Recent Articles Of GST

How to Apply Online for GST Registration

[DISPLAY_ULTIMATE_SOCIAL_ICONS]In this article, we will discuss how to register for GST. If your aggregate turnover exceeds the prescribed limit for taking registration under the GST Act i.e. in case of goods limit is Rs.40 lakh (in specified states Limit is Rs. 20 Lakhs) or in case of service such limit is Rs. 20 lakh (in specified state limit is Rs.10 lakh) or If you want to take voluntary registration under the GST Act, then you can also take voluntary registration.

In GST, registration is issued state-wise and while applying for registration, you should have PAN (Permanent Account Number) i.e. without PAN, Application for GST Registration cannot be made.

If within the state, you have more than one business place then you can take only one single registration for all the different places. But, if you have more than one business place in different states, then you have to apply for each state separately under the GST Act.

Steps to be followed for GST registration.

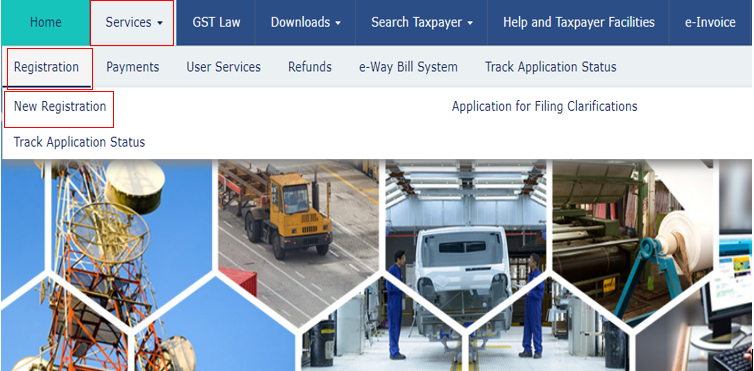

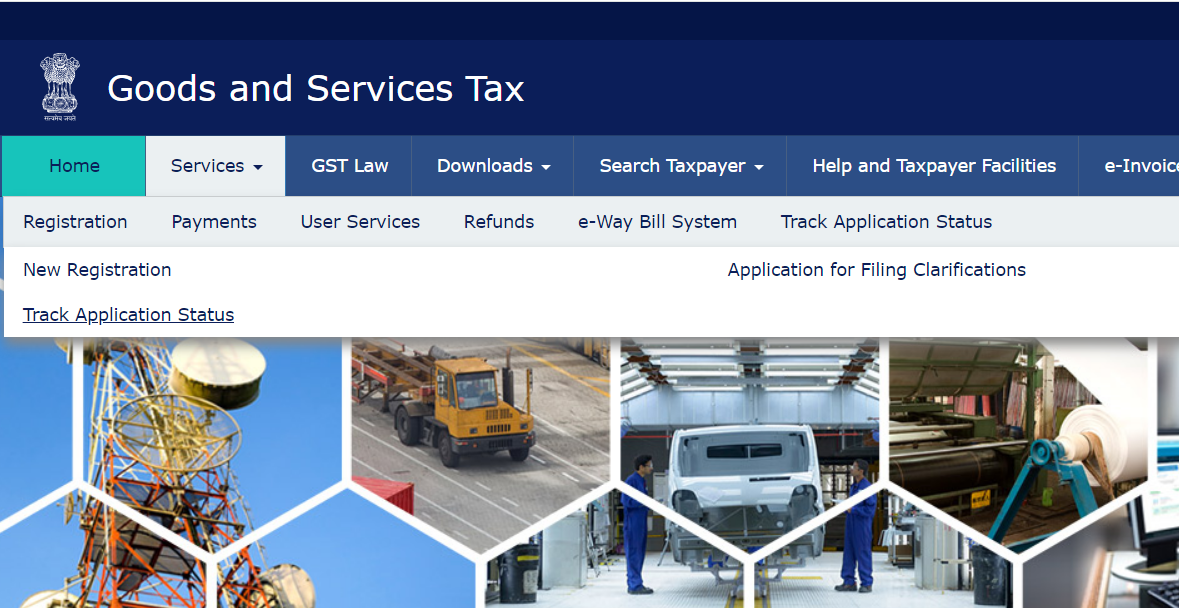

Step 1 – Go to the GST portal. Click on the Services tab, then click on the ‘Registration’ tab, and thereafter, select ‘New Registration’

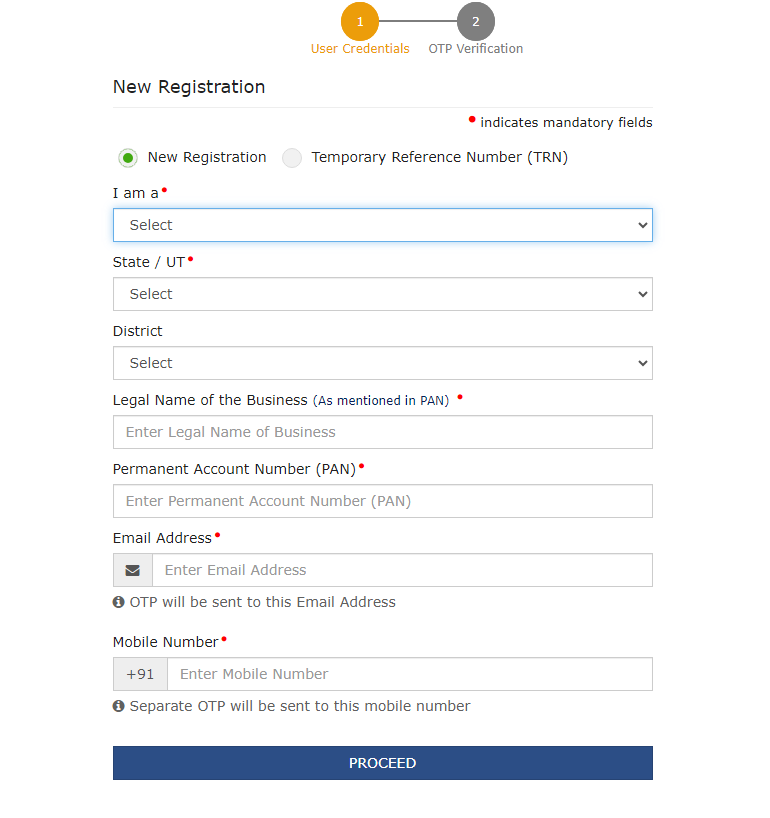

After clicking on new registration, this type of window will appear:-

Click on New Registration and fill respective details. After filing all the respective details click on proceed.

