Recent Articles Of GST

Leave Encashment: Tax Exemption Under Sec 10(10AA)

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Topic Covers:

1. Introduction

2. Taxability

3. Leave Encashment calculation and exemption

Introduction:

Generally, the employee gets leaves during the employment if the employee does not avail those leaves, either that will be lapse or carried forward. Employees can encash those leaves at the time of termination or retirement or every year. Section 10(10AA) deals with the provision of exemption for leave encashment.

Taxability :

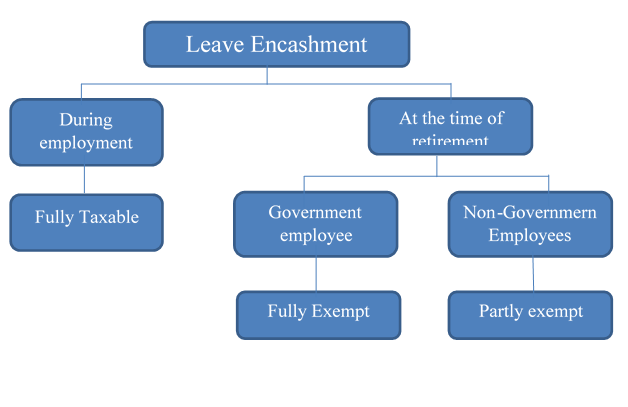

The amount encashed leaves is a part of the salary. If leave is encashed every year then it is part of the salary and will be taxable in the same year.

But if leave is encashed at the time of retirement or termination then it is exempted as per section 10(10AA) of the Income tax act.

Leave Encashment calculation and exemption:

Leave encashment received during the year is fully taxable. Whether received by a government employee or non-government employee.

Leave encashment received by a government employee at the time of retirement or termination is fully exempted.

1) Leave encashment received by a non-government employee at the time of retirement or termination is exempted up to the specified limit.

In the case of non-government employee exemption will be the least of the following amounts:

i) ₹ 25 lakhs ( Earlier this limit was ₹ 3 Lakhs, From 1st April 2023 it is increased to ₹ 25 Lakhs vide , notification no S.O. 2276(E) dated 24th May, 2023 )

ii) Leave salary actually received

iii) 10 months Salary (on the basis of the average salary of the last 10 months )

iv) Case equivalent to 30 days for every completed service year on the basis of the average salary of the last 10 months

As per the provision of section 10(10AA) maximum 30 days per year for the calculation of exemption

If more than 30 days of leave in the year are provided by the company, then a maximum of 30 days for a year will be considered to calculate the exemption, but if the company has provided leave of less than 30 days in the year, then the calculation will be done for exemption from fewer days

Salary means: Basic salary + Daily Allowances (forming part of salary) + fixed % commission on turnover

In cases where payment is received from more than one employer exemption will be calculated on the aggregate amount.

Leave encashment received from the previous employer in the past and also received from current employer. In this case, to calculate the exemption amount received from the previous employer will be deducted from the maximum exemption limit of ₹ 25 lakhs.

Example:

Suppose the service period of Mr A is 12 years & 5 months

He got 36 leaves every year during the service period, so the overall leaves allowed during service was 447 (36 x 12 )

Out of which Mr A availed 265 leaves, the balance unavailed leaves 182 days.

Mr A gets a Basic salary and DA ₹ 36000 per month and leave encashment received ₹ 2,18,400

Leave encashment exemption Calculation:

least of the following will be exempted amount-

1) Actual Amount receive - ₹218400

2) Maximum ₹ 25 lakhs (After notification no S.O. 2276(E) dated 24th May, 2023)

3) Average Salary for 10 month = ₹3,60,000 (36000x10)

4) Cash equivalent of unavailed leaves = 1200 x (12year x30)- availed leaves 265 =95x1200=114000

Least of the these 4 will be exempted i.e. ₹ 1,14,000

FAQs:

Q. Can I claim leave encashment for all the leaves annual leave, sick leave, sabbatical leave, maternity leave etc.?

A. No such differentiation is provided for leaves in the income tax act. Employer policy should be referred for this purpose. So can claim leave encashment for any type of leave if specified conditions are fulfilled.

Q. What are the tax implications If leave encashment is received by heirs of deceased ?

A. Leave encashment is fully exempt in case received by the legal hires.

Q. Is leave encashment taxable on retirement?

A. Yes, Leave encashment is taxable even if received at the time of retirement. However exemption as per the provision can be availed.