Recent Articles Of GST

Rectification of Return Under Section 154 of the Income Tax Act

Taxpayers may make errors at the time of filing income tax returns. The assessment officer highlights such mistakes from the records, during assessments. In some cases, it may so happen that an order passed by the assessing officer contains mistakes. Section 154 of the income tax act provides an opportunity for the assessing officer and the taxpayer to rectify any mistake or error that was made by him.

Order that can be rectified under section 154:

With a view to rectifying any mistake apparent from the record, an income-tax authority may, -

a) Amend any order passed under any provisions of the Income-tax Act.

b) Amend any intimation or deemed intimation sent under section 143(1).

c) Amend any intimation sent under section 200A(1) [i.e. TDS return].

d) Amend any intimation under section 206CB.

It is to be noted that, If an order is subject matter of any appeal, then the Assessing Officer can rectify only those matters that are not decided in such appeal. Any matter which is decided in such an appeal or revision cannot be rectified.

Initiation of rectification:

• The income-tax authority can rectify the mistake on its own motion.

• The taxpayer can intimate the mistake to the income-tax authority by making an application to rectify the mistake. Assessing officer review and pass the order.

Time Limit:

A rectification order cannot be issued after 4 years from the end of the financial year in which the order to be rectified was passed. This period of 4 years is calculated from the date of the order to be rectified, not from the date of the original order. Therefore, if an order is revised, set aside, or any other action is taken, the 4-year period will be counted from the date of the new order, not from the date of the original order.

If a taxpayer submits an application for rectification, the authority must either amend the order or reject the claim within 6 months from the end of the month in which the application is received.

To understand the provision let’s have an example:

Que. The assessment order was passed on 21-10-2013. The assessee made an application on 15-11-2015 for rectification under section 154 pointing out that depreciation has not been allowed on certain assets. The rectification order was passed on 18-2-2016. The assessee made another application under section 154 on 15-05-2018 pointing out that he was entitled to get depreciation on the factory building @ 10% instead of 5% allowed to him. The Assessing Officer rejected the second application for rectification as being made after the expiry of 4 years from the end of the financial year in which the original order, dated 21-10-2013 was passed.

Ans: In the above case, the word “order” in the expression “from the date of the order sought to be amended” does not necessarily mean the original order. It could be any order including the rectified order. The assessee could also apply for rectification within 4 years of the end of the previous year in which the amended order, dated 18-02-2016 was passed i.e. up to 31-03-2020. Hence, the action of the Assessing Officer was not justified.

How to file rectification :

Taxpayers can raise an online request to rectify the return if they finds it necessary.

