Recent Articles Of GST

GSTR -9 Annual Return Applicability, Due Dates, Turnover Limit & Steps to file

[DISPLAY_ULTIMATE_SOCIAL_ICONS]GSTR-9 is an Annual return to be filed by every registered person whose aggregate turnover is more than Rs. 2 crore.GSTR 9 is a compilation of GSTR 1, GSTR 3B, GSTR 2A, and inward & outward supply for the respective financial year.

GSTR-9 is required to be filed by every registered person having an aggregate turnover of more than Rs. 2 crore. However, the following persons are not required to file GSTR-9.

- Input service distributor.

- Casual taxable person.

- Non-resident taxable person.

- Tax deductor.

- Tax collector.

- OIDAR service provider who is located in a non-taxable territory.

Provided that the Commissioner may, on the recommendations of the Council, by notification, exempt any class of registered persons from filing annual returns under this section.

Due Date of Filing of Annual Return.

The due date to file GSTR-9 for a financial year is 31st of December of the following year.

For Example – The due date for filing of annual return for F.Y. 2022-23 is 31st December 2023.

Some other Important Points Before the Filing of Annual Return.

Before filing the annual return, ensure that all applicable returns such as GSTR -1 and GSTR- 3 have been filed.

Once the annual return is filed, no changes can be made. Also, you have to keep in mind that in a financial year, if you were registered in the composition scheme for some months and in the remaining months you are registered in the normal scheme, then you will have to file an annual return for the composition scheme also. It means, in this case, it is necessary to file both returns. i.e. GSTR -4 and GSTR-9.

GSTR-9 is divided into six parts :-

- Basic Detail.

- Details of Outward and inward supplies made during the financial year.

- Details of ITC for the financial year.

- Details of tax paid as declared in returns filed during the financial year.

- Particulars of the transactions for the financial year are declared in returns of the next financial year till the specified period.

- Other Information.

Now, we shall understand in depth, how to file GSTR-9

Table Number 4 – Details of advances, inward and outward supplies made during the financial year on which tax is payable.

Point- 4 (A) - Supplies made to un-registered persons (B2C) – In this table, during the financial year, any supply made to unregistered persons are submitted. These figures are auto-populated from GSTR-1. Auto-populated data can be cross-checked through filed GSTR -1 or IFF.

Point - 4(B) Supplies made to registered persons- During the financial year, any supply made to registered persons. Such details are submitted here. These figures are auto-populated from GSTR-1. Auto-populated data can be cross-checked through filed GSTR-1 and IFF.

Point - 4(C) - Zero rated supply (Export) on payment of tax (except supplies to SEZs)- Aggregate value of exports (except supplies to SEZs) on which tax has been paid shall be declared here. Table 6A of FORM GSTR-1 may be used for filling up these details.

Point - 4(D) - Supply to SEZs on payment of tax – During the financial year, any supply made to SEZ unit, such details are furnished in point D. Table 6B of GSTR-1 may be used for filling up these details.

Point 4 (E) - Deemed Exports - Details of Deemed Exports made during the financial year submitted in point E. Table 6C of FORM GSTR-1 may be used for filling up these details.

Point - 4(F) - Advances on which tax has been paid but the invoice has not been issued (not covered under (A) to (E) above)- During the financial year, supplies on which tax has been paid but invoices have not been issued and such advances are not covered from point A to point E are to be reported here. Table 11A of FORM GSTR-1 may be used for filling up these details.

Point – 4(G) - Inward supplies on which tax is to be paid on a reverse charge basis- Details of such inward supplies have to be submitted where tax has been paid in the Reverse Charge Mechanism.

Point - 4(H) - Sub-total (A to G above)- In Point H, the sub-total from Point A to Point G will auto-populate.

Point – 4(I) - Credit Notes issued in respect of transactions specified in (B) to (E) above – In Point I, details related to credit note has been issued in respect of transactions specified from Point B to Point E are required to be submitted.

Point – 4( J) - Debit Notes issued in respect of transactions specified in (B) to (E) above - In Point J, details related to debit note issued in respect of transactions specified from point B to point E are required to be submitted.