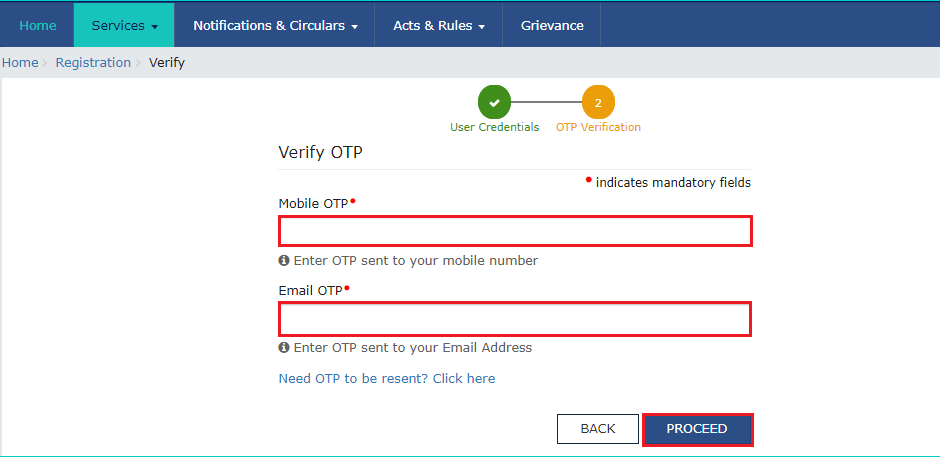

Enter the OTPs received on the email and mobile. Click on proceed.

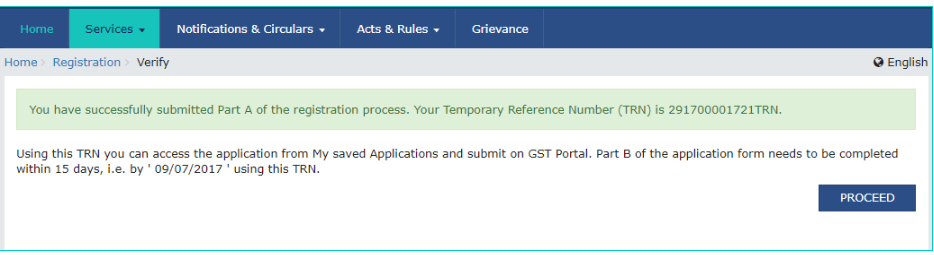

After successful verification, you will receive the 15-digit Temporary Reference Number (TRN) on your registered email and mobile no. This TRN is used for further reference. You need to complete filling the part-B details within the next 15 days.

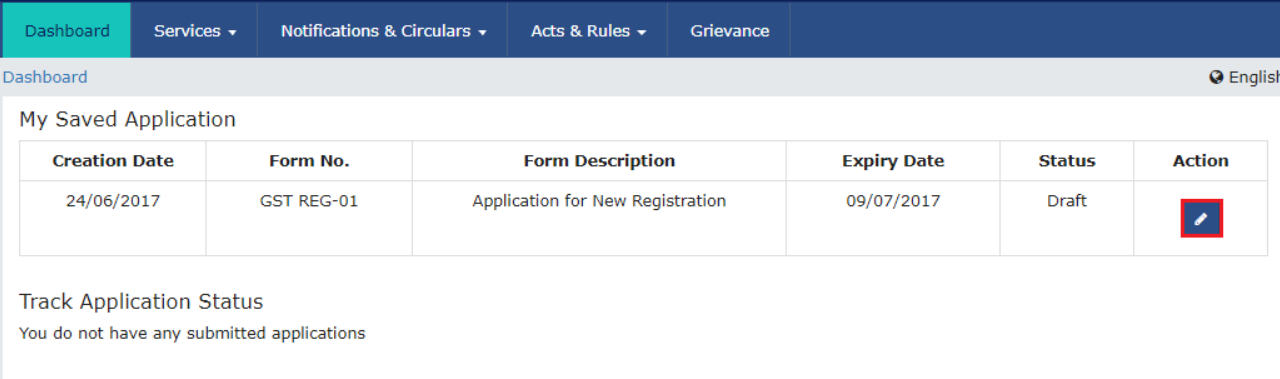

After clicking on proceed, this type of window will appear. Then, Click on the action tab.

After clicking on the action tab, Part-B will open. In Part-B, There are 10 tabs.

Before filling the part- B, here is the list of documents you need to keep while applying for GST registration-

• Address of Principal Place of Business like Municipal tax receipt, rent agreement, Registration deed.

• Electricity Bill.

• Photograph.

• Any license issued by local authority i.e. Establishment of registration certificate.

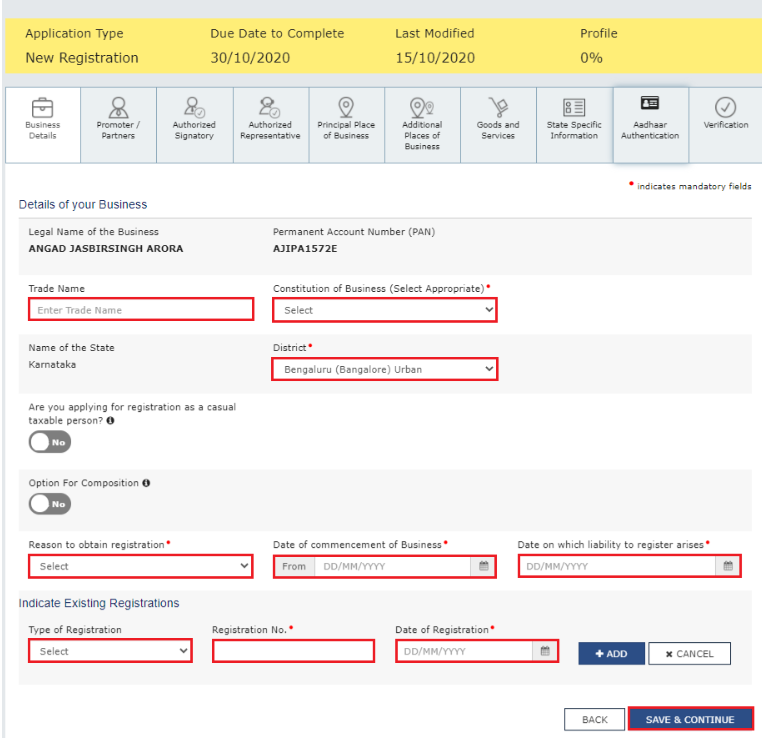

1st tab is related to Business details.

In the business details section, fill in information such as the trade name, constitution of the business, district, whether you are applying as a casual taxable person (if yes, then select yes; otherwise, select no), whether you want to register under the composition scheme (if yes, then select yes; otherwise, select no), reason for obtaining registration, date of commencement of business, etc. After filling in all the details, click on "save and continue."

