Topic Covers:

- Introduction

- Formation of HUF

- Legal recognition

- Tax Implications

Hindi Undivided Family (HUF)

According to the Income Tax Act HUF i.e. Hindu Undivided Family, is described as a separate entity, which means that its assessment and tax liability will be calculated as a separate entity. HUF has its separate PAN card.

HUF can be formed by the Hindu caste as well as Buddhists, Jains, and Sikhs. But Muslims, Christians, or Parsis cannot form HUFs.

Formation of HUF

To form the HUF, it is necessary to have at least 2 members. Even family has 2 male members, a father and son, they can form a HUF. There are 2 female members, if there are mother and daughter, then they can also make HUF, and if there are a husband and wife, then they can also make HUF. According to Hindu law, HUF is created as soon as marriage takes place.

HUF consists of Members, Coparceners, and Karta –

- Members – All persons who are part of HUF are called members of HUF

- Coparceners - According to Hindu law, coparceners are those members who are born in a Hindu undivided family and have legal rights in their ancestral property.

The following members are the coparceners in HUF

1st generation – Male member (senior most male)

2nd generation – Child (Male and Female both)

3rd generation – Grandchild (Male and Female both)

4th generation – Great grandchild (Male and Female both) - Karta –

Generally, Karta is the senior most Coparcener of the HUF, but in the case of Karta's death, the eldest surviving coparcener automatically becomes Karta. But if all the members mutually agree, then the other coparcener of HUF can also be made karta. One can also be a member in 2 HUFs. Like a female can be a member in her father's HUF and also in her husband's HUF.

Legal recognition:

A deed should be made for the legal recognition of HUF so that the PAN card of HUF can also be applied and a bank account can also be opened.

The deed of HUF can also be prepared on plain paper. But it is suggested that to prepare it on the proper stamp paper and also get it notarized. And whenever there is a change in the HUF, the deed should be modified.

The deed should contain various information -

- HUF Name and Address (HUF name is generally the name of the eldest coparcener, next to which "HUF" is predisposed, for example, if a person named Suresh Kumar creates his HUF, then his HUF name will be Suresh Kumar HUF)

- HUF Commencement date,

- Details of the coparceners name, address, photo, and signature

- Details of Gift.

A HUF lasts up to the 4th generation, and up to the 4th generation, all coparceners have the same rights in the HUF.

However, on the demise of the 1st generation, the 5th generation will be considered as the 4th generation.

This means that if you are a member of a HUF, then you also have the right to the property of your grandfather's father (great-grandfather).

HUF taxation:

Karta is the manager of the HUF. He is a representative of the HUF. The income of HUF is assessable separately under the income tax act. The Income of Karta in his individual capacity is assessable as an individual.

The income of HUF is covered in 4 heads –

- Income from House property

- Income from Business

- Income from capital gain, and

- Income from other sources.

Tax Benefits available to HUF:

- HUFs also have the option to choose the old and new tax regime like the individual assessee. HUF also charged at the slab rate like individual

- For HUF basic exemption limit is ₹ 2,50,000.

- HUF is not eligible to take benefit of section 87A i.e. tax rebate. But it is eligible to take benefit of chapter VI-A deductions like section 80C, 80D

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Tax Invoice

The provisions relating to Tax Invoices are provided under section 31 of the CGST Act 2017. A tax invoice shall be issued by a registered person supplying taxable goods or taxable services or both.

Time limit for issuance of invoice: [Sections 31(1), (2), (4) & (5) read with rule 47]

The time for issuing an invoice would depend on the nature of supply viz. whether it is a supply of goods or supply of services.

- In case of taxable supply of goods:

An Invoice shall be issued before or at the time of,- Removal of goods for supply to the recipient, where the supply involves movement of goods; or

- Delivery of goods or making available thereof to the recipient, in any other case.

- In case of continuous supply of goods:

Where successive statements of accounts/successive payments are involved, the invoice shall be issued before/at the time each such statement is issued or each such payment is received. - In case of taxable supply of services:

a) Invoice shall be issued before or after the provision of service, but within a period of 30 days from the date of supply of service.

b) 45 days in case of an insurer or banking company or financial institution, including a non-banking financial company (NBFC

- In case of continuous supply of services:

a) Where the due date of payment is ascertainable from the contract the invoice shall be issued on or before the due date of payment.

b) Where due date of payment is not ascertainable from the contract the invoice shall be issued before or at the time when the supplier of service receives the payment.

c) Where payment is linked to the completion of an event the invoice shall be issued on or before the date of completion of that event.

Where the supply of services ceases before its completion:

In a case where the supply of services ceases under a contract before the completion of the supply, the invoice shall be issued at the time when the supply ceases and such invoice shall be issued to the extent of the supply made before such cessation.

How to prepare Tax invoice and Contents of tax invoice :

There is no format prescribed for an invoice, but rules make it mandatory for an invoice to have the following fields :

- Name, address, and GSTIN of the supplier

- A consecutive serial number not exceeding 16 characters, in one or multiple series, containing alphabets/numerals/special characters hyphen or dash and slash, and any combination thereof, unique for a FY

- Date of its issue

- If the recipient is registered: Name, address and GSTIN or UIN of recipient.

- If the recipient is unregistered:

| If recipient is unregistered and value of supply is | Particulars of invoice |

| Rs. 50,000 or more | Name and address of the recipient and the address of delivery, along with the name of State and its code |

| less than Rs. 50,000 | unregistered recipient may still request the aforesaid details to be recorded in the tax invoice |

- HSN code for goods or services

- Description of goods or services

- Quantity in case of goods and unit or Unique Quantity Code thereof

- Total value of supply of goods or services or both

- Taxable value of supply of goods or services or both taking into account discount or abatement, if any

- Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess)

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess)

- Place of supply along with the name of State, in case of a supply in the course of inter-state trade or commerce

- Address of delivery where the same is different from the place of supply

- Whether the tax is payable on a reverse charge basis

- Signature or digital signature of the supplier or his authorized representative.

- Quick Response code, having embedded Invoice Reference Number (IRN) in it, in case an e-invoice has been issued.

Number of HSN digits required on the tax invoice and a class of registered person not required to mention HSN

| S. No. | Annual Turnover (AT) in the preceding FY | Number of Digits of HSN Code |

| 1. | AT ≤ Rs. 5 crores | For B2B supply - 4

For B2C supply – 4 (optional)* |

| 2. | AT > Rs. 5 crores | For B2B supply and B2C supply – 6 |

*As mentioned above, a registered person having aggregate turnover up to Rs. 5 crores in the previous financial year has been exempted from the requirement of mentioning the HSN Code in the manner specified in the above table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.

Manner of issuing the invoice:

- In case of a taxable supply of goods, an invoice shall be prepared in Triplicate. The original copy is for the recipient, the duplicate is for the transporter & the triplicate copy is for the supplier’s record.

- In case of taxable supply of services, an invoice shall be prepared in Duplicate. The Original copy is for the recipient, the duplicate is for supplier’s record.

Invoice in case of export of goods or services

In the case of the export of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT/ SUPPLY TO SEZ UNIT/SEZ DEVELOPER FOR AUTHORISED OPERATIONS ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT / SUPPLY TO SEZ UNIT/SEZ DEVELOPER FOR AUTHORISED OPERATIONS UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be.

It is important to note that the particulars of an Export Invoice contain following details:

- Name and address of the recipient

- Address of delivery

- Name of the country of destination

E-Invoice (Electronic billing) under GST

E-invoicing statutory provisions:

According to Rule 48(4) of the CGST Rules, 2017, taxpayers are obligated to create an electronic invoice by inputting the designated details into FORM GST INV-01 on the Invoice Registration Portal (IRP) and acquire the Invoice Reference Number (IRN).

Registered individuals, with the exception of specified groups, whose aggregate turnover in any previous financial year from 2017-18 onward surpasses Rs. 5 crores, have been designated as the category of individuals obligated to create E-invoices for B2B supplies (supply of goods or services or both to a registered person) or for exports. At present, such designated individuals are not obliged to report B2C (business-to-consumer) invoices on the Invoice Registration Portal (IRP). However, the inclusion of B2C invoice reporting into e-invoicing will be implemented in a subsequent phase. Additionally, it's important to note that e-invoicing does not apply to invoices issued by Input Service Distributors (ISD).

In cases where e-invoicing is mandatory, invoices issued by the mentioned individuals in any manner other than that specified in rule 48(4) will not be considered valid invoices. Additionally, when e-invoicing is in effect, there is no requirement to provide invoice duplicates or triplicates.

E-invoicing is mandatory even if a notified individual issues an invoice for supplies made by them, for which the tax is payable under the reverse charge mechanism as per Section 9(3).

Phase wise summary of E-invoice applicability:

| Phase | Applicable to taxpayers having an aggregate turnover of more than | Applicable date | Notification number |

| I | Rs 500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| II | Rs 100 crore | 01.01.2021 | 88/2020 – Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 – Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 – Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 – Central Tax |

| VI | Rs. 5 Crore | 01.08.2023 | 10/2023-Central Tax |

Cancellation of reported E-invoice

Electronic invoicing, commonly known as E-Invoicing or E-Invoice, is gaining prominence worldwide as governments take steps to combat tax evasion. This digital method of billing is being increasingly mandated by governments as a means to enhance tax compliance.