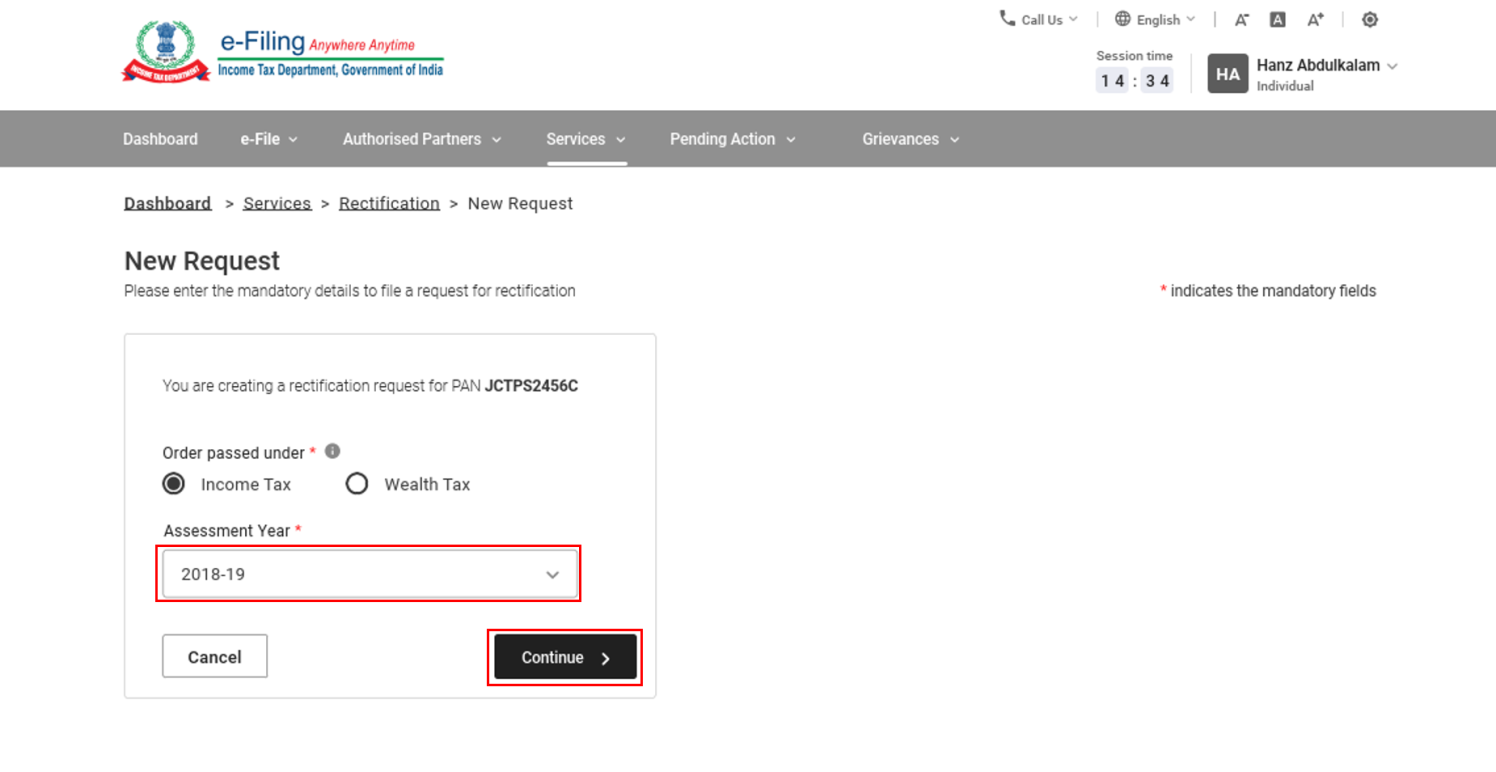

With a valid user Id and password, log in to the e-filing portal.

