System of Accounting:

The Income-tax Act allows deductions based on the accounting method followed by the assessee.

- Cash system of accounting: Deductions are allowed on an actual payment basis.

- Mercantile system of accounting: Deductions are allowed on an accrual basis.

Section 43B:

Section 43B provides a list of specified expenses for which deductions are allowed on a payment basis, even for those following the mercantile method of accounting.

Deductions are generally allowed if payment is made on or before the due date of furnishing the return of income.

Addition of Clause (h):

The Finance Act 2023 added clause (h) to Section 43B.

Clause (h) relates to any sum payable to a micro or small enterprise (MSE) beyond the time limit specified in Section 15 of the Micro, Small and Medium Enterprises Development Act 2006 (MSMED Act).

Deduction for MSMEs:

The deduction for payments to MSEs under Section 43B(h) is allowed on a payment basis. The payment should be made beyond the time limit specified in Section 15 of the MSMED Act.

Classified as micro and small enterprises

| Category of Enterprise | Criteria for Classification | Applicability of Section 43B(h) for Trade Payable |

| Micro Enterprise | Net investment in plant and machinery or equipment ≤ Rs 1 crore.- Net turnover does not exceed Rs 5 crores. | YES |

| Small Enterprise | Net investment in plant and machinery or equipment ≤ Rs 10 crore.

Net turnover does not exceed Rs 50 crores. |

YES |

| Medium Enterprise | - Net investment in plant and machinery or equipment ≤ Rs 50 crore Net turnover does not exceed Rs 250 crores. | No |

FAQ 1- What is the Timeframe under Section 15 of the MSMED Act for completing payments

| Section 43B(h) Reference | Time Limit under Section 15 of MSMED Act |

| Buyer's Payment Obligation | The buyer, as per the agreement in writing with the supplier, must make payment for supplied goods or services on or before the agreed-upon date, not exceeding 45 days. |

| If no agreement exists, payment must be made before the "appointed day." | |

| Definition - Appointed Day | "Appointed day" is defined in Section 2(b) of the MSMED Act as the day immediately after the expiry of the period of 15 days from the day of acceptance or the day of deemed acceptance of goods or services by a buyer from a supplier. |

FAQ – Whether invoice or purchase order be treated as an agreement ?

- The MSMED Act lacks a specific definition for the term 'agreement,' implying its inclusivity of both written and oral forms.

- Commonly understood, an agreement involves one party making an offer and another party agreeing to it.

- Typical agreement components encompass due dates, acceptance terms for goods/services, consequences for late payment, and provisions for dispute resolution.

- Documents such as invoices or purchase orders, containing these essential details, can be regarded as forming an agreement under the MSMED Act.

FAQ –Does the disallowance extend to amounts payable to retail traders or wholesalers?

As per government memoranda, Retail and Wholesale trade MSMEs can register on Udyam Registration Portal, but benefits are restricted to Priority Sector Lending only. According to the Office Memorandum dated 01.09.2021, such MSMEs, labeled as traders in Udyam Certificate, are not recognized as "Suppliers" for Section 15 and Section 43B(h), excluding certain benefits, including delayed payment provisions.

FAQ - Does the disallowance under Section 43B(h) extend to the GST component?

- Disallowance under Section 43B(h) for sums payable to Micro or Small Enterprises, including GST, is limited to the amount excluding GST when claimed as Input Tax Credit (ITC) in the books.

- If the buyer opts not to claim ITC under GST and treats it as an expense, deduction against GST will be allowed based on actual payment.

FAQ - Are the provisions of Section 43B(h) applicable to non-registered suppliers?

- Udyam Registration for MSMEs is optional as indicated by the term "may" in the notification; no mandatory requirement to upload documents.

- Section 43B(h) refers to Section 15 of MSMED Act, requiring Udyam Registration for the supplier's classification as a micro or small enterprise.

- Without Udyam Registration, Section 15 of MSMED Act may not be invoked for disallowance under Section 43B of the IT Act.

FAQ -Will the disallowance under Section 43B be enforced for supplies made prior to obtaining Udyam registration?

No, Section 43B(h) does not apply to payments related to supplies made before the Udyam Registration date. The entity is considered a micro-enterprise only from the registration date, as Udyam Registration does not have retrospective implications.

FAQ - Is Section 43B(h) applicable to outstanding amounts related to the acquisition of Capital Goods?

- Section 43B differs from Section 37(1) by not linking deductibility to the capital vs. revenue expenditure distinction.

- Section 43B applies to payable sums eligible for deduction under the Income Tax Act.

- Section 43B(h) is applicable to amounts owed to micro or small enterprises for the purchase of capital goods, allowing for 100% deductions under Sections 30 to 36.

- Disallowance under Section 43B(h) doesn't extend to depreciation if a 100% deduction for capital expenditure isn't permissible, as depreciation is not a sum payable for which deduction is otherwise allowable.

FAQ What if the cheque is handed over on or before the due date, but it is realised after the due date?

In accordance with established commercial practices, if a cheque is given to the payee and doesn't bounce afterward, the payment is considered made on the date of cheque handover. Consequently, such transactions should be treated as meeting the payment deadline.

FAQ - What steps can be taken to authenticate the authenticity of the Udyam Number provided by the supplier, whether it's printed on the invoice or presented in another manner?

Search his Udyam Registration Number on the Udyam Portal under the newly enabled “Verify Udyam Registration Number” at the following link: https://udyamregistration. gov.in/udyam_verify.aspx

FAQ - Can one obtain the Udyam Registration details of a supplier by searching for their name or PAN on the Udyam portal?

No. if one knows his Udyam Registration Number he can check status..

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Topic Covers:

- Introduction

- Chargeability

- Exemption from tax

- Tax treatment

- Rural Agriculture Land

- Conclusion

Introduction:

The most common and frequent question is regarding the tax treatment of immovable property received as a gift. In this article, we understand the taxability, exemptions i.e. when this transaction is not taxable, and other relevant provisions. Under the Income Tax Act, taxation of gifts is governed by section 56.

Chargeability:

According to Section 56(2)(x) of the Income Tax Act, Income shall be chargeable to tax where

Any person receives from any person,

Any sum of money without consideration exceeding ₹ 50,000

Any immovable property without consideration or adequate consideration

The provision of this section applies to every person i.e. individual, HUF, Firm, company etc. However, exemption for certain transactions has been provided through the provison of the section.

Immovable property received as a gift by an individual or HUF

Immovable property being land or building or both received without consideration by an individual or HUF will be charged to tax If the following conditions are satisfied:

Individual/HUF received an Immovable property.

The stamp duty value of such immovable property exceeds ₹ 50,000.

The immovable property is a capital asset within the meaning of section 2(14) for such an individual or HUF.

Exemption from tax

Immovable property received by an individual or HUF without consideration (i.e. as a gift) is not chargeable to tax

In the following cases, the gift of immovable property will not be charged to tax.

Property received from relatives.

Relative for this purpose means:

In the case of an Individual

Spouse of the individual;

Brother or sister of the individual;

Brother or sister of the spouse of the individual;

Brother or sister of either of the parents of the individual;

Any lineal ascendant or descendent of the individual;

Any lineal ascendant or descendent of the spouse of the individual; [As amended by Finance Act, 2023]

Spouse of the persons referred to in (b) to (f).

- b) In the case of HUF, any member thereof.

2) Property received on the occasion of the marriage of the individual.

3) Property received under will/ by way of inheritance.

4) Property received in contemplation of the death of the donor.

5) Property received from a local authority [as defined in Explanation to section 10(20) of the Income-tax Act].

6) Property received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referred to in section 10(23C) [w.e.f. AY 2023-24, this exemption is not available if the property is received by a specified person referred to in section 13(3)].

7) Property received from a trust or institution registered under section 12AA or section 12AB [w.e.f. AY 2023-24, this exemption is not available if the property is received by a specified person referred to in section 13(3)].

Tax treatment:

Gift received by an individual on the occasion of his marriage will not be charged to tax

A Gift (i.e. immovable property received without consideration) received by an individual on the occasion of his marriage is not charged to tax. Apart from marriage gifts received by an individual will be chargeable to tax. Hence, immovable property received on occasions like birthdays, anniversaries, etc., without any consideration will be charged to tax.

Gift from friends

Immovable property received without consideration from relatives is not chargeable to tax (list of relatives has been discussed above). Friends do not fall in the above list and hence, gifts received from friends will be charged to tax (if other criteria of taxing gifts are satisfied).

Gift of immovable property located abroad

If the conditions of the taxability of the gift of immovable property are satisfied, then a gift of immovable property without consideration or with an inadequate will be charged to tax whether the property is located in India or abroad.

Illustration:

An Individual received a gift of a flat from his friend. The stamp duty value of the flat is ₹ 94,000. In this case, whether the total value of the gifted property will be charged to tax or only the value exceeding ₹ 50,000 will be charged to tax?

If the conditions of the taxability of a gift of immovable property are satisfied, then the entire value of stamp duty received without consideration, i.e., received as a gift will be charged to tax. Hence, in this case, the entire stamp duty value of property, i.e., ₹ 94,000 will be charged to tax.

