Recent Articles Of GST

Section 43B (h) of the Income Tax Act: Payment to MSME allowable only on actual payment

The new provision was inserted under section 43B through the Finance Act 2023. This provision aims for timely payment to Micro and Small Enterprises. Non-compliance with this provision can significantly impact a business person's income tax liability.The clause of the section provides that, If the assessee has made the payment to the MSME after the time limit mentioned under section 15 of the Micro, Small and Medium Enterprises Development Act, 2006, then the assessee will get the deduction of that payment only on making the actual payment. One should note that the provision of this section applies to micro and small enterprises only, medium enterprises are not covered by the provisions. The provision is applicable from 1st April 2023.

One should also note that the general provision of section 43B allows the deduction of expenses in the same year, where the payment is made on or before the due date of return filing [ U/s139(1)]. This condition is not applicable to this section. This means that if the payment is not made on or before the specified time limit then, it will be eligible for deduction in the year in which it is actually paid.

Meaning of Micro and Small enterprises:

- Micro Enterprises: Manufacturing or service enterprises having investments in plant and machinery or equipment not exceeding ₹ 1 crore and annual turnover not surpassing ₹ 5 crore.

- Small Enterprises: Enterprises having investments in plant and machinery or equipment not exceeding ₹ 10 crore and annual turnover not exceeding ₹ 50 crore.

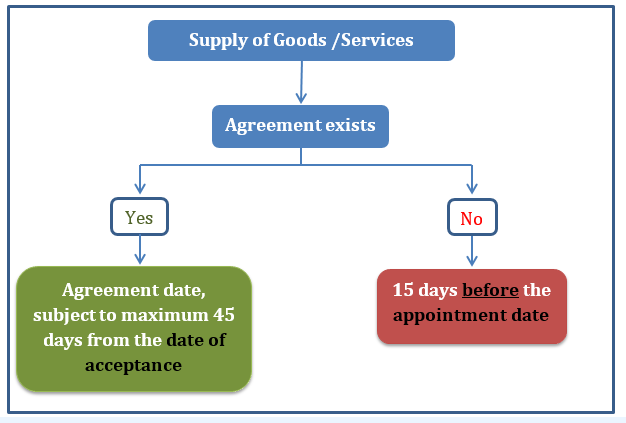

Section 15 of the Micro, Small and Medium Enterprises Development Act, 2006

“Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefore on or before the date agreed upon between him and the supplier in writing or, where there is no agreement on this behalf, before the appointed day.

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.”

If the assessee has purchased goods or services from Micro or Small Enterprises, then the payment should be made within the time limit specified in section 15 of the MSME Act (15 days or 45 days, whichever period is applicable). The expenses will be allowed for deduction in income tax. If the payment is not made on or before the due date, then it will be eligible for deduction in the year in which it will be paid.

Specified Time Limit:

The specified time limit for this section depends on whether you have a written agreement with micro or small enterprises or not.

Meaning of “Day of acceptance” and “Day of deemed acceptance”

Section 2 of the MSMED Act, 2006 defines the “Day of acceptance” or the “Day of deemed acceptance”

(a) The day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding the acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

Further, the “day of deemed acceptance” means when no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services.

Crux:

The date of the invoice is not important, the actual delivery or rendering of services will be considered to calculate the due date.

If an objection is raised for goods or services, then we will calculate the time limit from the date of removal of the objection.

