Recent Articles Of GST

Step by Step Guide On GST Refund Claims

In this article, we will discuss how to file a refund application under GST. A Person registered under the GST Act pays tax and Interest after payment of tax and interest. If any excess cash balance is available in the electronic cash ledger or in the case of an Inverted duty structure or the accumulated Input Tax Credit (ITC) which couldn't be utilised for tax payments due to zero-rated supply.

Such person can file a refund application in RFD-01 form electronically on the GST common portal. Application may be filed before the expiry of two years from the relevant date.

Relevant Date Means-

| Reason for claiming GST Refund | Relevant Date |

| Goods are exported by sea or air | Date on which the ship or the aircraft leaves India |

| Goods are exported by land | Date on which such goods pass the frontier |

| Supply of goods regarded as deemed exports | Date on which the return relating to such deemed exports is furnished |

| Zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit | Due date for furnishing of return under section 39 in respect of such supplies |

| Services exported out of India | Receipt of payment in convertible foreign exchange (or in Indian rupees wherever permitted by RBI) |

| Services exported out of India (in case of advance received) | Date of issue of invoice |

| Tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court | Date of communication of such judgment, decree, order or direction

|

| In the case of refund of unutilised input tax credit under clause (ii) of the first proviso to sub-section (3) | Due date for furnishing of return under section 39 for the period in which such claim for refund arises |

| Where tax is paid provisionally | Date of adjustment of tax after the final assessment |

| Person, other than the supplier | Date of receipt of goods or services or both by such person |

| In any other case | Date of payment of tax |

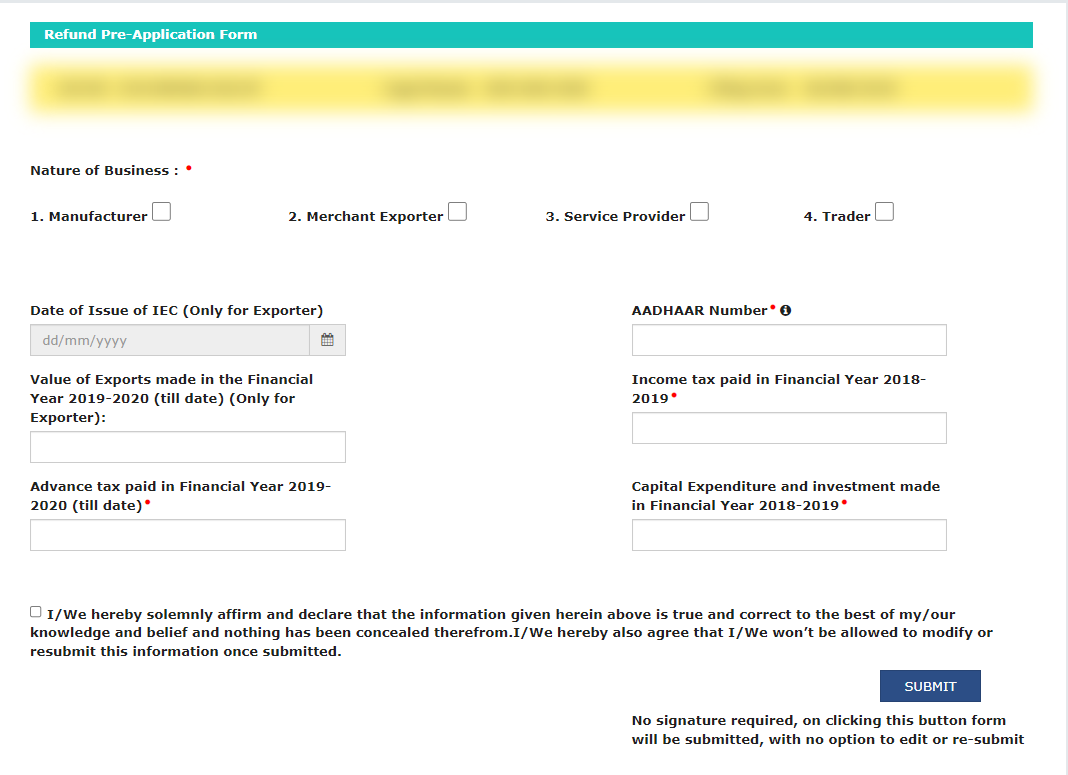

Step to Submit Refund Pre-application Form :-

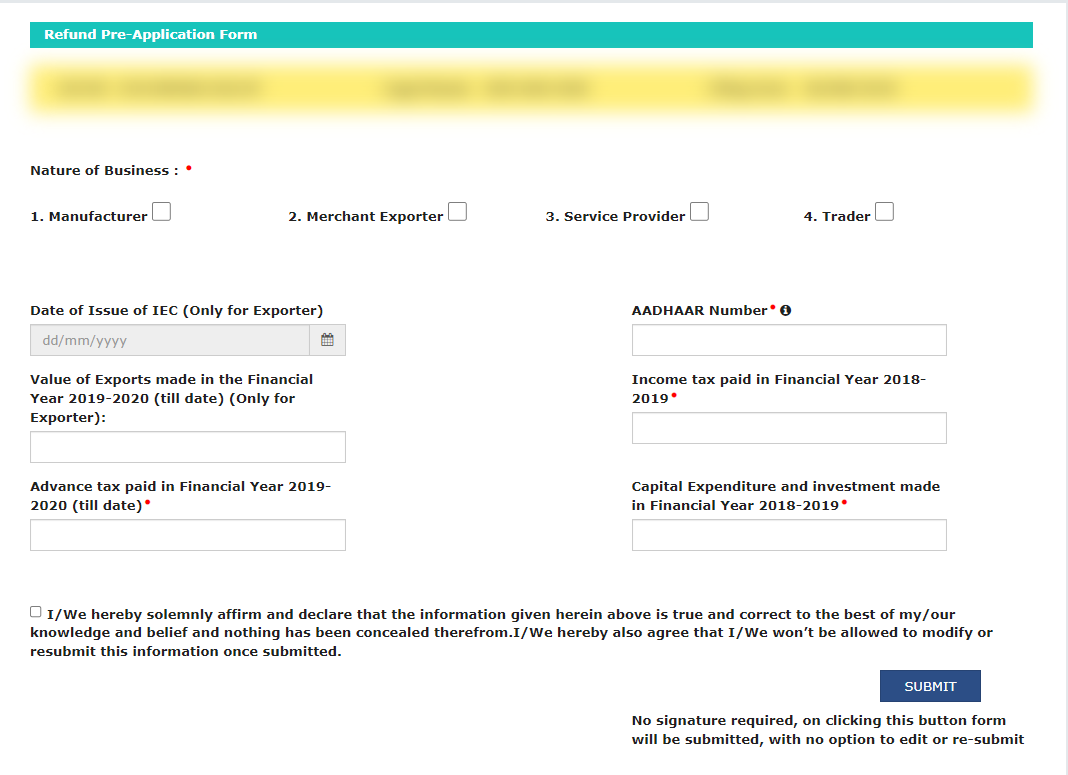

Before filing of refund application must file a Refund pre-application form. After filing of Refund pre-application form, this form cannot be edited. So, before filing it the user must be careful while entering the details.

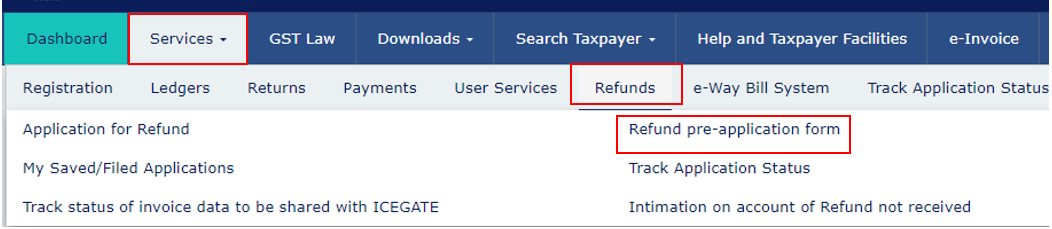

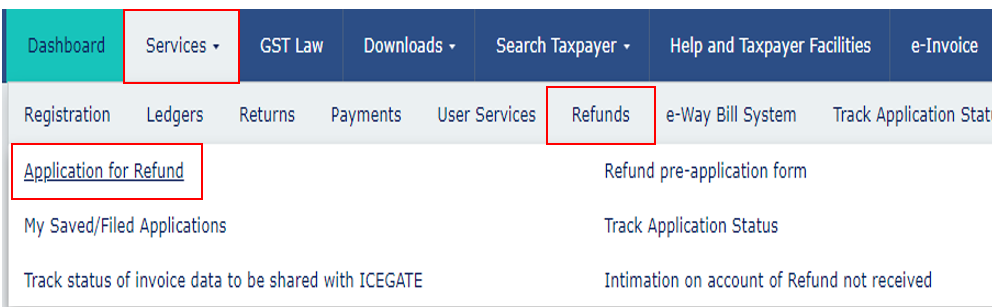

Go to GST Portal after login go to the Services >Refunds > Refund Pre-application form.

In the Refund pre-application form fill basic information of business like

Nature of business

Date of issue of IEC (only for exporter)

Aadhaar Number.

Value of exports made in the FY 2019-2020 (only for exporters)

Income tax paid in FY 2018-2019

Advance tax paid in FY 2019-2020

Capital expenditure and investment made in FY 2018-2019

Fill all the relevant details after filing it click on the check box and submit it.

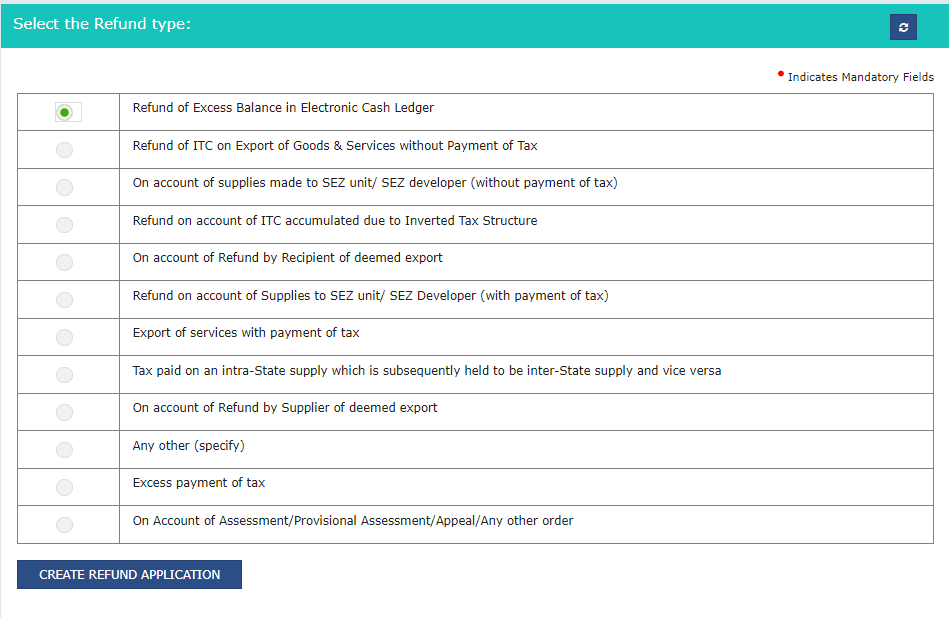

RFD-01 Refund application form file in different types of Scenario-

• Refund of excess balance in cash ledger.

• Refund of ITC on export of goods and services without payment of tax.

• On account of supply made to SEZ unit/ SEZ developer (without payment of tax).

• Refund on account of ITC accumulated due to inverted duty structure.

• On account of refund by recipient of deemed export.

• Refund on account of supplies to SEZ unit/ SEZ developer.

• Export of service without payment of tax.

• Tax paid on intra-state supply which is subsequently held as interstate supply vice–versa.

• On account of refund by supplier of deemed export.

• Any other (specify)

• Excess payment of tax

• On account of Assessment/ Provisional assessment/ Appeal/ Any other order.

Following Steps to be followed for Filing of Refund Application (RFD-01) Form.

