What Is the GST HSN Code for Plastic Products?

Based on specific characteristics and structure, plastic products are categorized under various HSN codes. The most common HSN code for plastic products are covered under Chapter-39. Under this HSN code a wide range of plastic items including plastic articles, plastic containers, plastic sheets, plastic bags, and more are covered.

What Is the GST Rate for Plastic Items?

The GST rates for plastic products are based on the type of plastic item. Generally on plastic products GST rate of 12%, 18%, or 28% is applicable. So to determine an accurate GST rate, it is important to identify the correct HSN code of that plastic product.

What Is the HSN Code and GST Rate for PVC?

Polyvinyl Chloride (PVC) is a commonly used type of plastic. PVC products are covered under chapter 39. GST rates on PVC products are depend upon the specific type of product. For example, GST rate on PVC pipes and fittings is 18% while GST at the rate of 28% is applicable on PVC sheets and films.

What Is the HSN Code for Plastic Item (8 Digit)?

Generally, the HSN codes for any products are 6 digits long. However to provide a more specific classification, an 8-digit HSN code can be used. The additional two digits further differentiate specific types or structures of plastic items. To ensure accurate classification it is essential to mention the specific HSN code for the particular plastic product.

What Is the HSN Code for Plastic Product Manufacturing?

The HSN code for the manufacturing of plastic products falls under the chapter 39. This code encloses a broad range of plastic products and articles produced through various manufacturing processes.

What Is the GST Rate for the 3923 HSN Code?

Items made of plastic are covered under HSN code 3923. However, for accurate classification and determination of the GST rate, it is required to mention the complete HSN Code. The GST rate for items falling under HSN code 3923 may vary based on the specific item or product. Generally plastic products falling under HSN code 3923 are subject to an 18% GST rate.

What Is HSN Code 39269080?

HSN code 39269080 pertains to "Other articles of plastics." This code includes various plastic products that are not classified under more specific HSN codes. The applicable GST rate for HSN code 39269080 is 18%.

What Is HSN Code 39249090?

HSN code 39249090 is designated for "Other household articles & Hygiene or toilet articles of plastics." This category includes various household items such as plastic hangers, buckets, dustpans and brushes. The GST rate applicable for HSN code 39249090 is 18%.

What is the HSN code 3915 for waste plastic?

HSN Code 3915: Harmonized System Code of WASTE, PARINGS AND SCRAP; SEMI-MANUFACTURES; ARTICLES WASTE, PARINGS AND SCRAP OF PLASTICS.

Is there GST on plastic granules?

Polymers of ethylene, in primary forms like Plastic granules, are classified under HSN 3901 and the GST rate is 18%.

What is the GST rate & HSN Code for plastic water bottles?

An 18% GST rate under HSN Code 3924 is applied to a range of water-based products.

What is the GST rate & HSN Code for plastic dustbins?

Plastic Household Items:

Plastic household items include buckets, mugs, and dustbins. The GST rate for plastic household items is 18% under HSN Code 39249010.

FAQs on Plastic Products :

Q : Plastic HSN code and GST Rate?

| Description of Goods | CGST Rate (%) | SGST / UTGST Rate (%) | IGST Rate (%) | |

| Chapter / Heading /Sub-heading / Tariff item | ||||

| 3926 | Plastic beads | 6% | 6% | 12% |

| 5604 | Rubber thread and cord, textile covered; textile yarn, and strip and the like of heading 5404 or 5405, impregnated, coated, covered or sheathed with rubber or plastics | 6% | 6% | 12% |

| 5607 | Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics | 6% | 6% | 12% |

| 5903 | Textile fabrics impregnated, coated, covered or laminated with plastics, other than those of heading 5902 | 6% | 6% | 12% |

| 5910 | Transmission or conveyor belts or belting, of textile material, whether or not impregnated, coated, covered or laminated with plastics, or reinforced with metal or other material | 6% | 6% | 12% |

| 3405 | Polishes and creams, for footwear, furniture, floors, coachwork, glass or metal, scouring pastes and powders and similar preparations (whether or not in the form of paper, wadding, felt, nonwovens, cellular plastics or cellular rubber, impregnated, coated or covered with such preparations), excluding waxes of heading 3404 | 9% | 9% | 18% |

| 3812 | Prepared rubber accelerators; compound plasticisers for rubber or plastics, not elsewhere specified or included; anti- oxidising preparations and other compound stabilisers for rubber or plastics.; such as Vulcanizing agents for rubber | 9% | 9% | 18% |

| 3915 | Waste, Parings and Scrap, of Plastics | 9% | 9% | 18% |

| 3916 | Monofilament of which any cross- sectional dimension exceeds 1 mm, rods, sticks and profile shapes, whether or not surface-worked but not otherwise worked, of plastics | 9% | 9% | 18% |

| 3917 | Tubes, pipes and hoses, and fittings therefor, of plastics | 9% | 9% | 18% |

| 3918 | Floor coverings of plastics, whether or not self-adhesive, in rolls or in form of tiles; wall or ceiling coverings of plastics | 9% | 9% | 18% |

| 3919 | Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics, whether or not in rolls | 9% | 9% | 18% |

| 3920 | Other plates, sheets, film, foil and strip, of plastics, non-cellular and not reinforced, laminated, supported or similarly combined with other materials | 9% | 9% | 18% |

| 3921 | Other plates, sheets, film, foil and strip, of plastics | 9% | 9% | 18% |

| 3922 | Baths, shower baths, sinks, wash basins, bidets, lavatory pans, seats and covers, flushing cisterns and similar sanitary ware of plastics | 9% | 9% | 18% |

| 3923 | Articles for the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics (except the items covered in Sl. No. 80AA in Schedule II) | 9% | 9% | 18% |

| 3924 | Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics | 9% | 9% | 18% |

| 3925 | Builder's wares of plastics, not elsewhere specified | 9% | 9% | 18% |

| 3926 | Other articles of plastics and articles of other materials of headings 3901 to 3914 other than bangles of plastic, plastic beads and feeding bottles | 9% | 9% | 18% |

| 4202 | Trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels, spectacle cases, binocular cases, camera cases, musical instrument cases, gun cases, holsters and similar containers; travelling bags, insulated food or beverages bags, toilet bags, rucksacks, handbags, shopping bags, wallets, purses, map-cases, cigarette-cases, tobacco- pouches, tool bags, sports bags, bottle- cases, jewellery boxes, powder-boxes, cutlery cases and similar containers, of leather, of sheeting of plastics, of textile materials, of vulcanised fibre or of paperboard, or wholly or mainly covered with such materials or with paper [other than handbags and shopping bags, of cotton or jute] | 9% | 9% | 18% |

| 6401 | Waterproof footwear with outer soles and uppers of rubber or of plastics, the uppers of which are neither fixed to the sole nor assembled by stitching, riveting, nailing, screwing, plugging or similar processes | 9% | 9% | 18% |

| 6402 | Other footwear with outer soles and uppers of rubber or plastics | 9% | 9% | 18% |

| 6403 | Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather | 9% | 9% | 18% |

| 6404 | Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of textile materials | 9% | 9% | 18% |

| 7607 | Aluminium foil (whether or not printed or backed with paper, paperboard, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0.2 mm | 9% | 9% | 18% |

| 8465 | Machine-tools (including machines for nailing, stapling, glueing or otherwise assembling) for working wood, cork, bone, hard rubber, hard plastics or similar hard materials | 9% | 9% | 18% |

| 8477 | Machinery for working rubber or plastics or for the manufacture of products from these materials, not specified or included elsewhere in this Chapter | 9% | 9% | 18% |

| 8480 | Moulding boxes for metal foundry; mould bases; moulding patterns; moulds for metal (other than ingot moulds), metal carbides, glass, mineral materials, rubber or plastics | 9% | 9% | 18% |

| 9024 | Machines and appliances for testing the hardness, strength, compressibility, elasticity or other mechanical properties of materials (for example, metals, wood, textiles, paper, plastics) | 9% | 9% | 18% |

| 9404 | Mattress supports; articles of bedding and similar furnishing (for example, mattresses, quilts, eiderdowns, cushions, pouffes and pillows) fitted with springs or stuffed or internally fitted with any material or of cellular rubber or plastics, whether or not covered [other than coir products (except coir mattresses), products wholly made of quilted textile materials and cotton quilts | 9% | 9% | 18% |

| 9606 21 00, 9606, 22 00, 9606 29, 9606 30 | Buttons, of plastics not covered with the textile material, of base metals, buttons of coconut shell, button blanks | 9% | 9% | 18% |

| 3926 | Plastic bangles | 0 | 0 | 0 |

Q : Plastic bucket HSN code and GST Rate?

A : Bucket HSN code and GST Rate is 39249090 & 18% simultaneously.

Q : 3923 HSN code GST Rate?

A : 3923 HSN Code is for Articles for ‘the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics (except the items covered in Sl. No. 80AA in Schedule II)’ and the GST Rate for HSN code 3923 is 18%.

