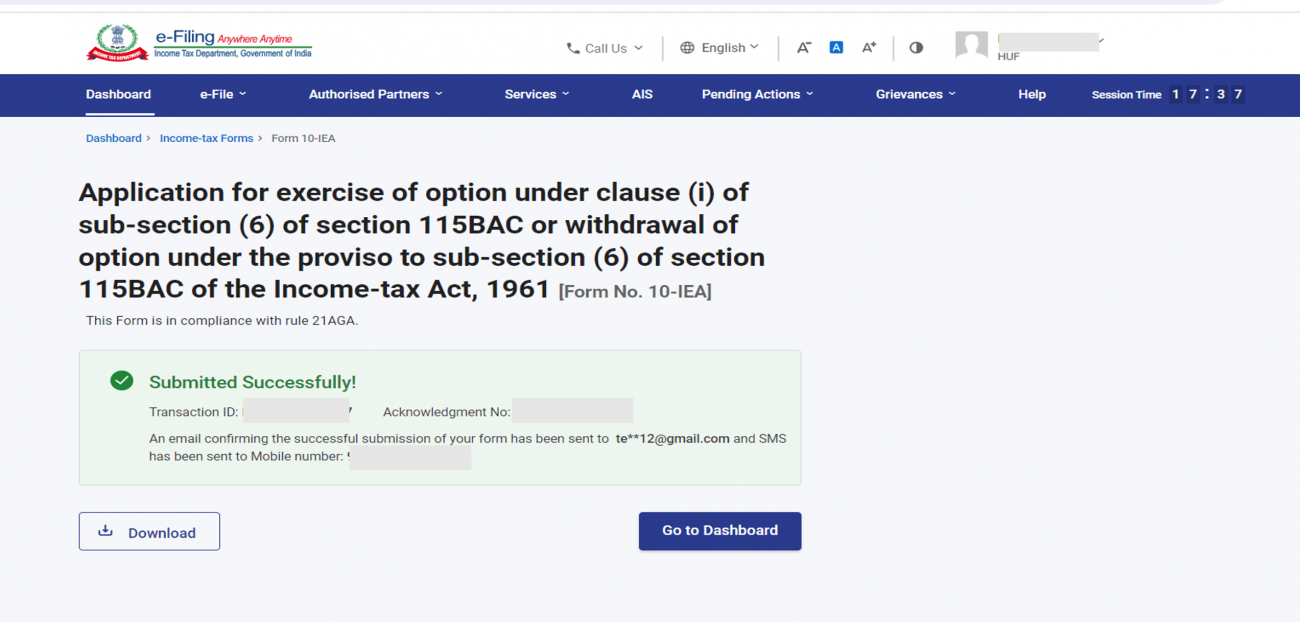

Step 11: After successful e-Verification, a success message is displayed along with a Transaction ID and an Acknowledgement Receipt Number. Please keep a note of the Transaction ID and Acknowledgement number for future reference. You can also download the form and locate the acknowledgment number.

To download the filed form, go to ‘e-File’ → 'Income Tax Forms' → 'View Filed Forms'.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

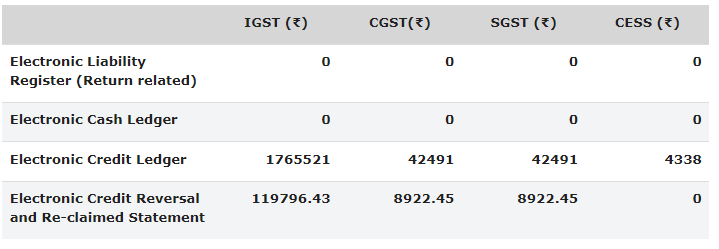

What is an E-ledger?

E-ledger is an electronic passbook. It is available to all registered persons on the GST portal. Where we can see our electronic cash ledger and electronic credit ledger balance. This balance can be used for payment of GST liability i.e. IGST/CGST/SGST/UTGST.

E-ledger contains :

Electronic Liability Ledger

Electronic Cash Ledger

Electronic Credit ledger

Electronic Credit Reversal and Re-claimed Statement

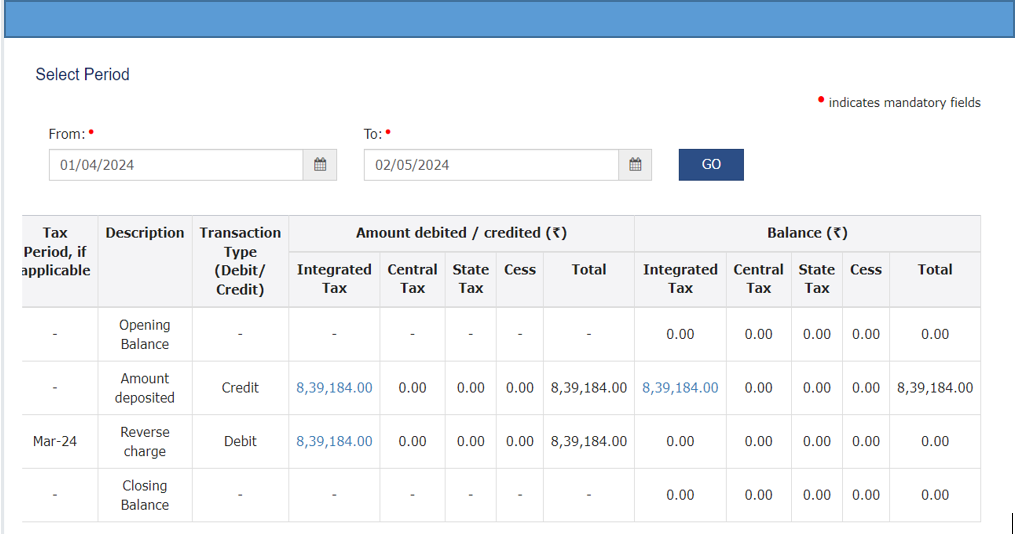

What is Electronic Cash Ledger :

An Electronic credit ledger is like an e-wallet. This e-wallet is used for payment of GST liability. If you do not have sufficient balance in the Electronic credit ledger then such liability is discharged through cash ledger. In a cash ledger, the balance can be deposited through the following mode.

Through Internet Banking

Unified Payment Interface (UPI)

IMPS

Credit card or Debit card

Through NEFT or RTGS

Cash deposit through an Authorised Bank

For Example- If we have to pay a GST liability of Rs.1,00,000 and the balance available in the electronic credit ledger is Rs.80,000, then Rs.20,000 GST liability will be discharged through the Cash ledger.

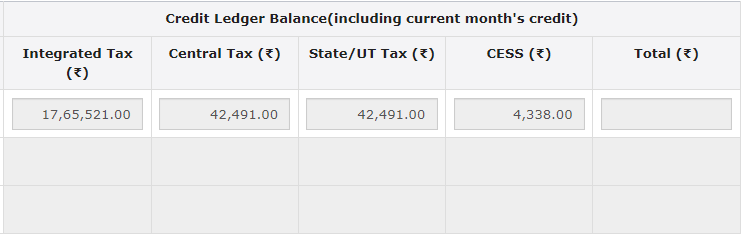

What is Electronic Credit Ledger :

When a registered person purchases any capital goods, Input, or Input service for business purposes and pays GST, such GST is credited in the electronic credit ledger. Such balance can be used for payment of GST liability but an Electronic Credit Ledger balance cannot be utilised for payment of interest, penalty, or late fees. Interest and Penalty can be paid only through a cash ledger.

What is Electronic Liability Ledger:

Electronic Liability Ledger shows the details of GST liability. The ledger contains the total GST liability and the manner in which it has been paid either through cash ledger or through credit ledger.

Every person who is liable to pay tax, interest, penalty, late fee, or any other amount on the GST portal and all amounts payable by him shall be debited to the Electronic Liability Ledger.

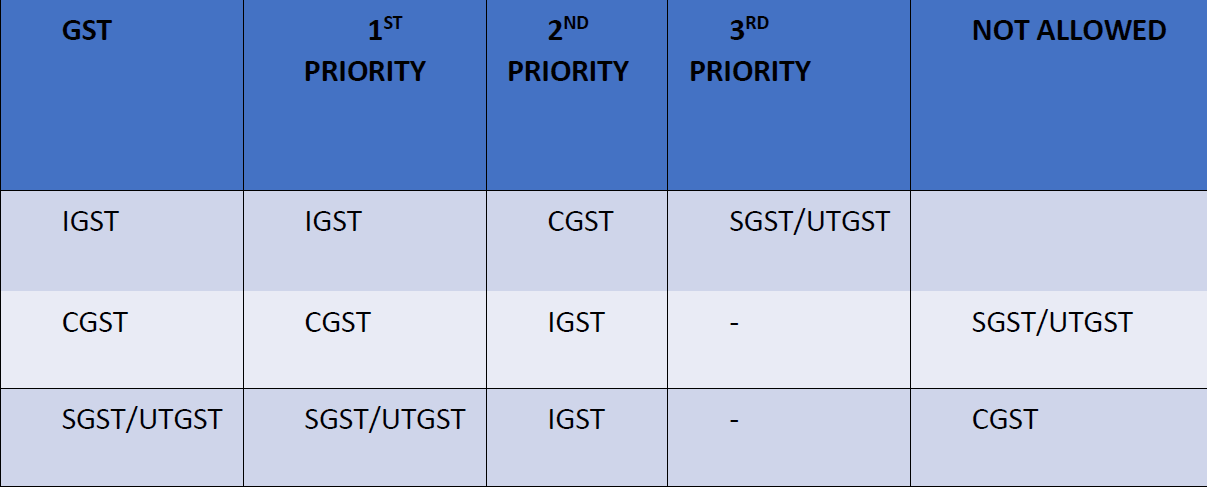

How to Utilize Electronic Credit Ledger Balance :-

Manner of Utilization of IGST-

If any IGST credit balance is available in the electronic credit ledger, it is first utilized for the payment of IGST. Any remaining balance can then be used for the payment of CGST, SGST, or UTGST in the specified order.

Manner of utilization of CGST-

If any CGST credit balance is available in the electronic credit ledger, it must be used for the payment of CGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Manner of utilization of SGST-

If any SGST credit balance is available in the electronic credit ledger, it must be used for the payment of SGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Manner of utilization of UTGST-

If any UTGST credit balance is available in the electronic credit ledger, it must be used for the payment of UTGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Note : CGST balance cannot be set off from SGST and UTGST.

FAQs on E-ledger under GST

Q.1- What is Electronic Cash Ledger ?

Ans. An Electronic credit ledger is like an e-wallet. This e-wallet is used for payment of GST liability.

Q.2. Can Electronic Credit Ledger balance be used for payment of late fees, Interest and Penalty ?

Ans. No, an Electronic Credit Ledger balance cannot be used for payment of late fees, Interest, and Penalty.

Q.3 Can CGST balance use for payment of SGST/UTGST ?

Ans. CGST balance cannot be used for payment of SGST/UTGST liability.

Q.4 How to utilized IGST balance?

Ans. 1st IGST balance is used for payment of IGST liability after utilization if the balance is remaining then it can be used for payment of CGST/SGST/UTGST liability.

Q.5 What is Electronic Credit Ledger?

Ans. An Electronic Credit Ledger is an e-wallet. This balance can be used for payment of GST liability i.e. IGST/CGST/SGST.

Q.6 Types of ledger under GST ?

Ans. There are 3 types of ledger -

• Electronic Cash Ledger.

• Electronic Credit Ledger.

• Electronic liability Ledger.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

If a person occasionally engages in transactions involving the supply of goods or services, in a state or Union Territory where they do not have a permanent operating address.

Who should apply for a temporary ID under GST?

Individuals who are either unregistered or not obligated to register under the GST regime should apply for a temporary user ID through the GST portal. GST registration is compulsory for such individuals regardless of their annual aggregate sales turnover.

This temporary user ID is provided solely to enable unregistered individuals to access certain exclusive functionalities available on the GST portal.

