Recent Articles Of GST

How to Login on GST Portal

How do I perform my initial login on the GST Portal as a new taxpayer using the Provisional ID or GSTIN and the provided password?

As a new taxpayer, to login first time to the GST Portal with GSTIN and password, you need to perform the following steps:

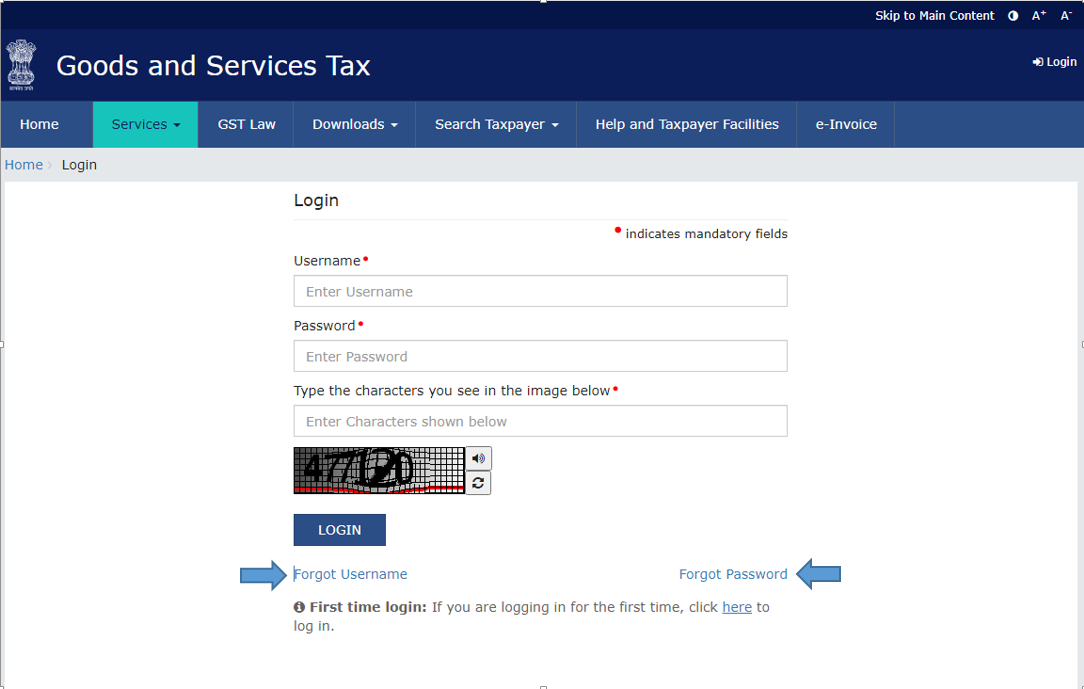

- Navigate to the web address https://www.gst.gov.in/ to access the GST Home page.

- Click the Login link given in the top right-hand corner of the GST Home page.

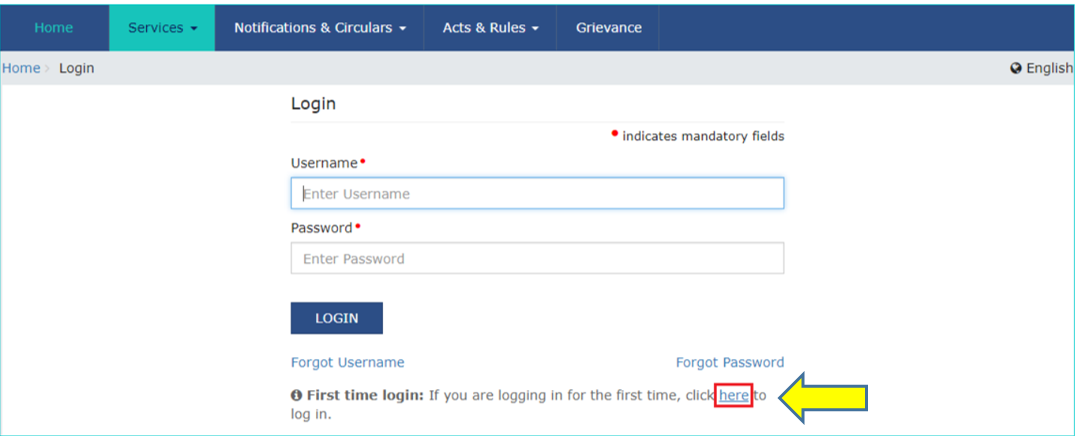

- The Login page is displayed. Click the here link in the instructions at the bottom of the page that says “First time login: If you are logging in for the first time, click here to login”.

4.The New User Login Page is displayed. In the Provisional ID / GSTIN/ UIN field, type the Provisional ID/ GSTIN/ UIN received on your e-mail address.

5.In the Password field, type the password received on your e-mail address.

6.In the Type the characters you see in the image below field, type the captcha text displayed in the box.

7.Click the LOGIN button.

