Recent Articles Of GST

How to Check PAN linked with Aadhar

India's two pillars of identity, the PAN card, and Aadhaar stand tall, each serving distinct purposes. The PAN, issued by the Income Tax department, acts as your financial fingerprint, while Aadhaar, from the Unique Identification Authority of India (UIDAI), is your unique digital key. Strengthening the financial ecosystem, India's PAN and Aadhaar join hands to combat tax evasion through unique identifier synergy.

Notable Timeline & Fee

| Particular | Deadline | Fee |

| PAN-Aadhaar linking was March 31, 2022, extended to June 30, 2022 | March 31, 2022 | N/A |

| linking between July 1, 2022, and June 30, 2022. | June 30, 2022 | Rs. 500 |

| linking between July 1, 2022, and June 30, 2023. | June 30, 2023 | Rs. 1,000 |

Get concise answers to your GST and Income Tax queries.

Clarify doubts and navigate complexities with ease.

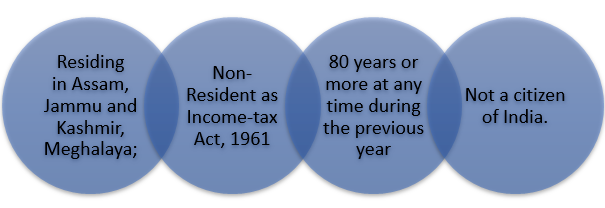

Exempt Categories: Those exempt from linking by June 30, 2023, include

Note:

- The exemptions provided are subject to modifications depending on subsequent government notifications on this subject

- For further details refer to Department of Revenue Notification No 37/2017 dated 11th May 2017”

- However, for users falling in any of the above categories, voluntarily desires to link Aadhaar with PAN fee payment of a specified amount is required to be done.

Importance of Linking:

- Inoperative PAN cards after July 1, 2023.

- Mandatory for filing Income Tax Returns (ITR).

- Necessary for accessing government services, obtaining subsidies, opening bank accounts, and passport applications.

Concerns of Non-Linking:

- Inoperative PAN affects ITR filing and processing.

- Pending returns and refunds not processed.

- Higher TCS/TDS rates and missing credits in Form 26AS.

- Inability to submit 15G/15H declarations for nil TDS.

- Restrictions on banking transactions, mutual fund purchases, and more.

Transactions Impacted:

- Opening bank accounts.

- Debit/credit card issuance.

- Mutual funds unit purchases.

- Cash deposits exceeding Rs. 50,000.

- Bank drafts/pay orders exceeding Rs. 50,000.

- Time deposits exceeding Rs. 50,000.

- Prepaid payment instrument transactions exceeding Rs. 50,000.

- Sale/purchase transactions exceeding Rs. 2,00,000.

- All bank transactions exceeding Rs. 10,000.

