Recent Articles Of GST

Reverse Charge Mechanism In GST

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Tax Liability Under Reverse Charge Mechanism

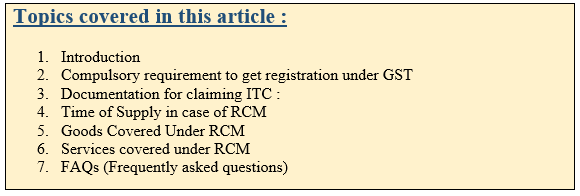

Introduction -

Generally, under the GST, Supplier is liable to pay GST in a forward charge mechanism. Where the supplier collects GST from the buyer and pays the Government.

As per Section 9(3) & 9(4) of CGST Act 2017 and Section 5(3) & 5(4) of IGST Act 2017, Government has notified specified goods or services, where the buyer (recipient) is liable to pay GST in reverse charge mechanism.

In RCM, the buyer (recipient) collects the GST and pays to the Government. All the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Compulsory requirement to get registration under GST

As per Section 24(iii) of CGST Act 2017, if a person is liable to pay GST under RCM, then such person is required to get compulsory registration under the GST Act, irrespective of turnover limit.

Documentation for claiming ITC :

In the case of RCM, the buyer issues a self-invoice.

Any amount payable under reverse charge shall be paid by debiting the electronic cash ledger. In other words, reverse charge liability cannot be discharged by using an input tax credit. However, after discharging reverse charge liability, credit of the same can be taken by the recipient.

Time of Supply in case of RCM-

Time of supply shall be the earlier of the following dates, namely-

- The date of payment as entered in the books of account of the recipient.

The date on which the payment is debited in his bank account, whichever is earlier. - The date immediately following 60 days from the date of issue of invoice or any other document, issued by the supplier.

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply.

Goods Covered under RCM-

| S. No. | Category of Supply of Goods | Supplier of Goods | Recipient |

| 1. | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 2. | Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| 3. | Tobacco leaves | Agriculturist | Any registered person |

| 4. | Raw cotton | Agriculturist | Any registered person |

| 5. | Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| 6. | Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person |

| 7. | Silk yarn | Any person who manufactures silk yarn from raw silk or silkworm cocoons for supply of silk yarn | Any registered person |

Services Covered under RCM –

| S. No. | Category of Supply of Services | Supplier of Goods | Recipient |

| 1. | Supply of Services by a goods transport agency (GTA) in respect of transportation of goods by road to -

(a) any factory registered under or governed by the Factories Act, 1948(63 of 1948); or (b) any society registered under the Societies Registration Act, (c) 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (d) any co-operative society established by or under any law; or any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) any body corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or any casual taxable person. |

Goods Transport Agency (GTA) | (a) Any factory registered under or governed by the Factories Act, 1948(63 of 1948); or

(b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) any co-operative society established by or under any law; or (d) any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) any body corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or any casual taxable person; located in the taxable territory. |

| 2. | Services supplied by an individual advocate including a senior advocate by way of representational services before any court, tribunal or authority, directly or indirectly, to any business entity located in the taxable territory, including where contract for provision of such service has been entered through another advocate or a firm of advocates, or by a firm of advocates, by way of legal services,

to a business entity. |

An individual advocate including a senior advocate or firm of advocates | Any business entity located in the taxable territory. |

| 3. | Services supplied by an arbitral

tribunal to a business entity. |

An arbitral tribunal. | Any business entity located in the

taxable territory. |

| 4. | Services provided by way of sponsorship to any body corporate or partnership firm. | Any person | Any body corporate or partnership firm located in the taxable territory |

| 5. | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding, -

(1) Renting of immovable property, and services specified below- (i) Services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or Passengers. |

