Recent Articles Of GST

GST on Mobile Phones

[DISPLAY_ULTIMATE_SOCIAL_ICONS]GST on Mobile Phones

In this article, we understood the GST rate on mobile phones, GST on mobile accessories, and whether we can claim an input tax credit on mobile phones under GST.

Introduction

Before the introduction of GST, earlier Excise and VAT were charged on mobile phones. Under the VAT Regime, rates varied from state to state. So, it was difficult to set a uniform price for the mobile phone.

With the introduction of GST, the tax rate is the same all over India and thus a uniform price can be set for a mobile phone.

When CGST & SGST or IGST will be applicable:

In GST, there are two types of transactions: Inter-state supply and Intra-state supply. If the supply is within the state, then CGST & SGST are levied, and if the supply is between two different states or union territories, then IGST is levied.

Example: Mr. Sourabh, located in M.P., purchases a mobile phone from a dealer located in the same state i.e. M.P. In such a case, 9% CGST and 9% SGST will be charged. If he purchases a mobile phone from a different state or Union Territory, then he is required to pay IGST at 18%.

How GST will be charged when a mobile phone is sold with a charger and USB cable?

To know how the GST will be charged, first we have to understand the definition of the Composition scheme.

“Composite supply" means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

In the case of composite supply, tax rate of principle supply is applicable to all products.

In case of mobile phones, a mobile phone is usually supplied along with the charger and USB cable, which is essential for using the mobile phone. So, the GST rate that applies to the mobile phone will also apply to the charger and USB cable.

However, in some cases, the earphones are also sold along with the mobile phone, which is not naturally bundled and is classified as mixed supplies.

How to compute GST on mobile phones?

Under the GST, GST is charged on the transaction value. Transaction value means the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related, and the price is the sole consideration for the supply.

For example : Mr. X sells a mobile phone to Mr. Y at the price of Rs.50,000, and the buyer (Mr. Y) and seller (Mr. X) are not related parties. In such a case, GST is charged on the transaction value, i.e. Rs.50,000.

In the case of exchange offers, dealers of smartphones often come up with exchange offers whereby customers can get a new phone in exchange for an old one, and they just need to pay the differential sum. Under GST, barter is also included in the definition of supply.

For example, where a new phone is sold for Rs. 28,000 in exchange for an old phone. The price of the new phone without exchange is Rs.35,000. In this case, GST will be charged on Rs. 35,000.

Discounts - At the time of sale, the supplier gives a discount, and such a discount is recorded on the invoice. Then, in such a case, while determining the taxable value, discounts are excluded from the taxable value.

For example, Mr. X sells a mobile phone to Mr. Y at Rs. 45,000 and gives a discount of Rs. 5,000, and such a discount is recorded on the invoice. Then the transaction value of such a transaction is Rs. 40,000.

What is the GST rate on mobile phones?

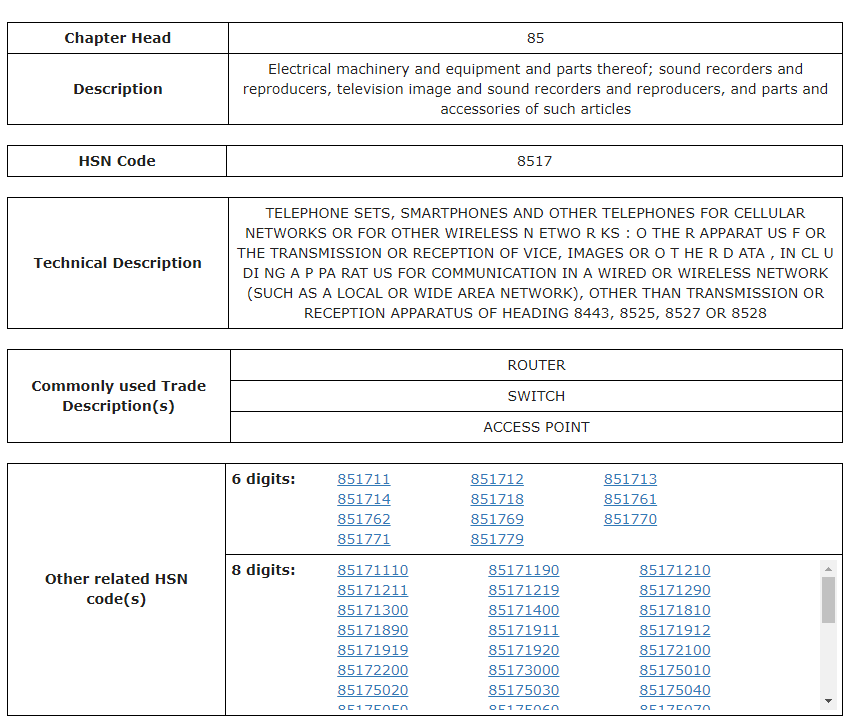

Before the GST regime, a smartphone’s price was not fixed as taxes varies from state to state. Under GST 18% GST charge on mobile phone. The related HSN code for mobile phone is 8517.

GST rate on mobile phones and accessories is covered under HSN chapter 85.

Rates of GST on mobile phones and accessories are below :

| Product name | HSN code | GST rate |

| Mobile phones | 8517 | 18%

|

| Lithium-ion batteries | 8507 60 00 | 18% |

| Power bank | 8507 | 18% |

| Memory card | 8523 | 18% |

| Speakers, headphones, earphones | 8518 | 18% |

| Plastic screen protector | 3919 | 18% |

| Tempered glass screen protector | 7007 | 18% |

Can a person claim GST paid on Mobile Phones?

Input tax credit (ITC) can be claimed on mobile phones subject to certain conditions :-

1. Every registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

2. He is in possession of a tax invoice or debit note issued by a supplier. He has received the goods or services or both.

3. Tax charged in respect of such supply has been actually paid to the Government. Then the buyer can claim ITC on the mobile phone.

FAQs on GST on mobile phones :-

Q.1 What is the GST rate on Mobile phones?

Ans. GST rate on Mobile phone is 18%.

Q.2 Can the buyer claim ITC on a Mobile phone?

Ans. Yes, if mobile phones are used for business and profession, then the buyer can claim an Input Tax Credit (ITC) on the mobile phone.