Illustration

On 1-6-2023, Mr. Pratik gifted his house to his friend Mr. Ram. The market value of the building is ₹ 6,40,000 and the value adopted by the Stamp Valuation Authority for charging stamp duty is ₹ 7,20,000. Advise Mr. Ram regarding the tax treatment in this case.

In the given case, the property is a capital asset for Mr. Ram, the property is received from his friend (friend is not covered in the definition of relative), also the property is not received on the occasions of marriage and the stamp duty value of the property exceeds ₹. 50,000. This transaction does not fall under exemption criteria.

In other words, all the conditions that are required to tax the gift are satisfied and hence the stamp duty value of the property i.e. ₹ 7,20,000 will be charged to tax in the hands of Mr. Ram, under the head “Income from other sources”

Rural Agriculture Land

The meaning of the term "property" is given in Clause (d) of Explanation to Section 56(2)(vii), immovable property means any land, building, or both. While defining the term "property" the word 'capital asset' has also been used in the explanation.

On this basis, it is being argued that, if any property is not a capital asset as per the definition of section 2(14), the same is not covered under the definition of property and therefore, provisions of section 56(2)(x) are not applicable. Examples of such cases are agriculture land, stock-in-trade, assets of personal effects etc.

The ITAT Jaipur Bench dealt with this issue in the case of 'ITO v. Trilok Chand Sain’ in the context of agricultural land. It has been held by the Hon'ble Bench that the definition of the term capital asset in section 2(14) of the Act is not relevant for the purpose of section 56(2)(vii) of the Act.

Conclusion

Section 56(2)(x) of the Income Tax Act states that income is chargeable to tax when an individual or Hindu Untouchable (HUF) receives money without consideration exceeding ₹ 50,000 or immovable property without consideration or adequate consideration. However, exemptions are available for certain transactions. Gifts of immovable property are not chargeable to tax in certain cases, such as from relatives (i.e. in blood relation), marriages, or inheritances. Gifts received on occasions like birthdays, anniversaries, or from friends are also taxable. Gifts of immovable property located abroad are also taxed. One should take a piece of advice from the experts before entering into such transactions.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

According to the RBI press release dated November 1, 2023, “Further, members of the public from within the country can send Rs 2000 banknotes through India Post from any post office in the country, to any of the RBI Issue Offices for credit to their bank accounts in India. The format of application for credit into the bank account is enclosed.”

Form For Exchanging Rs 2000 Notes ![]()

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

All GST-registered businesses are required to file monthly or quarterly GST returns and annual GST returns based on the type of business. This GST return filing is done online on the GST portal.

What is GST Return?

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer is required to file with the tax administrative authorities. This is used by tax authorities to calculate net tax liability.

Under GST, a registered dealer has to file GST returns that broadly include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Returns to be filled by taxpayers who are registered as a Normal Taxpayer

- GSTR-1: GSTR-1 is a return in which registered persons are required to fill details of outward supplies made. It does not involve making payment of tax; rather, it only requires providing details of the supplies made. The payment of tax is to be done in GSTR-3B.

Due Date:

- Registered persons who file monthly returns are required to file the GSTR-1 return for the tax period by the 11th of the succeeding month or earlier.

- Registered persons who file returns on a quarterly basis, are required to file the GSTR-1 return for the tax period by the 13th of the succeeding month or earlier.

Example: If you need to file a return for August 2023, the due date would be September 11, 2023.

- GSTR-3B: GSTR 3B is a self-declared summary return. In this return, the taxpayer is required to provide summary figures of sales, ITC claimed and net tax payable. This return is filed monthly or quarterly based on turnover limits.

Due Date:

- The due date for filing monthly GSTR 3B is the 20th day of the following month.

- The due date for filing Quarterly GSTR 3B is the 22nd day of the following month.

Example: If you need to file a return for August 2023 the due date would be 20th September 2023.

- GSTR-3B: All registered persons whose aggregate turnover during the year exceeds Rs. 2 Crore are required to furnish the annual return FORM-GSTR-9 electronically on the common portal by the 31st of December of the following financial year or earlier as notified by the commissioner through facilitation centres.

Example: If you need to file a return for the financial year 2022-23, the due date would be December 31, 2023. - GSTR-9C: All registered persons whose aggregate turnover during the year exceeds Rs. 5 Crore are required to furnish the annual return FORM-GSTR-9C electronically on the common portal by the 31st of December of the following financial year or earlier as notified by the commissioner through facilitation centres.

Example: If you need to file a return for the financial year 2022-23, the due date would be December 31, 2023.

Returns to be filled by taxpayers who are registered as a Composition Taxpayer - CMP-08: Composition taxpayers are required to show details of their quarterly sales and make tax payments in the quarterly statement. Details of inputs are not shown in this return.

Due Date:

The due date for filing this return is the 18th day of the month following the end of the quarter.

Example: The due date for filing the form for the April-23 to June-23 quarter will be July 18, 2023.

- GSTR-4: All registered persons who is registered under the composition scheme, regardless of their turnover, are required to furnish the annual return FORM-GSTR-4 electronically on the common portal by the 30th of April of the following financial year or earlier as notified by the commissioner through facilitation centres.

Example: If you need to file a return for the financial year 2022-23, the due date would be April 30, 2023.

Other Returns:

- GSTR-5: Form GSTR-5 is a return to be filed by all persons registered as Non- Resident Taxpayer (NRTP). This can either be done online or from a tax facilitation centre. This form contains the details of all outward supplies and inward supplies made and received by the non-resident taxpayer.

Form GSTR-5 is a return to be filed by all persons registered as Non- Resident Taxpayer (NRTP).

- GSTR-6: Form GSTR-6 is a monthly return to be filed by all the Input Service Distributors (ISD) for distribution of credit (ITC) amongst its units. Only those persons who are registered as Input Service Distributor (ISD) need to file Form GSTR-6. It is a mandatory return, to be filed on monthly basis. A ‘Nil’ return must be filed in case of no ITC being available for distribution or no ITC is being distributed during the month.

Due Date:

If you need to file a return for the month of April 2023, the due date would be on or before the 13th May 2023.

- GSTR-7: Form GSTR-7 is a return which is required to be filed by the persons who deduct tax at the time of making/crediting payment to suppliers towards the inward supplies received. Tax deductor has a legal obligation:

- To declare his TDS liability for a given period (monthly) in Form GSTR-7;

- Furnish details of the TDS deducted under three major heads viz., Central tax, State/UT tax and Integrated tax in accordance with that return;

- File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

- Issue TDS certificate to the deductee.

Due Date:

The due date for filing Form GSTR-7 is 10th day of the succeeding month.

- GSTR-8: Form GSTR-8 is a Statement of TCS (Tax Collected at Source) to be filed by E Commerce Operators. Form GSTR-8 contains the details of taxable supplies and the amount of consideration collected by such operator pertaining to the supplies made by other suppliers through such e commerce operator and amount of TCS collected on such supplies.

Due Date:

The due date for filing Form GSTR-8 for a particular tax period is 10th day of the succeeding month or as amended by Government by notification from time to time.

- GSTR-10: A taxable person whose GST registration is cancelled or surrendered has to file a return in Form GSTR-10 called as Final Return. This is statement of stocks held by such taxpayer on day immediately preceding the date from which cancellation is made effective.

Due Date:

This return should be filed within three months of the date of cancellation or date of order of cancellation, whichever is later.

- GSTR-11: Form GSTR-11 is a statement of inward supply of goods or services or both received by Unique Identity Number (UIN) holders, which is required to be filed by them on a quarterly basis.

Form GSTR-11 is to be filed on Quarterly basis. However, the form is not mandatory to be filed for such period in which there are no inward supplies received by such UIN holder. There is no due date for Filing of Form GSTR-11. UIN holder can file Form GSTR-11 any time after end of the relevant Quarter.

FAQ’s

Q-1: What is GST Return?

A GST return is a document containing details of income that a taxpayer is required to file with the tax authorities periodically. It includes details of sales, purchases, output GST (tax collected on sales), and input GST (tax paid on purchases).

Q-2: What are the types of GST returns?

There are various types of GST returns such as GSTR-1 (for outward supplies), GSTR-3B (monthly summary return), GSTR-4 (for composition dealers), GSTR-9 (annual return) etc.

Q-3: How to file GST return?

GST return filing can be done online through the GST portal by logging in with valid credentials and filling out the required forms with accurate details of transactions.

Q-4: What is the GST filing process?

The GST filing process involves logging into the GST portal, selecting the appropriate return form, filling in the details, verifying the information and then submitting the return.

Q-5: What is the due date for GST return filing?

The due dates for GST return filing vary depending on the type of return and the turnover of the taxpayer. It's important to check the GST portal or consult with a tax professional for specific due dates.

Q-6: What are the late fees for delayed GST return filing?

Late fees for delayed GST return filing vary based on the type of return and the number of days the return is overdue. There are late fees calculators available online for GSTR-3B, GSTR-1, GSTR-4, etc.

Q-7: What is the inward supply in GST?

Inward supply, also known as purchase or input supply, refers to the goods or services purchased by a taxpayer from a registered supplier within the same state or from outside the state.

Q-8: What are the GST filing charges?

GST filing charges may vary depending on the service provider. Some professionals charge on a monthly basis, while others may have fixed charges per return filing.