Whenever necessary, the seller has the option to cancel the IRN for an E-invoice that has already been reported by submitting a cancellation request on the Invoice Registration Portal (IRP) within the stipulated timeframe.

- Each invoice must be cancelled individually.

- There is no provision for modifying an already generated E-invoice.

- Once an IRN is cancelled the same invoice number cannot be reused to generate another invoice.

- Cancellations can be carried out within a 24-hour window.

It's important to note that while amendments and cancellations of E-invoices are allowed on the GST portal, any changes made will be reported to the proper officer in accordance with GST law.

Exemption from E-invoicing:

Electronic invoicing, commonly known as E-Invoicing or E-Invoice, is gaining prominence worldwide as governments take steps to combat tax evasion. This digital method of billing is being increasingly mandated by governments as a means to enhance tax compliance.

Exemption from E-invoicing:

The following entities are exempt from the mandatory requirement of e-invoicing:

- Special Economic Zone units (not SEZ developers)

- Insurer or banking company or financial institution including NBFC

- GTA supplying services in relation to the transportation of goods by road in a goods carriage

- Supplier of passenger transportation service

- Person supplying services by way of admission to the exhibition of cinematograph films on multiplex screens.

Thus, above mentioned entities are not required to issue e-invoices even if their turnover exceeds Rs. 5 Crore in the preceding financial year from 2017-18 onwards.

Example: In this situation, Hushway Private Limited operates both an SEZ (Special Economic Zone) unit and a regular DTA (Domestic Tariff Area) unit, and they share the same PAN (Permanent Account Number). The combined total turnover of Hushway Private Limited, considering both GSTINs (Goods and Services Tax Identification Numbers), exceeds Rs. 5 crores.

However, it's important to note that the turnover of the DTA unit alone is Rs. 2 crores for the previous financial year.

As per the e-invoicing regulations, the SEZ unit is exempt from e-invoicing requirements. However, the DTA unit falls under the purview of e-invoicing because the aggregate annual turnover of the entire legal entity, which includes both SEZ and DTA units, exceeds Rs. 5 crores. E-invoicing applicability is determined based on the aggregate annual turnover of the entity under the common PAN, and in this case, it surpasses the threshold, making e-invoicing mandatory for the DTA unit.

Bill of Supply under GST

As per Section 31(3)(c) of CGST Act 2017, a registered individual providing exempted goods or services or both or a registered person who pays tax under the composition scheme must issue a bill of supply in lieu of a tax invoice. A person choosing the composition levy should include the statement "composition taxable person, not permitted to collect tax on supplies" prominently at the top of the bill of supply issued by them.

Details of Bill of Supply:

A registered individual who chooses the composition levy is not required to charge tax to the recipients for their outward supplies. Likewise, when a registered person provides exempted goods and/or services, there are no tax obligations involved. In such cases, recipients should not anticipate a Tax Invoice from these suppliers as they are not authorized to issue one.

As no tax is gathered from the recipient by a registered person opting for the composition levy or a registered person providing exempted goods and/or services, the Bill of Supply issued by these individuals does not include information regarding the tax rate and tax amount. Moreover, the value to be indicated in the Bill of Supply does not represent taxable value either.

Particulars of Bill of Supply:

- Name, address, and GSTIN of the supplier

- A sequential serial number which should not exceed 16 characters can be in one or more series. It may consist of letters, numbers, or special characters such as hyphens, dashes, slashes, or any combination thereof. This serial number should be unique for a given financial year.

- Date of its issue

- Name, address, and GSTIN or UIN, if registered, of the recipient

- HSN Code for goods or services

- Description of goods or services or both

- Value of supply of goods or services or both taking into account discount/ abatement, if any

- The signature or digital signature of the supplier or their authorized representative is mandatory. However, in cases where an electronic bill of supply is issued in compliance with the Information Technology Act, 2000, the requirement for the physical signature or digital signature is waived.

Example: Goyal Brothers a wholesaler of goods has chosen the composition levy as per the provisions of sections 10(1) and 10(2). They will provide a Bill of Supply to their purchasers for goods rather than a tax invoice.

Note: Any tax invoice or equivalent document issued under any other prevailing legislation for non-taxable supplies shall be regarded as a bill of supply under the Act.

Payment Voucher under GST

As per Section 31(3)(f) & (g) of CGST Act 2017, the recipient is responsible for paying taxes under the reverse charge mechanism when they receive supplies of goods, services, or both that are designated for reverse charge purposes under section 9(3). These supplies can come from either a registered or an unregistered supplier.

Particulars of Payment Voucher

- Name, address, and GSTIN of the supplier if registered

- A unique consecutive serial number for a financial year should not exceed 16 characters and it can consist of alphabets, numerals, or special characters such as hyphens, dashes, slashes, or any combination of these characters

- Date of its issue

- Name, address, and GSTIN or UIN, if registered, of the recipient

- Description of goods or services in respect of which refund is made

- Amount paid

- Rate of tax (central tax, State tax, integrated tax, Union territory tax, or cess)

- Amount of tax payable in respect of such goods or services (central tax, State tax, integrated tax, Union territory tax or cess)

- Place of supply along with the name of State and its code, in case of a supply in the course of inter-state trade or commerce

- Signature/digital signature of supplier/his authorized representative

Receipt Voucher under GST

As per Section 31(3)(d) of CGST Act 2017, when a registered individual receives an advance payment for the supply of goods or services, they are required to generate a Receipt Voucher to formally document the receipt of this payment.

Particulars of Receipt Voucher

- Name, address, and GSTIN of the supplier

- A unique consecutive serial number for a financial year should not exceed 16 characters and it can consist of alphabets, numerals, or special characters such as hyphens, dashes, slashes, or any combination of these characters

- Date of its issue

- Name, address and GSTIN or UIN, if registered, of the recipient

- Description of goods or services

- Amount of advance taken

- Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess)

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess)

- Place of supply along with the name of State and its code, in case of a supply in the course of inter-state trade or commerce

- Whether the tax is payable on reverse charge basis

- Signature/digital signature of the supplier/his authorized representative

Where at the time of receipt of advance rate of tax and/or nature of supply is not determinable

| Where at the time of receipt of advance | |

| i. Rate of Tax is not determinable | Tax shall be paid at the rate of 18% |

| ii. Nature of supply is not determinable | Same shall be treated as inter-State supply |

Revised Invoice under GST

As per Section 31(3)(a) of CGST Act 2017, any individual or entity that holds a valid registration, granted prior to the issuance of their registration certificate has the authority to issue Revised Tax Invoices. These revised invoices should be generated for transactions that occurred within that period and they are intended to replace the previously issued invoices.

Revised Tax Invoices must be generated and prominently labeled as "Revised Invoice" within one month from the date of receiving the registration certificate.

This provision is essential because an individual or entity becoming liable for registration must submit their registration application within 30 days of becoming eligible for registration. When such an application is submitted within the specified timeframe and registration is approved, the effective registration date is the same as the date when the individual or entity became liable for registration.

Hence, there may be a time gap between the certificate of registration's issuance date and the effective registration date. To facilitate the claiming of Input Tax Credit (ITC) by the recipient for supplies made by such an individual or entity during this interim period, the law permits the issuance of revised invoices.

Example: Beta Private Ltd. initiated its goods supply business in Delhi on April 1st. However, it crossed the threshold limit for registration on September 3rd, making it liable for registration. The company submitted its registration application on September 29th and received the registration certificate on October 5th. As it applied for registration within the 30-day window of becoming liable, its effective registration date is September 3rd. Beta Private Ltd. has the authority to issue Revised Tax Invoices for taxable supplies made between September 3rd and October 5th, and this can be done on or before November 5th.

FAQ’s

Q-1: What do you mean by Tax Invoice in GST?

Ans: Tax Invoice meaning, an invoice or a GST bill is a list of goods sent or services provided, along with the amount due for payment.

Q-2: Who should issue GST Invoice?

Ans: Tax Invoice is issued by GST Registered Taxpayers. If you are a GST registered business, you need to provide GST-complaint invoices to your clients for sale of good and/or services.

What are the mandatory fields a GST Invoice should have?

A tax invoice is generally issued to charge the tax and pass on the input tax credit. A GST Invoice must have the following mandatory fields-

• Invoice number and date

• Customer name

• Shipping and billing address

• Customer and taxpayer’s GSTIN (if registered)**

• Place of supply

• HSN code/ SAC code

• Item details i.e. description, quantity (number), unit (meter, kg etc.), total value

• Taxable value and discounts

• Rate and amount of taxes i.e. CGST/ SGST/ IGST

• Whether GST is payable on reverse charge basis

• Signature of the supplier

**If the recipient is not registered AND the value is more than Rs. 50,000 then the invoice should carry:

1. name and address of the recipient,

2. address of delivery,

3. state name and state code

Q-3: How to personalize GST Invoices?

