Recent Articles Of GST

QRMP Scheme Under GST

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Introduction

The QRMP (Quarterly Returns with Monthly Payments) scheme enables eligible taxpayers to submit their Form GSTR-1 and Form GSTR-3B returns on a quarterly basis. Under this scheme, taxpayers are not obligated to file monthly returns. However, they are required to make tax payments on a monthly basis through challan submissions.

Eligibility for the Scheme

In terms of Notification No. 84/2020- Central Tax dated 10.11.2020, a registered person who is required to furnish a return in FORM GSTR- 3B and who has an Aggregate Annual Turnover of up to Rs. 5 Cr in the preceding financial year is eligible for the QRMP Scheme.

The Aggregate Annual Turnover for the previous financial year will be computed on the common portal, incorporating the information provided by the taxpayer in their returns for the tax periods of the preceding financial year. If the total annual turnover exceeds Rs. 5Cr in any quarter of the ongoing financial year, the registered person will be ineligible for the Scheme from the subsequent quarter.

Therefore, taxpayers with an aggregate turnover (computed on a PAN basis) for the current and preceding financial years amounts to Rs. 5 crore & less and who are required to file GSTR-3B return are eligible for the QRMP scheme.

The QRMP scheme is exclusively accessible to taxpayers who are required to file both Form GSTR-1 and Form GSTR-3B.

This scheme can be opted

- By registered taxpayers (Normal taxpayers, SEZ Developer, SEZ units)

- By taxpayers who have chosen to withdraw from the composition scheme.

- By persons who have applied for fresh registration whose AATO is up to ₹ 5 Crores.

Furnishing of details of outward supplies

The registered person opting for the QRMP Scheme must provide details of outward supply in FORM GSTR-1 on a quarterly basis in accordance with Rule 59 of the CGST Rules.

IFF facility has also been provided for the QRMP scheme. IFF stands for Invoice Furnishing Facility, through which, those who have opted for the QRMP scheme can declare the outward supplies of the first two months of a quarter through this facility.

It is highlighted that the IFF is not mandatory and is solely an optional facility made available to registered persons under the QRMP Scheme.

The details of invoices submitted through the IFF during the initial two months do not need to be provided again in FORM GSTR-1. As a result, the details of outward supplies made by such a registered person during a quarter will include information on invoices submitted using the IFF for each of the initial two months, along with details of invoices furnished in FORM GSTR-1 for the entire quarter. A registered person has the option to report the details of outward supplies made during a quarter exclusively in FORM GSTR-1, without utilizing the IFF.

This feature enables the filing of B2B invoices, credit notes and debit notes. The deadline for filing IFF for any given month is the 13th of the subsequent month.

If a registered person chooses the QRMP scheme and files details of outward supplies using the IFF facility, the recipient taxpayer can claim credit for those invoices within the same month.

If you possess multiple GSTNs under the same PAN, whether in different states or within the same state, you have the option to enroll in the QRMP scheme for specific GSTNs while opting out of the scheme for the others.