Q-9: What is the GST quarterly return due date?

GST quarterly return due dates vary depending on the type of return and the taxpayer's turnover. It's essential to refer to the GST portal or consult with a tax advisor for specific due dates.

Q-10: What is the last date of GST return filing?

The last date for GST return filing varies depending on the type of return and the taxpayer's turnover. It's crucial to check the GST portal or consult with a tax professional for specific deadlines.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

What is E-invoicing?

E-invoice is also known as E-invoicing is a system in which all Business-to-Business (B2B) invoices and other documents are electronically uploaded and authenticated on the government's GST Invoice Registration Portal (IRP) and after the successful verification of the invoice, a unique Invoice Reference Number (IRN) is generated by the IRP portal.

Additionally, it is mandatory for the applicable businesses to generate a QR code for the e-invoice. Further, together with the IRN and QR code, a digitally signed invoice would be available for the supplier. This is issued to the product's recipient and is known as the e-invoice or electronic invoice. E-invoicing eliminates the need to create new invoices on government portals; instead, it involves uploading GST invoices issued by businesses to the IRP Portal through designated software.

History of E-Invoicing :

In the 35th meeting of the GST Council held on 21st June 2019, the suggestion of an e-invoicing under GST was coined, which was hence, implemented on October 1, 2020, in a voluntary GST-phased manner for the online generation of B2B e-invoices under GST by the registered person with an annual aggregate turnover of over Rs. 500 crore.

This e-invoicing turnover limit was lowered to Rs. 100 crore on January 1, 2021. In April 2021 this limit was further reduced to Rs. 50 crore. Further e-invoicing turnover limit was reduced to Rs. 20 crore on April 1, 2022, and again e-invoicing turnover limit was reduced to Rs.10 crore on October 1, 2022. Currently, the turnover limit for e-invoicing is Rs. 5 crore as per Notification No. 10/2023–Central Tax dated May 10, 2023.

| Phase | Applicable to taxpayers with an aggregate turnover exceeding | Applicable Date | Notification

Number |

| I | Rs. 500 crore | 01.10.2020 | 61/2020 –Central Tax and 70/2020 – Central Tax |

| II | Rs. 100 crore | 01.01.2021 | 88/2020 - Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 - Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 - Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 - Central Tax |

| VI | Rs 5 crore | 01.08.2023

|

10/2023 - Central Tax |

Applicability of E-invoicing?

The registered person whose aggregate turnover in any preceding financial year exceeds Rs. 5 crores from F.Y. 2017-18 to 2022-23. And where the supply is made to the registered person or exported outside India then an e-invoicing provision is applicable.

The aggregate turnover limit includes the turnover of all GSTINs under a single PAN across India.

Benefit of E-invoicing.

- E-invoicing reduces reporting time.

- A sale and purchase register can be easily created from E-Invoicing data and it also makes GST return filing easier.

- E-way bills can be easily generated using E-Invoicing data.

- Invoices issued by the supplier can be tracked in real-time.

- Reconciling books of accounts and GST returns requires minimal matching of data.

- The tax filing process has become easier due to E-Invoicing.

- Fake invoices can be easily identified through e-invoicing. Therefore, it indirectly prevents fake invoices from being generated.

Persons exempted from E- Invoicing?

The following persons are exempt from an e-invoicing provision irrespective of their turnover.

- SEZ units.

- An insurer or a banking company or a financial institution, including a non-banking financial company.

- Goods Transport Agency.

- Suppliers of passenger transportation services.

- Suppliers of services by way of admission to an exhibition of cinematograph films on multiplex screens.

- A government department or a Local authority

- Supplier of OIDAR service located in non-taxable territory.

Can an e-invoice be cancelled partially/fully?

An e-invoice cannot be cancelled partially. If you want to cancel the e-invoice then it will be completely canceled. If the e-invoice has been cancelled then within 24 hours of cancellation IRN no. has to be reported. But if cancelled after 24 hours then it will be cancelled manually.

Penalty –

Where a taxable person fails to issue an invoice in accordance with the provisions of this Act or the rules made there under then shall be liable to a penalty which may extend to Rs. 50000 ( Rs. 25000 CGST and Rs. 25000 SGST)

Conclusion

E-invoicing has emerged as a game-changer in India's GST system, simplifying the invoicing process and promoting tax compliance. This comprehensive guide equips readers with the knowledge and understanding required to navigate the e-invoicing landscape in India. By embracing e-invoicing, businesses can optimize their invoicing processes, reduce errors, enhance data accuracy, and ensure compliance with GST regulations, ultimately driving efficiency and success in the GST era.

FAQs-

- Is the e-invoicing provision applicable for NIL-rated or wholly-exempt supplies?

Ans: No. e-invoicing provisions are not applicable for NIL-rated or wholly-exempt supplies.

- What are the benefits of e-invoicing?

Ans: The benefits of e-invoicing are E-way bill can be easily generated using E-Invoicing data. Invoices issued by the supplier can be tracked in real-time.

- What is the current e-invoice limit?

Ans. Rs. 5 crore is the current e-invoice limit.

- Who is required to generate e-invoices?

Ans: Registered person whose aggregate turnover in any preceding financial year exceeds Rs. 5 crore from F.Y. 2017-18 to 2022-23. And where the supply is made to the registered person or exported outside India then the e-invoicing provision is applicable

- Is there a time limit for generating e-invoices?

Ans: Yes, Taxpayers whose AATO exceeds Rs. 100 crore within 30 days to report e-invoices and credit/debit notes on the IRP.

- Are export invoices subject to e-invoicing?

A: No, export invoices are exempt from e-invoicing.

- Is Supply made by GTA e-invoicing provision applicable?

Ans. The E-invoicing provision is not applicable to GTA.

- What is the IRP?

Ans. The Invoice Registration Portal (IRP) is a Government platform where taxpayer generate and report e-invoices.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Introduction:

Under income tax turnover needs to be calculated to check the applicability of the provisions of the income tax. The threshold for tax audit is provided under section 44AB of the Income Tax Act. Different threshold limits are provided for person carrying business, person carrying profession and person opted for presumptive taxation. Difficulty arises when a person is engaged in more than one business or profession. In this article we discuss case where a person is engaged in a specified profession and a normal business.

Specified Profession: Profession mentioned under section 44AA are specified professions. Specified professionals include any person engaged in Legal, Medical, Engineering, Architectural, Technical Consultancy, Interior decoration, Film artist, Authorized Representative, Accountancy Profession, Company secretary, or Information Technology.

Normal Business or Non-specified professions: Profession or business which is not a specified profession under section 44AA.

Applicability of provision of sec. 44AB :

Section 44AB provides that

- “person carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year” (the limit will be ₹ 10 Cr. with some conditions)

- “person carrying on profession shall, if his gross receipts in profession exceed fifty lakh rupees in any previous year; or”

Let’s take the case of an assessee who is engaged in profession as well as in business. An audit for profession is mandatory when the gross receipts from the profession exceed ₹ 50 lakhs. And audit of business is required when turnover of the business exceeds the ₹ 1 Cr or 10Cr. (as the case may be).

So the question is how to calculate turnover for deciding the applicability of section 44AB i.e. audit needs to be done or not?

As per para 5.16 of the “Guidance Note on Tax Audit under Section 44AB of the Income-tax Act, 1961” published by the ICAI

In case, of an assessee carrying on business and at the same time engaged in a profession then what are the limits applicable to him under section 44AB for getting the accounts audited. Separate limit for profession and business will be considered. If the gross receipts or turnover exceed the relevant limit then it will be necessary for the assesee to get his accounts of the profession as well as the accounts of the business, audited.

Further where the assessee engaged in a profession specified under section 44AA has opted to declare profit from the profession under section 44ADA but declare profit lower than deemed profit and gain then it will be necessary for the assesee to get his accounts of the profession as per the following provision of section 44AB.

(d)“carrying on the profession shall, if the profits and gains from the profession are deemed to be the profits and gains of such person under section 44ADA and he has claimed such income to be lower than the profits and gains so deemed to be the profits and gains of his profession and his income exceeds the maximum amount which is not chargeable to income-tax in any previous year;”

So in the above case even though the gross receipts from the profession or turnover of the business of the assessee not exceeded the specified threshold limit, it is mandatory for the assessee to get books of accounts audited of profession as well as of business.

It is to be noted that if the assessee is engaged in the profession specified in section 44AA and a business. The assessee has option to declare profit from the profession as per section 44ADA. However he cannot take benefit of section 44AD in this case.

If the assessee is engaged in a profession which is not a profession specified in section 44AA and a business. The assessee has option to declare profit from his business as per section 44AD by fulfilling the conditions of this section.

