Recent Articles Of GST

E-ledger Under GST : Electronic Liability, Cash And Credit ledger

[DISPLAY_ULTIMATE_SOCIAL_ICONS]What is an E-ledger?

E-ledger is an electronic passbook. It is available to all registered persons on the GST portal. Where we can see our electronic cash ledger and electronic credit ledger balance. This balance can be used for payment of GST liability i.e. IGST/CGST/SGST/UTGST.

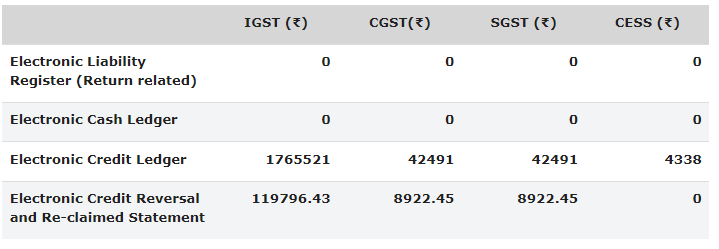

E-ledger contains :

Electronic Liability Ledger

Electronic Cash Ledger

Electronic Credit ledger

Electronic Credit Reversal and Re-claimed Statement

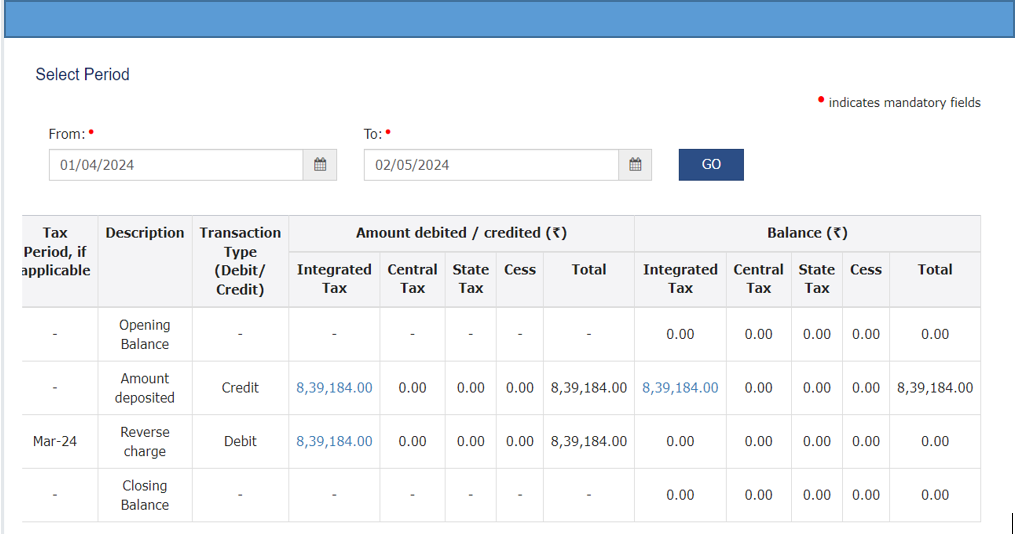

What is Electronic Cash Ledger :

An Electronic credit ledger is like an e-wallet. This e-wallet is used for payment of GST liability. If you do not have sufficient balance in the Electronic credit ledger then such liability is discharged through cash ledger. In a cash ledger, the balance can be deposited through the following mode.

Through Internet Banking

Unified Payment Interface (UPI)

IMPS

Credit card or Debit card

Through NEFT or RTGS

Cash deposit through an Authorised Bank

For Example- If we have to pay a GST liability of Rs.1,00,000 and the balance available in the electronic credit ledger is Rs.80,000, then Rs.20,000 GST liability will be discharged through the Cash ledger.

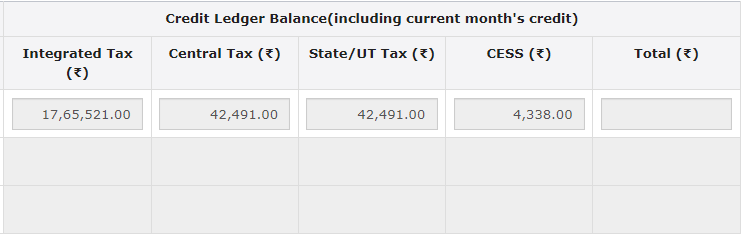

What is Electronic Credit Ledger :

When a registered person purchases any capital goods, Input, or Input service for business purposes and pays GST, such GST is credited in the electronic credit ledger. Such balance can be used for payment of GST liability but an Electronic Credit Ledger balance cannot be utilised for payment of interest, penalty, or late fees. Interest and Penalty can be paid only through a cash ledger.