Ans: You can personalize your invoice with your company’s logo.

Q-4: What are other types of invoices?

Ans: (A) Bill of Supply

A bill of supply is similar to a GST invoice except for that bill of supply does not contain any tax amount as the seller cannot charge GST to the buyer.

A bill of supply is issued in cases where tax cannot be charged:

• Registered person is selling exempted goods/services,

• Registered person has opted for composition scheme

• Invoice-cum-bill of supply

As per Notification No. 45/2017 – Central Tax dated 13th October 2017, if a registered person is supplying taxable as well as exempted goods/services to an unregistered person, then he can issue a single “invoice-cum-bill of supply” for all such supplies.

(B) Aggregate Invoice

If the value of multiple invoices is less than Rs. 200 and the buyer are unregistered, the seller can issue an aggregate or bulk invoice for the multiple invoices on a daily basis.

For example, you may have issued 3 invoices in a day of Rs.80, Rs.90 and Rs. 120. In such a case, you can issue a single invoice, totaling Rs.290, to be called an aggregate invoice.

(C) Reverse Charge Invoice

A taxpayer liable to pay tax under Reverse Charge Mechanism (RCM) has to issue an invoice for goods or services or both received by him. The receiver shall mention the fact that the tax is paid under RCM. In addition, they have to issue a payment voucher while making payment to the supplier.

(D) Debit and credit note

A debit note is issued by the seller when the amount payable by the buyer to seller increases:

• Tax invoice has a lower taxable value than the amount that should have been charged

• Tax invoice has a lower tax value than the amount that should have been charged

A credit note is issued by the seller when the value of invoice decreases:

• Tax invoice has a higher taxable value than the amount that should have been charged

• Tax invoice has a higher tax value than the amount that should have been charged

• Buyer refunds the goods to the supplier

• Services are found to be deficient

Q-5: Can you revise invoices issued before GST?

Ans: Yes. You can revise invoices issued before GST. Under the GST regime, all the dealers must apply for provisional registration before getting the permanent registration certificate.

Q-6: What is GST revised invoice?

Ans: This applies to all the invoices issued between the date of implementation of GST and the date your registration certificate has been issued. As a dealer, you must issue a revised invoice against the invoices already issued. The revised invoice has to be issued within 1 month from the date of issue of the registration certificate.

Q-7: GST Invoicing under Special Cases?

Ans: In some cases, like banking, passenger transport, etc., the government has provided relaxation on the invoice format issued by the supplier.

Q-8: How many copies of Invoices should be issued?

Ans: For goods– 3 copies

For services– 2 copies

Q-9: What’s the difference between invoice date and due date?

Ans: Invoice date refers to the date when the invoice is created on the bill-book, while the due date is when the payment is due on the invoice.

Q-10: How to issue an invoice under reverse charge?

Ans: In case of GST payable under reverse charge, you must additionally mention that tax is paid on a reverse charge, on the GST invoice.

Q-11: Is it mandatory to maintain invoice serial number?

Ans: Yes, the invoice serial number must be maintained strictly. You may change the format by providing a written intimating the GST department officer along with reasons for the same.

Q-12: Can I digitally sign my invoice through DSC?

Ans: Yes, you can digitally sign invoice through DSC.

Q-13: What is definition of Tax Invoice?

Ans: A Tax invoice is a legal document that is issued by seller to the buyer for the taxable transaction made between them. It included details of parties, goods/ services supplied and tax involved.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Introduction

Composition Scheme is an alternative method of levying tax which is applicable to small assessees whose turnover is less than Rs. 1.5 Crore (Rs.75 lakhs in case of a few States), designed for them. This is a popular scheme among small businesses and helps in promoting business in India. The objective of the composition scheme is to bring simplicity and reduce compliance costs for small assesses.

Further, this scheme is optional. People who opt composition scheme pay tax at a conceational rate i.e. 1% 5% and 6% instead of paying tax at the normal rate.

Benefits of the Composition Scheme:

In the Composition scheme, 4 quarterly and 1 annual return have to be filed, whereas normal taxpayers have to file 25 returns {12 GSTR-1 + 12 GSTR-3B + 1 Annual return (if applicable)} in a year. In the Composition scheme, the compliance part is less as compared to the normal scheme.

- Less expensive compliance:

The person who does not have the resources to comply with complex rules & regulations of GST can opt composition scheme. In the composition scheme quarterly return file. This reduces the compliance burden on small taxpayers, this results in less time and low cost required to file the return in compared to a normal taxpayer. - Lower tax rates:

Registered taxpayers under the Composition Scheme pay tax at lower rates compared to normal taxpayers.

For example, manufacturers and traders pay only 1% of turnover, while restaurants pay 5% of turnover.

Drawbacks of opting for the Composition Scheme:

While there are several benefits of being registered under the GST Composition Scheme, there are also drawbacks that need to be addressed:

No pass on of Input Tax Credit (ITC): Persons opting for the Composition Scheme cannot pass on ITC to other persons.

No benefit of ITC: ITC is not available on goods, services, and capital goods purchased.

Limited business area: If a person has opted for the composition scheme, they cannot make inter-state supplies. This means you can only sell your goods within the state. Your business will be limited to your state only. If you want to expand your business outside the state or export, you will have to opt out of the composition scheme.

Tax payment from own pocket: Although the GST rates are quite low under the Composition scheme, the taxpayer cannot collect the GST amount from the buyer. The tax amount is considered as part of the total turnover. Taxpayers have to pay GST from their own pockets, and they also need to mention at the top of the bill of supply that they are a Composition Dealer and are not eligible to collect tax on supplies.

Low interest of purchase by registered persons under the normal scheme: In the Composition scheme, the benefit of Input Tax Credit (ITC) cannot be passed on, which is why individuals registered under the normal scheme prefer not to purchase goods/services from Composition dealers. This is because the amount of tax becomes part of the cost since ITC cannot be passed on.

Who is eligible for the Composition Scheme under GST?

The eligibility of a taxpayer to opt for the Composition Scheme depends on their business turnover.

Turnover limit in case of Composition Levy for Goods:

Small taxpayers with an aggregate turnover not exceeding Rs. 1.50 Crore in the previous financial year are eligible for the Composition Scheme. The turnover limit for restaurant service providers remains the same.

For the following States, the turnover limit is Rs. 75 lakhs:

- a) Arunachal Pradesh

- b) Assam

- c) Manipur

- d) Meghalaya

- e) Mizoram

- f) Nagaland

- g) Sikkim

- h) Tripura

- i) Himachal Pradesh

The turnover of all businesses under the same PAN must be added up to calculate turnover for the purpose of this scheme.

Example: If you have registered under GST in Madhya Pradesh and Rajasthan states, then you need to check the turnover limit for both states to determine eligibility.

Turnover limit in case of Composition Levy for Services:

According to Section 10(2A), in the case of a composition scheme for service providers, the limit of aggregate turnover is not more than Rs. 50 lakhs in the previous financial year, then such person can opt composition scheme.

Person who is not eligible for Composition Scheme:

A taxable person who wants to pay tax at concessional rates can opt for this scheme, where GST will be paid at the notified rate by the Government.

However, there are cases where this scheme cannot be opted for, such as:

- Supplies on which GST is not charged as per the GST Act (e.g., petrol, diesel, etc.).

- Inter-state outward supplies.

- Persons engaged in manufacturing of notified goods by the Government (e.g., ice cream, pan masala, tobacco, aerated water, etc.).

- However, if a person engaged in trading of these goods can opt Composition Scheme.

- Casual taxable person and non-resident taxable person.

Persons providing services (except for restaurant and outdoor caterers) with a turnover exceeding Rs. 50 lakhs in the preceding financial year.

If a registered person supplies both goods and services, then they can provide services up to Rs. 5 lakhs or 10% of the preceding year's turnover, whichever is higher, without opting out of the composition scheme. Note: When computing the value of services, interest received on loans, deposits, or advances should not be counted in turnover.

Example-1: Mr. XYZ & Company deals with in both goods and services.

Details of the Turnover of the preceding financial year:

Sales of Goods: Rs. 38 Lakhs

Sales of Service: Rs. 22 Lakhs

Interest received on deposit: Rs. 2 Lakhs

Total turnover: Rs. 60 Lakhs

Solution: In this case, the turnover would be:

Sales of goods Rs. 38 Lakhs + Sales of service Rs. 22 Lakhs = Rs. 60 Lakhs

If Rs. 6 lakhs (10% of 60 lakhs) or Rs. 5 lakhs, whichever is higher, i.e. Rs. 6 lakhs, is the value of services provided, then services up to Rs. 6 lakhs can be provided. If services above this amount are provided, the composition scheme cannot be opted for.

Example 2: If there is no turnover in the previous year or if it is the first year of business, then in the composition scheme, services can be provided up to a maximum of Rs. 5 lakhs.

How will the aggregate turnover be computed for the purpose of the Composition Scheme?

Aggregate Turnover:

As per Section 2(6) of the CGST Act, in Aggregate turnover includes - taxable supplies, exempt supplies, exports of goods or services, and inter-state supplies.