The above provision and applicability can be summarised in the following table:

| Case | 1 | 2 | 3 | 4 | 5 | 6 |

| Turnover (TO) in Business in ₹ | 72 lakhs | 80 Lakhs | 172 lakh | 85 Lakhs | 85 Lakhs | 105 lakhs |

| Gross receipts (GR) in profession in ₹ | 45 Lakhs | 54 Lakhs | 42 Lakhs | 54 Lakhs | 54 lakhs | 32 |

| Profession specified under 44AA | Yes | Yes | No | No | No | Yes |

| Opted for 44AD or 44ADA | Yes ADA | No (GR limit exceeds) | Yes 44AD | No | Yes 44AD | No |

| Declare profit as per 44AD or 44ADA | Yes | NA | Yes 44AD | NA | No (Declared lower profit) | NA |

| Requirement of Audit | No | Yes [44AB (b)] | No | Yes [44AB (b)] | Yes [44AB (e)] | Yes [44AB(a)] |

Conclusion:

It can be conclude that, whether the audit is mandatory or not is depend not only on the turnover limit but also on the other relevant conditions like taxpayer has opted for presumptive or not, if opted profit is declared as per provisions or not. To comply with the law and prevent from the penalty provisions, one should check all the criteria and then decide the applicability of the audit.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application.

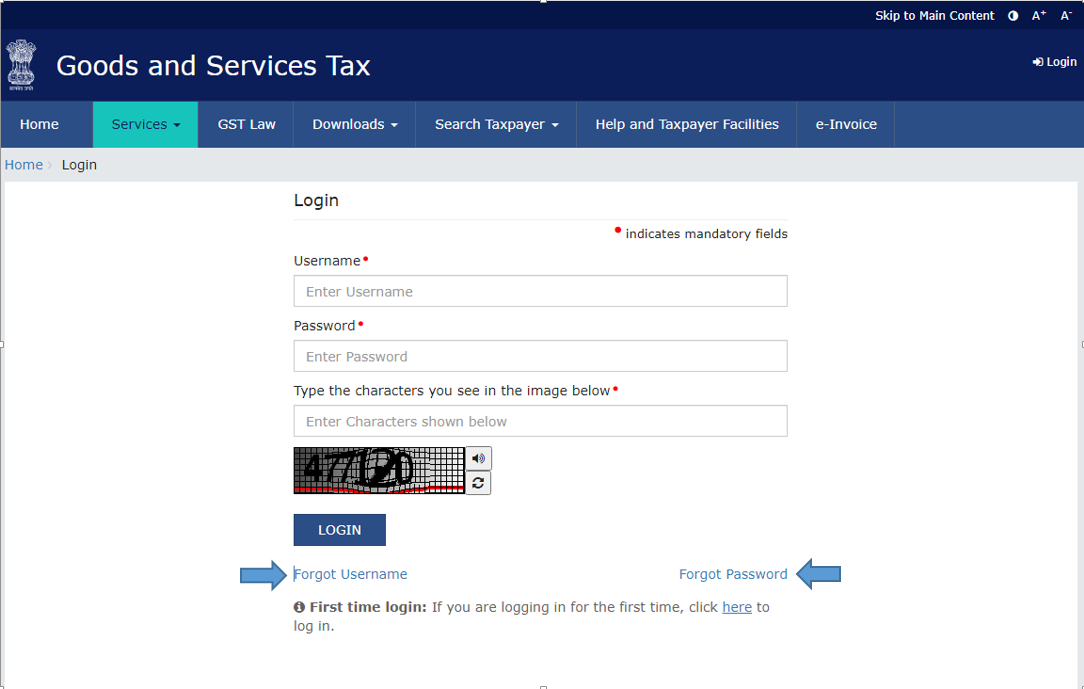

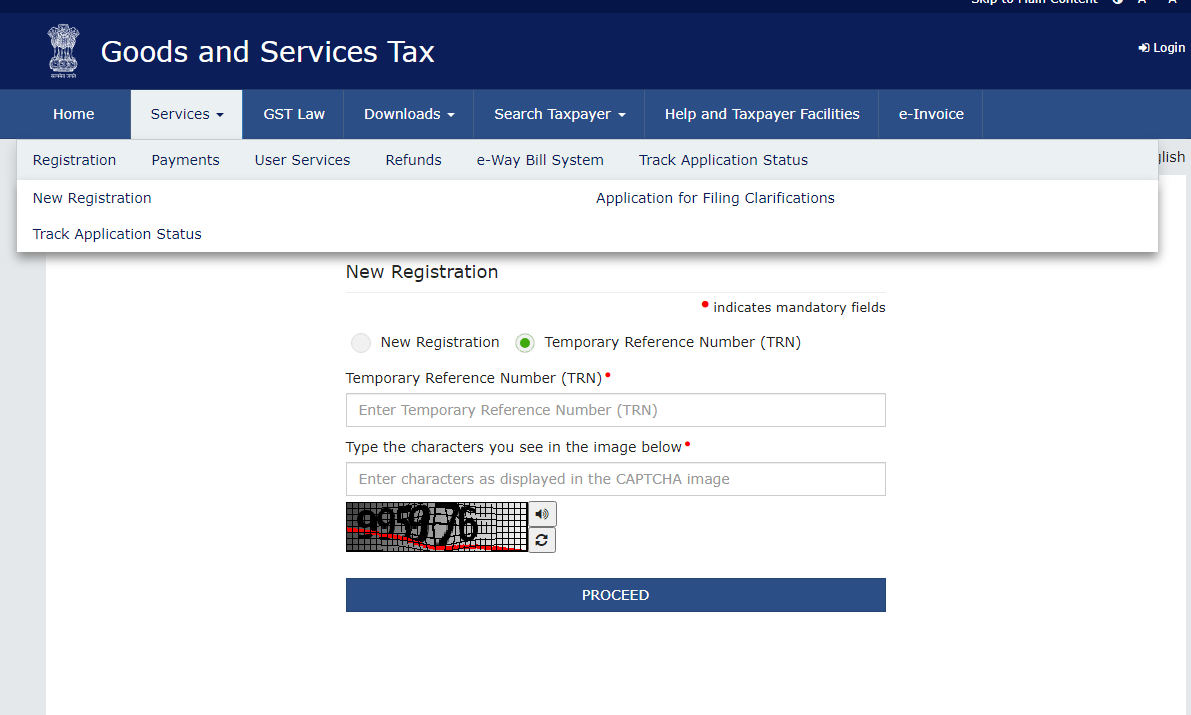

How do I perform my initial login on the GST Portal as a new taxpayer using the Provisional ID or GSTIN and the provided password?

As a new taxpayer, to login first time to the GST Portal with GSTIN and password, you need to perform the following steps:

- Navigate to the web address https://www.gst.gov.in/ to access the GST Home page.

- Click the Login link given in the top right-hand corner of the GST Home page.

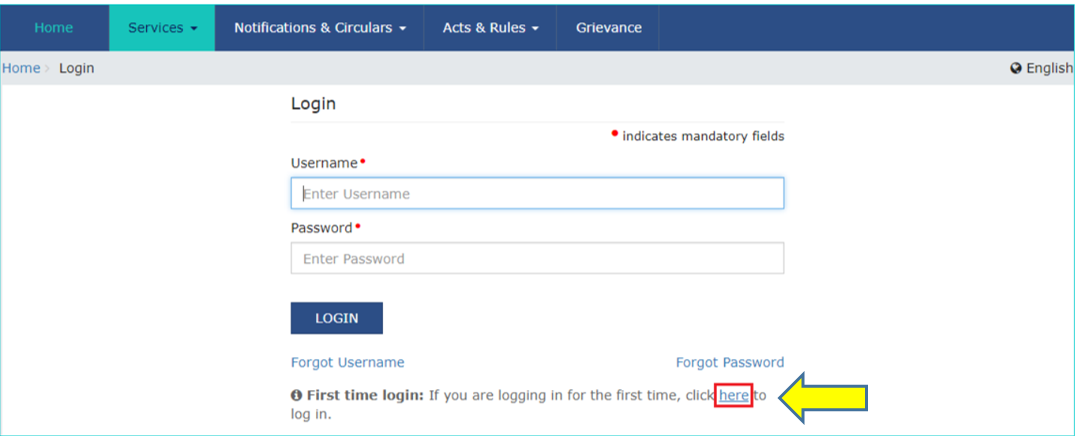

- The Login page is displayed. Click the here link in the instructions at the bottom of the page that says “First time login: If you are logging in for the first time, click here to login”.

4.The New User Login Page is displayed. In the Provisional ID / GSTIN/ UIN field, type the Provisional ID/ GSTIN/ UIN received on your e-mail address.

5.In the Password field, type the password received on your e-mail address.

6.In the Type the characters you see in the image below field, type the captcha text displayed in the box.

7.Click the LOGIN button.

