Recent Articles Of GST

How to create temporary ID on the GST portal

If a person occasionally engages in transactions involving the supply of goods or services, in a state or Union Territory where they do not have a permanent operating address.

Who should apply for a temporary ID under GST?

Individuals who are either unregistered or not obligated to register under the GST regime should apply for a temporary user ID through the GST portal. GST registration is compulsory for such individuals regardless of their annual aggregate sales turnover.

This temporary user ID is provided solely to enable unregistered individuals to access certain exclusive functionalities available on the GST portal.

Steps to apply for a temporary ID under GST

To apply for a temporary user ID, an unregistered user has to follow these steps:

Step 1. Visit the GST portal (www.gst.gov.in.)

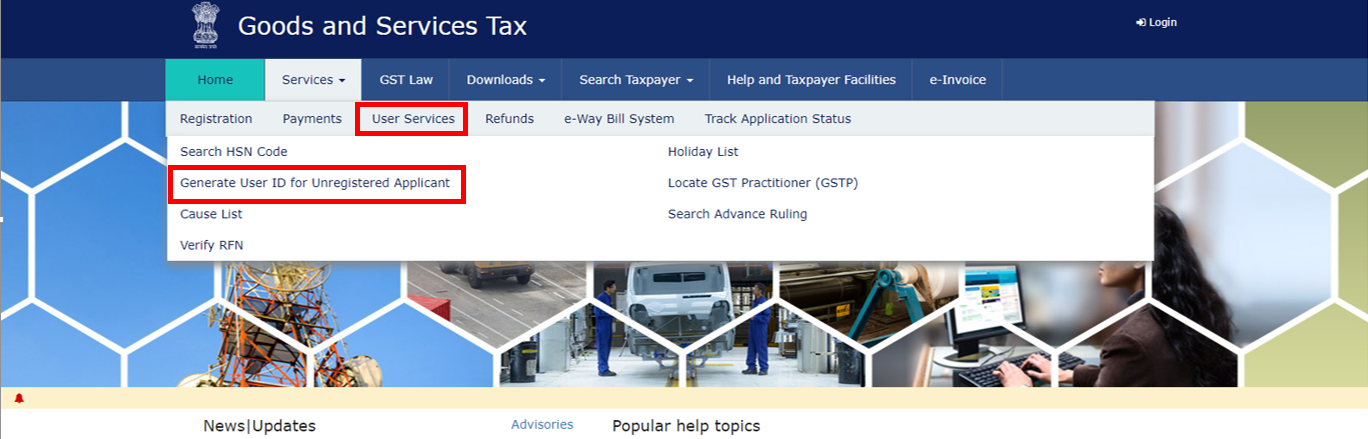

Step 2. The user should navigate to click Services > User Services > Generate User ID for unregistered Applicant.