Point- 4 (K) - Supplies/tax declared through Amendments- In Point K, details of supply declared through amendment are required to be submitted.

Point- 4 (L) - Supplies/tax reduced through Amendments – In point L, details of supply reduced through amendment required to be submitted.

Point- 4 (M) - Sub-total (I to L above) – In Point M, the Subtotal from Point I to Point L will auto-populate.

Point- 4 (N) - Supplies and advances on which tax is to be paid (H + M) above – Point N is a sub-total of Point H and Point M. In this point details are auto-populated.

Table No. 5 - Details of Outward supplies made during the financial year on which tax is not payable –

Outward supplies made during the financial year on which tax is not payable, details of such supplies are to be submitted in this table. In this table, data will be auto-populated based on the return filed. You can check the auto-populated data from your books of accounts. If the data does not match, then you can change it.

Point 5 -(A) - Zero-rated supply (Export) without payment of tax- In Point A, details of supply made through LUT (Zero-rated supply) are to be submitted here. FORM GSTR-1, Table six A can be used to fill details in Point-A.

Point 5(B)- Supply to SEZs without payment of tax- Details of Supply made to special economic zone unit without payment of tax are to be submitted here. FORM GSTR-1, Table six B can be used to fill details in Point-B.

Point 5(C) - Supplies on which tax is to be paid by the recipient on a reverse charge basis- Where the buyer (recipient) is liable to pay tax under RCM, such details are required to be submitted here. FORM GSTR-1, Table four B can be used to fill details in Point C.

Point 5(D) - Exempted- In point D, Details of exempted supply have to be submitted. FORM GSTR-1, Table eight can be used to fill details in Point D.

Point 5(E) - Nil-Rated- In Point E, details of the Nil-rated supply are required to be submitted.

Point 5(F) - Non-GST supply (includes ‘no supply’) – Details of Supplies that are outside the scope of GST are to be submitted here. FORM GSTR-1, Table eight can be used to fill details in Point F.

Point 5(G) - Sub-total (A to F above) - In point G, the sub-total amount from Point A to Point F is auto-populated.

Point 5(H) - Credit Notes issued in respect of transactions specified in A to F above - Any credit note issued In respect of the Transaction specified from point A to F, such details have to be submitted here.

Point 5(I) - Debit Notes issued in respect of transactions specified in A to F above – Any debit note issued in respect of the Transaction specified from point A to F, such details have to be submitted here.

Point 5(J) - Supplies declared through Amendments - Supply declared through amendment have to be submitted in Point J.

Point 5(K) - Supplies reduced through Amendments - In Point K, supply reduced through amendment such details have to be furnished here.

Point 5(L) - Sub-Total (H to K above) - In point L, Point H to K sub-total amount is auto-populated.

Point 5(M) - Turnover on which tax is not to be paid (G + L above) - In Point M, Point G and L sub-total amount is auto-populated.

Point 5(N)- Total Turnover (including advances) (4N + 5M - 4G above): In Point N, Total Turnover including advances is auto-populated from point N of table number four and point M of table number five. But, subtract inward supplies on which tax is to be paid on a reverse charge basis.

Part – III Details of ITC availed during the financial year- During the financial year, details of ITC and the Breakdown of such ITC have to be shown here.

Point 6(A) - Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) - In Point A, the Total input tax credit availed in Table 4A of FORM GSTR-3B for the taxpayer is auto-populated.

Point 6(B) - Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) - Aggregate value of input tax credit availed on all inward supplies except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs shall be declared here.

Point 6(C)- Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed- Aggregate value of input tax credit availed on all inward supplies received from unregistered persons (other than import of services) on which tax is payable on reverse charge basis shall be declared here. Table 4(A) (3) of FORM GSTR-3B may be used for filling up these details.

Point 6(D)- Inward supplies received from Inputs registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed- Aggregate value of input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis shall be declared here. Table 4(A) (3) of FORM GSTR-3B may be used for filling up these details.

Point 6(E) - Import of goods (including supplies from SEZs) - Details of input tax credit availed on import of goods including supply of goods received from SEZs shall be declared here. Table 4(A) (1) of FORM GSTR-3B may be used for filling up these details.

