Recent Articles Of GST

GSTR-1 : Due Date, Return Filing, Format, Eligibility & Rules

[DISPLAY_ULTIMATE_SOCIAL_ICONS]What is GSTR-1?

Form GSTR-1 is a monthly or quarterly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services.

Every registered taxable person, other than an input service distributor/ composition taxpayer/ persons liable to deduct tax u/s 51 / persons liable to collect tax u/s 52 is required to file Form GSTR-1, the details of outward supplies of goods and/or services during a tax period, electronically on the GST Portal.

Who should file GSTR-1?

Every individual or entity who is registered under GST is obligated to file GSTR-1, regardless of whether any transactions occurred during the specified period. For those, who have no transactions to report (nil GSTR-1 filers), there is an option to file through SMS, which became available starting the 1st week of July 2020.

The following registered persons are not required to file GSTR-1:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

When is the due date of GSTR-1?

The due date to file Form GSTR-1 is based on aggregate turnover. Businesses with sales of up to Rs.5 crore have the option to file quarterly returns under the QRMP scheme and due on 13th of the month succeeding the end of the relevant quarter.

Whereas, those taxpayers who do not opt for the QRMP scheme or have a total turnover above Rs.5 crore must file the return every month on or before the 11th of the succeeding month.

For example, Form GSTR-1 for the calendar month of April 2023 needs to be filed by 11th May 2023. Form GSTR-1 for the quarter of October to December 2023, needs to be filed by 13th January 2024.

| For businesses with turnover | Month/Quarter | Due Date |

| More than Rs.5 crore | April 2023 | 11th May 2023 |

| June 2023 | 11th July 2023 | |

| Sept 2023 | 11th Oct 2023 | |

| Turnover up to Rs.5 crore & opted QRMP Scheme | Oct-Dec 2023 | 13th Jan 2024 |

| Jan-Mar 2024 | 13th April 2024 |

How to revise GSTR-1?

A return once filed cannot be revised under GST. Any mistake made in the return can be rectified in the GSTR-1 filed for the next period (month/quarter). It means that if a mistake is made in GSTR-1 of September 2023, rectification for the same can be made in the GSTR-1 of October 2023 or subsequent months.

How to file GSTR-1?

GSTR-1 is a return that must be filed by every registered GST taxpayer. This return is filed either on a monthly or quarterly basis and provides comprehensive information about all outward supplies.

To file GSTR-1, first you need to login to the GST Portal.