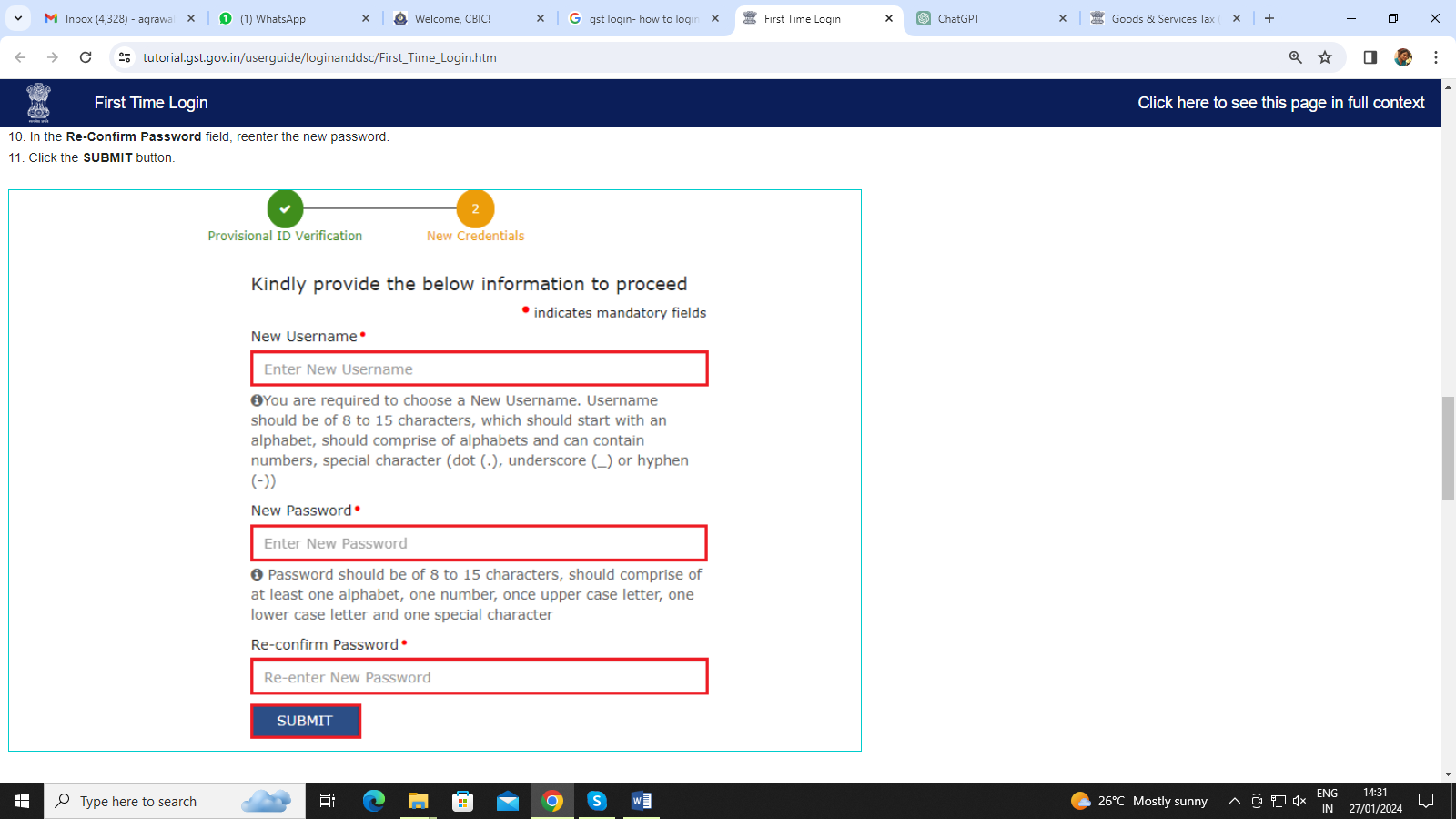

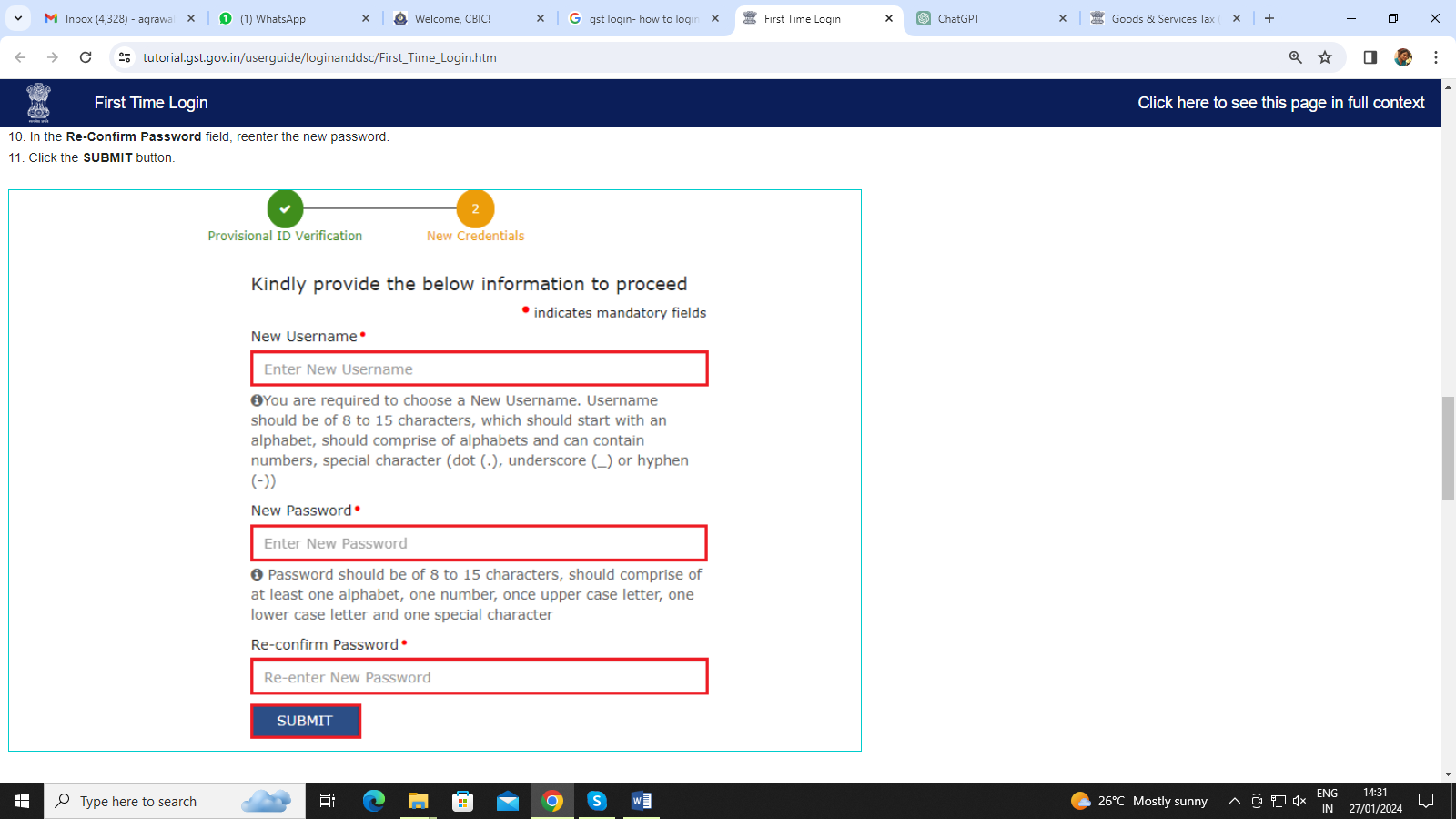

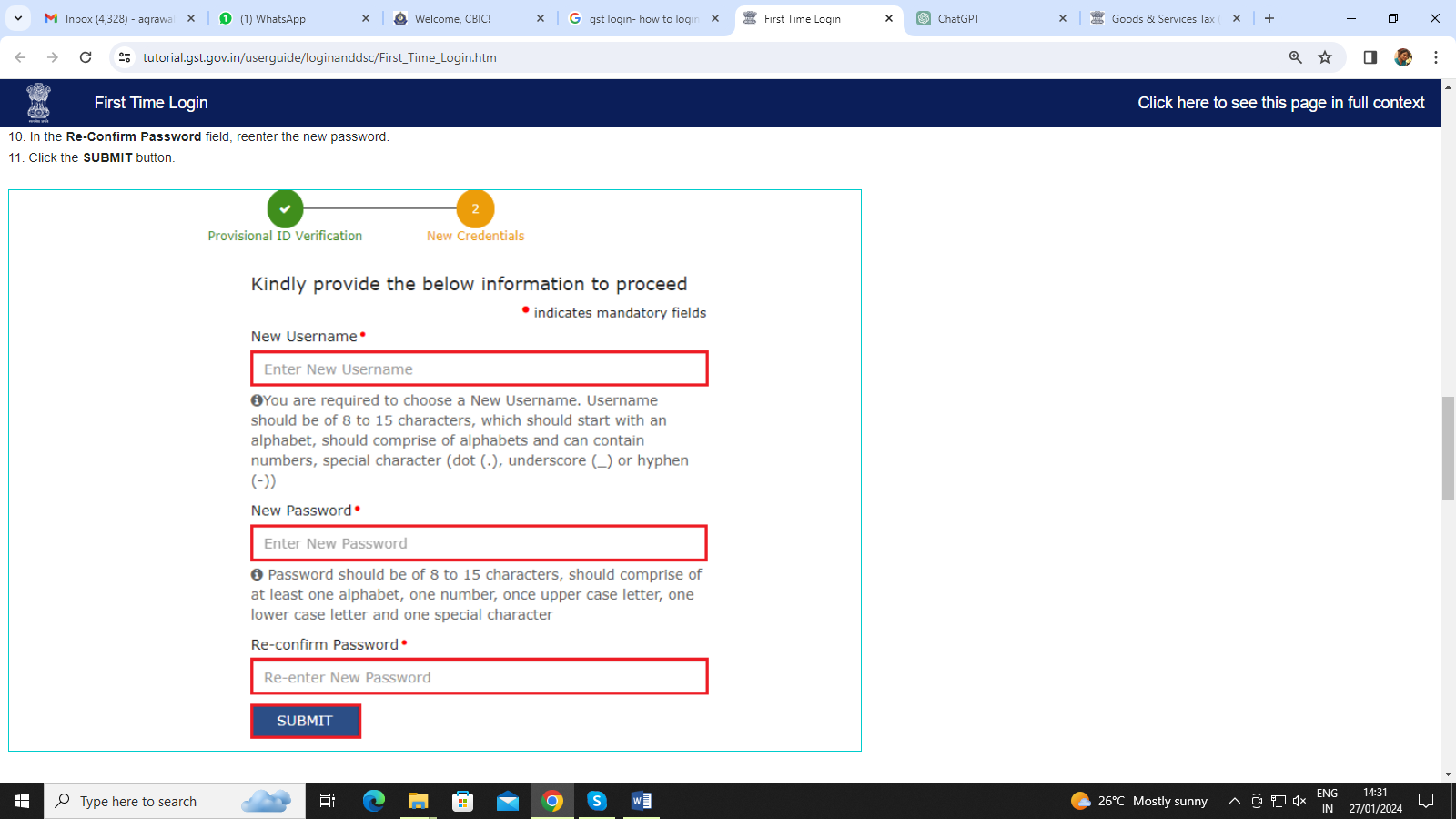

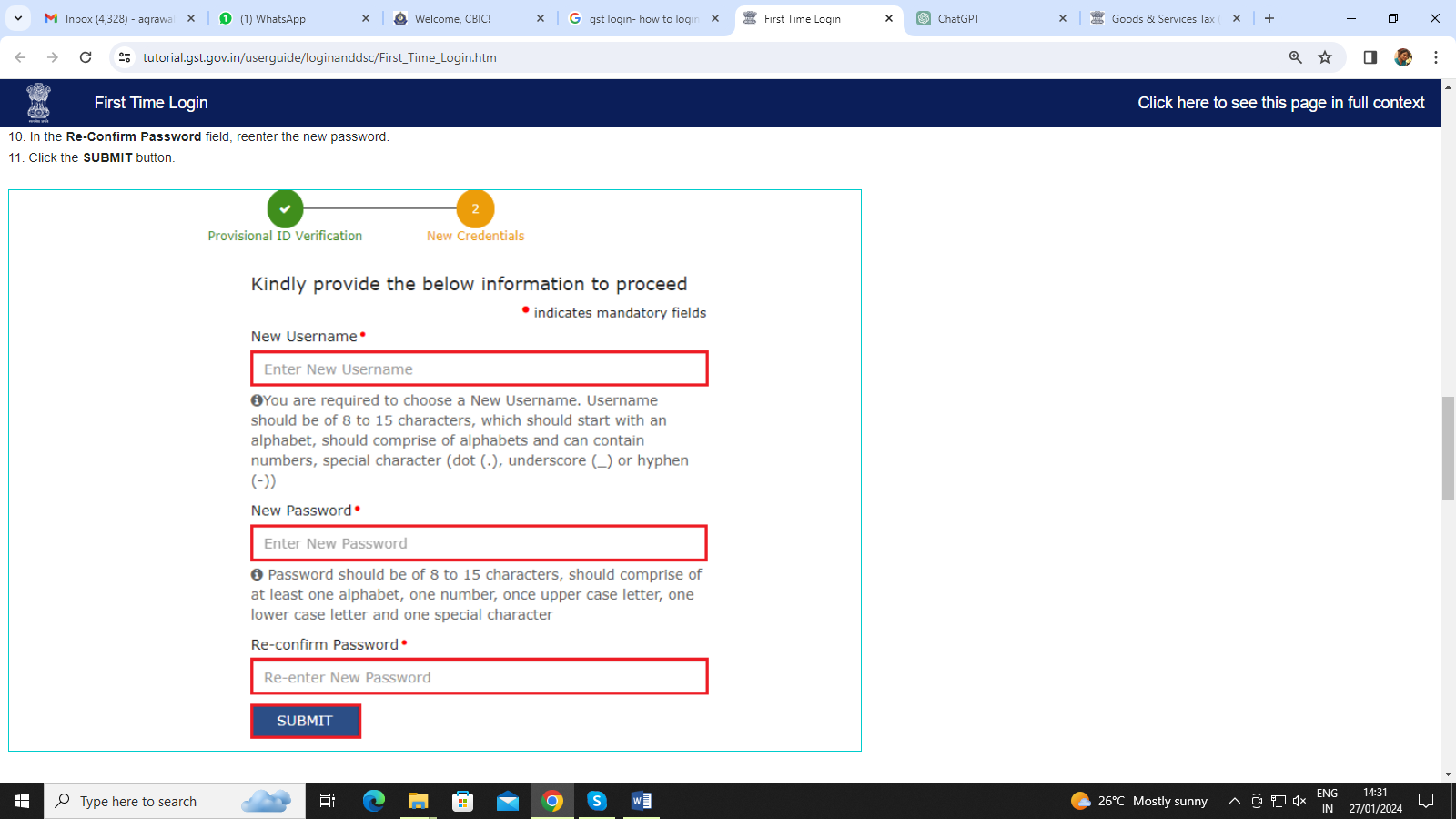

8.The New Credentials page is displayed. In the New Username field, enter the username that you want to create to login to the GST Portal.

9.In the New Password field, enter a password of your choice that you will be using from next time onwards

10. In the Re-Confirm Password field, re-enter the new password.

11.Click the SUBMIT button.

