Recent Articles Of GST

How to Generate E-Way bill

[DISPLAY_ULTIMATE_SOCIAL_ICONS]E-way bill has to be generated from E-way bill website https://ewaybillgst.gov.in.

There are two parts of the E-way bill.

Part A and Part B

Part-A :- The registered person who moves the goods is required to file Part A of the E-way bill before starting the movement of goods. In Part A, it is important to mention the transporter ID or vehicle number along with the invoice details. After Part A of the e-way bill is filed, no modification can be made in it. On filing Part A of the E-way bill, you will generate a unique number which will be valid for 72 hours to update Part B of the E-way bill.

Part-B :- After Part-A is filed by the supplier or receiver, Part-B is filed by the transporter. As long as the time limit of the E-way bill has not expired, there is no limit on the number of times it can be updated. But keep in mind that the actual movement of the vehicle should match the description of the described vehicle.

When an unregistered transporter enrolls himself on the e-way bill portal, Transporter ID is issued to him. This Transporter ID enables the transporter to generate E-way bills at any time.

The transporter can update Part B of the e-way bill. The reason for this could be anything like transferring the goods from another vehicle if the vehicle breaks down or if more than one transporter is involved in taking the consignment to the end consignee.

Pre-requisite required to generate E-way bill

To generate an e-way bill we need-

- Tax invoice or bill of supply

- Transportation details

- Mode of supply

- Vehicle type

- Vehicle number

- Transporter documents

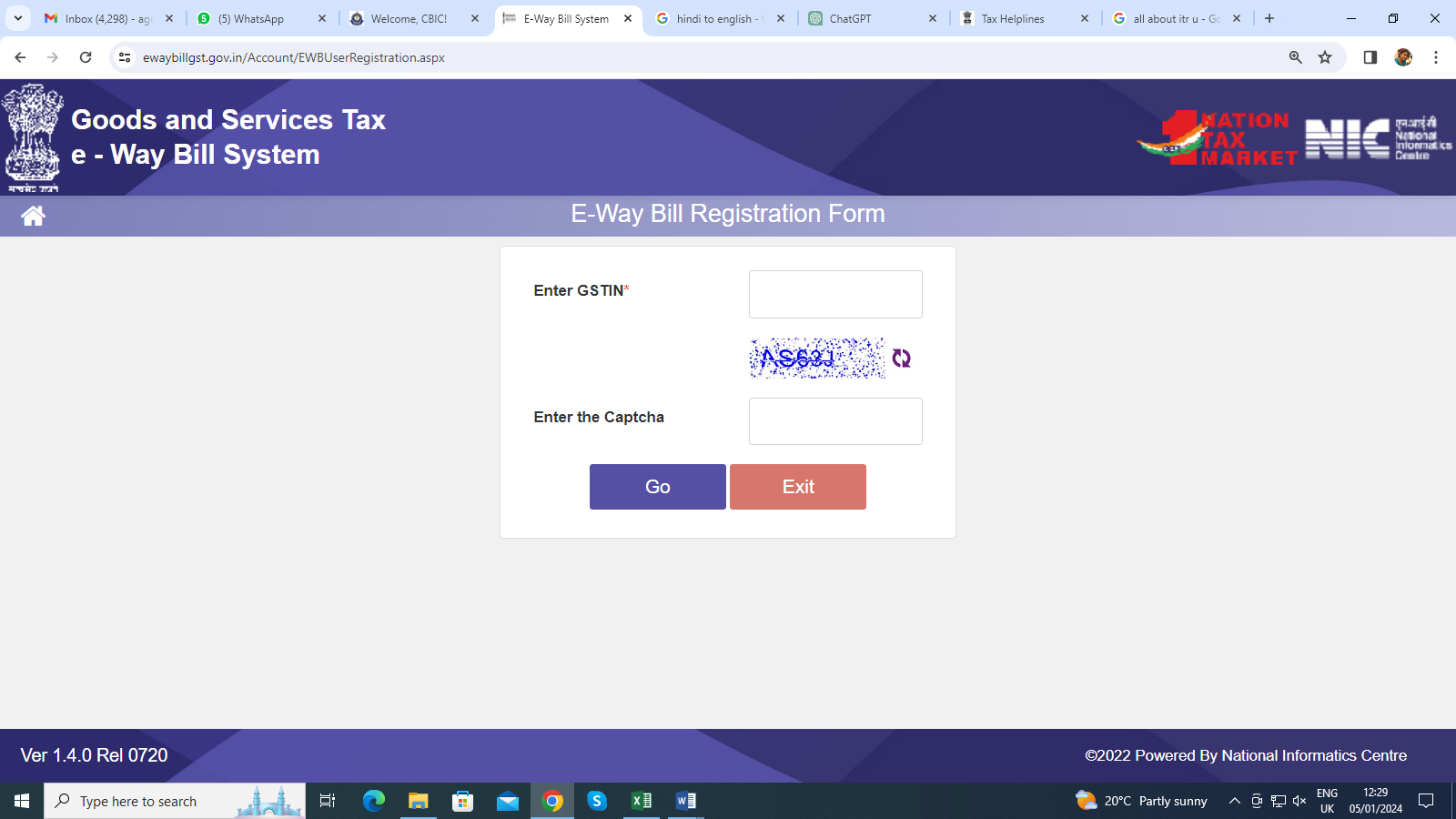

Step-1 To get Registered on E-way Bill portal:

- First of all, visit E-way bill website http://ewaybill.nic.in

- If you are registered on this website then you will login, if not registered then you will click on register and enter your GSTN and captcha

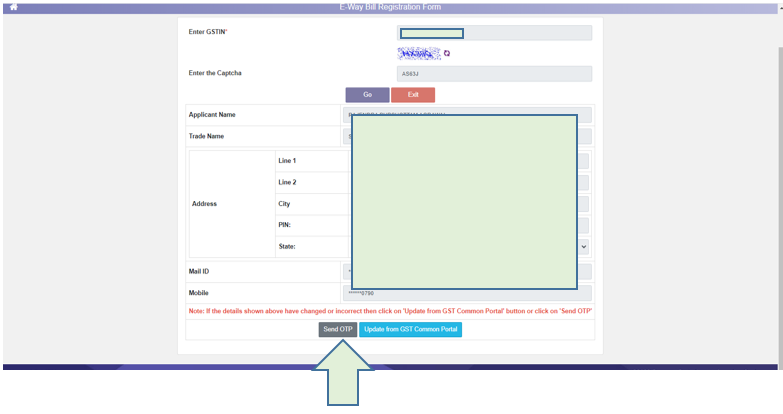

- then following information about your organization like Name, address, Email ID and mobile will display

- Now click on send OTP enter OTP and create a user id and password.

Step-2: How to Create an E-way Bill

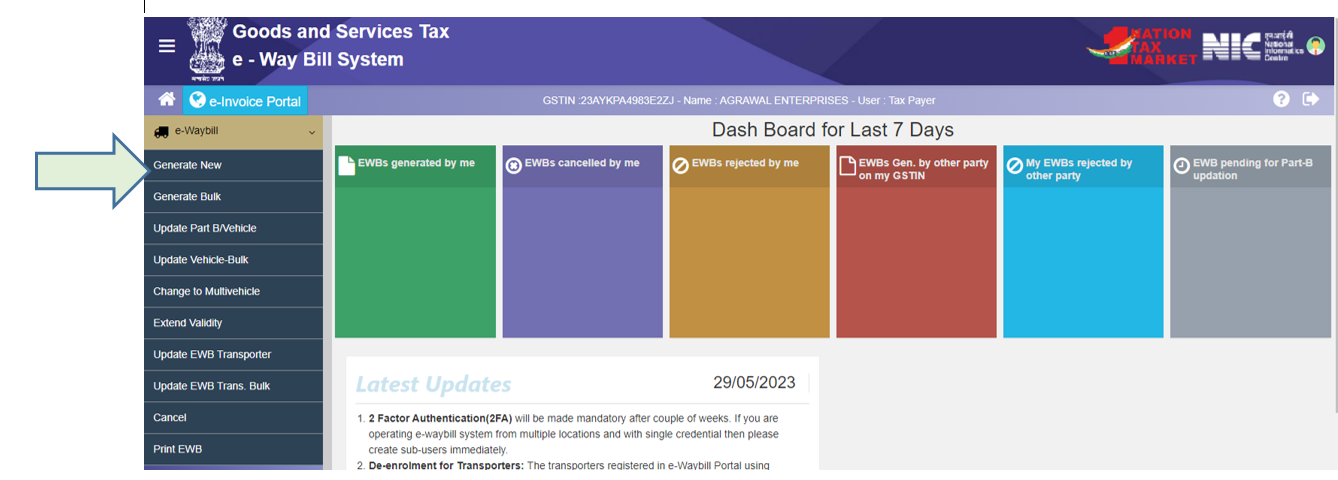

After creating a login ID, login to the E-way bill portal by entering the login credentials.

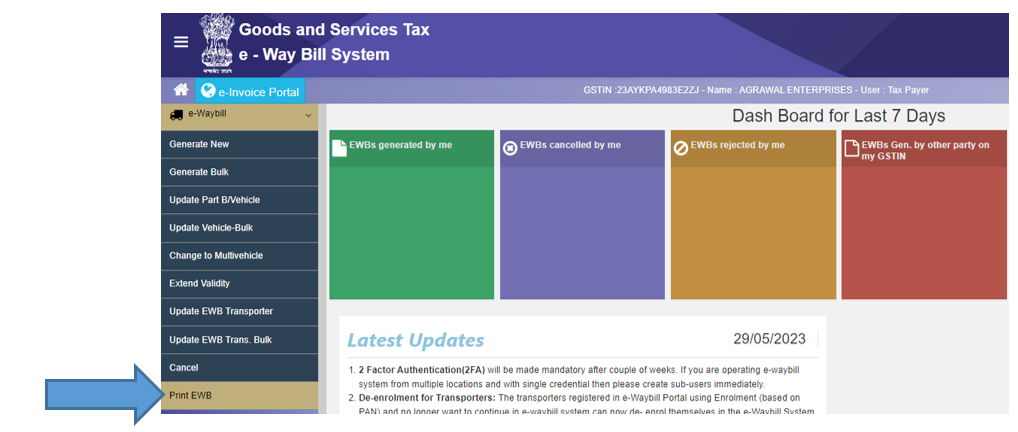

Now click on the e-way bill & then on the Generate New tab.