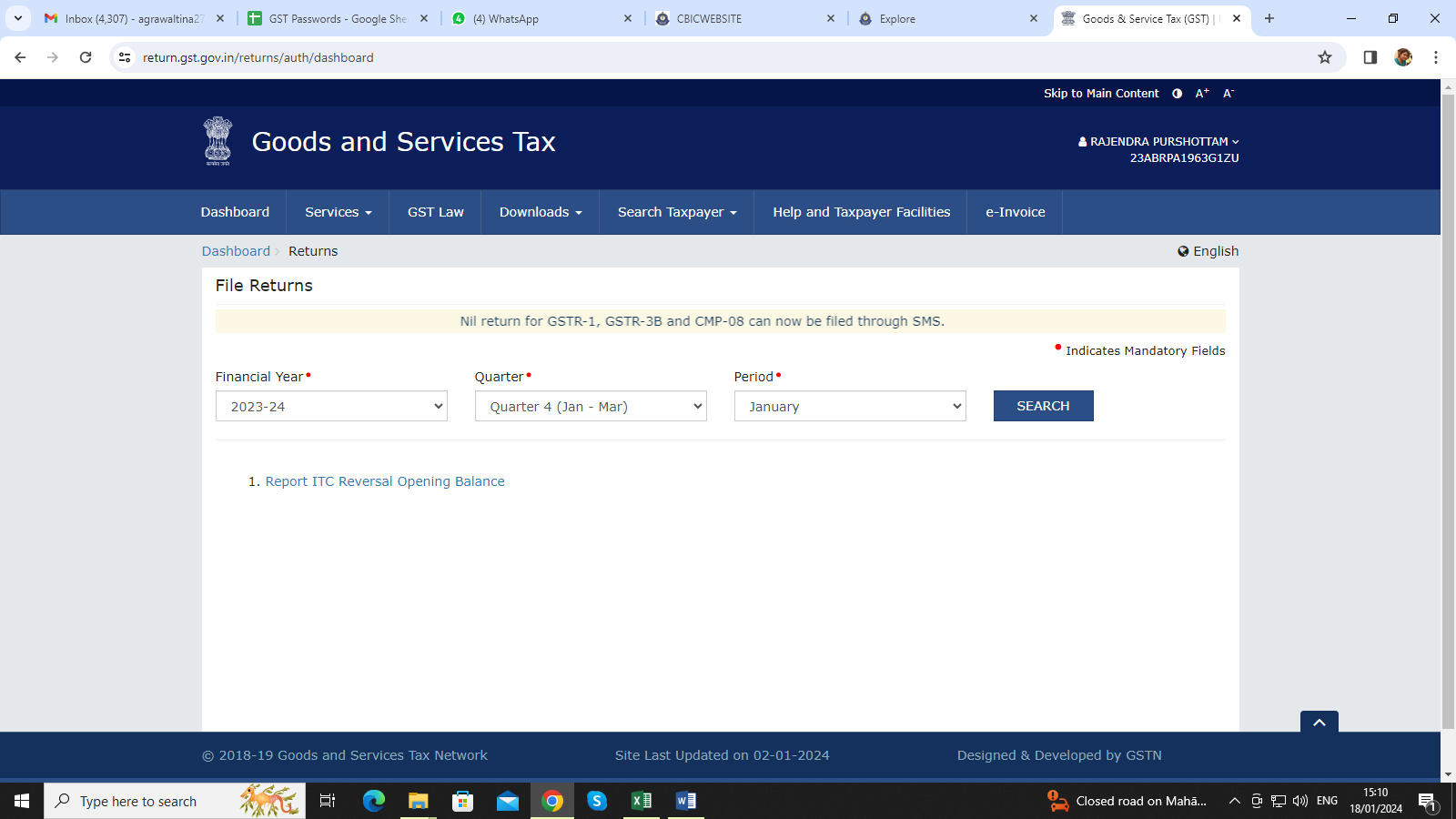

Step-1: Under Service tab << Return tab << Select Returns dashboard

Step-2: Select Financial Year, Quarter/Month & Period & Click on Search Tab.

Step-3: You have the option to choose between preparing return: Prepare Online & Prepare Offline.

Step-4: Select Prepare Online & the GSTR-1 form will now be accessible.