It excludes inward supplies on which tax is paid through the reverse charge mechanism and taxes like CGST, SGST, IGST, UTGST, and GST Compensation Cess.

The turnover of all businesses under the same PAN is considered, computed on an all-India basis.

Furthermore, as per Explanation-1 of Section-10, for the purpose of the Composition Scheme, the turnover includes supplies made from the 1st April of a financial year until the person becomes liable for GST registration, if applicable.

Tax Rates under Composition Scheme:

GST Rate on Composition Dealer- Manufacturer:

If you are a manufacturer and you have opted for the Composition Scheme, you have to pay 1% GST on the entire turnover. This means that even if your product is exempt, you will still have to pay 1% GST on it.

Example: If you are a manufacturer and you have sold taxable goods worth 10 lakhs and exempt goods worth 5 lakhs, then in this case, you will have to pay 1% on the total of 15 lakhs, i.e. you will have to pay 15,000 GST

GST Rate on Composition Dealer- Service Provider:

Service providers opting for the composition scheme pay 6% GST on their entire turnover.

GST Rate on Composition Dealer- Trader:

If you are a trader and you have opted for the Composition Scheme, you have to pay GST on taxable goods; no GST liability will arise on exempt goods.

Example: If you are a trader and you have sold taxable goods worth 10 lakhs and exempt goods worth 5 lakhs, then in this case, you only have to pay GST on taxable goods,

i.e. 1% on 10 lakhs, which amounts to 10,000 GST. No GST will be payable on the 5 lakhs worth of exempt goods.

GST Rate on Composition dealer- Restaurant & Outdoor catering services:

If you are engaged in Restaurant & Outdoor catering services and you have opted for the Composition Scheme, you have to pay 5% GST on the entire turnover. This means that even if your product is exempt, you will still have to pay 5% GST on it.

Example: If you are engaged in Restaurant & Outdoor catering services and you have sold taxable goods worth 10 lakhs and exempt goods worth 5 lakhs, then in this case, you will have to pay 5% on the total of 15 lakhs, i.e., you will have to pay 15,000.

Filing of Intimation / Statement / Return:

(a) Existing registered taxpayers can opt the Composition Levy scheme by filing FORM GST CMP 02 on the common portal.

(b) At the time of opting for the Composition Levy scheme, existing taxpayers must also file a statement in FORM GST ITC-03 to reverse the input tax credit availed on inward supplies.

(c) Composition Taxpayers need to file quarterly CMP-08, including a summary of supplies made and payment, up to 18th day of the month following the end of the quarter.

(d) Composition dealers also need to file a yearly return, CMP-08, up to the 30th April of the year following the financial year end.

(e) To opt out of the Composition Scheme, a Composition dealer can file FORM GST CMP 04.

Bill of supply, not tax invoice:

Composition scheme dealers are not allowed to collect tax from buyers. They must pay GST from their pocket and cannot charge GST on invoices. Therefore, a composition dealer issue a "Bill of Supply" instead of a tax invoice.

The composition dealer must mention the words "composition taxable person, not eligible to collect tax on supplies" at the top of the bill of supply.

What if the GST composition person turnover exceeds 1.5 crore/ 75 lakh?

If a Composition dealer's turnover exceeds Rs.1.50 Crore (Rs. 75 Lakhs for special category states), then they must provide intimation of withdrawal from the composition scheme through form CMP-04 within 7 days.

FAQs on Composition Scheme under GST

1. What is Composition Scheme?

Ans. Composition Scheme is an alternative method of levying tax which is applicable to small assessees whose turnover is less than Rs. 1.5 Crore and Rs.75 lakhs in case of a few States.

2. What are the GST rates applicable on Composition taxpayer?

Ans. Under the GST, tax rate for composition tax payer is 1 % 5% and 6%.

3. Who is eligible for Composition Scheme?

Ans. Taxpayer whose turnover in preceding financial year is less than Rs. 1.5 Crore or Rs.75 lakhs in specified state can opt composition scheme.

4. What are the benefits of the Composition Scheme?

Ans. In composition scheme taxpayer pay tax at lower rate i.e. 1% 5% and 6%. Less expensive compliances in compare to normal tax payer.

5. Can Composition Scheme taxpayer avail Input Tax Credit?

No, Person who opted composition scheme can not avail ITC on their purchases.

6. Person who opted Composition Scheme who to file their GST returns?

Ans. Composition Scheme taxpayer needs to file CMP-08 statement quarterly and file Form GSTR-4, annually.

7. If a taxpayer opt composition scheme. What are the restrictions for taxpayers?

Ans. Under the composition scheme taxpayer cannot make interstate supply. Issue bill of supply instead of tax invoice and cannot collect tax from buyers.

8. What happens if a person who opted Composition Scheme and turnover exceeds the prescribed limit Rs. 1.5 crore or Rs. 75 Lakh.

Ans. If a Composition dealer's turnover exceeds Rs.1.50 Crore or Rs. 75 Lakhs, then they are ineligible for composition scheme and within 7 days need to switch regular scheme.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

The new provision was inserted under section 43B through the Finance Act 2023. This provision aims for timely payment to Micro and Small Enterprises. Non-compliance with this provision can significantly impact a business person's income tax liability.The clause of the section provides that, If the assessee has made the payment to the MSME after the time limit mentioned under section 15 of the Micro, Small and Medium Enterprises Development Act, 2006, then the assessee will get the deduction of that payment only on making the actual payment. One should note that the provision of this section applies to micro and small enterprises only, medium enterprises are not covered by the provisions. The provision is applicable from 1st April 2023.

One should also note that the general provision of section 43B allows the deduction of expenses in the same year, where the payment is made on or before the due date of return filing [ U/s139(1)]. This condition is not applicable to this section. This means that if the payment is not made on or before the specified time limit then, it will be eligible for deduction in the year in which it is actually paid.

Meaning of Micro and Small enterprises:

- Micro Enterprises: Manufacturing or service enterprises having investments in plant and machinery or equipment not exceeding ₹ 1 crore and annual turnover not surpassing ₹ 5 crore.

- Small Enterprises: Enterprises having investments in plant and machinery or equipment not exceeding ₹ 10 crore and annual turnover not exceeding ₹ 50 crore.

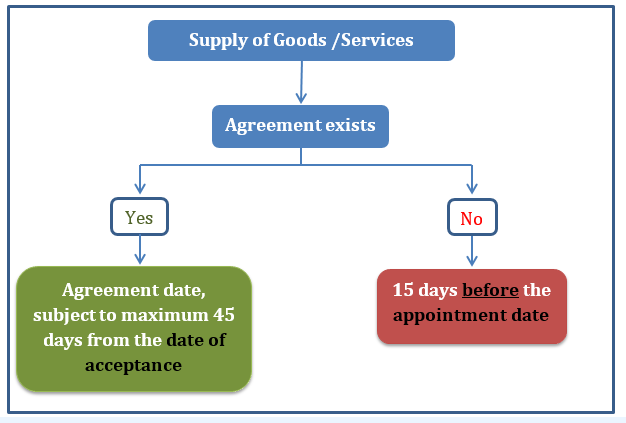

Section 15 of the Micro, Small and Medium Enterprises Development Act, 2006

“Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefore on or before the date agreed upon between him and the supplier in writing or, where there is no agreement on this behalf, before the appointed day.

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.”

If the assessee has purchased goods or services from Micro or Small Enterprises, then the payment should be made within the time limit specified in section 15 of the MSME Act (15 days or 45 days, whichever period is applicable). The expenses will be allowed for deduction in income tax. If the payment is not made on or before the due date, then it will be eligible for deduction in the year in which it will be paid.

Specified Time Limit:

The specified time limit for this section depends on whether you have a written agreement with micro or small enterprises or not.

Meaning of “Day of acceptance” and “Day of deemed acceptance”

Section 2 of the MSMED Act, 2006 defines the “Day of acceptance” or the “Day of deemed acceptance”

(a) The day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding the acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

Further, the “day of deemed acceptance” means when no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services.

Crux:

The date of the invoice is not important, the actual delivery or rendering of services will be considered to calculate the due date.

If an objection is raised for goods or services, then we will calculate the time limit from the date of removal of the objection.

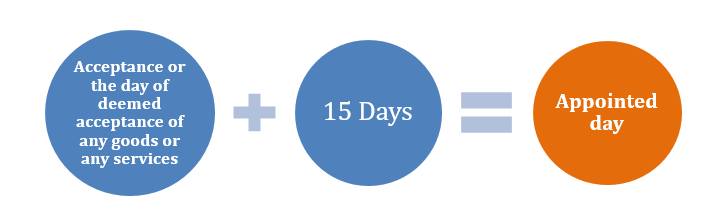

Meaning of Appointed Day

“Appointed day’ means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.”