Q : 3924 HSN code GST Rate?

A : 3924 HSN Code is for ‘Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics’ and the GST rate for HSN Coode 3924 is 18%.

Q : Plastic bag HSN code and GST Rate?

A : Plastic bag HSN code is 4202 is for ‘Trunks, suitcases, vanity cases, executive cases, briefcases, school satchels, spectacle cases, binocular cases, camera cases, musical instrument cases, gun cases, holsters, and similar containers; traveling bags, insulated food or beverage bags, toilet bags, rucksacks, handbags, shopping bags, wallets, purses, map cases, cigarette cases, tobacco pouches, tool bags, sports bags, bottle cases, jewelry boxes, powder boxes, cutlery cases, and similar containers, made of leather, sheeting of plastics, textile materials, vulcanized fiber, or paperboard, or wholly or mainly covered with such materials or with paper [other than handbags and shopping bags, of cotton or jute]’ & GST Rate for Plastic Bag is 18%.

Q : HSN 3923 is used for and GST Rate?

A : HSN 3923 is for Articles for the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics (except the items covered in Sl. No. 80AA in Schedule II)

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

E-Invoicing Applicability Under GST

Electronic invoicing, commonly known as E-Invoicing or E-Invoice, is gaining prominence worldwide as governments take steps to combat tax evasion. This digital method of billing is being increasingly mandated by governments as a means to enhance tax compliance.

Meaning

E-Invoice also known as E-invoicing is a system in which all Business-to-Business (B2B) invoices and other documents are uploaded and authenticated electronically on the government's GST Invoice Registration Portal (IRP). After the successful verification of the invoice, a unique Invoice Reference Number (IRN) is generated by the IRP portal. Additionally, the applicable businesses must generate a QR code for the e-invoice. Further, together with the IRN and QR code, a digitally signed invoice would be available for the supplier. This is issued to the product's recipient and is known as the e-invoice or electronic invoice.

E-invoicing statutory provisions:

According to Rule 48(4) of the CGST Rules, 2017, taxpayers are obligated to create an electronic invoice by inputting the designated details into FORM GST INV-01 on the Invoice Registration Portal (IRP) and acquire the Invoice Reference Number (IRN).

Registered individuals, except specified groups, whose aggregate turnover in any previous financial year from 2017-18 onward surpasses Rs. 5 crores, have been designated as the category of individuals obligated to create E-invoices for B2B supplies (supply of goods or services or both to a registered person) or for exports. At present, such designated individuals are not obliged to report B2C (business-to-consumer) invoices on the Invoice Registration Portal (IRP). However, the inclusion of B2C invoice reporting into e-invoicing will be implemented in a subsequent phase. Additionally, it's important to note that e-invoicing does not apply to invoices issued by Input Service Distributors (ISD).

In cases where e-invoicing is mandatory, invoices issued by the mentioned individuals in any manner other than that specified in rule 48(4) will not be considered valid invoices. Additionally, when e-invoicing is in effect, there is no requirement to provide invoice duplicates or triplicates.

E-invoicing is mandatory even if a notified individual issues an invoice for supplies made by them, for which the tax is payable under the reverse charge mechanism as per Section 9(3).

Phase-wise summary of E-invoicing applicability as per aggregate turnover of a taxpayer:

| Phase | Applicable to taxpayers having an aggregate turnover of more than | Applicable date | Notification number |

| I | Rs 500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| II | Rs 100 crore | 01.01.2021 | 88/2020 – Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 – Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 – Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 – Central Tax |

| VI | Rs. 5 Crore | 01.08.2023 | 10/2023-Central Tax |

What is the turnover limit for issuing E-Invoicing?

According to Notification No. 10/2023 Central Tax dated 10-05-2023, if the turnover of any taxpayer in any one year from FY 2017-18 to FY 2022-23 is Rs.5 Crore or more then from 01.08.2023 all B2B invoices will now compulsorily be created as E-invoice.

How to check the requirement of E-invoice applicability for FY 2022-23

| Financial Year | Case-1 | Case-2 | Case-2 |

| 2017-18 | T>5Cr | T<5Cr | T<5Cr |

| 2018-19 | T<5Cr | T<5Cr | T<5Cr |

| 2019-20 | T<5Cr | T<5Cr | T<5Cr |

| 2020-21 | T<5Cr | T<5Cr | T<5Cr |

| 2021-22 | T<5Cr | T<5Cr | T<5Cr |

| 2022-23 | T<5Cr | T<5Cr | T<5Cr |

| 2023-24 | T<5Cr | T<5Cr | T>5Cr |

| E-invoice | Yes (from 01.08.2023) |

Not applicable | Not applicable (e-invoice will be applicable from 01.04.2024) |

Who is exempt from E-Invoicing?

The Registered person who is exempt from e-invoicing irrespective of the annual turnover as per the CBIC Notification No.13/2020.

Businesses exempt from e-invoicing:

- SEZ units. (CBIC Notification No. 61/2020)

- An insurer or a banking company or a financial institution, including a non-banking financial company.

- Goods transport agency supplying services for transportation of goods by road in a goods carriage.

- Suppliers of passenger transportation services.

- Suppliers of services by way of admission to an exhibition of cinematograph films on multiplex screens.

- A government department and Local authority. (CBIC Notification No. 23/2021)

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR)

Documents exempt from e-invoicing

- Delivery challans

- Bill of supply

- Bill of entry

- ISD invoices

Transactions exempt from e-invoicing

- Any Business-to-Consumers (B2C) sales

- Nil-rated or non-taxable or exempt B2B sale of goods or services

- Nil-rated or non-taxable or exempt B2C sale of goods or services

- Imports, high sea sales, and bonded warehouse sales

- Free Trade & Warehousing Zones (FTWZ)

What will happen if Invoices have not been created?

According to section-122 of CGST Act’2017, there are broadly 2 penalties that are applicable in case of non-compliance with e-invoicing norms.

- Penalty for non-issuance of e-invoice: 100% of the tax due or Rs.10,000 whichever is higher.

- Penalty for incorrect or erroneous e-invoice: up to Rs.25,000.

Cancellation of reported E-invoice

The IRN reported on the Invoice Registration Portal (IRP) by the seller will be canceled by submitting a cancel request within 24 hours from the time of generation.

- Each invoice will be canceled individually.

- There is no provision to modify, alter or partially cancel an already generated E-invoice.

- Once the IRN has been canceled, the same invoice number cannot be used when generating another invoice.

- If an E-invoice has been cancelled, then reporting the IRN number must be done within 24 hours of canceling.

FAQ’s on E-Invoicing

Q-1 What is E-invoicing?

Ans- As per Rule 48(4) of CGST Rules, the notified class of registered persons has to prepare an invoice by uploading specified particulars of the invoice (in FORM GST INV-01) on the Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).

After following the above ‘e-invoicing’ process, the invoice copy containing inter alia, the IRN (with QR Code) issued by the notified supplier to the buyer is commonly referred to as an ‘e-invoice’ in GST.

Because of the standard e-invoice schema (INV-01), ‘e-invoicing’ facilitates the exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format.

Please note that ‘e-invoice’ in ‘e-invoicing’ doesn’t mean generation of invoice by a Government portal.

Q-2 What documents are presently covered under E-invoicing?

Ans- Invoices, Credit Notes & Debit Notes when issued by a notified class of taxpayers (to registered persons (B2B) or for the purpose of Exports) are currently covered under e-invoice.

Though different documents are covered, for ease of reference and understanding, the system is referred to as ‘e-invoicing’.

Q-3 What supplies are presently covered under E-invoice?

Ans- Supplies to registered persons (B2B), Supplies to SEZs (with/without payment), Exports (with/without payment), and Deemed Exports, by notified class of taxpayers are currently covered under e-invoice.

Q-4 B2C (Business to Consumer) supplies can also be reported by notified persons?

Ans- No. Reporting B2C invoices by notified persons is not applicable/allowed currently.

Q-5 Is E-invoicing applicable for NIL-rated or wholly-exempt supplies?

Ans- No. In those cases, a bill of supply is issued and not a tax invoice.

Q-6 Do SEZ Developers need to issue e-invoices?

Ans- Yes, if they have the specified turnover and fulfill other conditions of the notification.

In terms of Notification (Central Tax) 61/2020 dt. 30-7-2020, only SEZ Units are exempted from issuing e-invoices.

Q-7 Whether E-invoicing is applicable for supplies involving Reverse Charge?

Ans- If the invoice issued by the notified person is in respect of supplies made by him but attracting reverse charge under Section 9(3), e-invoicing is applicable.

For example, a taxpayer (say Goods Transport Agency or a Firm of Advocates having aggregate turnover in an FY is more than Rs. 500 Cr.) is supplying services to a company (who will be discharging tax liability as recipient under RCM), such invoices have to be reported by the notified person to IRP.

On the other hand, where supplies are received by a notified person from (i) an unregistered person (attracting reverse charge under Section 9(4)) or (ii) through import of services, e-invoicing doesn’t arise / not applicable.