Now we understand single bill generation - for this, we have to click on generate new tab and enter the required details.

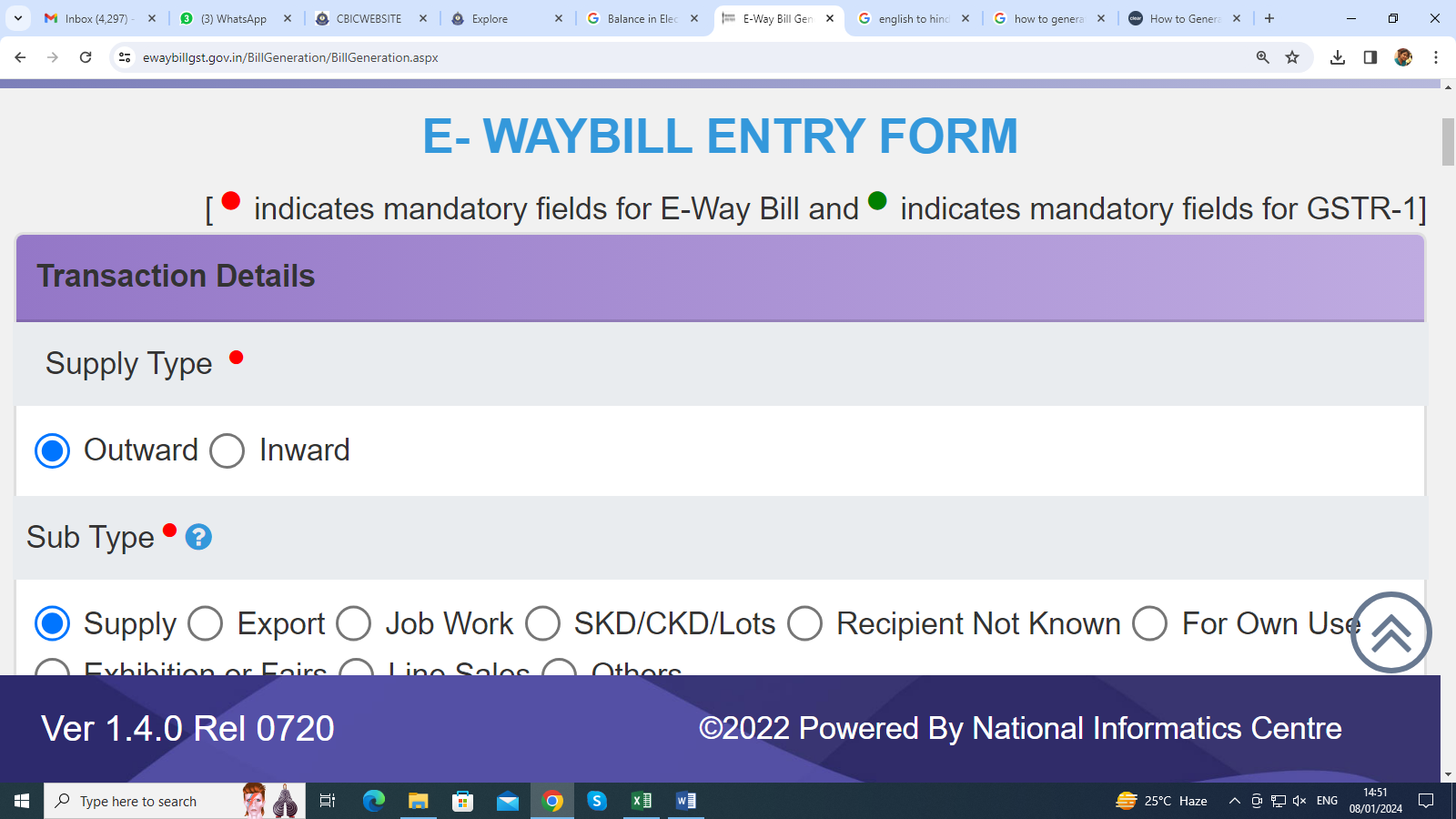

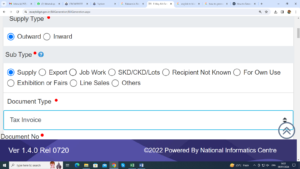

- First of all, you have to select the supply type. If you want to generate an E-bill for outward supply i.e. for sale then you will select outward and If you want to generate an E-bill for inward i.e. for purchase then you will select inward.

2. Sub type में आपको बताना होगा की की किस तरह का supply है –

- If there is regular supply then select supply.

- If you are exporting then select export or if you are sending goods for job work then select job work.

- If you are sending goods in lot or SKD / CKD then select this option.

- Own use is selected when the goods are being transported to one's own business places.

- Line sales have to be selected when the taxpayer takes the goods from his premises to the buyer/customer's place, in this case it is not determined what quantity will be sold.

- Recipient not known – When it is not known who the recipient is but when the taxpayer takes the goods from his premises to the buyer/customer's place.

- Exhibition/fair has to be selected when the goods are transferred from the taxpayer's premises to the place of exhibition or fair.

- Others will be selected only when the options mentioned so far are irrelevant.