Let’s understand the provision through the different cases given in the table:

- No Agreement Cases

Date of Invoice Date of Delivery of Goods/Rendering of Service Appointed Day (Due Date as per MSME Act) Date of Payment F.Y. in Deduction Allowed Remark 02/03/2024 02/03/2024 17/03/2024 25/03/2024 2023-24 Here it was paid after the due date as per MSME act but paid in the same FY so eligible for deduction in same FY 2023-24) 03/03/2024 03/03/2024 18/03/2024 03/04/2024 2024-25 Paid after appointed day then allowed as deduction in the year of payment

i.e. Deduction Allowed in FY 2024-25 as paid in FY 2024-2505/03/2024 18/03/2024 02/04/2024 01/04/2024 2023-24 Deduction in FY 2023-24 as it was paid before Appointed day 05/03/2024 18/03/2024 02/04/2024 02/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid on Appointed day as

if no agreements then payment is to be made "before the appointed day" so if paid on or after 02/04/24 allowed in FY 24-25) - If a written Agreement Exists

Date of Invoice Date of Delivery of Goods/Rendering of Service Agreement Days Due Date as Agreement Due Date as per MSME Act Payment Date Deduction Allowed in F.Y. Remark 03/03/2024 03/03/2024 15 18/03/2024 18/03/2024 28/03/2024 2023-24 Paid Within FY 03/03/2024 03/03/2024 15 18/03/2024 18/03/2024 06/04/2024 2024-25 Paid in Next FY and after Due Date as per MSME Act 06/03/2024 18/03/2024 15 02/04/2024 02/04/2024 02/04/2024 2023-24 Paid in Next FY but Within Due Date as per MSME Act 06/03/2024 18/03/2024 15 02/04/2024 02/04/2024 04/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY and after the due date as per MSME Act 18/03/2024 20/03/2024 15 04/04/2024 04/04/2024 03/04/2024 2023-24 it was paid on or before the due date as per MSM E so eligible for deduction in FY 23-24 18/03/2024 20/03/2024 15 04/04/2024 04/04/2024 07/04/2024 2024-25 Here it was paid after the due date as per MSM E so eligible for deduction in FY 24-25 03/02/2024 03/02/2024 60 03/04/2024 19/03/2024 25/03/2024 2023-24 Deduction Allowed in FY 2023-24 as it was paid in same FY {MSME maximum 45 days for agreement) 03/02/2024 03/02/2024 60 03/04/2024 19/03/2024 02/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY {MSME maximum 45 days for agreement) 03/02/2024 20/02/2024 60 20/04/2024 05/04/2024 05/04/2024 2023-24 Deduction Allowed in FY 2023-24 as it was paid on or before date agreed upon as per MSME Act 03/02/2024 20/02/2024 60 20/04/2024 05/04/2024 08/04/2024 2024-25 Deduction Allowed in FY 2024-25 as it was paid in next FY and that also after the due date as per MSME act

Frequently Asked Questions [FAQs]

1 . Can an invoice be considered a written agreement?

Whether an invoice can be considered a written agreement or not, will depend on the facts disclosed in the invoice. Generally, an invoice is a one-sided document issued by the seller. "Written Agreement" has not been defined in this Act.

An agreement is "An offer made by one person and accepted by another person which must be accepted by all parties involved."

Any separate document, purchase order, or even the invoice itself can be treated as a written agreement, as long as it clearly specifies the credit period and is signed by both parties.

An invoice as a written agreement –

If an invoice contains the following then it can be considered as a written agreement-

An invoice alone is not sufficient to treat as a formal written agreement, however if it includes the following, it can serve as evidence of the terms agreed upon:

- Credit period: The credit period should be explicitly mentioned in the invoice. The credit period indicates the number of days from the invoice date or date of delivery within which the payment is due.

- Signatures of both parties: They must be signed by the buyer and seller. This can add weight to the validity of the invoice as evidence of the agreement.

- Additional terms:Other relevant terms like late payment penalties or dispute resolution mechanisms must be mentioned clearly in the invoice, it strengthens the role of an invoice as a potential agreement.

The limitations that can be challenged to consider an invoice as an agreement.

- Invoices are primarily meant for recording the details of a transaction. Invoices are not necessarily serve as formal legal agreements.

- If the terms are unclear, ambiguous, or invoice is not signed properly then the enforceability of an invoice as an agreement can be challenged in court.

- For complex transactions or transactions involving significant amounts, it is always advised to have a separate written agreement.

Alternatives :

To avoid the dispute, some additional documents one should prepare like-

- Formal Contract: This is the most comprehensive and legally binding option, outlining all aspects of the agreement, including payment terms, warranties, dispute resolution, etc.

- Purchase Order: This is a document issued by the buyer that specifies the goods or services ordered, price, delivery schedule, and payment terms. Both parties can sign it to create a binding agreement.

- Letter of Agreement: This is a less formal document than a contract but can still be effective in outlining the key terms of the agreement, including payment terms.

An invoice cannot be considered a full-fledged written agreement alone, but the invoice can play a crucial role if it clearly has a credit period written on it, signed by both parties, as well as a context of resolving the dispute, but a formal contract, Additional documents like purchase order, or letter of agreement etc. are always advisable.

2. Will this section also be applicable if an assessee declares income in Presumptive Taxation [44AD/44ADA etc.]?

The Panaji Tribunal in the case of Good Luck Kinetic v. ITO (2015) stated that: Section 43B begins as a "non-obstante clause" "Notwithstanding anything contained in any other provision of this act." It means that the overriding effect of section 43B covers all other provisions of the act including sections 44AD, 44ADA & 44AE.

While the overriding effect of section of 44AD, 44ADA & 44AE covers only sections 28 to section 43C. Section 43B has a large overriding effect, as it also overrides other provisions of the act. Also, when Section 43B was inserted in the Finance Act, of 1983, the Memorandum explained in terms of this section that the object of this section is "to curb the practice of not discharging statutory liabilities for a longer period".

On the basis of the above, in our opinion computation of income for sections 44AD, 44ADA & 44AE will attract disallowance u/s 43B.

3. What does mean by the term “any Sum Payable”?

Any Sum includes Trade payable for capital goods, Inventory or expenses payable.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

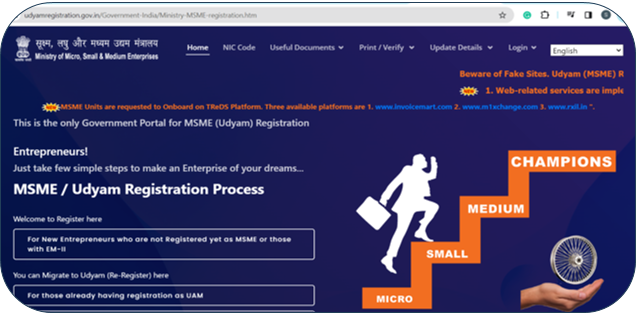

A Step-by-Step Guide to Verifying Udyam Registration Number Online

Introduction:

Udyam Registration is a crucial step for entrepreneurs in India looking to establish their small or micro enterprises. The online registration process has made it convenient for business owners to complete the necessary formalities. Once the registration is done, it is essential to verify the Udyam Registration Number to ensure its authenticity. In this article, we will guide you through the simple steps to verify your Udyam Registration Number online.

With introduction of section 43B(h) under Income Tax Act 1961.It is important to check the yearly status under MSME as Micro, Small or Medium enterprises

Step 1: Visit https://udyamregistration.gov.in/

The first step in the verification process is to visit the official Udyam Registration portal at https://udyamregistration.gov.in/. This website is the central platform for all Udyam-related activities and services.

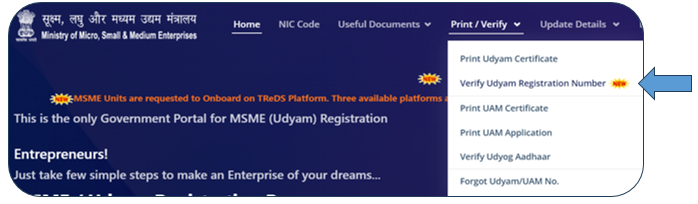

Step 2: Click on "Print & Verify" Sub Tab > "Verify Udyam Registration Number"

On the homepage, locate and click on the "Print & Verify" tab. A dropdown menu will appear, and from this menu, select the "Verify Udyam Registration Number" sub-tab. This will direct you to the verification page.

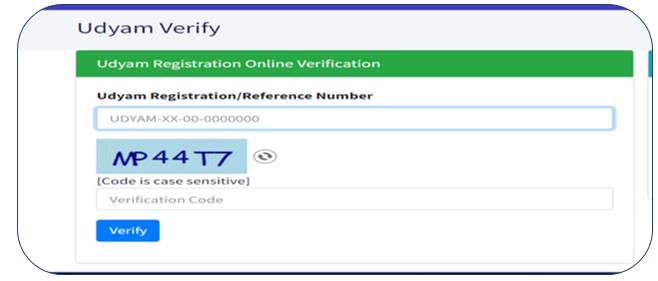

Step 3: Enter Udyam Registration/Reference Number & Captcha

Once you are on the verification page, you will be prompted to enter your Udyam Registration or Reference Number. This is the unique identification number assigned to your business during the registration process. Carefully input this number to proceed with the verification. a captcha code will be displayed on the verification page. Enter the characters shown in the captcha image into the designated text box.