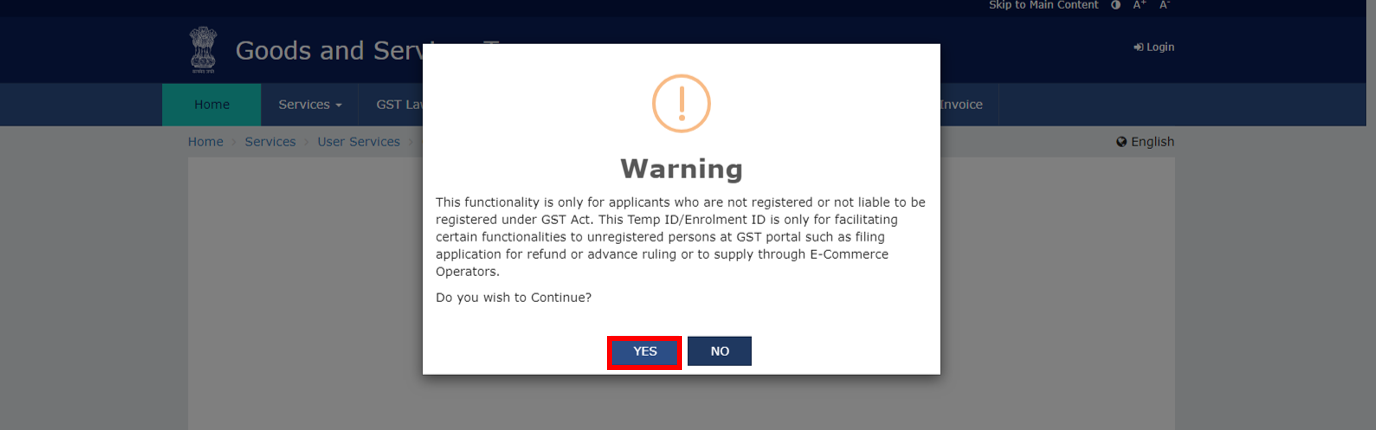

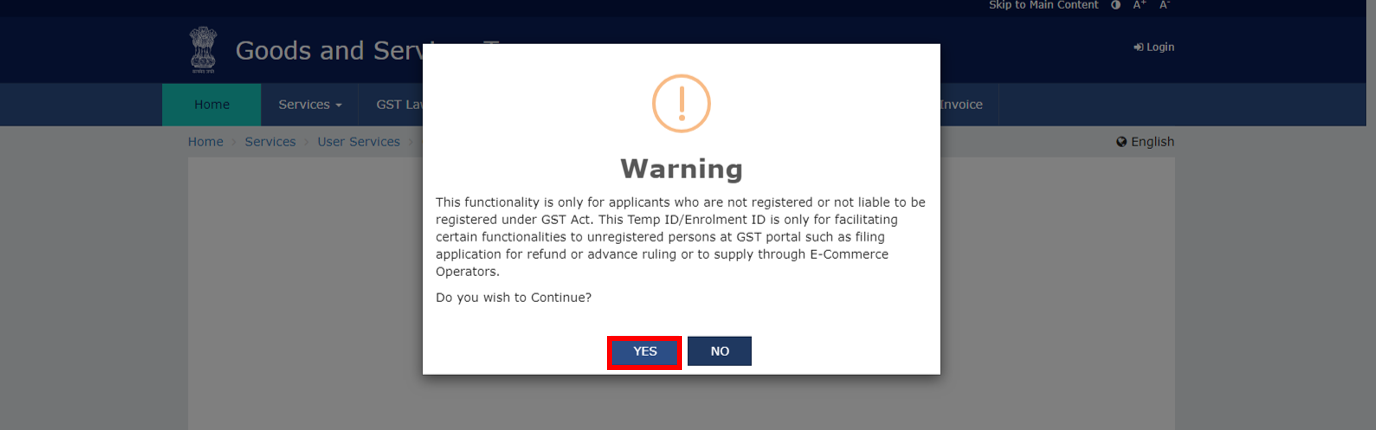

Step 3. Afterward, the user must read and acknowledge the warning message by clicking on ‘Yes.’

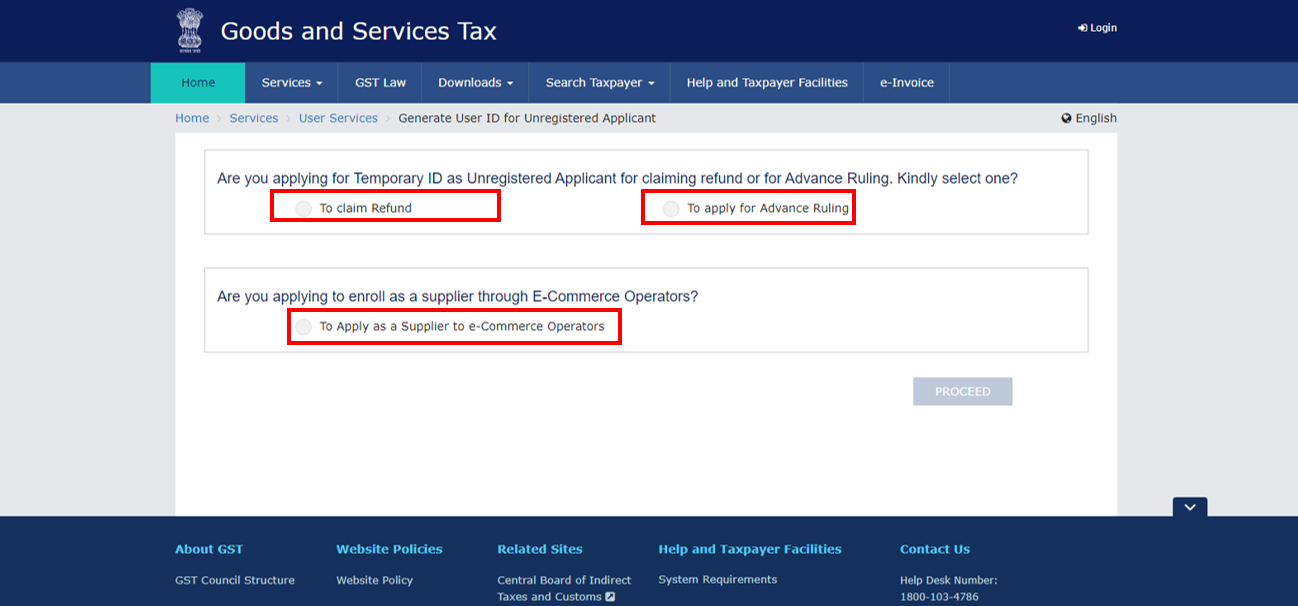

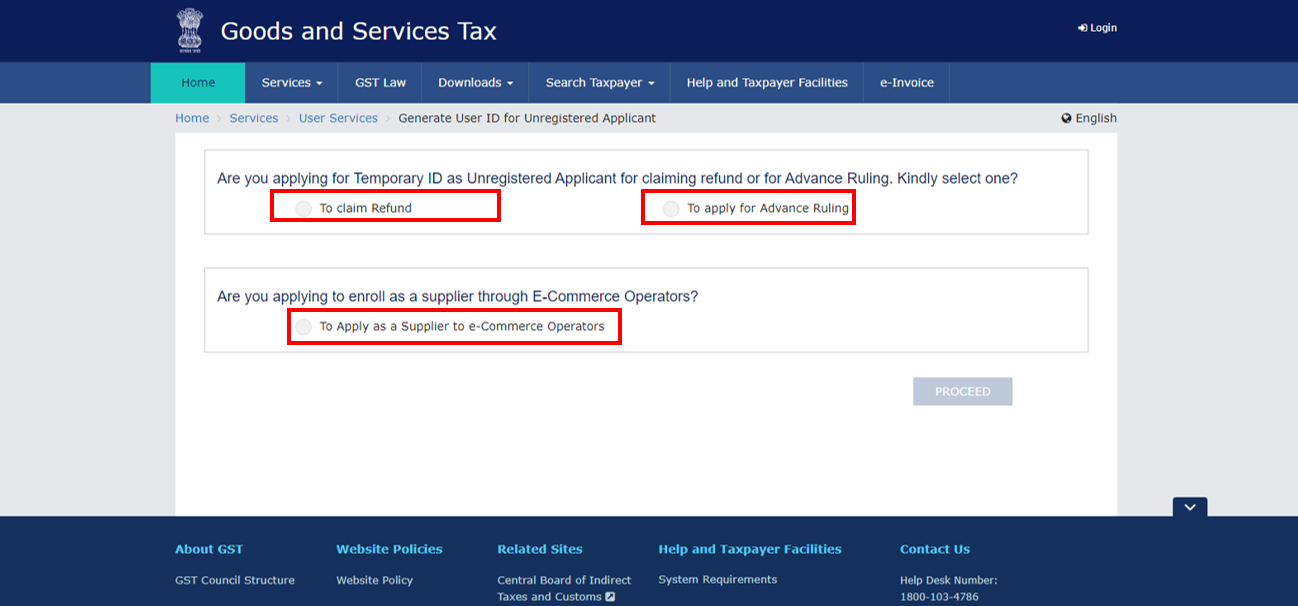

Step 4. Once the user clicks the ‘Yes’ button, the user then needs to select the reason as highlighted in red in the image below.

