Recent Articles Of GST

What is Form 26AS ? How to Download Form 26AS

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Income tax Form 26AS “A Tax credit Statement”

1. Introduction:

Form 26AS or Tax credit statement is one of the basic documents, required to file an Income tax return of the person. It gives a consolidated record of each tax-related transaction and information associated with the PAN (Permanent Account Number) of the assessee. The income information available in form 26AS should be reconciled with the income tax return of the taxpayer.

2. What is Form 26AS:

From 26AS is a consolidated statement of tax deducted at the source and tax collected at the source of a person which is deposited with the government. Other than details of TDS and TCS it also provides some other information of transactions done by the taxpayer in the particular financial year. The transaction comprises Advance tax/self-assessment tax/ Regular Assessment Tax deposited, Refund, specified financial transactions, etc.

3. Details and Information available in Form 26AS:

It is a consolidated Information Statement which contains the details of transactions for a particular Financial Year (FY). It contains the following details in its different parts:

Part I:

It contains the details regarding Tax Deducted at the source which includes the Name and TAN of the Deductor, Total Amount Paid/credited, Tax Deducted, and Total TDS Deposited.

Tax deducted on income from salary, contract, Interest income, etc. are displayed in this part of the Form.

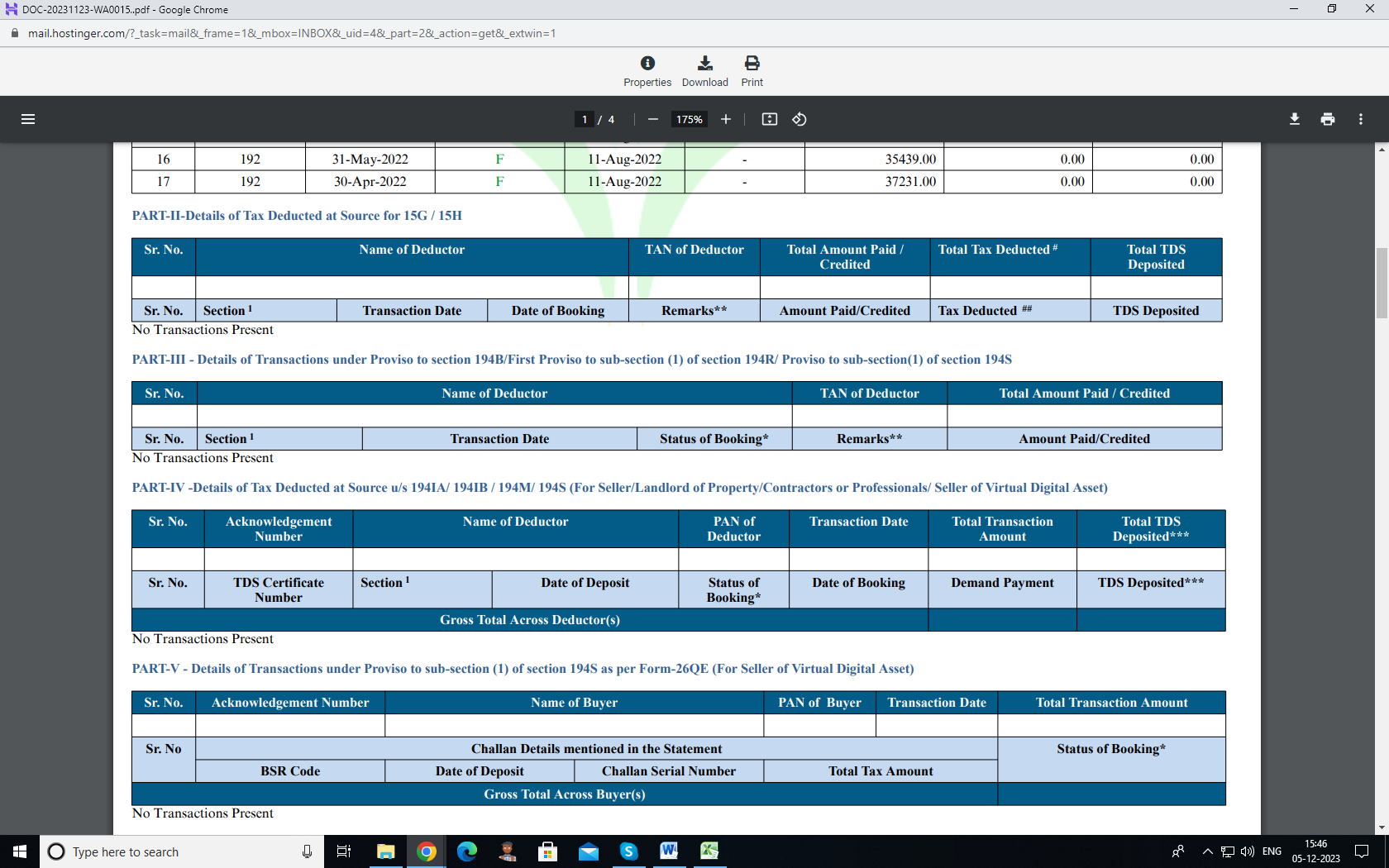

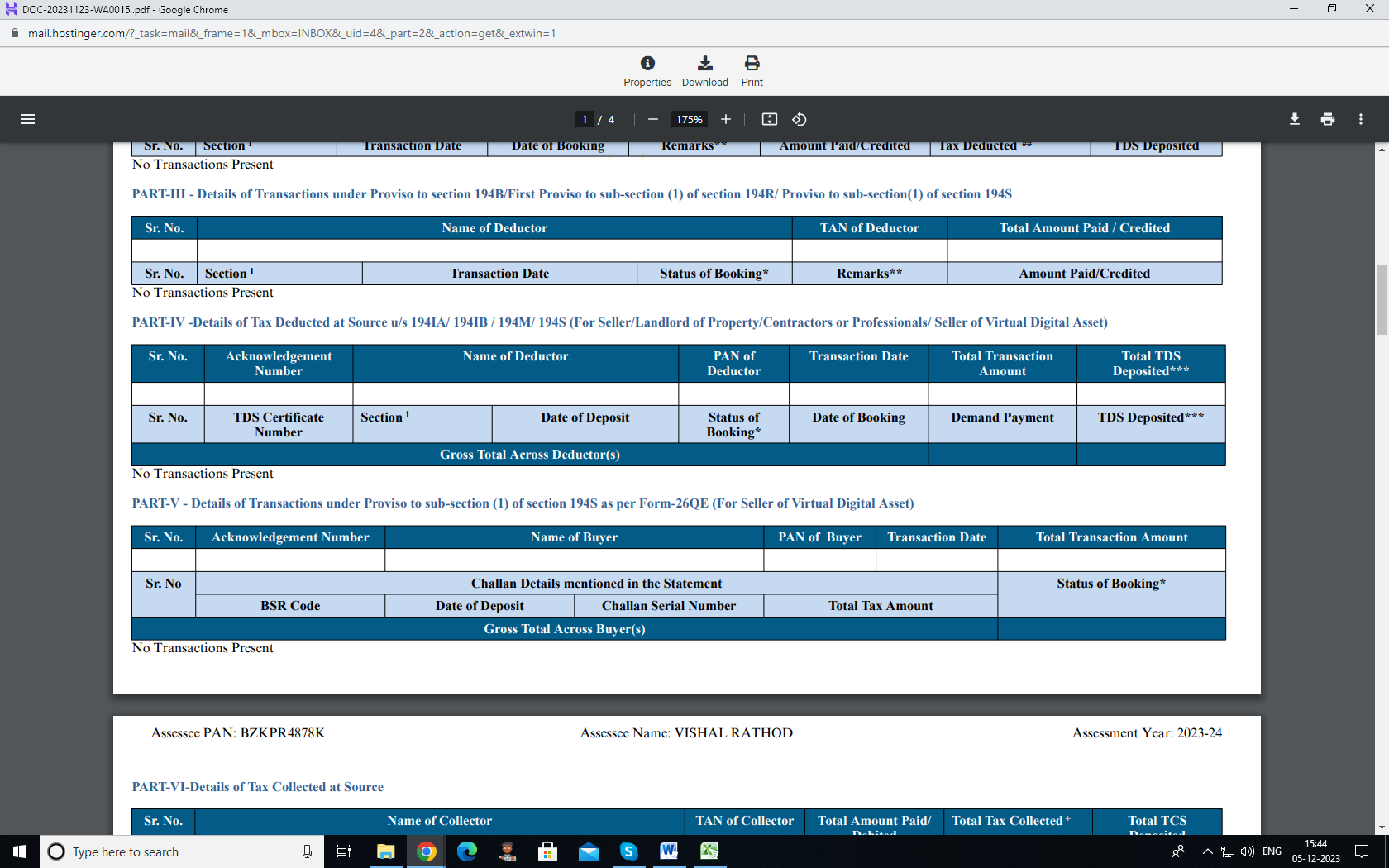

Part II:

It contains the details regarding Tax Deducted at Source in cases where Form 15G / 15H has been submitted by the deductee.

PART-III –

It provides the details of Transactions under Proviso to section 194B/First Proviso to sub-section (1) of section 194R/ Proviso to sub-section(1) of section 194S. i.e winnings from lotteries, game shows, card games, online games, crossword puzzles, quiz shows, benefit or perquisite in respect of business or profession partly in cash partly in kind, transaction regarding virtual digital assets

PART-IV

It contains details regarding Tax Deducted at Source u/s 194IA/ 194IB / 194M/ 194S (For Seller/Landlord of Property/Contractors or Professionals/ Seller of Virtual Digital Asset)

These details are provided in Form 26AS of a taxpayer who is the seller of the immovable property, landlord of the property, or contractors or seller of the VDA.

PART-V

It provides the details of Transactions under Proviso to sub-section (1) of section 194S as per Form-26QE (For Seller of Virtual Digital Asset) i.e. transactions regarding virtual digital assets

PART-VI

It gives details of Tax Collected at Source.

PART-VII

It provides details of Refund Paid (For which source is CPC TDS. For other details refer to AIS at the E-filing portal). Refund paid to assesse during the financial year reflects in this part of Form 26AS