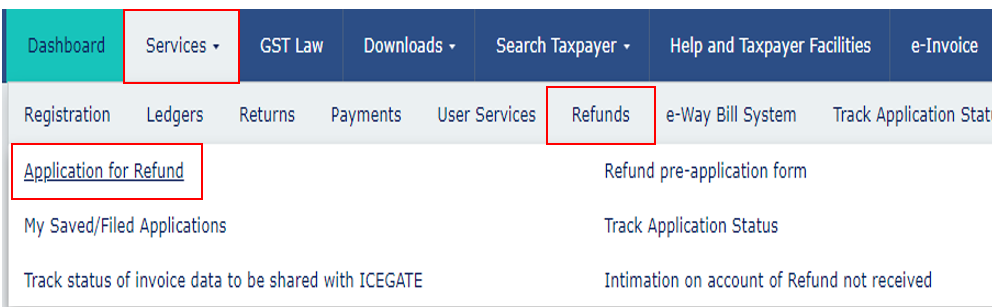

Go to Services > Refund > Application for Refund

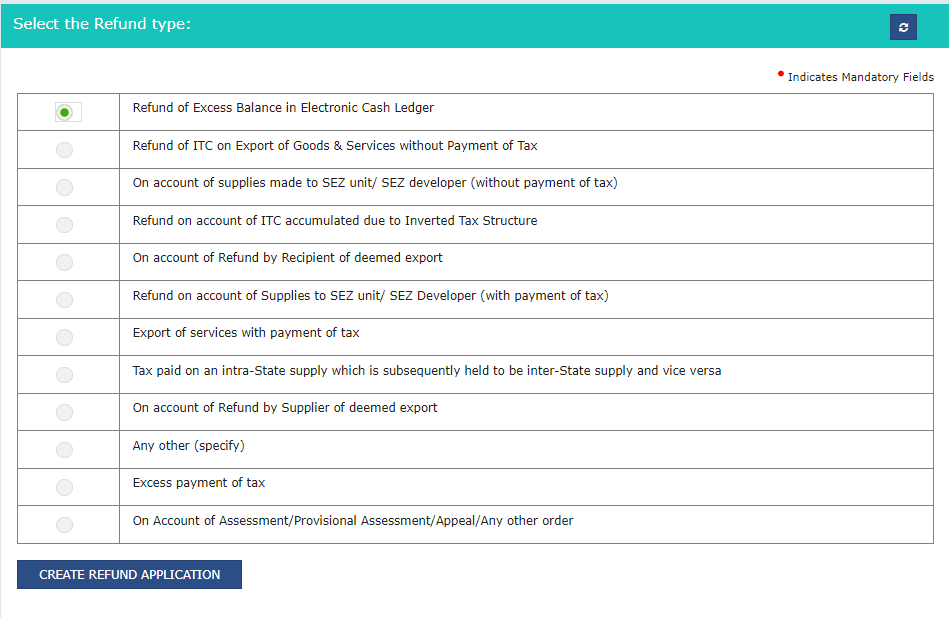

After clicking on 'Application for Refund,' a new window opens where we have to select the refund type.

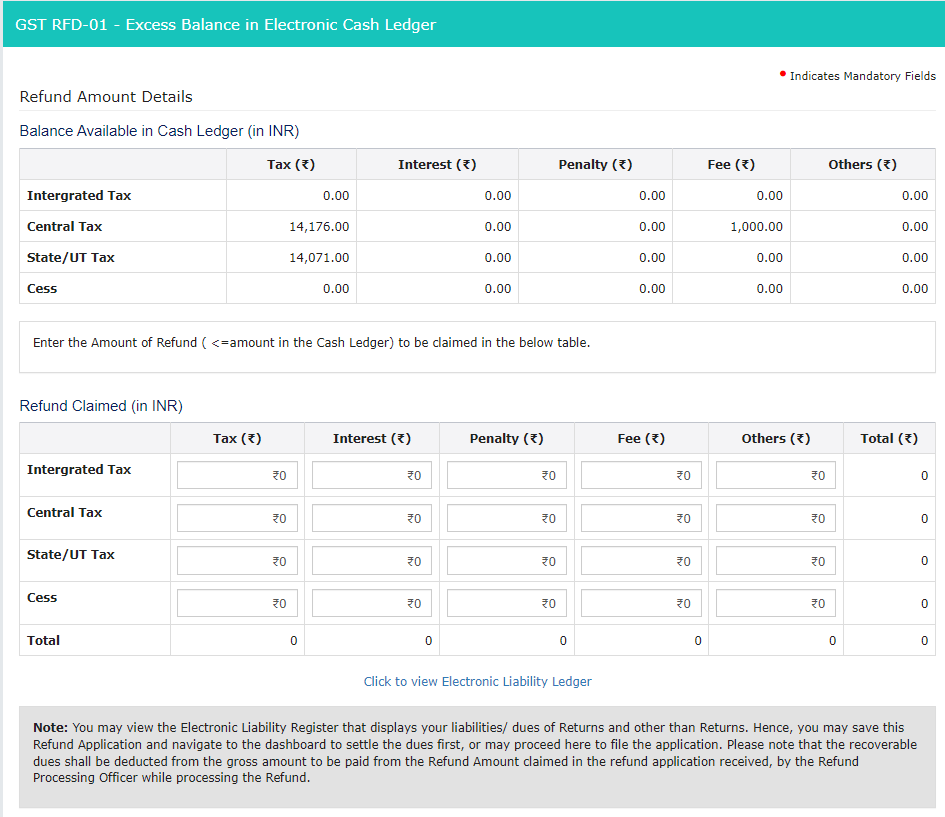

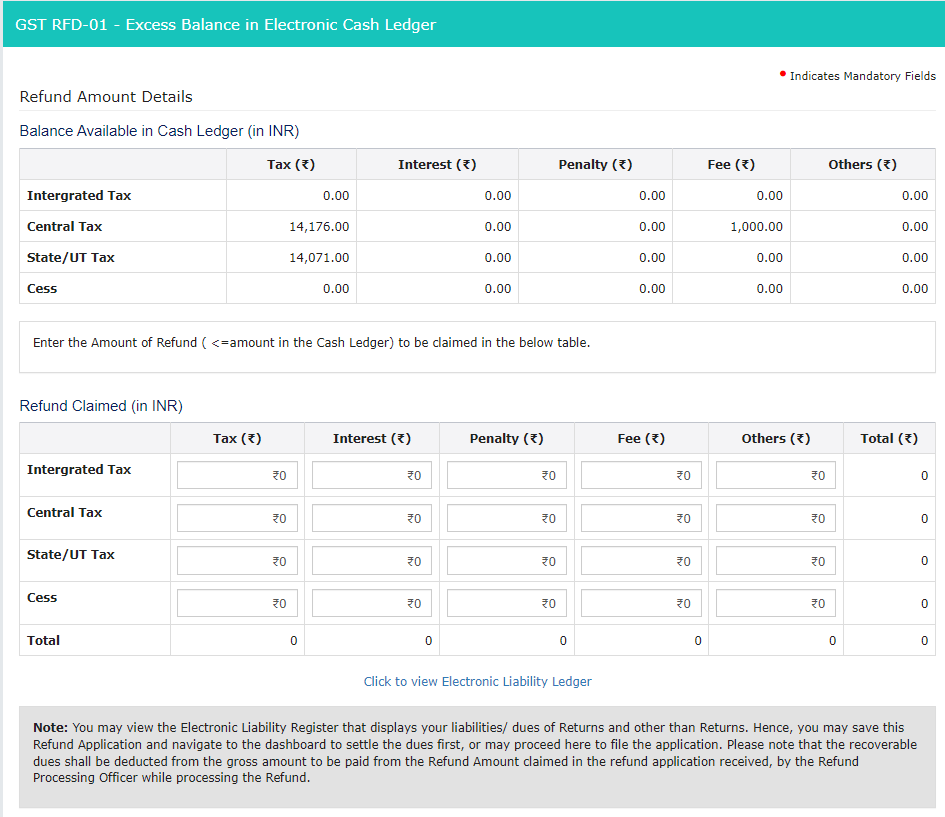

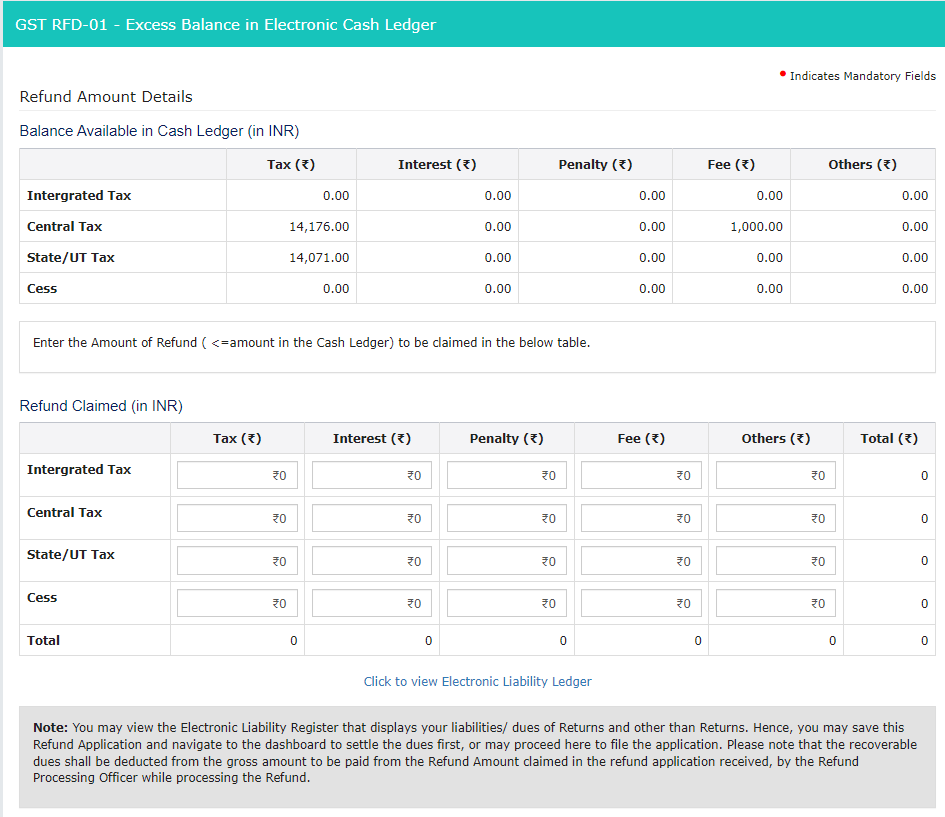

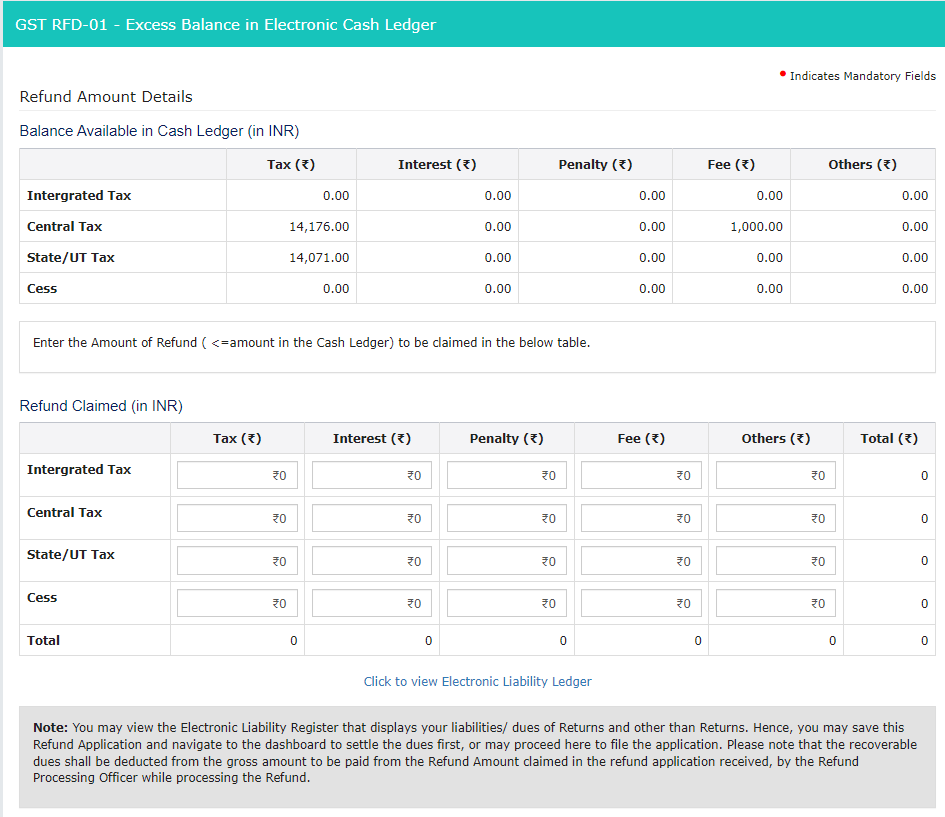

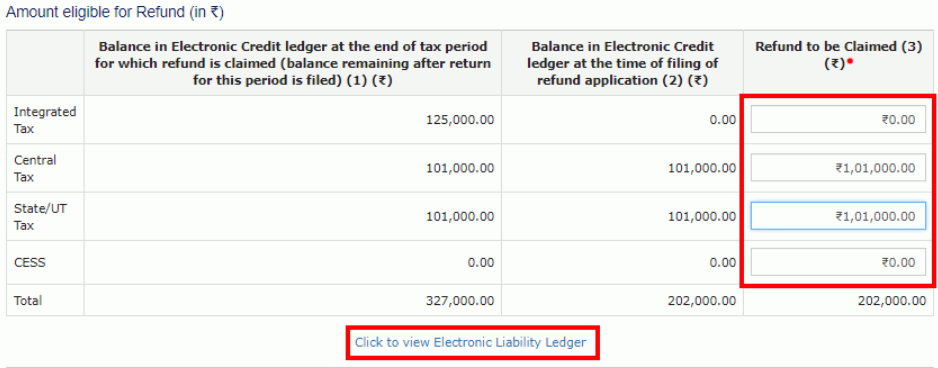

Case 1 - Refund of Excess Balance in Cash ledger.