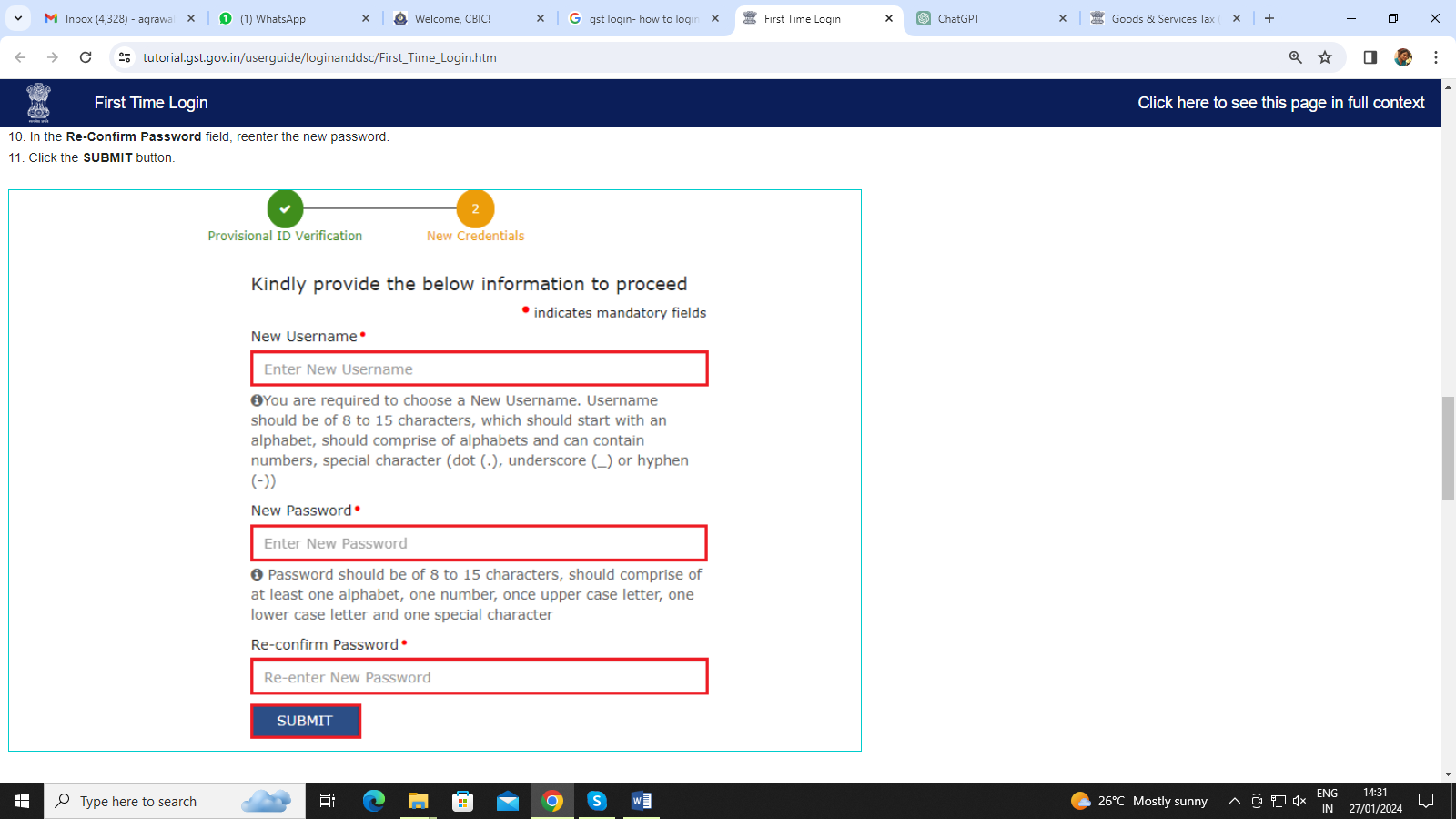

8.The New Credentials page is displayed. In the New Username field, enter the username that you want to create to login to the GST Portal.

9.In the New Password field, enter a password of your choice that you will be using from next time onwards

10. In the Re-Confirm Password field, re-enter the new password.

11.Click the SUBMIT button.

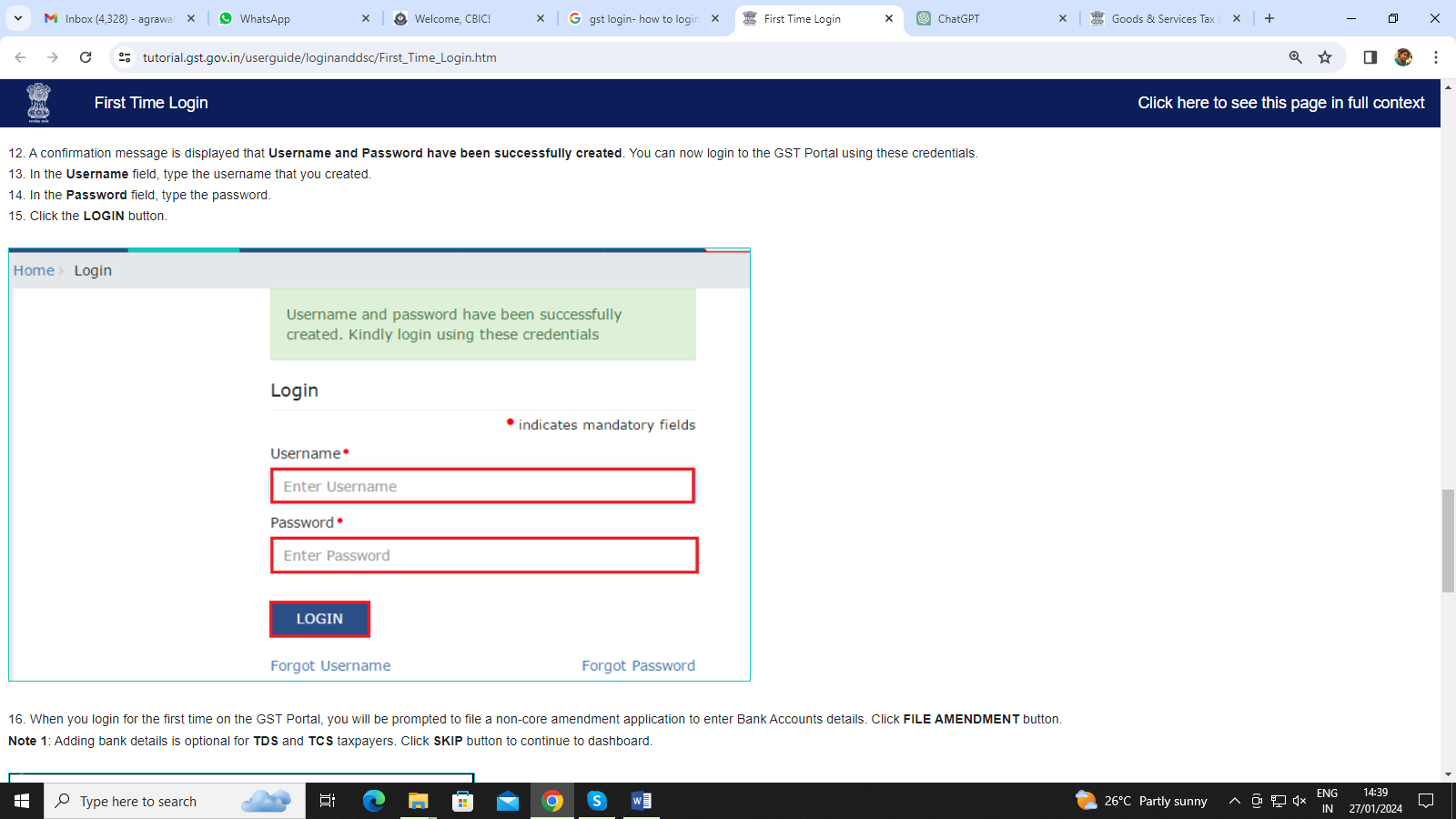

12. A confirmation message is displayed that Username and Password have been successfully created. You can now login to the GST Portal using these credentials.

13. In the Username field, type the username that you created.

14. In the Password field, type the password.

15. Click the LOGIN button.

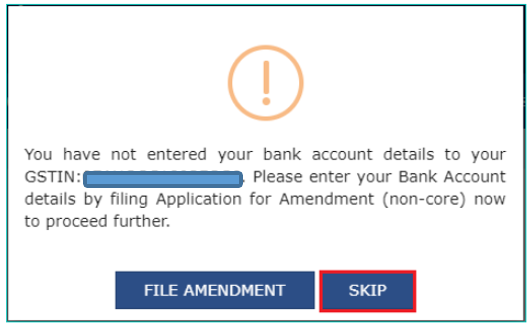

16. When you login for the first time on the GST Portal, you will be prompted to file a non-core amendment application to enter Bank Accounts details. Click FILE AMENDMENT button.

Note: - All Registered Taxpayers are required under the provisions of CGST Act, 2017 and the corresponding Rules framed thereunder to furnish details of their bank account/s within 30 days of the grant of registration or before the due date of filing GSTR-1/IFF, whichever is earlier.

FAQs on GST Login :

Q : What is GST login?

A : GST Login is a process by which Taxpayers can login to the GST portal to file their returns, can make GST payments and can perform other GST-related activities.

Q : How do I login to the GST portal?

A : To login to the GST portal, Taxpayers are required to visit www.gst.gov.in and click on the 'Login' button. Then, enter your username, password, and captcha code to access your account.