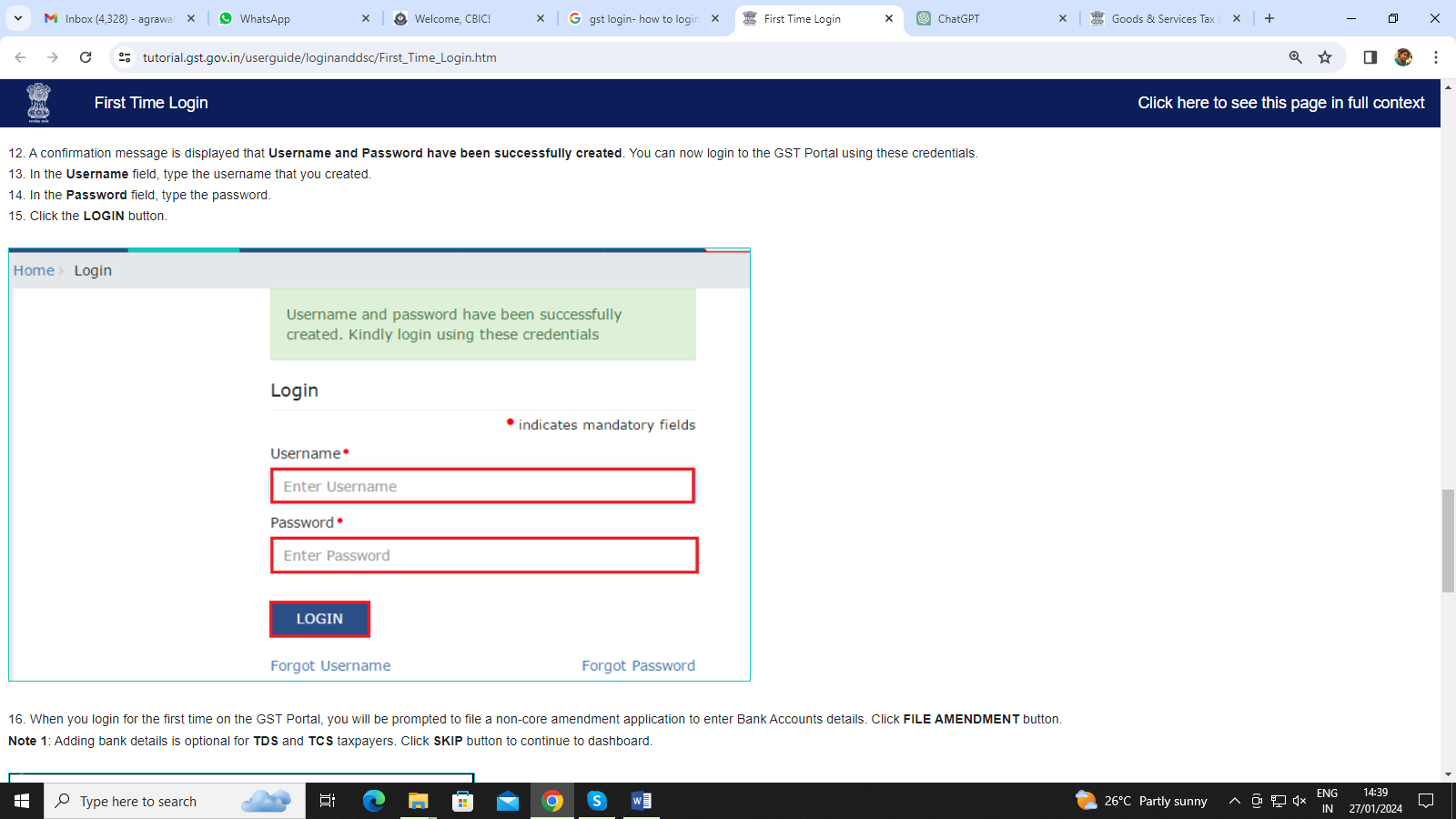

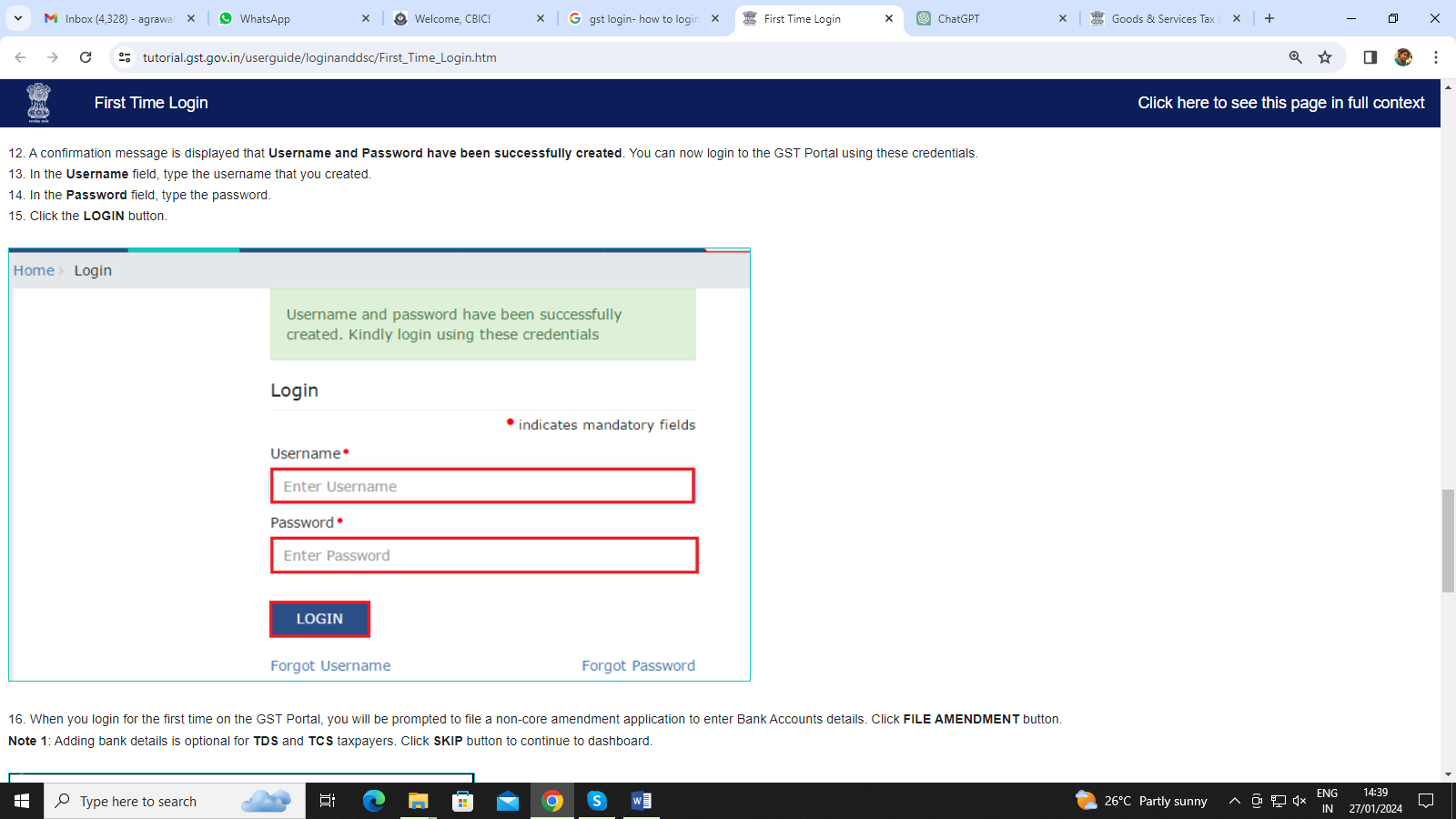

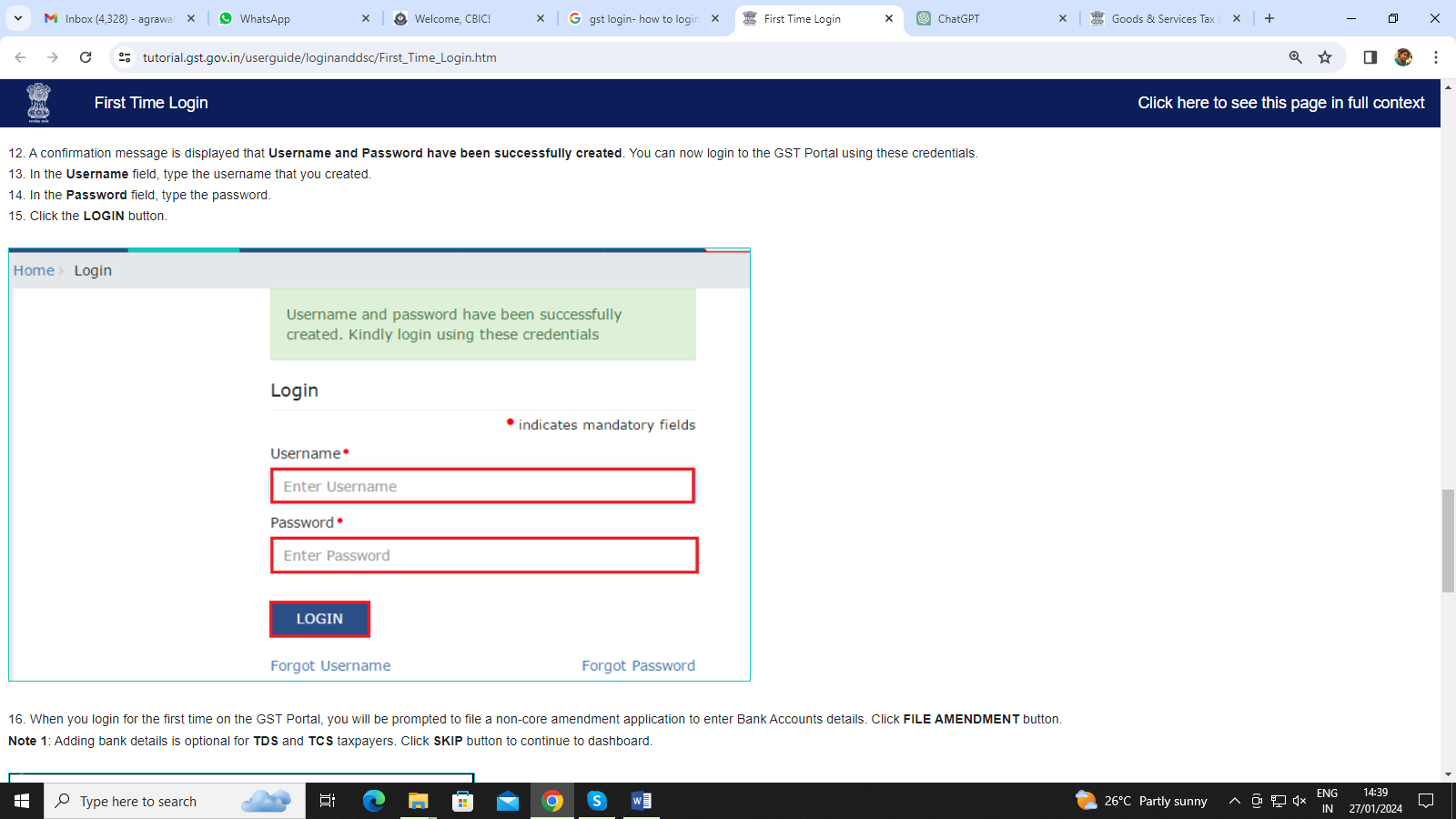

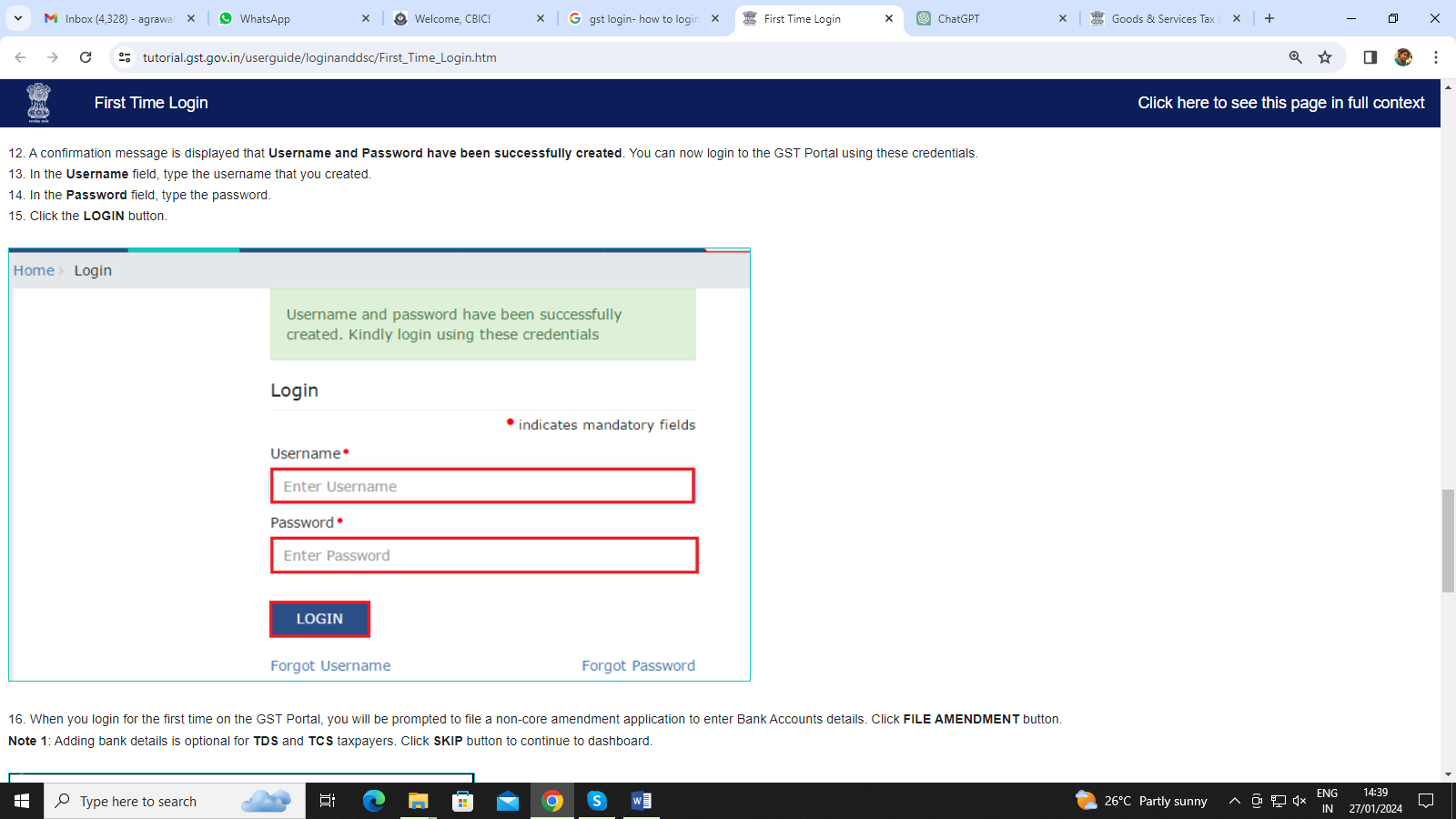

12. A confirmation message is displayed that Username and Password have been successfully created. You can now login to the GST Portal using these credentials.

13. In the Username field, type the username that you created.

14. In the Password field, type the password.

15. Click the LOGIN button.