Timeline for out-in or opt-out from QRMP Scheme

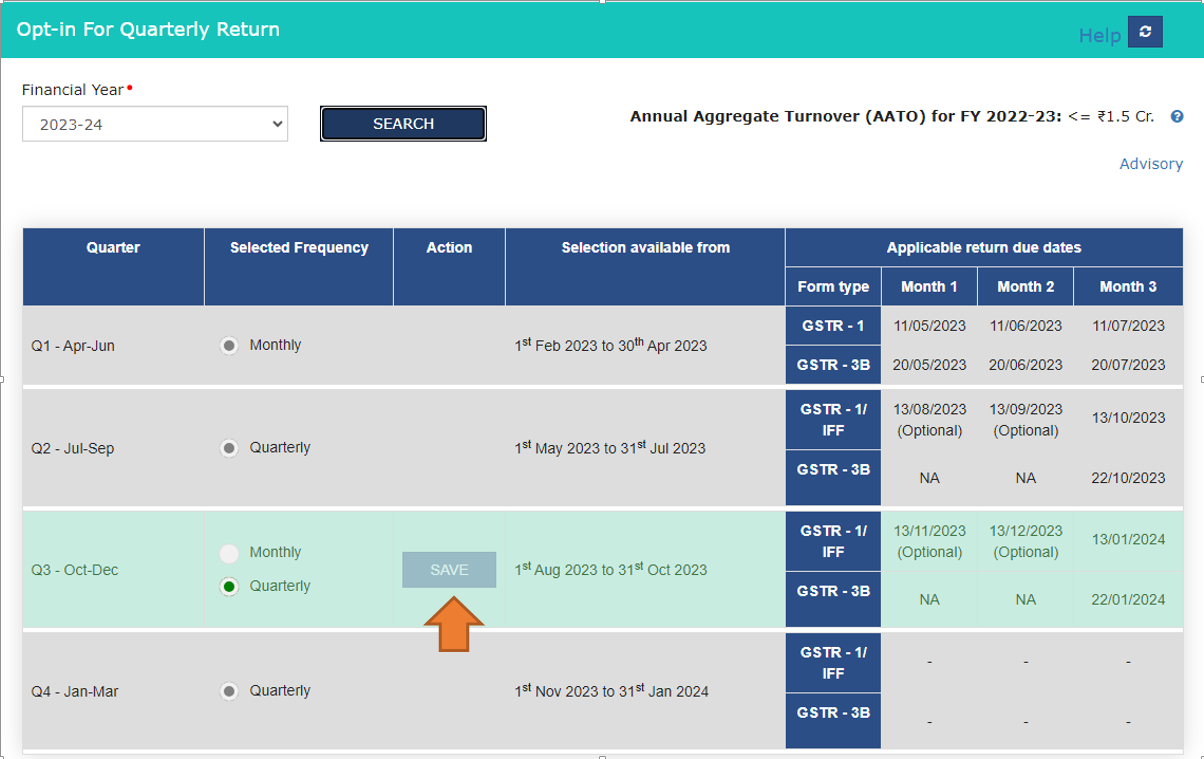

| S. No. | Quarter of a particular year | QRMP Scheme can be opted in or opted out during the following period |