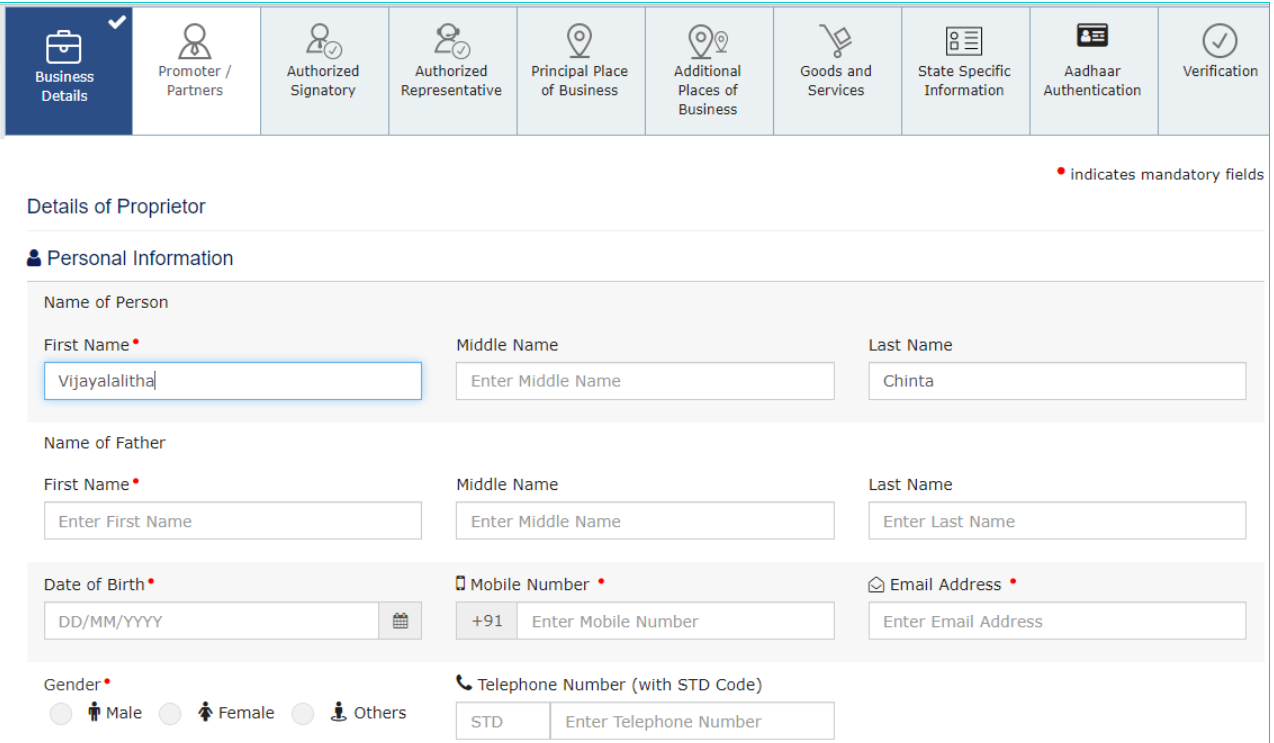

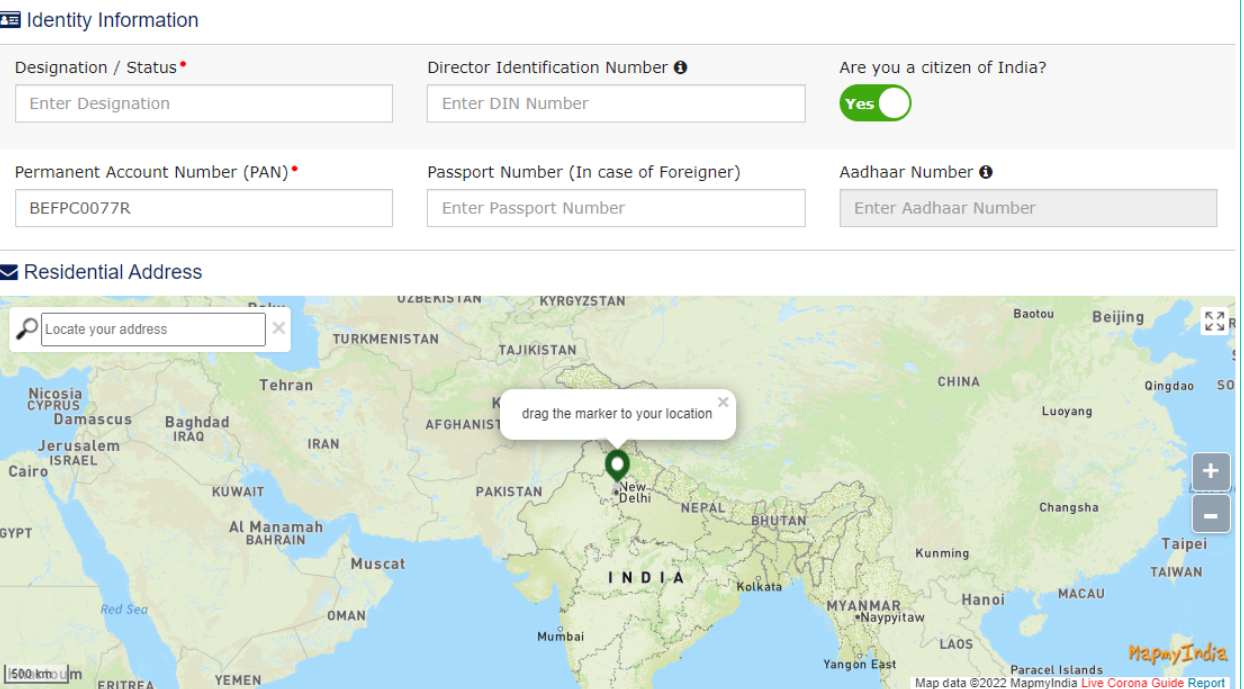

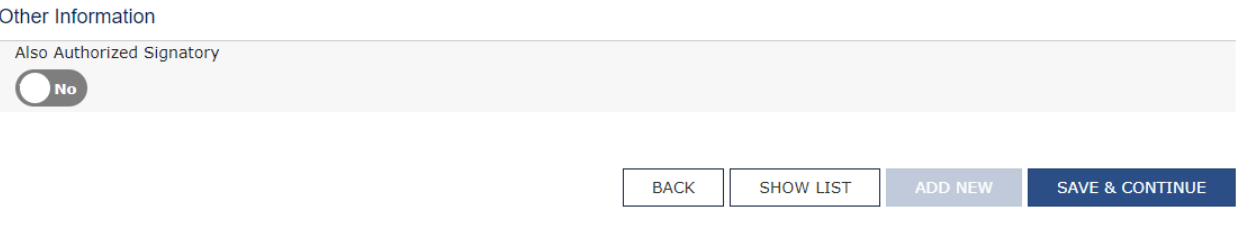

Next Tab is related to Promoter Partners details.