Steps to apply for a temporary ID under GST

To apply for a temporary user ID, an unregistered user has to follow these steps:

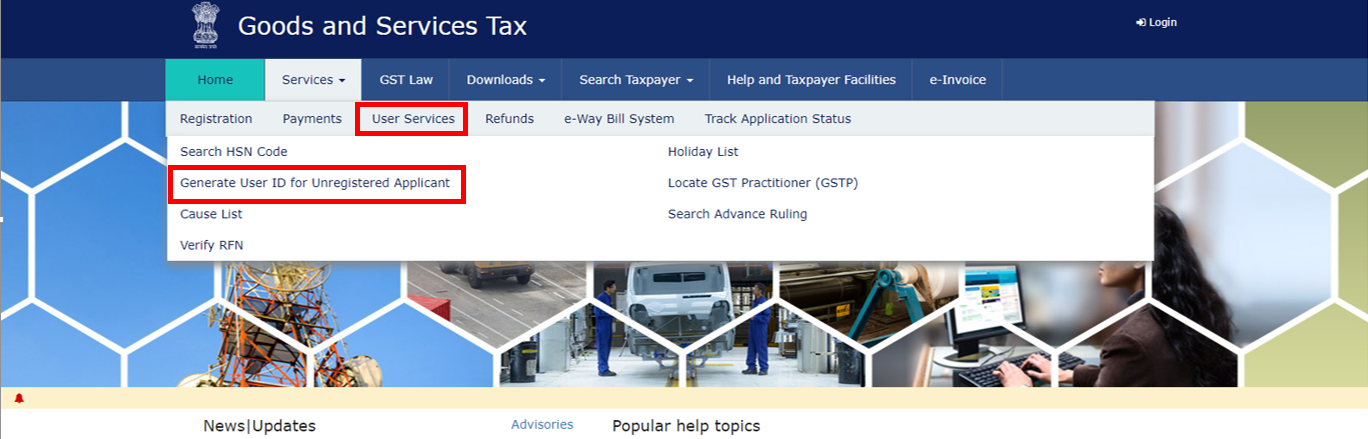

Step 1. Visit the GST portal (www.gst.gov.in.)

Step 2. The user should navigate to click Services > User Services > Generate User ID for unregistered Applicant.

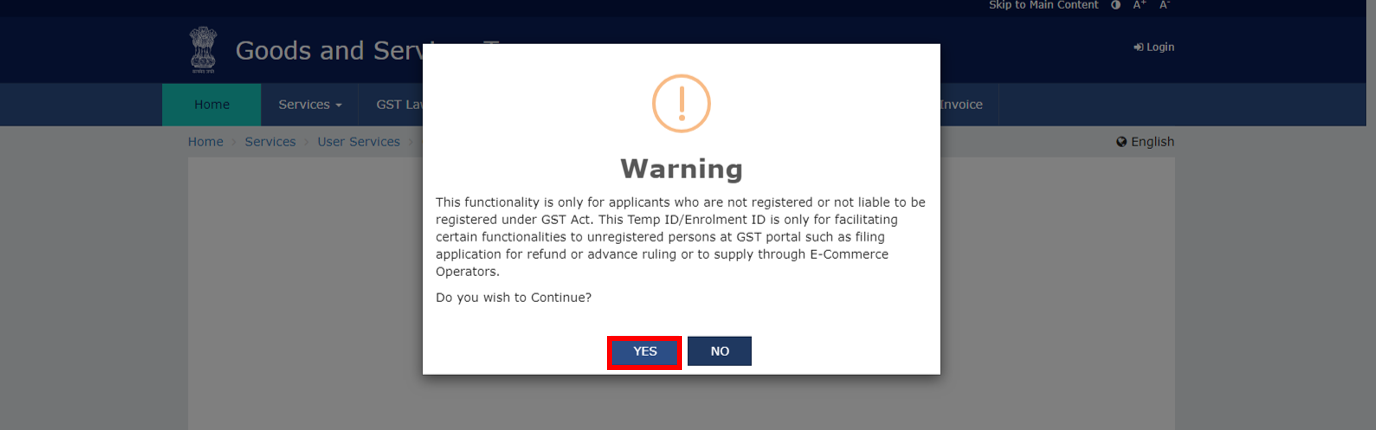

Step 3. Afterward, the user must read and acknowledge the warning message by clicking on ‘Yes.’

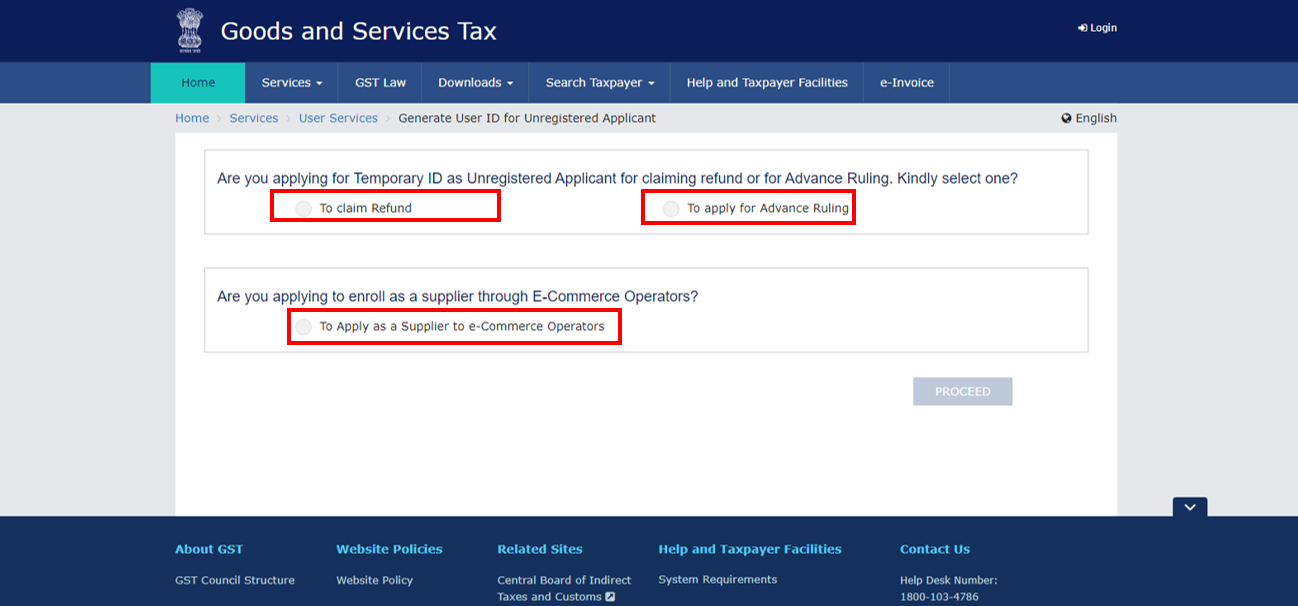

Step 4. Once the user clicks the ‘Yes’ button, the user then needs to select the reason as highlighted in red in the image below.

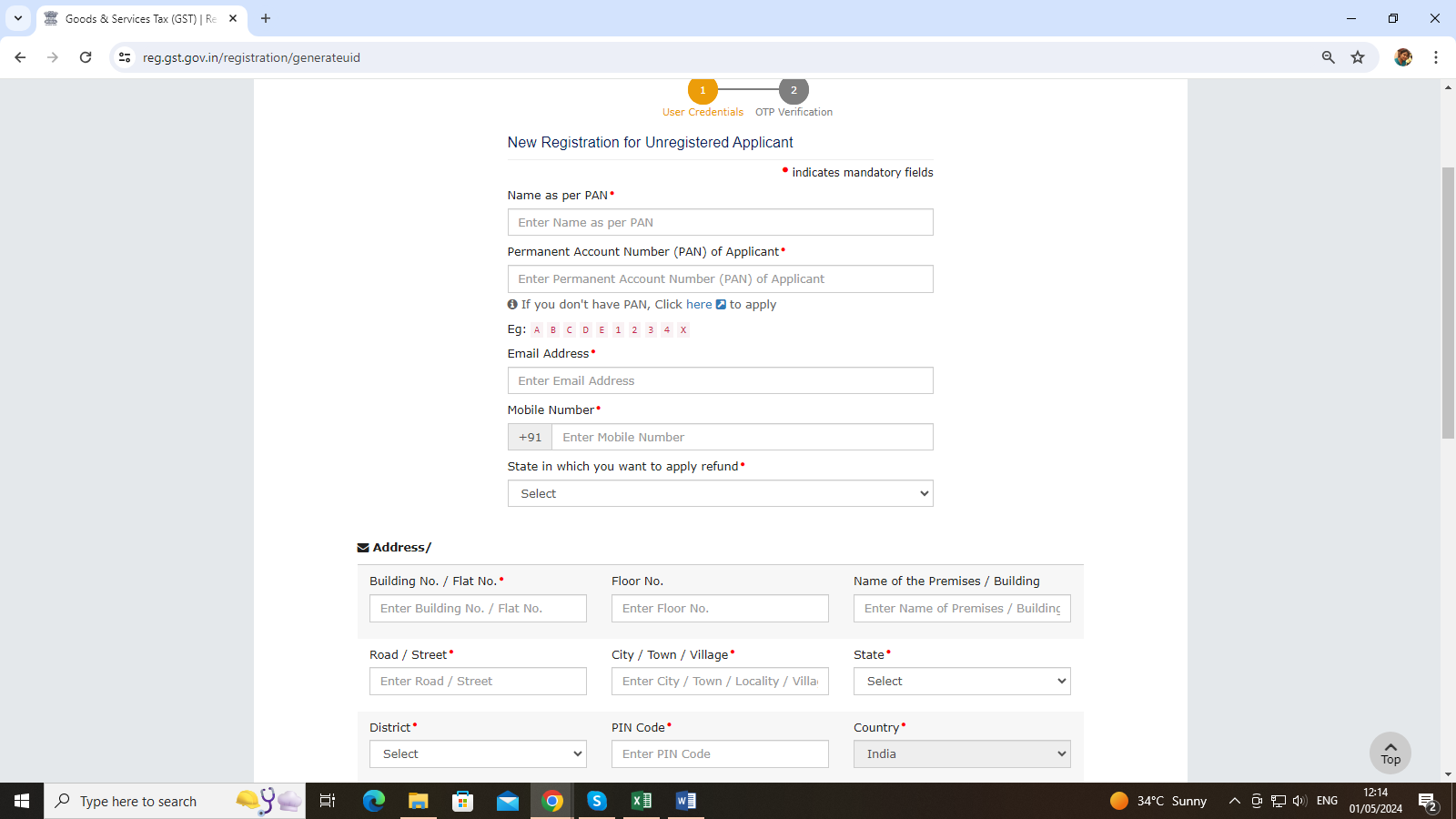

Step 5. Once the user selects the reason, the new registration for the unregistered applicant page appears.

Step 6. The user needs to enter the required details on the registration page.

Step 7. Once the user has completed filling in the details, they should enter the provided captcha text and then click on the ‘Proceed’ button.

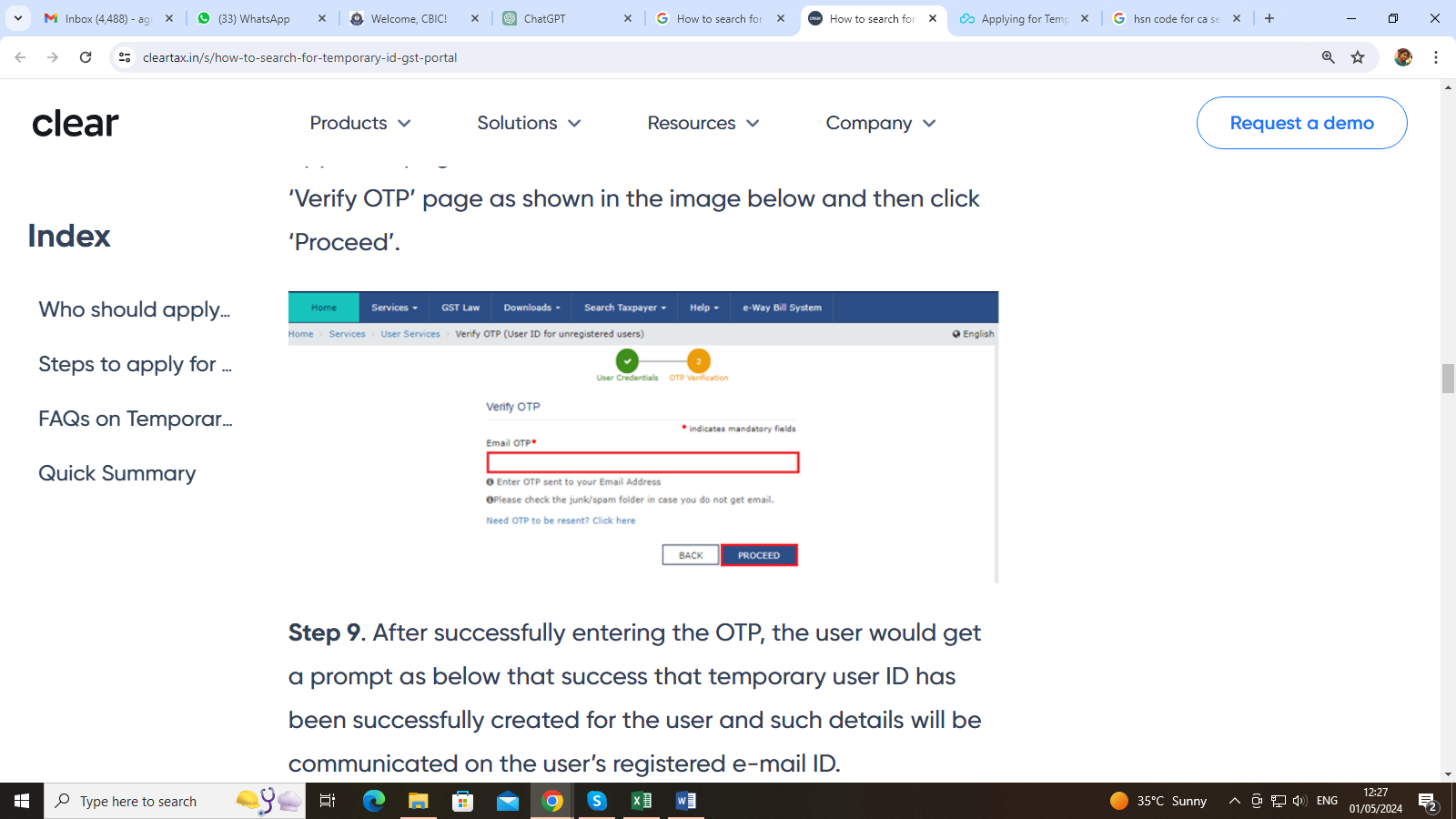

Step 8. The user will receive an Email OTP at the email address provided during the new registration for unregistered applicants. The user needs to enter the Email OTP on the 'Verify OTP' page, as shown in the image below, and then click on 'Proceed'.

