Recent Articles Of GST

What is GSTR-2A With Due Dates & Format

[DISPLAY_ULTIMATE_SOCIAL_ICONS]Introduction :-

Under the GST, a critical issue for a registered taxpayer arises regarding the claiming of ITC (input tax credit) in a particular period/Month. To address this conflict, the concept of GSTR 2A and 2B was introduced.

What is GSTR-2A

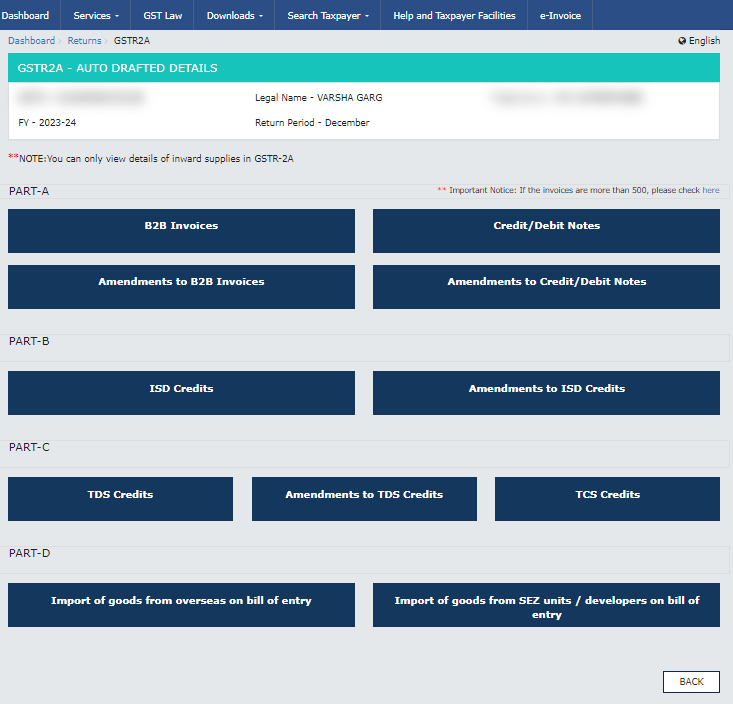

GSTR-2A is a dynamic statement, where purchase details is auto-generated as per details submitted by the supplier, accordingly GSTR-2A is updated. In GSTR-2A data is updated through returns filed by seller.

How to file GSTR-2A

You don’t have to file GSTR-2A. GSTR-2A is an auto-generated read-only statement. It can be viewed or downloaded by the recipient.

Difference between GSTR-2A and GSTR-2B.

| GSTR-2A | GSTR-2B |

| GSTR 2A is a dynamic statement. | GSTR 2B is a static statement. |

| No cut of date for GSTR-2A | Cut of date for GSTR-2B is 14th of the succeeding month. |

| Source of Information in GSTR-2A is GSTR-1 or IFF, GSTR-5, GSTR-6, GSTR-7, GSTR-8, ICE Gate portal. | GSTR-1 or IFF, GSTR-5, GSTR-6 |

| Supplier cannot claim ITC on the basis of GSTR-2A. | Supplier claim ITC on the basis of GSTR-2B. |

What happens, if the Supplier filed GSTR-1 after the due date-

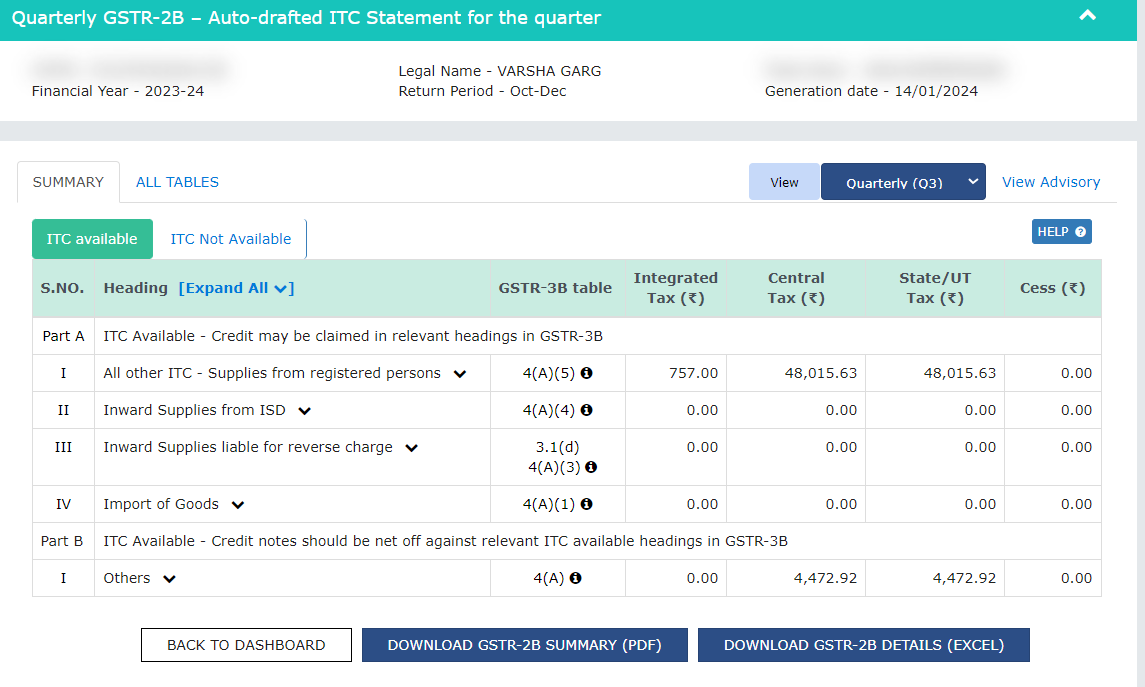

GSTR-2A is a dynamic statement. If the supplier files GSTR-1 after the due date then in such case invoice is reflected in GSTR-2A but the supplier cannot claim ITC. ITC can be claimed only through GSTR-2B. GSTR-2B is a static statement and it is generated on the 11th or 13th of the next month (depending on the return filing frequency)

GSTR-2A

GSTR-2B

FAQs Related to GSTR-2A under GST

Q.1 Can I claim ITC on the basis of GSTR-2A?

Ans. No, taxpayer cannot claim ITC on the basis of GSTR-2A.

Q.2 Any due date for filing of GSTR-2A?

Ans. You don’t have to file GSTR-2A. GSTR-2A is an auto generated read only statement.

Q.3 Can I as a taxpayer make change or add any invoice in GSTR-2A?

Ans. No, taxpayer cannot make any changes in GSTR-2A. It can only be viewed or down loaded by recipient.