Point 6(F) - Import of services (excluding inward supplies from SEZs): Details of input tax credit availed on import of services (excluding inward supplies from SEZs) shall be declared here. Table 4(A) (2) of FORM GSTR3B may be used for filling up these details.

Point 6(G) - Input Tax credit received from ISD- Aggregate value of ITC received from input service distributor shall be declared here. Table 4(A) (4) of FORM GSTR-3B may be used for filling up these details.

Point 6(H) - Amount of ITC reclaimed (other than B above) under the provisions of the Act- Aggregate value of ITC, reversed and reclaimed under the provisions of the Act shall be declared here.

Point 6(I) - Sub-total (B to H above) - In Point I, sub- total amount is auto-populated from Point B to H.

Point 6(J)- Difference (I - A above)- By subtracting Point A from Point I, the difference will be auto-populated here.

Point 6(K) - Transition Credit through TRAN-I (including revisions if any) - ITC is available through Tran–I. Its details are to be shown here. Also, if any revision has been done then it will also be included.

Point 6(L) - Transition Credit through TRAN-II - ITC availed through Tran -II. Its details are to be shown here.

Point 6(M) - Any other ITC availed but not specified above- ITC availed but not covered in any of the heads specified under 6B to 6L above shall be declared here.

Point 6(N) - Sub-total (K to M above) – In Point N, the sub-total amount is auto-populated from Point K to M.

Point 6(O) - Total ITC availed (I + N above) - During the year, whatever ITC we have availed will be auto-populated here.

Table No. 7 - Details of ITC Reversed and Ineligible ITC for the financial year-

Point 7(A) As per Rule 37- If the consideration is not paid, within the prescribed time. Due to this ITC has been reversed, then its details have to be submitted here.

Point 7(B) - As per Rule 39- Rule 39 determines the procedures for distributing ITC to input service distributors. If ITC is reversed as per rule 39, then its details have to be entered here.

Point 7(C) - As per Rule 42- During the financial year, if taxable supply, non-taxable supply, and exempt supply are made and ITC is used for non-business and personal purposes. Then the ITC used for non-business and personal purposes will have to be reversed. As per Rule 42, the details of the reversed ITC have to be entered here.

Point 7(D) -As per Rule 43- Rule 43 talks about determining ITC on capital goods or ITC reversal. If you have reversed ITC as per Rule 43 then its details have to be entered here.

Point 7(E) As per section 17(5) - If ITC is reversed as per section 17(5). Then its details have to be entered here.

Point 7(F) Reversal of TRAN-I credit - ITC is reversed due to TRAN -I. Its details have to be entered here.

Point 7(G) Reversal of TRAN-II credit- ITC is reversed due to TRAN -II. Its details have to be entered here.

Point 7(H) Other reversals (pl. specify) - ITC which has been reversed during the year. And such ITC is not covered anywhere. Its details have to be entered here.

Point 7(I) Total ITC Reversed (Sum of A to H above) - ITC reversed from point A to point H will be auto-populated here.

Point 7(J) Net ITC Available for Utilization (6O - 7I) - ITC which is available for Utilization. Its total will auto-populate here.