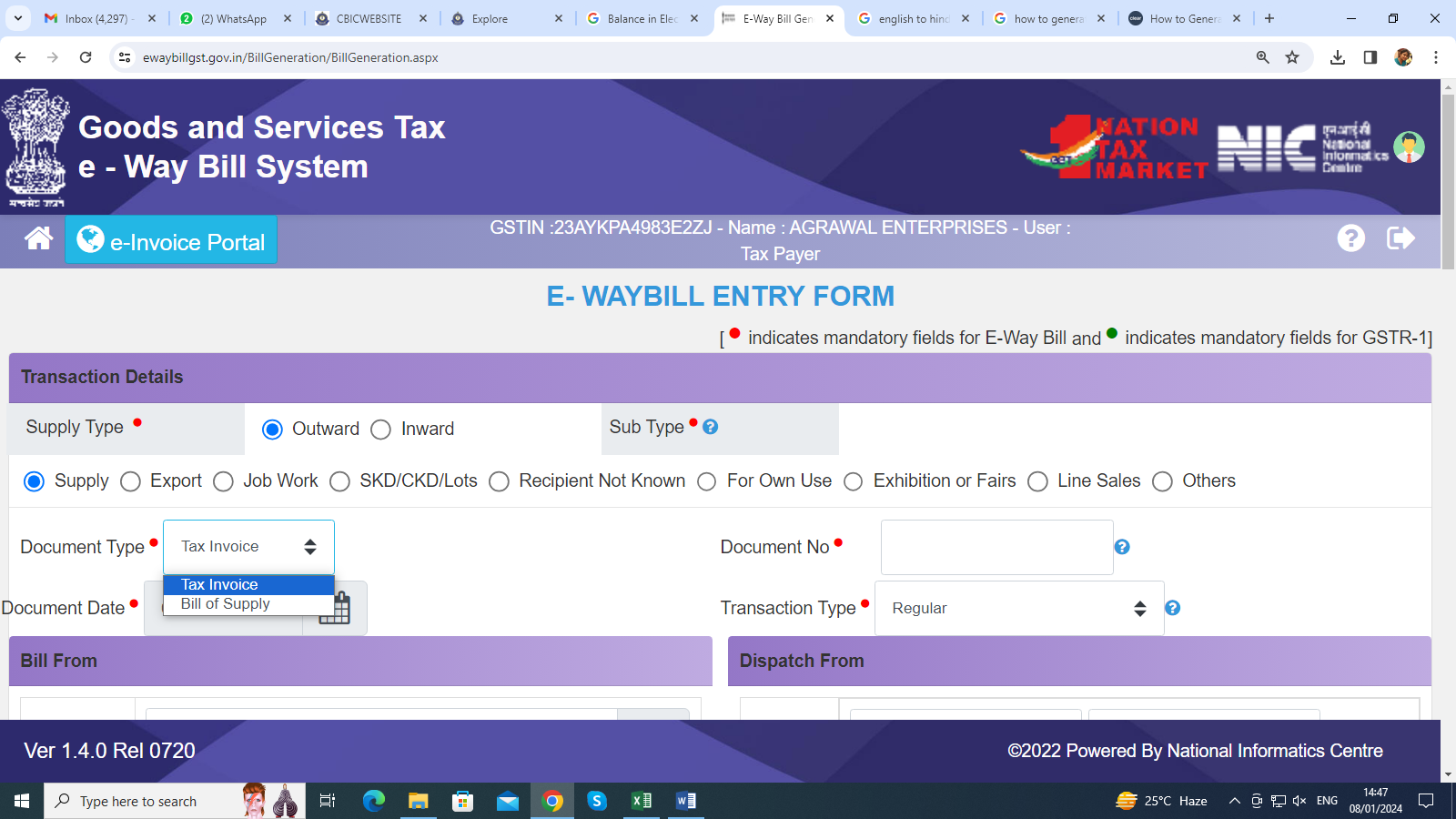

3. Now you have to select document Type on the basis of which E-way bill is generated. Here you have 2 options

- Tax Invoice

- Bill of supply

4. Enter document number & document date

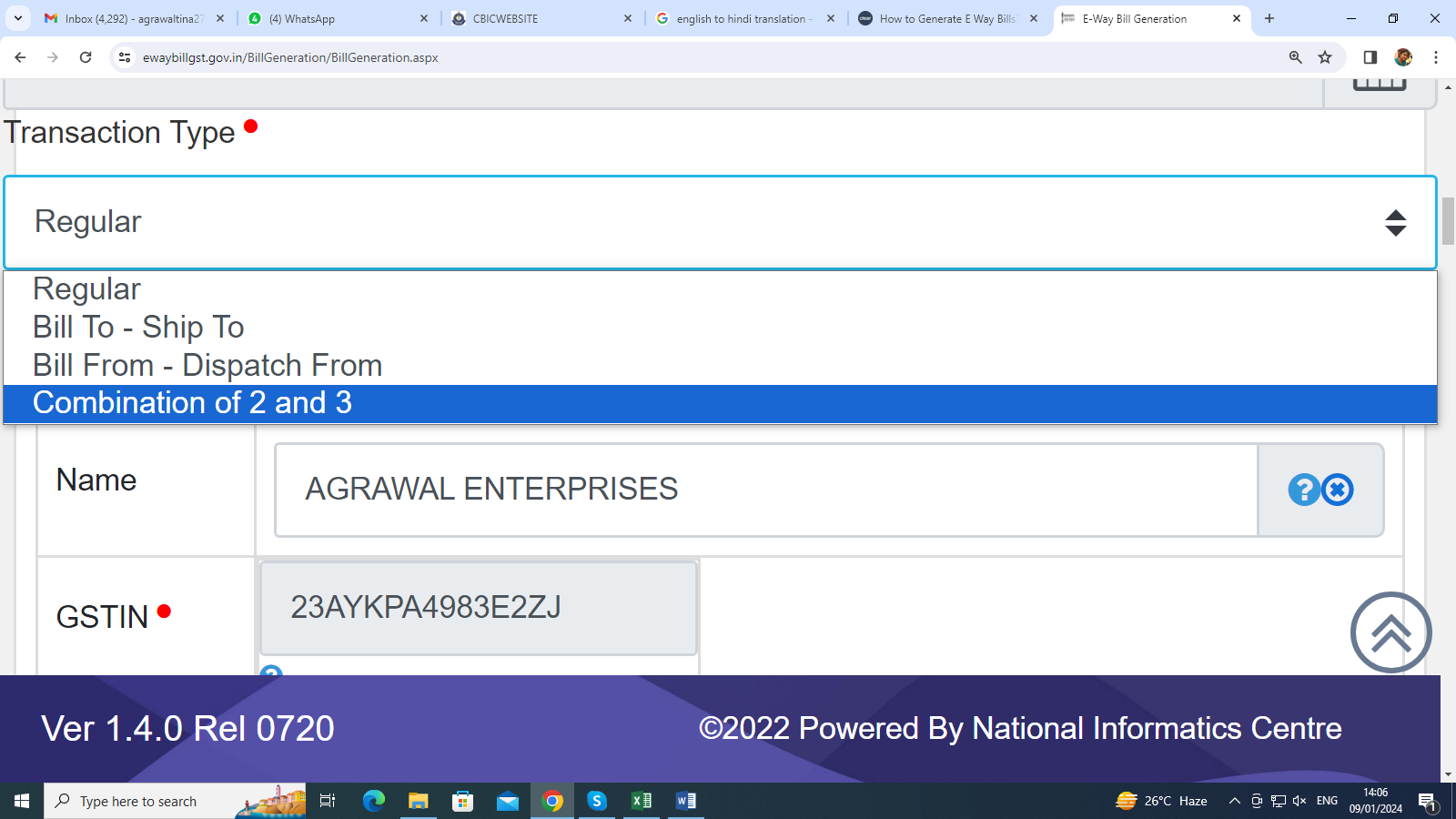

5. Transaction type has to be entered. Let us understand this

- In case of normal supply, select Regular means when the goods are delivered from the principal place of consignor to the principal place of consignee.

- Bill to ship to is selected when 3 parties are involved in the transaction, meaning when billing is being done from the buyer's location but the goods are being supplied at a different place as per the buyer's instruction.

- Bill from-dispatch from: means in this the goods are delivered from the additional place of business of the consignor to the principal place of the consignee.

- Combination of 2&3 means when the goods are delivered from the consigner’s additional place of business and the goods are delivered to a third place under the instruction of the buyer.