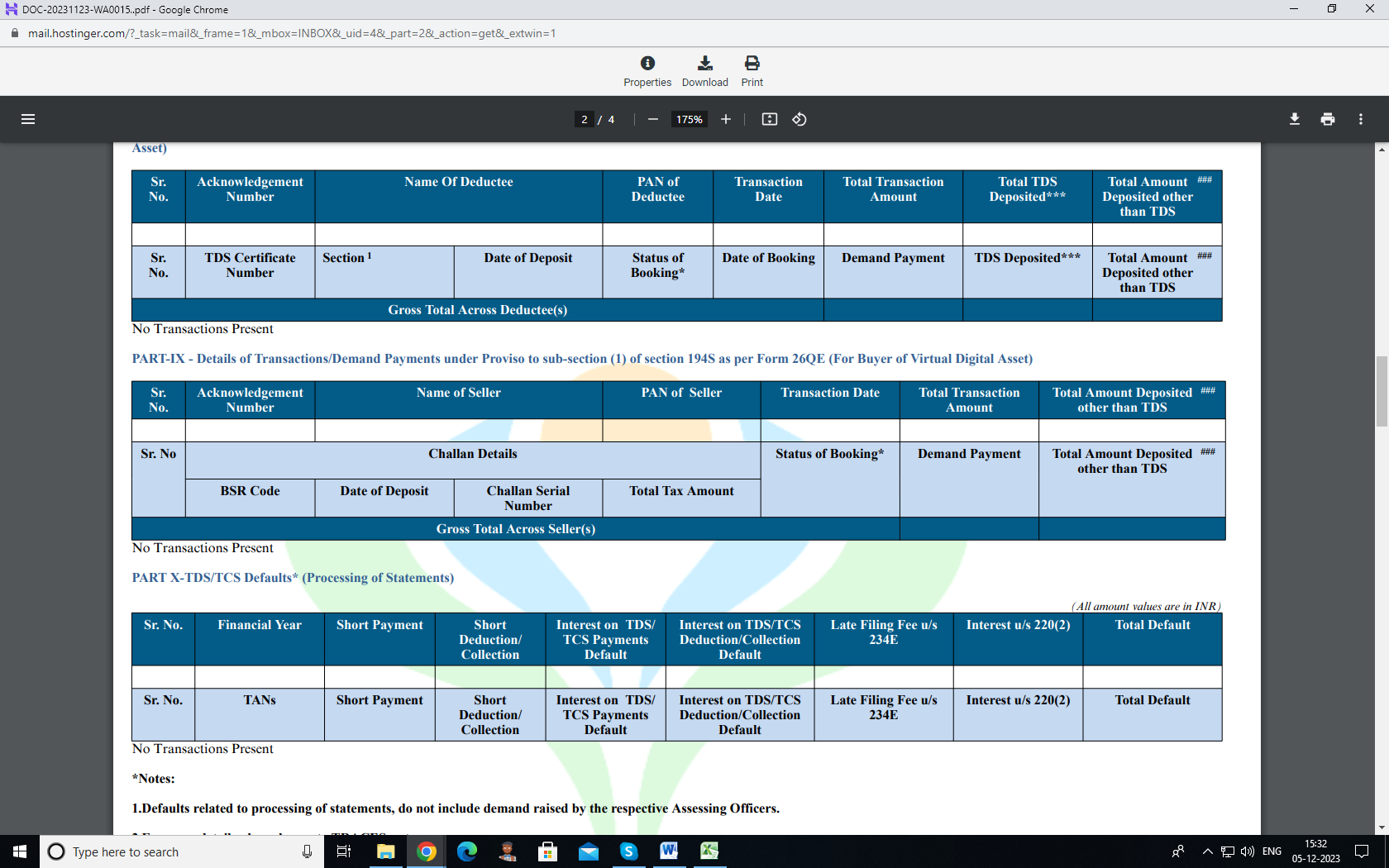

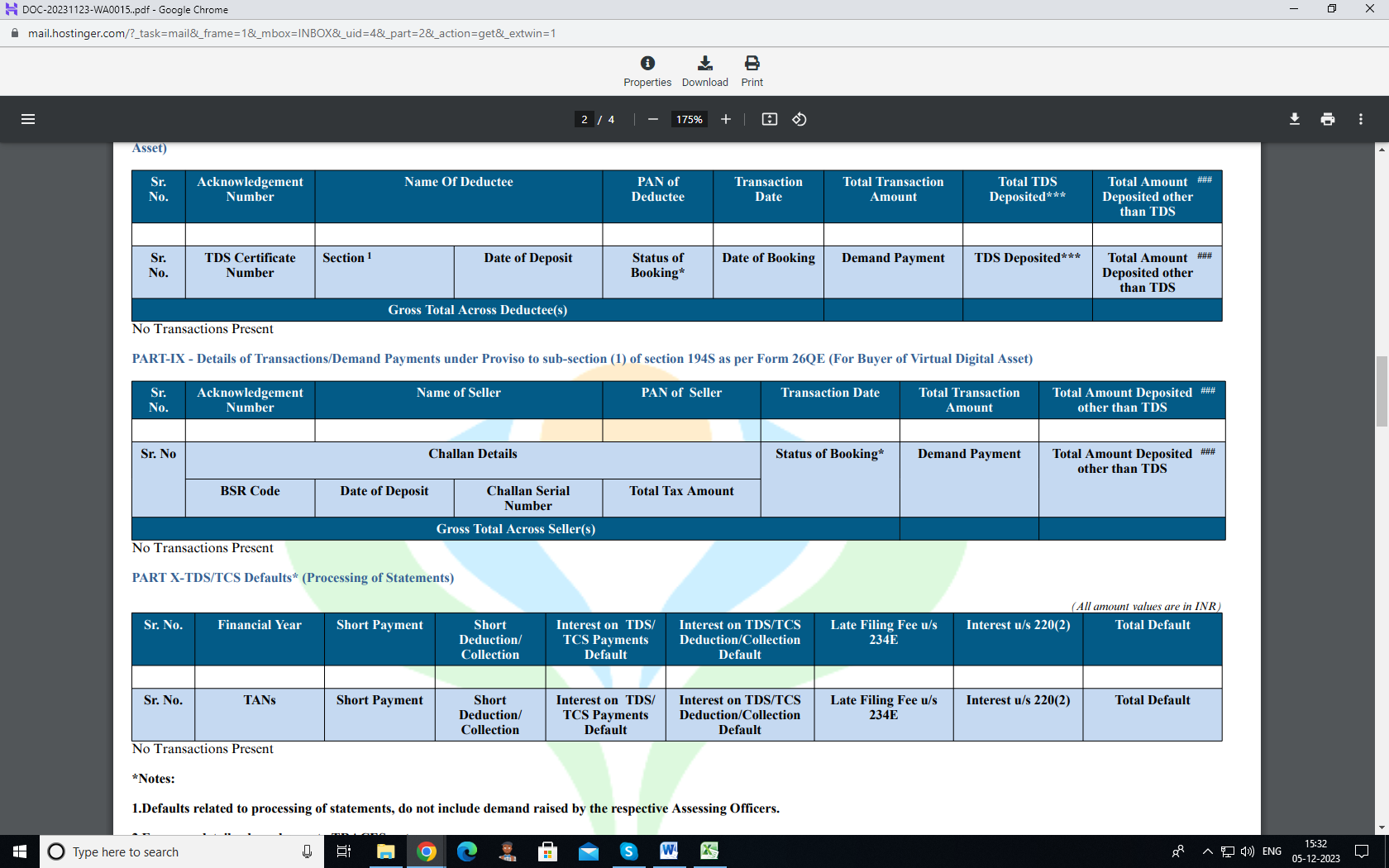

PART-VIII

It contains details of Tax Deducted at Source u/s 194IA/ 194IB /194M/194S (For Buyer/Tenant of Property /Person making payment to contractors or Professionals / Buyer of Virtual Digital Asset)

Transactions related to Immovable property, like purchase, TDS on rent paid to landlord, payment to contractor u/s 194 or payment for VDA u/s 194S beyond the specified limit.

These details are provided in Form 26AS of a taxpayer who is the buyer of the immovable property, tenant of the property, or payer to contractors or buyer of the VDA.