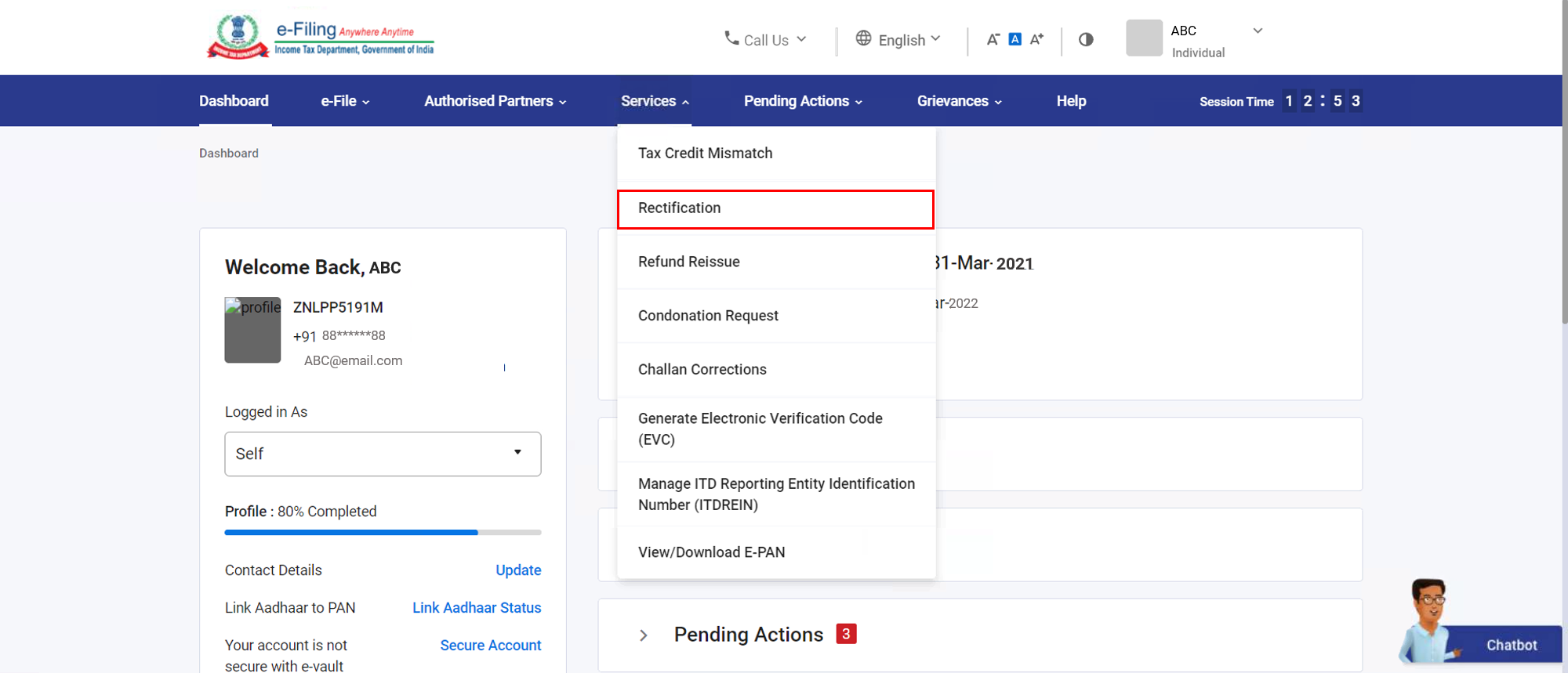

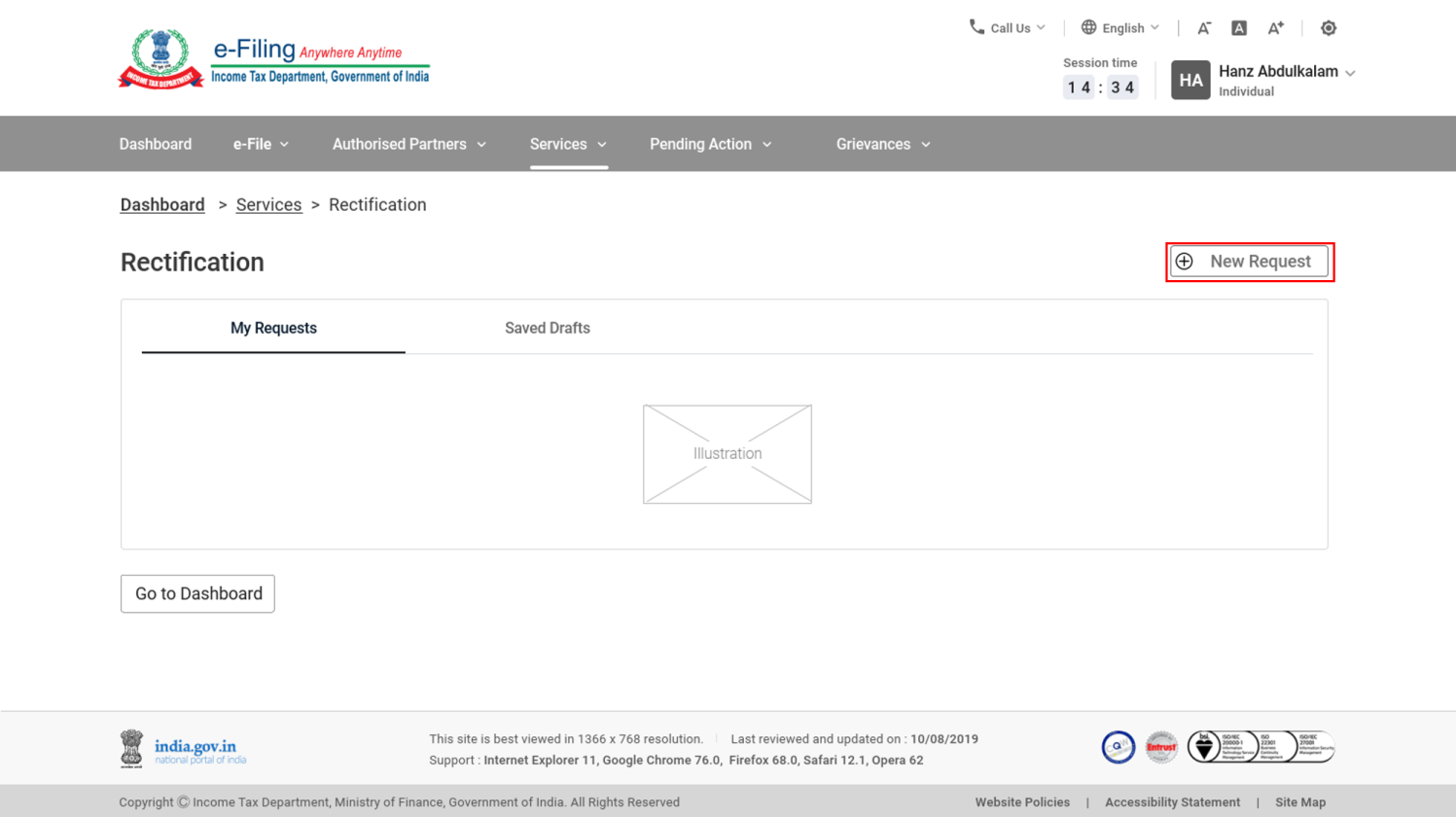

Click on the ‘Services’ and