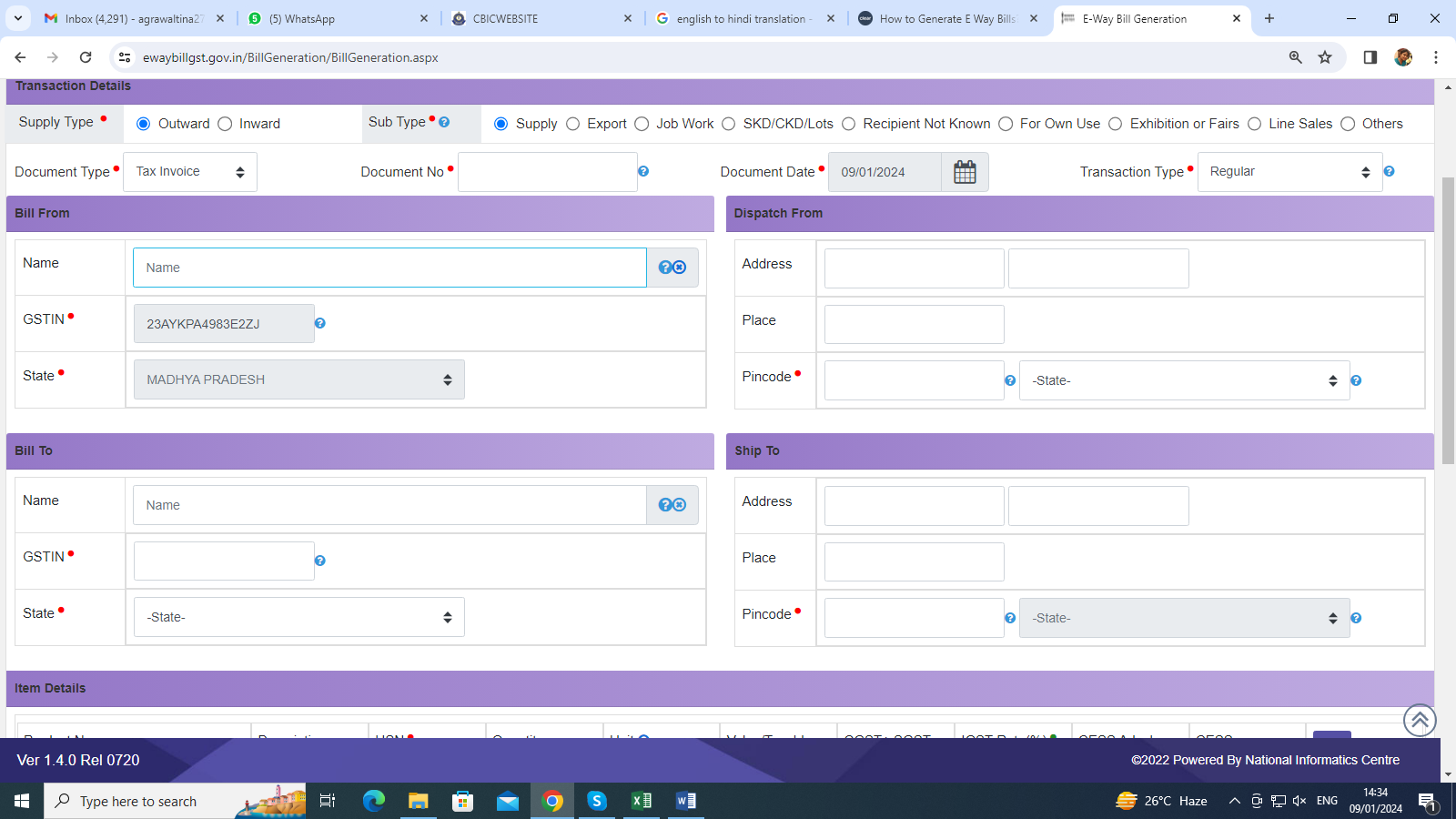

4) In Bill from tab, details of the person with whose login id is logged in like name, state, GSTIN will be shown. In dispatch from tab the address of principal place of business will be shown but if the dispatch address is different than you can enter it manually.

5) In Bill to you have to enter the name, GSTIN, state of the person you are billing and in ship to you have to enter the address where the goods are to be delivered.