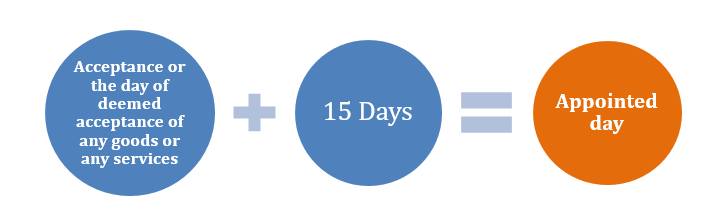

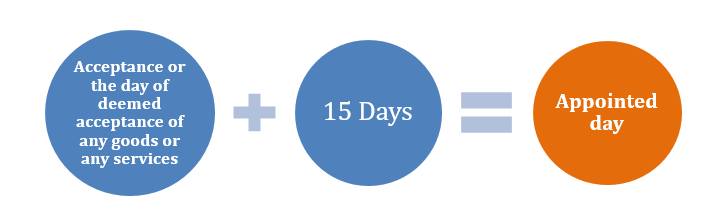

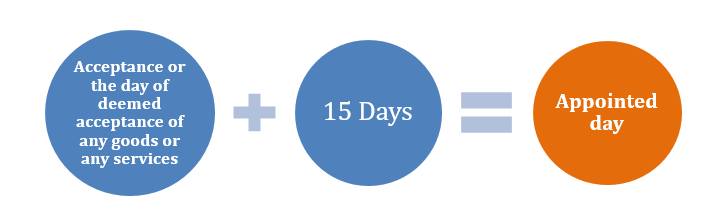

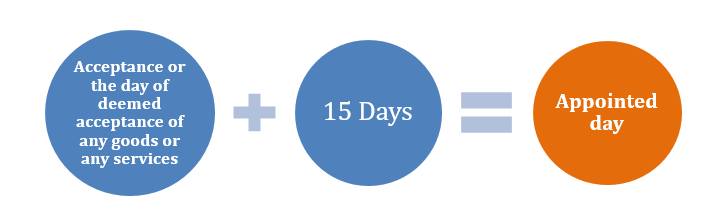

Meaning of Appointed Day

“Appointed day’ means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.”

Let’s understand the provision through the different cases given in the table:

- No Agreement Cases

Date of Invoice Date of Delivery of Goods/Rendering of Service Appointed Day (Due Date as per MSME Act) Date of Payment F.Y. in Deduction Allowed Remark 02/03/2024 02/03/2024 17/03/2024 25/03/2024 2023-24 Here it was paid after the due date as per MSME act but paid in the same FY so eligible for deduction in same FY 2023-24) 03/03/2024 03/03/2024 18/03/2024 03/04/2024 2024-25 Paid after appointed day then allowed as deduction in the year of payment

i.e. Deduction Allowed in FY 2024-25 as paid in FY 2024-2505/03/2024 18/03/2024 02/04/2024 01/04/2024 2023-24 Deduction in FY 2023-24 as it was paid before Appointed day 05/03/2024 18/03/2024 02/04/2024 02/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid on Appointed day as

if no agreements then payment is to be made "before the appointed day" so if paid on or after 02/04/24 allowed in FY 24-25) - If a written Agreement Exists

Date of Invoice Date of Delivery of Goods/Rendering of Service Agreement Days Due Date as Agreement Due Date as per MSME Act Payment Date Deduction Allowed in F.Y. Remark 03/03/2024 03/03/2024 15 18/03/2024 18/03/2024 28/03/2024 2023-24 Paid Within FY 03/03/2024 03/03/2024 15 18/03/2024 18/03/2024 06/04/2024 2024-25 Paid in Next FY and after Due Date as per MSME Act 06/03/2024 18/03/2024 15 02/04/2024 02/04/2024 02/04/2024 2023-24 Paid in Next FY but Within Due Date as per MSME Act 06/03/2024 18/03/2024 15 02/04/2024 02/04/2024 04/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY and after the due date as per MSME Act 18/03/2024 20/03/2024 15 04/04/2024 04/04/2024 03/04/2024 2023-24 it was paid on or before the due date as per MSM E so eligible for deduction in FY 23-24 18/03/2024 20/03/2024 15 04/04/2024 04/04/2024 07/04/2024 2024-25 Here it was paid after the due date as per MSM E so eligible for deduction in FY 24-25 03/02/2024 03/02/2024 60 03/04/2024 19/03/2024 25/03/2024 2023-24 Deduction Allowed in FY 2023-24 as it was paid in same FY {MSME maximum 45 days for agreement) 03/02/2024 03/02/2024 60 03/04/2024 19/03/2024 02/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY {MSME maximum 45 days for agreement) 03/02/2024 20/02/2024 60 20/04/2024 05/04/2024 05/04/2024 2023-24 Deduction Allowed in FY 2023-24 as it was paid on or before date agreed upon as per MSME Act 03/02/2024 20/02/2024 60 20/04/2024 05/04/2024 08/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY and that also after the due date as per MSME act