Click on Refund of excess balance in cash ledger after click on Click to Create Refund Application.

Enter the amount of Cash to be claimed as a refund.

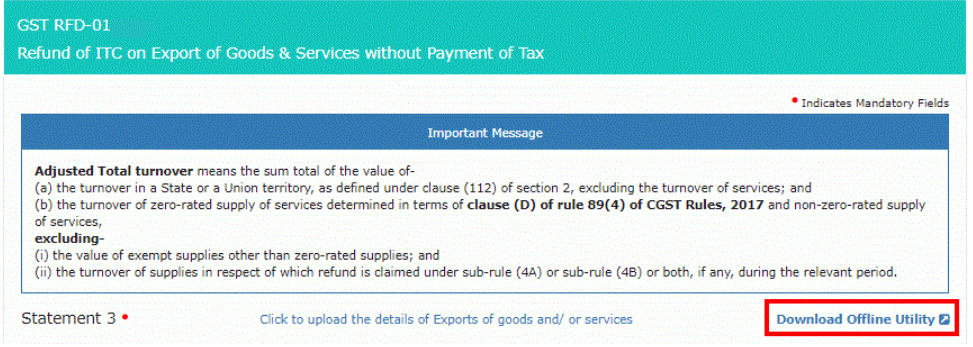

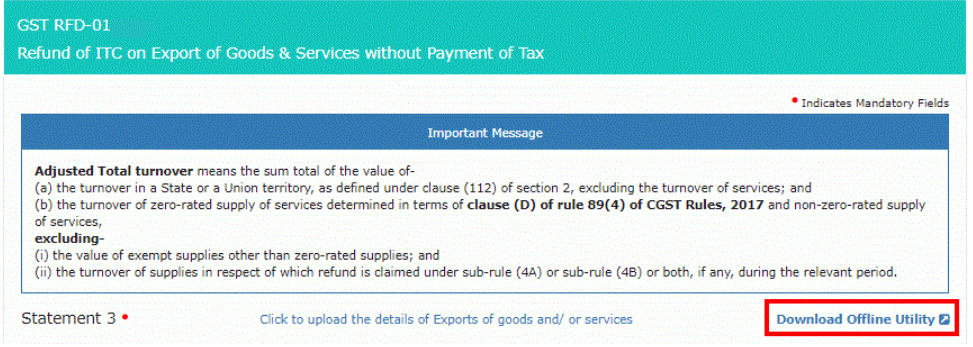

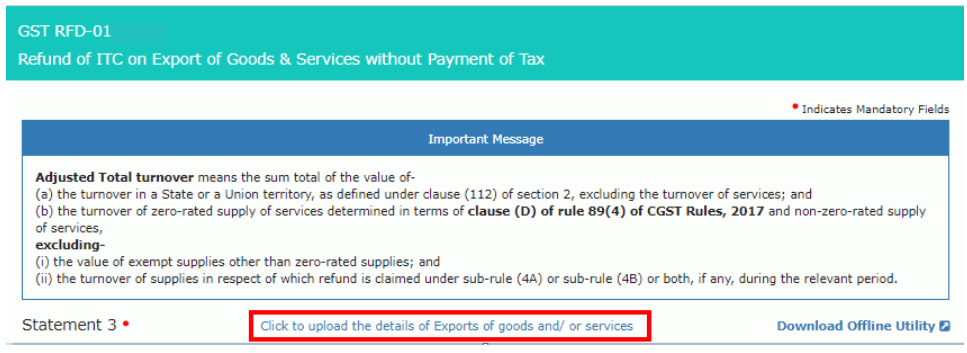

Case 2 - Refund of ITC on Exports of Goods and Services without Payment of tax.

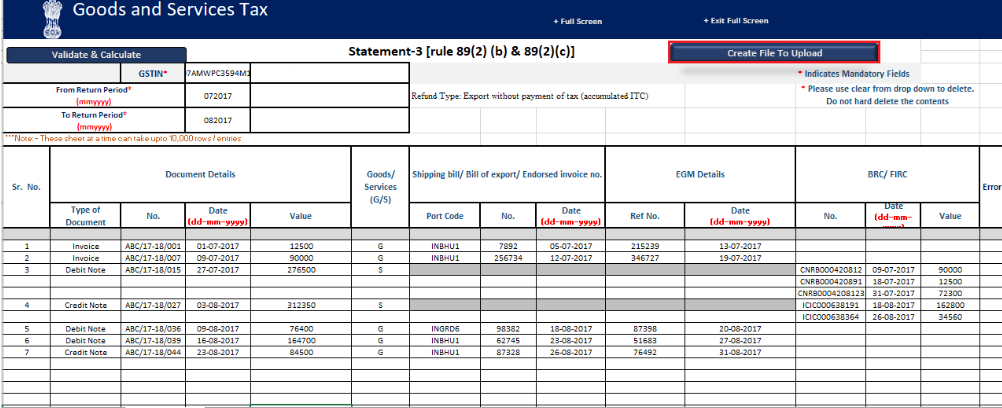

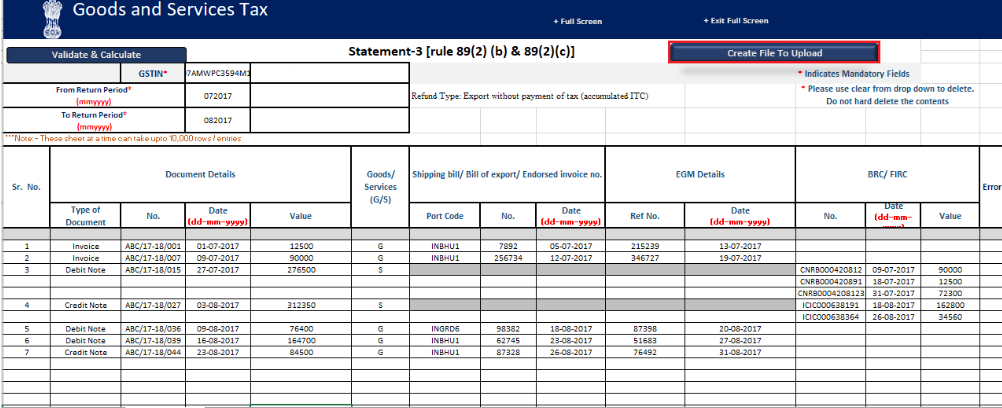

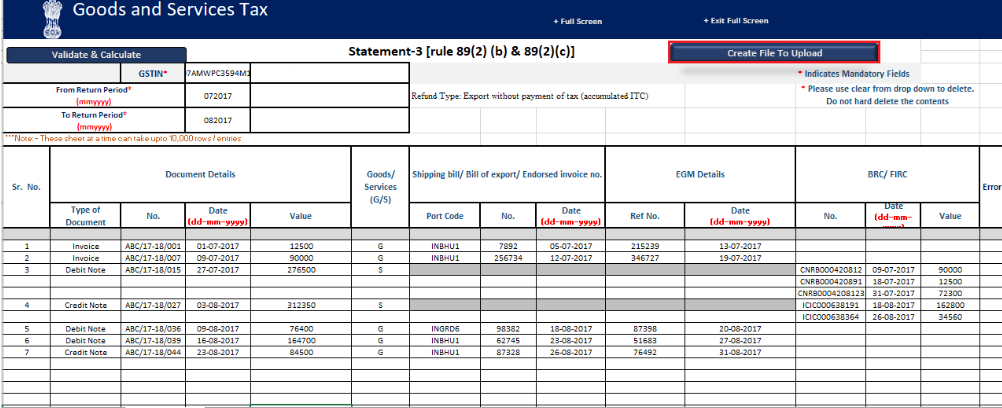

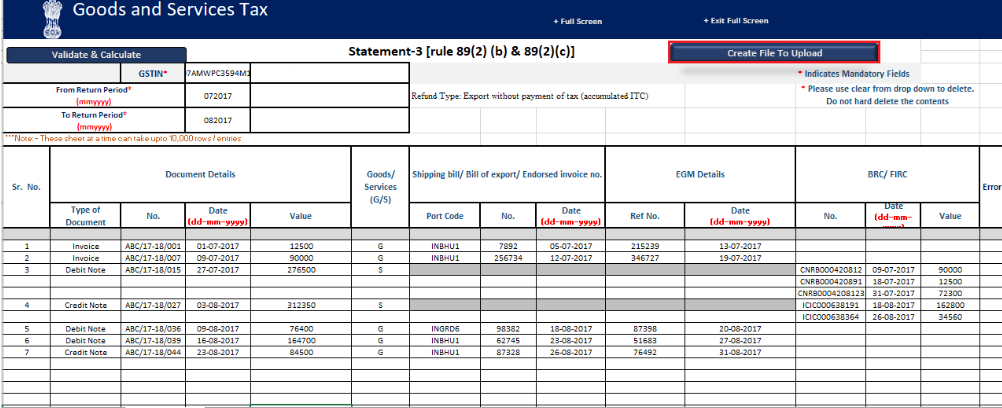

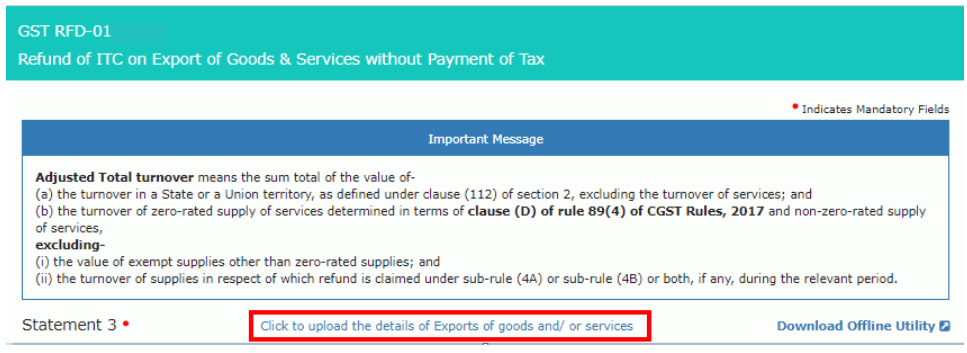

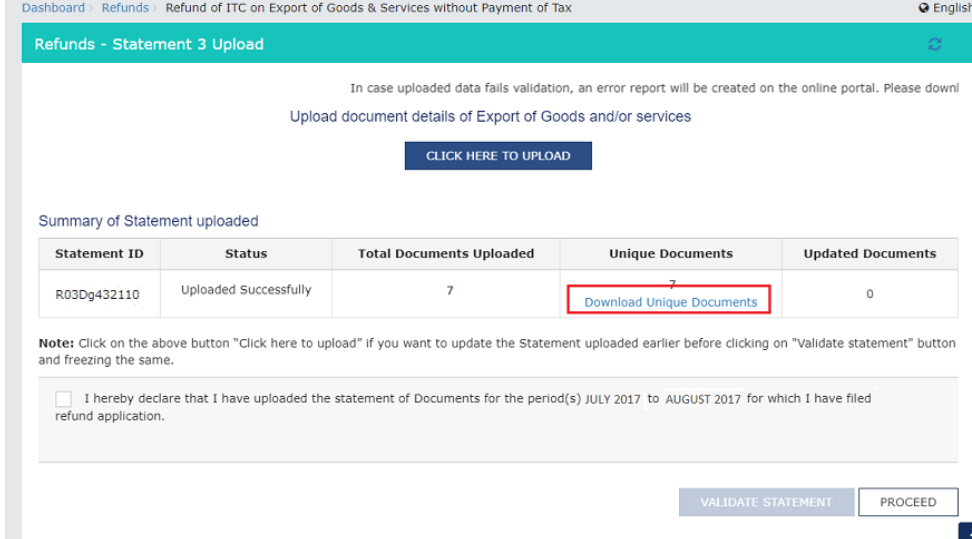

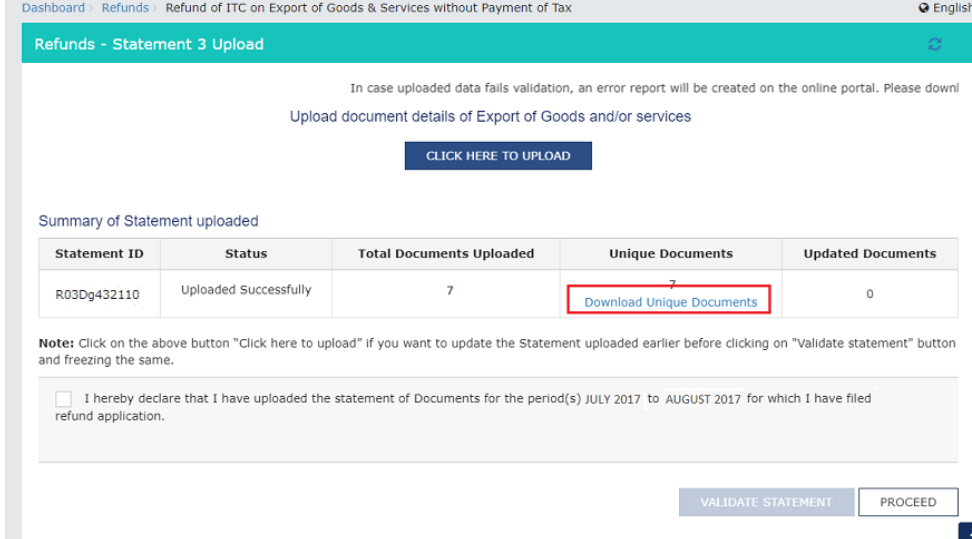

Step -1 Download “Statement- 3” and enter the details of the export invoice document on export invoice which refund is claimed.