Central Government ,State Government, Union territory or local authority | Any business entity located in the taxable territory. |

| 6. | Services supplied by the Central Government, State Government, Union territory or local authority by way of renting of immovable property to a registered person | Central Government, State Government, Union territory or local authority | Any person registered under the central goods and service tax Act,2017 |

| 7. | Services supplied by a director of a company or a body corporate to the said company or the body corporate. | A director of a company or a body

corporate |

The company or a body corporate located in the taxable territory |

| 8. | Services supplied by an insurance agent to any person carrying on insurance business. | An insurance agent | Any person carrying on insurance business, located in the taxable territory.

|

| 9.

|

Services supplied by a recovery agent to a banking company or a financial institution or a non-

Banking financial company. |

A recovery agent | A banking company or a financial institution or a non-banking financial company, located in the taxable

territory. |

| 10. | Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient | Any person located in a non-taxable territory | Any person located in the taxable territory other than non-taxable online recipient. |

| 11. | Services supplied by a person located in non taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India | A person located in non-taxable territory | Importer. |

| 12. | Service provided by business facilitator to a banking company | Business Facilitor | A Banking company, located in the taxable territory. |

| 13. | Services provided by an agent of Business Correspondent to Business Correspondent | An Agent of Business Correspondent | A Business Correspondent located in taxable territory |

| 14. | Security Service (service provided by way of supply of security personnel) provided to a registered person by any person other than a body corporate.

Exception – This entry shall not apply to a) Department/Establishment of Central Government State government or union territory or, b) Local authorities or, c) Governmental Agencies; who have taken registration for the purpose of deducting TDS under section 51 d) Registered person opted under composition scheme.

|

Any person other than Body corporate | A registered person, located in the taxable territory. |

| 15.

|

Service supplied by individual direct selling agent other than a body corporate, partnership or limited liability partnership firm to bank or non- banking financial institution. | Individual direct selling agent other than a body corporate partnership or limited liability partnership firm | A banking company or a non-banking financial company, located in the taxable territory. |

| 16 | Service provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the service recipient provided to a body corporate | Renting of motor vehicle service provide by any person other than a body corporate | Any Body corporate located in the taxable territory |

| 17 | Services of lending of securities under Securities Lending Scheme, 1997 of SEBI.

|

Lender. | Borrower. i.e. person who borrow the securities under the scheme through an approved intermediary. |

| 18

|

Supply of service by Music Composer, Photographer, Artist or the like by transfer or permitting the use or enjoyment of a copyright covered under copyright Act, renting to original dramatic musical or artist work to A Music company , Producer | Music Composer, Photographer, Artist | A Music company , Producer |

| 19. | Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under copyright Act relating to original literary works to a publisher located in the taxable territory.

Exception -

|

Author | Transfer or permitting the use or enjoyment of a copyright covered under the copyright act. |

FAQs (Frequently Asked Questions) :-

Q : Full form of RCM in GST?

A : RCM stands for Reverse charge mechanism.

Q : What is RCM in GST?

A : Forward charge mechanism places the responsibility on the supplier to pay tax, while the Reverse Charge Mechanism (RCM) shifts the onus to the buyer.

Q : What is RCM in gst with example?

A :Reverse charge mechanism example :

Suppose a Company avails legal services from an advocate. In this case, the recipient of the service i.e. the Company is liable to pay the GST directly to the government.

Q : Can rcm liability under GST be settled using input tax credit?

A : No, reverse charge liability cannot be settled using input tax credit. Taxpayer need to pay GST first, then he can claim credit of the reverse charge.

Q : When ITC on RCM can be claimed?

A : In case of Reverse charge mechanism (RCM), the buyer issues a self-invoice. Any amount payable under reverse charge shall be paid by debiting the electronic cash ledger. In other words, reverse charge liability cannot be discharged by using input tax credit. However, after discharging reverse charge liability, credit of the same can be taken by the recipient.

Q : Is RCM applicable on import of goods?

A : No, at the time of import of goods, custom duty is applicable.

Q : What is the meaning of Reverse Charge in GST?

A : Reverse Charge in GST means the liability to pay tax shifts from the supplier to the recipient of goods or services.