Recent Articles Of GST

What is GSTR-3B : Return Filing, Due Date, Late fees & Eligibility

[DISPLAY_ULTIMATE_SOCIAL_ICONS]What is GSTR-3B?

GSTR-3B is a summary return and the purpose of the return is for taxpayers to declare their summary GST liabilities for a particular tax period and discharge these liabilities. A normal taxpayer is required to file Form GSTR-3B returns for every tax period.

Who should file GSTR-3B?

Every individual or entity who is registered under GST is obligated to file GSTR-3B, regardless of whether any transactions occurred during the specified period. For those, who have no transactions to report (nil GSTR-3B filers), there is an option to file through SMS.

The following registered persons are not required to file GSTR-3B:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

When is the due date of GSTR-3B?

The due date to file Form GSTR-3B is based on aggregate turnover. Businesses with sales of up to Rs.5 crore have an option to file quarterly returns under the QRMP scheme and the due date is 22nd/24th of the month succeeding the end of the relevant quarter.

In the case of persons who file GSTR-3B on a quarterly basis, due dates have been divided into two groups. State group south and State group north.

- For South states group due date is 22nd of the month succeeding the end of the relevant quarter.

- For North states group due date is 24th of the month succeeding the end of the relevant quarter.

Following States are included in the South State Group-

Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli, Daman and Diu, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Pondicherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh

Following States are included in the North State Group-

Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Mizoram, Manipur, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha.

Whereas, those taxpayers who do not opt for the QRMP scheme or have a total turnover above Rs.5 crore must file the return every month on or before the 20th of the succeeding month.

For example, Form GSTR-3B for the calendar month of April 2023 needs to be filed by 20th May 2023. Form GSTR-3B for the quarter of April to June 2023, needs to be filed by 22nd / 24th July 2023.

| For businesses with turnover | Month/Quarter | Due Date |

| More than Rs.5 crore | April 2023 | 20th May 2023 |

| May 2023 | 20th June 2023 | |

| June 2023 | 20th July 2023 | |

| Turnover up to Rs.5 crore & opted QRMP Scheme | April-June 2023 | 22th /24th July 2023 |

Late fees for filing of GSTR-3B?

Every registered taxpayer is required to file a GSTR-3B return within the prescribed time limit. If GSTR-3B returns are not filed within time then late fees is levied.

Taxpayer with Nil GST liability late fees is Rs. 20 per day (Rs.10 CGST and Rs. 10 SGST) maximum late fees is Rs. 500 (Rs. 250 CGST and Rs. 250 SGST)

Taxpayers having an aggregate turnover of up to Rs. 1.5 Crores in the preceding F.Y. late fees is Rs. 50 per day (Rs.25 CGST and Rs. 25 SGST) maximum late fees is Rs. 1000 (Rs. 500 CGST and Rs. 500 SGST)

Taxpayers having an aggregate turnover of more than Rs. 1.5 Crores and up to Rs. 5 crores in the preceding F.Y. late fees is Rs. 50 per day (Rs.25 CGST and Rs. 25 SGST) maximum late fees is Rs. 5000 (Rs. 2500 CGST and Rs. 2500 SGST)

More ever penal interest at the rate 18% per annum will be charged on the outstanding tax amount.

After filing the GSTR-3B return can we revised it ?

No, you cannot revise the GSTR-3B return after submitted. So before filing GSTR-3B make sure that all the details mentioned in GSTR-3B are correct.

How to file GSTR-3B?

GSTR-3B is a return that must be filed by every registered GST taxpayer. This return is filed either on a monthly or quarterly basis and provides comprehensive information about all outward supplies.

To file GSTR-3B, first, you need to login to the GST Portal.

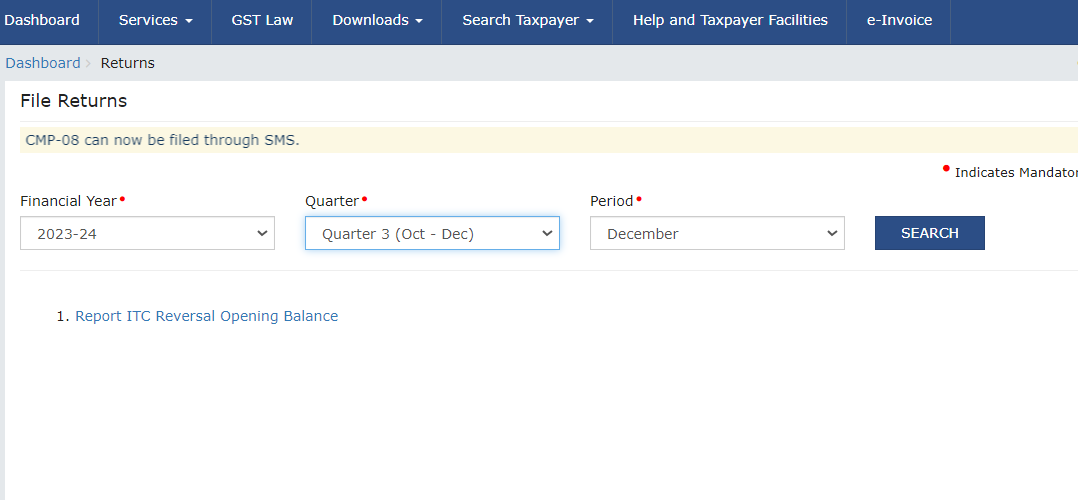

Step-1: Under Service tab >> Return tab >> Select Returns dashboard

Step-2: Select Financial Year, Quarter/Month & Period & Click on Search Tab.