In this tab fill basic details of partners like Name, Date of birth, Contact no., email address, Gender, Designation, and address and Photograph.

If a partner is also an authorized signatory then select yes. After filling all the details, click on Save & Continue.

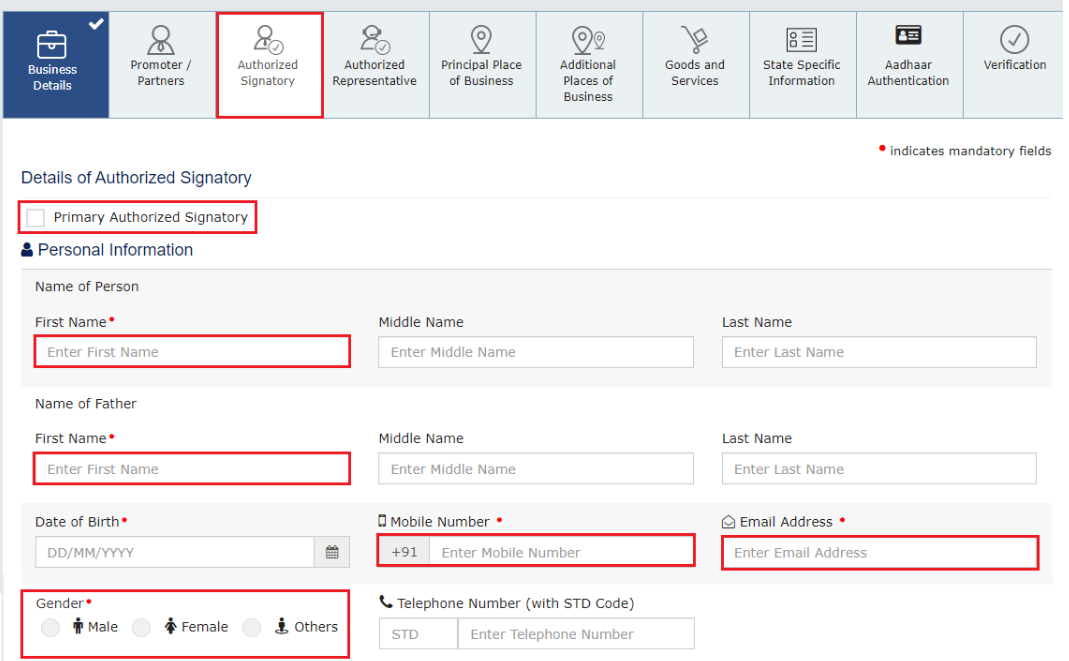

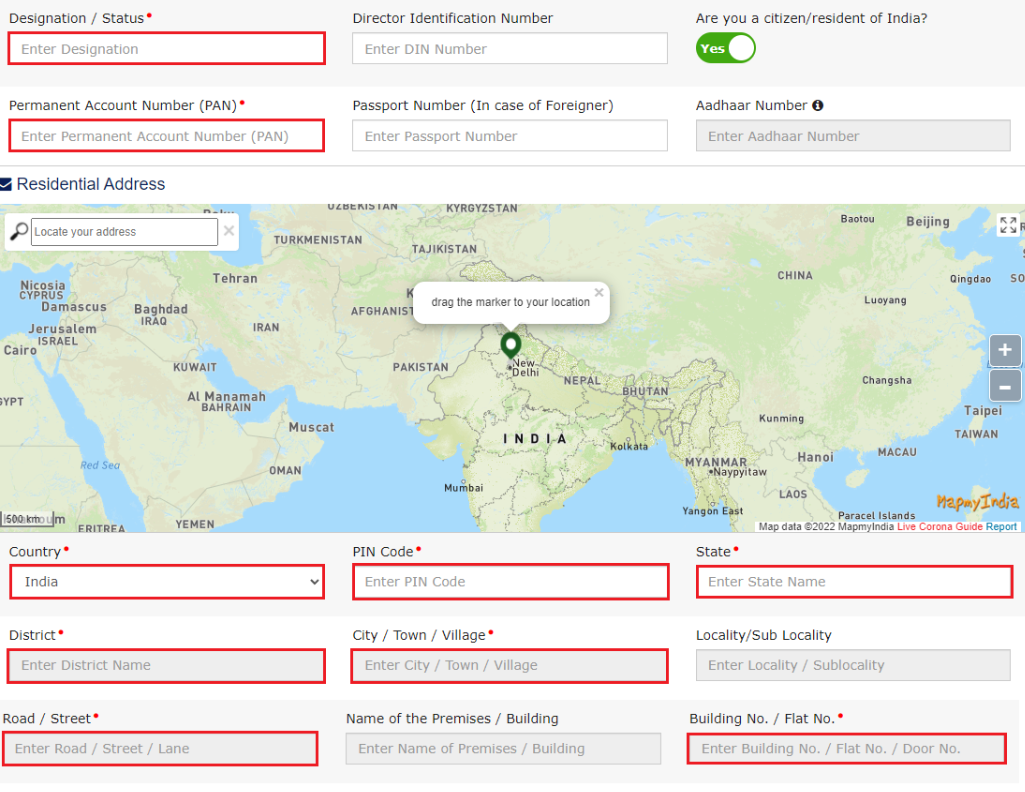

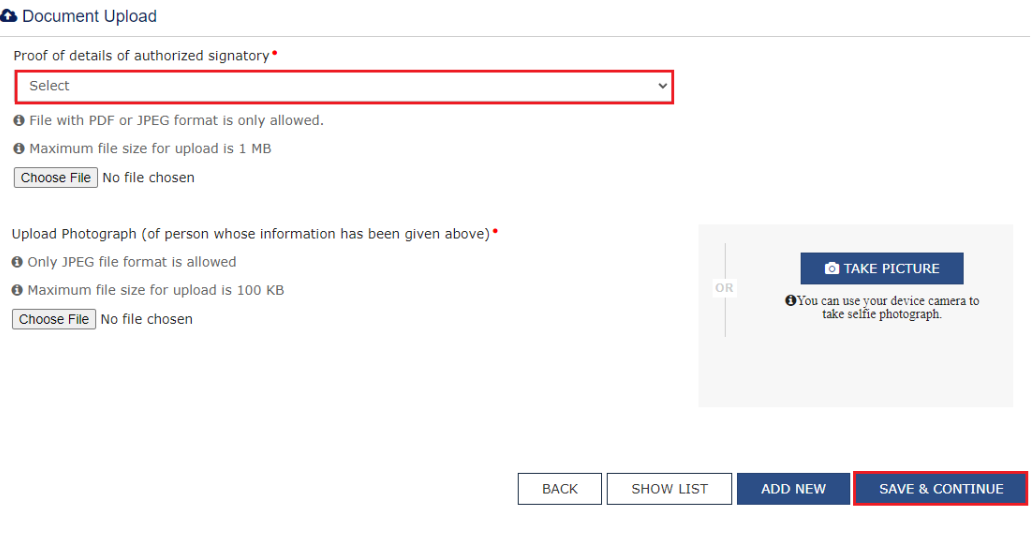

Next tab is related to the Authorized signatory.