Step 9. Upon successfully entering the OTP, the user will receive a prompt indicating that the temporary user ID has been created successfully. The details will be communicated to the user's registered email ID.

Step 10. Once the temporary user ID is successfully created, the user will receive an email on their registered email ID containing the temporary user ID and password for logging in to the GST portal.

FAQ’s

Q1. Who is eligible to apply for a Temporary User ID on the GST Portal?

Ans. Any individual or entity who is not registered under the GST Act or is not liable to be registered can apply for a Temporary User ID on the GST Portal. This User ID is specifically designed to facilitate access to certain exclusive functionalities available to unregistered individuals and entities on the GST Portal.

Q2. Is a non-resident individual eligible to apply for a Temporary User ID on the GST Portal?

Ans. Yes, a non-resident individual is eligible to apply for a Temporary User ID on the GST Portal.

Q3. Does a non-resident individual need to provide PAN details when applying for a Temporary User ID on the GST Portal?

Ans. No, for non-resident individuals providing PAN details is not mandatory while applying for a Temporary User ID on the GST Portal.

Q4. What supporting documents are required when applying for a Temporary User ID on the GST Portal?

Ans. No supporting documents are required when applying for a Temporary User ID on the GST Portal.

Q5. What activities can an unregistered applicant perform after creating a Temporary User ID on the GST Portal?

Ans. After creating a Temporary User ID on the GST Portal, unregistered applicants can perform activities such as tracking application status, viewing ledgers, creating challans, and searching for taxpayers.

Q6. Is it possible to add Authorized Signatory details while applying for a Temporary User ID on the GST Portal?

Ans. You can add details of up to two Authorized Signatories while applying for a Temporary User ID on the GST Portal.

Q7. What happens after entering the OTP?

Ans. After successfully entering the OTP, a confirmation message will appear stating that the temporary User ID has been created, and the details are sent to the registered email ID.

Q8. Will a notification be sent once the temporary ID is generated?

Ans. Once the Temporary User ID is created, the Temporary User ID and password to log in to the GST Portal are sent to the registered email ID.

Q9. Is it possible to update profile details after logging into the GST Portal?

Ans. Yes, after logging into the GST Portal, you can edit your profile details. Simply navigate to the "EDIT PROFILE" button on the dashboard to update the trade name, details of the authorized signatory, and applicant's address. Once the profile is updated, you will receive a notification on your registered email ID.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

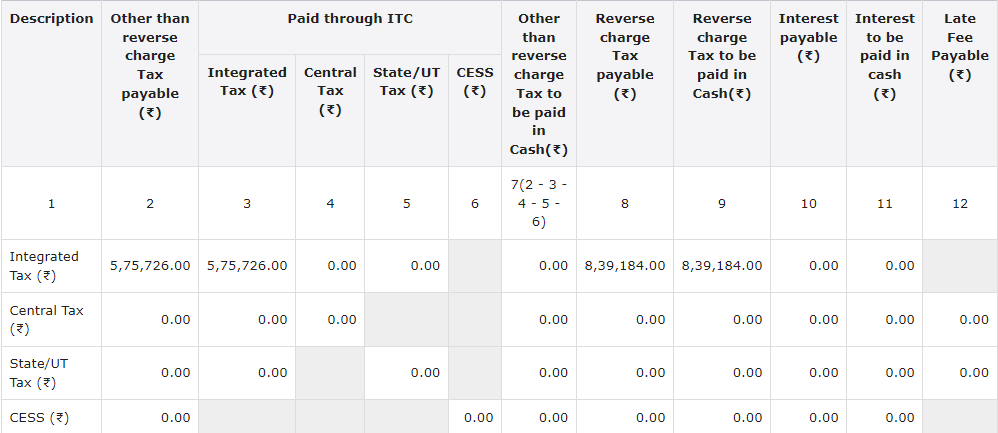

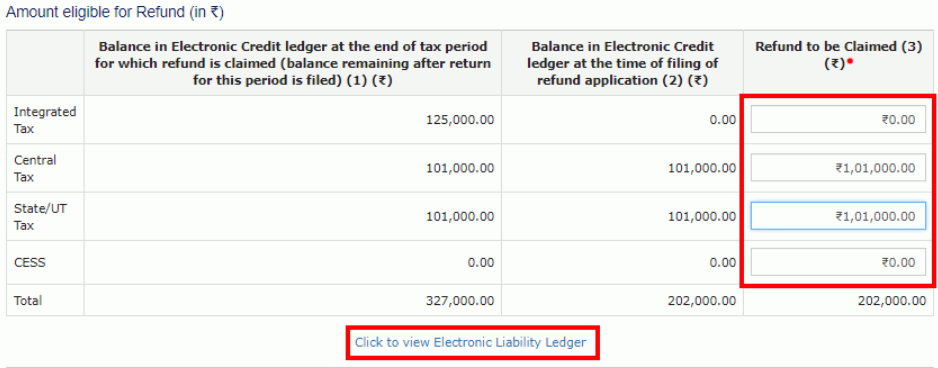

In this article, we will discuss how to file a refund application under GST. A Person registered under the GST Act pays tax and Interest after payment of tax and interest. If any excess cash balance is available in the electronic cash ledger or in the case of an Inverted duty structure or the accumulated Input Tax Credit (ITC) which couldn't be utilised for tax payments due to zero-rated supply.

Such person can file a refund application in RFD-01 form electronically on the GST common portal. Application may be filed before the expiry of two years from the relevant date.

Relevant Date Means-

| Reason for claiming GST Refund | Relevant Date |

| Goods are exported by sea or air | Date on which the ship or the aircraft leaves India |

| Goods are exported by land | Date on which such goods pass the frontier |

| Supply of goods regarded as deemed exports | Date on which the return relating to such deemed exports is furnished |

| Zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit | Due date for furnishing of return under section 39 in respect of such supplies |

| Services exported out of India | Receipt of payment in convertible foreign exchange (or in Indian rupees wherever permitted by RBI) |

| Services exported out of India (in case of advance received) | Date of issue of invoice |

| Tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court | Date of communication of such judgment, decree, order or direction

|

| In the case of refund of unutilised input tax credit under clause (ii) of the first proviso to sub-section (3) | Due date for furnishing of return under section 39 for the period in which such claim for refund arises |

| Where tax is paid provisionally | Date of adjustment of tax after the final assessment |

| Person, other than the supplier | Date of receipt of goods or services or both by such person |

| In any other case | Date of payment of tax |

Step to Submit Refund Pre-application Form :-

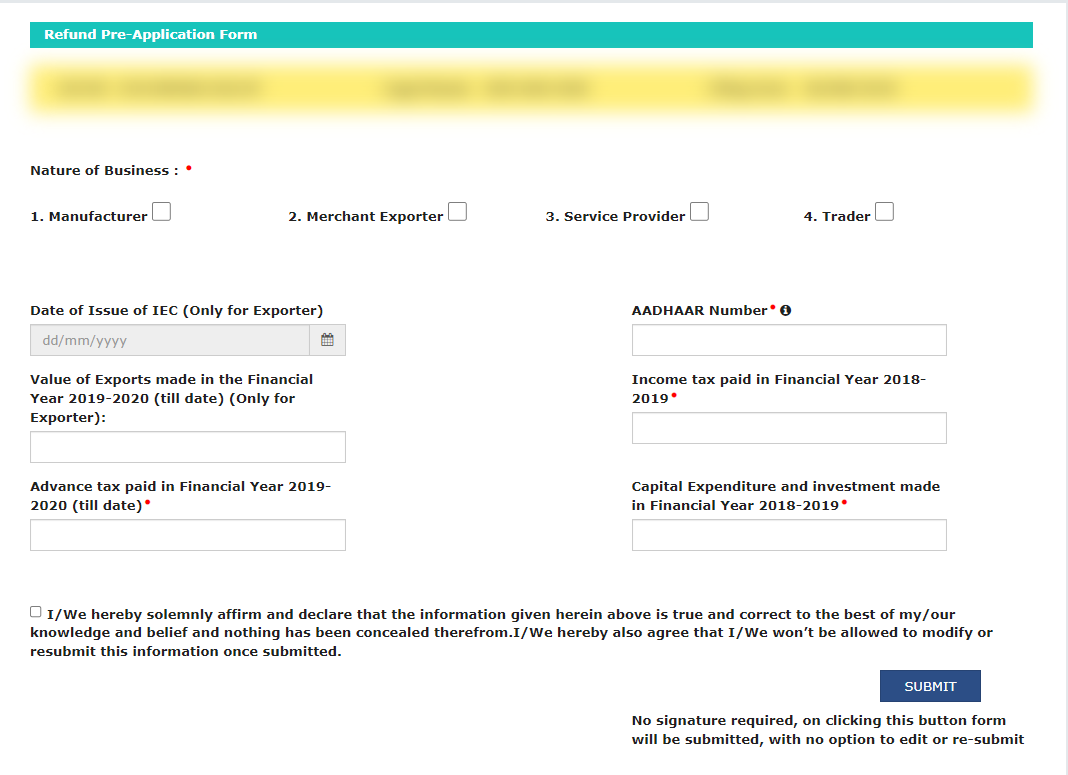

Before filing of refund application must file a Refund pre-application form. After filing of Refund pre-application form, this form cannot be edited. So, before filing it the user must be careful while entering the details.

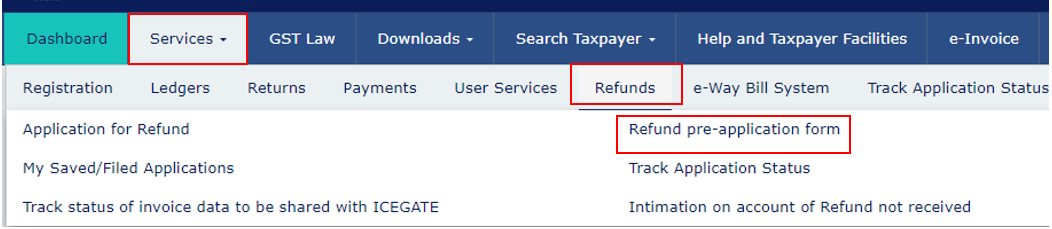

Go to GST Portal after login go to the Services >Refunds > Refund Pre-application form.

In the Refund pre-application form fill basic information of business like

Nature of business

Date of issue of IEC (only for exporter)

Aadhaar Number.

Value of exports made in the FY 2019-2020 (only for exporters)

Income tax paid in FY 2018-2019

Advance tax paid in FY 2019-2020

Capital expenditure and investment made in FY 2018-2019

Fill all the relevant details after filing it click on the check box and submit it.