select Rectification from the drop-down menu.

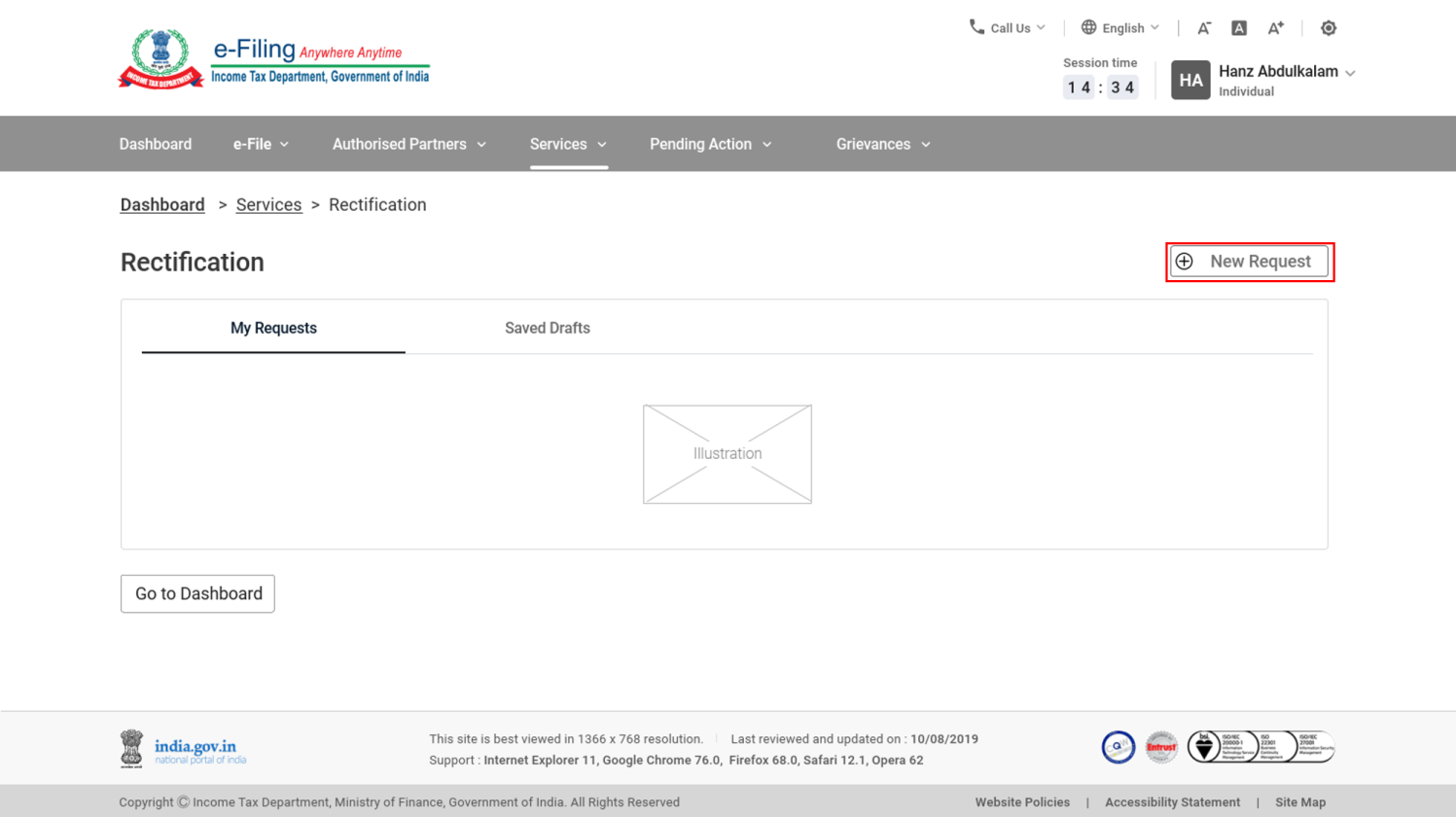

Click on ‘New request’.