In Step 2- Generate a JSON file and upload it to the GST portal. Validate for any errors.

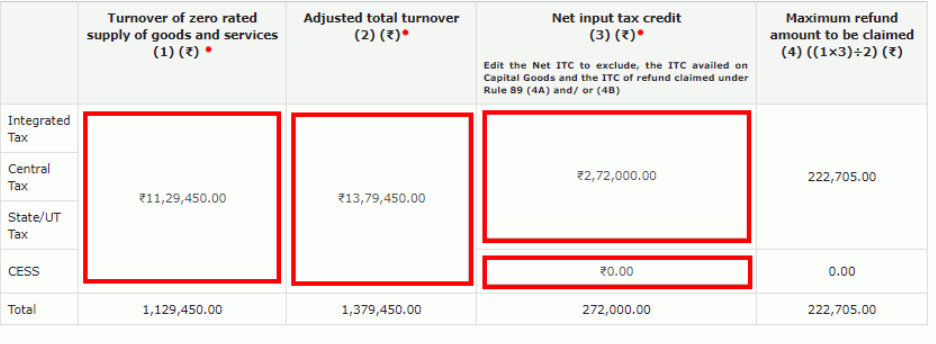

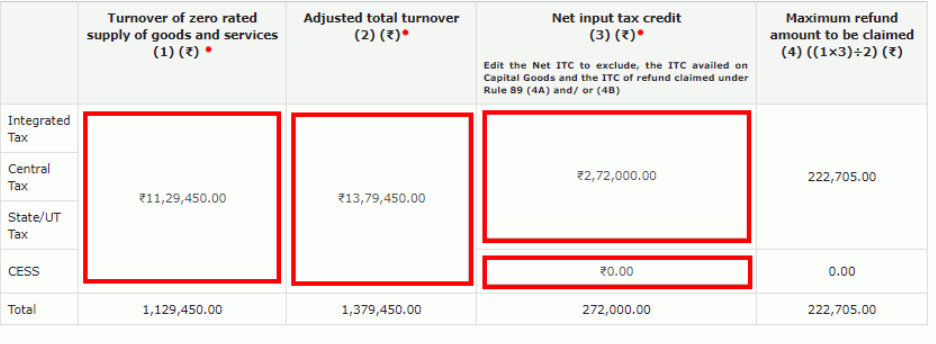

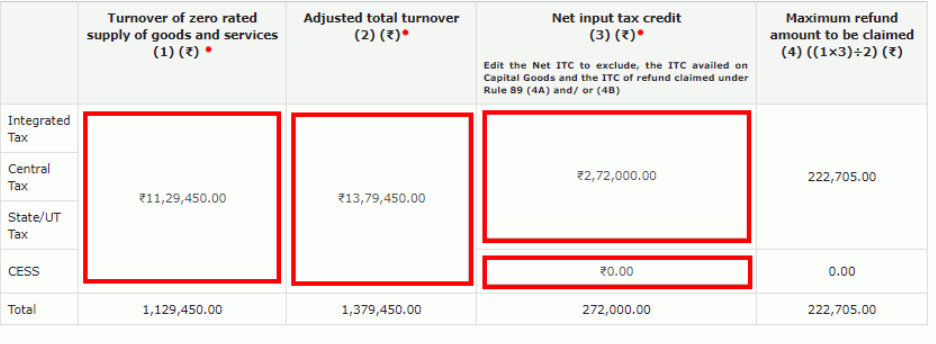

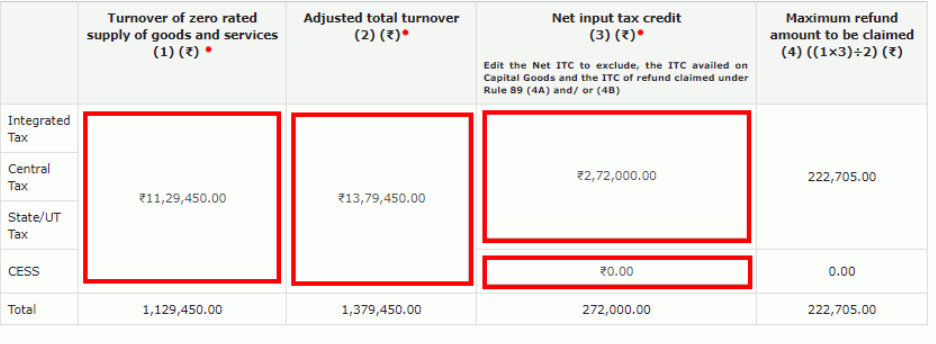

In Step-3 - In the column, ‘Computation of Refund to be claimed Statement-3A [rule 89(4)]’, enter aggregate turnover, adjusted total turnover and net input tax credit.

Step-4 Validations take place to compute the maximum amount of refund that the taxpayer is eligible for

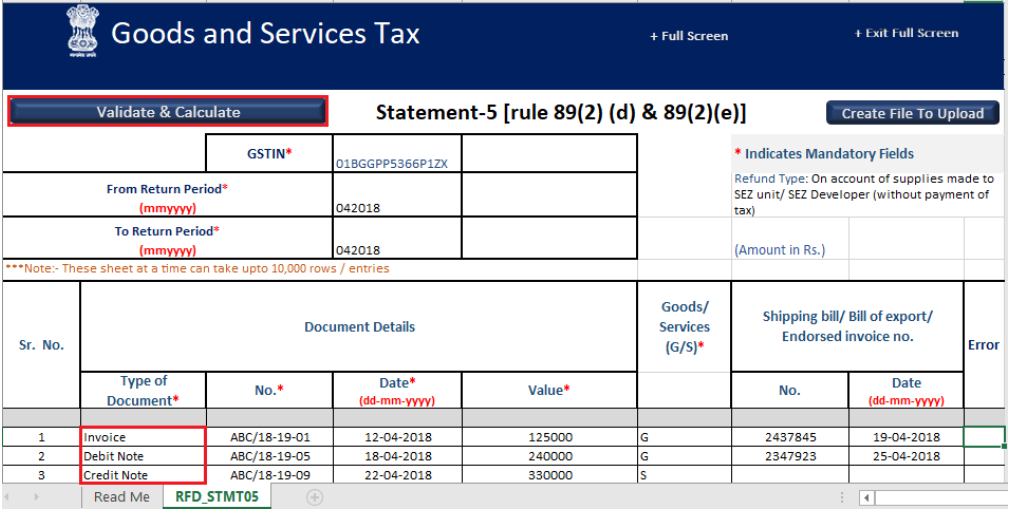

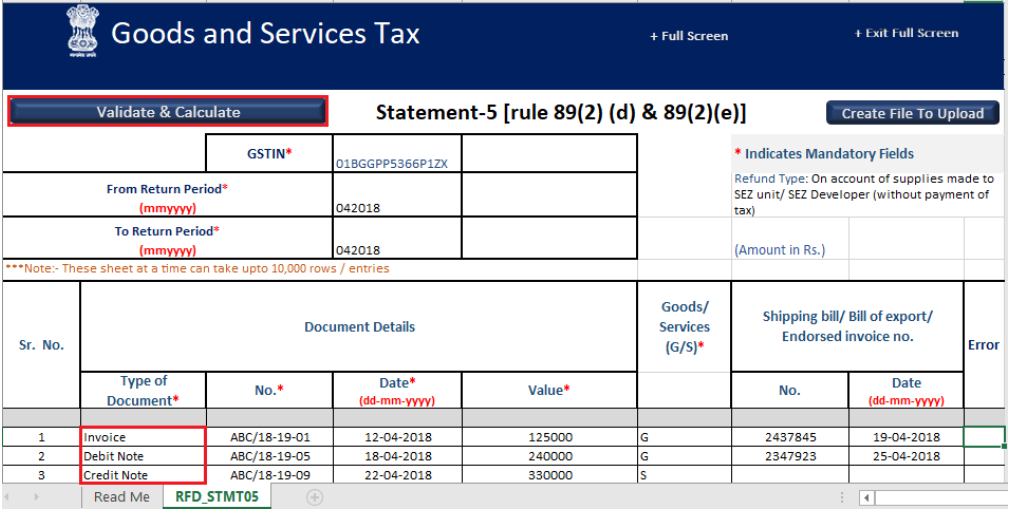

Case 3 – On Account of supplies made to SEZ unit/SEZ developer (without payment of tax)

Before filing of this form GSTR-1 and GSTR-3B must be filed. The step reamin same in step laid down in case -2 given above. However, the statement will be Statement 5 and a CSV file can be uploaded instead of JSON.

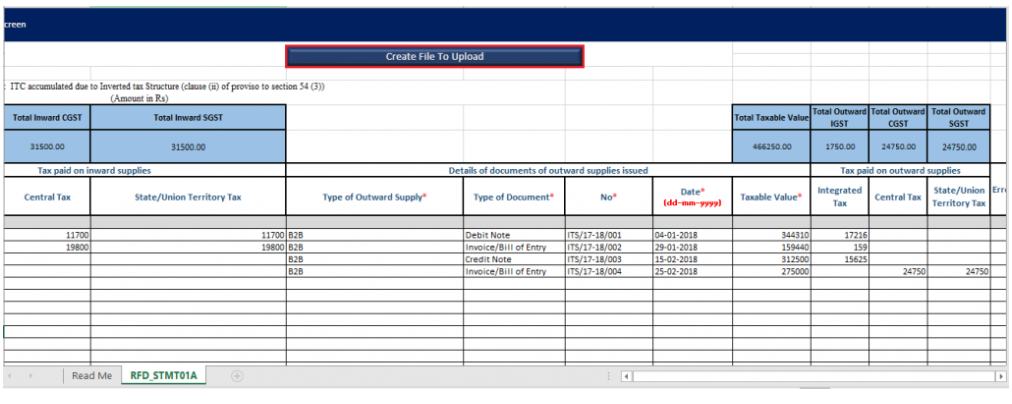

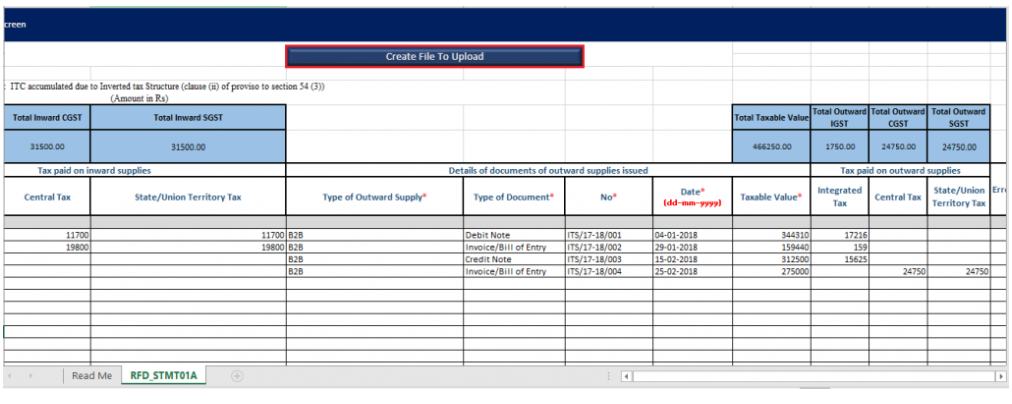

Case 4 - Refund on account of ITC accumulated due to inverted duty structure.