| 1 | Q1 (April – May – June) | 1st February to 30th April |

| 2 | Q2 (July – Aug – Sept) | 1st May to 31st July |

| 3 | Q3 (Oct-Nov-Dec) | 1st August to 31st October |

| 4 | Q4 (Jan-Feb-March) | 1st November to 31st January of next year |

How to opt in/ opt-out from QRMP Scheme

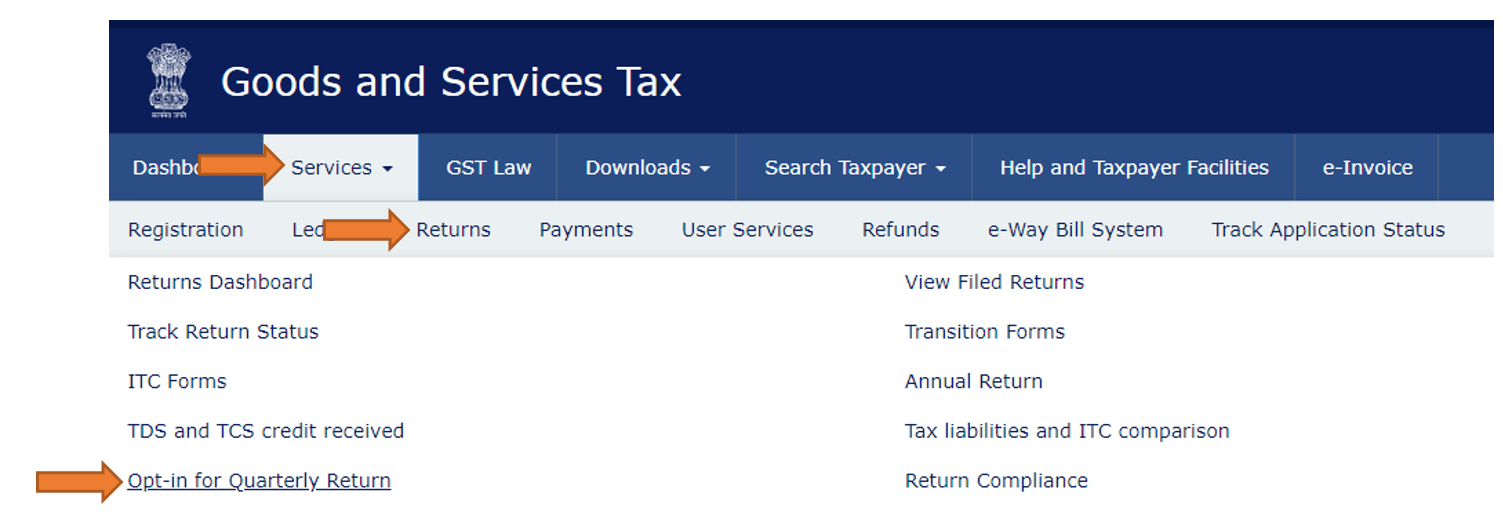

The eligible taxpayer can choose to opt in or opt-out from the scheme by accessing the GST portal and navigating to Services > Returns > Opt-in for Quarterly Return or opt out of the QRMP scheme.

FAQ’s

Q-1: What is Quarterly Returns with Monthly Payment (QRMP) Scheme?

Ans. The Quarterly Returns with Monthly Payment (QRMP) Scheme enables eligible taxpayers to submit their Form GSTR-1 and Form GSTR-3B returns quarterly while fulfilling their tax obligations monthly via a challan.

Q-2: How can I switch from monthly to quarterly GST filing?

Ans. To opt in or opt out of the QRMP scheme, sign in to the GST portal with your valid credentials, then proceed to Services > Returns > Opt-in for Quarterly Return option.

Q-3: Who is eligible to file quarterly GST returns?

Ans. All taxpayers with an aggregate annual turnover (based on PAN) of up to ₹ 5 Crore in the current financial year and the preceding financial year (if applicable) and who have already filed their last due Form GSTR-3B return, are eligible for the QRMP scheme.

Q-4: Is there a turnover limit for filing quarterly GST returns?

Ans. Taxpayers with an aggregate annual turnover of up to Rs. 5crores are allowed to file quarterly GST returns.

Q-5: What are the differences between monthly and quarterly GST returns?

Ans. Monthly GST returns require taxpayers to file returns and pay taxes every month, whereas quarterly returns involve filing returns once every quarter while making monthly tax payments.

Q-6: What is the payment due date for quarterly GST returns?

Ans. In the first two months of the quarter, payment of liability can be made by either of the following two methods:

a. Fixed Sum Method: Portal will generate a pre-filled challan in Form GST PMT-06. The system-generated pre-filled challan in this case is commonly also known as 35% challan.

b. Self-Assessment Method: The actual tax due is to be paid through challan, in Form GST PMT-06, by considering the tax liability on inward and outward supplies and the input tax credit available for the period as per law.

The due date for making payment by challan is 25th of the next month.

Q-7: What is the turnover limit for filing monthly GST returns?

Ans. There's no specific turnover limit for filing monthly GST returns. However, taxpayers with a turnover exceeding Rs. 5crores are generally required to file monthly returns.

Q-8: Is the QRMP scheme available to every taxpayer?

Ans. The QRMP scheme is accessible exclusively to taxpayers obligated to file Form GSTR-1 and Form GSTR-3B returns and it can be opted for by:

• Registered taxpayer (Normal taxpayer, SEZ Developer, SEZ unit)

• Taxpayers who have chosen to withdraw from the composition scheme.

• Person who has applied for fresh registration whose AATO is up to ₹ 5 Crores.

Q-9: I have opted for the QRMP scheme. Will I now be required to file both Form GSTR-1 and Form GSTR-3B on quarterly frequency?

Ans. Certainly, under the QRMP scheme, both Form GSTR-1 and Form GSTR-3B are to be filed on a quarterly basis. However, tax payments are required to be made monthly, with tax dues settled through a challan.

Q-10: If a tax payer has opted for QRMP scheme and his AATO exceeds ₹ 5 Crores, then will the scheme be valid?

Ans. If a taxpayer's Aggregate Annual Turnover (AATO) exceeds the ₹ 5 Crore limit, they will no longer qualify for the QRMP scheme.

Q-11: Whether it is required to exercise the option every quarter/year?

Ans. Registered persons do not need to opt in or out of the scheme every quarter. Once the option has been chosen, they will continue to submit returns according to the selected option for future tax periods, unless they decide to revise the option or their Aggregate Annual Turnover (AATO) exceeds ₹ 5Crore.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.

Beta feature

Beta feature

Beta feature