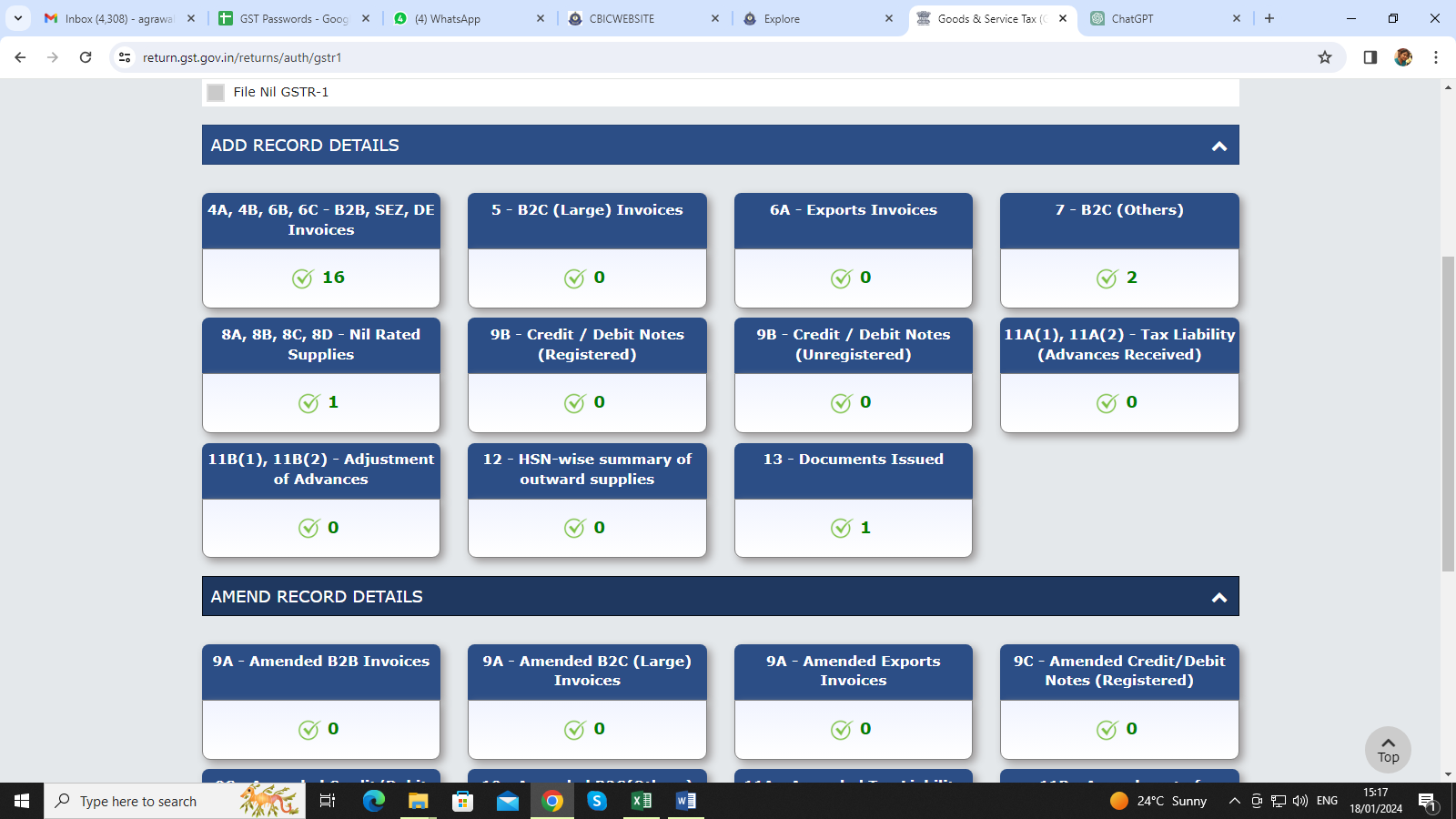

Step-5: The return is structured into 15 sections, listed as follows:

Tables 1, 2 & 3: GSTIN, Legal name, Trade name, Financial year, Tax period, Status of return filling and due date.

Table 4: Taxable outward supplies to registered persons (including UIN-holders) excluding zero-rated supplies and deemed exports.

Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs.2.5 lakh

Table 6: Supplier under Export (Export Invoices) i.e. zero-rated supplies and deemed exports

Table 7: Taxable supplies to unregistered persons other than the supplies covered in table 5

Table 8: Interstate & Intrastate Outward supplies that are nil rated, exempted and non-GST in nature

Table 9: Under Table 9 it has 9A, 9B & 9C. Details are as follows:

Table 9A: There are 3 types of tiles: Amended B2B Invoices, Amended B2C (Large) Invoices and Amended Export Invoices. These tiles pertain to Amendments made to outward supplies which were reported in tables 4, 5 & 6 of the earlier tax periods.

Table 9B: There are 2 types of tiles: Debit note and credit note issued to registered persons & unregistered persons.

Table 9C: There are 2 types of tiles: Amended Credit/Debit Notes (Registered) and Amended Credit/Debit Notes (Unregistered). These tiles relate to Amendments made to Credit & Debit Notes for both registered and unregistered persons, which were previously reported in table 9B during the earlier tax period.