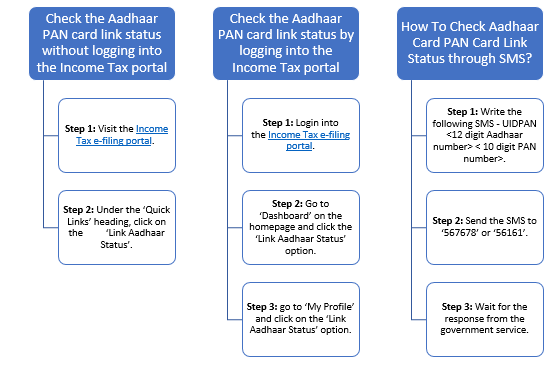

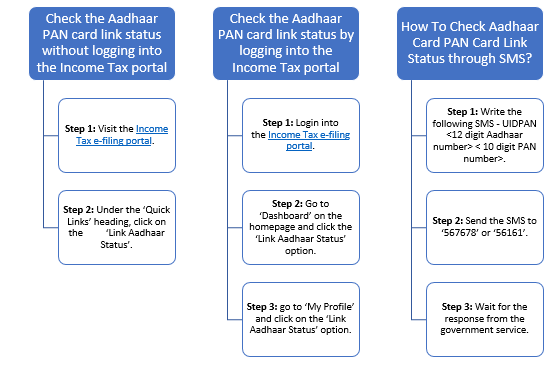

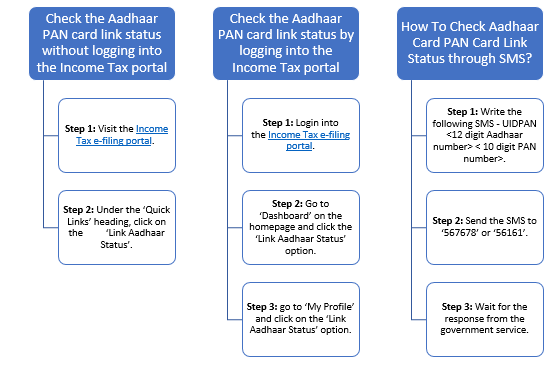

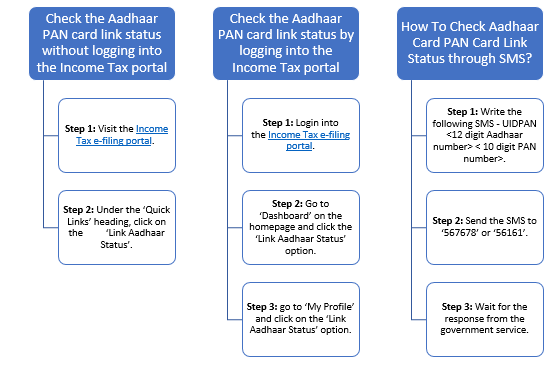

How To Check Aadhar PAN Card Link Status Online

To check the Aadhar linking status with PAN there are 3 options one can choose any of the following options to find out the Aadhar link status.

Restoration of PAN Operability:

1. PAN can be made operative in 30 days by providing Aadhaar details and paying an Rs. 1,000 fee.

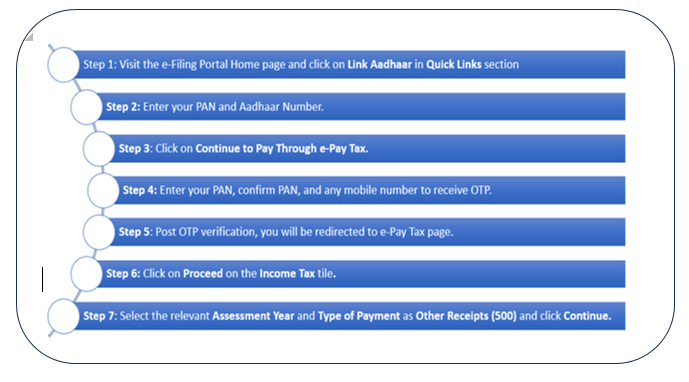

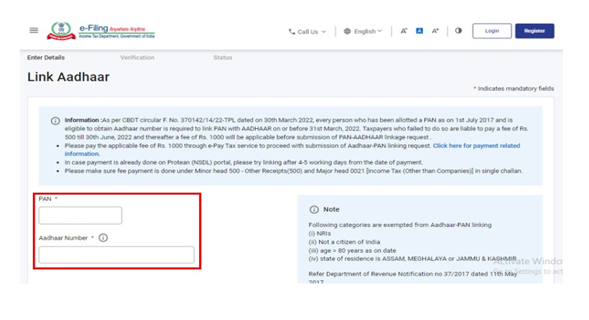

Link Aadhaar User Manual {Issue by Income Tax }

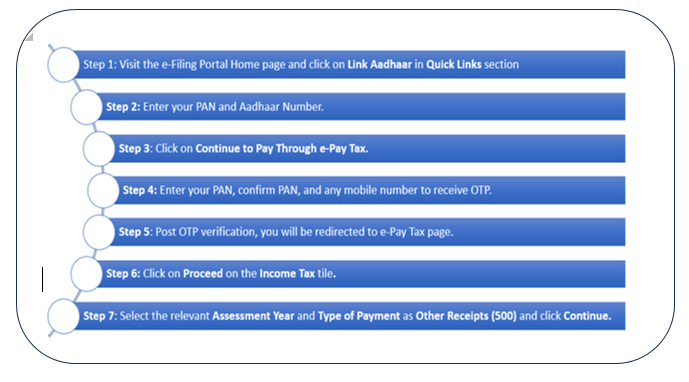

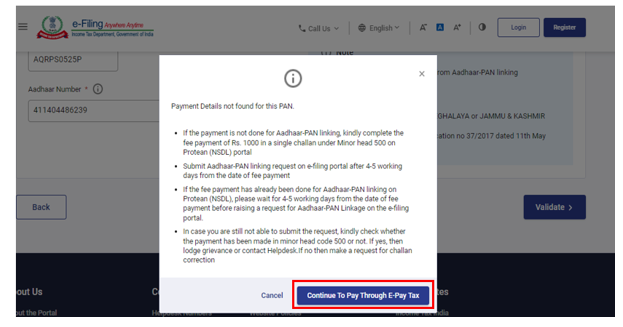

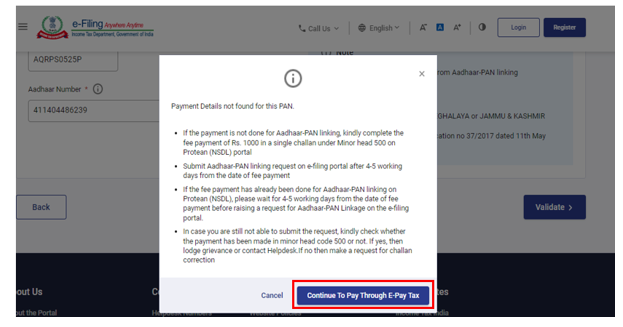

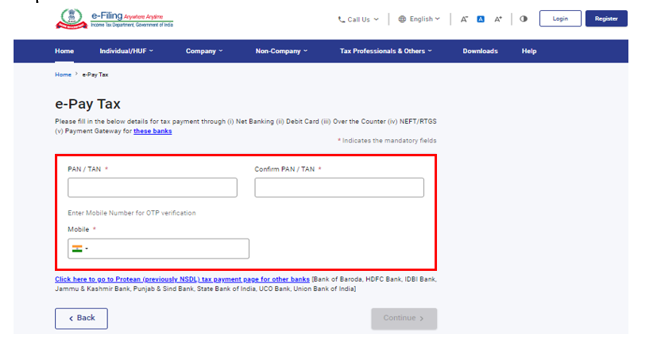

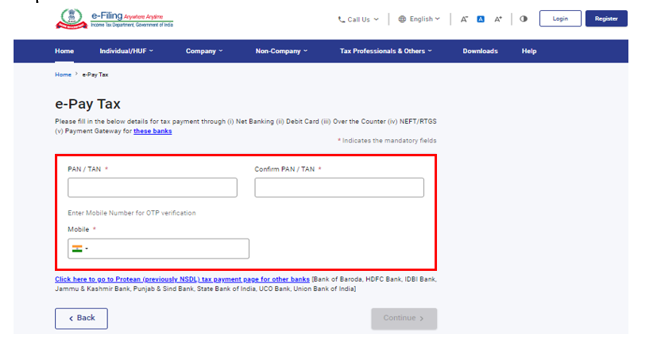

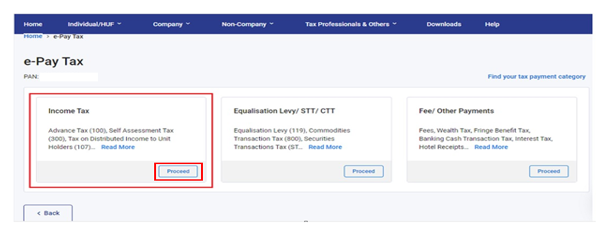

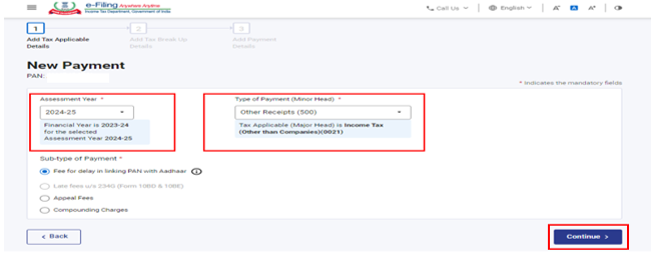

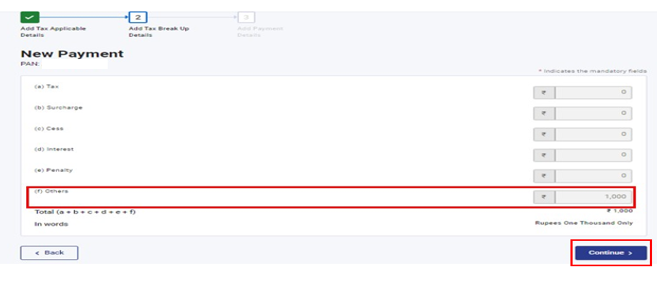

If PAN and Aadhaar are not linked, the person must pay a fee for not linking within the time limit. The steps are mentioned below.