Q-8 If E-invoice is applicable and issued, am I supposed to issue copies of invoice in triplicate/duplicate?

Ans- Where e-invoicing is applicable, there is no need of issuing invoice copies in triplicate/duplicate. This is clearly specified in Rule 48(6).

Q-9 For generating IRN, whether the GSTINs of supplier and recipient should be active on the GST system?

Ans- Yes, as e-invoicing is mandated for specified registered persons to other ‘registered persons’, both the GSTINs of supplier and recipient shall be active in the GST System, as on the date of the document being reported.

Q-10 Taxpayers (for whom e-invoicing is compulsory) will be making supplies to small businesses (for whom e-invoicing is not mandatory). How these small businesses will get the invoice from those big suppliers?

Ans- In the same way, as it is being done now. For example, the large taxpayers can convert the signed e-invoice JSON into PDF and share the copy by e-mail or send printed copies by post, courier etc.

However, a mechanism to enable system-to-system exchange of e-invoices will be made available in due course.

Q-11 Can I amend the details of a reported invoice for which IRN has already been generated?

Ans- Amendments are not possible on IRP. Any changes in the invoice details reported to IRP can be carried out on the GST portal (while filing GSTR-1). In case GSTR1 has already been filed, then use the mechanism of amendment as provided under GST. However, these changes will be flagged to the proper officer for information.

Q-12 Can an IRN/invoice reported to IRP be cancelled?

Ans- Yes, the cancellation request can be triggered through ‘Cancel API’ within 24 hours from the time of reporting the invoice to IRP.

However, if the connected e-way bill is active or verified by the officer during transit, cancellation of IRN will not be permitted. In case of cancellation of IRN, GSTR-1 be updated with such ‘cancelled’ status.

Q-13 What is E-invoicing applicability from 1st April 2021?

Ans- As per Notification No. 5/2021- Central Tax, from 1.04.2021 E-invoice is applicable to taxpayers having an aggregate turnover of more than Rs. 50 Crore.

Q-14 What is the E-invoice turnover limit from 1st April 2022?

Ans- As per Notification No. 1/2022- Central Tax, from 1.04.2022 E-invoice is applicable to taxpayers having an aggregate turnover of more than Rs. 20 Crore.

Q-15 From which date E-invoice turnover limit of Rs. 10 Crore is applicable?

Ans- As per Notification No. 17/2022- Central Tax, from 1.10.2022 E-invoice is applicable to taxpayers having an aggregate turnover of more than Rs. 10 Crore.

Q-16 What is the time limit to generate E-invoicing?

Ans- E-invoice must be generated within 30 days from the date of Invoice, debit-credit note as the case may be. However, this rule of E-invoicing is applicable only to businesses with an Annual aggregate turnover of Rs.100 Crore & more.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

India's two pillars of identity, the PAN card, and Aadhaar stand tall, each serving distinct purposes. The PAN, issued by the Income Tax department, acts as your financial fingerprint, while Aadhaar, from the Unique Identification Authority of India (UIDAI), is your unique digital key. Strengthening the financial ecosystem, India's PAN and Aadhaar join hands to combat tax evasion through unique identifier synergy.

Notable Timeline & Fee

| Particular | Deadline | Fee |

| PAN-Aadhaar linking was March 31, 2022, extended to June 30, 2022 | March 31, 2022 | N/A |

| linking between July 1, 2022, and June 30, 2022. | June 30, 2022 | Rs. 500 |

| linking between July 1, 2022, and June 30, 2023. | June 30, 2023 | Rs. 1,000 |

Get concise answers to your GST and Income Tax queries.

Clarify doubts and navigate complexities with ease.

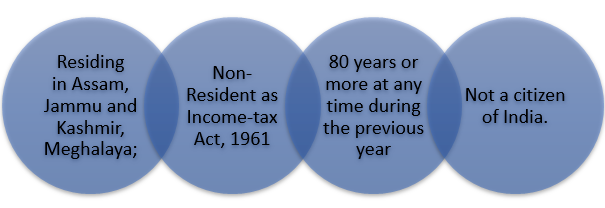

Exempt Categories: Those exempt from linking by June 30, 2023, include

Note:

- The exemptions provided are subject to modifications depending on subsequent government notifications on this subject

- For further details refer to Department of Revenue Notification No 37/2017 dated 11th May 2017”

- However, for users falling in any of the above categories, voluntarily desires to link Aadhaar with PAN fee payment of a specified amount is required to be done.

Importance of Linking:

- Inoperative PAN cards after July 1, 2023.

- Mandatory for filing Income Tax Returns (ITR).

- Necessary for accessing government services, obtaining subsidies, opening bank accounts, and passport applications.

Concerns of Non-Linking:

- Inoperative PAN affects ITR filing and processing.

- Pending returns and refunds not processed.

- Higher TCS/TDS rates and missing credits in Form 26AS.

- Inability to submit 15G/15H declarations for nil TDS.

- Restrictions on banking transactions, mutual fund purchases, and more.

Transactions Impacted:

- Opening bank accounts.

- Debit/credit card issuance.

- Mutual funds unit purchases.

- Cash deposits exceeding Rs. 50,000.

- Bank drafts/pay orders exceeding Rs. 50,000.

- Time deposits exceeding Rs. 50,000.

- Prepaid payment instrument transactions exceeding Rs. 50,000.

- Sale/purchase transactions exceeding Rs. 2,00,000.

- All bank transactions exceeding Rs. 10,000.

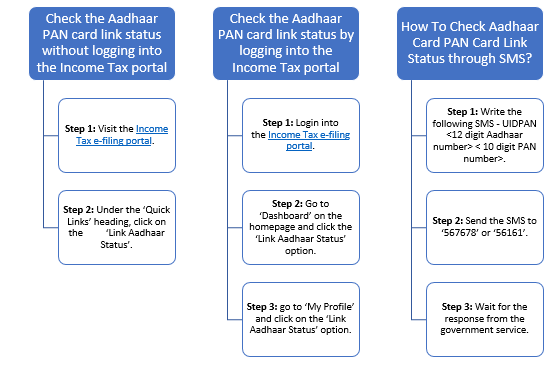

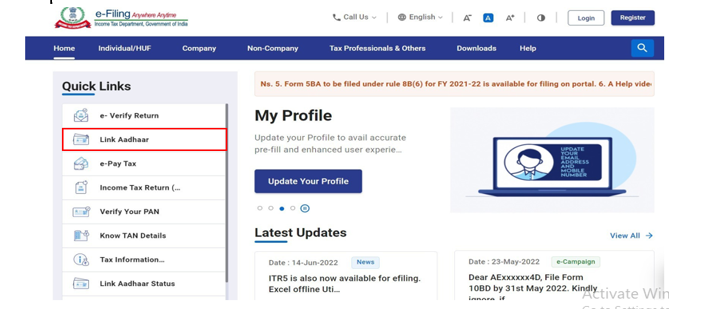

How To Check Aadhar PAN Card Link Status Online

To check the Aadhar linking status with PAN there are 3 options one can choose any of the following options to find out the Aadhar link status.

Restoration of PAN Operability:

1. PAN can be made operative in 30 days by providing Aadhaar details and paying an Rs. 1,000 fee.

Link Aadhaar User Manual {Issue by Income Tax }

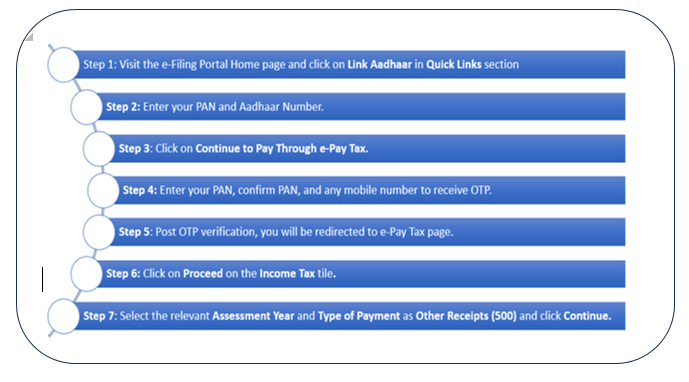

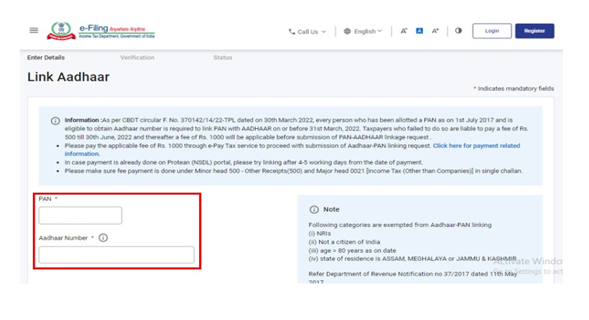

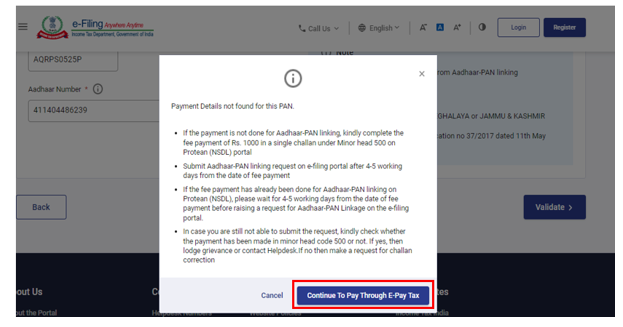

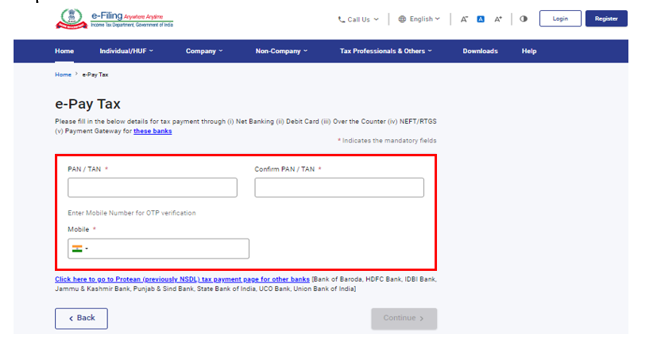

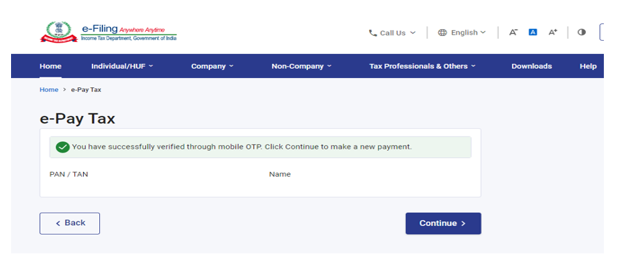

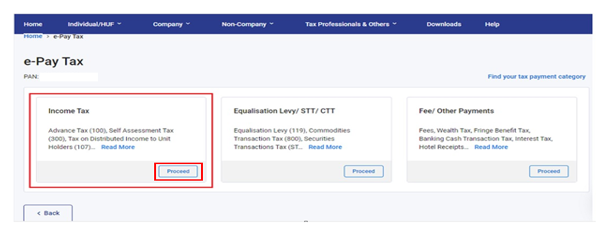

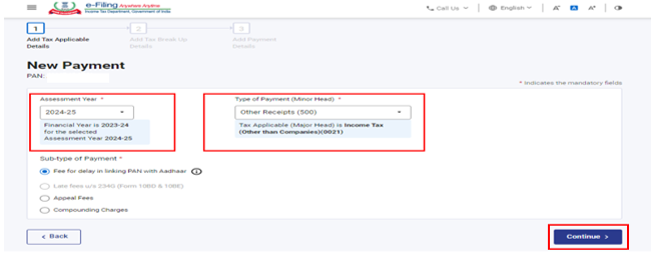

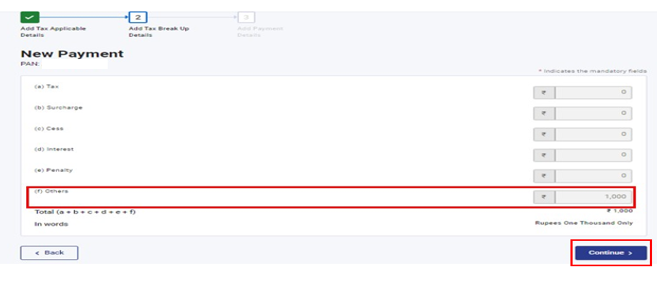

If PAN and Aadhaar are not linked, the person must pay a fee for not linking within the time limit. The steps are mentioned below.

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Step 7

Step 8

After making the payment of the fee, you can link your Aadhaar with your PAN on the e-Filing Portal.

Step 1 Go to link Adhaar link.

Step 2 Put your PAN and Adhaar number and validate it.

Step 3 Enter your name and Mobile number in the next window.

Step 4 Put the OTP received on mobile number.

Step 5 A pop-up window will open for “link of Aadhaar has been submitted successfully”.

Disclaimer:-The information available on this Website/Application is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on Website/Application, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this Website/Application

What does the Reversal of Input Tax Credit mean?

In certain situations, even if the basic conditions for claiming ITC are fulfilled, the claims for ITC should be reversed. Depending on when such reversal is undertaken, interest payments may also be required.

Here are some examples in the Goods and Services Tax (GST) Act where reversing Input Tax Credit (ITC) is necessary when filing GST returns. It is essential to reverse additional ITC taken or ITC wrongly taken during the process of filing GST returns.

An instance where the reversal of Input Tax Credit is necessary is outlined under Rule 42 of the Central Goods and Services Tax (CGST) Act, 2017. Under Rules 42 of the CGST Act 2017, ITC in relation to inputs or input services is attracted by the provisions of sub-section (1) or sub-section (2) of Section 17.

As per Section 17(1) of CGST Act 2017, Credit admissibility if goods and/or services are used for providing both business as well as non-business purposes:

Goods or Services or both used partly for business and partly for other purposes, credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

As per Section 17(2) of CGST Act 2017, Credit admissibility if goods and/or services are used for providing both taxable as well as exempted supplies:

Where the goods or services or both are used by the registered person

- partly for effecting taxable supplies including zero-rated supplies and

- partly for effecting exempt supplies

Credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.So, As per ITC Reversal Rule, Rule 42 of CGST Act, Input Tax Credit applied to inputs, and input services used for both taxable and non-taxable/exempt supplies or for manufacturing, where some of the supplies were utilized for non-business or personal purposes must be assessed and subsequently reversed.

The total Input Tax Credit (ITC) can be apportioned among the following types of ITC:

Specific Credit: Input Tax Credit (ITC) can be attributable specifically to supplies that are taxable or non-taxable or for supplies utilized for personal or non-business purposes. This ITC can be easily identified for a particular supply.

Common Credit: The amount of Input Tax Credit (ITC) that cannot be exclusively attributed to a specific supply but is used partially for making taxable supplies and partially for non-taxable supplies or partially for personal consumption can be referred to as common ITC.

Rules 42 and 43 provide a method for determining the reversal of Input Tax Credit (ITC), which is used partially for making taxable supplies and partially for non-taxable supplies or for personal/non-business purposes.

Therefore, if you are a supplier dealing with both taxable and exempt services/non-taxable services, you are required to determine and reverse the common credit used for both taxable and non-taxable services based on the formula provided as per CGST Rules, Rules 42 and 43.

Rule 42 pertains to determining the common credit of Input Tax Credit (ITC) on goods and services, while Rule 43 discusses determining the common credit of ITC on capital goods and reversing the amount attributable to both.

The determination method for the reversal of Input Tax Credit as specified in Rules 42 and 43 of the Central Goods and Services Tax Rules, 2017

The amount of Input Tax Credit (ITC) that needs to be reversed is calculated by multiplying the ratio of the turnover of exempted supplies by the total turnover of the common Input Tax Credit.

Additionally, in the case of "real estate services," the Input Tax Credit (ITC) that needs to be reversed is calculated by multiplying the ratio of the carpet area of the exempted area to the total carpet area by the common Input Tax Credit.

Rule 42: Calculation of Input Tax Credit for Input & Input Services and its reversal in normal cases (i.e. excluding real estate services):

If a taxpayer is involved in supplying both taxable and non-taxable supplies, the calculation for eligible Input Tax Credit will be as follows:

| Step 1 | Calculate the Total Input Tax in a tax period, which should be the total of all types of taxes paid on inward supplies and is denoted as “T”. Out of the total input tax credit (T) on inputs and input services, the ineligible credits shall be T1 + T2 + T3 and the eligible credits shall be T4 which would be as follows- |

| Step 2 | Taxes paid for supplies used exclusively for purposes other than business, denoted as “T1”. |

| Step 3 | Taxes paid for supplies used exclusively for effecting Exempted supplies, denoted as “T2” |

| Step 4 | Taxes paid for supplies on which credit is not available under Section 17(5), denoted as “T3” |

| Step 5 | Amount of ITC credited to Electronic Credit Ledger of Registered Person, denoted as “C1” i.e. C1 = T- (T1 + T2 + T3) |

| Step 6 | ITC on supplies other than Exempted but including Zero-rated supplies, denoted as “T4”. This credit is purely for business purposes and is fully eligible as ITC. |

| Step 7 | Common Input Tax Credit on inward supplies used for taxable as well as exempted outward supplies denoted as “C2” i.e. C2 = C1 – T4 |

| Step 8 | ITC attributable towards exempted supplies, denoted as “D1” i.e. D1 = (E/F) * C2 |

| Step-9 | If common ITC [C2] is used for both Business as well as Non-Business purposes then ITC attributable to Non-Business purposes shall be 5% of Common Credit and is denoted as D2 i.e. D2= C2*5% |

| Step-10 | The balance of the common credit shall be the eligible credit out of the common credit deemed as used for business purposes and is denoted as C3 i.e. C3= C2-(D1+D2) |

| Step-11 | The amounts of T1, T2, & T3 are ineligible credits. |

| Step-12 | C3 is to be computed separately for CGST, SGST, UTGST, and IGST |

| where- E = Aggregate value of Exempted Supplies during the Tax Period & F = Total Turnover in the state of the Registered person during the Tax Period |

|

Remarks:

- If the calculated amount exceeds the provisional calculation, the additional amount should be added to the output tax liability.