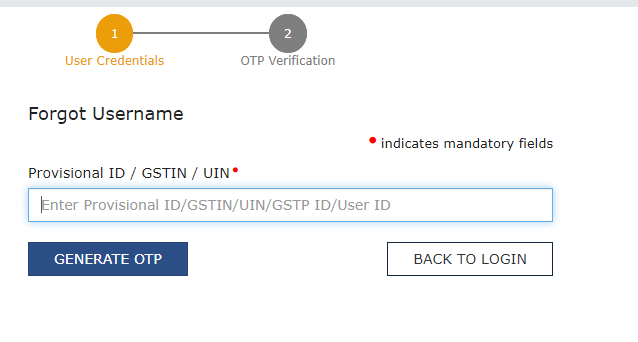

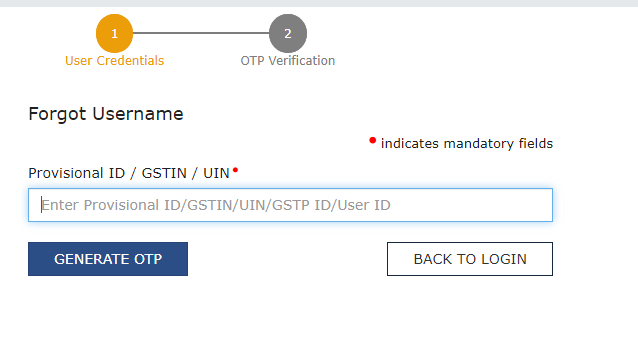

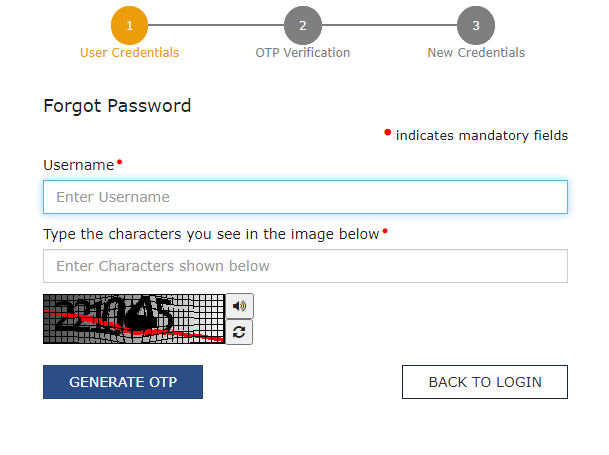

Q : What to do in case of I forget my GST login details?

A : If you forget your GST login details, then click on the 'Forgot Username' or 'Forgot Password' link on the GST portal login page. You have to enter Provisional ID / GSTIN / UIN for your username and for forgot password you have to enter a username. Then you will receive OTP on mobile/mail ID. By this way, you can easily get your login credential details.

Forgot Username :

Forgot Password

Forgot Password

Q : Is there a specific GST login ID for login to GST Portal

A : Yes, GSTN provides every registered taxpayer a unique GSTIN (Goods and Services Tax Identification Number), by which a user can access to GST portal.

Q : Can I login to the GST portal using my TRN?

A : Yes, you can login to the GST portal using your Temporary Reference Number (TRN), if you are a for new GST number and have not received your GST Registration.

Q : I am facing issues with GST login. What should I do?

A : If you facing any issues in respect of GST login, then you can contact the GST helpdesk for technical issues or seek assistance from a GST practitioner/Tax professionals for resolution.

Q : What is ARN (Application Reference Number)?

A : ARN or Application Reference Number, is a unique identifier assigned to each application made on the GST portal. It is used to track the status of the GST application.

Q: How to check & track GST Status?

A : To track the status of your GST application, you can use the ARN (Application Reference Number) provided during the application process. Visit the GST portal and use the "Track Application Status" option, where you will need to enter your ARN to check the current status of your application.

Q: What is Full Form of ARN in GST?

A : ARN in the context of GST stands for "Application Reference Number." It is a unique identifier assigned to each GST application for tracking purposes.

Q: How to check GST Status by ARN ?

A : You can check the status of your GST application by using the ARN on the GST portal. Navigate to the "Track Application Status" option and enter your ARN to get the current status of your application.

Q: Can I login the GST portal using TRN?

A : No, you cannot log on the GST portal using the Temporary Reference Number (TRN). However, you can track your registration application status using TRN by following these steps:

- Visit https://www.gst.gov.in/

- Click Services> Registration> New Registration

- Select the ‘Temporary Reference Number’ option.

- Click proceed.

- Verify your credentials using the OTP received on the registered mobile number and e-mail ID.

- ‘My Saved Application’ page will be displayed, wherein you can track the status of your application.

Once you complete the registration process, you will receive the credentials on your registered e-mail ID to login to the GST portal.

Q: How to change GST Mobile Number?

A : To change the mobile number in your GST registration, log in to the GST portal, go to the "Services" tab and select "Amendment of Registration Non-Core Fields." Update the mobile number in the appropriate section.

Q: What if GST Server down?

A : If the GST server is down, it may temporarily affect your ability to access the portal or perform transactions. In such cases, it's advisable to try again later.

Q: How to check Annual Turnover in GST Portal?

A: To check the annual turnover in the GST portal, log in to your account, go to the "Services" tab, and select "Returns Dashboard." The annual turnover can be found in the GSTR-3B return.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

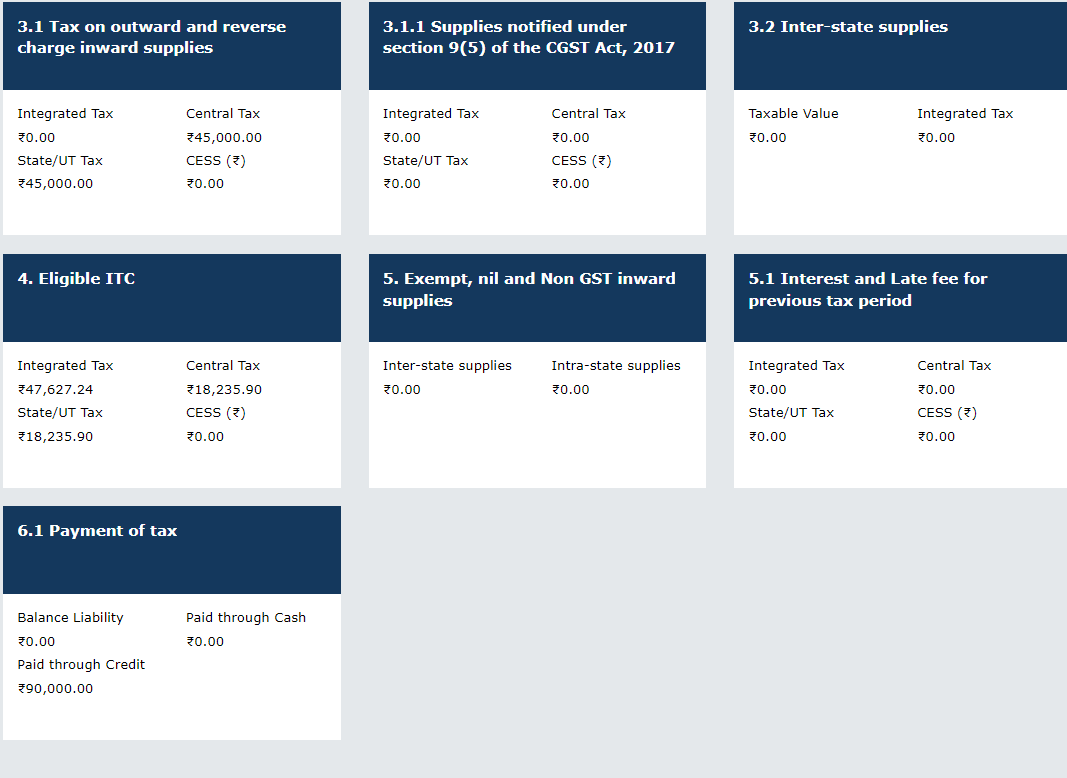

What is GSTR-3B?

GSTR-3B is a summary return and the purpose of the return is for taxpayers to declare their summary GST liabilities for a particular tax period and discharge these liabilities. A normal taxpayer is required to file Form GSTR-3B returns for every tax period.

Who should file GSTR-3B?

Every individual or entity who is registered under GST is obligated to file GSTR-3B, regardless of whether any transactions occurred during the specified period. For those, who have no transactions to report (nil GSTR-3B filers), there is an option to file through SMS.

The following registered persons are not required to file GSTR-3B:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

When is the due date of GSTR-3B?

The due date to file Form GSTR-3B is based on aggregate turnover. Businesses with sales of up to Rs.5 crore have an option to file quarterly returns under the QRMP scheme and the due date is 22nd/24th of the month succeeding the end of the relevant quarter.

In the case of persons who file GSTR-3B on a quarterly basis, due dates have been divided into two groups. State group south and State group north.

- For South states group due date is 22nd of the month succeeding the end of the relevant quarter.

- For North states group due date is 24th of the month succeeding the end of the relevant quarter.

Following States are included in the South State Group-

Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli, Daman and Diu, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Pondicherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh

Following States are included in the North State Group-

Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Mizoram, Manipur, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha.

Whereas, those taxpayers who do not opt for the QRMP scheme or have a total turnover above Rs.5 crore must file the return every month on or before the 20th of the succeeding month.

For example, Form GSTR-3B for the calendar month of April 2023 needs to be filed by 20th May 2023. Form GSTR-3B for the quarter of April to June 2023, needs to be filed by 22nd / 24th July 2023.

| For businesses with turnover | Month/Quarter | Due Date |

| More than Rs.5 crore | April 2023 | 20th May 2023 |

| May 2023 | 20th June 2023 | |

| June 2023 | 20th July 2023 | |

| Turnover up to Rs.5 crore & opted QRMP Scheme | April-June 2023 | 22th /24th July 2023 |

Late fees for filing of GSTR-3B?