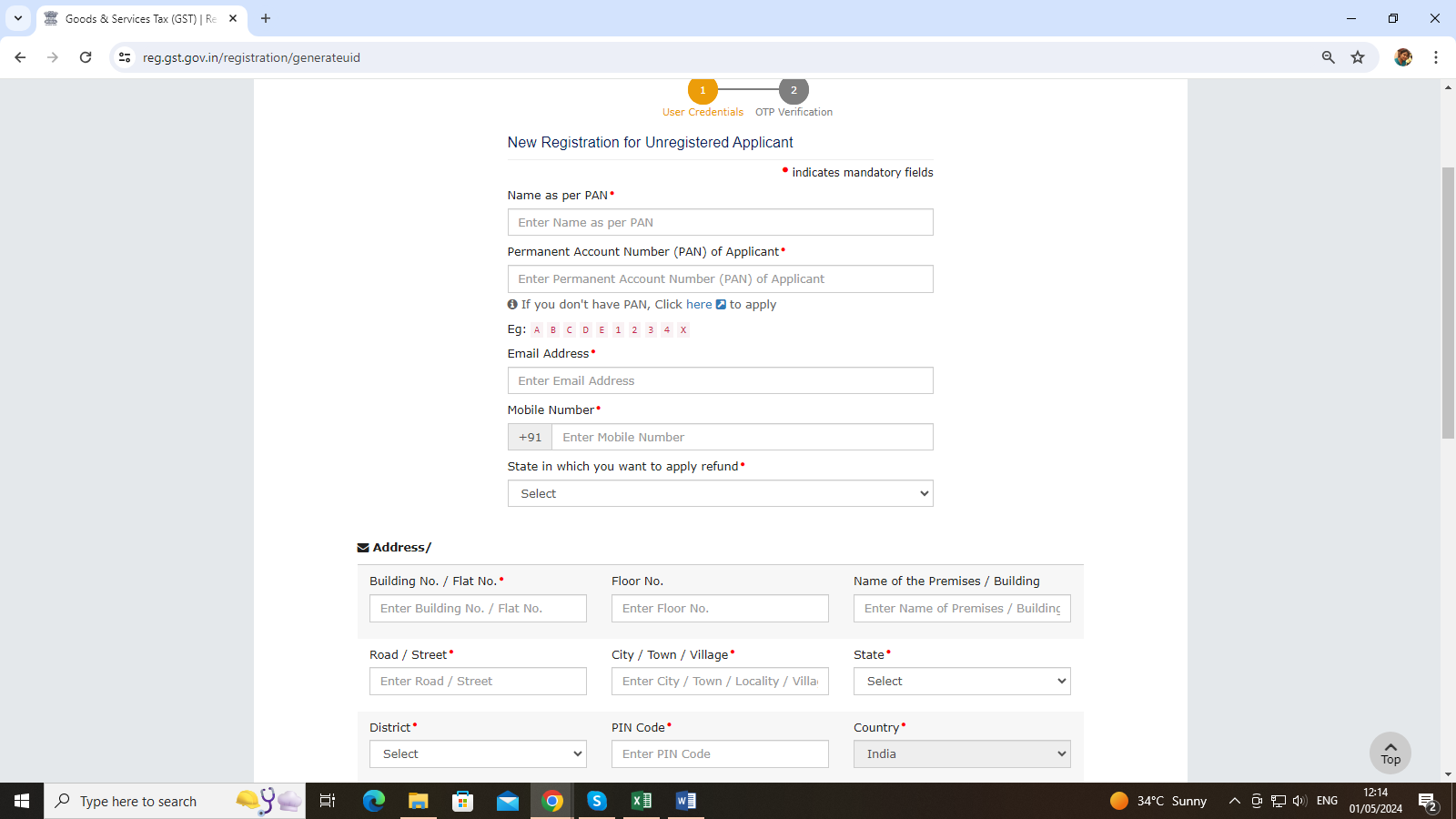

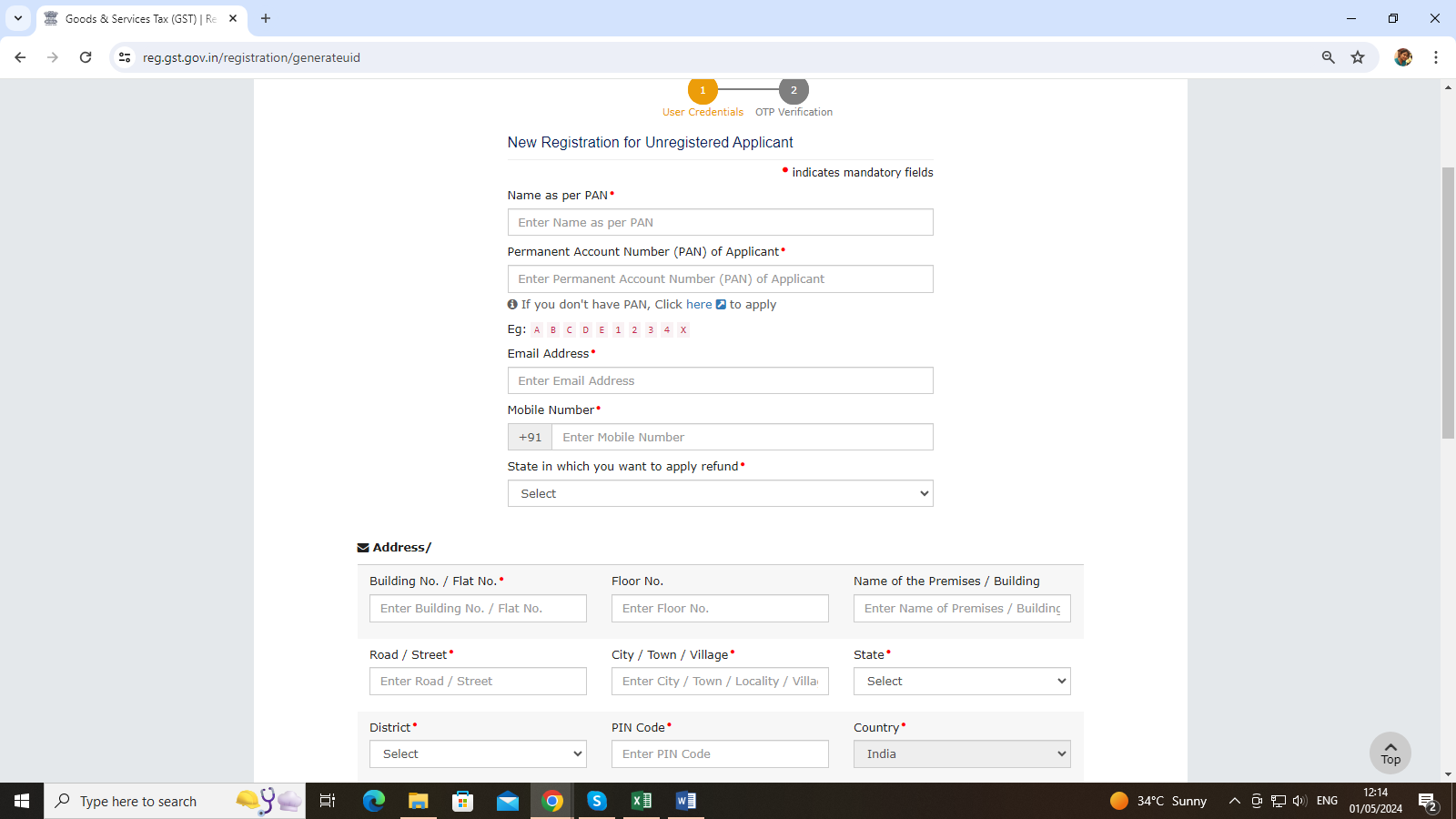

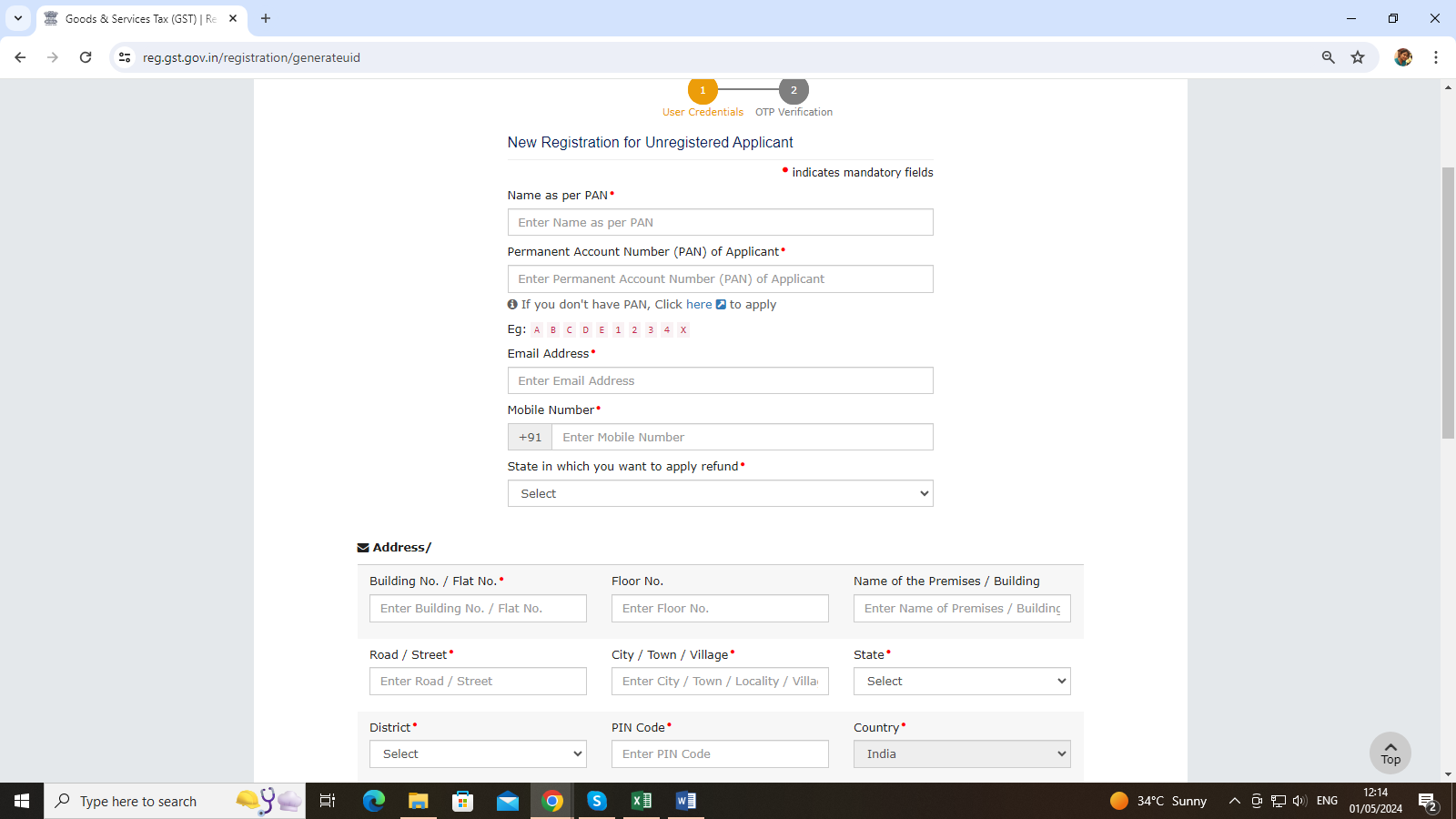

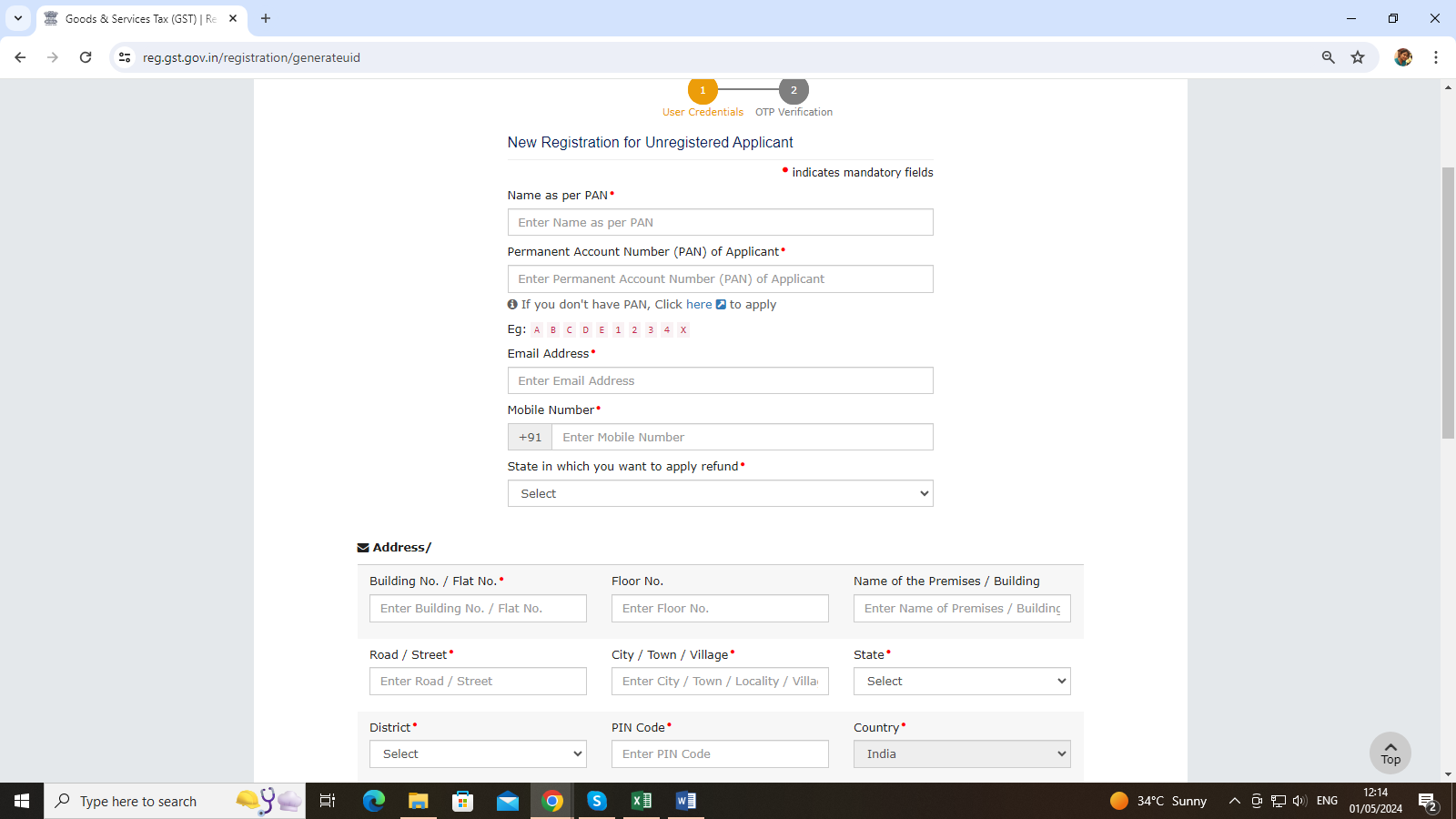

Step 5. Once the user selects the reason, the new registration for the unregistered applicant page appears.

Step 6. The user needs to enter the required details on the registration page.

Step 7. Once the user has completed filling in the details, they should enter the provided captcha text and then click on the ‘Proceed’ button.