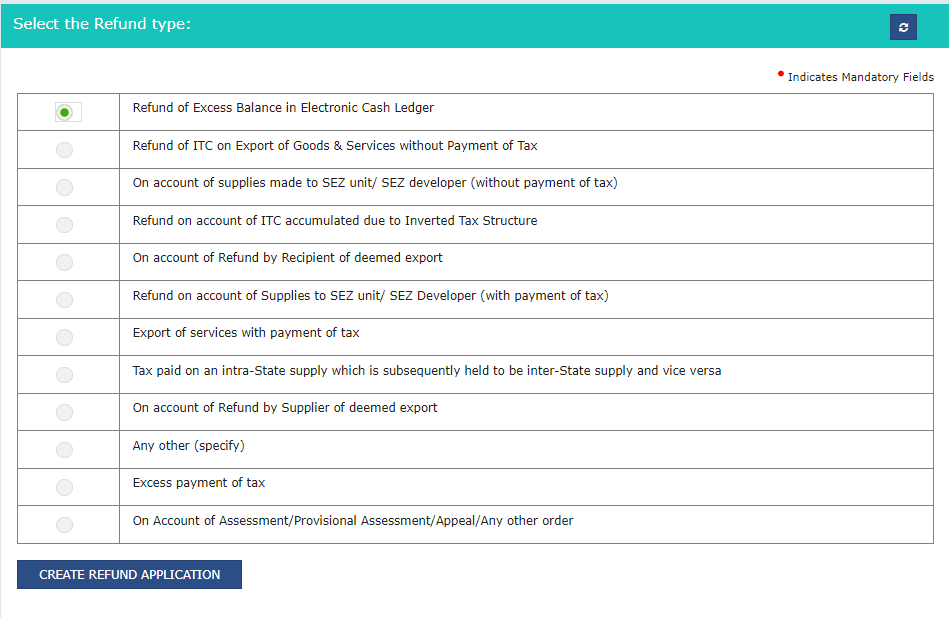

RFD-01 Refund application form file in different types of Scenario-

• Refund of excess balance in cash ledger.

• Refund of ITC on export of goods and services without payment of tax.

• On account of supply made to SEZ unit/ SEZ developer (without payment of tax).

• Refund on account of ITC accumulated due to inverted duty structure.

• On account of refund by recipient of deemed export.

• Refund on account of supplies to SEZ unit/ SEZ developer.

• Export of service without payment of tax.

• Tax paid on intra-state supply which is subsequently held as interstate supply vice–versa.

• On account of refund by supplier of deemed export.

• Any other (specify)

• Excess payment of tax

• On account of Assessment/ Provisional assessment/ Appeal/ Any other order.

Following Steps to be followed for Filing of Refund Application (RFD-01) Form.

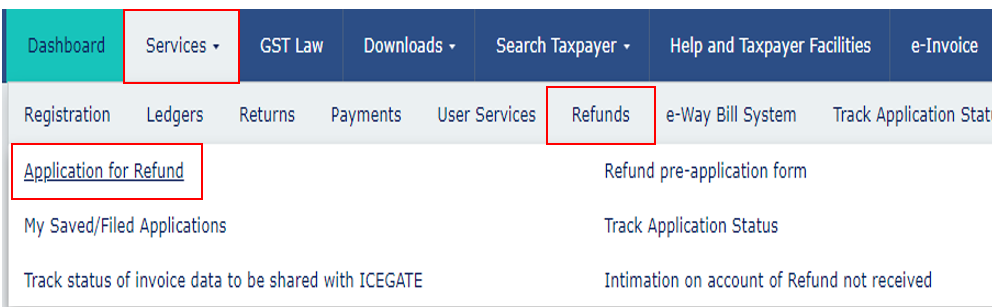

Go to Services > Refund > Application for Refund

After clicking on 'Application for Refund,' a new window opens where we have to select the refund type.

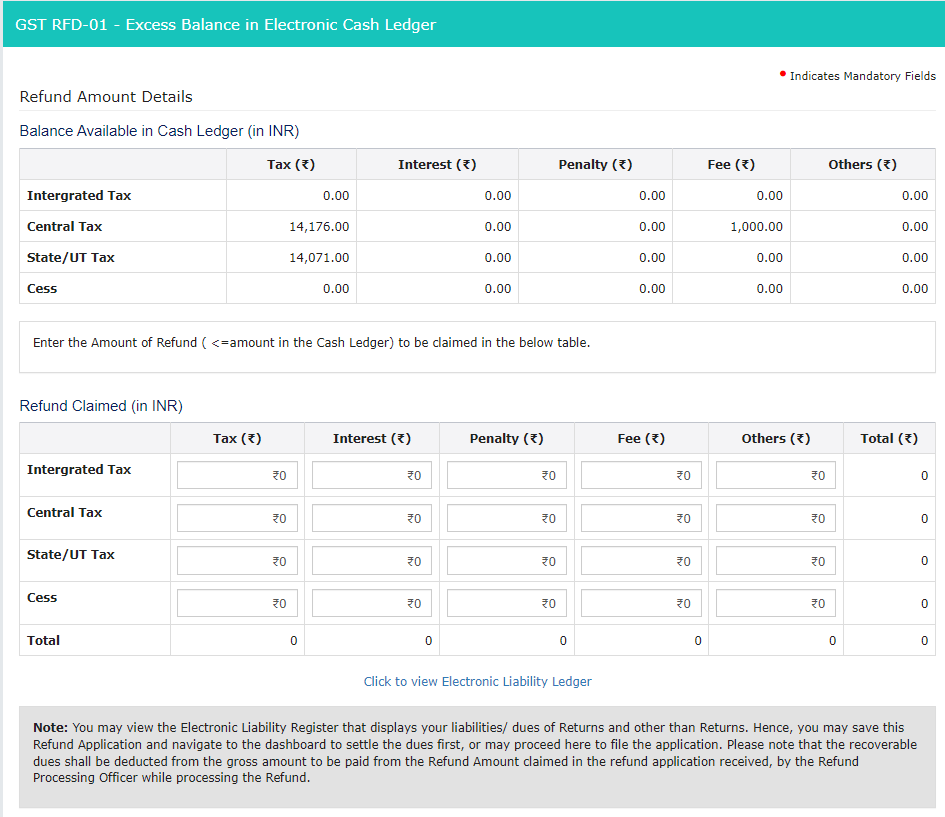

Case 1 - Refund of Excess Balance in Cash ledger.

Click on Refund of excess balance in cash ledger after click on Click to Create Refund Application.

Enter the amount of Cash to be claimed as a refund.

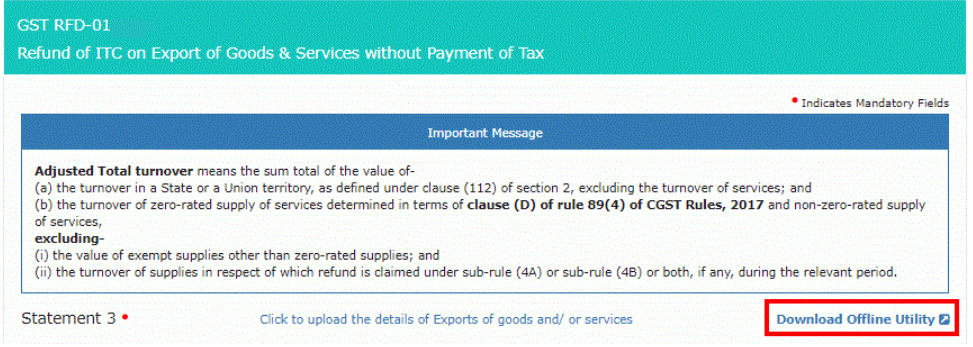

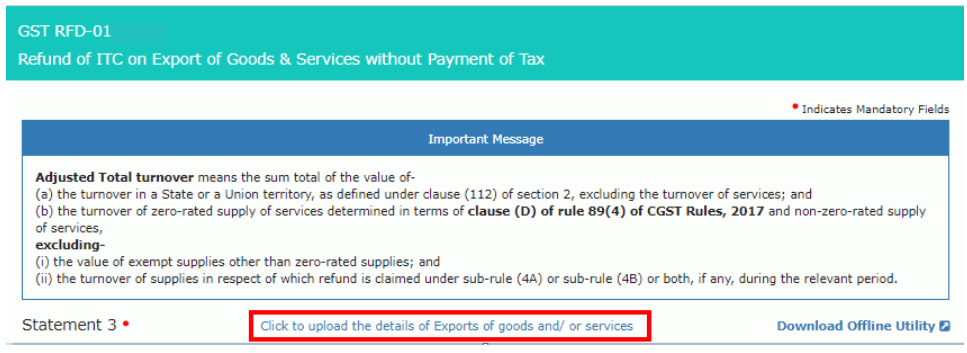

Case 2 - Refund of ITC on Exports of Goods and Services without Payment of tax.

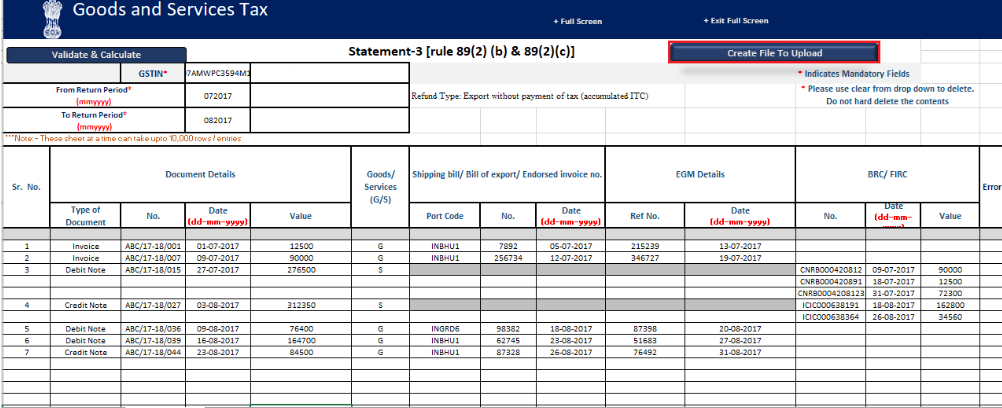

Step -1 Download “Statement- 3” and enter the details of the export invoice document on export invoice which refund is claimed.

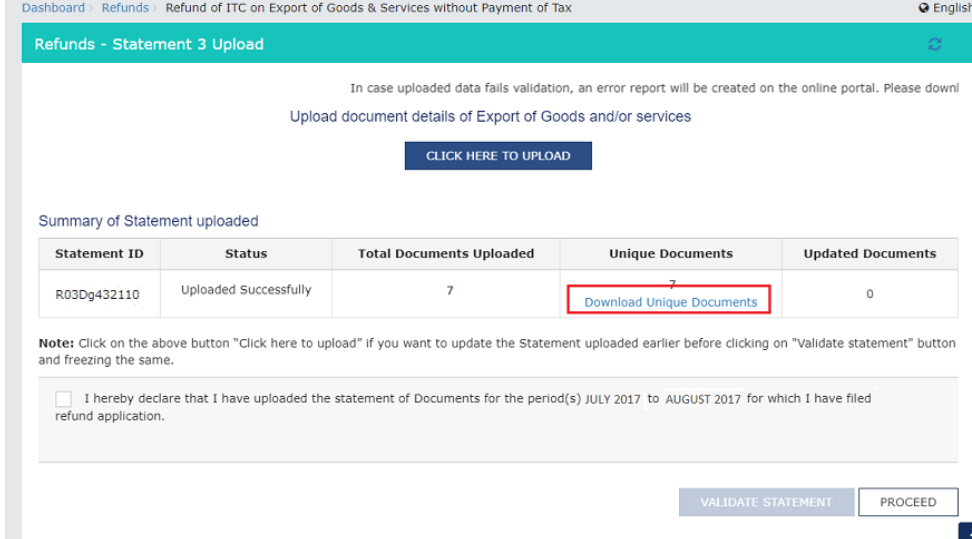

In Step 2- Generate a JSON file and upload it to the GST portal. Validate for any errors.

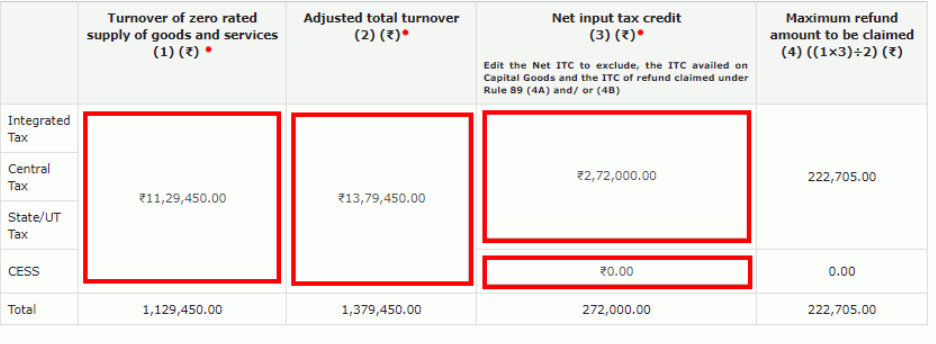

In Step-3 - In the column, ‘Computation of Refund to be claimed Statement-3A [rule 89(4)]’, enter aggregate turnover, adjusted total turnover and net input tax credit.