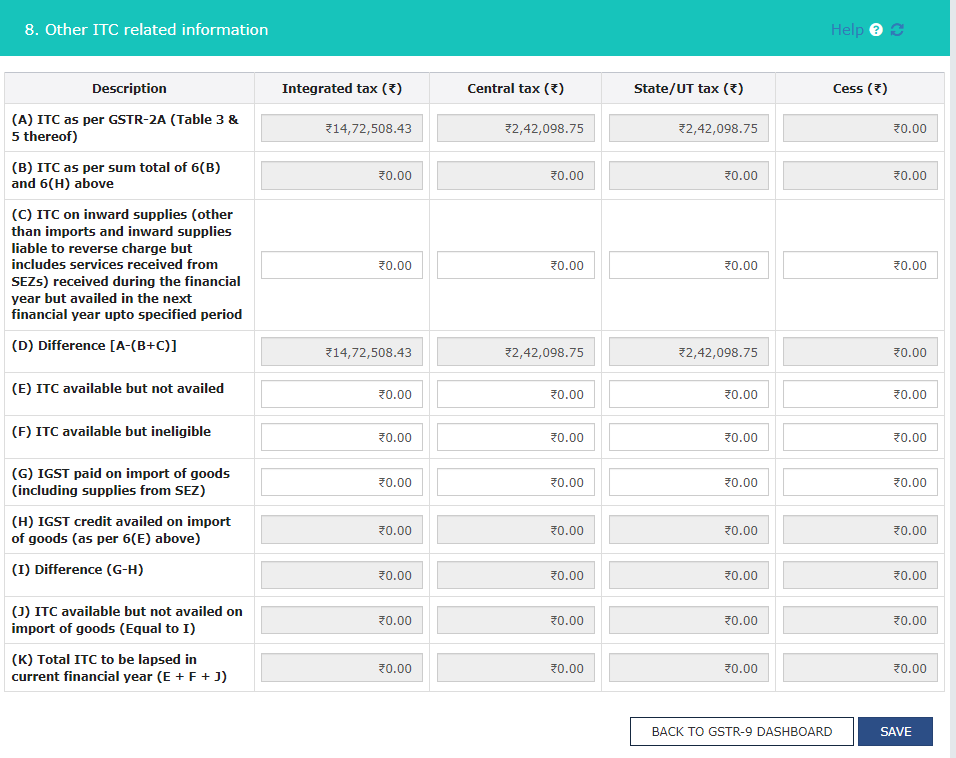

Table No. 8 - Other ITC Related Information

Point 8(A) ITC as per GSTR-2A (Table 3 & 5 thereof). - During the financial year 2022-23, inward supply has been received and the ITC available on it reflected in GSTR 2A is auto-populated and this cannot be edited.

Point 8(B) ITC as per sum total of 6(B) and 6(H) above- The sum-total from Table 6B and 6H of inputs, capital goods, and input services received as inward supply and ITC reclaimed as per the provisions of GST Act during the financial year is auto-populated.

Point 8(C) ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during the financial year but availed in the next financial year up to the specified period. - This involves ITC received during the financial year but availed in the next financial year in the specified time period.

For example – In F.Y.2022-23 ITC received. But was availed in the next financial year within the period specified under Section 16(4) of the CGST Act (i.e. April 2023 to September 2023 period ITC availed)

Point 8(D) Difference [A-(B+C)] – In Point 8(D), the difference [A - (B + C)] is auto calculated

A : ITC is auto-populated from GSTR 2A,

Less :

B : During the financial year we have received inputs, capital goods, and input services in the form of inward supply, and as per the provision of the GST Act, ITC has been reclaimed

C : ITC on inward supply received during the financial year but availed in the next financial year in the specified time period.

Point 8(E) ITC available but not availed- The credit which was available and not availed in FORM GSTR-3B shall be declared here.

Point 8(F) ITC available but ineligible- The credit which was available and the credit was not availed in FORM GSTR-3B as the same was ineligible shall be declared here.

Point 8(G) IGST paid on import of goods (including supplies from SEZ) - Aggregate value of IGST paid at the time of imports including imports from SEZs during the financial year shall be declared here.

Point 8(H) IGST credit availed on import of goods (as per 6(E) above) - ITC as declared in Table 6E will be auto-populated here.

Point 8(I) Difference (G-H) -

Point 8(J) ITC available but not availed on import of goods (Equal to I) - During the year we have import of goods and ITC is available on it but has not been availed. It is auto populate in Point J.

Point 8(K) Total ITC to be lapsed in the current financial year (E + F + J) - The total ITC which shall lapse for the current financial year shall be computed in this row.