- Interest is to be paid from the month of April of the next financial year until the date of payment.

EXAMPLE:

Alfa Ltd. is a company providing taxable as well as exempted services. Turnover of Alfa Ltd. for the period of January 2023 is as under:

| Particulars | Amount (Rs.) |

| Value of taxable supply of service | 60,00,000 |

| Value of exempt supply of service | 15,00,000 |

| Value of zero-rated supply of service | 20,00,000 |

| Value of service made for personal use | 5,00,000 |

Details of ITC for the month:

| Particulars | CGST Paid (Rs.) | SGST Paid (Rs.) | IGST Paid (Rs.) |

| Total ITC available | 2,00,000 | 2,00,000 | 100000 |

| The above ITC on input service includes: | |||

| Credit on input services exclusively used for supplying exempt services | 20,000 | 20,000 | 15,000 |

| Credit on input services exclusively used for supplying taxable services (including zero-rated supplies) | 1,08,000 | 1,08,000 | 55,000 |

| Credit availed on inputs which are ineligible under section 17(5) | 20,000 | 20,000 | 8,000 |

| Credit on input service exclusively used for personal use | 18,500 | 18,500 | 5,000 |

CALCULATE:

- Entitlement of ITC of A Ltd. For the month of January 2023 under rule 42 of CGST rules.

- The amount to be added to the output tax liability of A Ltd

Answer

Computation of ITC eligible for tax period January 2023:

| Particulars | CGST | SGST | IGST |

| Total TC in a tax period [T] | 2,00,000 | 2,00,000 | 100000 |

| Less: | |||

| Credit on input service exclusively used for personal use [T1] | 18,500 | 18,500 | 5,000 |

| Credit on input services exclusively used for supplying exempt services [T2] | 20,000 | 20,000 | 15,000 |

| Credit availed on inputs which are ineligible under section 17(5) [T3] | 20,000 | 20,000 | 8,000 |

| Amount of ITC [C1] | |||

| C1 = T- [T1 + T2 + T3] | 141,500 | 141,500 | 72,000 |

| Less: Credit on input services exclusively used for supplying taxable services (including zero-rated) [T4] |

1,08,000 | 1,08,000 | 55,000 |

| Common credit of input and input services used for providing supply of services [C2] C2= C1-T4 |

33500 | 33500 | 17000 |

| Total inadmissible common credit as per rule 42(1) [D1+ D2] [WN-1] | 6700 | 6700 | 3400 |

| Net eligible common credit C3= C2- [D1+D2] | 26800 | 26800 | 13600 |

| Total eligible credit [T4+ C3] | 134800 | 134800 | 68600 |

| 2) Amount to be added to output tax liability [D1 + D2] |

6700 | 6700 | 3400 |

Working note 1: Calculation of the amount of ITC towards exempt supplies and supplies made for non-business use:

| Particulars | CGST (Rs.) | SGST (Rs.) | IGST (Rs.) |

| Aggregate value of exempt supply of service[E] | 15,00,000 | 15,00,000 | 15,00,000 |

| Total turnover for Jan 2023 | 1,00,00,000 | 1,00,00,000 | 1,00,00,000 |

| Credit attributable towards exempt supplies D1= [E/F] *C2 |

5025 | 5025 | 2550 |

| Credit attributable for supplies made towards non-business purposes as per clause (j) of rule 42(1) D2= C2*5% |

1675 | 1675 | 850 |

| Total inadmissible common credit as per rule 42(1) D1+D2 |

6700 | 6700 | 3400 |

Need for Reversal of ITC under Rules 42/43 of CGST Act, 2017

As per Section 17 (1) & (2) of the CGST Act, 2017, Where the goods or services or both are used by the registered person partly for taxable supplies including zero-rated supplies, and partly for exempt supplies and used non-business or personal purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies. Therefore, as per Rule 42 of the CGST Act, 2017, common credits which are used for both taxable as well as non-taxable/exempt supplies proportionate ITC amount to the extent of supplies that are non-taxable/used for personal consumption shall be identified and reversed.

FAQ (Frequently Asked Question) on Input Tax Credit (ITC) Reversal :-

Q. What is ITC reversal?

A. According to Rule 42 of the CGST Act, 2017, common credits which are used for both taxable as well as non-taxable/exempt supplies proportionate ITC amount to the extent of supplies that are non-taxable/used for personal consumption shall be identified and reversed.

Q. What is Rule 42 of CGST Rules?

A.Rule 42 is related to the reversal of ITC when inputs are used for taxable/ non-taxable, exempt supplies/personal supply and the reversal of ITC according to the supply type.

Q. What does Rule 43 of CGST Rules entail?

A. Rule 43 of CGST Rules is related to the reversal of ITC in the case of capital goods when capital goods are used for taxable/ non-taxable, exempt supplies/personal supply.

Q. Is there a time limit for ITC reversal in case of non-payment to the supplier?

A. Yes, there is a provision for the reversal of ITC, if the payment is not made within 180 days.

Q. ITC reversal on the sale of capital goods?

A. As per Section 18(6)of CGST, In case of supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery determined under section 15, whichever is higher:

Q. What is ITC Full form?

A. ITC stands for Input Tax Credit.

Q. In case of delay, is there any interest on the reversal of ITC?

A. Yes, there will be applicability of interest in case of delay in reversal of ITC

Q. Concept of blocked ITC in GST?

A.Section-17 (5) refers to the cases of Blocked ITC in certain cases, where input tax credit is not allowed i.e. certain categories of goods and services on which input tax credit cannot be claimed.

Q. Eligibility of ITC on capital goods?

A. If the capital goods are being used for business purposes or are to be used for business purposes, then input tax credit of GST paid can be claimed. Along with this, if only exempted supply is being done using that capital goods, then in that case ITC will not be available on capital goods.

ITC on Capital Goods

| Only for personal use | No ITC |

| Only for exempted sales | No ITC |

| Only Normal Taxable Sales (including Zero Rated Supply) | Full ITC |

| Partly for personal / Exempted and partly for normal sales | Proportionate ITC |

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

SAC Code In GST

When Goods and Services Tax was introduced, the Central Board of Indirect Tax and Customs (CBIC) made things easier by introducing the HSN with its classification and SAC (Services Accounting Code) code systems. These codes help identify different services and their corresponding GST rates, making it easier to calculate the right amount of tax.

What do you understand by SAC Code?

The full form of SAC Code is Servicing Accounting Code. SAC code system applies to all the services provided within India. This system helps in identifying, categorizing, measuring and deciding the applicability of GST on services in India.

SAC (Services and Accounting Code) codes are derived from the internationally recognized Harmonized System of Nomenclature, which is a global system used for classifying and coding all products worldwide. This system supports the compliance of GST based on international standards. It will provide a common framework to the government for the proper collaboration of data related to sales and purchases and analyze the same. Businesses make use of SAC codes to submit their GST returns and fulfill their tax obligations to the government.

What is the SAC Number?

Under GST, a SAC code consists of six digits. Breaking up the 6-digit SAC is as follows:

- The first two digits in SAC are the same for all services i.e. 99 as services are covered under Chapter 99

- The middle two digits represent the major nature of services

- The last two digits represent the detailed nature of services

For Example, SAC for Information Technology IT Design and Development Services which is commonly called as software development is 998314 which is derived as follows:

- The first two digits in SAC are the same for all services i.e. 99.

- The middle two digits indicate the major nature of services, in this case IT services.

- The last two digits represent the detailed nature of services, in this case Design and Development services.

GST rates and SAC code of different services:

The various SAC codes and GST rates for different services provide dealers and businesses with a clear understanding of the tax applied to the services they offer or receive.

Is it compulsory to specify the SAC code in the invoice?

As per Notification Number 78/2020, CT(R), dated 10th November 2020, it is mandatory for service providers to furnish the SAC (Services Accounting Code) if their annual aggregate turnover exceeds Rs.5crore in the previous year on their invoices as well as while filling GSTR-1.

For businesses earning below Rs.5 crore, a 4-digit SAC code must be furnished for B2B (Business-to-Business) transactions. This rule is summarized as follows:

| Supply of Services | SAC digits |

| To Registered B2B business | 4 |

| To consumers or composition dealers, i.e., B2C | 4 but optional |

| To unregistered dealers | Nil |

It aids in correctly classifying services and ensures the accurate application of GST rates to transactions. The SAC code assists the government in monitoring and regulating the collection of taxes and also ensures compliance with GST laws.