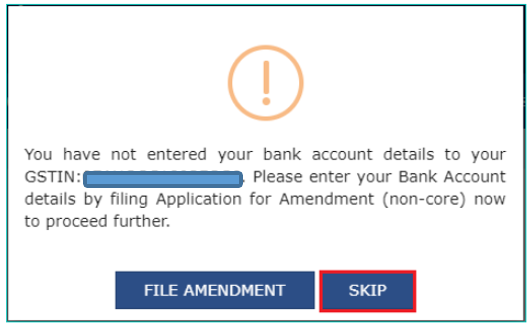

16. When you login for the first time on the GST Portal, you will be prompted to file a non-core amendment application to enter Bank Accounts details. Click FILE AMENDMENT button.

Note: - All Registered Taxpayers are required under the provisions of CGST Act, 2017 and the corresponding Rules framed thereunder to furnish details of their bank account/s within 30 days of the grant of registration or before the due date of filing GSTR-1/IFF, whichever is earlier.

FAQs on GST Login :

Q : What is GST login?

A : GST Login is a process by which Taxpayers can login to the GST portal to file their returns, can make GST payments and can perform other GST-related activities.

Q : How do I login to the GST portal?

A : To login to the GST portal, Taxpayers are required to visit www.gst.gov.in and click on the 'Login' button. Then, enter your username, password, and captcha code to access your account.