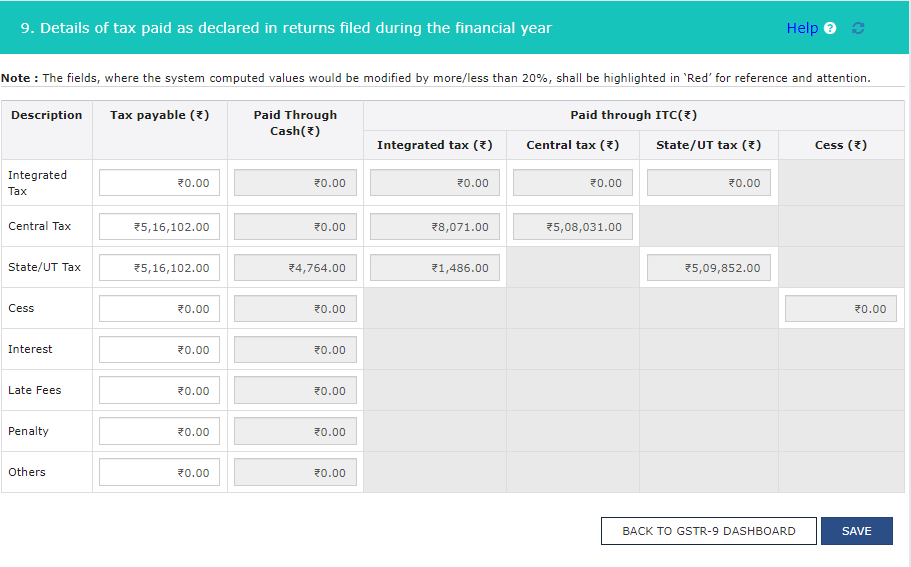

Part-IV Table No. 9 - Details of tax paid as declared in returns filed during the financial year.-

In Table No. 9 data is auto populated from GSTR 3B. This table is related to liability. This is a summarized form of tax-paid liability declared and payable and paid in cash or utilized through ITC during the year.

If we have a normal return then we do not have to make any changes here. But if differential tax is payable. Then, add the tax amount in the tax payable column.

If any differential tax is payable. Pay through Form DRC – 03 with interest. We can edit the tax payable column. But paid through cash and paid through ITC column cannot be edited.

Part-V. Particulars of the transactions for the financial year are declared in returns of the next financial year till the specified period.

In the current financial year, we declared details related to the previous year and the next financial year. Such details have to be submitted here.

For Example – In the current F.Y. 2022-23, we declared details related to the previous year 2021-2022 Or

Details of the current financial year 2022-23, declared in the period from April 2023 to September 2023 period. Such details have to be submitted here.

Table No. 10 - Supplies/tax declared through Amendments (+) (net of debit notes) -This table contains details of such supplies and taxes that have been declared through amendments. It is shown in the table only after the net of debit notes.

For Example - If you missed any sale and shown in the period from April 2023 to September 2023. Then details of such supply are to be furnished here.

Table No. 11- Supplies/tax reduced through Amendments (-) (net of credit notes) - This table contains details of supplies and taxes that have been reduced through amendments. It is shown in the table only after the net of credit notes.

Table No. 12- Reversal of ITC availed during the previous financial year- In this table, submit the details of ITC reversal which was availed in the previous financial year.

Table No. 13 -ITC availed for the previous financial year - In this table, Details of ITC availed in the previous financial year are required to be submitted.

Table No. 14 Differential tax paid on account of declaration in 10 & 11 above.

The details of the differential tax amount, which has come due to table numbers 10 & 11 have to be submitted here. Table 14 particularly related to, liability which was related to the financial year 2022-23. But declared and paid in the financial year 2023-24. In table 10- supplies tax declared through amendment, we increase the supplies and declare additional liability, and in table 11- supplies, tax reduced through amendment, we reduce the supplies and reduce additional liability.

If the net effect is an increase in liability and we have paid tax on it in the financial year 2023-24, then, it will be shown in table no. 14.

Similarly, if the interest amount is also paid, then, it will be shown in the interest column in table no.14.

Part- VI - Other Information.