Inverted Duty structure refers to a situation where the tax rate and amount paid on inputs are higher than on the outputs. The steps remain the same as laid down in case 2 above. However, “Statement 1A” will be submitted” Afterward, enter details such as turnover of inverted rated supply, tax payable, adjusted total turnover, and net input tax credit.

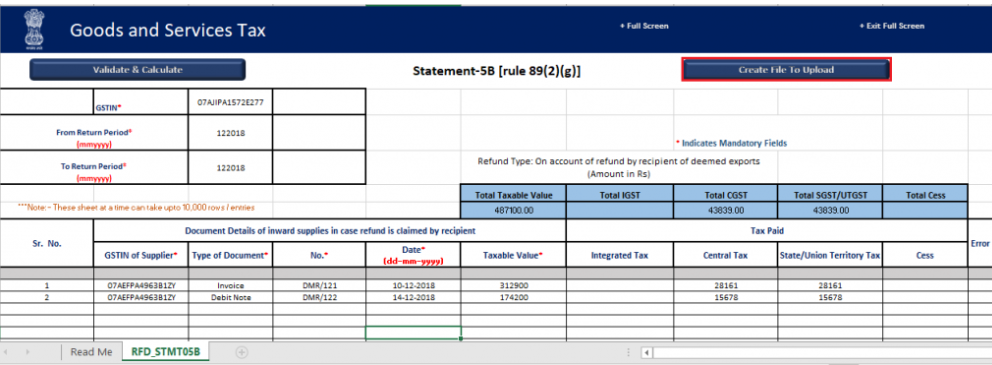

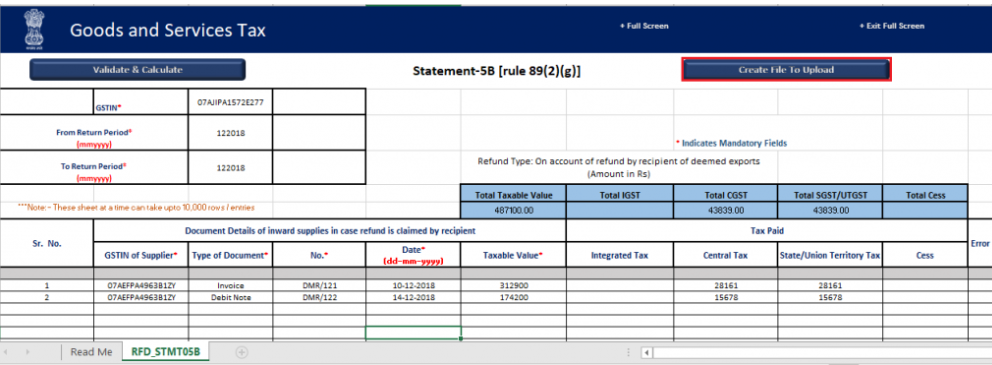

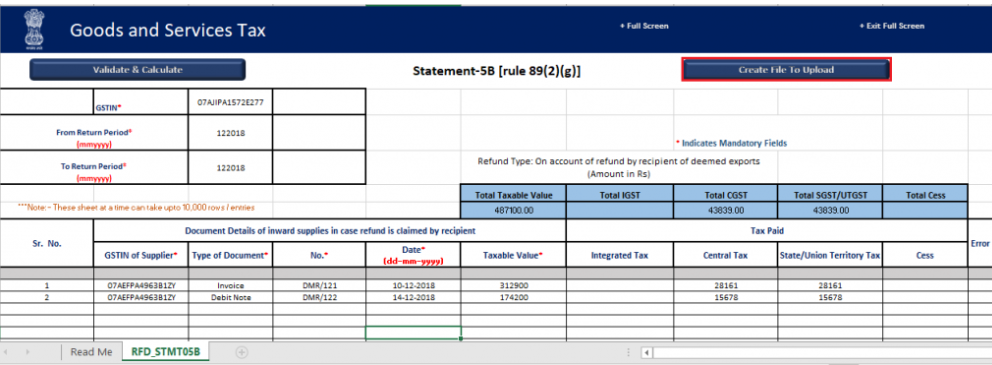

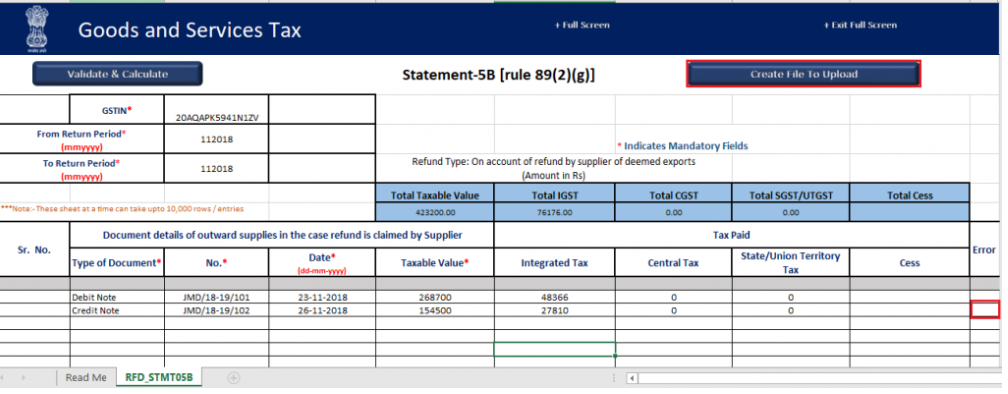

Case 5 - On account of Refund by the recipient of deemed exports

In the case of deemed export, steps remain same as laid down in case -2 given above. However, “Statement 5B” will be submitted. Thereafter, enter details such as the net input tax credit of deemed exports and the refund to be claimed.

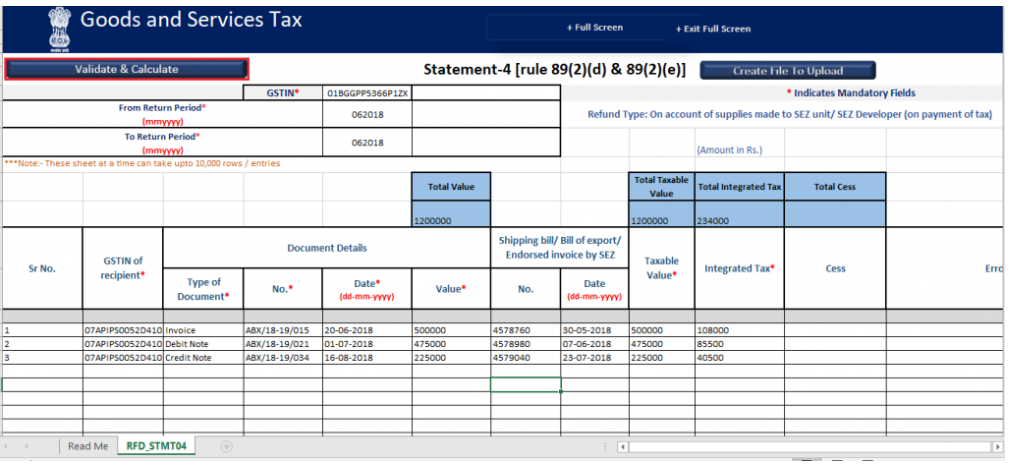

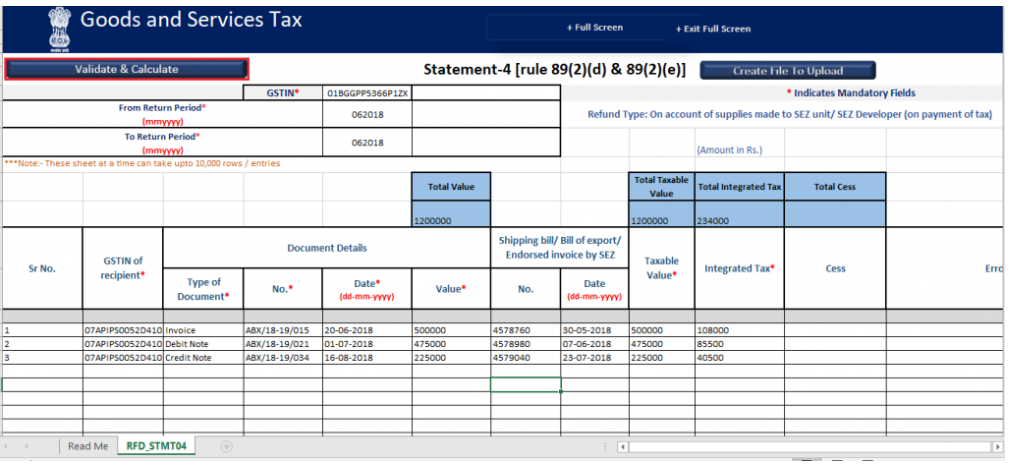

Case 6 – Refund on supplies made to SEZ unit/SEZ developer (with payment of tax)

Steps remain the same as laid down in case -2 given above. However, the statement will be “Statement-4”. The refund amount will auto-populated based on the statement uploaded.