Use of SAC (Service accounting code) in GST :-

There are several benefits of using SAC codes, such as:

Uniformity: It creates uniformity in the tax system.

Identification of services: Allocation by unique codes to different services, thus enabling easy distinguishing between different services.

Identification of GST Rate: Businesses can easily identify the GST rate applicable to the services rendered by them.

Compliance: It simplifies the process of tax calculation and filing of GST returns for businesses.

Monitoring and tracking: By using SAC Code, the government can monitor and track the taxes paid on services.

Difference between SAC Code and HSN Code

| Particulars | SAC | HSN |

| Full form | Full form of SAC is Service accounting Code | Full form of HSN is Harmonized System of Nomenclature |

| Nature of Classification | Used to classify services | Used to classify goods |

| Digit | Six digit | Eight digit |

| Structure | ||

| First two digits | Represent the major service category | Represent the chapter |

| Next two digits | Represent the specific service | Represent the Heading |

| Final two digits of SAC and final four digits of HSN | Represent the sub-service | Represent the product code |

Benefits of SAC code

- Help in Finding the appropriate GST Rates for the Service:

With the help of the SAC code, it is easy to identify the applicable GST rates for a specific service. GST rates for various services vary based on their nature and classification. Businesses can easily determine the correct GST rate for any service by using the SAC code system and ensuring that they levy the right amount of tax from their customers. - Separation of Services from Other Activities:

With the help of SAC codes, businesses can avoid any confusion or misinterpretation of their services and can ensure that they are classified correctly under the GST. - Support in Filing of GST Return:

The GST returns require Taxpayers to report their sales, purchases and the amount of tax payable. Businesses can easily identify the services for which they have charged GST and report the same in their GST returns. This helps in avoiding any errors or discrepancies in GST filings. By using SAC Codes, Businesses ensure that they are complying with the GST regulations.

FAQs (Frequently Asked Questions) on SAC Code

Q : What is SAC Code (SAC full form in GST)?

A : SAC code stands for Service Accounting Code.

Q : SAC code means?

A : SAC code meaning is Service Accounting Code. It is used to classify services.

Q : What is HSN and SAC code?

A : SAC code stands for Service Accounting Code. It is used to classify services.

HSN Code stands for Harmonized System of Nomenclature. It is used to classify goods.

Q : Is it mandatory to mention the SAC code in the invoice?

A. SAC Code requirement in Invoice (SAC code turnover limit)

| Annual Aggregate Turnover in PY | Type of Invoice | No of digits of SAC to be declared |

| Up to 5 crores | Mandatory for B2B tax invoices | 4 |

| Optional for B2C tax invoices | 4 | |

| More than 5 Crores | Mandatory for all invoices | 6 |

Q : Software Development & IT Services SAC Code?

A: Information technology (IT) design and development services SAC code is 998314.

| Group 99831 | Management consulting and management services; information technology services. | |

| 998311 | Management consulting and management services including financial, strategic, human resources, marketing, operations and supply chain management. | |

| 998312 | Business consulting services including public relations services | |

| 998313 | Information technology (IT) consulting and support services | |

| 998314 | Information technology (IT) design and development services | |

| 998315 | Hosting and information technology (IT) infrastructure provisioning services | |

| 998316 | IT infrastructure and network management services | |

| 998319 | Other information technology services n.e.c |

Q : What is the Accounting services SAC code and Rate?

A : SAC codes for accounting services is as below :-

- SAC Code 998221 – Financial auditing services

- SAC Code 998222 – Accounting and bookkeeping services

- SAC Code 998223 – Payroll services

- SAC Code 998224 – Other similar services

Q : SAC Codes for Legal Services

A : SAC Codes for Legal Services is as below :

- SAC Code 998211 – Legal advisory and representation services concerning criminal law.

- SAC Code 998212 – Legal advisory and representation services concerning other fields of law.

- SAC Code 998213 – Legal documentation and certification services concerning patents, copyrights and other intellectual property rights.

- SAC Code 998214 – Legal documentation and certification services concerning other documents.

- SAC Code 998215 – Arbitration and conciliation services

- SAC Code 998216 – Other legal services

Q : How can I search SAC Code for all the services ?

A : Click on the link below to get the SAC Codes of different services:

https://lawlegends.in/article/sac-code-and-description/

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

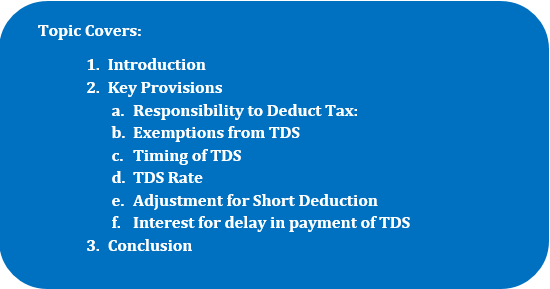

1. What is Sec 194A in TDS?

Section 194A of the Income Tax Act outlines the provisions for Tax Deducted at Source (TDS) on interest payments other than interest on securities to a resident. This section specifies who is responsible for deducting TDS, under what circumstances TDS is applicable, the rate of TDS, exemptions, and relaxation provisions. The provision of this section is not applicable if payment is made to a non-resident.

2. Key Provisions of TDS under Sec 194A:

-

- Responsibility to Deduct Tax:

TDS on interest other than interest on securities is the responsibility of:- Any person other than an individual or Hindu Undivided Family (HUF).

- An individual or HUF whose total sales, gross receipts, or turnover from business or profession exceed ₹1 crore (for business) or ₹50 lakhs (for profession) in the financial year immediately preceding the one in which interest is credited or paid.

- Exemptions from TDS

Exception for Low-Value Payments: No TDS is required if the interest payable during the financial year by the payer to the payee does not exceed the following limit:Payer Threshold limit Banking Co, Co-operative Society engaged in the banking business, Post Office 40,000 (50,000 in case the payee is a senior citizen) In any other case 5,000 For banking companies, the TDS limit is computed with reference to branches. However, if the payer has adopted Core Banking Solution (CBS), the limit is computed with reference to the entity and not individual branches.

- Declaration for Exemption:

Payees can apply for an exemption or lower TDS rates by submitting Form No. 13 to the Assessing Officer or furnishing a declaration in Form 15G.In the case of a resident individual whose income is below the exemption limit, such an individual can furnish a declaration in writing (as the case may be) to the payer, for non-deduction of tax under this section.15G: when the recipient is other than a senior citizen.

15H: when the recipient is a senior citizen. The payee can also file an online application in Form No. 13 to obtain a certificate of no deduction of tax or lower deduction of tax at source. The AO may issue an appropriate certificate on receiving such an application. Before issuing the certificate in this regard AO verified the document and information that the total income of the payee justifies the deduction of income-tax at any lower rate or nil deduction of income tax. - Interest to partners:

Tax will not be deducted under section 194A in respect of interest credited or paid by the firm to its partners. - Other case:

Various categories of interest payments are exempt from TDS, including interest paid to any banking company, LIC, Unit Trust of India, any company or co-operative society carrying on the business of insurance, and any financial corporation established by or under a Central, State, or Provincial Act..

Interest paid by a co-operative society (other than a co-operative bank) to a member, financial corporations, and government entities. Additional exemptions apply for specific schemes, deposits, and infrastructure bonds. The Central government has the power to issue notifications to provide the relaxation from deduction of tax on certain payments or to certain persons

- Declaration for Exemption:

- Responsibility to Deduct Tax:

Timing of TDS:

Tax must be deducted at the time of payment or credited to the payee, whichever is earlier.

TDS Rate:

According to Sec 194A TDS rate is:

i. 10% (without surcharge, health, and education cess). However, between May 14, 2020, and March 31, 2021, the rate was 7.5%.

ii. 20% in case PAN is not provided by the payee

Adjustment for Short Deduction:

The person responsible for deducting tax can adjust the TDS amount to correct any excess or deficiency arising from previous deductions or failures to deduct during the financial year.

Interest for delay in payment of TDS:

According to section 201, the person is liable to pay interest if TDS is required to be deducted on payment but not deducted or deducted but not deposited to the government. The person shall be liable to pay interest at the following rates:

- 1% for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted.

- 5% for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid to the Government

Note: Amendment has been made to section 201 by The Finance Act, 2022 that if the Assessing Officer has passed an order treating the assessee in- default, then the interest shall be paid by the assessee in accordance with the said order. [Effective from Assessment Year 2023-24]

Conclusion:

Section 194A of the Income Tax Act governs the TDS on interest payments other than interest on securities. It lays down rules for who should deduct TDS, under what conditions, and at what rates. The section also provides exemptions and relaxation provisions to promote compliance and ensure the correct deduction of tax on interest income.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

The topics covered under this article Framework under the Goods and Services Tax (GST)

Under the GST law, taxes can be classified into four types:

- Central Goods and Services Tax (CGST)

- State Goods and Services Tax (SGST)

- Integrated Goods and Services Tax (IGST)

- Union Territory Goods and Services Tax (UTGST)

The central government collects either CGST and SGST or only IGST, depending on whether the transaction is intra-state or inter-state, respectively.