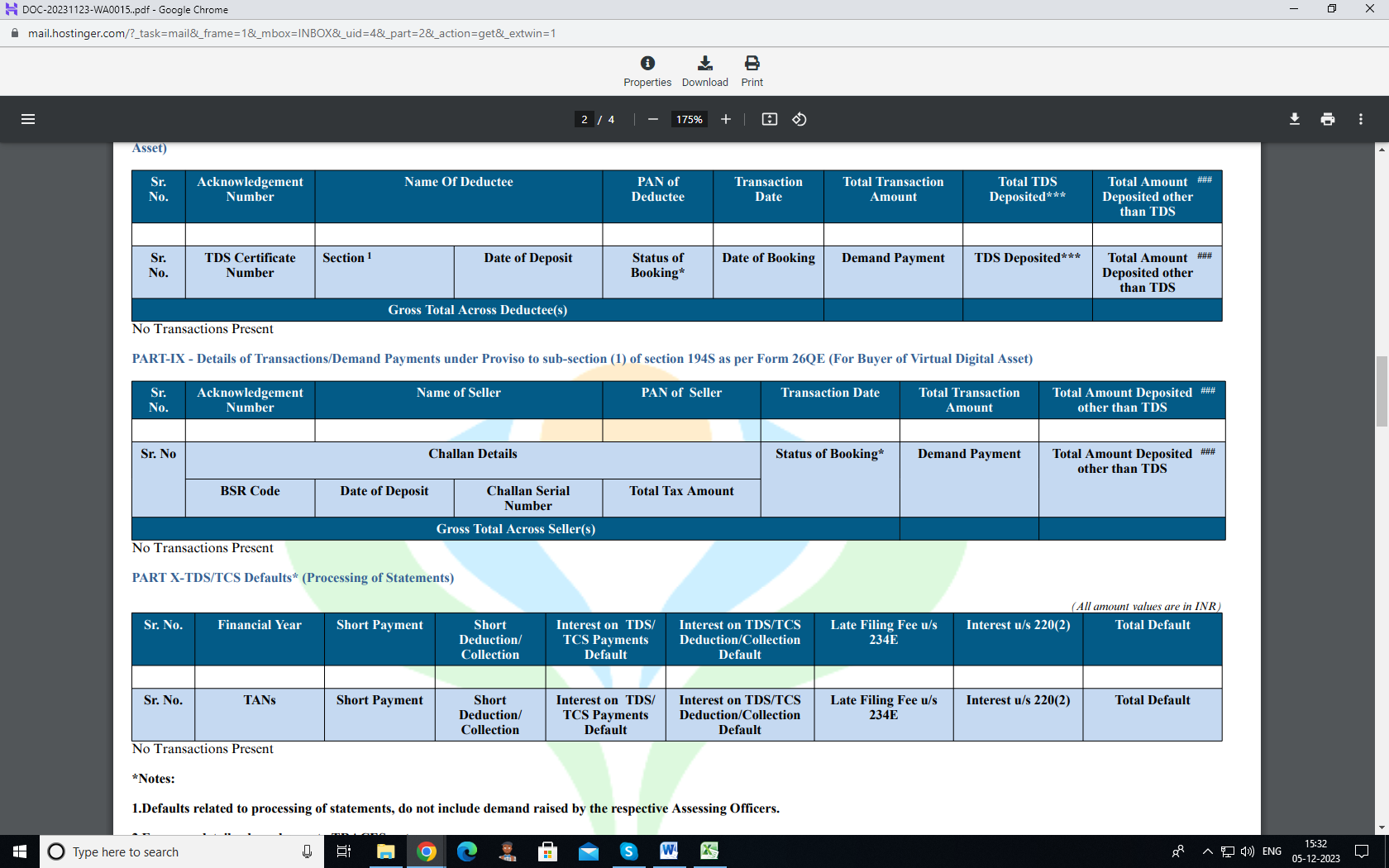

PART-IX

It gives details of Transactions/Demand Payments under Proviso to sub-section (1) of section 194S as per Form 26QE (For Buyer of Virtual Digital Asset)

PART X

TDS/TCS Defaults (Processing of Statements):

4. How to View or Download Tax Credit Statement (Form 26AS)

Taxpayers can view or download Form 26AS from the e-filing portal by following the steps given below:

- Step1: Log in to ‘e-Filing’ Portal https://www.incometax.gov.in/iec/foportal/

- Step2: Go to the 'e-file'> Income Tax Returns and click on 'View Form 26AS”.

- Step3: Read the disclaimer, click 'Confirm' and the user will be redirected to TDS-CPC Portal.

- Step4: In the TDS-CPC Portal, Agree the acceptance of usage. Click 'Proceed'.

- Step5: Click ‘View Tax Credit (Form 26AS)’ and Select the ‘Assessment Year’

- Step6: Select the ‘View type’ (HTML, Text or PDF)

- Step7: Click ‘View / Download’ (To export the Tax Credit Statement as PDF, view it as HTML > click on 'Export as PDF'.)

5. TDS Deducted and TDS Credited to Form 26AS

The taxpayer should reconcile the TDS deducted with the TDS credited to Form 26AS. If it does not match or the TDS credited in Form 26AS is less than the actual TDS deducted. Then in this case the occurrence of discrepancy may be due to reasons like non-furnishing of TDS details to the IT Department by the deductor, deducting the tax in incorrect PAN, etc. If a discrepancy is due to the deductor, then the taxpayer should ask the deductor to correct the same.

6. Conclusion:

All taxpayers should reconcile the income and Tax information declared in the ITR with Form 26AS before filing the Income tax return for the relevant year. The discrepancy may lead to litigation or other repercussions. Form 26AS is a statement of information which is in possession of the department. The compliance with law can prevent from the penalties and other litigations.