Step-4 Validations take place to compute the maximum amount of refund that the taxpayer is eligible for

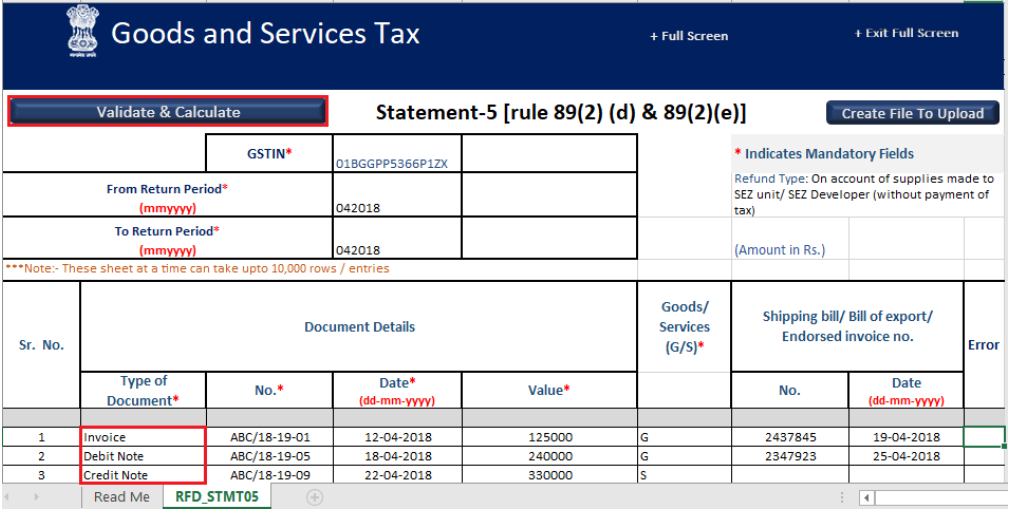

Case 3 – On Account of supplies made to SEZ unit/SEZ developer (without payment of tax)

Before filing of this form GSTR-1 and GSTR-3B must be filed. The step reamin same in step laid down in case -2 given above. However, the statement will be Statement 5 and a CSV file can be uploaded instead of JSON.

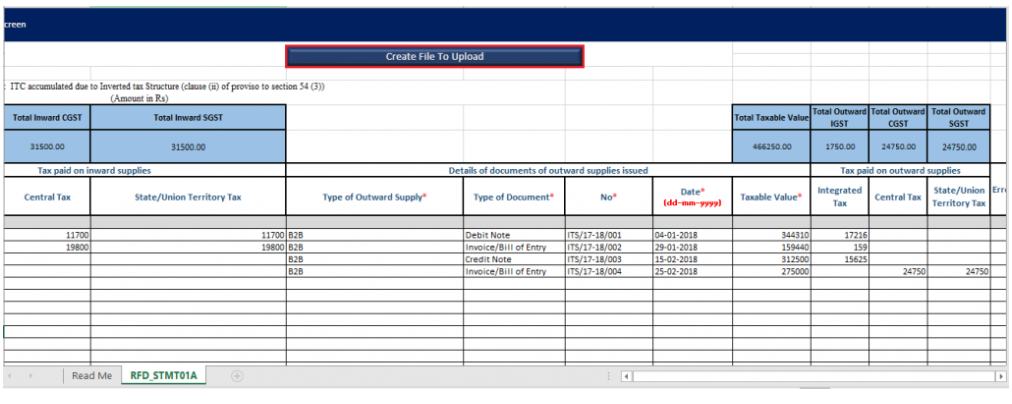

Case 4 - Refund on account of ITC accumulated due to inverted duty structure.

Inverted Duty structure refers to a situation where the tax rate and amount paid on inputs are higher than on the outputs. The steps remain the same as laid down in case 2 above. However, “Statement 1A” will be submitted” Afterward, enter details such as turnover of inverted rated supply, tax payable, adjusted total turnover, and net input tax credit.

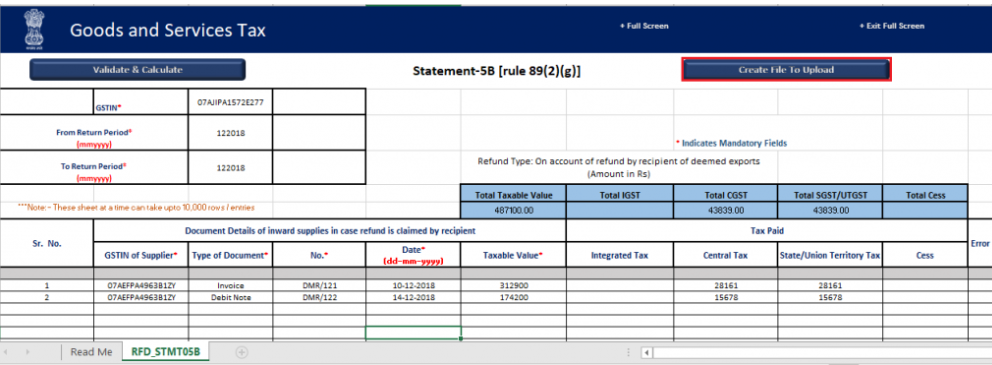

Case 5 - On account of Refund by the recipient of deemed exports

In the case of deemed export, steps remain same as laid down in case -2 given above. However, “Statement 5B” will be submitted. Thereafter, enter details such as the net input tax credit of deemed exports and the refund to be claimed.

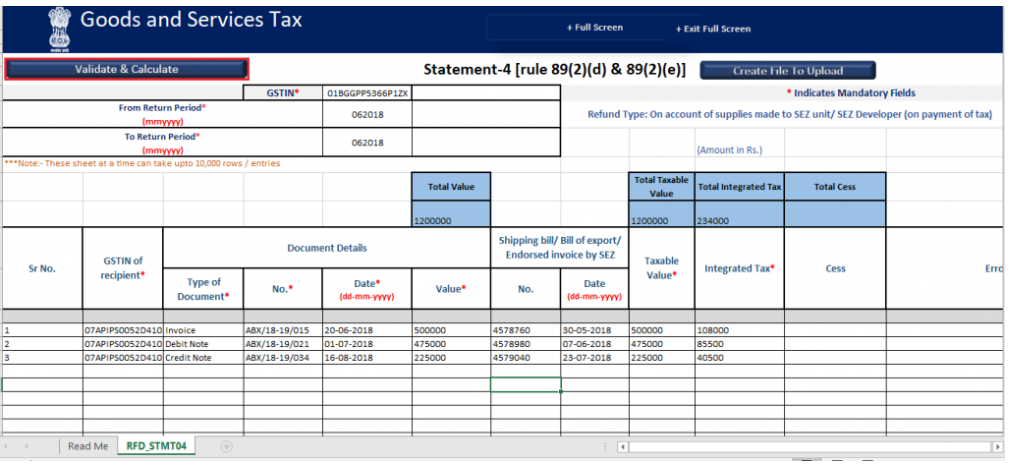

Case 6 – Refund on supplies made to SEZ unit/SEZ developer (with payment of tax)

Steps remain the same as laid down in case -2 given above. However, the statement will be “Statement-4”. The refund amount will auto-populated based on the statement uploaded.

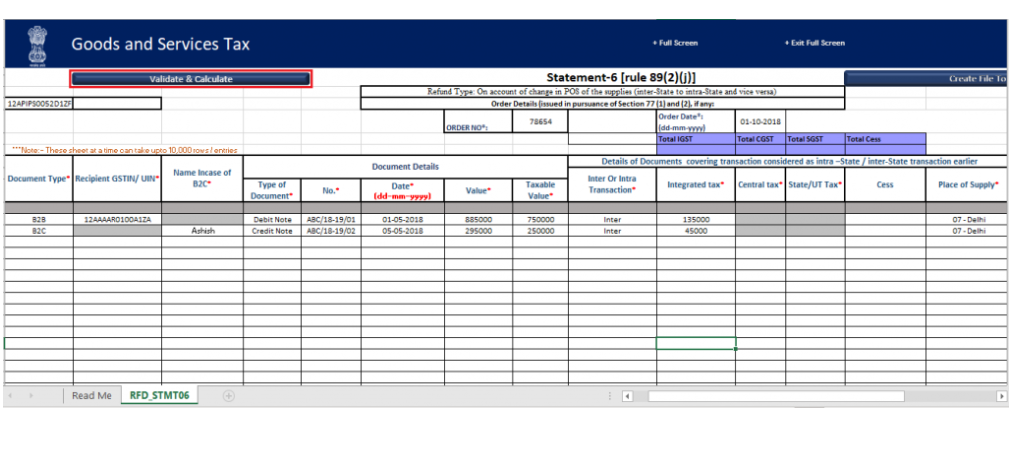

Case 7 - Tax paid on an intrastate supply later held as interstate supply and vice versa

Steps remain the same as the ones laid down in case-2 given above. However, the statement will be “Statement-6”. The refund amount will get auto-populated based on the statement uploaded.

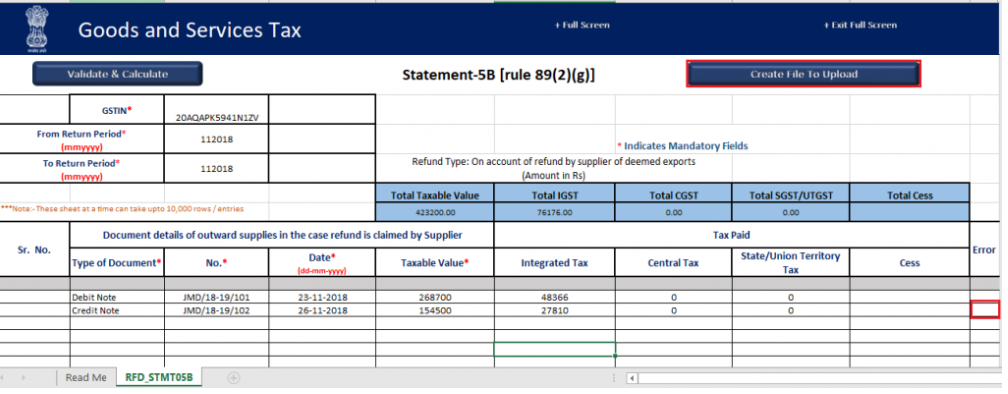

Case 8 - On Account of Refund by Supplier of Deemed Export –

The steps remain the same as the laid down in case-2 given above. However, the statement will be “Statement 5B”. The refund amount will get auto-populated based on the statement uploaded.

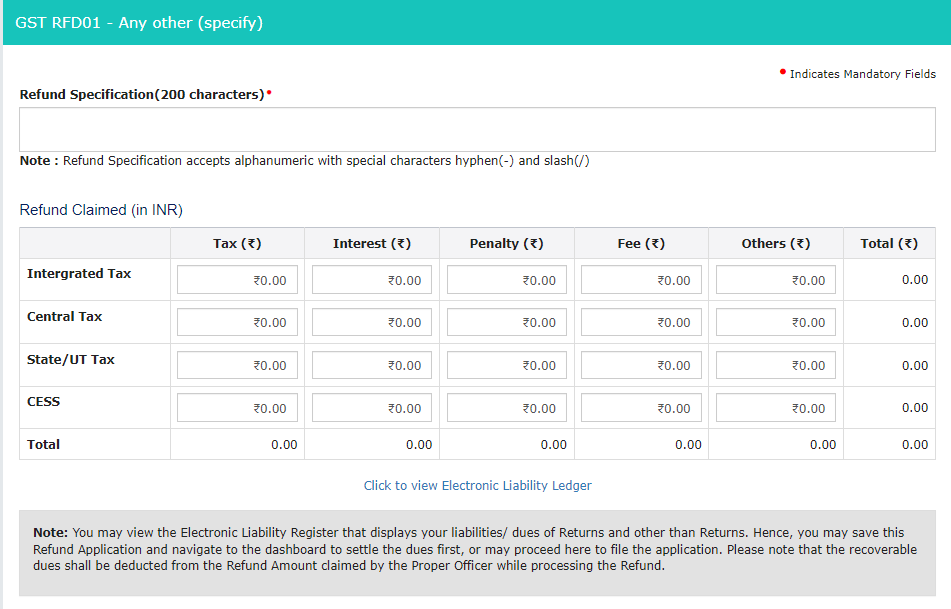

Case 9 - Any Other (specify) –

Mention the reason for the refund specifically in 200 characters along with the amount in the refund specification box.