Inter-state Supply:

This refers to the supply of goods or services where the supplier's location and the place of supply are in:

- Two different States

- Two different Union territories

- A State and a Union territory

It also includes the supply of goods or services when the supplier is in India, and the place of supply is outside India, or to/by a Special Economic Zone developer or unit, or in the taxable territory, not being an intra-state supply.

Intra-state Supply:

This pertains to the supply of goods or services where the supplier's location and the place of supply are in the same State or Union territory. However, certain supplies, such as those to or by a Special Economic Zone developer or unit, goods imported into India until they cross customs frontiers, or supplies to a tourist, are not treated as intra-state.

When IGST is applicable:

IGST, or Integrated Goods and Services Tax, is levied on all interstate supplies of goods and services. It standardizes taxation for supplies made outside the state or country. The IGST rate is typically equal to the combined rate of CGST and SGST.

When CGST is applicable:

CGST, or Central Goods and Services Tax, is levied by the Central Government on intra-state supplies of goods and services. It is charged along with SGST or UTGST at the same rates, following the Dual GST model.

When SGST is applicable:

SGST, or State Goods and Services Tax, is imposed by State Governments on intrastate sales of goods and services. It is charged along with CGST at equal rates for intra-state supplies.

What is UTGST:

UTGST, or Union Territory Goods and Services Tax, is similar to SGST. The key difference is that the tax revenue goes to the treasury of the respective union territory where the goods or services are finally consumed.

FAQs (Frequently Asked Questions)

Q. What is the full form of GST?

A. The full form of GST is Goods and Services Tax. It is an indirect tax levied on the supply or sale of certain goods and services.

Q. What are the types of GST?

A.

- GST comprises

- CGST,

- SGST,

- UTGST and IGST.

Occasionally, a cess may also be levied.

Q. What taxes are levied on an intra-state supply?

A. In the case of Intra State Supply, CGST and SGST are imposed on the supplies.

Q. What is the maximum rate at which IGST can be levied?

A. The maximum rate for IGST is 28%.

Q. What is the meaning of intra-state in GST?

A. According to Section-8 of the IGST Act 2017,

(1) Subject to the provisions of section 10, the supply of goods where the location of the supplier and the place of supply of goods are in the same State or same Union territory shall be treated as intra-state supply:

Provided that the following supply of goods shall not be treated as intra-State supply namely:-

- Supply of goods to or by a Special Economic Zone developer or a Special Economic Zone unit;

- Goods imported into the territory of India till they cross the customs frontiers of India; or

- Supplies made to a tourist are referred to in section 15.

(2) Subject to the provisions of section 12, the supply of services where the location of the supplier and the place of supply of services are in the same State or same Union territory shall be treated as intra-state supply:

Provided that the intra-state supply of services shall not include the supply of services to or by a Special Economic Zone developer or a Special Economic Zone unit.

Explanation 1. For this Act, where a person has,-

- An establishment in India and any other establishment outside India;

- An establishment in a State or Union territory and any other establishment outside that State or Union territory; or

- An establishment in a State or Union territory and any other establishment registered within that State or Union territory, then such establishments shall be treated as establishments of distinct persons.

Explanation 2. - A person carrying on a business through a branch or an agency or a representational office in any territory shall be treated as having an establishment in that territory.

Example: ABC Ltd. located in Indore, Madhya Pradesh supplies LED Lamps worth Rs. 1,00,000 to another entity located in Bhopal, Madhya Pradesh. The GST is charged at 18%, which is apportioned as 9% CGST and 9% SGST.

GST Calculation:

GST Amount = Invoice Value * GST Rate = Rs. 1,00,000 * 18% = Rs. 18,000/-

CGST Amount = GST Amount / 2 = Rs. 18,000 / 2 = Rs. 9,000/-

SGST Amount = GST Amount / 2 = Rs. 18,000 / 2 = Rs. 9,000/-

The dealer collects a total of Rs. 18,000 as GST from the customer. Out of this amount:

Rs. 9,000 is paid as CGST to the Central Government.

Rs. 9,000 is paid as SGST to the Madhya Pradesh State Government.

Q. What is the meaning of inter-state in GST?

A. According to Section 7 of the IGST Act 2017,

(1) Subject to the provisions of section 10, supply of goods, where the location of the supplier and the place of supply are in-

- two different States;

- two different Union territories; or

- a State and a Union territory,

shall be treated as a supply of goods in the course of inter-state trade or commerce.

(2) Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-state trade or commerce.

(3) Subject to the provisions of section 12, supply of services, where the location of the supplier and the place of supply are in-

- two different States;

- two different Union territories; or

- a State and a Union territory,

shall be treated as a supply of services in the course of inter-state trade or commerce.

(4) Supply of services imported into the territory of India shall be treated to be a supply of services in the course of inter-state trade or commerce.

(5) Supply of goods or services or both,-

- when the supplier is located in India and the place of supply is outside India;

- to or by a Special Economic Zone developer or a Special Economic Zone unit; or

- in the taxable territory, not being an intra-state supply and not covered elsewhere in this section,

shall be treated to be a supply of goods or services or both in the course of inter-state trade or commerce.

In Simple Words:

Interstate supply refers to a scenario in which the provider of goods or services is located in a distinct state or Union Territory, and the destination or place of receipt of those goods or services is situated in another state or Union Territory. Additionally, supplies involving activities such as imports, exports, or transactions with Special Economic Zone (SEZ) units or Export-oriented Units (EOUs) are also categorized as interstate supplies. In the context of India's taxation system, the Central Government imposes the Integrated Goods and Services Tax (IGST) on interstate supplies of goods and services, ensuring uniform taxation and revenue distribution across states and Union Territories.

For Example: A Company XYZ Ltd, located in Indore, Madhya Pradesh, supplies LED Lamps worth Rs. 1,00,000 to Mumbai, Maharashtra, this transaction is categorized as an interstate supply. This is because the supplier is in Madhya Pradesh (one state) and the place of supply is in Maharashtra (a different state).

The applicable GST rate on the goods supplied is 18%. Therefore, IGST (Integrated Goods and Services Tax) is levied on this interstate supply. Here's how the IGST calculation works:

IGST Amount = Value of Supply * GST Rate

IGST Amount = Rs. 1,00,000 * 18% = Rs. 18,000

So, in this case, the dealer, Company ABC Ltd, will charge Rs. 18,000 as IGST to the customer in Mumbai, Maharashtra. This IGST amount is then paid to the Central Government. It's important to note that IGST is a unified tax collected by the Central Government and a share of it is later distributed to the destination state, which in this case is Maharashtra. This ensures the seamless flow of goods and services across state borders while maintaining a fair revenue-sharing mechanism between states and the central government.

Q. What are the GST set-off rules?

A. GST Set-off Rules refer to allowing businesses to claim credit for their inputs.

Q. What is the difference between inter and intra-state in GST?

A.

- Intra-state supply : Transactions within the same state or union territory

- Inter-state supply : Transactions between different states, union territories

Q. What is Integrated GST (IGST)?

A. Integrated Goods and Services Tax (IGST) is levied on all interstate supplies (i.e. supplies made outside the state or country) of goods, services, or both.

Q. What does 'I' stand for in IGST?

A.'I' in IGST stands for Integrated. It means that this tax is integrated across states for transactions involving the movement of goods and services.

Q. What is the meaning of inward supply?

A. Inward supply refers to the receipt of goods or services or both by a person from the supplier, whether within the same state or from another state.

Q. What is the maximum rate of CGST?

A. The maximum rate for IGST is 14%.

Q. What is the maximum rate of SGST?

A. The maximum rate for IGST is 14%.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.

Introduction:-

Definition of Restaurant Service - "Restaurant Service" refers to the supply, as part of any service, of goods such as food or any other article intended for human consumption or any beverage, provided by a restaurant, eating joint, including mess, canteen, whether for consumption on or away from the premises where the food or beverage is supplied. Outdoor catering involves the supply of goods, including food or any other article for human consumption or any beverage, at events such as exhibitions, conferences, marriage halls, and other outdoor or indoor functions that are event-based and occasional. "Hotel accommodation" includes the supply of accommodation in hotels, inns, guest houses, clubs, campsites, or other commercial places meant for residential or lodging purposes.

As per the 2nd Schedule paragraph 6 clause b, restaurant service is treated as a composite supply.

According to Circular No. 164/20/2021-GST dated 06/10/2021, "restaurant service" encompasses services provided by restaurants, cafes, and similar eating facilities, including takeaway services, room services, and door delivery of food. Takeaway and door delivery services for the consumption of food are considered restaurant services. As per the Council's recommendation, services provided by cloud kitchens/central kitchens, involving the cooking and supply of food, fall under restaurant service and attract 5% GST (without Input Tax Credit).