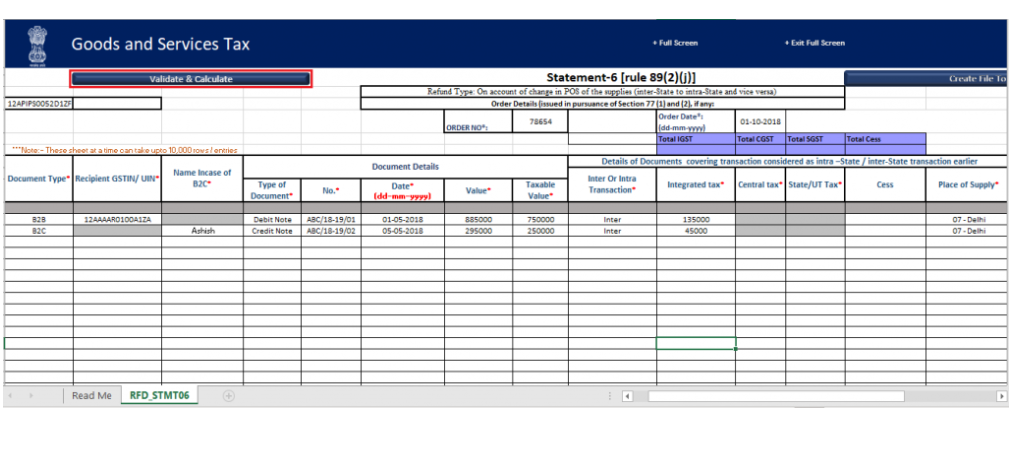

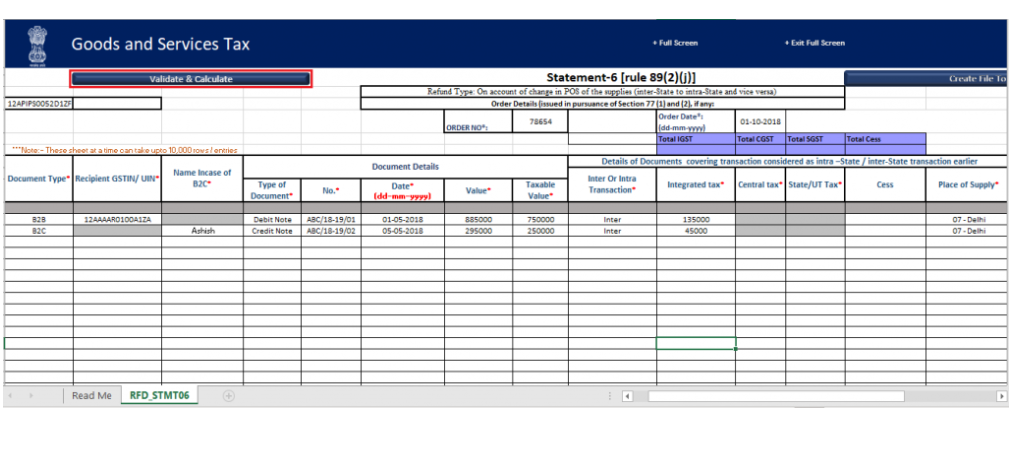

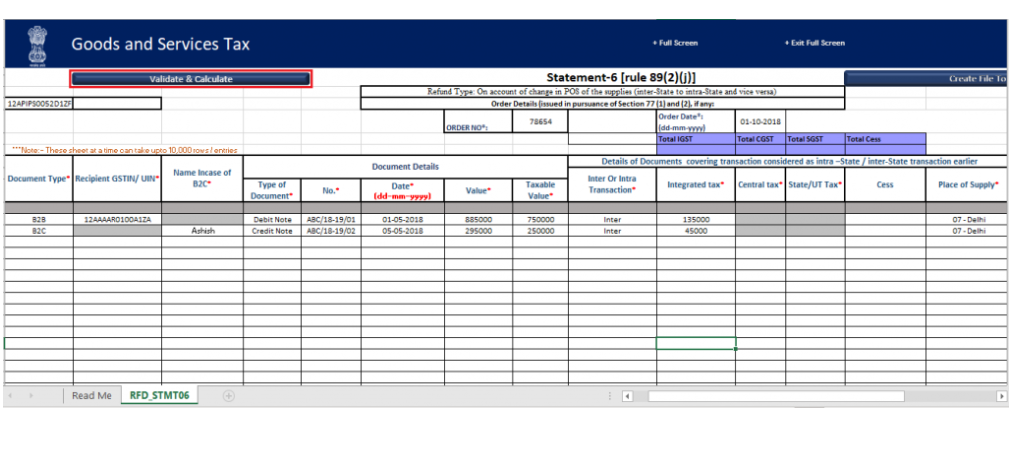

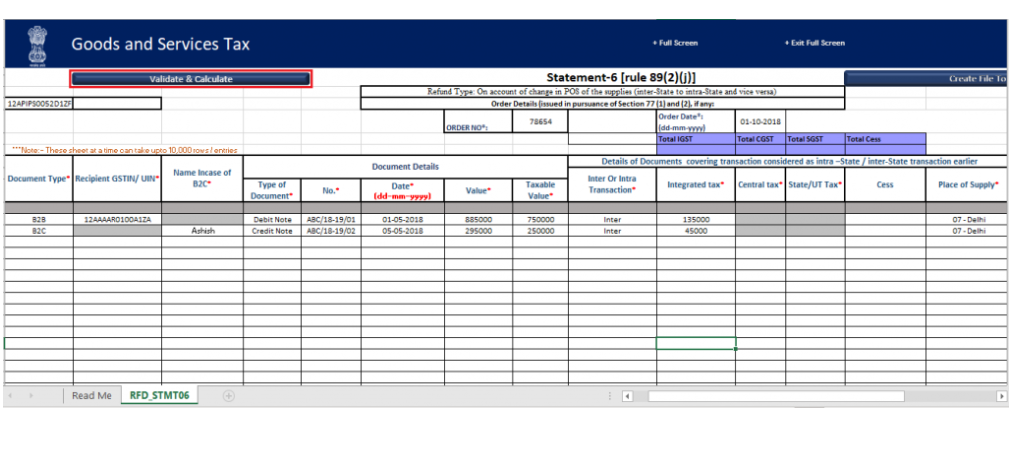

Case 7 - Tax paid on an intrastate supply later held as interstate supply and vice versa

Steps remain the same as the ones laid down in case-2 given above. However, the statement will be “Statement-6”. The refund amount will get auto-populated based on the statement uploaded.

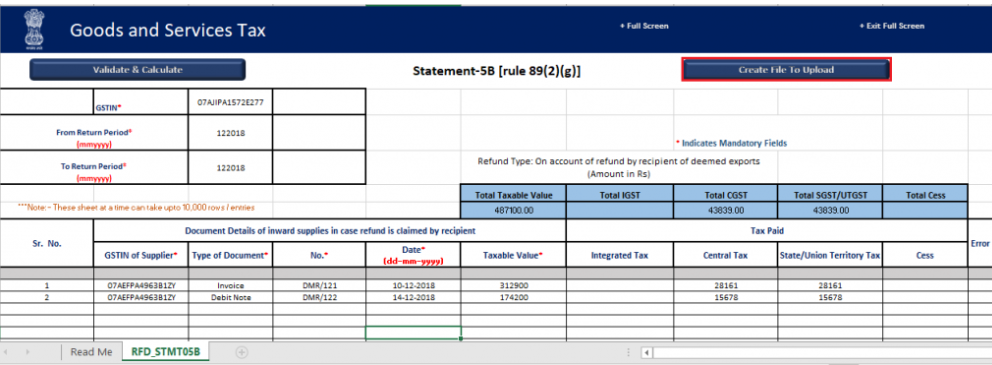

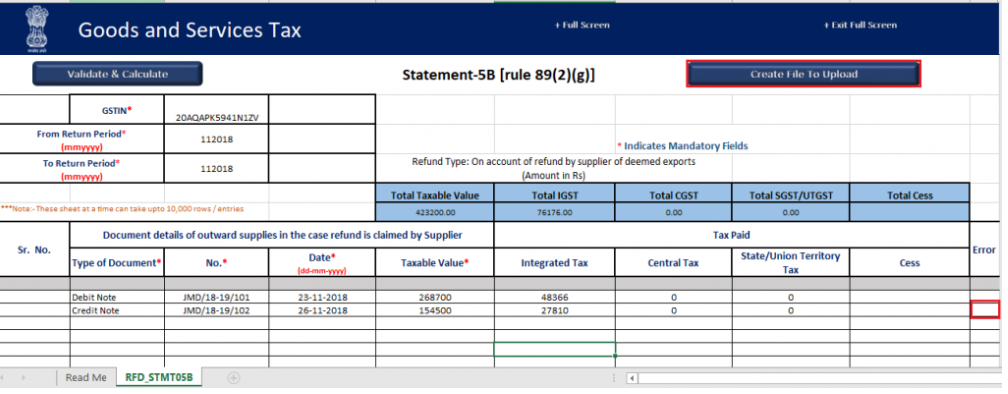

Case 8 - On Account of Refund by Supplier of Deemed Export –

The steps remain the same as the laid down in case-2 given above. However, the statement will be “Statement 5B”. The refund amount will get auto-populated based on the statement uploaded.

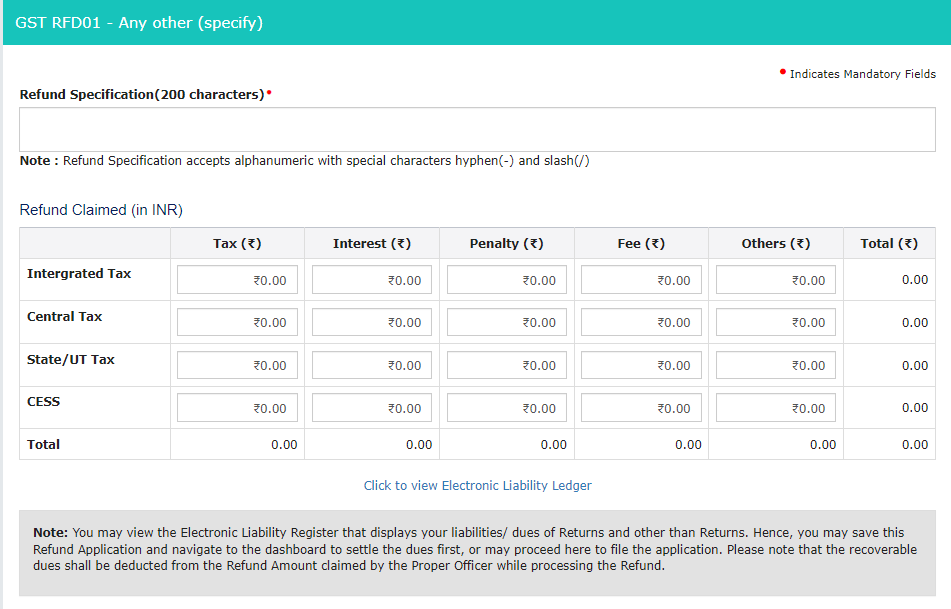

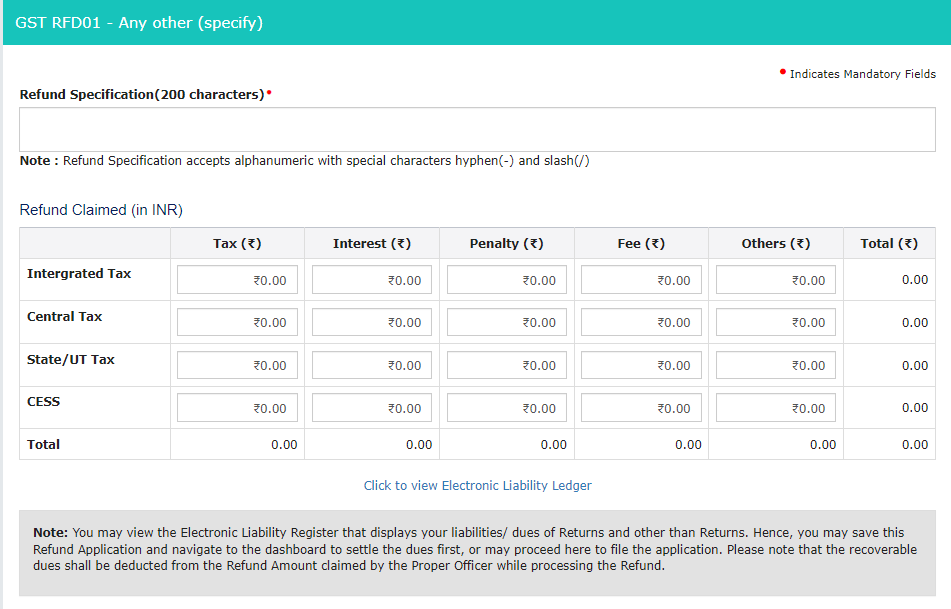

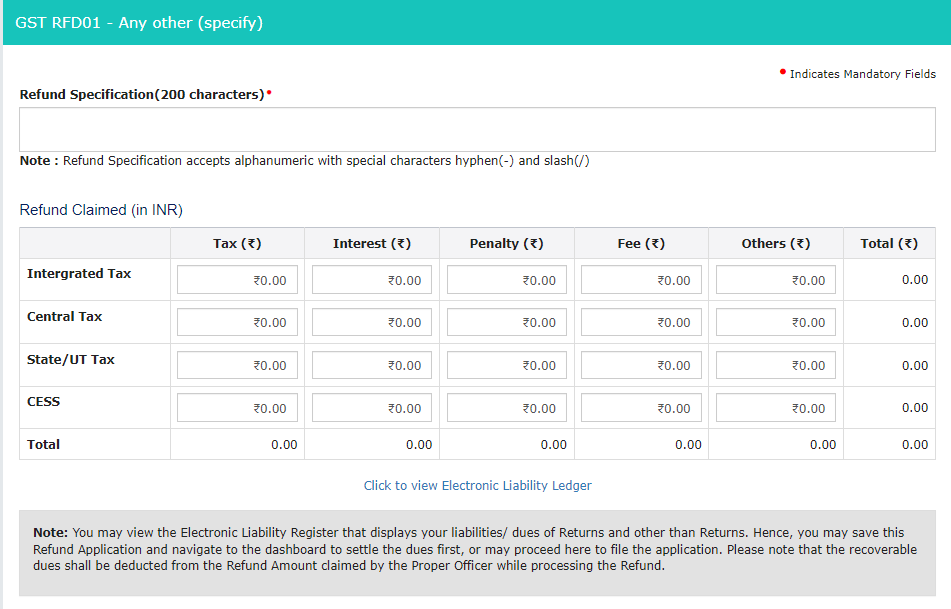

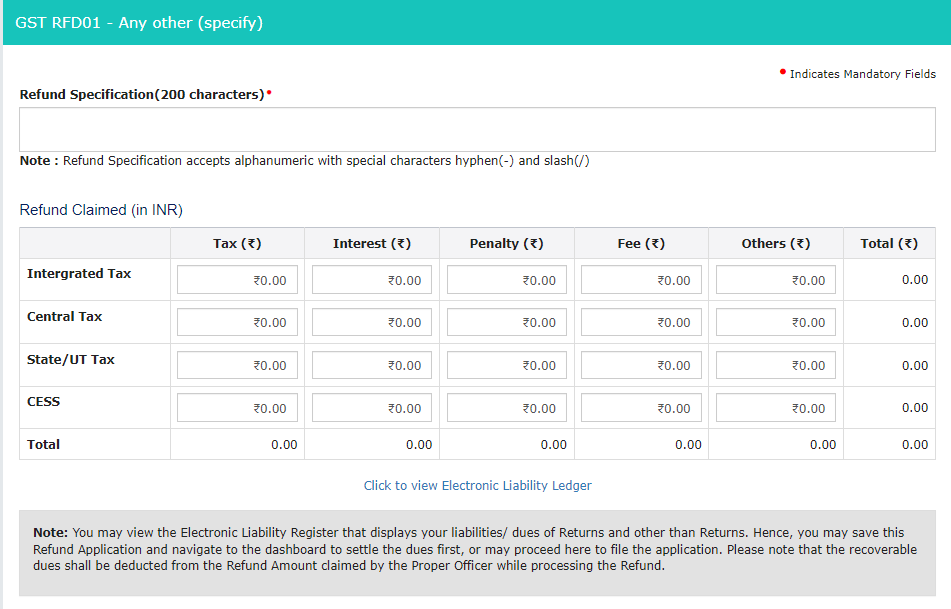

Case 9 - Any Other (specify) –

Mention the reason for the refund specifically in 200 characters along with the amount in the refund specification box.