Step-3: You have the option to choose between preparing a return: Prepare Online & Prepare Offline.

Step-4: Select Prepare Online & the GSTR-3B form will now be accessible.

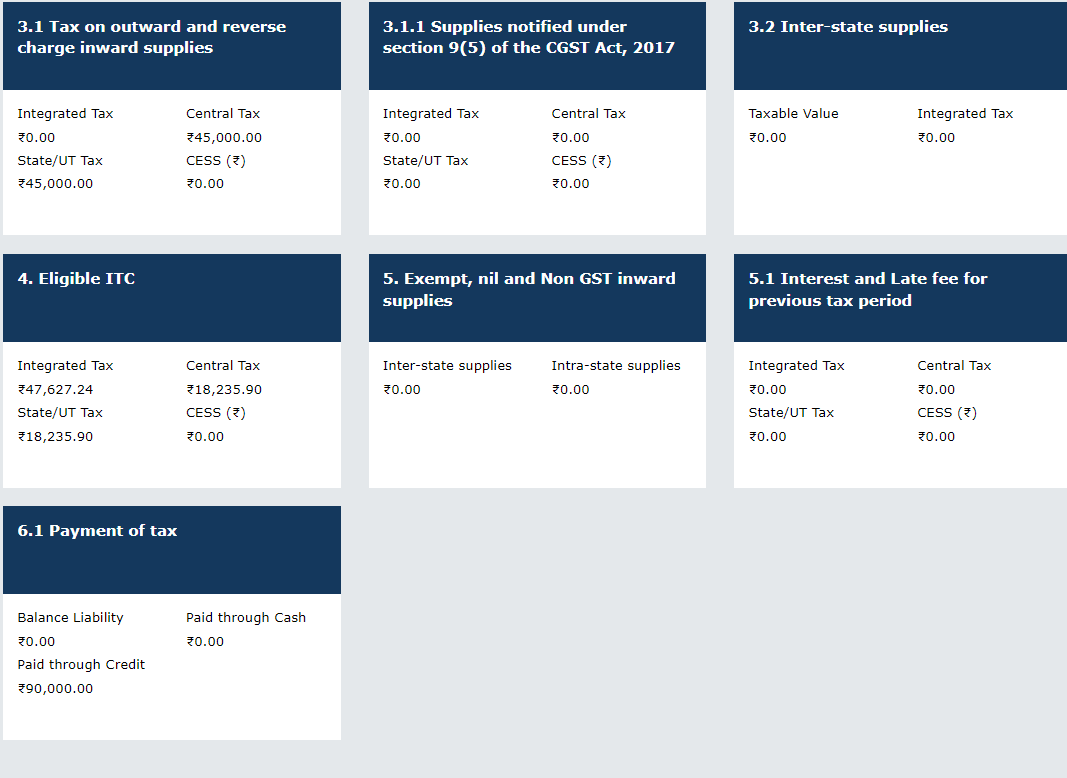

After filing relevant details in all table

Step 5: Click “Preview draft GSTR-3B.

Step 6: If there is no error in the draft GSTR3B, click “Proceed to Payment”.

Step 7: Scroll down and you will see “Cash Ledger” balance with return-related liabilities. The ledger will be auto-populated with taxes to be paid in part or full by ITC (Input Tax Credit).

Step 8: If you do not have sufficient balance in the Electronic Cash Ledger, you will be prompted to create a challan. Select “Yes” to create a new challan.

Step 9: On the “Create Challan” page, select the relevant payment mode and click on Generate Challan button to make a payment.

Step 10: Preview draft GSTR3B and ensure that the last column pertaining to “Additional Cash Required” is zero.

Step 11: Click “Make payment/ post credit to ledger”

Step 12: Click “Yes”. Offset Successful message will be displayed.

Step 13: Select “Proceed to File”

Step 14: Select the declaration check box and click “File GSTR 3B with EVC/DSC”. EVC stands for Electronic Verification Code while DSC stands for Digital Signature Certificate.

Step 15: A Successful filing message will be displayed bearing “Acknowledgement Reference Number (ARN)”. Note this number for future reference.

FAQs on Form GSTR-3B

1. Can I edit the values auto-populated from Forms GSTR-1 & GSTR-2B in Form GSTR-3B?

Yes, currently, the auto-populated values in GSTR-3B are editable. However, the tile with the edited field will be highlighted in RED and a warning message will be displayed.

2. How can I download system-generated GSTR-3B?

You can download system-generated GSTR-3B in PDF format by clicking on the SYSTEM GENERATED GSTR-3B button.