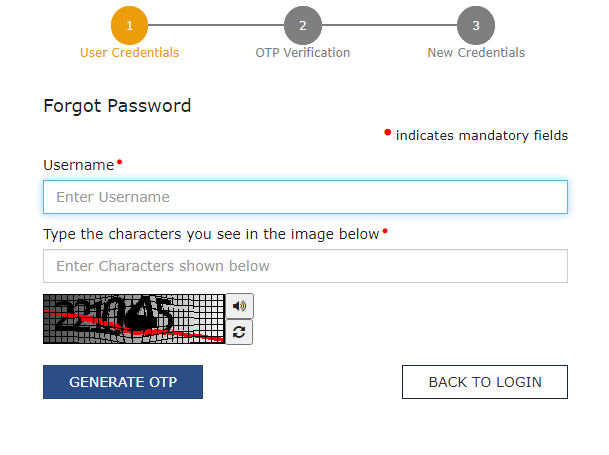

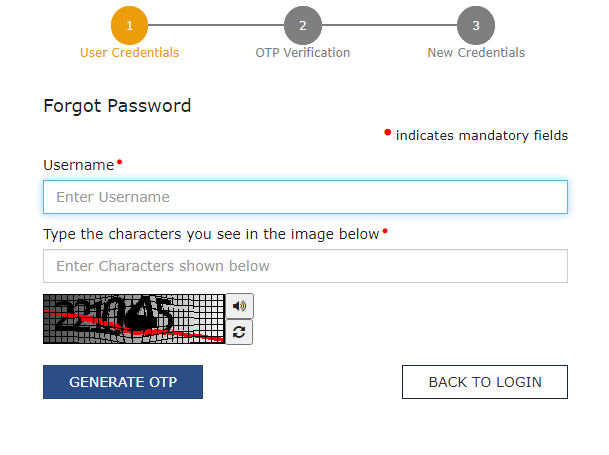

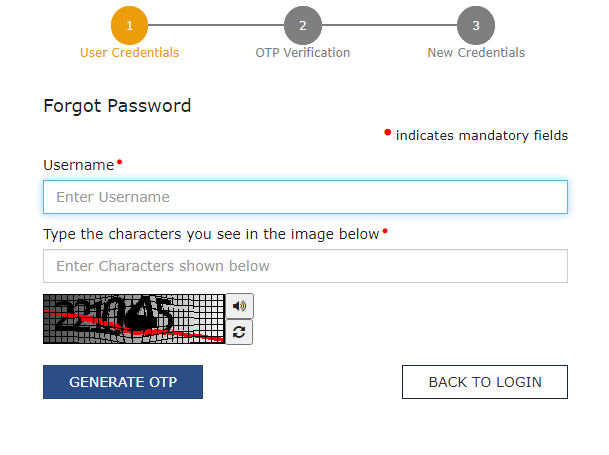

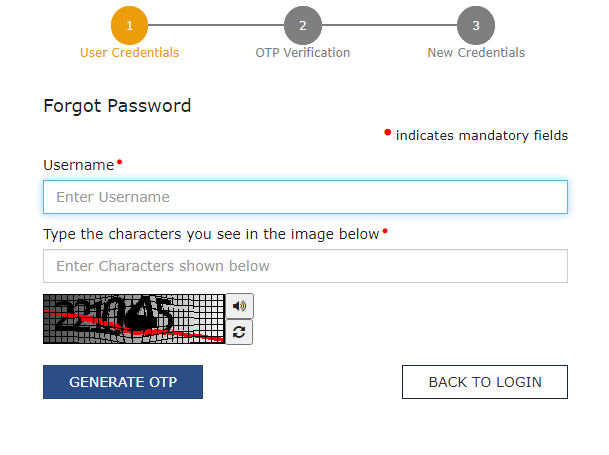

Q : What to do in case of I forget my GST login details?