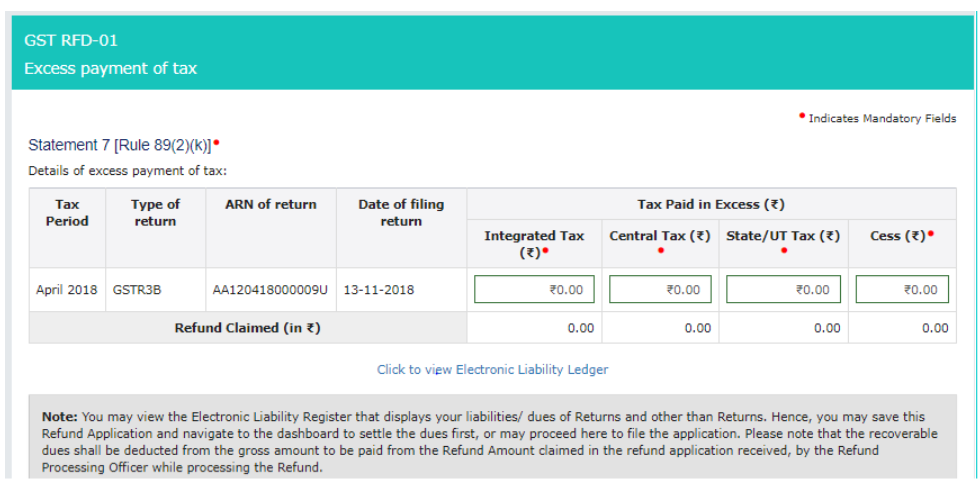

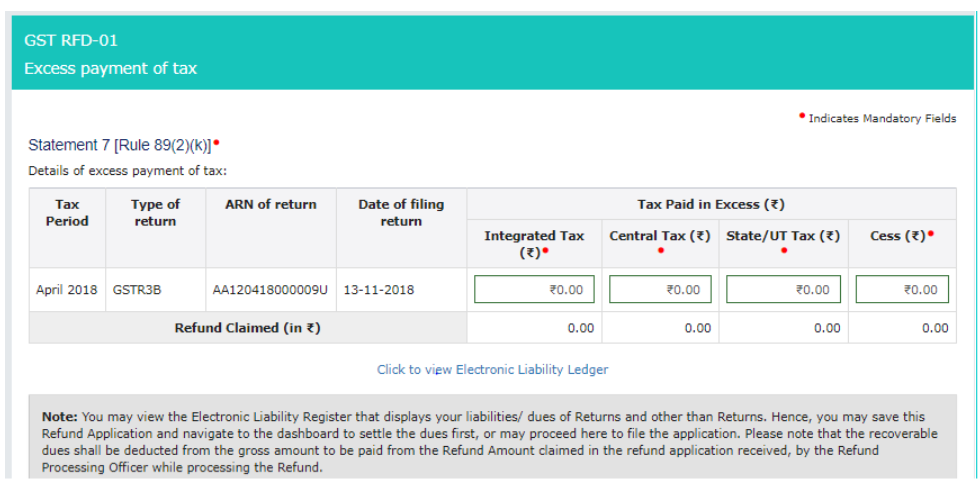

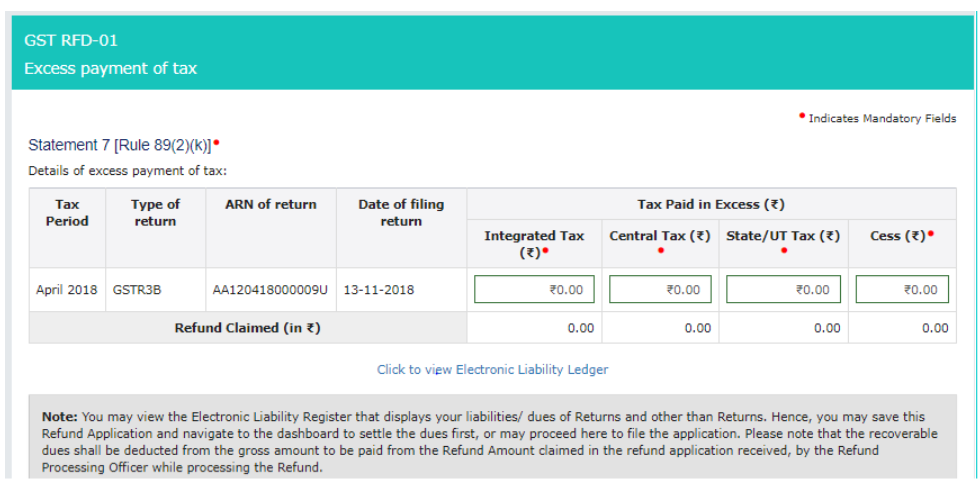

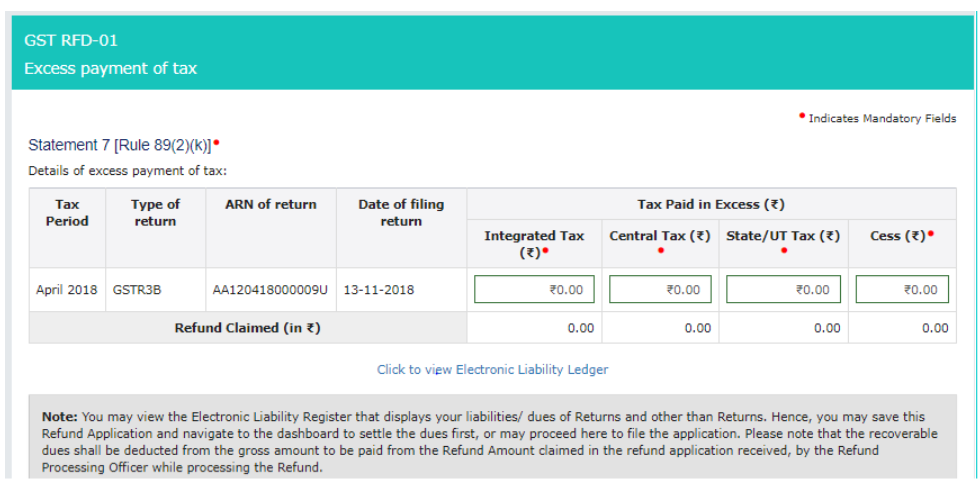

Case 10 - Excess Payment of Tax –

Enter details of the GSTR-3B in which such tax payment was done in cash. Fill all relevant details like tax period, Type of return, ARN no. date of filing of return, and tax details.