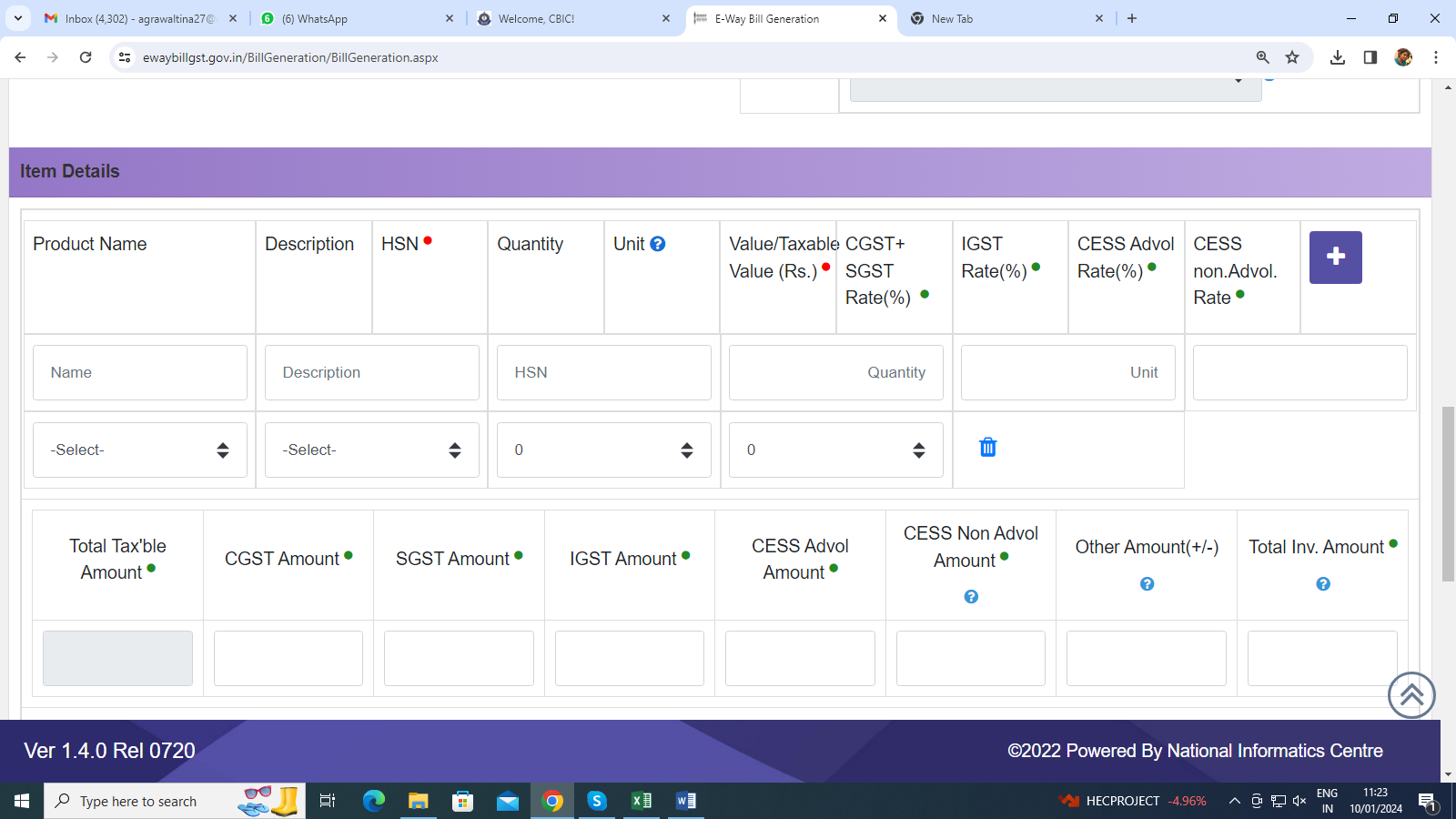

6) Now give the details of Consignment item HSN wise.

Product Name, Description, HSN, Quantity, Units (units means product bags, buckles, bottles, carton, box etc), Taxable value, Tax rates of CGST & SGST & IGST (in %) & Tax rate of Cess, if any charged (in %).

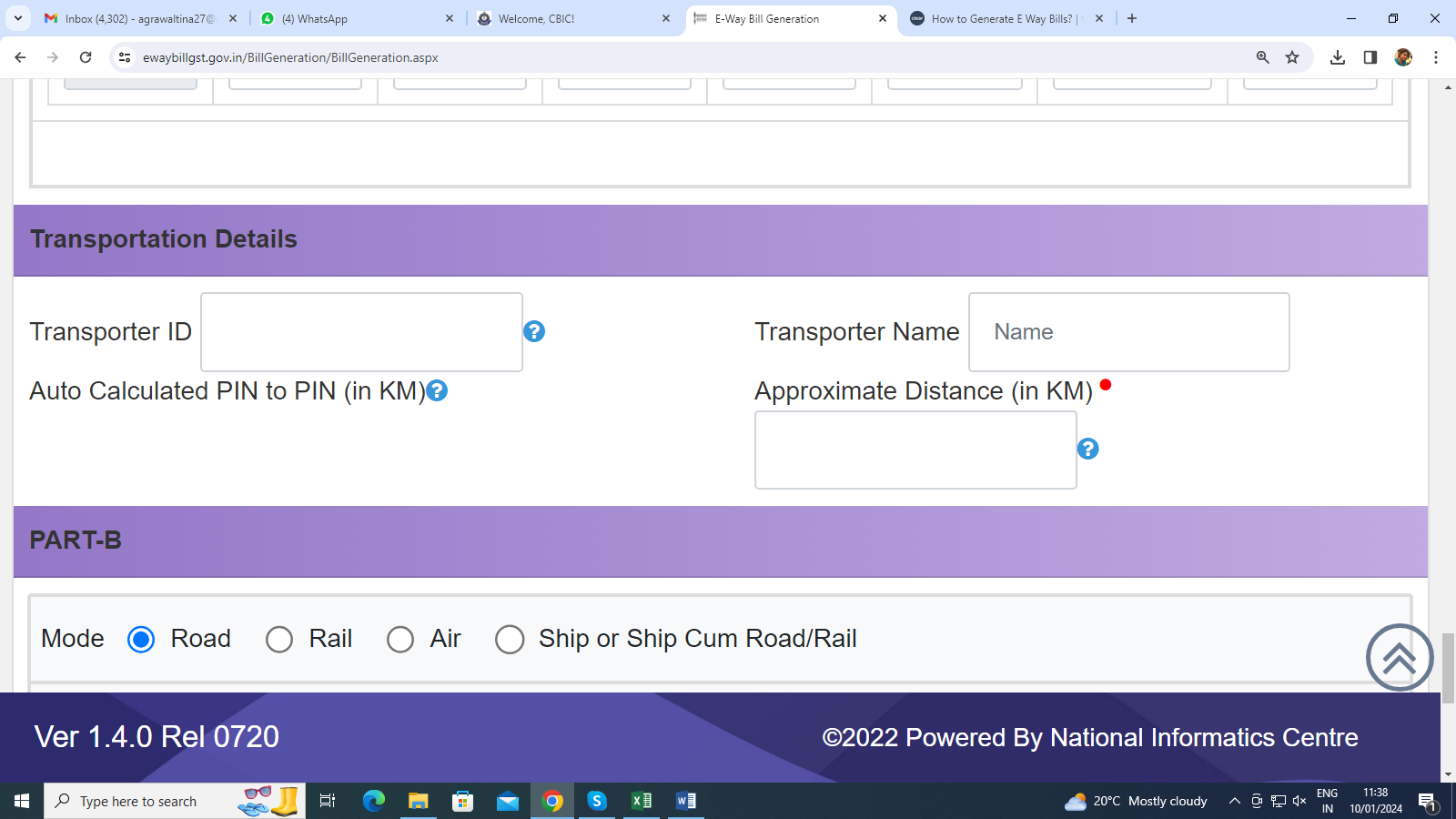

7) Now enter transportation details as follows:

Transporter id, Transporter Name.