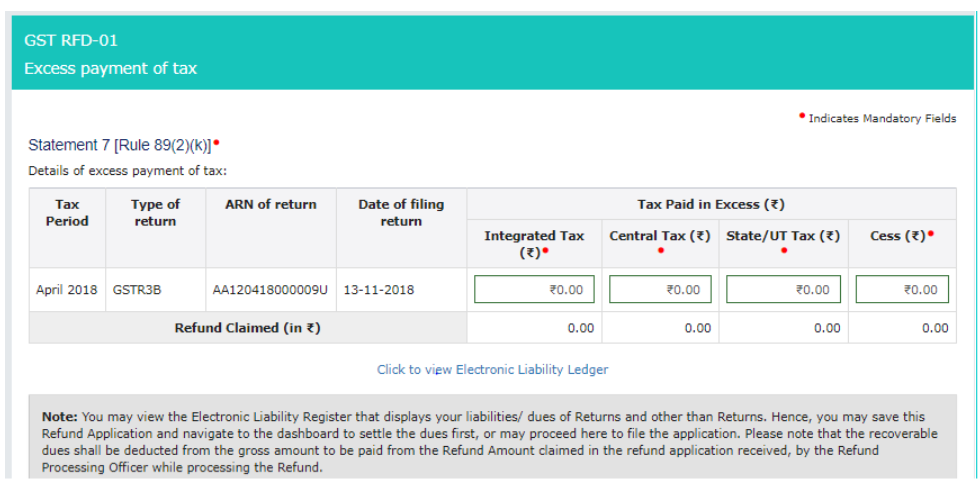

Case 10 - Excess Payment of Tax –

Enter details of the GSTR-3B in which such tax payment was done in cash. Fill all relevant details like tax period, Type of return, ARN no. date of filing of return, and tax details.

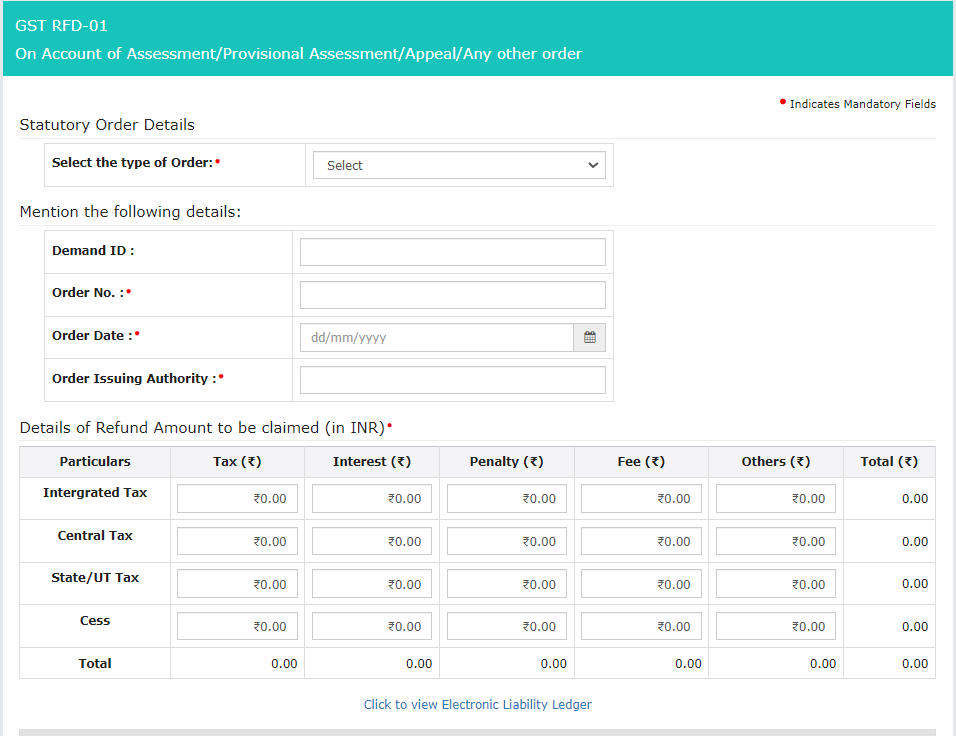

Case 11 – On account of Assessment/ Provisional assessment/ Appeal/ Any other order.

In this table select the type of order. Order No. Order Date. Order issuing authority and details of the refund amount to be claimed.

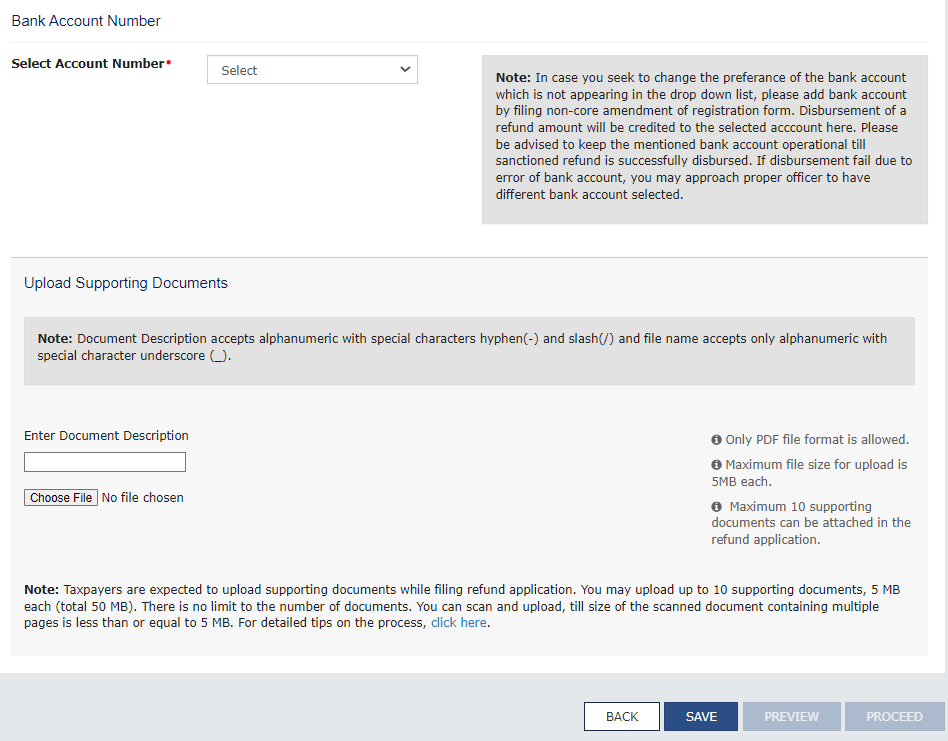

After filing relevant details select the Bank account number and upload supporting documents. Maximum 10 supporting document can be uploaded in the refund application.

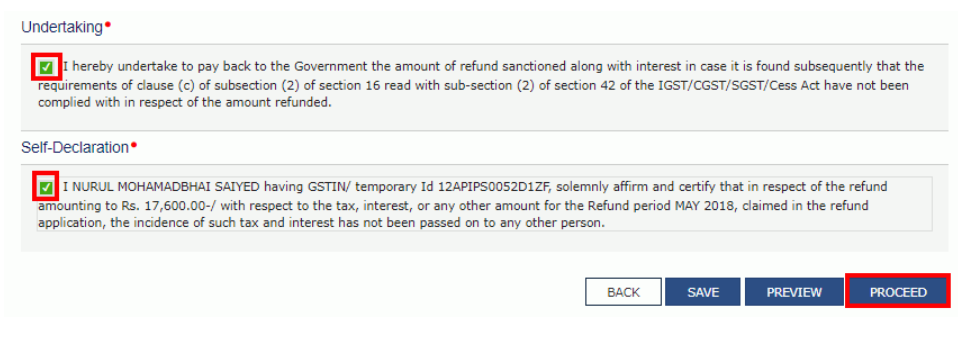

After that click on the undertaking check box and the self-declaration check box & click on proceed. Application can be verify through DSC or EVC.

After filing of refund application taxpayer can track the refund application status under the refund tab on GST portal.

FAQs related to refund under GST

Q.1 Which form is used for file refund application?

Ans. RFD-01 form file for claim refund amount.

Q.2 What is the time limit to claim refund amount?

Ans. Refund application can be filed for 2 years from the relevant date.

Q.3 If wrongly paid excess GST(CGST/SGST/IGST) can claim refund?

Ans. Yes. If taxpayer pay excess GST can claim refund amount filing through RFD-01 application form.

Q.4 What is time limit to claim refund Where tax is paid on provisional basis?

Ans. 2 years from Date of adjustment of tax after the final assessment.

Q.5 What is the time limit to claim refund in case of Zero-rated supply of goods or services?

Ans. 2 years from Due date for furnishing of return under section 39 in respect of such supplies.

Q.6 How to file RFD-01 Refund application?

Ans. RFD-01 refund application file electronically through GST common portal.

Q.7 Can un-utilised balance of electronic credit be allowed as refund?

Ans. In case of zero rate supplies and Inverted duty structure can claim refund of unutilised balance of electronic credit.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Introduction

2. Section 115BBJ- Charging Section

3. Calculation of Net Winnings

Introduction

Online gaming is now a popular industry in India. Online gaming offers a chance to win real money with fun. Income Tax Act, introduces taxation on winnings from online gaming through the Finance Act 2023. This provision became applicable from the 1st of April 2023.

Further, CBDT has also clarified the TDS rules by issuing issued a circular for online gaming winnings.

Section 115BBJ – Charging Section

Online games like rummy Dream 11, and others offer the winner real money. However, the earnings are taxable and this income should be disclosed under the “Income from other sources” head. The rate of tax is provided under sections 115BBJ and rate to deduct the TDS is provided under section 194BA. Winners must pay a flat tax of 30% on this income, regardless of how much they earn.

Joining and referral bonuses:

Online games that offer bonuses, referral bonuses, and other incentives to the players are not considered prize winnings and are treated as taxable deposits and are included in the net winnings of the user account.

The net winnings are calculated as the total withdrawal minus the total fresh deposits and the opening balance. The net winnings are liable to tax at the rate of 30% under section 115BBJ of the Act. The person paying the net winnings is required to deduct TDS under section 194BA of the Act at the end of the financial year or when the amount is withdrawn, whichever is earlier.

Calculation of Net Winnings:

Net winnings = Total withdrawal - Total fresh deposits + opening balance.

Calculation of Net winnings

Illustration:

| S.No. | Particular | Date | Amount |

| Opening Balance | 01.04.2023 | ₹ 10,00,000 | |

| Amount Deposited | 05.05.2023 | ₹ 15,00,000 | |

| Amount Deposited by way of bonus (not withdraw able) in user account | 12.12.2023 | ₹ 15,000 | |

| First Amount withdrawn | 01.02.2024 | ₹ 25,00,000 | |

| Amount Deposited | 10.02.2024 | ₹ 10,00,000

|

|

| Amount Deposited | 11.02.2024 | ₹ 6,00,000 | |

| Subsequent withdrawals On | 15.02.2024 | ₹ 25,00,000 | |

| 15.03.2024 | ₹ 30,00,000 | ||

| Closing Balance | 31.03.2024 | ₹ 14,00,000 |

Solution: Net Winnings for FY 2023-24

| Withdrawals | 01.02.2024 | ₹ 25,00,000 |

| 15.02.2024 | ₹ 25,00,000 | |

| 15.03.2024 | ₹ 30,00,000 | |

| Total Withdrawal (A) | ₹ 80,00,000 | |

| Deposits | 05.05.2023 | ₹ 15,00,000 |

| 12.12.2023 | ₹ 15,000 | |

| 10.02.2024 | ₹ 10,00,000

|

|

| 11.02.2024 | ₹ 6,00,000 | |

| Total Deposits (B) | ₹ 31,15,000 | |

| Net Winnings | ₹ 52,85,000 | |

Scenario 1: At the time of first withdrawal during the FY

At the time of first withdrawal

Net winnings = A-(B+C), where –

A : Amount withdrawn from the user account

B : Aggregate amount of non-taxable deposit made in the user account by the owner of such account during the FY, till the time of such withdrawal

C : Opening balance of the user account at the beginning of the FY

| Withdrawals | 01.02.2024 | ₹ 25,00,000 |

| Total Withdrawal (A) | ₹ 25,00,000 | |

| Deposits | 05.05.2023 | ₹ 15,00,000 |

| 12.12.2023 | ₹ 15,000 | |

| Total Deposits (B) | ₹ 15,15,000 | |

| Opening Balance | ₹ 10,00,000 | |

| Net Winnings | (15,000) | |

Scenario 2: At the time of subsequent withdrawal during the FY TDS at the time of subsequent withdrawal on 15.02.2024