If the promoter or partner is also an authorized signatory, then in the earlier table under "Other Information (Promoter/Partner)," click on "Yes."

If the promoter partner is not authorised signatory then fill all respctive details like Name, Date of birth, Contact no. PAN, E-mail address, Gender, Designation, Address and Photograph.

After fill all the details click on Save & Continue.

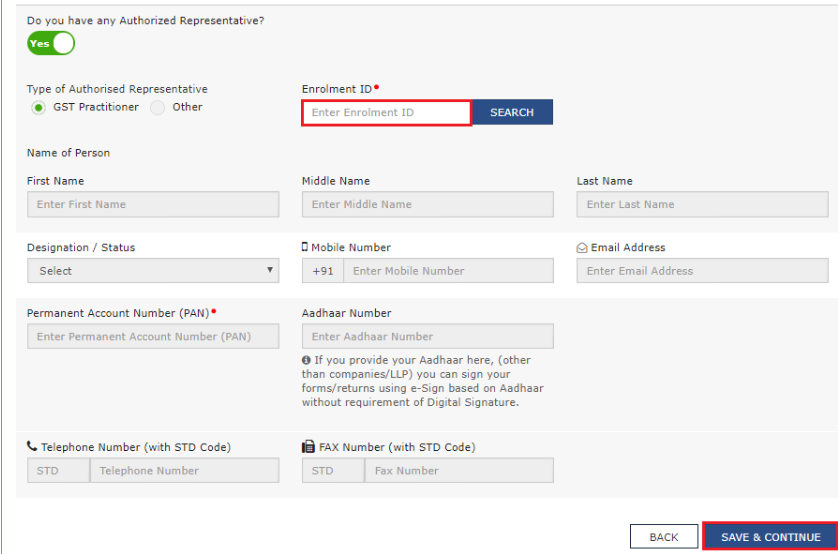

Next tab is related to Authorized Representative.

If you have an authorized representative click on “Yes” and fill the respective details.

