Recent Articles Of GST

GST on Food and Restaurant Services

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Introduction:-

Definition of Restaurant Service - "Restaurant Service" refers to the supply, as part of any service, of goods such as food or any other article intended for human consumption or any beverage, provided by a restaurant, eating joint, including mess, canteen, whether for consumption on or away from the premises where the food or beverage is supplied. Outdoor catering involves the supply of goods, including food or any other article for human consumption or any beverage, at events such as exhibitions, conferences, marriage halls, and other outdoor or indoor functions that are event-based and occasional. "Hotel accommodation" includes the supply of accommodation in hotels, inns, guest houses, clubs, campsites, or other commercial places meant for residential or lodging purposes.

As per the 2nd Schedule paragraph 6 clause b, restaurant service is treated as a composite supply.

According to Circular No. 164/20/2021-GST dated 06/10/2021, "restaurant service" encompasses services provided by restaurants, cafes, and similar eating facilities, including takeaway services, room services, and door delivery of food. Takeaway and door delivery services for the consumption of food are considered restaurant services. As per the Council's recommendation, services provided by cloud kitchens/central kitchens, involving the cooking and supply of food, fall under restaurant service and attract 5% GST (without Input Tax Credit).

Threshold Limit for Registration:

As per Section 22 of the CGST Act 2017, individuals with an annual turnover exceeding Rs. 20 lakhs are required to register under the GST Act. Voluntary registration is also allowed, even if turnover is below Rs. 20 lakhs. Those opting for the Regular scheme must file GSTR-1 and GSTR-3B returns regularly. GSTR-1 details outward supplies made by the restaurant, while GSTR-3B summarizes both outward and inward supplies along with GST payments. Timely filing of GST returns is crucial to avoid penalties and fines.

Tax Rate:

Under GST, restaurants are subject to a 5% GST rate without the option to claim Input Tax Credit (ITC) or an 18% GST rate with ITC claims. The applicable rate is determined based on the restaurant's location.

| S. No. | Type of Restaurants | GST Rate | ITC |

| 1 | Food supplied or catering services by Indian Railways/IRCTC | 5% | No ITC benefit is available in this case. |

| 2 | Standalone restaurants, including takeaway | 5% | No ITC benefit is available in this case. |

| 3 | Standalone outdoor catering services or food delivery service | 5% | No ITC benefit is available in this case. |

| 4 | Restaurants within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 5 | Normal/composite outdoor catering within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 6 | Restaurants within hotels (Where room tariff is more than Rs 7,500) |

18% | ITC benefit available in this case |

| 7 | Normal/composite outdoor catering within hotels (Where room tariff is more than or equal to Rs 7,500) | 18% | ITC benefit available in this case |

Supply Through E-commerce Operator:

In cases where food is supplied through an E-commerce Operator, the responsibility for GST payment lies with the operator. For instance, when food is delivered via platforms such as Swiggy or Zomato, these E-commerce Operators are accountable for collecting and remitting the tax at the final point of delivery. They are required to pay a 5% GST on restaurant services, alleviating the need for restaurants to directly handle GST collection. This mechanism simplifies the taxation process for food supply services facilitated by E-commerce Operators.

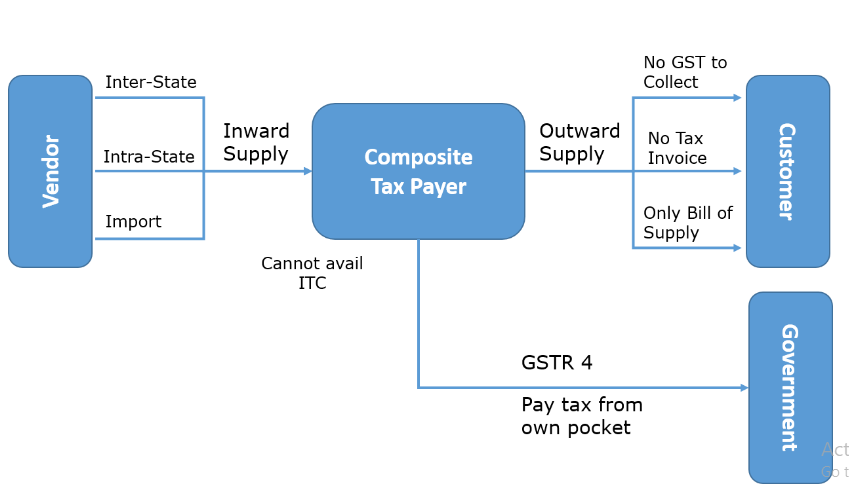

Can Restaurants Service Providers Opt for the Composition Scheme?

As per Section 10 of the CGST Act 2017, a person, whose aggregate turnover in the preceding financial year did not exceed Rs. 1.5 Crore (or Rs. 75 Lakh in specified states), may opt for the composition scheme. Under the composition scheme, the applicable tax rate is 5% (2.5% CGST and 2.5% SGST). However, it's important to note that a person opting for the composition scheme is not allowed to claim an Input Tax Credit (ITC) on inward supplies. This scheme offers a simplified approach to tax compliance for small businesses with a turnover below the specified threshold.

FAQs (Frequently Asked Questions) :

Q : GST on catering services?

A :

| S. No. | Type of Restaurants | GST Rate | |

| 1 | Food supplied or catering services by Indian Railways/IRCTC | 5% without ITC | |

| 2 | Standalone outdoor catering services or food delivery services | 5% without ITC | |

| 3 | Normal/composite outdoor catering within hotels (Where room tariff is less than Rs 7,500) |

5% without ITC | |

| 4 | Normal/composite outdoor catering within hotels (Where room tariff is more than or equal to Rs 7,500) | 18% with ITC | |

Q : GST on restaurant food?

A : GST Rate on restaurant food :-

| S. No. | Type of Restaurants | GST Rate | ITC |

| 1 | Standalone restaurants, including takeaway | 5% | No ITC benefit is available in this case. |

| 2 | Restaurants within hotels (Where room tariff is less than Rs 7,500) |

5% | No ITC benefit is available in this case. |

| 3 | Restaurants within hotels (Where room tariff is less than Rs.7500) |

12% | ITC benefit is available in this case. |

| 4 | Restaurants within hotels (Where room tariff is more than Rs 7,500) |

18% | ITC benefit available in this case |