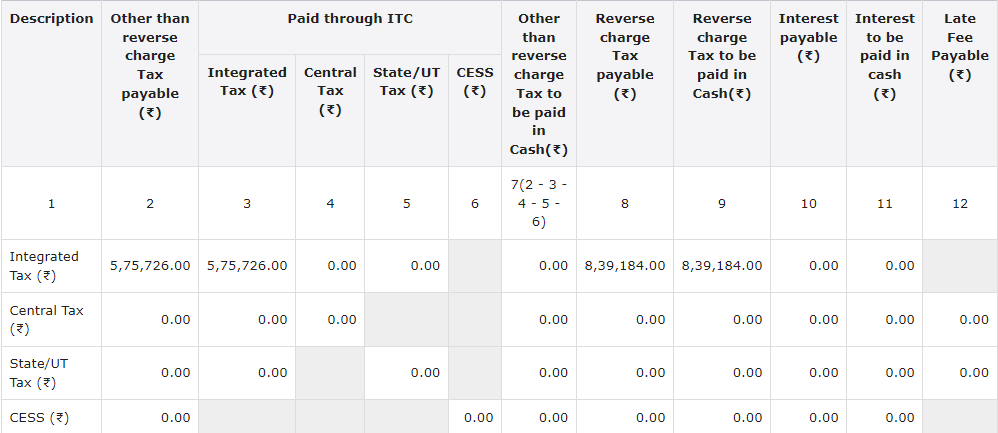

What is Electronic Liability Ledger:

Electronic Liability Ledger shows the details of GST liability. The ledger contains the total GST liability and the manner in which it has been paid either through cash ledger or through credit ledger.

Every person who is liable to pay tax, interest, penalty, late fee, or any other amount on the GST portal and all amounts payable by him shall be debited to the Electronic Liability Ledger.

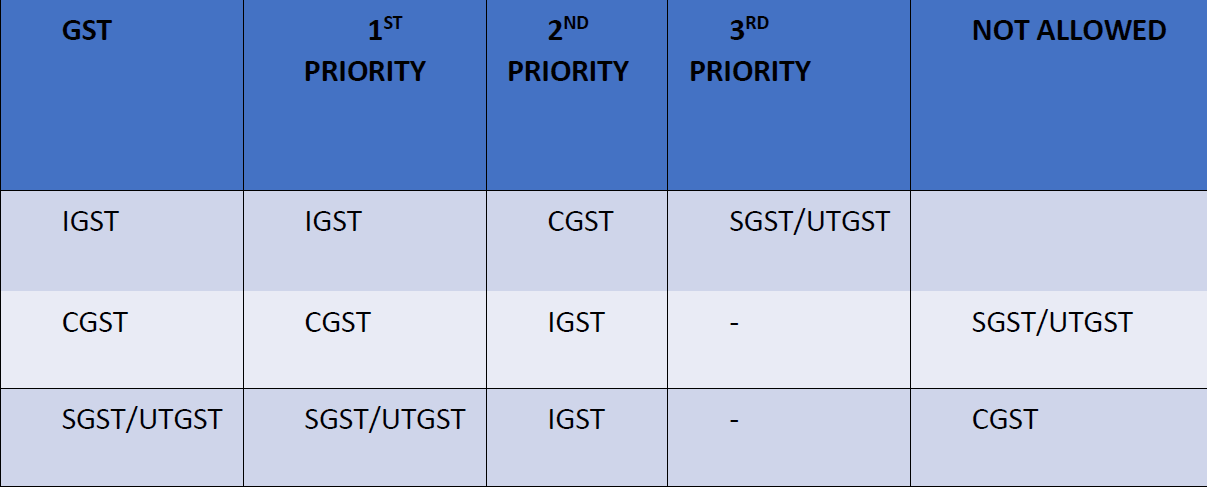

How to Utilize Electronic Credit Ledger Balance :-

Manner of Utilization of IGST-

If any IGST credit balance is available in the electronic credit ledger, it is first utilized for the payment of IGST. Any remaining balance can then be used for the payment of CGST, SGST, or UTGST in the specified order.

Manner of utilization of CGST-

If any CGST credit balance is available in the electronic credit ledger, it must be used for the payment of CGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Manner of utilization of SGST-

If any SGST credit balance is available in the electronic credit ledger, it must be used for the payment of SGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Manner of utilization of UTGST-

If any UTGST credit balance is available in the electronic credit ledger, it must be used for the payment of UTGST. After utilization, if any balance remains, it can be used for the payment of IGST.

Note : CGST balance cannot be set off from SGST and UTGST.

FAQs on E-ledger under GST

Q.1- What is Electronic Cash Ledger ?

Ans. An Electronic credit ledger is like an e-wallet. This e-wallet is used for payment of GST liability.

Q.2. Can Electronic Credit Ledger balance be used for payment of late fees, Interest and Penalty ?

Ans. No, an Electronic Credit Ledger balance cannot be used for payment of late fees, Interest, and Penalty.

Q.3 Can CGST balance use for payment of SGST/UTGST ?

Ans. CGST balance cannot be used for payment of SGST/UTGST liability.

Q.4 How to utilized IGST balance?

Ans. 1st IGST balance is used for payment of IGST liability after utilization if the balance is remaining then it can be used for payment of CGST/SGST/UTGST liability.

Q.5 What is Electronic Credit Ledger?

Ans. An Electronic Credit Ledger is an e-wallet. This balance can be used for payment of GST liability i.e. IGST/CGST/SGST.

Q.6 Types of ledger under GST ?

Ans. There are 3 types of ledger -

• Electronic Cash Ledger.

• Electronic Credit Ledger.

• Electronic liability Ledger.