Step 4: Click Verify

After entering the Udyam Registration/Reference Number and the captcha code, click on the "Verify" button. The system will then process the information provided and verify the authenticity of the Udyam Registration Number. Upon successful verification, the system will display the status of your Udyam Registration.

Disclaimer:-The information available on this website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/Application.

Topic Covers:

- Introduction

- Classification of seller and buyer

- Non- applicability of TCS

- Exemption from Collection of tax

- Goods Means

- TCS Rates

- TCS at higher rate

- Other points

What is TCS?

TCS stands for Tax Collected at Source. It is a tax payable by a seller which he collects from the buyer at the time of sale of goods. It is an extra amount collected by the seller in the form of tax. Specific people need to deduct TCS who is the seller.

Classification of Seller for TCS-

There are some specific people or organisations who have been classified as sellers for tax collected at the source. No other seller of goods can collect tax at source from the buyers apart from the following list:

- Central Government

- State Government

- Local Authority

- Statutory Corporation or Authority

- Company registered under the Companies Act

- Partnership firms

- Co-operative Society

- Any person or HUF who is subjected to an audit of accounts under the Income-tax Act for a particular financial year.

Buyers for TCS-

A buyer is a person who obtains goods of a specified nature in any sale or right to receive any such goods, by way of auction, tender, or any other mode.

Non-Applicability of TCS

The below buyers are exempted :

- Public sector companies

- Central Government

- State Government

- Embassy of High Commission

- Consulate and other Trade Representation of a Foreign Nation

- Clubs such as sports clubs and social clubs

- Where resident buyer utilises such purchase for the purposes of manufacturing, processing, or producing articles or things or for the purposes of generation of power (not for trading) and gives this declaration in writing in duplicate.

Exemption from Collection of tax-

There are two main cases where Tax Collected at Source (TCS) is exempted: Section 206C(1A)

Case 1: Goods purchased for personal consumption

TCS is not applicable if the goods are purchased by an individual for personal consumption. This means that if you buy a car, a piece of jewellery, or any other item for your own use, you will not be subject to TCS.

Case 2: Goods purchased for manufacturing, processing, or production

TCS is not applicable if the goods are purchased by a buyer who intends to use them for manufacturing, processing, or production. This means that if you buy raw materials, machinery, or other supplies for your business, you will not be subject to TCS.

In order to claim this exemption, the buyer must submit a declaration in Form 27C to the seller. The declaration must state that the goods are to be used for manufacturing, processing, or production and not for trading purposes. A copy of the declaration must be submitted to the Chief Commissioner or Commissioner of Income Tax within seven days of the end of the month in which the sale is effected.

Goods Means For this Purpose :-

- Alcoholic liquor for human consumption,

- Tendu leaves,

- Timber obtained under a forest lease,

- Timber obtained by any mode other than

- Any other forest produce not being timber or tendu leaves,

- Scrap,

- Minerals, being coal or lignite or iron ore

- Motor vehicle value exceeding ₹ 10 lakhs.

This Exemption is not Applicable on Other Than Section 206C(1) i.e. 206C(1C), 206C(1F) etc.

TCS Rates –

| Nature of Goods | Percentage |

| Alcoholic liquor for human consumption | 1% |

| Tendu leaves | 5% |

| Timber obtained under a forest lease | 2.50% |

| Timber obtained by any mode other than (c) | 2.50% |

| Any other forest produce not being timber or tendu leaves | 2.50% |

| Scrap | 1% |

| Minerals, being coal or lignite or iron ore | 1% |

TCS at a higher rate:

- Section 206CC mandates tax collection at the higher of the following rates if the collectee fails to furnish PAN (or Adhaar number in the case of section 206C(1H)) to the collector:

- Twice the rate specified in the relevant provision of the Act.

- 5% (1% if tax is required to be collected at source under section 206C(1H)). Effective from July 1, 2023, the maximum TCS rate for non-furnishing of PAN should not exceed 20%.

- The specified rates apply even if the collectee furnishes a declaration under section 206C(1A) but does not provide PAN.

- Both the collectee and collector must quote the PAN of the collectee in all correspondence, bills, vouchers, and other documents exchanged between them.

- If the PAN provided to the collector is invalid or does not belong to the collectee, it is deemed that the collectee has not furnished PAN. In such cases, tax is collectible at the higher rate specified in (i) above.

- Section 206CC does not apply to a non-resident without a permanent establishment in India.

Higher Rate of TCS for Non-filers of Income-tax Return [Section 206CCA]:

- Section 206CCA requires TCS at the higher of:

- Twice the rate specified in the relevant provision of the Act.

- 5%. Effective from July 1, 2023, the maximum TCS rate for non-filers of income-tax return should not exceed 20%.

- If both Section 206CC and Section 206CCA are applicable to the specified person, TCS is required at the higher of the rates specified in both sections.

"Specified person" refers to an individual who has not filed the income-tax return for the preceding assessment year, where the time limit under section 139(1) has expired, and the aggregate of TDS/TCS in their case is ₹50,000 or more in the said previous year. However, it excludes non-residents without a permanent establishment in India and those not required to furnish an income tax return, as notified by the Central Government.

For instance, if tax collection is required in January 2024, the higher rate under section 206CCA applies if the buyer has not filed the income tax return for the assessment year 2023-24, and the aggregate TDS/TCS in the buyer's case is ₹50,000 or more in the previous year 2022-23.

Other points -

Notification No. 99/2022-Income Tax | Dated: 17th August, 2022 [ S.O. 3878(E)]

CBDT notifies that provisions of Section 206C (1G) of the Income Tax Act shall not apply to a person (being a buyer) who is a non-resident in terms of section 6 and who does not have a permanent establishment (PE) in India.

Circular No. 10 of 2023

Circular to remove difficulty in implementation of changes relating to Tax Collection at Source (TCS) on Liberalised Remittance Scheme (LRS) and on purchase of overseas tour program package

Finance Act, 2023 has amended sub-section (1G) of section 206C of the lncome-tax Act, 1961 (hereinafter referred to as 'the Act') to, inter-alia,

(i) Increase the rate of Tax Collection at Source (TCS) from 5% to 20% for remittance under LRS as well as for purchase of overseas tour program package; and

(ii) Remove the threshold of ₹ 7 lakh for triggering TCS on LRS.

These two changes did not apply when the remittance is for education and medical purposes.

Threshold of ₹ 7 Lakh per financial year per individual in clause (i) of sub-section (1G) of section 206C shall be restored for TCS on all categories of LRS payments, through all modes of payment, regardless of the purpose: Thus, for first ₹ 7 Lakh remittance under LRS there shall be no TCS. Beyond this ₹ 7 Lakh TCS shall be applicable.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

What is GSTR-1?

Form GSTR-1 is a monthly or quarterly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services.

Every registered taxable person, other than an input service distributor/ composition taxpayer/ persons liable to deduct tax u/s 51 / persons liable to collect tax u/s 52 is required to file Form GSTR-1, the details of outward supplies of goods and/or services during a tax period, electronically on the GST Portal.

Who should file GSTR-1?

Every individual or entity who is registered under GST is obligated to file GSTR-1, regardless of whether any transactions occurred during the specified period. For those, who have no transactions to report (nil GSTR-1 filers), there is an option to file through SMS, which became available starting the 1st week of July 2020.

The following registered persons are not required to file GSTR-1:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

When is the due date of GSTR-1?

The due date to file Form GSTR-1 is based on aggregate turnover. Businesses with sales of up to Rs.5 crore have the option to file quarterly returns under the QRMP scheme and due on 13th of the month succeeding the end of the relevant quarter.

Whereas, those taxpayers who do not opt for the QRMP scheme or have a total turnover above Rs.5 crore must file the return every month on or before the 11th of the succeeding month.

For example, Form GSTR-1 for the calendar month of April 2023 needs to be filed by 11th May 2023. Form GSTR-1 for the quarter of October to December 2023, needs to be filed by 13th January 2024.

| For businesses with turnover | Month/Quarter | Due Date |

| More than Rs.5 crore | April 2023 | 11th May 2023 |

| June 2023 | 11th July 2023 | |

| Sept 2023 | 11th Oct 2023 | |

| Turnover up to Rs.5 crore & opted QRMP Scheme | Oct-Dec 2023 | 13th Jan 2024 |

| Jan-Mar 2024 | 13th April 2024 |

How to revise GSTR-1?

A return once filed cannot be revised under GST. Any mistake made in the return can be rectified in the GSTR-1 filed for the next period (month/quarter). It means that if a mistake is made in GSTR-1 of September 2023, rectification for the same can be made in the GSTR-1 of October 2023 or subsequent months.

How to file GSTR-1?

GSTR-1 is a return that must be filed by every registered GST taxpayer. This return is filed either on a monthly or quarterly basis and provides comprehensive information about all outward supplies.

To file GSTR-1, first you need to login to the GST Portal.