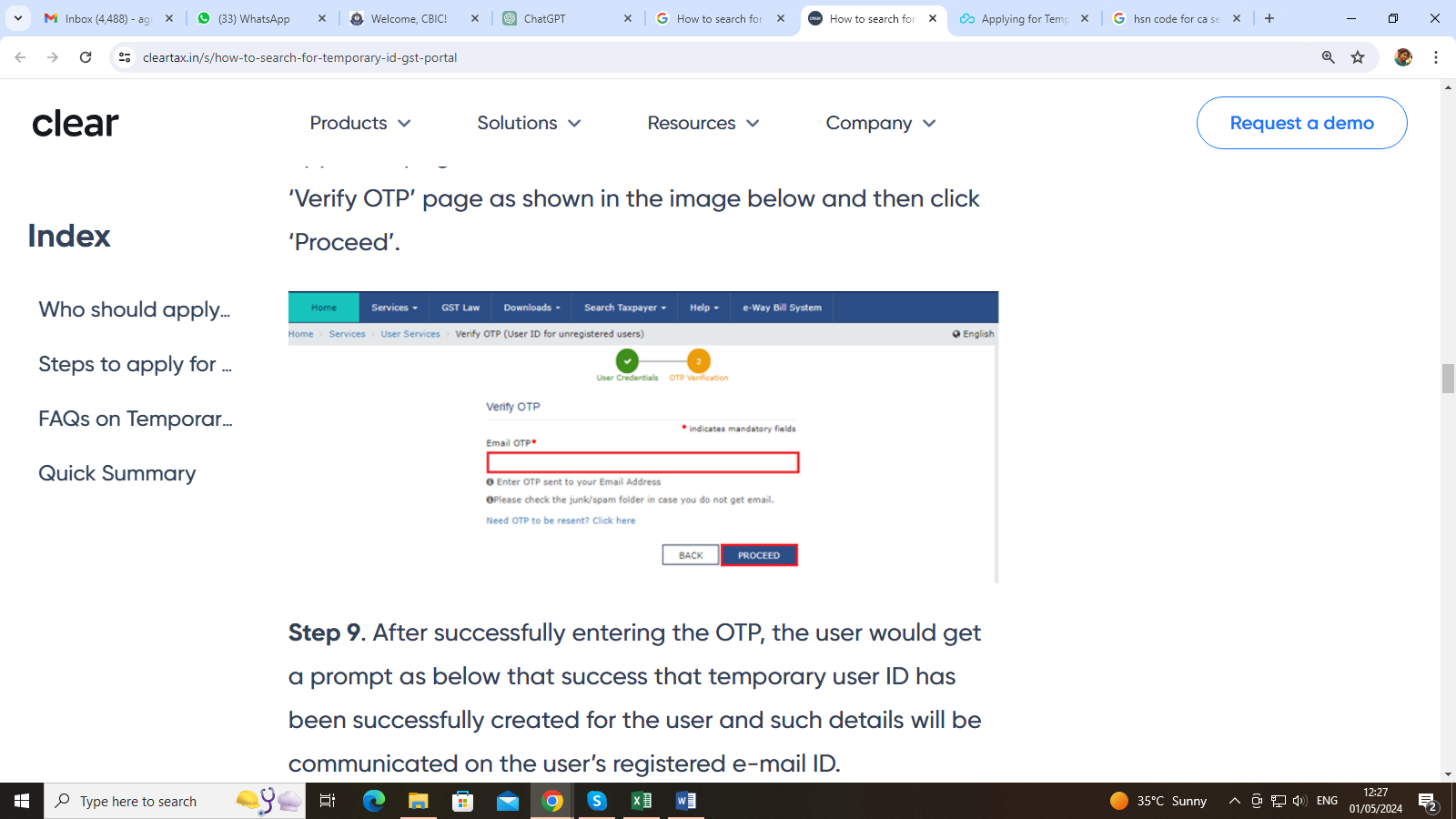

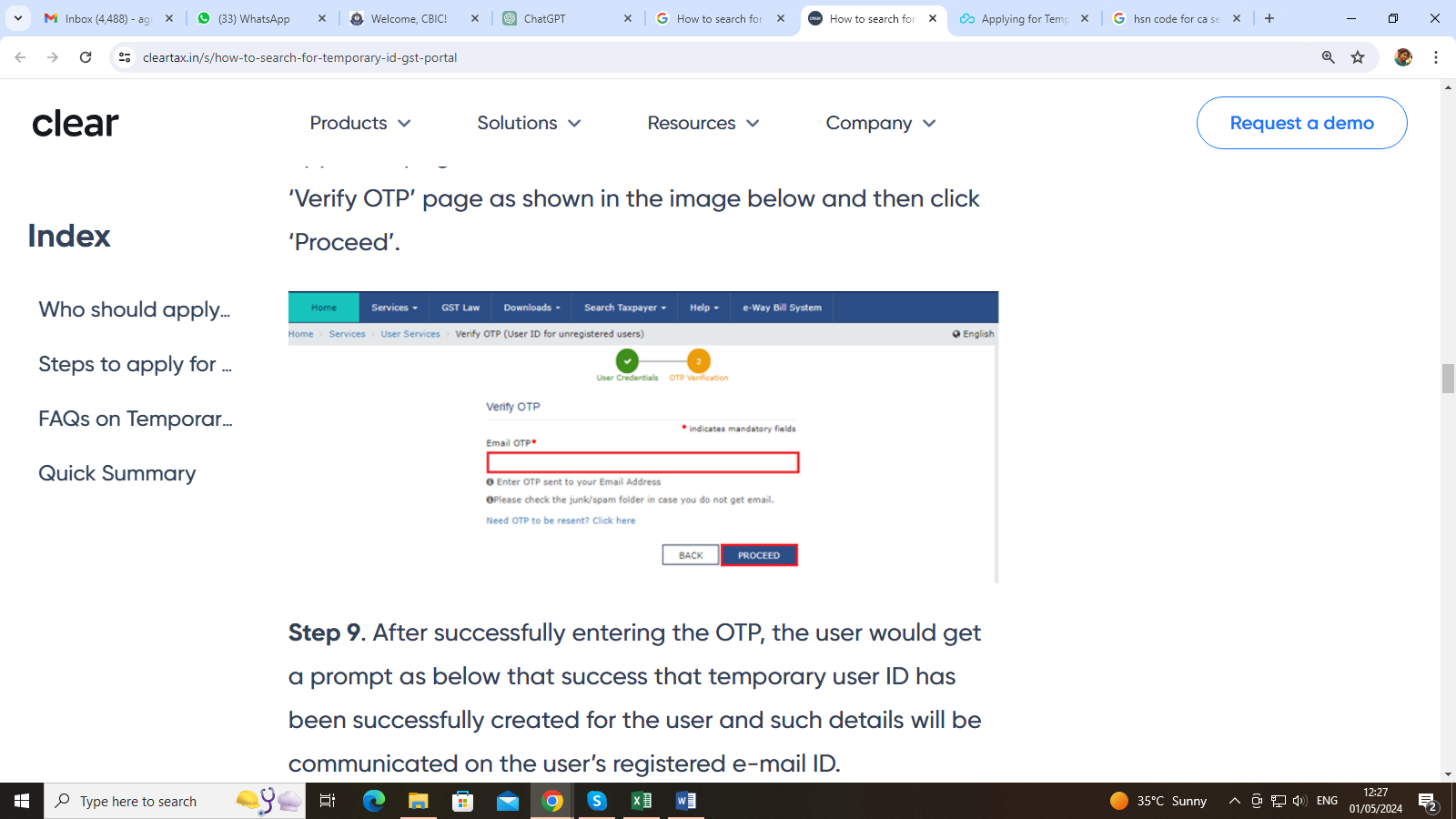

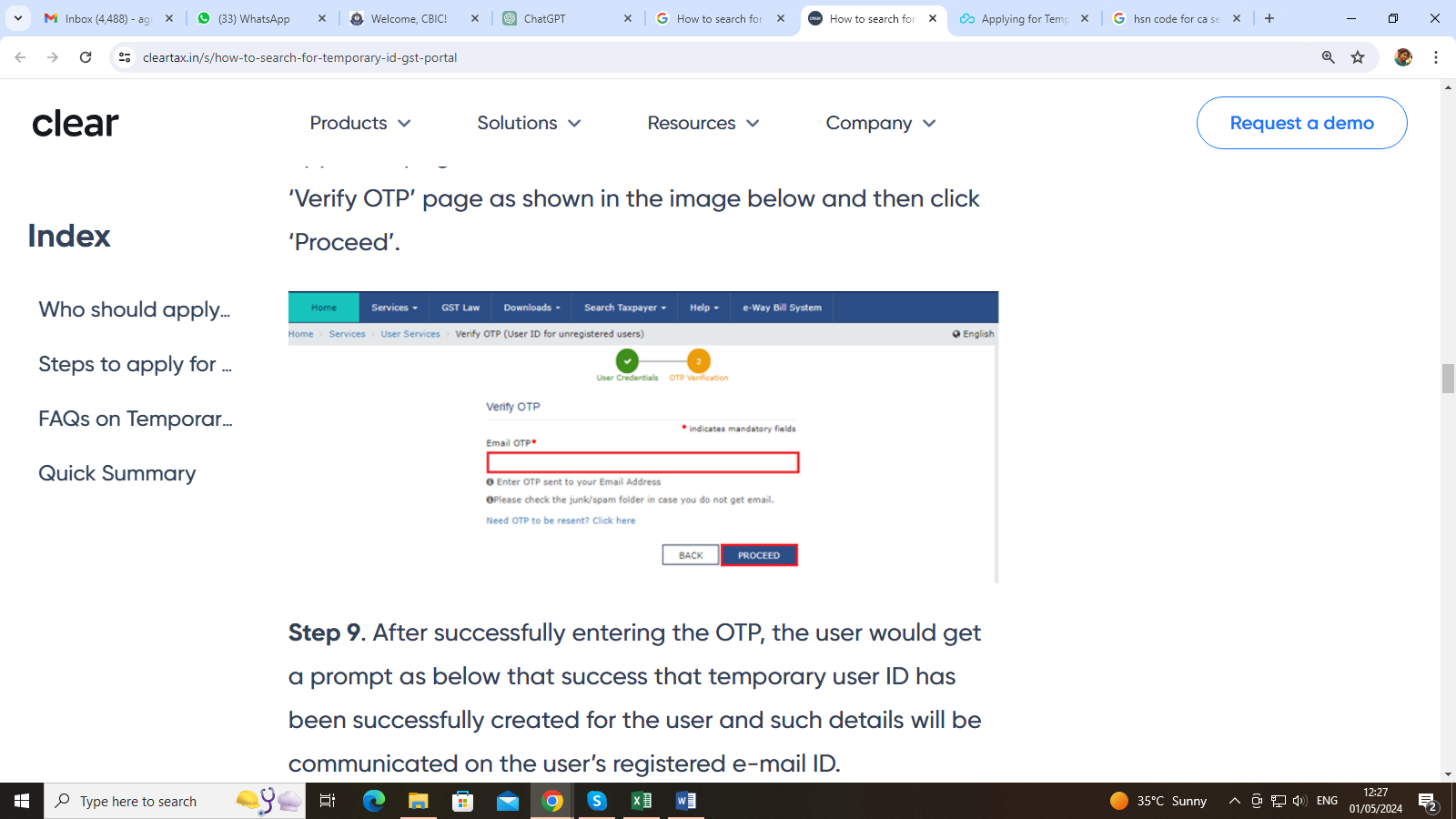

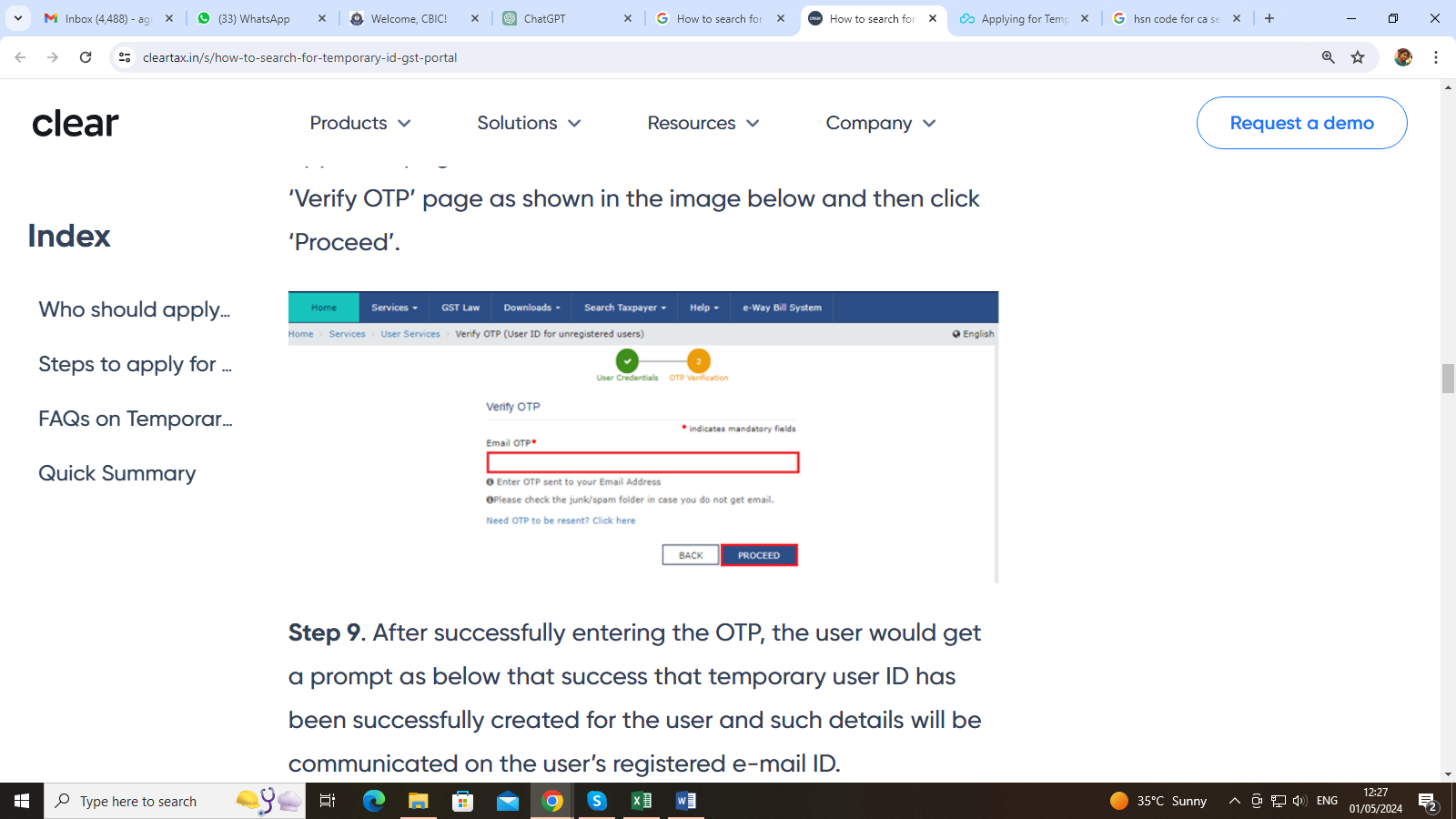

Step 8. The user will receive an Email OTP at the email address provided during the new registration for unregistered applicants. The user needs to enter the Email OTP on the 'Verify OTP' page, as shown in the image below, and then click on 'Proceed'.

Step 9. Upon successfully entering the OTP, the user will receive a prompt indicating that the temporary user ID has been created successfully. The details will be communicated to the user's registered email ID.

Step 10. Once the temporary user ID is successfully created, the user will receive an email on their registered email ID containing the temporary user ID and password for logging in to the GST portal.

FAQ’s

Q1. Who is eligible to apply for a Temporary User ID on the GST Portal?

Ans. Any individual or entity who is not registered under the GST Act or is not liable to be registered can apply for a Temporary User ID on the GST Portal. This User ID is specifically designed to facilitate access to certain exclusive functionalities available to unregistered individuals and entities on the GST Portal.