At the time of each subsequent withdrawal

Net winnings = A-(B+C+E), where –

A : Aggregate amount withdrawn from the user account during FY till the time of subsequent withdrawal including the amount of such subsequent withdrawal

B : Aggregate amount of non-taxable deposit made in the user account by the owner of such account during the FY, till the time of such subsequent withdrawal

C : Opening balance of the user account at the beginning of the FY

E : Net winnings comprised in the earlier withdrawals, if tax has been deducted under section 194BA on such winning

| Withdrawals | 01.02.2024 | ₹ 25,00,000 |

| 15.02.2024 | ₹ 25,00,000 | |

| Total Withdrawal (A) | ₹ 50,00,000 | |

| Deposits | 05.05.2023 | ₹ 15,00,000 |

| 12.12.2023 | ₹ 15,000 | |

| 10.02.2024 | ₹ 10,00,000

|

|

| 11.02.2024 | ₹ 6,00,000 | |

| Total Deposits (B) | ₹ 31,15,000 | |

| Opening Balance (C ) | 01.04.2023 | ₹ 10,00,000 |

| Net Winnings | ₹ 8,85,000 | |

TDS at the time of subsequent withdrawal on 15.03.2024

| Withdrawals | 01.02.2024 | ₹ 25,00,000 |

| 15.02.2024 | ₹ 25,00,000 | |

| 15.03.2024 | ₹ 30,00,000 | |

| Total Withdrawal (A) | ₹ 80,00,000 | |

| Deposits | 05.05.2023 | ₹ 15,00,000 |

| 12.12.2023 | ₹ 15,000 | |

| 10.02.2024 | ₹ 10,00,000

|

|

| 11.02.2024 | ₹ 6,00,000 | |

| Total Deposits (B) | ₹ 31,15,000 | |

| Opening Balance (C ) | 01.04.2023 | ₹ 10,00,000 |

| Net Winnings(D) | ₹ 8,85,000 | |

| Amount to deduct TDS A-(B+C+D) | ₹ 30,00,000 | |

Scenario 3: At the end of FY TDS at the closing i.e., on 31.03.2024

At the end of the FY

Net winnings = (A+D)-(B+C+E), where –

A : Aggregate amount withdrawn from the user account during the FY

B : Aggregate amount of non-taxable deposit made in the user account by the owner of such account during the FY

C : Opening balance of the user account in the beginning of the FY

D : Closing balance of the user account at the end of the FY

E : Net winnings comprised in the earlier withdrawals, if tax has been deducted under section 194BA on such winning

| Withdrawals | 01.02.2024 | ₹ 25,00,000 |

| 15.02.2024 | ₹ 25,00,000 | |

| 15.03.2024 | ₹ 30,00,000 | |

| Total Withdrawal (A) | ₹ 80,00,000 | |

| Deposits | 05.05.2023 | ₹ 15,00,000 |

| 12.12.2023 | ₹ 15,000 | |

| 10.02.2024 | ₹ 10,00,000

|

|

| 11.02.2024 | ₹ 6,00,000 | |

| Total Deposits (B) | ₹ 31,15,000 | |

| Opening Balance (C ) | 01.04.2023 | ₹ 10,00,000 |

| Closing Balance | ₹ 14,00,000 | |

| Winnings | ₹ 8,85,000

₹ 30,00,000 |

|

| A+D- (B+C+E) | ₹ 14,00,000 | |

Note: We would suggest you to read circular no. 5 of 2023, dated 22nd May 2023 and Rule 133 of Income Tax Rules 1962.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Introduction:

The majority of credit card users are familiar with the high annual interest rates associated with revolving credit, such as those found in credit cards, which can reach as high as 42%. Many individuals who are unable to clear their credit card dues within one billing cycle prefer to convert their purchases into EMIs. This allows them to pay a much lower interest rate compared to the revolving credit interest on their spending. But do you know that the total cost of such an option could be 18% higher than the interest rate you expect to pay?

Scope of taxation on interest on credit cards:

Various services and fees charged by financial institutions are subject to the GST, which is passed on to the consumer. While some services or charges may be exempt from GST, many are not.

As per Sl. No. 28 of Notification No. 9/2017- Integrated Tax (Rate) dated 28th June 2017, against heading 9971, GST exemption is applicable to services involving the extension of deposits, loans, or advances, provided that the consideration is in the form of interest or discount, excluding interest associated with credit card services.

In other words, interest on non-credit-card loans is exempt from GST whereas interest charged on credit card loans will not be exempt from GST.

The exemption notification specifically applies to transactions involving the provision of loans, deposits or advances where the consideration is in the form of interest or discount. Therefore, any fees or charges imposed by banks, such as processing fees, late payment charges and statement issuance fees will still be subject to GST.

GST rate on credit card transactions with SAC code

GST on credit cards extends to several facts of credit card services, encompassing interest on credit card EMIs, processing fees, late payment charges, annual fees, over-limit charges and any additional fees or charges levied by your credit card provider.

Below is a table showing the GST charges for credit cards and their respective SAC code

| Description of Services

|

SAC Code | Rate (%) |

| Financial and Related Services | 9971 | 18% |

Availability of ITC claims

The provisions of section 17(5) of the CGST Act do not block the availability of ITC on bank charges. This means that you can claim ITC for the GST paid on bank charges without any hindrance.

You need to provide your GST registration number to your credit card issuer so that ITC can be accurately reported in your GSTR-2B.

Insight of High Court Judgment

This point was clarified when the Calcutta High Court in the case of Ramesh Kumar Patodia Vs Citi Bank NA and Ors. took a view that the interest component of EMI of loan advanced by the Bank through a credit card is not covered by the exemption notification and so will attract GST.

The additional cost you incure due to GST depends on the offered interest rate. For example, if you're availing an EMI option at 20% p.a., your additional cost in terms of interest rate will be 18% of 20%, which is 3.6%. Therefore, the effective interest cost, including GST, will be 23.6%.

In this case, the additional charge does not go to the lender but to the government as it is a tax.

Practical Aspect of How you pay 18% more when you convert your credit card spend into EMI

| Particulars | What Borrower Pays (Rs) | What Lender Gets (Rs) |

| Product Price | 100,000 | 100,000 |

| Tenure | 12 months | 12 months |

| Offered Interest Rate | 15% | 15% |

| Total Principal Repayment | 100,000 | 100,000 |

| Total Interest Payment | 8,310 | 8,310 |

| Applicable GST Rate | 18% | 0 |

| Total Tax on Interest | 1,496 | 0 |

| Total Cost Of Finance | 9,806* | 8,310 |

| Higher Cost (%) | 18% | NA |

| Internal Rate of Return (IRR) | 17.70% | 15% |

*Interest + Tax

In the above example with the EMI option at 15% p.a., the additional cost in terms of interest rate will be 18% of 15%, which is 2.7%. Therefore, the effective interest cost, including GST, will be 17.7%. Therefore the additional charges bear by the borrower does not go to the lender but to the government as it is a tax.

FAQ’s

Q1. What is IGST in credit card EMI?

Ans. IGST stands for Integrated Goods and Services Tax. It is applicable when a credit card transaction involves the movement of goods or services from one state to another. In the context of credit card EMIs, IGST is charged on the interest component of the EMI.

Q2. What is GST on credit card EMIs?

Ans. GST is applicable on the interest component of the credit card EMI. The current GST rate on financial services is 18%.

Q3. Is GST charged on loan processing fees?

Ans. Yes, GST is charged on loan processing fees. The current GST rate on loan processing fees is 18%.

Q4. How much GST is charged on credit card EMIs?

Ans. GST is charged at the rate of 18% on the interest component of credit card EMIs.

Q5. Can I pay all EMIs of credit card at once?

Ans. Yes, you can choose to pay off all your credit card EMIs at once. However, it's important to note that prepaying your EMIs may attract prepayment charges.

Q6. Can GST be paid by credit card?

Ans. Yes, GST payments can be made using a credit card. You can pay GST through the GST portal using your credit card.

Q7. How is the interest on credit card EMIs calculated?

Ans. Interest on credit card EMIs is calculated on the reducing balance method. The interest is charged on the outstanding balance after deducting the principal amount already paid.

Q8. How to calculate credit card EMI with GST?

Ans. You can use a credit card EMI calculator to determine the monthly EMI amount, including GST. The calculator takes into account the loan amount, tenure, interest rate and GST rate to provide you with the EMI amount.

Q9. What are the GST charges on credit card transactions?

Ans. GST is not directly charged on credit card transactions. However, GST is applicable on interest charges, processing fees, and other charges associated with credit card transactions.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covered:

1. Introduction:

2. Applicability of provision of sec. 44AB

3. Non-Applicability of Tax Audit

4. Tax Audit Report

5. Due date for filing Tax Audit report

6. Penalty for non-compliance

7. Conclusion

Introduction:

Persons are required to get an audit of the books of accounts as per the provisions of the Income tax act. The section provides the threshold for tax audit requirement is provided under section 44AB of the Income Tax Act. In this article, we will discuss the applicability of the section, audit report, and penalty.

Applicability of provision of sec. 44AB

The requirement of a tax audit can be bifurcated in the following manner:

1. For Normal Businesses:

Taxpayers engaged in any business activity are required to get tax audit of books of accounts of business if the turnover or sales exceed ₹ 1 crore in a financial year.

If a majority of transactions of the business are made digitally i.e. cash payments/ receipts are less than 5% of total payments/ receipts then the turnover limit for tax audit applicability increases from ₹ 1 crore to 10 crores.

2. For presumptive Businesses

If a presumptive taxation scheme is opted by the taxpayer, and as per the provision of presumptive scheme, the minimum profit of 6% or 8% of turnover is not reported, and total income is more than the basic exemption limit then a tax audit will be required.

If a business exits the presumptive taxation scheme in any previous years, it can’t opt in for the presumptive scheme for the next 5 financial years. In this case, books of accounts are need to be audited.

3. For Professions under the normal scheme of taxation

In the case of profession tax audit is mandatory when gross receipts exceed ₹ 50 lakhs in a financial year.

4. For Professions under the presumptive scheme of taxation

If a taxpayer opts for a presumptive taxation scheme, the minimum profit of 50% of turnover is not reported, and the total income is more than the basic exemption limit then a tax audit will be required.

5. For specified businesses

When a taxpayer is engaged in goods carriage business he is eligible for Presumptive Taxation under Sec 44AE, 44BB, or 44BBB but if he reports profit lower than the prescribed rate under the relevant section, then a tax audit will be required.

6. Tax Audit in case of Equity or derivative Trading

Income from trading in Equity Intraday, & Derivative Trading i.e. future and option trading is considered Business Income. So in this case also the tax Audit as per the provisions of the Income Tax Act is required.

If the turnover exceeds the threshold limit for tax audit i.e. ₹ 10 Crore since all transactions are digital.

Non-Applicability of Tax Audit

Taxpayers reporting profits of business/ profession as per the presumptive taxation scheme u/s 44AD/ 44ADA respectively then tax audit is not applicable.

In case where the business turnover is between 2 crores to 10 crores, then irrespective of profit/ loss, a tax audit is not applicable. If the condition of less than 5% of cash transaction is satisfied.

Tax Audit Report

The Tax auditor shall furnish the audit report in a prescribed form which could be either Form 3CA-CD or Form 3CB-CD where:

Form No. 3CA-CD is required to be furnished when a person carrying on business or profession has already gotten his accounts audited under any other law like Companies Act, Society Act.

Form No. 3CB-CD is required to be furnished when a person carrying on business or profession is required to get his accounts audited only under the income tax act.

Due date for filing Tax Audit report

After the tax audit is performed, the Chartered Accountant has to report all the findings to the department by filing Form 3CA/CB-3CD as the case may be. The audit report must be signed digitally by the chartered accountant.

The due date to file the audit report is 30th September of the relevant assessment year. While due date to file ITR where tax audit is done is 31st October of the relevant assessment year.

Penalty for non-compliance

As per the provision of the income tax act a taxpayer is required to get a tax audit of the books of accounts but fails to do so then the penalty will be lower of following:

• 0.5% of the of the total sales, turnover, or gross receipts,

• OR

• INR 1,50,000/-

No penalty will be imposed under section 271B If there is a valid reason for the failure,.