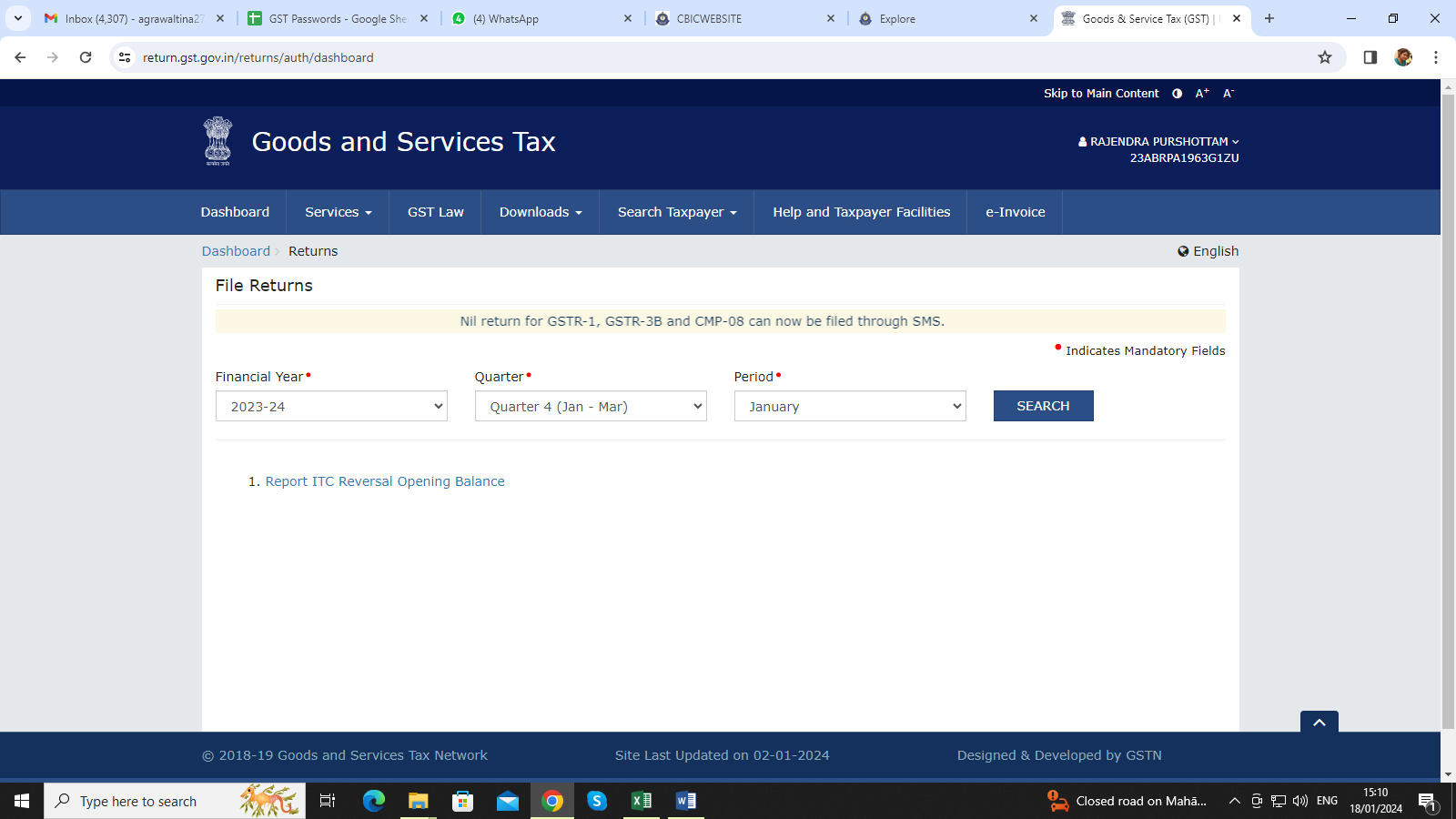

Step-1: Under Service tab << Return tab << Select Returns dashboard

Step-2: Select Financial Year, Quarter/Month & Period & Click on Search Tab.

Step-3: You have the option to choose between preparing return: Prepare Online & Prepare Offline.

Step-4: Select Prepare Online & the GSTR-1 form will now be accessible.

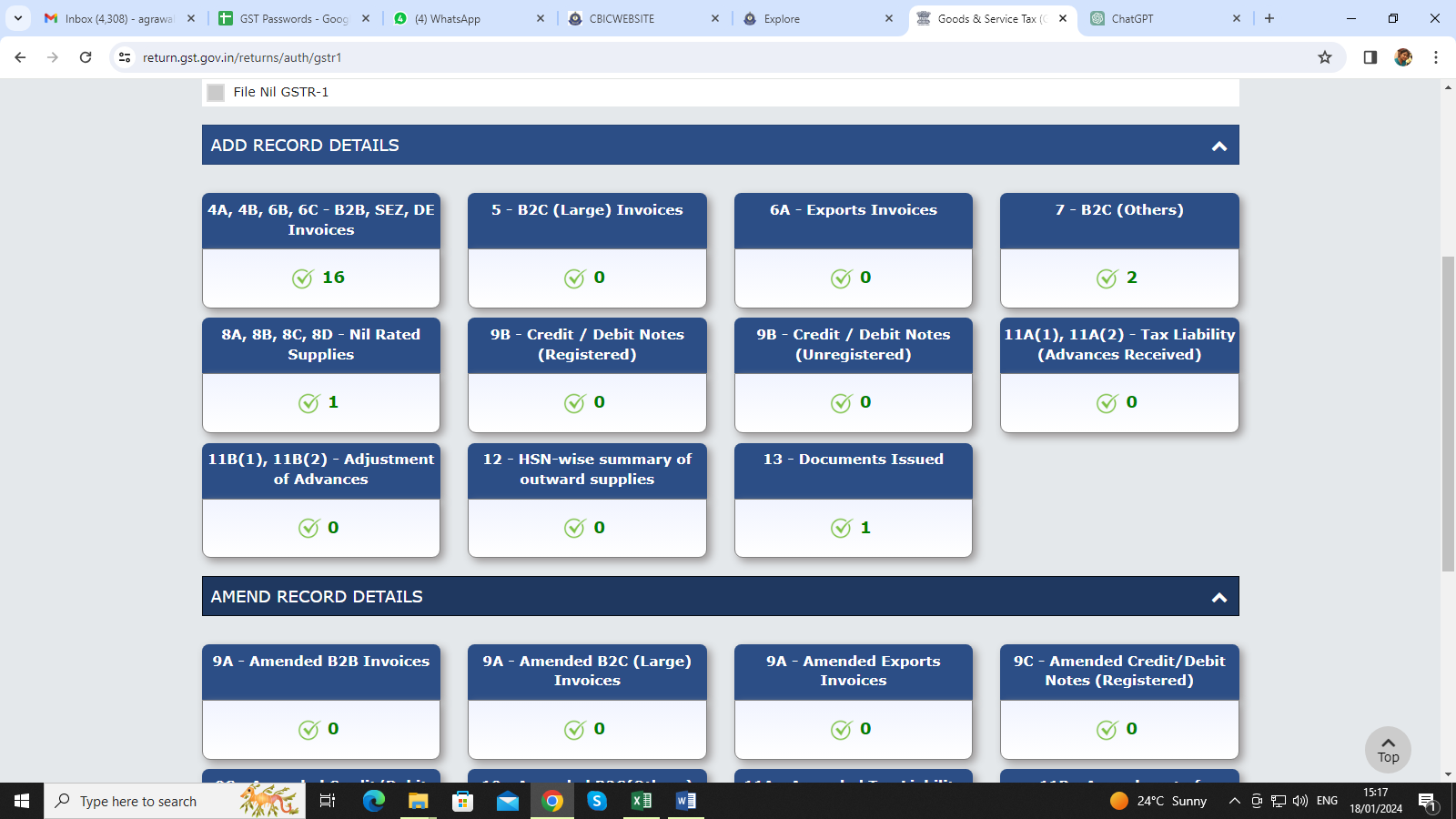

Step-5: The return is structured into 15 sections, listed as follows:

Tables 1, 2 & 3: GSTIN, Legal name, Trade name, Financial year, Tax period, Status of return filling and due date.

Table 4: Taxable outward supplies to registered persons (including UIN-holders) excluding zero-rated supplies and deemed exports.

Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs.2.5 lakh

Table 6: Supplier under Export (Export Invoices) i.e. zero-rated supplies and deemed exports

Table 7: Taxable supplies to unregistered persons other than the supplies covered in table 5

Table 8: Interstate & Intrastate Outward supplies that are nil rated, exempted and non-GST in nature

Table 9: Under Table 9 it has 9A, 9B & 9C. Details are as follows:

Table 9A: There are 3 types of tiles: Amended B2B Invoices, Amended B2C (Large) Invoices and Amended Export Invoices. These tiles pertain to Amendments made to outward supplies which were reported in tables 4, 5 & 6 of the earlier tax periods.

Table 9B: There are 2 types of tiles: Debit note and credit note issued to registered persons & unregistered persons.

Table 9C: There are 2 types of tiles: Amended Credit/Debit Notes (Registered) and Amended Credit/Debit Notes (Unregistered). These tiles relate to Amendments made to Credit & Debit Notes for both registered and unregistered persons, which were previously reported in table 9B during the earlier tax period.