Table 10: Amended B2C (Others) invoices previously reported in table 7 of the prior tax period.

Table 11: Details of advances received or adjusted in the current tax period or amendments of the information reported in the earlier tax period.

Table 11A: Amended Tax Liability (Advances Received)

Table 11A(1), 11A(2): Tax Liability (Advances Received)

Table 11B: Amendment of Adjustment of Advances

Table 11B(1), 11B(2): Adjustment of Advances

Table 12: Summary of Outward supplies based on HSN codes

Table 13: Summary of Documents issued during the tax period.

Table 14: For suppliers - Reporting of GSTIN-wise (GSTIN of ECO operators) sales through e-commerce operators, where the e-commerce operators are liable to collect TCS u/s 52 or liable to pay tax u/s 9(5) of the CGST Act.

Table 14A: For suppliers - Amendments to Table 14

Table 15: For E-commerce operators - Reporting both B2B and B2C, suppliers' GSTIN-wise sales through e-commerce operators on which e-commerce operator must deposit TCS u/s 9(5) of the CGST Act

Table 15A: For E-commerce operators -

Table 15A I - Amendments to Table 15 for sales to GST registered persons (B2B)

Table 15A II - Amendments to Table 15 for sales to unregistered persons (B2C)

Step-6: Once data is entered in all relevant tabs, click on the Generate Summary.

Step-7: Navigate to the "Proceed to File" tab where the consolidated summary has been generated.

Step-8: Choose "File Statement" and proceed to file your return, opting for either the Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) option.

FAQs on Form GSTR-1

1. What is Form GSTR-1? Who must fill out Form GSTR-1?

The Form GSTR-1 is the quarterly or monthly Statement of Outward Supplies that must be submitted by all normal and casual taxpayers who make outward deliveries of services and goods or both. It also contains the details of supplies made outward to other taxpayers of both goods and services.

Every taxpayer who is registered not including an input service distributor/composition taxpayer/persons who are liable to deduct tax under 51 and persons with the power to collect tax under section 52 must submit Form GSTR-1, which contains providing the details of any outward supply of services or goods during the tax year, electronically through GST Portal. GST Portal.

2. When do I have the option to opt-in for the Quarterly Return option to file of the Form GSTR-1?

You can choose quarterly submission of the Form GSTR-1 if you meet the following conditions:

If your aggregate turnover in the previous financial year was more than Rs. 5 Crore or

If you're registered in the current financial year, and anticipate that your gross turnover will exceed Rs. 5 Crores

Note: If you've selected the Opt-in to Quarterly Return You must complete both Form GSTR-1 as well as Form GSTR-3B every quarter.

3. I've already selected the quarterly filing of the GSTR-1 return. Do I have the option to change my choice in the near future?

Option to change frequency is provided if you haven't filed a returns during the year in accordance with the original frequency.

4. Do you have to file Form GSTR-1 compulsory even no supply?

Form GSTR-1 has to be submitted regardless of whether there was no business or other activity (Nil Return) during the tax year i.e. GSTR-1 is compulsory even no supply.

5. What are the different ways of making Form GSTR-1?

Form GSTR-1 is prepared by using the following ways:

a) Online entry into GST Portal..

b) Uploading invoices as well as other Form GSTR-1 information using the Returns Offline tool.

c) Utilizing third-party applications of Application Software Provider (ASPs) through GST Suvidha Providers (GSPs).

6. What information must be provided on Form GSTR-1?

The following information about the tax period should be included in the form GSTR-1

a) Invoice level information of supplies provided to registered people with UINs;

b) Details of the invoice level for Inter- State supplies of an invoice value higher than Rs. 2,50,000 to persons who are not registered (consumers);

c) Details of Credit/Debit Notes provided by the supplier to invoices;

d) Details of exports of services and goods, including the deemed exported goods and services (SEZ);

e) State-level summary of supplies provided to unregistered people (consumers);

f) Summary of the details of advances made in connection with future supply and adjustment of them;

g) Specifics of any modifications made to the data reported for any of the above categories.

h) Nil-rated, exempted, tax-free, and other products that are not GST-compliant;

i) HSN/SAC wise summary of supplies to the outward supply.