Every registered taxpayer is required to file a GSTR-3B return within the prescribed time limit. If GSTR-3B returns are not filed within time then late fees is levied.

Taxpayer with Nil GST liability late fees is Rs. 20 per day (Rs.10 CGST and Rs. 10 SGST) maximum late fees is Rs. 500 (Rs. 250 CGST and Rs. 250 SGST)

Taxpayers having an aggregate turnover of up to Rs. 1.5 Crores in the preceding F.Y. late fees is Rs. 50 per day (Rs.25 CGST and Rs. 25 SGST) maximum late fees is Rs. 1000 (Rs. 500 CGST and Rs. 500 SGST)

Taxpayers having an aggregate turnover of more than Rs. 1.5 Crores and up to Rs. 5 crores in the preceding F.Y. late fees is Rs. 50 per day (Rs.25 CGST and Rs. 25 SGST) maximum late fees is Rs. 5000 (Rs. 2500 CGST and Rs. 2500 SGST)

More ever penal interest at the rate 18% per annum will be charged on the outstanding tax amount.

After filing the GSTR-3B return can we revised it ?

No, you cannot revise the GSTR-3B return after submitted. So before filing GSTR-3B make sure that all the details mentioned in GSTR-3B are correct.

How to file GSTR-3B?

GSTR-3B is a return that must be filed by every registered GST taxpayer. This return is filed either on a monthly or quarterly basis and provides comprehensive information about all outward supplies.

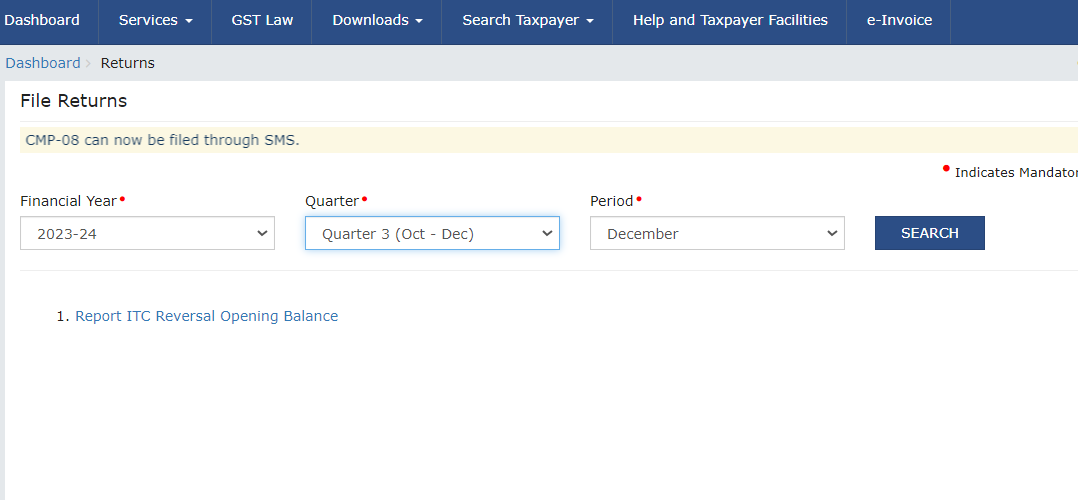

To file GSTR-3B, first, you need to login to the GST Portal.

Step-1: Under Service tab >> Return tab >> Select Returns dashboard

Step-2: Select Financial Year, Quarter/Month & Period & Click on Search Tab.

Step-3: You have the option to choose between preparing a return: Prepare Online & Prepare Offline.

Step-4: Select Prepare Online & the GSTR-3B form will now be accessible.

After filing relevant details in all table

Step 5: Click “Preview draft GSTR-3B.

Step 6: If there is no error in the draft GSTR3B, click “Proceed to Payment”.

Step 7: Scroll down and you will see “Cash Ledger” balance with return-related liabilities. The ledger will be auto-populated with taxes to be paid in part or full by ITC (Input Tax Credit).

Step 8: If you do not have sufficient balance in the Electronic Cash Ledger, you will be prompted to create a challan. Select “Yes” to create a new challan.

Step 9: On the “Create Challan” page, select the relevant payment mode and click on Generate Challan button to make a payment.

Step 10: Preview draft GSTR3B and ensure that the last column pertaining to “Additional Cash Required” is zero.

Step 11: Click “Make payment/ post credit to ledger”

Step 12: Click “Yes”. Offset Successful message will be displayed.

Step 13: Select “Proceed to File”

Step 14: Select the declaration check box and click “File GSTR 3B with EVC/DSC”. EVC stands for Electronic Verification Code while DSC stands for Digital Signature Certificate.

Step 15: A Successful filing message will be displayed bearing “Acknowledgement Reference Number (ARN)”. Note this number for future reference.

FAQs on Form GSTR-3B

1. Can I edit the values auto-populated from Forms GSTR-1 & GSTR-2B in Form GSTR-3B?

Yes, currently, the auto-populated values in GSTR-3B are editable. However, the tile with the edited field will be highlighted in RED and a warning message will be displayed.

2. How can I download system-generated GSTR-3B?

You can download system-generated GSTR-3B in PDF format by clicking on the SYSTEM GENERATED GSTR-3B button.

3. Why does downloading the System-generated GSTR-3B button is disabled, even though I am a monthly GSTR-1 filer?

In case you have not filed your monthly GSTR-1 for the selected month or the GSTR-2B for the selected month is generated, then the system-generated GSTR-3B button will be disabled.

4. If only GSTR-2B is generated and GSTR-1 is not filed, how will the auto-population work?

The system-generated Form GSTR-3B is partially available as you have not filed your Form GSTR-1. Form GSTR-1 is a statement of your inward supplies and it is always advised to file Form GSTR-1 before proceeding to file Form GSTR-3B.

5. If GSTR-1 is filed, but GSTR-2B is not generated, how will the auto-population work?

In Form GSTR-3B the auto-population will be partially available in table 3.1 (a, b, c, e) and table 3.2. Table 3.2 (d) and table 4 will be auto-drafted once the Form GSTR-2B is generated.

6. Why is the warning message displayed when I am filing Form GSTR-3B?

In case you have made any upward/ downward variance to the auto-drafted details from Forms GSTR-1 & GSTR-2B in Form GSTR-3B, then the field(s) edited will be highlighted in red color and a warning message will be displayed. However, you can still proceed to make payment and continue to file Form GSTR-3B.

7. In the system-generated PDF, only the interest values are displayed, why so?

In cases where Form GSTR-1 is not filed and Form GSTR-2B form is not generated for the current month, but there is some interest liability due to the filing of Form GSTR-3B of the previous return period, the system-generated PDF will have only interest values. For GSTR-1, which is not filed, and for GSTR-2B, which is not generated, no values will be displayed.

8. Will the interest computed by the system be on gross liability or net liability?

Interest will be computed by the system in accordance with the first proviso to Section-50 of the CGST Act, 2017, as amended. Consequently, interest for the liability pertaining to the present period will be levied only on the portion of the liability which is discharged by debiting the electronic cash ledger (Net liability), and on the entire liability if the liability pertains to the previous period(s) (Gross liability).

9. Will there be any invoice matching in Form GSTR-3B?

No, all the details in Form GSTR-3B will be self-declared in a summary manner and the taxes will be paid based on the table 6 of Form GSTR-3B (refer to the Rules as available on the GST Council or CBIC website, applicable for Form GSTR-3B Form).

10. Will the Utilize cash/ITC functionality be available for discharging return-related liabilities?

No, all the details in Form GSTR-3B will be declared in a consolidated manner by the taxpayer and the taxes will be paid based on table 6 of Form GSTR-3B.

11. What should be the mode of payment for the liabilities under table 3.1.1?

The tax liabilities declared in row (i) in table 3.1.1 are reflected under ‘Other than reverse charge’. These liabilities, however, must be paid in cash only.

12. From which return period table 3.1.1 is made available in Form GSTR-3B?

The table 3.1.1 Supplies notified under section 9(5) of the CGST Act, 2017 has been made available from the July Return period. For taxpayers who have opted for the QRMP scheme, it is made available from the Jul-Sep return period.

13. One is required to Confirm after entering data in each section in Form GSTR-3B. Will the GST System save the confirmed data if a taxpayer exits without completing the form?

No, to ensure that the furnished data is saved in a partially complete Form GSTR-3B, a taxpayer is required to click on Save Form GSTR-3B before closing the form.

14. Where do I have to enter details of inward taxable supply?

You are not required to enter all details of inward taxable supply. Only details of Eligible and Ineligible ITC need to be declared in table 4.

15. I am a facing problem while filing Form GSTR-3B, even though I have entered all the details in it. After submitting the form, all values are automatically reflected as "Zero" and the status of the Form is showing submitted. Why?

This issue has occurred because you have tried to make payment, without saving the details added in Form Form GSTR- 3B. You must always save the form, before proceeding towards making payment.