Frequently Asked Questions [FAQs]

1 . Can an invoice be considered a written agreement?

Whether an invoice can be considered a written agreement or not, will depend on the facts disclosed in the invoice. Generally, an invoice is a one-sided document issued by the seller. "Written Agreement" has not been defined in this Act.

An agreement is "An offer made by one person and accepted by another person which must be accepted by all parties involved."

Any separate document, purchase order, or even the invoice itself can be treated as a written agreement, as long as it clearly specifies the credit period and is signed by both parties.

An invoice as a written agreement –

If an invoice contains the following then it can be considered as a written agreement-

An invoice alone is not sufficient to treat as a formal written agreement, however if it includes the following, it can serve as evidence of the terms agreed upon:

- Credit period: The credit period should be explicitly mentioned in the invoice. The credit period indicates the number of days from the invoice date or date of delivery within which the payment is due.

- Signatures of both parties: They must be signed by the buyer and seller. This can add weight to the validity of the invoice as evidence of the agreement.

- Additional terms:Other relevant terms like late payment penalties or dispute resolution mechanisms must be mentioned clearly in the invoice, it strengthens the role of an invoice as a potential agreement.

The limitations that can be challenged to consider an invoice as an agreement.

- Invoices are primarily meant for recording the details of a transaction. Invoices are not necessarily serve as formal legal agreements.

- If the terms are unclear, ambiguous, or invoice is not signed properly then the enforceability of an invoice as an agreement can be challenged in court.

- For complex transactions or transactions involving significant amounts, it is always advised to have a separate written agreement.

Alternatives :

To avoid the dispute, some additional documents one should prepare like-

- Formal Contract: This is the most comprehensive and legally binding option, outlining all aspects of the agreement, including payment terms, warranties, dispute resolution, etc.

- Purchase Order: This is a document issued by the buyer that specifies the goods or services ordered, price, delivery schedule, and payment terms. Both parties can sign it to create a binding agreement.

- Letter of Agreement: This is a less formal document than a contract but can still be effective in outlining the key terms of the agreement, including payment terms.

An invoice cannot be considered a full-fledged written agreement alone, but the invoice can play a crucial role if it clearly has a credit period written on it, signed by both parties, as well as a context of resolving the dispute, but a formal contract, Additional documents like purchase order, or letter of agreement etc. are always advisable.

2. Will this section also be applicable if an assessee declares income in Presumptive Taxation [44AD/44ADA etc.]?

The Panaji Tribunal in the case of Good Luck Kinetic v. ITO (2015) stated that: Section 43B begins as a "non-obstante clause" "Notwithstanding anything contained in any other provision of this act." It means that the overriding effect of section 43B covers all other provisions of the act including sections 44AD, 44ADA & 44AE.

While the overriding effect of section of 44AD, 44ADA & 44AE covers only sections 28 to section 43C. Section 43B has a large overriding effect, as it also overrides other provisions of the act. Also, when Section 43B was inserted in the Finance Act, of 1983, the Memorandum explained in terms of this section that the object of this section is "to curb the practice of not discharging statutory liabilities for a longer period".

On the basis of the above, in our opinion computation of income for sections 44AD, 44ADA & 44AE will attract disallowance u/s 43B.

3. What does mean by the term “any Sum Payable”?

Any Sum includes Trade payable for capital goods, Inventory or expenses payable.