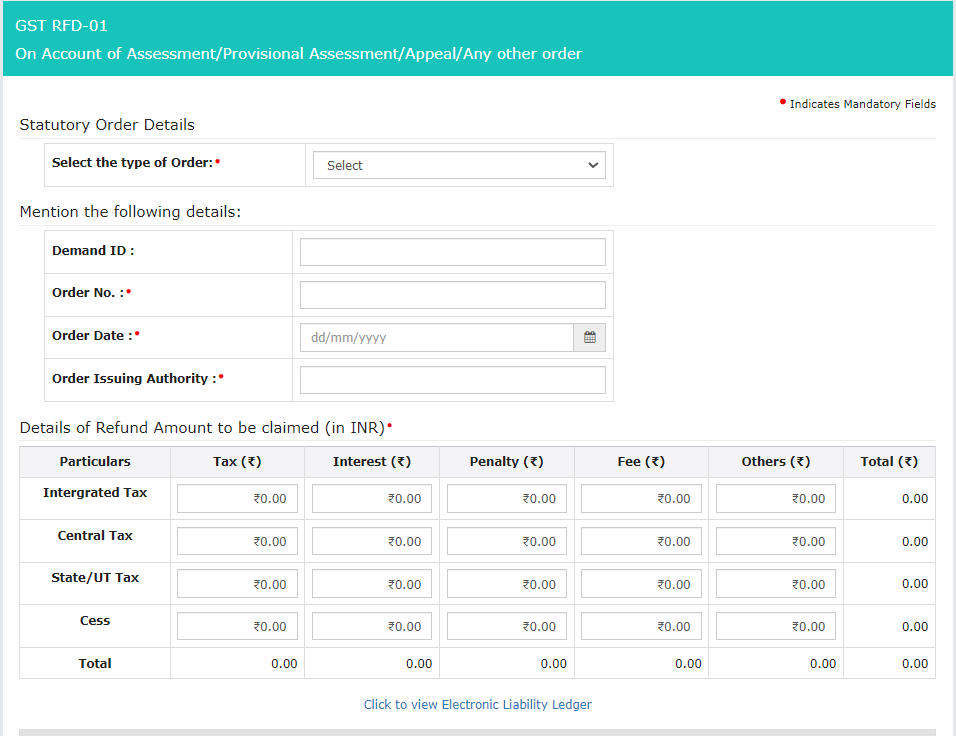

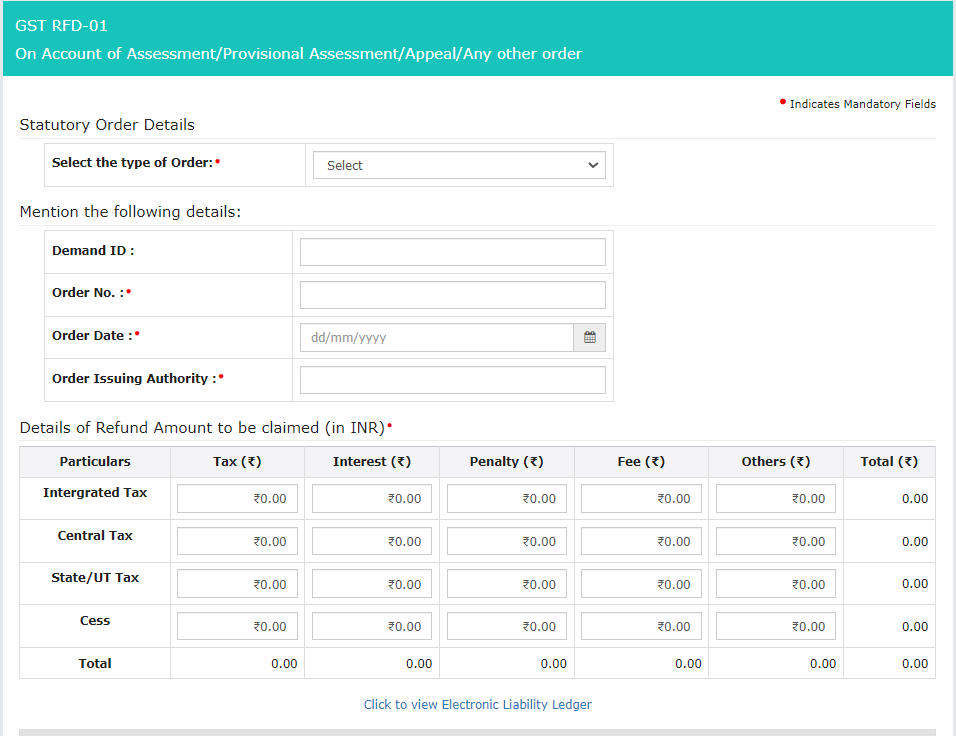

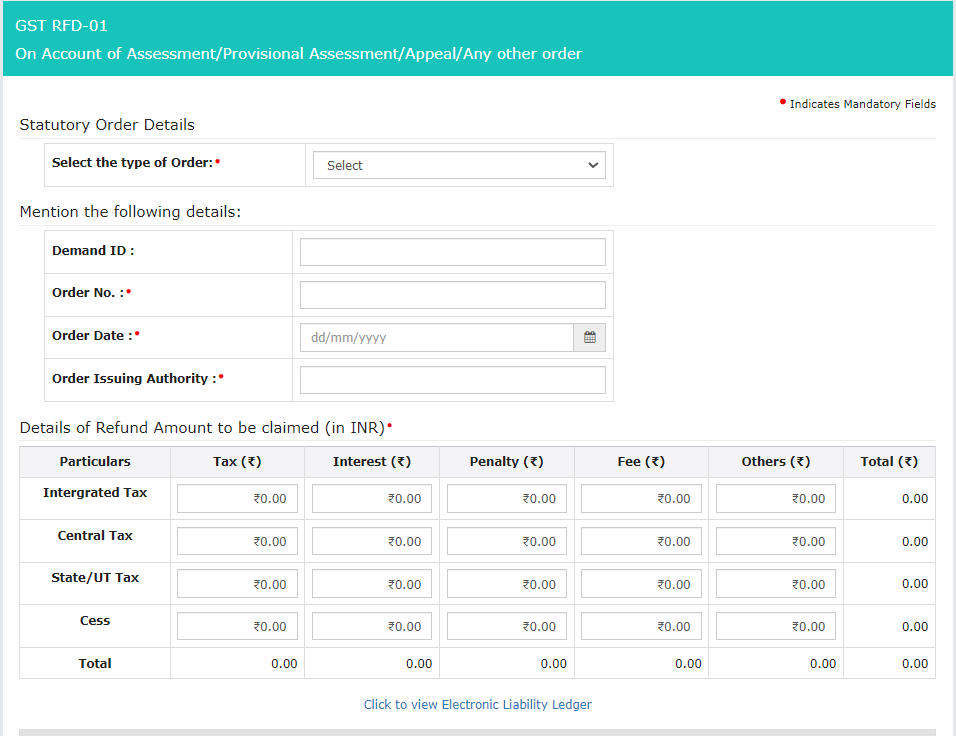

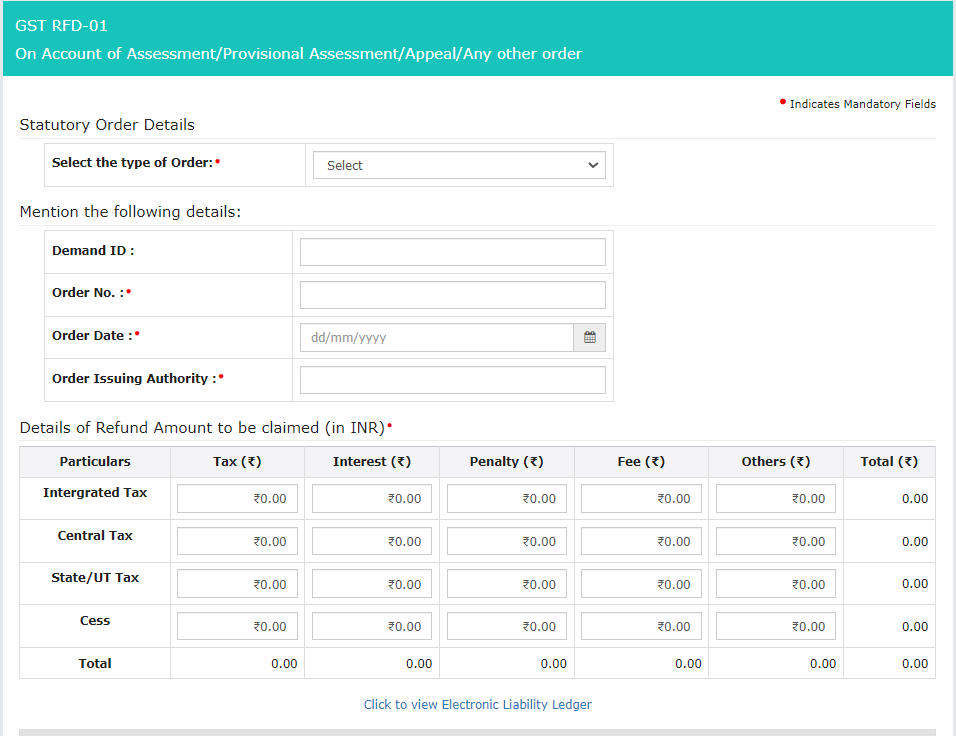

Case 11 – On account of Assessment/ Provisional assessment/ Appeal/ Any other order.

In this table select the type of order. Order No. Order Date. Order issuing authority and details of the refund amount to be claimed.

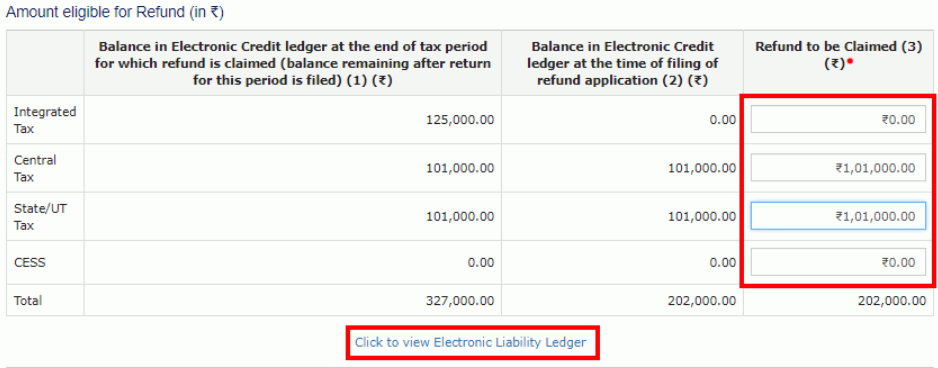

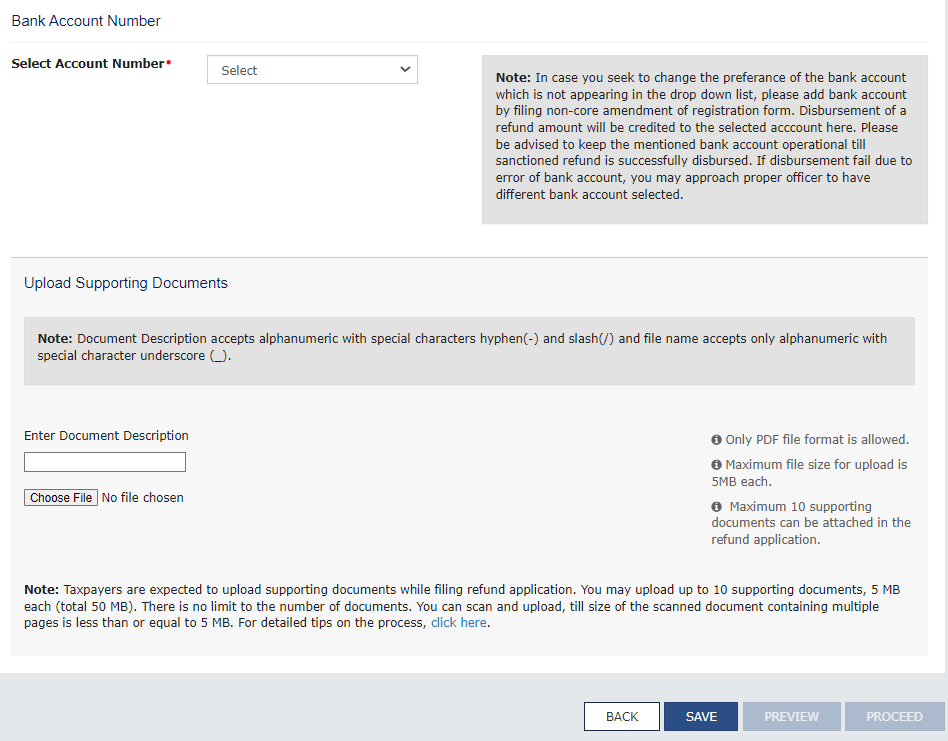

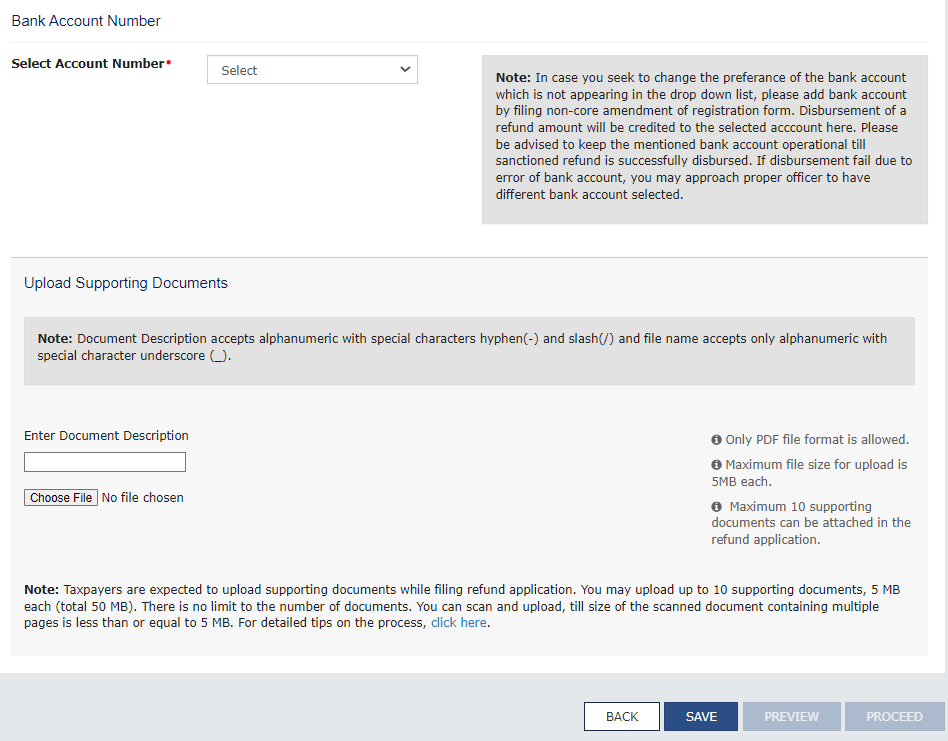

After filing relevant details select the Bank account number and upload supporting documents. Maximum 10 supporting document can be uploaded in the refund application.

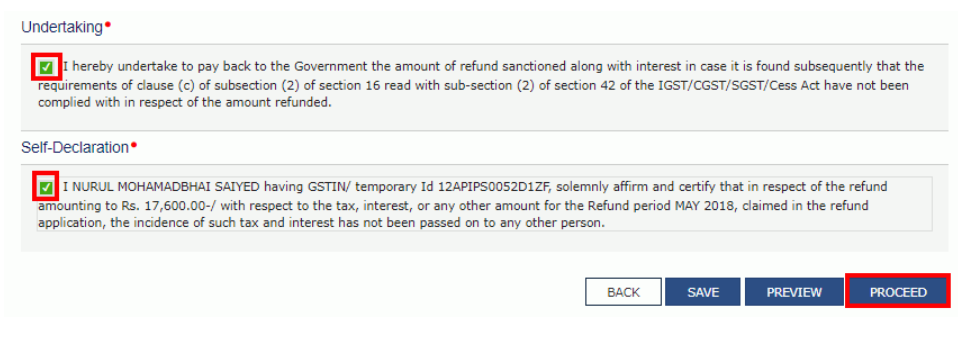

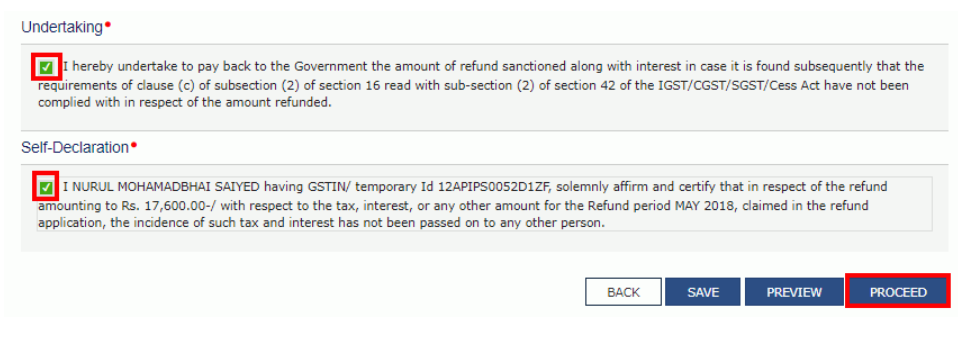

After that click on the undertaking check box and the self-declaration check box & click on proceed. Application can be verify through DSC or EVC.

After filing of refund application taxpayer can track the refund application status under the refund tab on GST portal.

FAQs related to refund under GST

Q.1 Which form is used for file refund application?

Ans. RFD-01 form file for claim refund amount.

Q.2 What is the time limit to claim refund amount?

Ans. Refund application can be filed for 2 years from the relevant date.

Q.3 If wrongly paid excess GST(CGST/SGST/IGST) can claim refund?

Ans. Yes. If taxpayer pay excess GST can claim refund amount filing through RFD-01 application form.

Q.4 What is time limit to claim refund Where tax is paid on provisional basis?

Ans. 2 years from Date of adjustment of tax after the final assessment.

Q.5 What is the time limit to claim refund in case of Zero-rated supply of goods or services?

Ans. 2 years from Due date for furnishing of return under section 39 in respect of such supplies.

Q.6 How to file RFD-01 Refund application?

Ans. RFD-01 refund application file electronically through GST common portal.

Q.7 Can un-utilised balance of electronic credit be allowed as refund?

Ans. In case of zero rate supplies and Inverted duty structure can claim refund of unutilised balance of electronic credit.