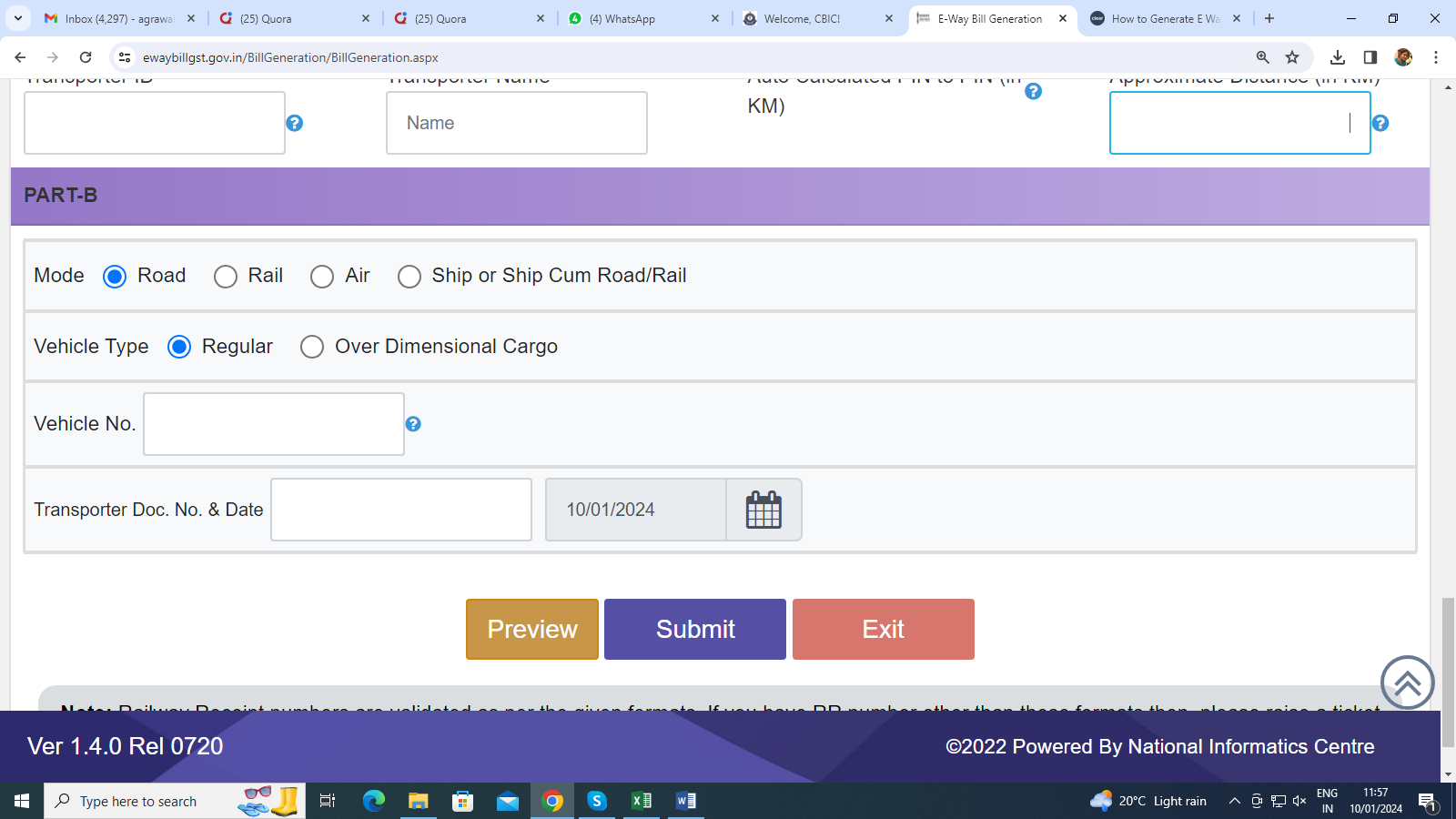

8) Under Part B select mode of transportation by road, rail, air, ship. Select type of Vehicle between Regular Vehicle or over dimensional cargo (Over dimensional cargo means vehicles which are larger in size than a regular vehicle). Now enter Vehicle Number, Transporter Doc No. & Date.

Preview all the filled details & click on the submit button.

After submitting you can take a print out of the generated E-way bill.

FAQ’s

- What is an E-way bill?

An E-way bill is an electronic document required for the movement of goods valued over as specified in India. It needs to be generated on the E-way bill portal by the consignor or consignee before the commencement of the movement of goods.

- How to download the E-way bill app for PC?

Currently, there is no standalone E-way bill app for PC. Users can access the E-way bill portal through a web browser on their PCs to generate E-way bills.

- Can I generate an E-way bill using a debit note?

No, an E-way bill is generated based on the invoice issued for the goods. A debit note is used to make adjustments in the invoice value.

- What is the E-way bill portal?

The E-way bill portal is an online platform provided by the government for businesses to generate, manage and cancel E-way bills. It can be accessed at https://ewaybillgst.gov.in/.

- Can I log in to the E-way bill portal on a mobile device?

Yes, you can log in to the E-way bill portal on a mobile device.

- What is the GST waybill?

GST waybill is another term for an E-way bill, which is required under the Goods and Services Tax (GST) regime for the inter-state and intra-state movement of goods.