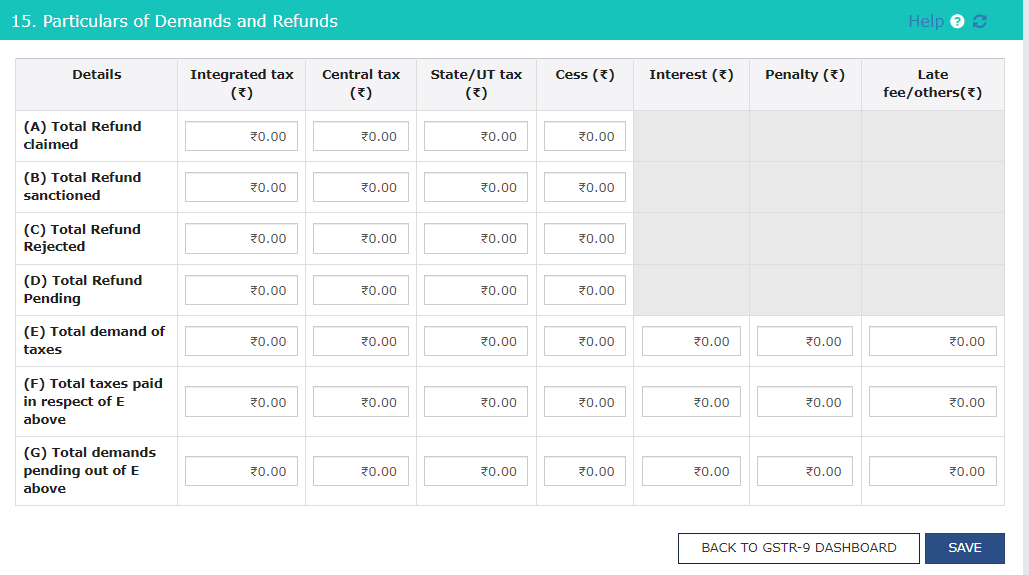

Point 15 (A) Total Refund claimed - In Point A, You have to declare the details related to the total refund claimed during the year.

Point-15(B) Total Refund sanctioned - In Point B, You have to declare the details related to the total refund sanctioned during the year.

Point-15(C) Total Refund Rejected - In Point C, You have to declare the details related to the total refund rejected during the year.

Point-15(D) Total Refund Pending - In Point D, You have to declare the details related to the total refund pending during the year.

Point-15(E) Total demand of taxes – In point E, you have to declare the details related to the Aggregate value of demands of taxes.

Point-15(F) Total taxes paid in respect of E above – In point F, you have to declare the details related to the Aggregate value of taxes paid out of the total demand of taxes.

Point-15(G) Total demands pending out of E above – In point G, you have to declare the details related to the Aggregate value of demands pending out of 15E above.

Table No. 16 Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on an approval basis

Point 16(A) - Supplies received from Composition taxpayers - During the year Aggregate value of supplies received from composition taxpayers shall be declared here. Table 5 of FORM GSTR-3B may be used for filling up these details.

Point 16(B)-Deemed supply under Section 143- Aggregate value of all deemed supplies from the principal to the job-worker as per Section 143 of the CGST Act shall be declared here. We have to enter the amount in the taxable value. Also, the value of the respective integrated tax Central tax, and State tax has to be entered manually.

Point 16 (C) - Goods sent on an approval basis but not returned- Aggregate value of all deemed supplies for goods which were sent on an approval basis but were not returned to the principal supplier within 180 days of such supply shall be declared here. Also, the value of the respective integrated tax Central tax, and State tax has to be entered manually.

Table No. 17 - HSN Wise Summary of outward supplies.

If in the preceding financial year, turnover is more than Rs. 5 crores, then enter details of HSN-wise outward supply.

Table No. - 18 HSN Wise Summary of Inward Supplies.

Table No. 19- Late fee payable and paid.

Late fee will be applicable if an annual return is filed after the due date.

FAQs (Frequently Asked Questions)

Q : What is GSTR-9 Turnover limit?

A : GSTR-9 is an Annual return to be filled by every registered person whose aggregate turnover is more than Rs. 2 crore.

Q : What is GSTR-9 due date?

A : The due date to file GSTR-9 for a financial year is 31st of December of the following year

Q : What is GSTR-9 due date for FY 2022-23?

A : Due Date for filing of annual return for F.Y. 2022-23 is 31st December 2023.

Q : GSTR-9 late fees.

A : Late fee for not filing GSTR-9 within the due date is Rs. 200/- per day (CGST Rs.100/- and SGST Rs.100), subject to a maximum of 0.25 percent of the assessee’s Turnover in the State or Union Territory).