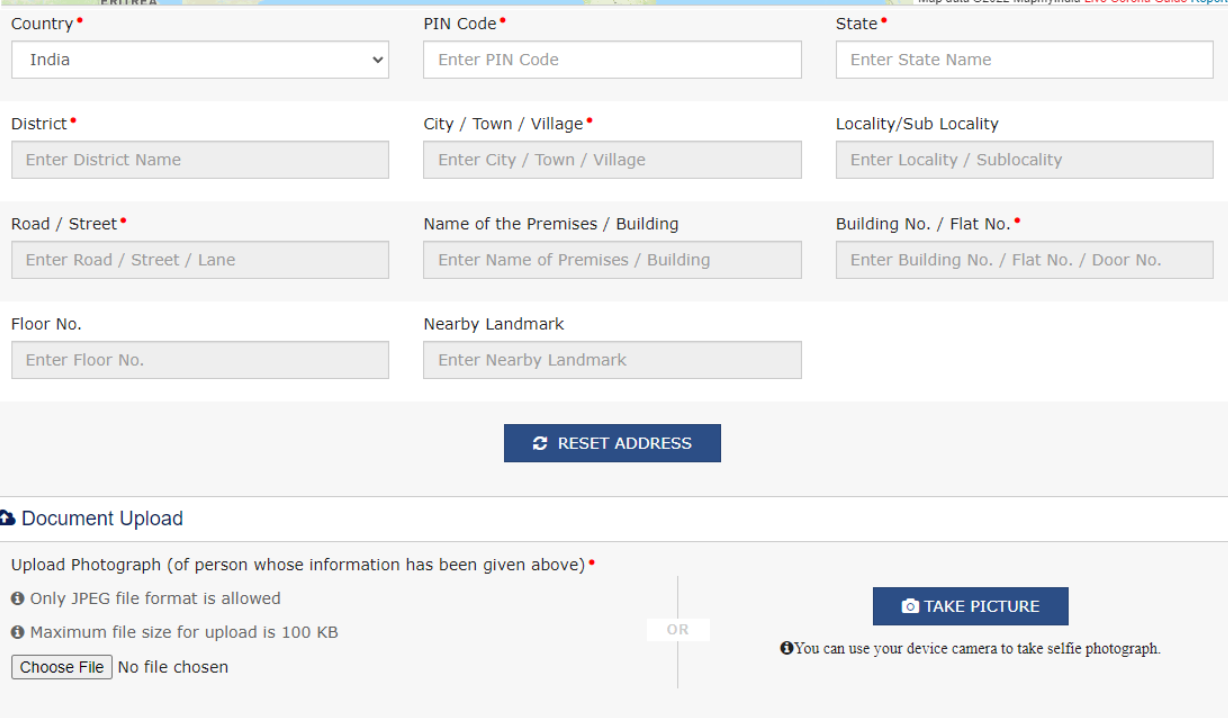

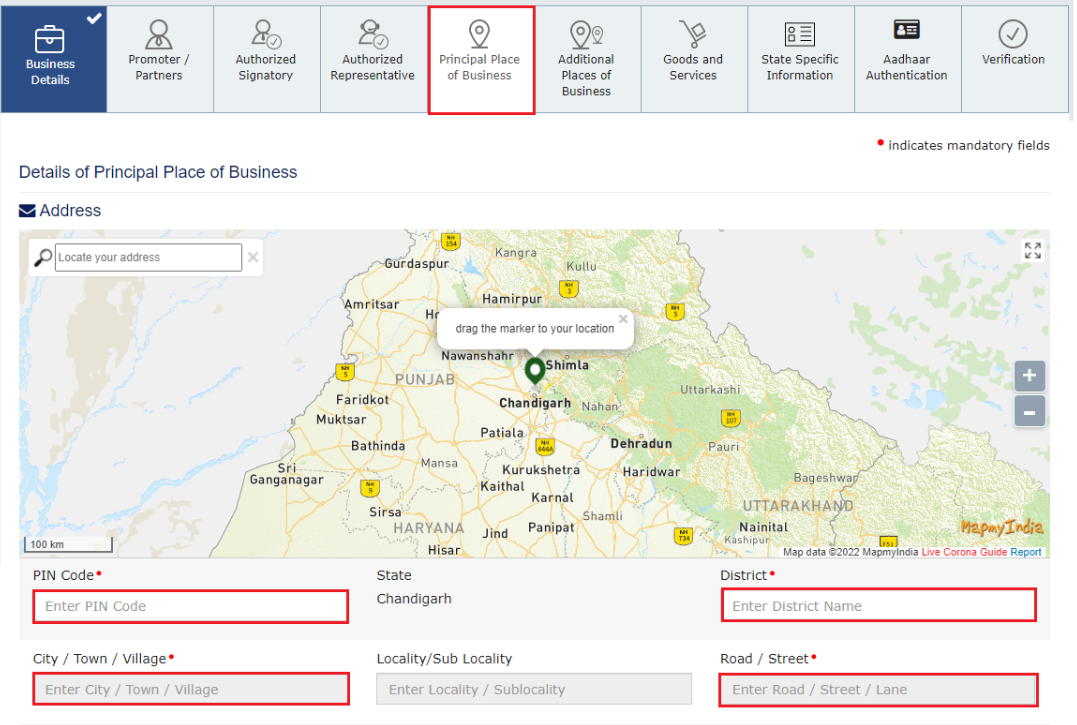

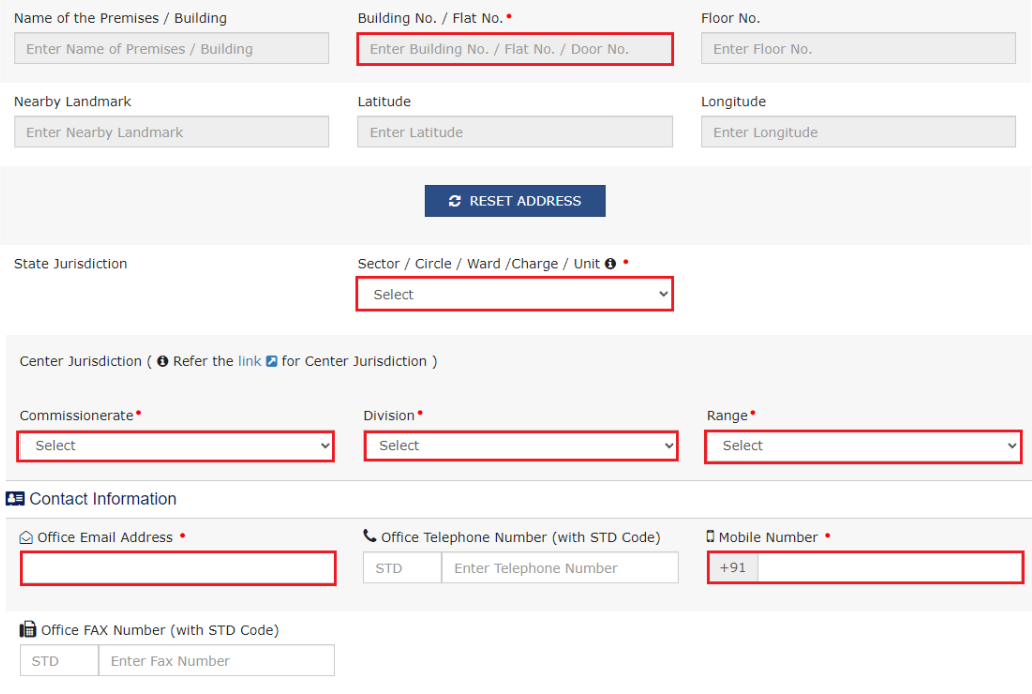

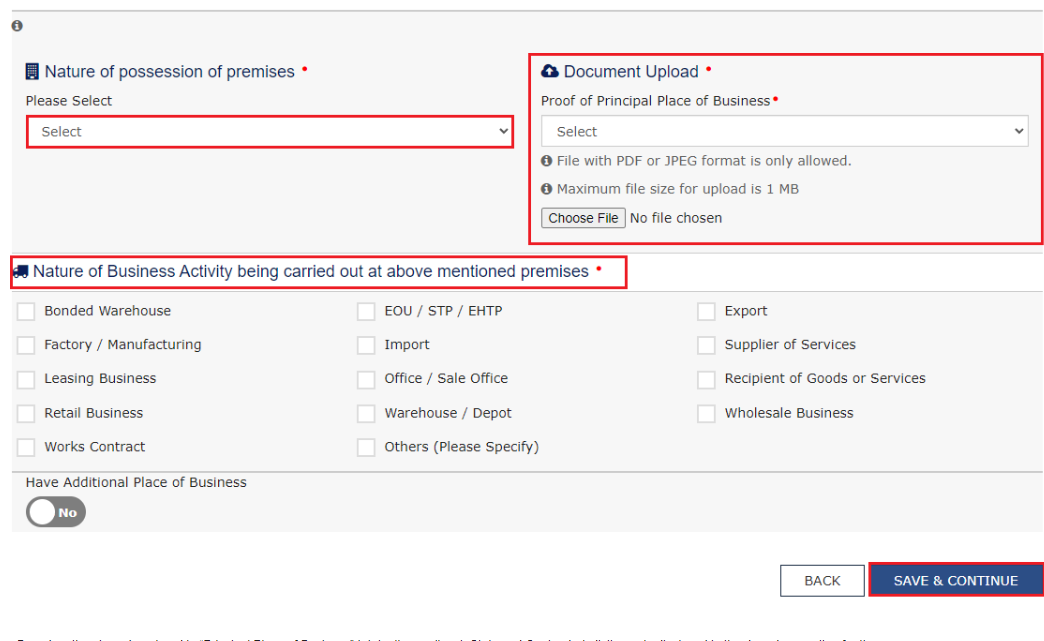

Next tab is related to the Principal Place of Business.

In this tab, enter the details of the business like the address of principal place of business, State jurisdiction, Commissionerate division range, Office email address and Contact number and Nature of business activity like trading, Manufacturing, Import, Export, etc.

If you have any additional place of business then select “yes”, otherwise select “No”.

After fill all the details upload the documents like

• Address of Principal Place of Business like Municipal tax receipt, Rent agreement, Registration deed any one of them.

• Electricity Bill.

• Any license issued by local authority i.e. Establishment of registration certificate.

After filling all details click on save and continue.