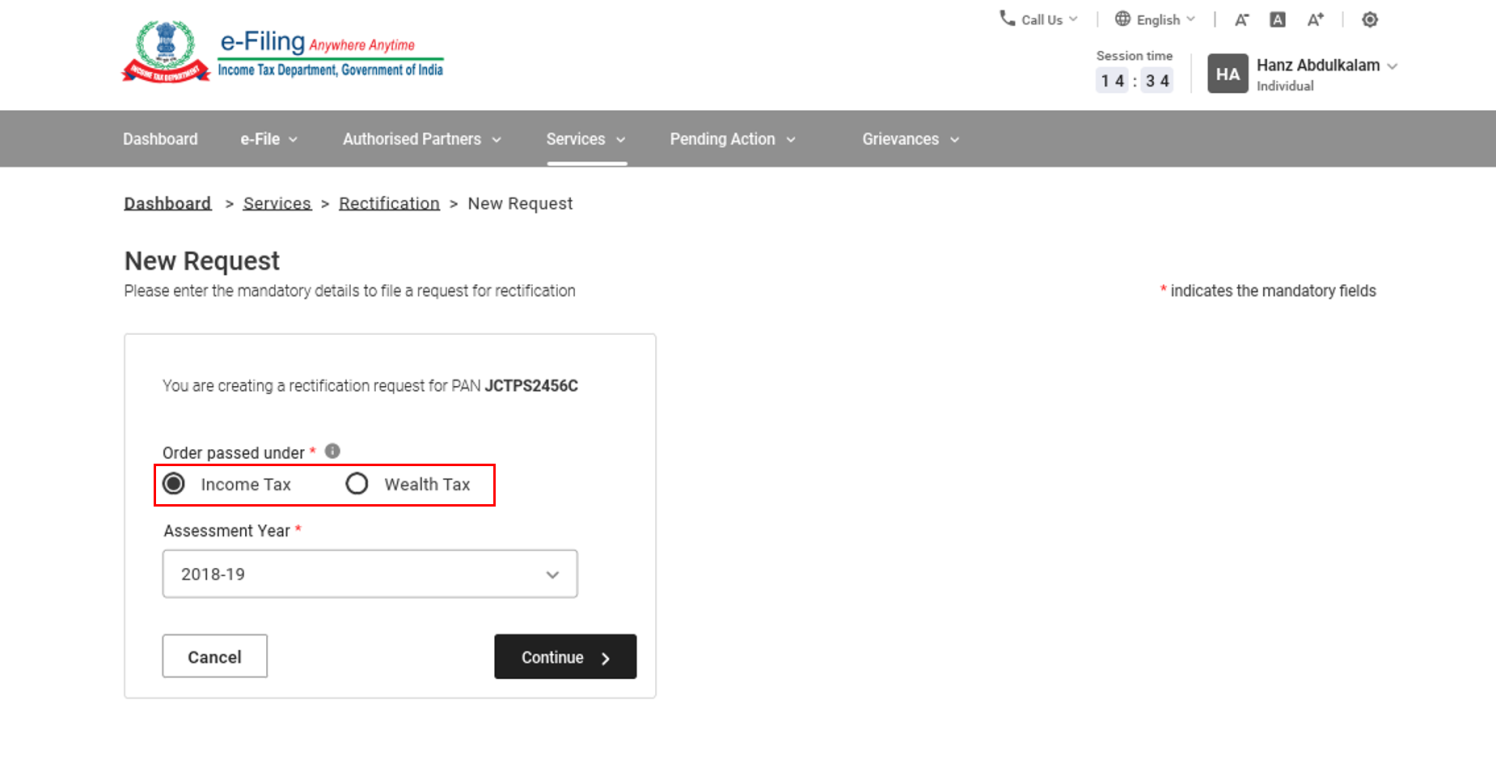

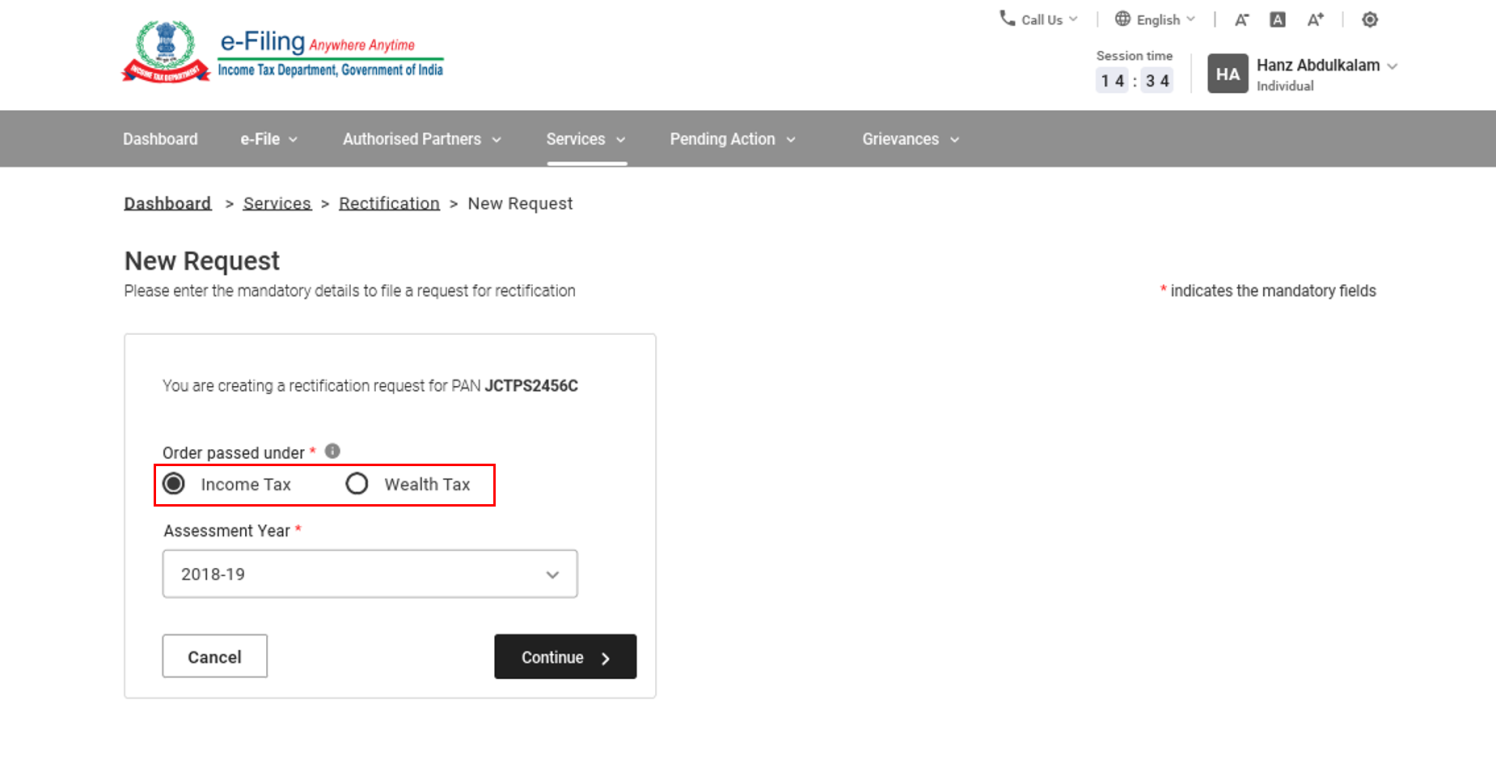

Once on the ‘New Request’ page, your PAN number gets auto-filled. Now you have to select between wealth tax and Income Tax.