Table 10: Amended B2C (Others) invoices previously reported in table 7 of the prior tax period.

Table 11: Details of advances received or adjusted in the current tax period or amendments of the information reported in the earlier tax period.

Table 11A: Amended Tax Liability (Advances Received)

Table 11A(1), 11A(2): Tax Liability (Advances Received)

Table 11B: Amendment of Adjustment of Advances

Table 11B(1), 11B(2): Adjustment of Advances

Table 12: Summary of Outward supplies based on HSN codes

Table 13: Summary of Documents issued during the tax period.

Table 14: For suppliers - Reporting of GSTIN-wise (GSTIN of ECO operators) sales through e-commerce operators, where the e-commerce operators are liable to collect TCS u/s 52 or liable to pay tax u/s 9(5) of the CGST Act.

Table 14A: For suppliers - Amendments to Table 14

Table 15: For E-commerce operators - Reporting both B2B and B2C, suppliers' GSTIN-wise sales through e-commerce operators on which e-commerce operator must deposit TCS u/s 9(5) of the CGST Act

Table 15A: For E-commerce operators -

Table 15A I - Amendments to Table 15 for sales to GST registered persons (B2B)

Table 15A II - Amendments to Table 15 for sales to unregistered persons (B2C)

Step-6: Once data is entered in all relevant tabs, click on the Generate Summary.

Step-7: Navigate to the "Proceed to File" tab where the consolidated summary has been generated.

Step-8: Choose "File Statement" and proceed to file your return, opting for either the Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) option.

FAQs on Form GSTR-1

1. What is Form GSTR-1? Who must fill out Form GSTR-1?

The Form GSTR-1 is the quarterly or monthly Statement of Outward Supplies that must be submitted by all normal and casual taxpayers who make outward deliveries of services and goods or both. It also contains the details of supplies made outward to other taxpayers of both goods and services.

Every taxpayer who is registered not including an input service distributor/composition taxpayer/persons who are liable to deduct tax under 51 and persons with the power to collect tax under section 52 must submit Form GSTR-1, which contains providing the details of any outward supply of services or goods during the tax year, electronically through GST Portal. GST Portal.

2. When do I have the option to opt-in for the Quarterly Return option to file of the Form GSTR-1?

You can choose quarterly submission of the Form GSTR-1 if you meet the following conditions:

If your aggregate turnover in the previous financial year was more than Rs. 5 Crore or

If you're registered in the current financial year, and anticipate that your gross turnover will exceed Rs. 5 Crores

Note: If you've selected the Opt-in to Quarterly Return You must complete both Form GSTR-1 as well as Form GSTR-3B every quarter.

3. I've already selected the quarterly filing of the GSTR-1 return. Do I have the option to change my choice in the near future?

Option to change frequency is provided if you haven't filed a returns during the year in accordance with the original frequency.

4. Do you have to file Form GSTR-1 compulsory even no supply?

Form GSTR-1 has to be submitted regardless of whether there was no business or other activity (Nil Return) during the tax year i.e. GSTR-1 is compulsory even no supply.

5. What are the different ways of making Form GSTR-1?

Form GSTR-1 is prepared by using the following ways:

a) Online entry into GST Portal..

b) Uploading invoices as well as other Form GSTR-1 information using the Returns Offline tool.

c) Utilizing third-party applications of Application Software Provider (ASPs) through GST Suvidha Providers (GSPs).

6. What information must be provided on Form GSTR-1?

The following information about the tax period should be included in the form GSTR-1

a) Invoice level information of supplies provided to registered people with UINs;

b) Details of the invoice level for Inter- State supplies of an invoice value higher than Rs. 2,50,000 to persons who are not registered (consumers);

c) Details of Credit/Debit Notes provided by the supplier to invoices;

d) Details of exports of services and goods, including the deemed exported goods and services (SEZ);

e) State-level summary of supplies provided to unregistered people (consumers);

f) Summary of the details of advances made in connection with future supply and adjustment of them;

g) Specifics of any modifications made to the data reported for any of the above categories.

h) Nil-rated, exempted, tax-free, and other products that are not GST-compliant;

i) HSN/SAC wise summary of supplies to the outward supply.

7. Which types of registered taxpayers aren't required to file the GSTR-1 Form?

The following taxpayers are not required to fill out Form GSTR-1

a) Taxpayers who are part of the Composition Scheme

b) Non-resident foreign taxpayers

c) Online Information Database as well as access retrieval services provider

d) Input Service Distributors (ISD)

e) Tax Deducted at Source (TDS) (deductors); and

f) E-commerce businesses collecting TCS

8. What are the requirements to file Form GSTR-1?

The pre-requisites for filing Form GSTR-1 include:

a. A taxpayer must be registered as an active GSTIN during the tax period for which Form GSTR-1 must be submitted;

b. In order to access the GST Portal, the taxpayer should possess valid login credentials (i.e., User ID and Password).

c. If required, taxpayers should ensure their digital signature (DSC) remains active and non-expired or revoked;

d. If a taxpayer wishes to utilize EVC, they must obtain access to the registered mobile number of the Primary Authorized Signatory.

9. Who must use DSC when filing their returns?

DSC filing is compulsory for Public and Private Limited Companies, Limited Liability Partnerships (LLPs), and Foreign Limited Liability Partnerships (FLLPs).

10. What is the due date for filing GSTR-1?

• Due date for QRMP scheme taxpayers :- On or before the13th of the month succeeding the end of relevant quarter.

Example : GSTR-1 for QRMP scheme taxpayers for the quarter (January to March 24) will be 13th April 2024.

• Due date for Other than QRMP (Regular) taxpayers :- On or before the 11th of the succeeding month.

Example : GSTR-1 filing deadline for January, 2024 is 11th February 2024

11. Last date of amendment in invoices of previous financial years?

The last date for amending details on invoices issued during the prior financial year is the 30th November of the subsequent financial year or annual return, whichever is earlier. Error or omission correction in respect of invoices from the previous financial year cannot be accepted after 30th November.

12. Is a taxpayer required to link credit or debit notes directly with their original invoices?

No, Taxpayers can report them without having any original invoice as a reference.

13. What does the Total Invoice Value column of Form GSTR-1 represent?

The "Total Invoice Value" column on Form GSTR-1 represents invoice values inclusive of taxes.

14. Will there be any validation on the relationship between Invoice Value and Taxable Value?

Taxable value is defined under GST Law and there will be no confirmation that invoice values match up with its total.

15. Am I allowed to include details for both Goods and Services on one invoice?

Absolutely, all goods and services can be entered into one invoice.

16. What are B2B Supplies?

B2B supplies refer to transactions between registered taxable entities/persons for which taxes have been withheld (i.e. Business-to-Business supplies).

17. What Is B2C Supply?

B2C supplies refer to transactions between Registered providers and Unregistered buyers (Business-to-Consumer).

18. When must Debit Notes Be Reported in My Return?

Debit Notes must be reported within one month of being issued from their supplier.

19. When are Credit Notes Reported in the Return?

Credit Notes must be reported either when issued, or no later than September month following the end of the financial year in which supply occurred, or furnishing of annual return (whichever comes first).

20. Is a taxpayer required to report credit notes and debit notes related to consumer supplies separately?

No. They can all be reported consolidated using Form GSTR 1 by netting off their values against each other.

21. Is a supplier required to pay taxes on any advance received from their receivers?

Supplier is required to pay taxes on advances only in case of services (more than Rs.1000). In case of advance in relation to goods, no tax is required to pay at the time of supply. Suppliers must remit tax on advances received from receivers for services they provide and report these in Form GSTR-1 at once they are received. Any advance payments should be netted off against invoiced amounts already issued as well as those which have already been reported elsewhere within that return form.

22. How is tax paid on advance payments adjusted against invoice(s) issued in subsequent tax periods?

A taxpayer must report an advance as payable within their tax return for that particular tax period in which it was received; when an invoice is then issued by an entity that includes their advance, then taxpayer can adjust against it as part of their bill payment obligation.Adjust the tax liability associated with each invoice issued during that tax period in Form GSTR-1 by using its advance adjustment table. This can be seen in Form GSTR-1 of that particular period.

23. What is the treatment of exports?

Exports are treated as zero-rated inter-state supplies under GST law and thus taxpayers have two options when exporting: either they can export without incurring integrated tax with the filing of LUT or Pay IGST and claim a refund of ITC against their exports.

24. Is a Shipping Bill Number Necessary When Declaring Export Invoices in GSTR-1?

No, taxpayers may provide details of export invoices without specifying shipping bill details if such details are unavailable to them.

25. How can the details of shipping bill details be provided after filing Form GSTR-1?

If the taxpayer receives any such details after having filed their Form GSTR-1, they need to declare them via the amendment section in Form GSTR-1 of that month in which they received them.

26. How should I report supplies to SEZ units or developers in Form GSTR-1?

Since all SEZ units and developers registered under GSTIN are required to report any invoice details of supplies delivered directly or indirectly with an appropriate SEZ flag, then this information needs to be recorded under "supplies to registered taxpayers (B2B invoice details)."