Q2. Is a non-resident individual eligible to apply for a Temporary User ID on the GST Portal?

Ans. Yes, a non-resident individual is eligible to apply for a Temporary User ID on the GST Portal.

Q3. Does a non-resident individual need to provide PAN details when applying for a Temporary User ID on the GST Portal?

Ans. No, for non-resident individuals providing PAN details is not mandatory while applying for a Temporary User ID on the GST Portal.

Q4. What supporting documents are required when applying for a Temporary User ID on the GST Portal?

Ans. No supporting documents are required when applying for a Temporary User ID on the GST Portal.

Q5. What activities can an unregistered applicant perform after creating a Temporary User ID on the GST Portal?

Ans. After creating a Temporary User ID on the GST Portal, unregistered applicants can perform activities such as tracking application status, viewing ledgers, creating challans, and searching for taxpayers.

Q6. Is it possible to add Authorized Signatory details while applying for a Temporary User ID on the GST Portal?

Ans. You can add details of up to two Authorized Signatories while applying for a Temporary User ID on the GST Portal.

Q7. What happens after entering the OTP?

Ans. After successfully entering the OTP, a confirmation message will appear stating that the temporary User ID has been created, and the details are sent to the registered email ID.

Q8. Will a notification be sent once the temporary ID is generated?

Ans. Once the Temporary User ID is created, the Temporary User ID and password to log in to the GST Portal are sent to the registered email ID.

Q9. Is it possible to update profile details after logging into the GST Portal?

Ans. Yes, after logging into the GST Portal, you can edit your profile details. Simply navigate to the "EDIT PROFILE" button on the dashboard to update the trade name, details of the authorized signatory, and applicant's address. Once the profile is updated, you will receive a notification on your registered email ID.