3. Why does downloading the System-generated GSTR-3B button is disabled, even though I am a monthly GSTR-1 filer?

In case you have not filed your monthly GSTR-1 for the selected month or the GSTR-2B for the selected month is generated, then the system-generated GSTR-3B button will be disabled.

4. If only GSTR-2B is generated and GSTR-1 is not filed, how will the auto-population work?

The system-generated Form GSTR-3B is partially available as you have not filed your Form GSTR-1. Form GSTR-1 is a statement of your inward supplies and it is always advised to file Form GSTR-1 before proceeding to file Form GSTR-3B.

5. If GSTR-1 is filed, but GSTR-2B is not generated, how will the auto-population work?

In Form GSTR-3B the auto-population will be partially available in table 3.1 (a, b, c, e) and table 3.2. Table 3.2 (d) and table 4 will be auto-drafted once the Form GSTR-2B is generated.

6. Why is the warning message displayed when I am filing Form GSTR-3B?

In case you have made any upward/ downward variance to the auto-drafted details from Forms GSTR-1 & GSTR-2B in Form GSTR-3B, then the field(s) edited will be highlighted in red color and a warning message will be displayed. However, you can still proceed to make payment and continue to file Form GSTR-3B.

7. In the system-generated PDF, only the interest values are displayed, why so?

In cases where Form GSTR-1 is not filed and Form GSTR-2B form is not generated for the current month, but there is some interest liability due to the filing of Form GSTR-3B of the previous return period, the system-generated PDF will have only interest values. For GSTR-1, which is not filed, and for GSTR-2B, which is not generated, no values will be displayed.

8. Will the interest computed by the system be on gross liability or net liability?

Interest will be computed by the system in accordance with the first proviso to Section-50 of the CGST Act, 2017, as amended. Consequently, interest for the liability pertaining to the present period will be levied only on the portion of the liability which is discharged by debiting the electronic cash ledger (Net liability), and on the entire liability if the liability pertains to the previous period(s) (Gross liability).

9. Will there be any invoice matching in Form GSTR-3B?

No, all the details in Form GSTR-3B will be self-declared in a summary manner and the taxes will be paid based on the table 6 of Form GSTR-3B (refer to the Rules as available on the GST Council or CBIC website, applicable for Form GSTR-3B Form).

10. Will the Utilize cash/ITC functionality be available for discharging return-related liabilities?

No, all the details in Form GSTR-3B will be declared in a consolidated manner by the taxpayer and the taxes will be paid based on table 6 of Form GSTR-3B.

11. What should be the mode of payment for the liabilities under table 3.1.1?

The tax liabilities declared in row (i) in table 3.1.1 are reflected under ‘Other than reverse charge’. These liabilities, however, must be paid in cash only.

12. From which return period table 3.1.1 is made available in Form GSTR-3B?

The table 3.1.1 Supplies notified under section 9(5) of the CGST Act, 2017 has been made available from the July Return period. For taxpayers who have opted for the QRMP scheme, it is made available from the Jul-Sep return period.

13. One is required to Confirm after entering data in each section in Form GSTR-3B. Will the GST System save the confirmed data if a taxpayer exits without completing the form?

No, to ensure that the furnished data is saved in a partially complete Form GSTR-3B, a taxpayer is required to click on Save Form GSTR-3B before closing the form.

14. Where do I have to enter details of inward taxable supply?

You are not required to enter all details of inward taxable supply. Only details of Eligible and Ineligible ITC need to be declared in table 4.

15. I am a facing problem while filing Form GSTR-3B, even though I have entered all the details in it. After submitting the form, all values are automatically reflected as "Zero" and the status of the Form is showing submitted. Why?

This issue has occurred because you have tried to make payment, without saving the details added in Form Form GSTR- 3B. You must always save the form, before proceeding towards making payment.

16. Is it mandatory to provide a tax liability breakup if the return is filed within the due date?

If any tax liability pertains to the previous tax period(s), then the same has to be provided by the taxpayer for the correct computation of the interest liability by the system. You can click on the TAX LIABILIY BREAKUP, AS APPLICABLE button to provide tax-period wise breakup of liability while filing GSTR 3B.

17. I have already filed Form GSTR-3B, but now I want to make some modifications. Can I file an amendment?

Form GSTR-3B once filed cannot be revised. Adjustment, if any, may be done while filing Form GSTR-3B for subsequent period.

18. Can I preview Form GSTR-3B before submission?

After adding details in various sections of Form GSTR-3B, scroll down the page and click the PREVIEW DRAFT Form GSTR-3B button to preview before making payments.

The summary of Form GSTR-3B will be displayed in a PDF. If it is incorrect, you can edit the information in the relevant section of the form, or else you can click the MAKE PAYMENT/POST CREDIT TO LEDGER button.

19. Can I reset Form GSTR-3B?

No, you cannot reset Form GSTR-3B.

Disclaimer:-The information available on this website/ App is solely for informational purposes. We make no representation or warranties of any kind, express or implied about the accuracy, reliability, with respect to information and material or video available on website/APP, any reliance you place on such information is therefore strictly at your own risk. We are not liable for any consequence of any action taken by you relying on the material/information provided on this website.