7. Which types of registered taxpayers aren't required to file the GSTR-1 Form?

The following taxpayers are not required to fill out Form GSTR-1

a) Taxpayers who are part of the Composition Scheme

b) Non-resident foreign taxpayers

c) Online Information Database as well as access retrieval services provider

d) Input Service Distributors (ISD)

e) Tax Deducted at Source (TDS) (deductors); and

f) E-commerce businesses collecting TCS

8. What are the requirements to file Form GSTR-1?

The pre-requisites for filing Form GSTR-1 include:

a. A taxpayer must be registered as an active GSTIN during the tax period for which Form GSTR-1 must be submitted;

b. In order to access the GST Portal, the taxpayer should possess valid login credentials (i.e., User ID and Password).

c. If required, taxpayers should ensure their digital signature (DSC) remains active and non-expired or revoked;

d. If a taxpayer wishes to utilize EVC, they must obtain access to the registered mobile number of the Primary Authorized Signatory.

9. Who must use DSC when filing their returns?

DSC filing is compulsory for Public and Private Limited Companies, Limited Liability Partnerships (LLPs), and Foreign Limited Liability Partnerships (FLLPs).

10. What is the due date for filing GSTR-1?

• Due date for QRMP scheme taxpayers :- On or before the13th of the month succeeding the end of relevant quarter.

Example : GSTR-1 for QRMP scheme taxpayers for the quarter (January to March 24) will be 13th April 2024.

• Due date for Other than QRMP (Regular) taxpayers :- On or before the 11th of the succeeding month.

Example : GSTR-1 filing deadline for January, 2024 is 11th February 2024

11. Last date of amendment in invoices of previous financial years?

The last date for amending details on invoices issued during the prior financial year is the 30th November of the subsequent financial year or annual return, whichever is earlier. Error or omission correction in respect of invoices from the previous financial year cannot be accepted after 30th November.

12. Is a taxpayer required to link credit or debit notes directly with their original invoices?

No, Taxpayers can report them without having any original invoice as a reference.

13. What does the Total Invoice Value column of Form GSTR-1 represent?

The "Total Invoice Value" column on Form GSTR-1 represents invoice values inclusive of taxes.

14. Will there be any validation on the relationship between Invoice Value and Taxable Value?

Taxable value is defined under GST Law and there will be no confirmation that invoice values match up with its total.

15. Am I allowed to include details for both Goods and Services on one invoice?

Absolutely, all goods and services can be entered into one invoice.

16. What are B2B Supplies?

B2B supplies refer to transactions between registered taxable entities/persons for which taxes have been withheld (i.e. Business-to-Business supplies).

17. What Is B2C Supply?

B2C supplies refer to transactions between Registered providers and Unregistered buyers (Business-to-Consumer).

18. When must Debit Notes Be Reported in My Return?

Debit Notes must be reported within one month of being issued from their supplier.

19. When are Credit Notes Reported in the Return?

Credit Notes must be reported either when issued, or no later than September month following the end of the financial year in which supply occurred, or furnishing of annual return (whichever comes first).

20. Is a taxpayer required to report credit notes and debit notes related to consumer supplies separately?

No. They can all be reported consolidated using Form GSTR 1 by netting off their values against each other.

21. Is a supplier required to pay taxes on any advance received from their receivers?

Supplier is required to pay taxes on advances only in case of services (more than Rs.1000). In case of advance in relation to goods, no tax is required to pay at the time of supply. Suppliers must remit tax on advances received from receivers for services they provide and report these in Form GSTR-1 at once they are received. Any advance payments should be netted off against invoiced amounts already issued as well as those which have already been reported elsewhere within that return form.