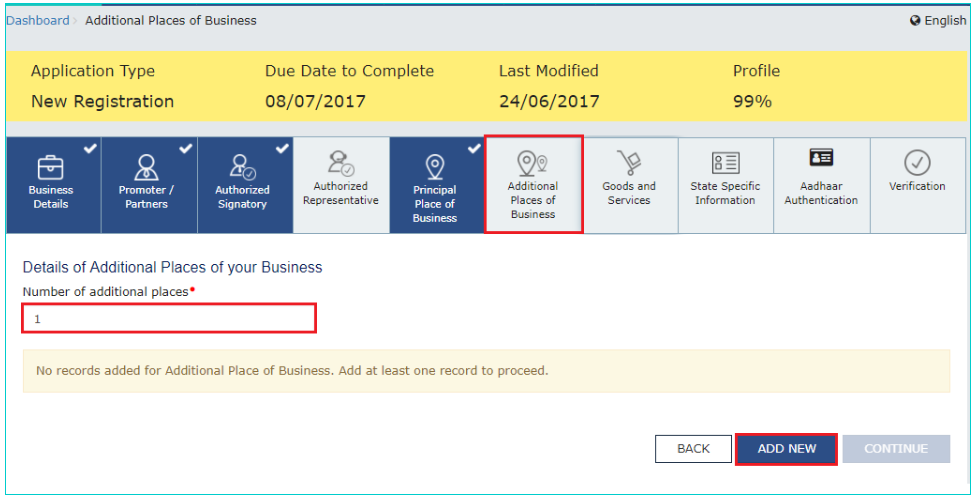

Next tab is related to additional place of business.

If have additional place of business enter the details.

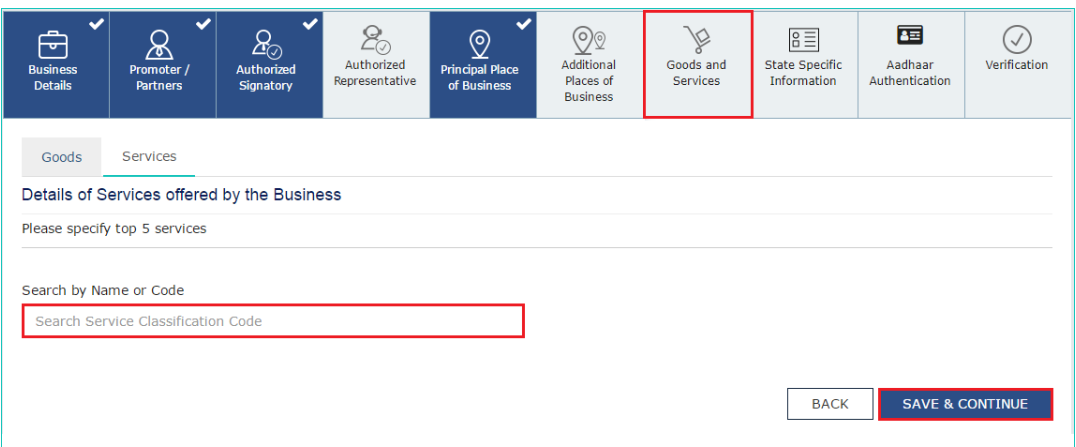

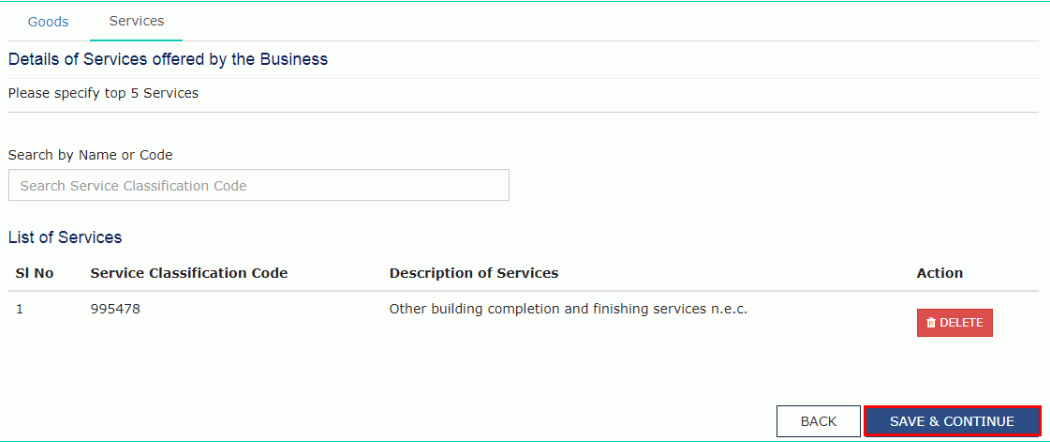

Next tab is related to Goods and services.

In this tab, enter the HSN/SAC code of goods or service and add product here maximum 5 HSN/ SAC code can be added.

After fill the details click save and continue.

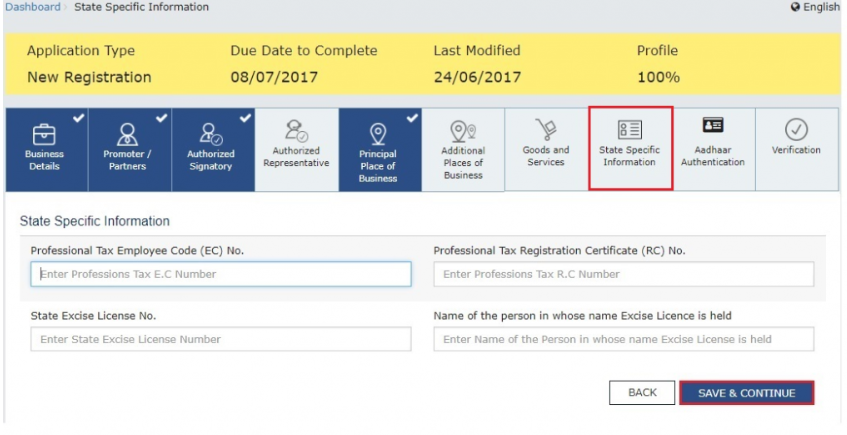

Next tab is related to State Specific Authentication.

In this tab, if any state requires a specific license, then enter such details here. This tab is not mandatory.

After fill the details click on save and continue.

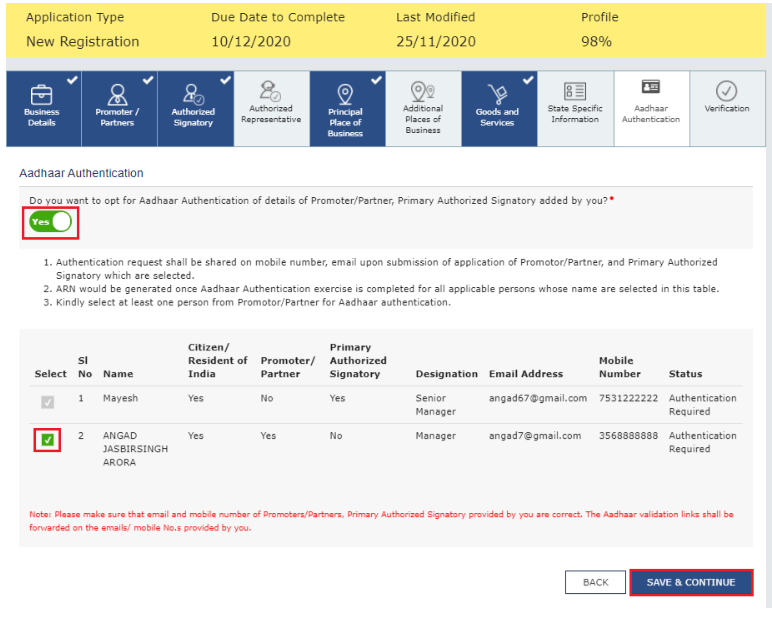

Next tab is related to Aadhaar Authentication.