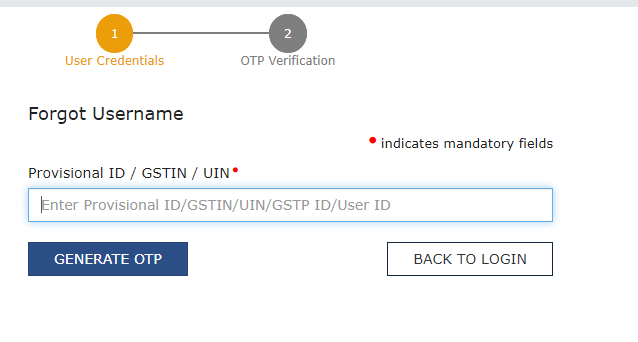

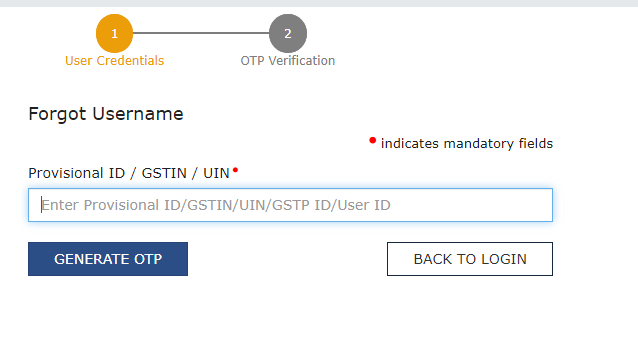

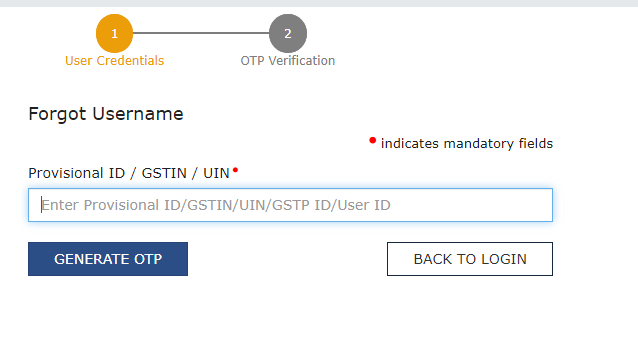

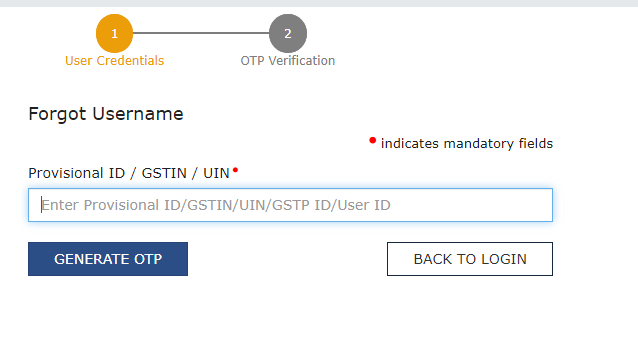

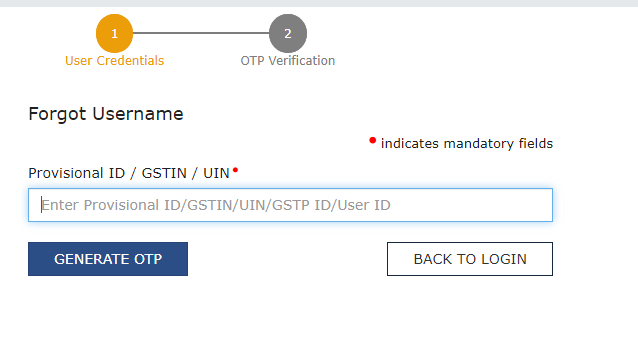

A : If you forget your GST login details, then click on the 'Forgot Username' or 'Forgot Password' link on the GST portal login page. You have to enter Provisional ID / GSTIN / UIN for your username and for forgot password you have to enter a username. Then you will receive OTP on mobile/mail ID. By this way, you can easily get your login credential details.

Forgot Username :

Forgot Password

Forgot Password

Q : Is there a specific GST login ID for login to GST Portal

A : Yes, GSTN provides every registered taxpayer a unique GSTIN (Goods and Services Tax Identification Number), by which a user can access to GST portal.

Q : Can I login to the GST portal using my TRN?

A : Yes, you can login to the GST portal using your Temporary Reference Number (TRN), if you are a for new GST number and have not received your GST Registration.

Q : I am facing issues with GST login. What should I do?

A : If you facing any issues in respect of GST login, then you can contact the GST helpdesk for technical issues or seek assistance from a GST practitioner/Tax professionals for resolution.

Q : What is ARN (Application Reference Number)?

A : ARN or Application Reference Number, is a unique identifier assigned to each application made on the GST portal. It is used to track the status of the GST application.

Q: How to check & track GST Status?

A : To track the status of your GST application, you can use the ARN (Application Reference Number) provided during the application process. Visit the GST portal and use the "Track Application Status" option, where you will need to enter your ARN to check the current status of your application.

Q: What is Full Form of ARN in GST?

A : ARN in the context of GST stands for "Application Reference Number." It is a unique identifier assigned to each GST application for tracking purposes.

Q: How to check GST Status by ARN ?

A : You can check the status of your GST application by using the ARN on the GST portal. Navigate to the "Track Application Status" option and enter your ARN to get the current status of your application.

Q: Can I login the GST portal using TRN?

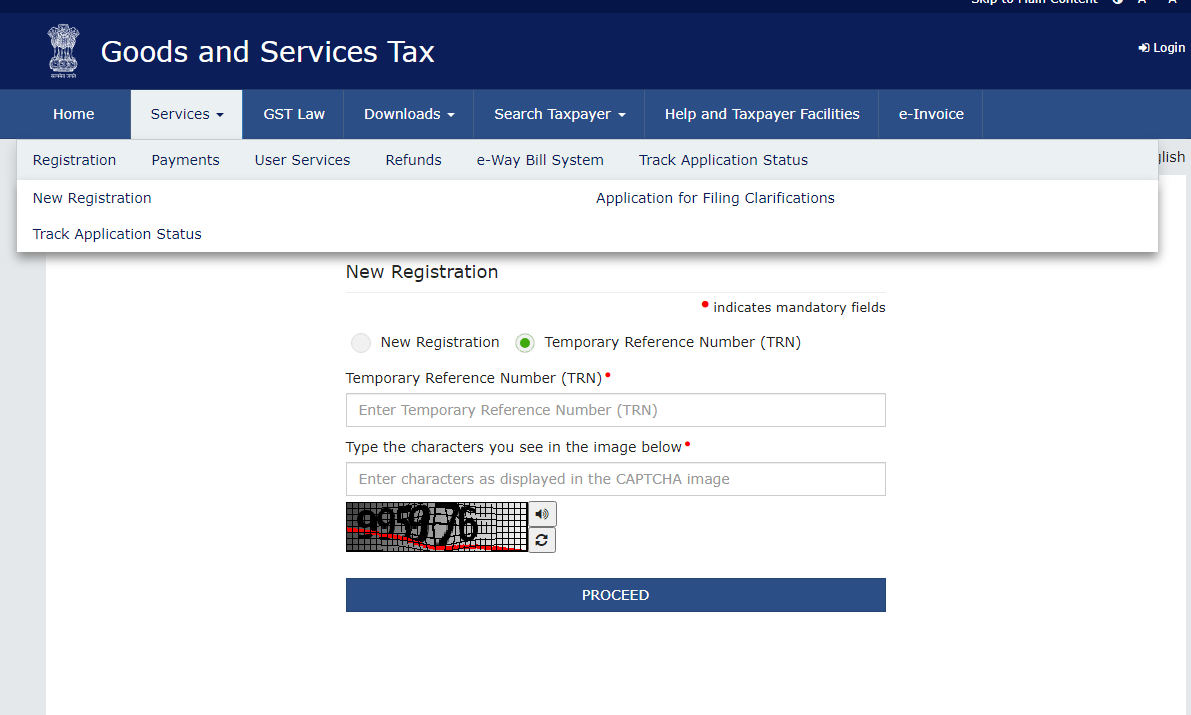

A : No, you cannot log on the GST portal using the Temporary Reference Number (TRN). However, you can track your registration application status using TRN by following these steps:

- Visit https://www.gst.gov.in/

- Click Services> Registration> New Registration

- Select the ‘Temporary Reference Number’ option.

- Click proceed.

- Verify your credentials using the OTP received on the registered mobile number and e-mail ID.

- ‘My Saved Application’ page will be displayed, wherein you can track the status of your application.

Once you complete the registration process, you will receive the credentials on your registered e-mail ID to login to the GST portal.

Q: How to change GST Mobile Number?

A : To change the mobile number in your GST registration, log in to the GST portal, go to the "Services" tab and select "Amendment of Registration Non-Core Fields." Update the mobile number in the appropriate section.

Q: What if GST Server down?

A : If the GST server is down, it may temporarily affect your ability to access the portal or perform transactions. In such cases, it's advisable to try again later.

Q: How to check Annual Turnover in GST Portal?

A: To check the annual turnover in the GST portal, log in to your account, go to the "Services" tab, and select "Returns Dashboard." The annual turnover can be found in the GSTR-3B return.