22. How is tax paid on advance payments adjusted against invoice(s) issued in subsequent tax periods?

A taxpayer must report an advance as payable within their tax return for that particular tax period in which it was received; when an invoice is then issued by an entity that includes their advance, then taxpayer can adjust against it as part of their bill payment obligation.Adjust the tax liability associated with each invoice issued during that tax period in Form GSTR-1 by using its advance adjustment table. This can be seen in Form GSTR-1 of that particular period.

23. What is the treatment of exports?

Exports are treated as zero-rated inter-state supplies under GST law and thus taxpayers have two options when exporting: either they can export without incurring integrated tax with the filing of LUT or Pay IGST and claim a refund of ITC against their exports.

24. Is a Shipping Bill Number Necessary When Declaring Export Invoices in GSTR-1?

No, taxpayers may provide details of export invoices without specifying shipping bill details if such details are unavailable to them.

25. How can the details of shipping bill details be provided after filing Form GSTR-1?

If the taxpayer receives any such details after having filed their Form GSTR-1, they need to declare them via the amendment section in Form GSTR-1 of that month in which they received them.

26. How should I report supplies to SEZ units or developers in Form GSTR-1?

Since all SEZ units and developers registered under GSTIN are required to report any invoice details of supplies delivered directly or indirectly with an appropriate SEZ flag, then this information needs to be recorded under "supplies to registered taxpayers (B2B invoice details)."

27. Is it required to submit the details of supplies made through E-Commerce?

Yes, the GSTIN number of the E-Commerce portal must also be declared when filing returns pertaining to taxable supplies made through this channel.

Form GSTR-1 would only become effective once relevant provisions of GST law have been announced.

28. How should exempt supplies through E-Commerce operators be reported in Form GSTR-1?

Exempt supplies should be reported consolidated under the "Nil Rated and Exempt Supplies" section of Form GSTR-1.

29. When is it permissible to make changes to uploaded invoice details? Taxpayers can modify/delete invoices up until they submit Form GSTR-1 of that particular tax period, with no limit as to when these modifications/deletions must take place. As invoice details uploaded are in draft version and therefore subject to modification prior to submission of Form GSTR-1.

30. Can There Be Duplicate Invoice Series in One Financial Year for One GSTIN?

A duplicate invoice series cannot exist within one financial year for any given GSTIN as the system will reject and provide an error upon validation of such duplicate supply invoices.

31. Can a registered taxpayer issue multiple tax invoices within one financial year?

Yes, any registered taxpayer may issue multiple series of tax invoices within any one financial year, with no limit set on the number of series they can produce in one financial year.

32. Does GST law stipulate a format for invoice numbers?

Yes, invoice numbers should contain up to 16 characters including alphabetic characters as well as special characters like dashes and slashes.

33. How are HSN-wise summaries reported in Form GSTR-1?

Starting May 21st, an HSN-wise listing of outward supplies with rate and quantitative details are furnished on Form GSTR-1.

From May 21 onwards, HSN-wise summaries of outbound supplies will be provided with quantitative details.

34. When should a normal taxpayer opting for a composition scheme enter invoices into Form GSTR-1?

If a taxpayer opts for a composition scheme, Form GSTR-1 will only be available for filing during the time when they were registered as normal taxpayer. Thus they would still be able to file Form GSTR-1 even if late for this particular period - prior to opting into the composition scheme.

35. When do monthly tax liabilities need to be paid by regular taxpayers?

Regular taxpayers must settle any liabilities related to filing GSTR-3B by the 20th of the following month.

36. Can I File Form GSTR-1 and What are its Steps?

You can download our App Law Legends, where from the tutorial video, you can learn how to file GSTR-1 practically and in step wise manner.

37. After successfully submitting the GSTR-1 form, does a taxpayer need to sign and submit it electronically?

Yes, a taxpayer must electronically sign the GSTR-1 form once submitted successfully or else it will be considered as not-filed and no changes can be made by taxpayer post submission. Once successfully filed, however, Form GSTR-1 remains frozen with no further changes allowed after successful submission.