In this tab, Click on Yes “for aadhaar authentication”.

After click on the check box click on save and continue.

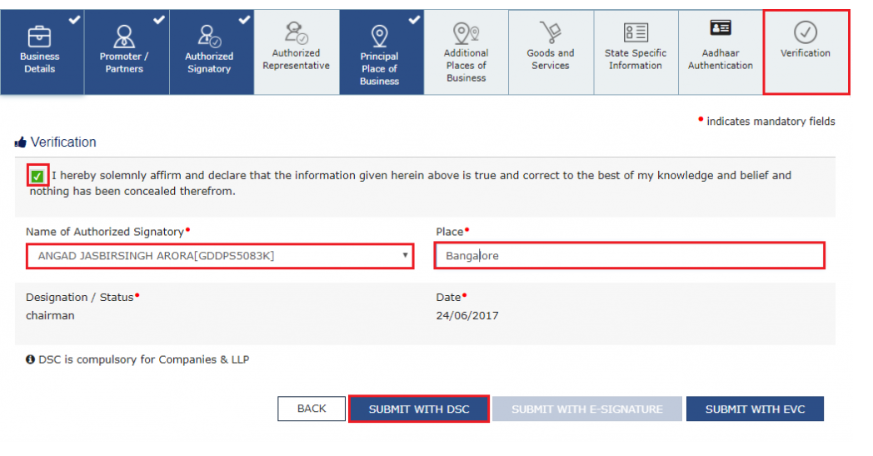

Next tab is related to Verification.

In this tab click on the check box for verification, select name of authorized signatory and enter the Place.

After filling all the details, you can verify through DSC or EVC.

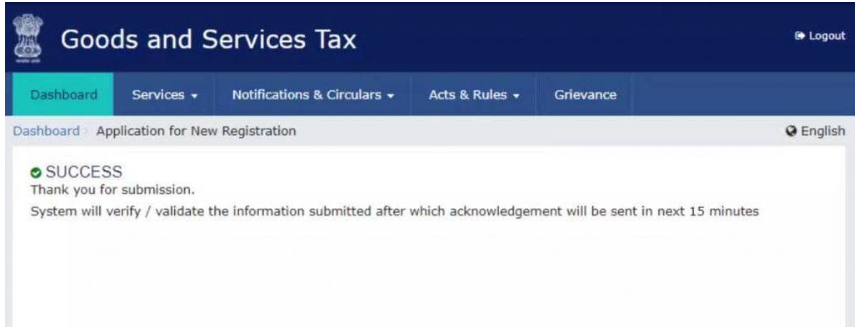

After successful verification, a success message is displayed on the dashboard.

FAQs on GST Registration

Q : How we can obtain GST registration?

A : GST registration can be applied by submitting an application online on the GST portal as described above and completing the verification process.

Q : What is the full form of TRN in GST?

A : TRN stands for ‘Temporary Reference Number’, Which is used for GST Registration procedure.

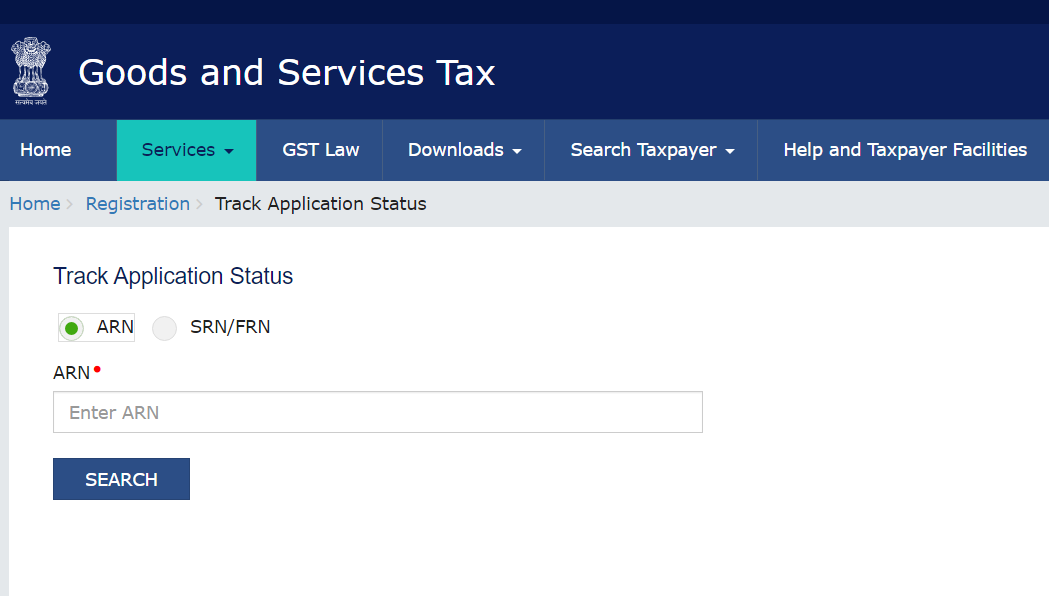

Q : How to check GST Registration Status with ARN ?

A : To check GST status application using the ARN,

1. Visit the GST Portal (www.gst.gov.in),

2. Navigate to the ‘Registration’ section,

3. Select the ‘Track Application Status’ option.

4. Enter your ARN to view the current status of your application.

Q : What are the steps for GST registration?

A : Below are the steps for GST Registration :

• GST Registration will be made online on www.gst.gov.in

• Navigates to services > Registration > New Registration.

• Generate a Temporary Reference Number (TRN) by filling basic information (PAN, mobile no., mail ID etc.)

• Complete online application with business details.

• Upload all the required documents.

• Verification will be done by GST authorities.

• After verification by GST authorities, if they are satisfied with all documents and information provided, then GST Registration will be granted.

Q : Can we apply for GST registration online?

A : Yes, there is only online procedure for GST Registration.

Q : How much cost for GST Registration?

A : GST Registration procedure is absolutely free. Government does not take any fees for registration. However, you have to pay professional charges to CA, Tax Consultant for their professional services.

Q : Where can we find videos on GST registration?

A : You can download our App Law Legends where you will get the video for GST Registration.

Q : GST Registration process in Hindi.

A : You can download Law Legends where you will get the full explanation for GST Registration in Hindi.