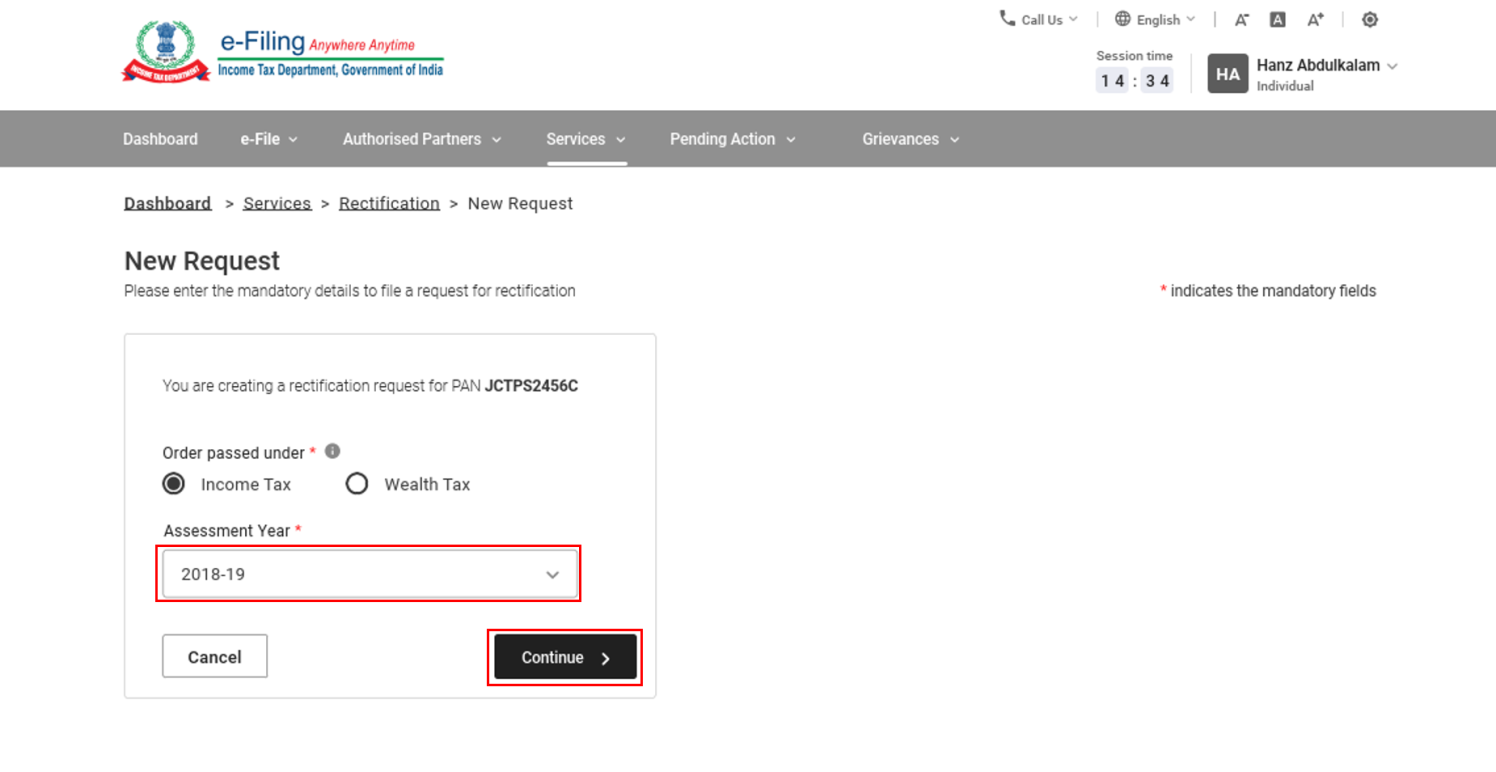

Select assessment year from the drop-down menu and click ‘continue’.

The rectification requests can be classified as follows -

| Income Tax Rectification | Reprocess the return |

| Tax credit mismatch correction | |

| Additional information for 234C interest | |

| Status Correction | |

| Exemption section correction | |

| Return data correction (Offline) | |

| Return data correction (Online) | |

| Wealth Tax Rectification | Reprocess the Return |

| Tax Credit Mismatch Correction | |

| Return Data Correction (XML) |

Select the correct rectification requests provide the required information then submit the request and complete the verification procedure.

In conclusion, if a filed income tax return or the order contains a mistake apparent from the record then it can be rectified by virtue of provision of section 154. The assessing officer has the power to rectify the mistake on his own or on application by the assesse within the time limit. The rectification can be result in enhancing the tax liability or refund, and intimated to the assessee in both the cases. It is hectic to comply with the law in such cases, it is advisable to take professional help in that case.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website/APP.