38. What kind of communications are sent upon successfully filing Form GSTR-1?

a) A unique Application Reference Number (ARN) will be generated upon successful filing.

b) An SMS and email will also be sent directly to the taxpayer on his primary authorised signatory's Mobile Number and Email ID.

39. What are the different methods by which the GSTR-1 form can be signed electronically?

Taxpayers may electronically sign their returns using either a DSC (mandatory for all companies and LLPs) or EVC (Electronic Verification Code sent directly to the registered mobile number of an authorized signatory).

40. What precautions must I take while applying for a Digital Signature Certificate (DSC)?

1. The GST Portal only accepts PAN-based DSC's.

2. A DSC should not have expired

3. Register Your DSC Certificate on the GST Portal

4. Install EM Signer Version 2.6 on the computer to use its features.

5. Connect the DSC Dongle to your computer

41. Will a taxpayer receive notice if he or she fails to file Form GSTR-1 by its due date?

Yes, they will receive a system-generated defaulter notice in format 3A from HMRC in this event.

42. Must a taxpayer verify the registrations provided to Form GSTR-1 recipients?

Yes, the taxpayer must verify the validity of each recipient’s GSTIN before uploading invoice details; otherwise the system will generate an invalidation error and refuse any invoice details associated with that GSTIN.

43. How many decimal digits must various values be declared on Form GSTR-1?

Invoice value, taxable value and tax amounts should all be declared in terms of two decimal places for completeness.

44. Is There Any Exception to Filing Form GSTR-1 before the end of the current tax period?

A taxpayer cannot file Form GSTR-1 before the end of the current tax period. However, following are the exceptions to this rule:

a) Casual Taxpayers who have closed down their business can file Form GSTR-1 prior to the end of their tax period.

b) Taxpayers who have applied to cancel registration will be permitted to submit Form GSTR-1 within 72 hours of confirmation of their application for cancellation before the end of their current tax period.

45. I can't see the invoices I have uploaded. What should I do?

Scroll to the bottom of Form GSTR-1 - Details of outward supplies of goods or services and click GENERATE GSTR1 SUMMARY button; this will create an auto-drafted summary as well as any invoices added by you that require action from recipients and start reflecting in their relevant sections of Form GSTR-1.

If you want an immediate overview, after adding invoices, click GENERATE GSTR1 SUMMARY button and generate it instantly. However, please note that it can only be generated every 10 minutes; any attempts at recreating within this time frame may result in an error message being displayed at the top of the page.

The GST Portal automatically creates the summary at 30-minute intervals.

Check if any error files have been generated when uploading JSON generated from the Offline Tool. If errors do appear, download their reports and rectify issues using Offline Tool.

46. Why is my tile summary different than the number of invoices I entered/uploaded?

Your invoice count on the tile summary is updated only when you click GENERATE GSTR1 SUMMARY; to refresh, just click it again.

But a summary can only be generated once every 10 minutes; any attempts at creating it sooner could generate an error message on top of the page.

The GST Portal automatically generates an updated summary every 30 minutes.

Check if any error file was generated when uploading JSON generated by Offline Tool and upload. If any did exist, download its report and rectify any issues using the Offline Tool.

47. How can I delete or modify invoices I uploaded successfully previously?

Clicking the Edit/ Delete button enables you to make any necessary edits or deletions to invoices that were successfully uploaded previously. Your uploaded invoice details remain in draft form until Form GSTR-1 has been submitted, giving you ample time for making any necessary alterations or revisions before finally being finalised and submitted.

48. How Can I File Nil Form GSTR-1?

You may file Nil Form GSTR-1 by first Generating a Summary, and then Submitting your Return without entering any data and signing with the appropriate signature or Nil Return can also be filled through SMS.

49. I missed filing my GSTR-1 form last month; can I still file one now for the current month?

No, As per Section 37(4) of the CGST Act, taxpayers are not permitted to file GSTR-1 if their previous GSTR-1 for that tax period was not submitted on time. Furthermore, per Section 39(10) of the same act they cannot file GSTR-3B until GSTR-1 for that tax period has been submitted on time.