Threshold Limit for Registration:

As per Section 22 of the CGST Act 2017, individuals with an annual turnover exceeding Rs. 20 lakhs are required to register under the GST Act. Voluntary registration is also allowed, even if turnover is below Rs. 20 lakhs. Those opting for the Regular scheme must file GSTR-1 and GSTR-3B returns regularly. GSTR-1 details outward supplies made by the restaurant, while GSTR-3B summarizes both outward and inward supplies along with GST payments. Timely filing of GST returns is crucial to avoid penalties and fines.

Tax Rate:

Under GST, restaurants are subject to a 5% GST rate without the option to claim Input Tax Credit (ITC) or an 18% GST rate with ITC claims. The applicable rate is determined based on the restaurant's location.

| S. No. | Type of Restaurants | GST Rate | ITC |

| 1 | Food supplied or catering services by Indian Railways/IRCTC | 5% | No ITC benefit is available in this case. |

| 2 | Standalone restaurants, including takeaway | 5% | No ITC benefit is available in this case. |

| 3 | Standalone outdoor catering services or food delivery service | 5% | No ITC benefit is available in this case. |

| 4 | Restaurants within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 5 | Normal/composite outdoor catering within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 6 | Restaurants within hotels (Where room tariff is more than Rs 7,500) |

18% | ITC benefit available in this case |

| 7 | Normal/composite outdoor catering within hotels (Where room tariff is more than or equal to Rs 7,500) | 18% | ITC benefit available in this case |

Supply Through E-commerce Operator:

In cases where food is supplied through an E-commerce Operator, the responsibility for GST payment lies with the operator. For instance, when food is delivered via platforms such as Swiggy or Zomato, these E-commerce Operators are accountable for collecting and remitting the tax at the final point of delivery. They are required to pay a 5% GST on restaurant services, alleviating the need for restaurants to directly handle GST collection. This mechanism simplifies the taxation process for food supply services facilitated by E-commerce Operators.

Can Restaurants Service Providers Opt for the Composition Scheme?

As per Section 10 of the CGST Act 2017, a person, whose aggregate turnover in the preceding financial year did not exceed Rs. 1.5 Crore (or Rs. 75 Lakh in specified states), may opt for the composition scheme. Under the composition scheme, the applicable tax rate is 5% (2.5% CGST and 2.5% SGST). However, it's important to note that a person opting for the composition scheme is not allowed to claim an Input Tax Credit (ITC) on inward supplies. This scheme offers a simplified approach to tax compliance for small businesses with a turnover below the specified threshold.

FAQs (Frequently Asked Questions) :

Q : GST on catering services?

A :

| S. No. | Type of Restaurants | GST Rate | |

| 1 | Food supplied or catering services by Indian Railways/IRCTC | 5% without ITC | |

| 2 | Standalone outdoor catering services or food delivery services | 5% without ITC | |

| 3 | Normal/composite outdoor catering within hotels (Where room tariff is less than Rs 7,500) |

5% without ITC | |

| 4 | Normal/composite outdoor catering within hotels (Where room tariff is more than or equal to Rs 7,500) | 18% with ITC | |

Q : GST on restaurant food?

A : GST Rate on restaurant food :-

| S. No. | Type of Restaurants | GST Rate | ITC |

| 1 | Standalone restaurants, including takeaway | 5% | No ITC benefit is available in this case. |

| 2 | Restaurants within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 3 | Restaurants within hotels (Where room tariff is less than Rs.7500) |

12% | ITC benefit is available in this case. |

| 4 | Restaurants within hotels (Where room tariff is more than Rs 7,500) |

18% | ITC benefit available in this case |

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Introduction :

Deduction from the gross income is a considerable part of the calculation of tax liability. The income tax liability is to be calculated on Net Total Income. The Income Tax Act provides that on determination of the gross total income of an assessee after considering income from all the heads, certain deductions therefrom may be allowed. These income tax deductions are provided in Chapter VI-A of the Income Tax Act. The income tax deductions are to be reduced from the gross total income of the assessee to arrive at Net Total Income.

Deduction Under Section 80C

This is the most common income tax deduction available for the individual regarding specified investments and expenditures. Assessee can claim these investments or expenditures as a deduction to reduce the tax liability for a particular year.

Amount paid by the assessee on account of common investments or expenditures for which the deduction under Income Tax Section 80C is allowed are as under:

- Payment for life insurance premium

- Tuition fees for the full-time education of any 2 children

- Contributions to the Employees’ or Recognised Provident Fund

- Contribution to notified unit-linked insurance plan (ULIP)

- Contribution to Public Provident Fund Account

- Notified annuity plan of Life Insurance Corporation or other insurers

- Investment in Equity Linked Saving Scheme(ELSS)

- Term deposits for a fixed period of not less than 5 years with a scheduled bank

- Contribution to an approved superannuation fund

- Subscription to any notified security or notified deposit scheme (Sukanya Samriddhi Account Scheme)

- Subscription to notified savings certificates like NSC, KVP

- Stamp duty and registration charges for the purchase of house property

- The principal amount paid towards a home loan

- Deposit in Senior Citizen Savings Scheme

- Contribution to Tier-II NPS account by central government’s employees.

Section 80CCC

Payment made to certain specified Pension Funds of LIC or other insurers (Subject to certain conditions). The premium must be deposited for a contract for an annuity plan of the LIC or any other insurer for receiving a pension from the fund.

Section 80CCD

Contribution or amount paid to the New Pension Scheme (NPS) notified by the Central Government (Subject to certain conditions) is allowable as a deduction from the gross total income of the individual.

The allowable deduction under this section should be calculated as follows :

- Amount contributed to a pension scheme

- 10% of salary(in case of employees)/ 20% of gross total income(in other case) whichever is less

- (subject to ceiling limit of ₹ 1,50,000 as provided under Section 80CCE) shall be allowed as a deduction under section 80CCD(1).

- Additional deduction to the extent of ₹ 50,000 shall also be available to the assessee under section 80CCD(1B). The additional deduction is not subject to a ceiling limit of ₹ 1,50,000 as provided under Section 80CCE.

- Amount paid by the employer shall also be allowed as a deduction under section 80CCD(2) while computing the total income of the employee. However, the amount of deduction could not exceed 14% of the salary in case of central/state Govt. employees and 10% in case of any other employees.

Section 80C, 80CCC and 80CCD Deduction limit :

Up to 1,50,000 (Subject to overall limit of ₹ 1,50,000 under Section 80C, 80CCC and 80CCD.

Eligible Assessee:

Individual assessee

Section 80D

This deduction is allowed when the amount is paid (in any mode other than cash) by an individual or HUF to LIC or other insurers to effect or keep in force any health insurance of a specified person (self, spouse, dependent children, or parents or member of HUF). An individual can also make payment to the Central Government health scheme on account of preventive health check-ups.

- The aggregate Deduction for preventive health check-ups shall not exceed ₹ 5,000.

- Payment for preventive health check-up may be made in cash.

- A deduction shall also be allowed up to ₹ 50,000 towards medical expenditure incurred on the health of a specified person provided such person is a resident senior citizen and no amount has been paid for health insurance of such person. This means either deduction for medical expenditure can be claimed or for health insurance.

Deduction Limit :

- For self, spouse, and dependent children: Up to ₹ 25,000 (₹ 50,000 if the specified person is a senior citizen)

- For parents: An additional deduction of ₹ 25,000 shall be allowed (₹ 50,000 if the parent is a senior citizen)

Eligible Assessee: Individual & HUF

The above deductions can be summarised in the following table:

| Deductions (U/s 80C, 80CCC, 80CCCD, & 80D) [Chapter VI-A] | ||

| Applicable Section | Investments & Expenses | Deduction Limit(₹) |

| 80 C, 80CCC, 80CCD(1) | An investment made in | 1.5 Lakhs ( Max Under This Section ) |

| The premium of a life insurance policy | ||

| PPF, EPF, and superannuation funds | ||

| Equity-linked saving scheme (ELSS) | ||

| Sukanya Samriddhi Yojana (SSY) | ||

| Unit Linked Insurance Plan (ULIP) | ||

| Tax saving Term Fixed Deposit for at least 5 years | ||

| Infrastructural bonds (e.g., NABARD bonds) | ||

| Post Office Deposits | ||

| Premiums paid for life insurance pension plans | ||

| contribution towards National Pension Scheme (NPS) | NPS Contribution: - 20% of annual income (10% in case employer also contributes) - Rs. 1.5 lakhs | |

| Expenses paid | ||

| The principal amount paid towards a home loan | 1.5 Lakhs ( Max Under This Section ) | |

| Stamp duty and registration charges for the purchase of house property | ||

| Tuition fees | ||

| 80CCD(1b) | Additional deduction on | ₹ 50,000 . |

| The contributions in NPS | ||

| Contributions towards Atal Pension Yojana | ||