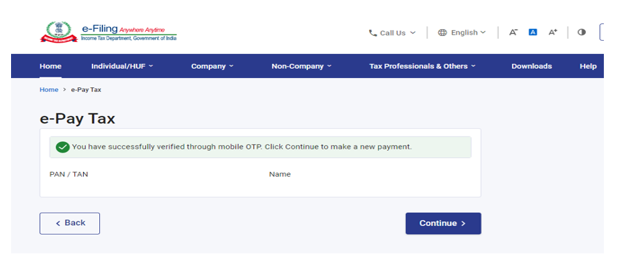

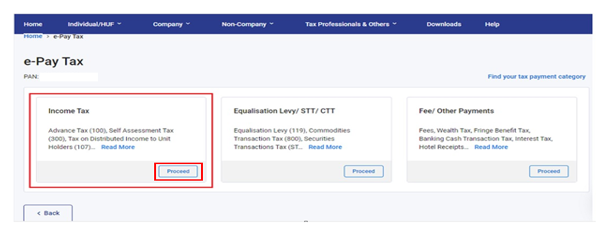

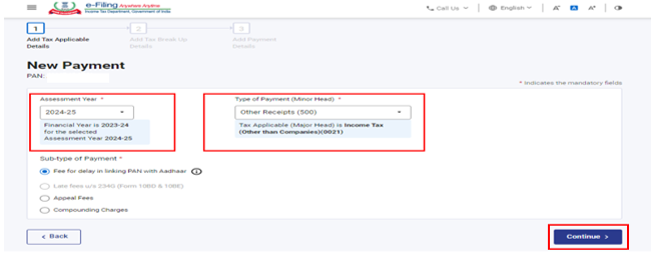

Step 1

Step 2

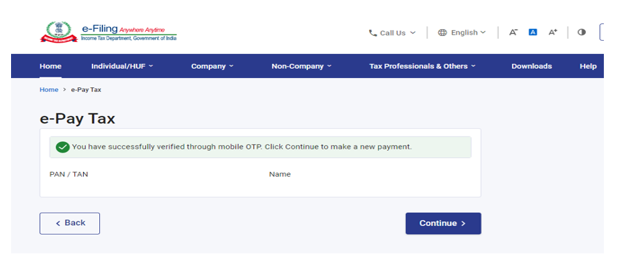

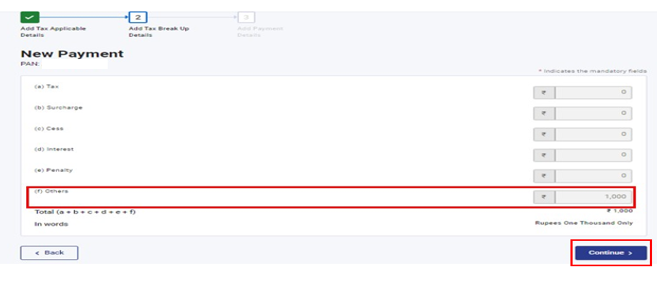

Step 3

Step 4

Step 5

Step 6

Step 7

Step 8

After making the payment of the fee, you can link your Aadhaar with your PAN on the e-Filing Portal.

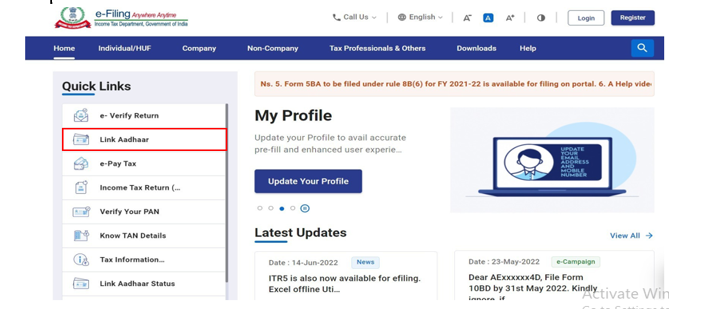

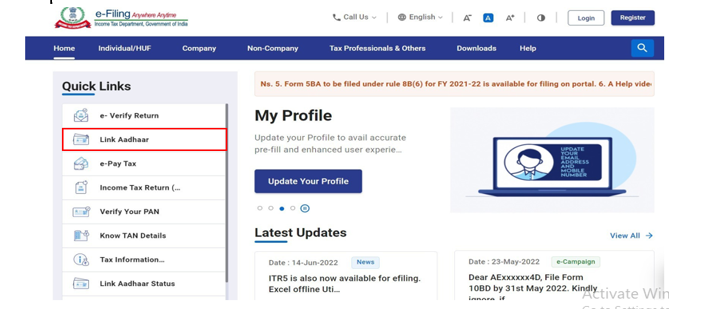

Step 1 Go to link Adhaar link.

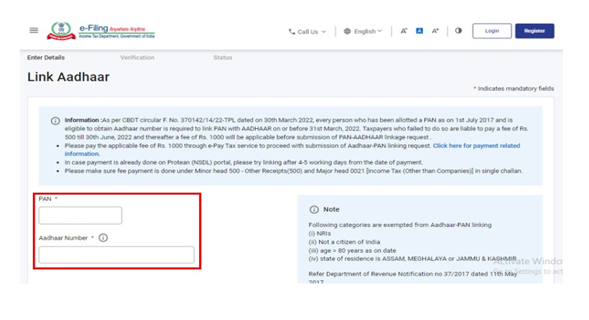

Step 2 Put your PAN and Adhaar number and validate it.

Step 3 Enter your name and Mobile number in the next window.

Step 4 Put the OTP received on mobile number.

Step 5 A pop-up window will open for “link of Aadhaar has been submitted successfully”.