16. Is it mandatory to provide a tax liability breakup if the return is filed within the due date?

If any tax liability pertains to the previous tax period(s), then the same has to be provided by the taxpayer for the correct computation of the interest liability by the system. You can click on the TAX LIABILIY BREAKUP, AS APPLICABLE button to provide tax-period wise breakup of liability while filing GSTR 3B.

17. I have already filed Form GSTR-3B, but now I want to make some modifications. Can I file an amendment?

Form GSTR-3B once filed cannot be revised. Adjustment, if any, may be done while filing Form GSTR-3B for subsequent period.

18. Can I preview Form GSTR-3B before submission?

After adding details in various sections of Form GSTR-3B, scroll down the page and click the PREVIEW DRAFT Form GSTR-3B button to preview before making payments.

The summary of Form GSTR-3B will be displayed in a PDF. If it is incorrect, you can edit the information in the relevant section of the form, or else you can click the MAKE PAYMENT/POST CREDIT TO LEDGER button.

19. Can I reset Form GSTR-3B?

No, you cannot reset Form GSTR-3B.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Vide Notification No.16 -2024 dated 24-Jan-2024, for the upcoming Assessment Year 2024-25, ITR-6 undergoes the following changes to enhance transparency and compliance. The ITR-6 form is applicable to all the companies other than those claiming exemption under section 11.There are the following Key Changes in ITR-6 :

Legal Entity Identifier (LEI)

- Insert a New column for LEI.

- Entities seeking a refund of Rs. 50 crores or more must furnish LEI details.

Micro, Small, or Medium Enterprise Recognition

- Mandatory disclosure of identification status as a Micro, Small, or Medium Enterprise.

- There is an inclusion of registration number as per the MSME Act, 2006.

Company's Due Date for Filing Return

- ITR-6 requires companies to provide a due date for filing returns.

Reason for Tax Audit under Section 44AB

- The new details sought regarding circumstances necessitating tax audit under Section 44AB.

- It includes reasons such as exceeding turnover limits and specific sections not following a presumptive basis.

Acknowledgement Number and UDIN for Audit Reports

- Required to furnish the audit report's acknowledgement number and UDIN.

- To authenticity of audit-related information.

Disclosure of MSME Payments Beyond Time Limit

- There is an addition of a column under Part A-OI to disclose sums payable to MSMEs beyond specified time limits as 43B(h)

Winnings from Online Games (Section 115BBJ)

- Introduction of Section 115BBJ to tax winnings from online games.

- Amendment of Schedule OS to disclose income from winning online games Section 115BBJ.

Reporting Dividend Income from the International Financial Service Centre [ IFSC ]

- Amendment to Section 115A for the reduced tax rate on dividend income from IFSC.

- Schedule OS updated to reflect the change in tax treatment.

Schedule-CG Disclosure of Capital Gains Accounts Scheme [CGAS]

- Modification of Schedule CG to capture detailed information on sums deposited in CGAS including date of deposit, account number, and IFS code.

Schedule 115TD [ Accreted Income ]

- New schedule for reporting tax payable on accreted income.

- Relevant for entities converting into a non-charitable form or facing specified situations.

Schedule 80GGC [ Political Contributions ]

- A new schedule requiring details of contributions made to political parties, along with detailed information which includes the date of contribution, contribution modes, and transaction references etc.

Schedule 80-IAC [ Start-ups ]

- New schedule seeking additional details for deductions claimed under Section 80-IAC which include information of the date of incorporation, nature of business, and deduction-related details, etc.

Schedule 80LA [ Offshore Banking Units ]

- Insertion of a new schedule seeking details for deductions under Section 80LA where information includes the type of entity, authority granting registration, and deduction-related details.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application

What is Speculative Business in Income Tax?

Speculative business is considered as a separate business in the Income Tax Act. However, the act does not provide a manner to calculate the income or turnover of the speculative business. But the provisions regarding the treatment of losses incurred in such business are specifically stated in the act. In this article, we discuss the meaning of speculative business, calculation of turnover and applicability of audit and set off and carried forward of losses.

Speculative Business meaning:

A speculative transaction means a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scripts.

Explanation 2 to Section 28 of the Income Tax Act, 1961 defines this term when the speculative business should be deemed as a separate business from the other businesses.

Intraday Trading :

‘Intra-day trading’ means the trading of buying and selling of shares within the same day without delivery of shares. It will be always treated as a speculative business irrespective of the fact whether carried on a recognised stock exchange or off-market.

Transactions not considered as speculative transactions:

Section 43(5) of income tax states the definition of speculative transaction and exceptions of this transaction are also stated there which are as follows:

- Hedging contract with respect to raw materials or merchandise

- Hedging contract in the aspect of stocks and shares

- Forward contract

- Trading in derivatives

- Trading in commodity derivatives

A single transaction cannot constitute speculative business

Explanation 2 to Section 28 clearly defines that “Where speculative transactions carried on by an assessee are of such a nature as to constitute a business, the business (hereinafter referred to as "speculation business") shall be deemed to be distinct and separate from any other business.”

Within the meaning of section 43(5) ‘Single transaction of settlement of a contract otherwise than by actual delivery of the goods amount to “speculative transaction” but to constitute a business there must be something more to show that the nature of the transactions was such as, it can be termed as “speculation business” which has been treated as distinct and separate from other business.

(Refer case of Commissioner of Income tax vs. Kamani Tubes Ltd. 207 ITR 0298, (1994) Bombay High Court).

Calculation of Turnover of Speculative Business:

As per the “Guidance Note on Tax Audit under Section 44AB of the Income-tax Act, 1961” published by ICAI.

A speculative transaction means a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scripts. Thus, in a speculative transaction, the contract for sale or purchase which is entered into is not completed by giving or receiving delivery so as to result in the sale as per the value of the contract note. The contract is settled otherwise and squared up by paying out the difference which may be positive or negative. As such, in such a transaction, the difference amount is 'turnover'.

In the case of an assessee undertaking speculative transactions, there can be both positive and negative differences arising from the settlement of various such contracts during the year. Each transaction resulting into, whether a positive or negative difference is an independent transaction.

Further, the amount paid on account of a negative difference is not related to the amount received on account of a positive difference. In such transactions, though the contract notes are issued for full value of the purchased or sold asset, the entries in the books of account are made only for the differences. Accordingly, the aggregate of both positive and negative differences is to be considered as the turnover of such transactions for determining the liability to audit vide section 44AB.

The above can be understood by the following table:

| Intraday transaction | Buy Rate | Qty | Buy value | Sell Rate | Qty | Sell value | Turnover |

| TML | 400 | 250 | 100000 | 420 | 250 | 105000 | 5000 |

| LT | 2500 | 50 | 125000 | 2200 | 50 | 110000 | (15000) |

| INFY | 1440 | 300 | 432000 | 1500 | 300 | 450000 | 18000 |

| Total Turnover | 38000 | ||||||

Applicability of Audit section 44AB:

The threshold limit is not specifically mentioned for speculative business. So general provision i.e. provisions of section 44AB applies to such business.

Also, the provision for excluding the turnover of speculative business activity is not specifically provided under the law. The definition of speculative transactions is provided under section 43(5) and income from these transactions is considered as speculative business income.

In case a assessee is engaged in a normal business and a Speculative business then while calculating the threshold limit of ₹ 1 cr or 10 Cr (as the case may be) for the tax audit the turnover from all businesses will be aggregated to check the eligibility for the audit.

Hence in case the assessee is engaged in a normal business and a Speculative business then turnover from all the businesses will be aggregated while calculating the threshold limit of ₹ 1 cr. or 10 cr. as the case may be for tax audit purposes.

- Ram is engaged in 2 businesses and turnover from Business A is ₹ 60 lakhs, and B Speculative business is ₹ 50 lakhs. In this case, the aggregate turnover from both business activities is ₹ 110 lakhs (60+50) which exceeds the limit ₹ 1Cr. The assessee is required to get his accounts audited of both businesses. (Assuming limit of 10Cr. not applicable)

- Radhe is engaged in 2 businesses and turnover from Business A is ₹ 50 lakhs, B Speculative business is ₹ 44 lakhs. In this case, the aggregate turnover from both business activities is ₹ 94 lakhs (30+44) which does not exceeds the limit ₹ 1Cr. The assessee is not required to get his accounts audited in this case. (Assuming limit of 10Cr. not applicable)

Set off and carried forward of losses:

Section 73 of the Income Tax Act states the provisions regarding set off and carried forward of losses from speculative business, which are as follows:

- Loss from the speculation business can only be set off from any other speculation business income.

- Where for any assessment year any loss computed in respect of a speculation business has not been wholly set off then so much of the loss as is not so set off or the whole loss where the assessee had no income from any other speculation business, shall, be carried forward to the following assessment year, and—

- The carried forward loss shall be set off only against the profits and gains of any speculation business for that assessment year.

- If the loss cannot be wholly so set off, the amount of loss not so set off shall be carried forward to the following assessment year and so on.

- Loss can be carried forward only for four assessment years immediately succeeding the assessment year in which the loss was first computed.

Conclusion:

Speculation business is a distinct business for the taxpayer and separate provisions are stated for set off and carried forward of losses arising from such business. Under the income tax manner of calculation of turnover is not provided however the ICAI has provided the guidance regarding the same. This is very helpful for compliance with the law. It is suggested to take professional help for tailored solution in particular case.