Conclusion :

It can be concluded that, whether the audit required or not is not only depend on the turnover limit but also on the other relevant factors like taxpayer has opted for presumptive or not, if opted profit is declared as per provisions or not. To comply with the law and prevent from the penalty provisions, one should check all the criteria and then decide the applicability of the audit.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application

Failure to pay tax by the GST laws may lead to the initiation of provisions for demand and recovery under GST.GST is payable on a self-assessment basis, meaning the taxpayer must determine their tax liability. If the taxpayer's assessment is incorrect, such as underpaying taxes, not paying any tax, improperly using input tax credit, or ITC has been mistakenly refunded, then in such situations, demands will be raised by GST authorities.

Types of Demand under GST

The GST officials can issue GST demand notices for short payment or non-payment of GST in the following two different situations:

1. When there is no reason for fraud or wilful misstatement or suppression of facts.

2. When there is a reason for fraud or wilful misstatement or suppression of facts.

GST Demand when there is No Fraud or Misrepresentation

A demand notice under Section 73 of the GST Act is issued in cases where there is no indication of fraud, wilful misstatement or suppression of facts, i.e., without any intention to evade tax:

• Tax is unpaid/short paid or,

• Refund is wrongly made or,

• The input tax credit has been wrongly availed/utilised

The GST officer, will issue a notice to the taxpayer explaining the reasons. They will be required to pay the due amount, interest, and penalties.

Time Limit for Issue of Notice and Adjudication under Section 73

The proper officer must issue the show-cause notice at least three months before the prescribed time limit. Once the notice above has been issued within the stipulated time frame, the proper officer can provide a statement detailing any unpaid tax, incorrect refunds, etc., for periods not covered in the notice. It is not necessary to issue a separate notice for each tax period.

The proper officer will have to issue a demand order within 3 years from the due date of filing the annual return for the year in respect of which the main offense is committed and in case of erroneous refund the demand order can be issued within 3 years from the date of erroneous refund.

Voluntary Payment

An assessee has the option to voluntarily pay taxes along with interest before the issuance of a notice or statement and inform the departmental officer in writing. If the departmental officer is satisfied, they will refrain from issuing a notice regarding the same.

Penalty

As per Section-73(8), if the taxpayer settles all dues within 30 days from the date of the notice, the penalty will not be applicable. All proceedings related to the notice shall be deemed to be closed.

If any amount of self-assessed tax or any amount collected as tax has not been paid within a thirty days from the due date of payment, a penalty equivalent to ten percent of the tax amount or ten thousand rupees, whichever is higher, is applicable to the person liable.

GST Demand when there is a Fraud

A demand notice under Section 74 of the GST Act is issued in cases where there is indication of fraud, wilful misstatement or suppression of facts, i.e., with an intention to evade tax:

• Unpaid/short paid tax or,

• Wrong refunds or,

• Wrongly availed/utilised input tax credit

The GST officer, will issue a show cause notice to the taxpayer explaining the reasons. The taxpayer will be required to pay the due amount along with interest and penalties.

Time Limit for Issue of Notice and Adjudication under Section 74

The officer must issue a notice for the recovery of tax at least six months before the time limit. Once the aforementioned notice has been issued within the stipulated time frame, the proper officer can provide a statement detailing any unpaid tax, incorrect refunds, etc., for periods not covered in the notice. It is not necessary to issue a separate notice for each tax period.

If there is any non-payment, short payment or if input tax credit has been wrongly availed or utilized due to fraud, willful misstatement or suppression of facts, the case should be adjudicated within five years from the date of filing the annual return for the relevant financial year & in case of erroneous refund, the demand order can be issued within 5 years from the date of erroneous refund.

Voluntary Payment

An assessee can voluntarily pay taxes along with interest and a 15% penalty before the issuance of a notice or statement and must inform the departmental officer about the same in writing. If the departmental officer is satisfied, they will refrain from issuing a notice regarding the same.

Penalty under Section 74 of GST Act

| Payment of Penalty | Amount of Penalty |

| Dues paid before issuance of show cause notice | 15% of tax amount due |

| Dues paid within 30 days of issuance of show cause notice | 25% of tax amount due |

| Dues paid after 30 days of issuance of

Order |

50% of tax amount due |

| Any other case | 100% of tax amount due |

Section 75 of GST Act

Section 75 of the CGST Act deals with general provisions related to the determination of tax and demand under GST. The following are some of the important provisions under Section 75 of the GST Act.

Stay of Notice

If the service of notice or issuance of an order is stayed by an order of the Court or Appellate Tribunal, the period of such stay will be excluded while computing the three-year or five-year time limit for the issuance of notice or adjudication.

No Fraud or Wilful Misrepresentation

If any Appellate Authority, Appellate Tribunal or Court concludes that the notice issued under Section 74 is not sustainable because the charges of fraud, willful misstatement or suppression of facts to evade tax have not been established, the officer shall determine the tax payable as if the notice were issued under Section 73.

Time Limit for Passing Order

Where any order is required to be issued following the direction of the Appellate Authority, Appellate Tribunal or a court, such order should be issued within two years from the date of communication of the said direction.

Opportunity for Being Heard

An opportunity for a hearing should be granted in cases where a written request is received from the person liable for tax or penalty, or where any adverse decision is contemplated against such person.

Maximum Adjournments Allowed

If the person liable for tax shows sufficient cause, the proper officer shall grant them time and adjourn the hearing, stating the reasons in writing. However, such adjournment shall not be granted to a person more than three times during the proceedings.

Limitations

The amount of tax, interest, and penalty demanded in the order shall not exceed the amount specified in the notice, and no demand shall be confirmed on grounds other than those specified in the notice.

If a penalty is imposed under section 73 or section 74, no further penalty for the same act or omission shall be imposed on the same person under any other provision of this Act.

If the order is not issued within three years as stipulated in subsection (10) of section 73 or within five years as stipulated in subsection (10) of section 74, the adjudication proceedings shall be deemed concluded.

Applicability of Interest

Interest on the tax that is short-paid or not paid shall be payable, whether or not specified in the order determining the tax liability.

FAQ’s

Q1. What is Section 73 of the CGST Act?

Ans. A demand notice under Section 73 of the GST Act is issued in cases where there is no indication of fraud, wilful misstatement or suppression of facts, i.e., without any intention to evade tax in a way of tax is unpaid/short paid or refund is wrongly made or the input tax credit has been wrongly availed/utilised.

Q2. What is Section 74 of the CGST Act?

Ans. A demand notice under Section 74 of the GST Act is issued in cases where there is indication of fraud, wilful misstatement or suppression of facts, i.e., with an intention to evade tax in a way of Unpaid/short paid tax or Wrong refunds or Wrongly availed/utilised input tax credit.

Q3. What is the penalty under Section 73 of the CGST Act?

Ans.

| Payment of Penalty | Amount of Penalty |

| Dues paid prior to the issuance of show cause notice |

No penalty |

| Dues paid within 30 days of issuance of show cause notice | No penalty |

| Dues paid after 30 days of issuance of Order | 10% of tax dues or INR 10,000, Whichever is higher |

| Any other case | 10% of tax dues or INR 10,000, Whichever is higher |

Q4. What is the penalty under Section 74 of the CGST Act?

Ans.

| Payment of Penalty

|

Amount of Penalty |

| Dues paid before issuance of show cause notice

|

15% of tax amount due |

| Dues paid within 30 days of issuance of show cause notice

|

25% of tax amount due |

| Dues paid after 30 days of issuance of

Order

|

50% of tax amount due |

| Any other case

|

100% of tax amount due |

Q5. What does Section 74(5) of the CGST Act mean?

Ans. Section 74(5) of the CGST Act allows taxable can voluntarily pay taxes along with interest and a 15% penalty before the issuance of a notice or statement and also inform the departmental officer about the same in writing.

Q6. What does Section 73(5) of the CGST Act mean?

Ans. Taxpayers have the option to voluntarily pay taxes along with interest before receiving any notice or statement from the departmental officer. They also inform the officer in writing about their voluntary payment.

Q7. What is a GST Demand Notice?

Ans. A GST Demand Notice is a formal communication issued by the tax authorities to demand payment of outstanding tax along with any applicable interest and penalties. It is issued after the taxpayer has been served with a Show Cause Notice (SCN) and has been given an opportunity to respond.

Q8. What does Section 73(9) of the CGST Act entail?

Ans. Section 73(9) of the CGST Act stipulates that after considering any representation made by the person liable to pay the tax, the proper officer shall determine the amount of tax, interest and penalty. The penalty shall be an amount equal to ten percent of the tax due or ten thousand rupees, whichever is higher, and shall issue an order accordingly.

Q9. What is Section 73(10) of the CGST Act?

Ans. Section 73(10) of the CGST Act states that the proper officer must issue a demand order within three years from the due date of filing the annual return for the relevant year or within three years from the date of erroneous refund.

Q10. What does Section 73(8) of the CGST Act mean?

Ans. As per Section-73(8), if the taxpayer settles all dues within 30 days from the date of the notice, the penalty will not be applicable. All proceedings related to the notice shall be deemed to be closed.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Topic Covers:

1. Introduction

2. Qualifying Criteria

3. Deduction Amount

4. Additional Information

5. Changes in ITR forms

Introduction:

This deduction under Section 80DD of the income tax act is available to both resident individuals (regardless of citizenship) and resident Hindu Undivided Families (HUFs). This deduction is allowed to assessee for expenditures made for differently abled dependent.

Qualifying Criteria:

1. Dependent Disabled Relative:

The taxpayer must have a dependent disabled relative, which includes:

For Individuals: Spouse, children, parents, brothers, and sisters of the individual.

For HUFs: Any member of the Hindu Undivided Family.

Definition of Dependent Relative:

“A relative is considered dependent if they rely mainly or wholly on the individual or HUF for financial support and maintenance.”

2. Disability Definition:

Disability is defined as per Section 2(i) of the Persons with Disabilities (Equal Opportunities, Protection of Rights, and Full Participation) Act, 1995. This includes conditions such as autism, cerebral palsy, and multiple disabilities, as specified in sec. 2(a), 2(c), and 2(h) of the National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities Act, 1999.

The person with a disability must have a certificate from a medical authority certifying 40% or more of one or more disabilities, including blindness, low vision, leprosy-cured, hearing impairment, locomotors disability, mental retardation, or mental illness.

3. No Benefit under Section 80U:

To claim deduction under section 80DD the dependent individual with a disability must not have claimed deductions under Section 80U.

4. Expenses on Disabled Relative:

The taxpayer should have:

• Incurred expenses for the medical treatment (including nursing), training, and rehabilitation of the dependent person with a disability, or

• Paid or deposited an amount in an approved scheme designed for the maintenance of the disabled dependent by entities like the Life Insurance Corporation or other insurers or the Administrator or Unit Trust

of India.

• The scheme should ensure payment of an annuity or a lump-sum amount for the benefit of the dependent person with a disability in the case of the taxpayer's death or upon the taxpayer attaining the age of 60

years or more, with discontinuation of payments or deposits.

5. Medical Certificate:

The taxpayer must provide a copy of the certificate issued by a medical authority when submitting their income tax return. The medical authority is defined as per Section 2(p) of the Persons with Disabilities Act, 1995, or as specified by the Central Government for certifying various disabilities.

Deduction Amount:

A deduction is restricted upto the prescribed amount as given below:

• If the relative is suffering from severe disability: ₹1,25,000.

• If the relative is suffering from a disability but not severe disability: ₹75,000.

Definition of Severe Disability:

A person with 80% or more of one or more disabilities, as specified in sec. 56(4) of the Persons with Disabilities Act, 1995, or

A person with a severe disability referred to in sec. 2(o) of the National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities Act, 1999.

Additional Information:

a. Revision of Medical Certificate:

If the disability status needs reassessment after a specific period, the taxpayer can claim this deduction only if they obtain a new certificate from the medical authority and submit it with their income tax return.

b. Treatment when Handicapped Person Predeceases (Sec. 80DD(3)):

If the taxpayer has deposited any amount in an annuity plan of LIC or UTI for the benefit of the disabled person, and the disabled person passes away, any amount received from such an annuity plan will be considered the taxpayer's income for the year of receipt.

However, there will be no taxation if the amount is received by the dependent person with a disability before their death as an annuity or lump sum upon reaching the age of 60 years or more, with the discontinuation of payments or deposits.

Changes in ITR forms

To claim the deduction under section 80DD from the financial year 2023-24 a new 'Schedule 80DD' has been inserted in the ITR forms. This schedule seeks details of deductions in respect of maintenance, including details of medical treatment of dependents with disabilities. These details comprise:

• Nature of the disability

• Type of dependent (spouse, son, daughter, father, mother, brother, sister or member of the HUF)

• PAN of the dependent

• Aadhaar of the dependent

• Date of filing and acknowledgement number of Form 10-IA

• UDID Number