Recent Articles Of GST

Intimation Under Section 143(1) of Income Tax Act

What is Section 143(1)

Section 143(1) of the Income Tax Act outlines the processing procedure for returns filed under Section 139 or in response to a notice issued under Section 142(1). This assessment is complete without calling the assessee. This is also known as Summary-assessment, Preliminary Assessment. This may also called as a system-generated assessment based on various information collected by the income tax department form AIS / TIS / 26AS / SFT etc. This notice is typically generated by the mainframe system to highlight visible mistakes in the submitted return. It specifically focuses on errors that are readily identified through the automated processing system.

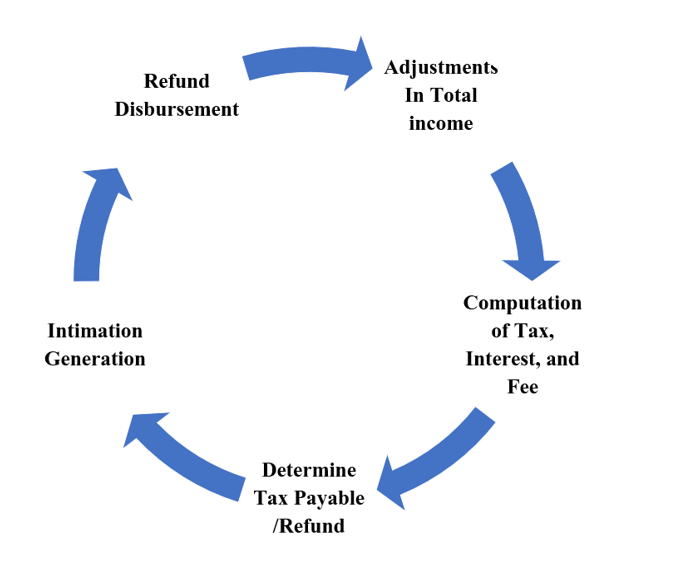

Procedure of assessment under section 143(1)

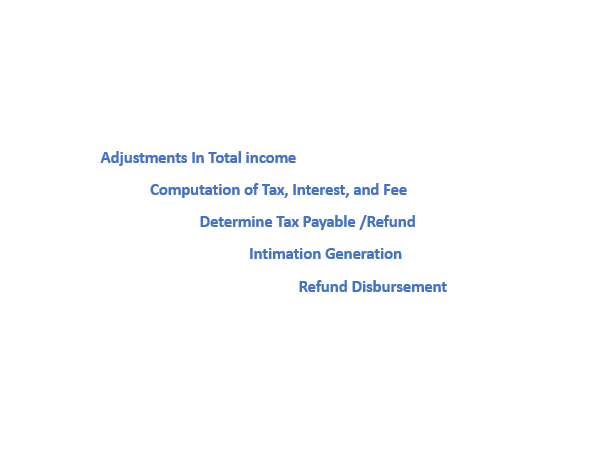

The processing involves a series of adjustments to compute the total income or loss as shown in the diagram.

What are Adjustments made In Total income?

- Rectify the arithmetical errors in the return.

- Correcting any apparent incorrect claims identified from the information in the return.

- Disallowing the claimed loss if the return for the relevant previous year, for which the loss set off is sought, was filed beyond the due date specified in Section 139(1).

- Disallowing any expenditure or additional income indicated in the audit report but not reported in the total income computation in your return.

- Disallowing deductions claimed u/s 10AA or provisions of Chapter VI-A related to deductions for certain incomes if the return is filed after the due date specified in Section 139(1).

- Adding income reported in Form 26AS, Form 16A, or Form 16, STF etc. which has not been incorporated in the total income computation in the return.

Section 143(1) ensures that returns undergo thorough processing, addressing errors, correcting claims, and making necessary adjustments to arrive at the accurate total income or loss.

Time-limit

Assessment under section 143(1) can be made within a period of 9 months from the end of the financial year in which the return of income is filed.

Question : Whether any action to be taken by the assesssee if no intimation is received till the expiry of one year?

Reply : No, in Such Case Your ITR–V acknowledgment will be deemed your intimation.

Types of intimation

- Intimation with No Demand or No Refund

- Intimation with Demand

- Intimation with Refund

How to deal with Intimation under Section 143(1)

Receiving an Intimation under Section 143(1) can be a routine part of the assessment process. Here's a step-by-step process for dealing with Intimation received

- Review the Intimation

- Understand Adjustments

- Verify Information: Cross-Check with Form 26AS/TIS/AIS

- Examine & Compare Deductions and Exemptions

- Reconcile Payments of Tax in Income tax Return & Under Intimation

- Professional Advice if Needed

- Respond within Timelines if discrepancies with income tax return

- Rectify Errors

- Keep Records of response

Password to open intimation u/s 143(1)?

To open the intimation under Section 143(1), it is essential to input the correct password. This security measure ensures secure access to the file, safeguarding the confidentiality of the information contained within. The password for these files is your PAN number in lowercase and your date of birth or date of incorporation in DDMMYYYY format. For example, if your PAN number is AARIK7108R and your date of birth is 10 October 1983, then the password will be ‘aarik7108r10101983’.

Can to get the Intimation u/s 143(1) again?

Steps to Download Intimation Order After Income Tax Return Processing:

Visit the official e-Filing Portal of Income Tax

Redirect to 'Income Tax Returns':

- Go to the 'e-file' section

- Select 'Income Tax Returns.'

- Click on 'View Filed Returns' to proceed

- Download Intimation Order

By following these steps, you can easily download the Intimation Order after the processing of your Income Tax Return by the Centralized Processing Centre (CPC).

Centralized Processing Centre [CPC] & It’s Role

The Government of India (GOI) on the recommendations of the Business Process Re-engineering Committee (BPR Committee) approved (February 2009) the establishment of a Centralised Processing Centre.

The Income Tax Department has been granted the authority to establish a Centralized Processing Center (CPC) dedicated to handling tax returns. The primary goal of this center, is to determine the tax liability and process refunds for taxpayers.

Notably, the CPC autonomously processes returns submitted by assesses without any involvement from the taxpayer or jurisdictional officers. This streamlined approach aims to ensure swift and accurate processing of returns while providing timely information to taxpayers.

Upon the completion of the processing phase, the department issues an intimation to the taxpayer. This intimation serves as a communication channel, allowing the taxpayer an opportunity to respond to any adjustments made by the CPC. It is crucial for the taxpayer to address these adjustments within 30 days of receiving the intimation.